👋Session Alert! How the Top 1% Finance Leaders Think - 11th Feb. Register Now→

How to train employees on using prepaid cards responsibly

Empowering responsible spending

Prepaid cards have become essential tools for managing employee expenses in today’s fast-paced business environment.

Unlike traditional credit cards, they offer you greater control, real-time visibility, and preset spending limits—all while making life easier for your employees. But giving someone a company card also comes with responsibility. That’s why it’s crucial to train your team on how to use prepaid cards wisely.

A clear framework for usage, spending policies, and accountability ensures that every transaction aligns with your business goals while building a culture of trust and financial discipline.

The shift towards prepaid cards for business spending

More and more companies like yours are shifting to prepaid cards to manage business expenses efficiently. They eliminate the back-and-forth of reimbursements and reduce the risks associated with credit misuse.

Prepaid cards streamline expense tracking and empower employees to make real-time purchases within defined budgets. For small businesses, startups, and even large enterprises, they’re quickly becoming the preferred alternative to traditional payment methods, offering agility without compromising on control.

Why training on responsible card usage is paramount?

Handing out prepaid cards without proper training is like giving your team a powerful tool without showing them how to use it. While these cards offer built-in controls, misuse—intentional or not—can still lead to budget leaks, policy violations, or compliance issues. That’s why training is critical.

When your employees understand spending limits, category restrictions, and reporting expectations, they’re more likely to use company funds responsibly. It also empowers them to make decisions confidently, without the fear of overstepping.

Ultimately, well-trained employees help you maintain financial hygiene while driving smarter, policy-aligned spending.

Guidelines for responsible prepaid card use

Training your employees on prepaid card use isn’t just about telling them what not to do—it’s about giving them the knowledge and confidence to use the card effectively and ethically.

To ensure responsible use, your team should be well-versed in how the card functions, understand your internal policies, and know exactly what they can and can’t spend on. A structured onboarding process combined with ongoing support helps avoid confusion, reduces the chance of policy violations, and promotes accountability.

Here’s what to cover in your training sessions:

1. Understanding card functionality

Start by explaining how prepaid cards differ from credit or debit cards. These are pre-funded tools with fixed balances—meaning your employees can only spend what’s loaded.

Teach them how to check balances, track expenses in real time, and what happens if a transaction exceeds the available amount. Awareness of these mechanics helps avoid failed transactions or unnecessary delays.

2. Adhering to company policies

Company policies are what ensure that prepaid cards are compliant with internal protocols as well as external regulations. Training your employees should include an emphasis on the company policies on card usage rules, spending limits, as well as the approval processes that transactions will follow.

Ensure that these policies are clear and easily understandable by everyone so that they can follow ethical card usage practices.

3. Recognizing permitted vs. prohibited expenses

In order to ensure that your employees follow spend policies, it is important to draw clear boundaries. Grey areas invite unnecessary ambiguities, and employees end up using their cards for disallowed spending.

Instead, give them training with explicit guidelines on what kind of expenses have been approved for business use and give a clear definition of non-allowable expenditures to prevent both card misuse as well as unnecessary mistakes.

Get the perfect prepaid card for your business!

Must-have practical skills for using prepaid card

While understanding policies is important, your employees also need hands-on skills to use prepaid cards effectively in real-world situations. This part of the training should focus on day-to-day operations—how to activate the card, make purchases, report expenses, and handle issues like returns or disputes.

When your team is confident in these areas, they’re less likely to make errors and more likely to uphold your company’s financial integrity.

Card activation and security best practices

Start with secure card activation procedures. Employees should be instructed to activate cards only through official channels—either a designated platform or a secure link provided by your card issuer.

Emphasize best practices like setting strong PINs, never sharing card details, and immediately reporting lost or stolen cards. A proactive approach to security minimizes fraud risk and keeps company funds safe.

Making purchases (online & offline)

Explain how to use the card across different channels—POS terminals, online checkouts, and mobile apps. Clarify any specific limitations, such as merchant category restrictions or international usage blocks.

