👋Exciting news! UPI payments are now available in India! Sign up now →

Cost accounting vs. financial accounting: Key differences

When you're running a business, accounting serves as the backbone of your financial operations, providing the essential data needed to make informed decisions, track performance, and ensure compliance with regulations.

Accounting transforms raw financial transactions into meaningful information that guides strategic planning, budgeting, and day-to-day operations. Within this broader field, cost accounting and financial accounting fulfill distinct yet complementary roles.

Cost accounting focuses internally on analyzing and controlling production costs, helping you optimize efficiency and pricing strategies. Meanwhile, financial accounting looks outward, presenting standardized financial statements to external stakeholders like investors, creditors, and regulators.

Together, these accounting disciplines provide you with both the internal insights and external transparency necessary for sustainable business success.

What is cost accounting?

Definition and brief overview

Cost accounting is a specialized branch of accounting that focuses on capturing, analyzing, and reporting the costs associated with producing goods or services.

Unlike financial accounting, which provides information to external stakeholders, cost accounting serves internal management by providing detailed cost information for decision-making, planning, and control purposes.

It involves systematic recording, classification, and allocation of costs to determine the true cost of products, services, or business processes. This information helps managers make informed decisions about pricing, budgeting, performance evaluation, and operational efficiency improvements.

How does cost accounting work?

Cost accounting operates by collecting and analyzing cost data throughout the production process. It begins with identifying and classifying costs into categories such as direct materials, direct labor, and overhead costs.

These costs are then allocated to specific products, services, or departments using various costing methods and allocation bases. The system tracks costs from raw materials through finished goods, providing detailed reports on cost per unit, departmental costs, and variance analysis.

This process enables management to monitor spending, identify cost reduction opportunities, and establish accurate pricing strategies for sustainable profitability.

Types of cost accounting

Cost and financial accounting serve different purposes within an organization's accounting framework. While financial accounting focuses on external reporting and compliance, cost accounting provides internal management with detailed cost analysis for operational decision-making.

1. Standard costing

Standard costing establishes predetermined costs for materials, labor, and overhead, then compares actual costs against these standards to identify variances. This method helps control costs and evaluate performance by highlighting areas where actual costs deviate from expected levels.

2. Marginal costing

Marginal costing (also called variable costing) only assigns variable costs to products, treating fixed costs as period expenses. This approach is valuable for short-term decision-making, break-even analysis, and understanding how changes in production volume affect profitability.

3. Activity-Based Costing (ABC)

Activity-Based Costing (ABC) allocates overhead costs based on activities that drive those costs rather than traditional volume-based measures. This method provides more accurate product costing, especially for complex manufacturing environments with diverse product lines.

4. Job/batch costing

Job/batch costing tracks costs for specific jobs or batches of products, making it ideal for customized or small-volume production. Each job receives its own cost sheet, accumulating direct materials, direct labor, and allocated overhead costs.

5. Absorption costing

Absorption costing (full costing) assigns all manufacturing costs—both variable and fixed—to products. This method is required for external financial reporting and provides a comprehensive view of product costs.

6. Lean costing

Lean costing implifies cost accounting by eliminating waste and focusing on value streams rather than individual products. It supports lean manufacturing principles by providing relevant cost information without excessive detail.

7. Process costing

Process costing averages costs across large volumes of identical products moving through continuous production processes. This method is common in industries like chemicals, food processing, and oil refining where products are homogeneous.

What is financial accounting?

Definition and brief overview

Financial accounting is the systematic process of recording, measuring, and communicating a company's financial transactions and performance to external stakeholders.

You use financial accounting to prepare standardized financial statements—including income statements, balance sheets, and cash flow statements—that provide a clear picture of your organization's financial health.

This branch of accounting follows established principles and regulations, ensuring consistency and comparability across different companies and time periods, which helps investors, creditors, and regulators make informed decisions about your business.

How does financial accounting work?

Financial accounting operates through a structured cycle where you record business transactions in journals, post them to ledgers, and prepare trial balances. You then create financial statements that summarize your company's financial position and performance.

Unlike cost accounting and financial accounting, which focuses on internal management decisions, financial accounting emphasizes external reporting requirements.

You must follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to ensure your reports meet regulatory standards and stakeholder expectations.

Types of financial accounting

Financial accounting primarily encompasses two fundamental approaches that determine when you recognize transactions and events. Cash accounting records transactions only when money actually changes hands, making it simpler but potentially less accurate for long-term financial planning.

Accrual accounting, the more comprehensive method, recognizes transactions when they occur regardless of payment timing, providing a more complete picture of your financial position.

You'll also encounter specialized areas like tax accounting for regulatory compliance and management accounting for internal decision-making, each serving distinct purposes within your overall financial reporting framework.

1. Cash accounting

Cash accounting involves recording transactions only when payment is received or made. You recognize revenue when cash enters your business and expenses when you actually pay them. This method is straightforward and commonly used by small businesses and individuals because it directly reflects your actual cash position.

2. Accrual accounting

Records transactions when they occur, regardless of when payment happens. You recognize revenue when earned and expenses when incurred, even if cash hasn't changed hands. This method provides a more accurate picture of your financial performance and is required for larger businesses, as it better matches revenues with related expenses in the same accounting period.

Why understanding both cost and financial accounting matters for business success

1. Informed decision-making through dual insights

When you understand both accounting types, you gain access to comprehensive data that transforms your decision-making capabilities. Cost accounting provides detailed insights into internal operations, production efficiency, and resource utilization, while financial accounting offers external perspectives on profitability, liquidity, and overall financial position.

This dual approach enables you to make strategic decisions backed by both operational efficiency metrics and financial performance indicators, ensuring your choices align with both short-term operational goals and long-term financial sustainability.

2. Holistic financial health assessment

Your business's true financial health emerges only when you combine insights from both accounting disciplines. Cost accounting reveals internal efficiency patterns, highlighting areas where you're optimizing resources and identifying bottlenecks in production or service delivery.

Meanwhile, financial accounting reflects your overall profitability, compliance status, and market position. Together, they provide a complete picture that helps you understand not just whether your business is profitable, but why it's profitable and how sustainable that profitability is in the competitive landscape.

3. Enhanced budgeting and forecasting

Accurate planning becomes achievable when you leverage data from both accounting systems. Cost accounting provides granular details about production costs, overhead allocation, and operational expenses that inform realistic budget projections.

Financial accounting contributes historical performance data, trend analysis, and regulatory compliance requirements that shape your strategic planning. This combination enables you to create more precise forecasts for future investments, allocate resources effectively across departments, and develop growth strategies grounded in both operational realities and financial possibilities.

4. Compliance and reporting synergy

Mastering both accounting types ensures you meet all statutory requirements seamlessly. Financial accounting keeps you compliant with external regulations under the Companies Act, Income Tax Act, and GST provisions, while cost accounting supports internal audit requirements and management reporting standards.

When you understand both systems, you can design processes that satisfy regulatory demands while generating actionable insights for internal decision-making, creating efficiency in compliance rather than treating it as a burden.

5. Competitive advantage through cost control and transparency

The difference between cost accounting and financial accounting becomes your strategic advantage when you harness both effectively. Cost accounting drives operational efficiency through precise cost control, waste reduction, and process optimization.

Financial accounting builds stakeholder confidence through transparent reporting, accurate financial statements, and consistent performance disclosure. By combining cost efficiency with transparent financial reporting, you position your business for sustainable growth while maintaining investor trust and market credibility in an increasingly competitive environment.

Cost accounting vs financial accounting—A quick comparison

Cost accounting and financial accounting serve distinct purposes in business operations, each with unique characteristics and applications. While both systems track financial information, they differ significantly in their approach, users, and regulatory requirements.

Understanding these differences helps businesses implement the right accounting framework for their specific needs. We'll explore the key distinctions across various aspects, including purpose, compliance requirements, reporting timeframes, and decision-making impact in the detailed comparison below.

Cost accounting vs financial accounting—a quick comparison

Key differences between cost accounting and financial accounting

Understanding the distinctions between cost accounting and financial accounting is crucial for business professionals and students alike.

While both serve essential roles in organizational management, they differ significantly in their approaches, objectives, and applications within modern business environments.

1. Purpose

Purpose of cost accounting

Cost accounting focuses on internal management needs by tracking, analyzing, and controlling costs associated with production processes, services, and business operations. Its primary objective is to provide detailed cost information that helps managers make informed decisions about pricing, budgeting, performance evaluation, and resource allocation.

Cost accounting supports strategic planning by identifying cost drivers, measuring efficiency, and determining the profitability of different products, services, or departments. This information enables managers to optimize operations, reduce waste, and improve overall organizational performance.

Purpose of financial accounting

Financial accounting serves external stakeholders by providing a comprehensive view of an organization's financial position, performance, and cash flows. Its main purpose is to communicate financial information to investors, creditors, regulators, and other external parties through standardized financial statements.