Reinforce that all purchases must be business-related and within approved budget thresholds.

Real-time expense reporting and receipt capture

Train employees on using your company’s expense management system or app. Show them how to snap and upload receipts instantly, categorize expenses correctly, and submit reports without delay. This reduces manual errors and gives your finance team instant visibility into spend.

Handling disputes and returns

Mistakes and billing issues can happen. Provide employees with a clear step-by-step process to report unauthorized or incorrect charges. Outline how to initiate returns or refunds and when to escalate to your finance or admin team.

Knowing how to handle these situations calmly and efficiently helps resolve problems without disrupting workflows.

Navigating regulations: Ensuring compliance and accountability

Responsible use of prepaid cards isn’t just about internal policies—it’s also about staying on the right side of the law. As an employee, your actions directly impact the company’s compliance with tax regulations and audit readiness.

That’s why your training should include a clear understanding of documentation standards, reporting practices, and the consequences of misuse.

Understanding tax implications (GST & income tax)

Proper documentation—like valid tax invoices and accurate expense categorization—is essential for GST claims and overall tax reporting.

Employees should know that incomplete or vague submissions could jeopardize input tax credits or invite scrutiny during audits. Their attention to detail protects the business from penalties and keeps financial records clean.

The importance of audit trails

Every card transaction should be traceable. Timely expense reports, matched with receipts and accurate notes, form a reliable audit trail. This transparency is crucial not only for regulatory compliance but also for maintaining trust with stakeholders and preparing for external audits or internal reviews.

Consequences of misuse

Training should include a clear explanation of what happens if a card is used irresponsibly—whether intentionally or by mistake. Misuse may lead to revocation of card privileges, disciplinary action, or even legal consequences in severe cases.

Reinforcing accountability ensures that every employee takes their spending responsibilities seriously.

Cultivating a culture of trust and transparency

Open communication channels

Make it clear that questions and concerns are always welcome. Whether it’s about a policy, a suspicious transaction, or uncertainty over a purchase, employees should feel safe bringing issues forward.

This proactive communication helps you catch small problems before they become costly mistakes.

Regular review and feedback

Establish routine audits and one-on-one reviews of card usage. These aren’t just compliance checks—they’re learning opportunities.

Provide constructive feedback, highlight areas for improvement, and use real data to guide better decision-making in the future.

Recognizing exemplary behavior

Celebrate employees who consistently follow policies, submit accurate reports on time, and use their cards with integrity.

A small incentive or public acknowledgment can reinforce positive behavior and set a benchmark for others to follow.