Financial accounting ensures transparency and accountability by presenting historical financial data in a format that allows stakeholders to assess the company's financial health, profitability, and future prospects. This information is essential for investment decisions, credit evaluations, and regulatory compliance.

2. Primary users of accounting information

Users of cost accounting information

Internal management teams, including executives, department heads, production managers, and operational supervisors, are the primary users of cost accounting information. These professionals rely on detailed cost data to make tactical and strategic decisions about resource allocation, product pricing, process improvements, and performance evaluation.

Cost accounting information also serves budget planners, project managers, and business analysts who need granular cost details to support their specific functions within the organization.

Users of financial accounting information

External stakeholders constitute the primary audience for financial accounting information. These include investors and shareholders who evaluate investment opportunities, creditors and lenders who assess creditworthiness, regulatory agencies that ensure compliance with financial reporting standards, and potential business partners who need to understand the company's financial stability.

Additionally, financial analysts, auditors, and tax authorities rely on financial accounting information to perform their respective functions and make informed decisions about the organization.

3. Regulatory and statutory compliance

Cost accounting

Cost accounting operates with minimal regulatory oversight and is not subject to mandatory compliance with standardized frameworks. Organizations have significant flexibility in designing their cost accounting systems to meet specific internal needs and objectives.

While certain industries may have specific cost accounting requirements for government contracts or regulatory purposes, companies generally have discretion in choosing their cost accounting methods, procedures, and reporting formats. This flexibility allows organizations to tailor their cost accounting systems to their unique operational requirements and strategic objectives.

Financial accounting

Financial accounting is heavily regulated and must comply with established accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Public companies are required to follow these standards rigorously and submit regular financial reports to regulatory authorities.

The standardized nature of financial accounting ensures consistency, comparability, and reliability of financial information across different organizations and time periods. Non-compliance with these standards can result in legal consequences, penalties, and loss of credibility with stakeholders.

4. Time frame and reporting frequency

Cost accounting

Cost accounting operates on flexible time frames that align with management's decision-making needs. Reports can be generated daily, weekly, monthly, or as needed to support specific operational requirements.

This real-time or near-real-time reporting capability allows managers to respond quickly to changing business conditions, monitor performance against budgets, and make timely adjustments to operations. The frequency and timing of cost accounting reports are determined by internal management needs rather than external regulatory requirements.

Financial accounting

Financial accounting follows standardized reporting periods, typically quarterly and annually, as mandated by regulatory requirements. Public companies must publish quarterly financial statements and comprehensive annual reports within specified timeframes.

This standardized reporting schedule ensures that stakeholders receive consistent and timely financial information for decision-making purposes. The historical nature of financial accounting means that reports reflect past performance and financial position, providing a retrospective view of the organization's financial activities.

5. Scope of information covered

Scope of cost accounting

Cost accounting focuses primarily on internal operational data, including direct materials, direct labor, manufacturing overhead, and other cost elements related to production and service delivery. It covers detailed cost analysis by product, department, process, or activity, providing granular insights into cost behavior and performance.

Cost accounting also encompasses budgeting, variance analysis, and performance measurement systems that help managers understand cost structures and identify opportunities for improvement within their specific areas of responsibility.

Scope of financial accounting

Financial accounting encompasses all financial transactions and events that affect the organization's financial position. This includes assets, liabilities, equity, revenues, expenses, and cash flows from all business activities.

Financial accounting provides a comprehensive view of the organization's entire financial picture, incorporating both operating and non-operating activities. The scope extends beyond internal operations to include external transactions, investments, financing activities, and other events that impact the organization's overall financial performance and position.

6. Types of transactions covered

Cost accounting

Cost accounting focuses on internal transactions related to production, service delivery, and operational activities. This includes material requisitions, labor time records, overhead allocations, work-in-process transfers, and other internal cost movements.

Cost accounting tracks resource consumption patterns, monitors cost center performance, and analyzes cost behavior across different operational activities. The emphasis is on understanding how costs flow through the organization and how they relate to specific products, services, or business segments.

Financial accounting

Financial accounting covers all business transactions that have monetary impact, including sales transactions, purchases, investments, borrowings, asset acquisitions, and other external exchanges. It records both cash and non-cash transactions, such as depreciation, accruals, and provisions.

Financial accounting encompasses transactions with customers, suppliers, employees, investors, lenders, and government entities. The comprehensive nature of financial accounting ensures that all economic events affecting the organization are properly recorded and reported to stakeholders.

7. Nature of reports

Cost accounting

Cost accounting reports are highly detailed and customizable, designed to meet specific management information needs. These reports often include variance analyses, cost center performance summaries, product costing schedules, and operational efficiency metrics.

The format and content of cost accounting reports can be tailored to different management levels and functional areas. Reports may include both financial and non-financial metrics, such as production volumes, quality measures, and efficiency ratios, providing a comprehensive view of operational performance.

Financial accounting

Financial accounting reports follow standardized formats prescribed by accounting standards and regulatory requirements. The primary financial statements include the balance sheet, income statement, statement of cash flows, and statement of equity.

These reports present information in a structured format that enables comparison across different companies and time periods. Financial accounting reports are formal documents that must be prepared according to specific guidelines and are often subject to independent audit verification.

8. Dependency on estimates

Cost accounting

Cost accounting relies heavily on estimates and assumptions, particularly for overhead allocation, standard costing, and budgeting purposes. Cost accountants use various estimation techniques to allocate indirect costs, establish standard costs, and forecast future expenses.

These estimates are essential for decision-making but require regular review and adjustment based on actual performance. The use of estimates in cost accounting is acceptable as long as they provide reasonable approximations for management decision-making purposes.

Financial accounting

Financial accounting also involves estimates, but these must be based on reliable evidence and follow established accounting principles. Examples include depreciation methods, bad debt provisions, and inventory valuation techniques.

However, financial accounting estimates are subject to more rigorous standards and must be supportable and consistent with historical patterns. The reliability and accuracy of estimates in financial accounting are crucial because they affect the financial statements used by external stakeholders for decision-making.

9. Audit requirements

Cost accounting

Cost accounting systems typically do not require independent external audits, as they are designed primarily for internal management use. However, organizations may conduct internal audits of their cost accounting systems to ensure accuracy and effectiveness.

In certain regulated industries or government contracting situations, cost accounting systems may be subject to external review or compliance audits. The audit requirements for cost accounting are generally less formal and are driven by internal control needs rather than regulatory mandates.

Financial accounting

Financial accounting for public companies is subject to mandatory external audits by independent certified public accountants. These audits verify the accuracy, completeness, and compliance of financial statements with applicable accounting standards.

The audit process includes testing internal controls, examining supporting documentation, and expressing an opinion on the fairness of the financial statements. Private companies may also choose to have their financial statements audited to enhance credibility with lenders, investors, and other stakeholders.

10. Core focus areas

Cost accounting

Cost accounting focuses on internal efficiency, cost control, and operational performance measurement. Key areas include product costing, process improvement, budgeting and variance analysis, and performance evaluation.

Cost accounting emphasizes understanding cost behavior, identifying cost reduction opportunities, and supporting pricing decisions. The focus is on providing actionable information that helps managers optimize operations, improve profitability, and achieve strategic objectives through effective cost management.

Financial accounting

Financial accounting focuses on accurate financial reporting, compliance with accounting standards, and providing transparent information to external stakeholders. Core areas include revenue recognition, asset valuation, liability measurement, and comprehensive income reporting.

Financial accounting emphasizes the fair presentation of financial position and performance, ensuring that stakeholders have reliable information for investment, lending, and other economic decisions. The focus is on historical accuracy and compliance with established reporting standards.

11. Impact on decision-making

Cost accounting

Cost accounting directly supports tactical and operational decision-making by providing detailed cost information for pricing, product mix optimization, make-or-buy decisions, and resource allocation.

Managers use cost accounting information to evaluate performance, identify improvement opportunities, and make short-term operational adjustments. The real-time nature of cost accounting information enables quick responses to changing business conditions and supports continuous improvement initiatives that enhance organizational competitiveness.

Financial accounting

Financial accounting supports strategic decision-making by external stakeholders who use financial statements to evaluate investment opportunities, assess creditworthiness, and monitor organizational performance.

Investors rely on financial accounting information to make buy, hold, or sell decisions, while creditors use it to evaluate loan applications and monitor debt covenant compliance. The standardized nature of financial accounting information enables comparative analysis across different companies and industries, supporting informed economic decision-making.

12. Level of detail and granularity

Cost accounting

Cost accounting provides highly detailed and granular information that can be analyzed at various levels, from individual products to entire departments or business segments. This detailed information includes cost per unit, cost per activity, cost per customer, and other specific cost metrics that help managers understand cost behavior and performance.

The granularity of cost accounting information allows for precise analysis of cost drivers and enables targeted improvement initiatives. Managers can drill down into specific cost components to identify areas for optimization.

Financial accounting

Financial accounting provides summarized information that presents the overall financial picture of the organization. While financial statements contain detailed line items, the level of detail is less granular than cost accounting reports.