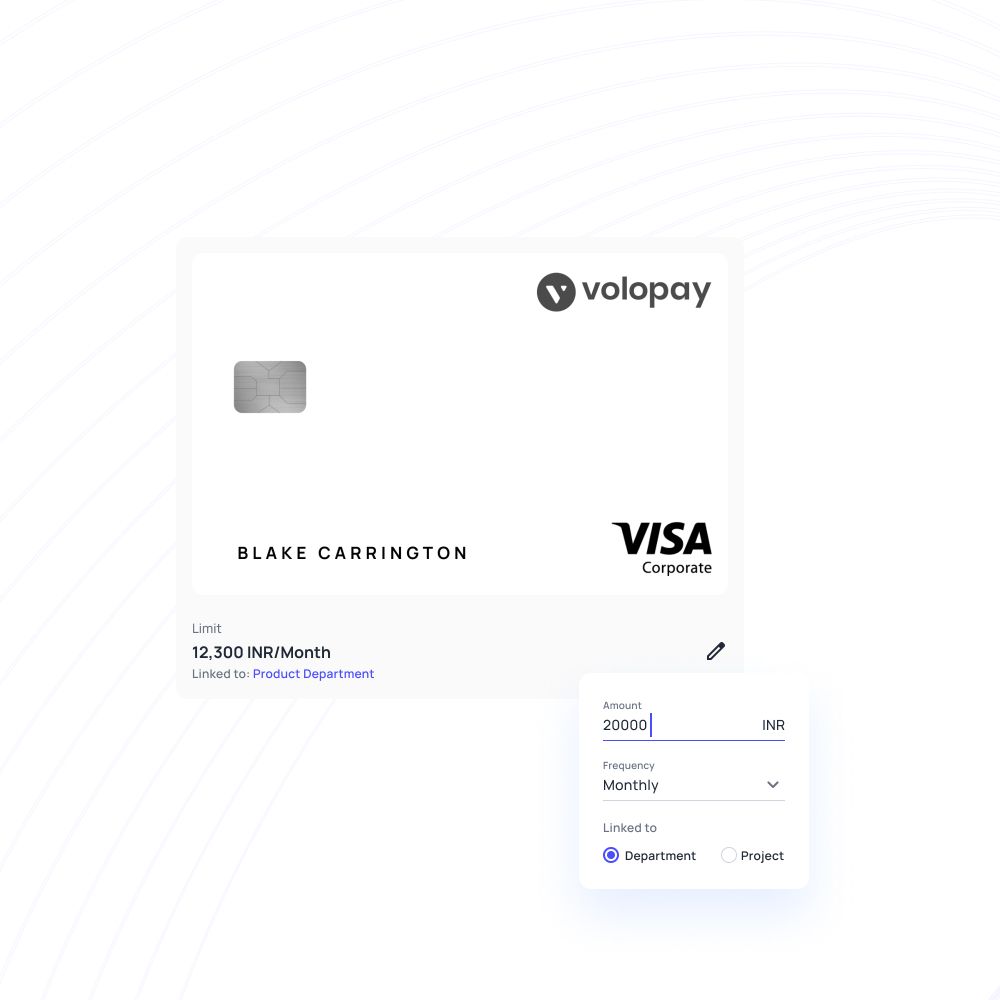

Volopay cards for expense management

Volopay’s prepaid cards are designed to simplify and strengthen your company’s expense management from day one. With an intuitive interface, your employees can activate their cards, track spending in real time, and upload receipts with ease—no steep learning curve required.

Volopay makes onboarding seamless and empowers your team to spend responsibly within set budgets. Whether you're scaling your business or tightening financial controls, Volopay helps you build a smarter, more transparent expense culture.

Bring Volopay to your business

Get started now

FAQs on responsible prepaid cards usage

If a prepaid card is lost or stolen, the employee should immediately report it to the finance team or the card administrator. With Volopay, cards can be frozen instantly through the mobile app or web dashboard, minimizing the risk of unauthorized transactions. A replacement card can then be issued promptly.

Prepaid cards can be an excellent tool for managing overseas business expenses. With Volopay, you can issue cards in multiple currencies, helping employees avoid high foreign exchange fees. It's also easy to monitor international spending in real-time, making post-trip reconciliation simpler for both employees and finance teams.

Prepaid cards should strictly be used for business-related expenses. Allowing personal use complicates accounting, affects tax reporting, and can blur audit trails. With Volopay, you can enforce strict merchant and category restrictions to ensure cards are only used for approved business purposes.

Volopay cards come with advanced security features, including two-factor authentication, instant freezing, and transaction alerts. Since they're not linked to your primary bank account, the financial exposure is limited, providing an extra layer of protection.

Yes, you can define custom spending limits per card, per user, or per department. Whether it’s daily caps or monthly allowances, Volopay gives you complete control over how much employees can spend, reducing the risk of overspending.

Absolutely. Volopay integrates with major accounting platforms like Xero, QuickBooks, and NetSuite. Transactions are synced automatically, with receipts and categories attached, saving your team hours on manual bookkeeping.

Volopay cards are ideal for travel, SaaS subscriptions, office supplies, client meetings, and other operational expenses. You can issue cards for individual employees, departments, or specific vendors to track and control spending with greater precision.