Financial accounting focuses on aggregate financial performance and position rather than detailed operational metrics. The summarized nature of financial accounting information makes it suitable for external stakeholders who need an overview of organizational performance rather than detailed operational data.

13. Integration with tools and systems

Cost accounting

Cost accounting systems are typically integrated with enterprise resource planning (ERP) systems, manufacturing execution systems, and other operational databases to capture real-time cost information.

These systems often incorporate advanced analytics tools, business intelligence platforms, and specialized costing software to support detailed cost analysis and reporting. Integration with operational systems enables automatic data capture and reduces manual data entry, improving accuracy and timeliness of cost information.

Financial accounting

Financial accounting systems are integrated with general ledger systems, accounts payable and receivable systems, and regulatory reporting platforms to ensure accurate and timely financial reporting. These systems must comply with accounting standards and regulatory requirements, often requiring specialized financial reporting software and audit trail capabilities.

Integration with various business systems ensures that all financial transactions are properly recorded and reported in accordance with established accounting principles and regulatory requirements.

Benefits and limitations of cost accounting

Cost accounting serves as a vital tool for internal management, providing detailed insights into production costs and operational efficiency. While it offers significant advantages for decision-making and cost control, you should also be aware of its inherent limitations and challenges in implementation.

Benefits of cost accounting

1. Cost control

Cost accounting enables you to monitor and control expenses effectively by providing detailed breakdowns of direct materials, labor, and overhead costs. You can identify cost variances between actual and budgeted expenses, allowing for immediate corrective action. This systematic approach helps you eliminate wasteful spending and optimize resource allocation across different departments and processes.

2. Informed decision-making

You gain access to comprehensive cost data that supports strategic business decisions. Whether you're evaluating product profitability, determining optimal pricing strategies, or deciding on make-or-buy alternatives, cost accounting provides the factual foundation you need. This detailed information helps you assess the financial viability of new projects and investments with greater confidence.

3. Efficiency monitoring

Cost accounting allows you to track operational efficiency by comparing actual performance against established standards. You can identify bottlenecks, measure productivity levels, and benchmark performance across different time periods or business units. This continuous monitoring helps you implement process improvements and maintain competitive advantage in your industry.

4. Inventory management

You can accurately value inventory using various costing methods such as FIFO, LIFO, or weighted average. Cost accounting provides detailed tracking of raw materials, work-in-progress, and finished goods, enabling you to maintain optimal inventory levels. This precision helps you reduce carrying costs while avoiding stockouts that could disrupt production schedules.

5. Supports strategic planning

Cost accounting data forms the foundation for long-term strategic planning and budgeting processes. You can analyze historical cost trends, project future expenses, and develop realistic financial forecasts. This information enables you to set achievable targets, allocate resources effectively, and align operational activities with your overall business objectives.

Limitations of cost accounting

1. Complex and time-consuming

Cost accounting systems require significant time and resources to implement and maintain effectively. You must invest in specialized software, train personnel, and establish detailed data collection procedures. The complexity increases with business size and diversity, making it challenging for smaller organizations to justify the investment required for comprehensive cost accounting systems.

2. Not universally applicable

Cost accounting works best in manufacturing environments where costs can be easily traced to specific products or processes. You may find it less effective in service industries or organizations with intangible outputs. The system's effectiveness diminishes when dealing with joint products, by-products, or businesses with highly variable cost structures.

3. Heavily dependent on estimates

Many cost allocations rely on estimates and assumptions that may not reflect actual resource consumption. You must make subjective decisions about overhead allocation bases, standard costs, and capacity utilization rates. These estimates can introduce inaccuracies that compromise the reliability of cost information and potentially lead to misguided management decisions.

4. No standard format

Unlike cost accounting and financial accounting, cost accounting lacks standardized reporting formats and procedures. You have flexibility in designing your system, but this creates challenges when comparing performance across different organizations or time periods. The absence of universal standards can make it difficult to benchmark your costs against industry competitors.

5. Limited external use

Cost accounting information is primarily designed for internal management purposes and has limited value for external stakeholders. You cannot use this data for financial reporting to investors, creditors, or regulatory authorities, who require information prepared according to generally accepted accounting principles. This limitation means you must maintain separate accounting systems for different purposes.

Advantages and disadvantages of financial accounting

Financial accounting serves as the cornerstone of business reporting, providing you with structured financial information that meets regulatory requirements and stakeholder needs. While it offers crucial benefits for external communication and compliance, you should also understand its inherent limitations that may affect your decision-making processes.

Advantages of financial accounting

Financial accounting provides you with numerous benefits that are essential for running a successful business. Unlike cost accounting, which focuses on internal cost management and control, financial accounting creates standardized reports that serve external stakeholders and regulatory bodies.

This difference between cost and financial accounting highlights why financial accounting remains indispensable for business operations.

1. Ensures legal and regulatory compliance

You must comply with various legal and regulatory requirements, and financial accounting helps you meet these obligations. Financial statements prepared according to accounting standards like GAAP or IFRS ensure that your business adheres to statutory requirements, avoiding legal penalties and maintaining good standing with regulatory authorities.

2. Provides standardized and comparable reports

Financial accounting gives you standardized reporting formats that enable easy comparison across different periods and with other businesses in your industry. These uniform standards help you benchmark your performance and make informed strategic decisions based on reliable, comparable data.

3. Useful for external stakeholders

Your investors, banks, creditors, and regulatory bodies rely on financial accounting information to make decisions about your business. These stakeholders need transparent, accurate financial data to assess your company's financial health, profitability, and growth prospects.

4. Facilitates loans, funding, and investor trust

When you seek financing or investment, financial accounting records serve as crucial evidence of your business's financial stability and performance. Banks and investors use these reports to evaluate creditworthiness and investment potential, making it easier for you to secure funding.

5. Helps assess overall business performance

Financial accounting provides you with comprehensive insights into your business's overall performance through profit and loss statements, balance sheets, and cash flow statements. This information helps you evaluate your company's financial position and make strategic decisions for future growth.

Disadvantages of financial accounting

Despite its advantages, financial accounting has several limitations that you should consider when using it for business management. These constraints can affect your ability to make timely decisions and gain detailed operational insights.

1. Focuses on past data, not future planning

Financial accounting primarily records historical transactions and events, which means you're looking at past performance rather than future projections. This backward-looking nature limits your ability to use financial accounting for strategic planning and forecasting future business scenarios.

2. Lacks detailed operational insights

You won't find specific departmental or product-level details in financial accounting reports. These statements provide aggregate information that doesn't help you identify operational inefficiencies or understand the performance of individual business units, products, or services.

3. Reports are periodic, not real-time

Financial accounting reports are typically prepared monthly, quarterly, or annually, which means you don't have access to real-time financial information. This delay can hinder your ability to respond quickly to changing market conditions or emerging business challenges.

4. Not ideal for internal decision-making

Since financial accounting is designed primarily for external stakeholders, it may not provide the detailed, timely information you need for day-to-day operational decisions. Internal management requires more specific, frequent, and detailed financial data than what financial accounting typically provides.

5. Can be manipulated within legal limits

Financial accounting allows for certain subjective judgments and estimates, which means you might encounter "window dressing" – the practice of presenting financial information in the most favorable light while staying within legal boundaries. This manipulation can sometimes obscure the true financial picture of your business.

Role of accounting in Indian regulatory landscape

When you navigate India's regulatory environment, understanding the distinction between cost accounting and financial accounting becomes crucial. Cost accounting focuses on internal management decisions by tracking production costs, overhead allocation, and operational efficiency.

Financial accounting, however, emphasizes external reporting requirements, statutory compliance, and stakeholder communication. Both systems interconnect within Indian regulatory frameworks to ensure comprehensive business oversight and legal adherence.

1. Companies Act, 2013

Under the Companies Act, 2013, you must maintain proper books of accounts reflecting a true and fair financial position. The Act mandates specific accounting standards, audit requirements, and board reporting obligations.

Your company's financial statements must comply with Indian Accounting Standards (Ind AS) or applicable accounting principles, ensuring transparency for shareholders and regulatory authorities.

2. Income Tax Act

The Income Tax Act requires you to maintain accounting records that support your tax computations and claims. Your books must substantiate income, deductions, and allowances claimed on tax returns.

The Act prescribes specific methods for depreciation, inventory valuation, and expense recognition that may differ from commercial accounting practices, necessitating careful reconciliation between book profits and taxable income.

3. GST compliance

GST compliance demands meticulous record-keeping of all transactions, input tax credits, and output tax liabilities. You must maintain detailed registers, invoices, and supporting documents in prescribed formats.

The accounting system should facilitate accurate GST return filing, input credit reconciliation, and audit trail maintenance to ensure seamless compliance with GST regulations and avoid penalties.

4. ICAI guidelines

The Institute of Chartered Accountants of India (ICAI) provides authoritative guidance on accounting standards, auditing practices, and professional ethics. You must follow ICAI's pronouncements on accounting treatments, disclosure requirements, and presentation formats.

These guidelines ensure consistency in financial reporting and maintain professional standards across the accounting fraternity in India.

5. Cost audit rules

Cost Audit Rules under the Companies Act mandate detailed cost accounting records for specified industries and company sizes. You must maintain cost records showing particulars of utilization of materials, labor, and overheads.

The rules require the appointment of cost auditors, submission of cost audit reports, and compliance with cost accounting standards to ensure efficient resource utilization and cost control.

Industry-wise relevance of cost and financial accounting

Understanding how different sectors in India prioritize cost versus financial accounting helps businesses optimize their accounting practices based on industry-specific needs and regulatory requirements.

Manufacturing

Manufacturing companies heavily rely on cost accounting for production optimization, inventory valuation, and pricing strategies. Detailed cost centers, material consumption tracking, and overhead allocation are critical for profitability analysis.

Standard costing, variance analysis, and activity-based costing help manufacturers control expenses, improve efficiency, and maintain competitive pricing in India's price-sensitive market environment.

Retail/trading

Retail and trading businesses primarily focus on financial accounting for inventory management, sales tracking, and margin analysis. Cash flow management, accounts receivable/payable, and periodic financial statements are essential.

Cost accounting remains minimal, mainly involving simple purchase-to-sale cost tracking. GST compliance, revenue recognition, and working capital management drive most accounting priorities in this sector.

IT/services

IT and service companies use light cost accounting, mainly for project costing and resource allocation. Financial accounting emphasizes accrual-based revenue recognition, deferred revenue management, and compliance with international standards.

Software capitalization, intellectual property valuation, and foreign exchange accounting are key focus areas. Service delivery margins and billing efficiency drive accounting decisions more than traditional cost controls.

Startups/SMEs

Startups and SMEs need both cost and financial accounting for scaling operations and building investor trust. Cost accounting helps optimize burn rates and unit economics, while financial accounting ensures compliance and transparency for funding rounds.

Management information systems, cash flow forecasting, and statutory compliance become increasingly important as these businesses grow and seek external investment or partnerships.

NBFCs/finance

Non-banking financial companies and financial institutions operate under strict regulatory frameworks requiring robust financial accounting systems. RBI compliance, provisioning norms, capital adequacy ratios, and asset quality monitoring drive accounting priorities.

Cost accounting focuses on operational efficiency and branch profitability. Risk management, audit trails, and regulatory reporting dominate the accounting function in this heavily regulated sector.

How smart accounting tools transform your finance function

Modern businesses can't afford inefficiencies in financial management. With increasing complexity in compliance, operations, and scalability, choosing the right accounting tools becomes mission-critical. The right mix of cost accounting, financial accounting, and automation ensures data-driven decisions, real-time visibility, and competitive advantage.

1. Align tools with business size and complexity

Your accounting software should grow with your business, not hold it back. Small businesses need straightforward solutions that handle basic bookkeeping, invoicing, and tax preparation without overwhelming complexity.

Mid-sized companies require more sophisticated capabilities. Enterprise organizations demand comprehensive ERP integration, advanced analytics, and robust compliance features. Consider your transaction volume, number of users, and reporting complexity when making your selection.

A tool that's too simple will limit your growth, while one that's too complex will waste resources and reduce adoption rates.

2. Prioritize integration and automation

Disconnected systems create data silos and manual inefficiencies that drain your team's productivity. Your accounting tools should seamlessly integrate with your existing tech stack, including CRM systems, inventory management, payroll, and banking platforms.

API-first platforms enable smooth data flow between applications, eliminating duplicate data entry and reducing errors. Set up automated workflows for recurring transactions, month-end closing procedures, and standard reports. This consistency improves accuracy while reducing the time required for routine financial operations.

3. Ensure compliance and reporting accuracy

Regulatory compliance isn't optional, and manual processes increase your risk of errors and penalties. Your accounting tools should automatically handle tax calculations, generate required reports, and maintain audit trails that satisfy regulatory requirements.

Choose solutions that stay current with changing regulations in your industry and geographic regions. Cloud-based platforms typically provide automatic updates for tax rates, reporting formats, and compliance requirements, reducing your administrative burden.

4. Focus on real-time cost control

Traditional monthly reporting cycles leave you reacting to problems rather than preventing them. Real-time cost tracking enables proactive management of your financial performance, helping you identify issues before they impact your bottom line.

Modern cost accounting tools provide instant visibility into project profitability, departmental spending, and resource allocation. This immediate feedback allows you to adjust strategies, reallocate resources, and optimize operations based on current data rather than historical reports.

Implement automated alerts for budget variances, unusual spending patterns, or cash flow concerns.

5. Look for insight-driven features

You need tools that transform raw data into actionable insights through advanced analytics, forecasting capabilities, and predictive modeling. Machine learning algorithms can identify spending patterns, predict cash flow trends, and flag potential issues before they become problems.

These intelligent features help you make more informed decisions and optimize your financial performance. Connect your accounting data with sales performance, operational metrics, and market indicators to gain comprehensive business insights that drive strategic planning and competitive advantage.

The role of automation in streamlining cost and financial accounting

Traditional accounting processes burden you with time-consuming manual tasks, creating delays and leaving room for human error. Cost and financial accounting systems often operate in silos, leading to inefficiencies and inconsistent data across departments.

Modern automation tools revolutionize both domains by integrating real-time data processing, eliminating redundant tasks, and providing seamless workflows that enhance accuracy and speed in your accounting operations.

Benefits of automating cost accounting

- ● Real-time tracking of input costs

Automation enables you to monitor material, labor, and overhead costs as they occur, eliminating the lag time associated with manual data collection. Real-time cost tracking provides immediate visibility into cost variances, allowing you to make informed decisions quickly.

This instant access to cost data helps you identify inefficiencies before they impact your bottom line and maintain tighter control over your budget allocations.

- ● Integration with inventory and production systems

Automated cost accounting systems seamlessly connect with your inventory management and production planning platforms, creating a unified data ecosystem. This integration ensures that cost calculations automatically reflect current inventory levels, production schedules, and resource utilization.

You benefit from synchronized data across all systems, reducing the risk of discrepancies and providing a comprehensive view of your operational costs.

- ● Automated cost allocation by job/process

Modern systems automatically distribute costs across different jobs, projects, or processes based on predetermined allocation rules and real-time activity data. This automation eliminates the tedious manual calculations traditionally required for cost allocation, ensuring consistent and accurate distribution of overhead costs.

You can easily track profitability by project or department while maintaining detailed cost breakdowns for analysis and reporting purposes.

- ● Predictive insights for cost control

Advanced automation tools use historical data and machine learning algorithms to forecast future costs and identify potential cost overruns before they occur. These predictive capabilities enable you to implement proactive cost control measures and adjust your strategies based on anticipated trends.

You gain valuable insights into cost patterns, seasonal variations, and operational efficiency metrics that support strategic decision-making.

- ● Reduced manual data entry and fewer errors

Automation significantly minimizes the need for manual data input by capturing information directly from source systems and transactions. This reduction in manual processes eliminates human error, improves data accuracy, and frees up your accounting team to focus on analysis and strategic tasks.

You benefit from consistent data quality and reduced time spent on error correction and reconciliation activities.

Benefits of automating financial accounting

- ● Auto-generation of statutory financial statements

Automated systems compile and generate your financial statements directly from transaction data, ensuring compliance with accounting standards and regulations. Financial accounting vs cost accounting becomes seamless as the system automatically categorizes and reports both internal cost data and external financial information.

You receive accurate balance sheets, income statements, and cash flow statements without manual compilation, reducing preparation time and enhancing reliability.

- ● Seamless tax and compliance reporting

Automation streamlines your tax preparation and regulatory compliance by automatically organizing transactions according to tax requirements and generating necessary reports. The system maintains up-to-date tax codes and regulatory changes, ensuring your reports remain compliant with current laws.

You can easily access audit-ready documentation and submit required filings with confidence in their accuracy and completeness.

- ● Integration with invoicing, payments, and banking

Automated financial accounting systems connect directly with your invoicing platforms, payment processors, and banking systems to create a seamless financial workflow. This integration automatically records transactions, updates account balances, and reconciles bank statements without manual intervention.

You benefit from real-time financial position updates and reduced time spent on routine reconciliation tasks.

- ● Real-time dashboards for stakeholders

Modern automation provides interactive dashboards that display key financial metrics and performance indicators in real-time for different stakeholder groups. These dashboards offer customizable views for management, investors, and department heads, ensuring everyone has access to relevant financial information.

You can monitor cash flow, profitability, and other critical metrics instantly, enabling faster decision-making and improved stakeholder communication.

- ● Audit trail maintenance and version control

Automated systems maintain comprehensive audit trails that track every transaction, modification, and user interaction within your financial accounting processes. This built-in documentation ensures compliance with auditing standards and provides clear visibility into data changes over time.

You benefit from automatic version control that preserves historical records while maintaining data integrity and supporting regulatory requirements.

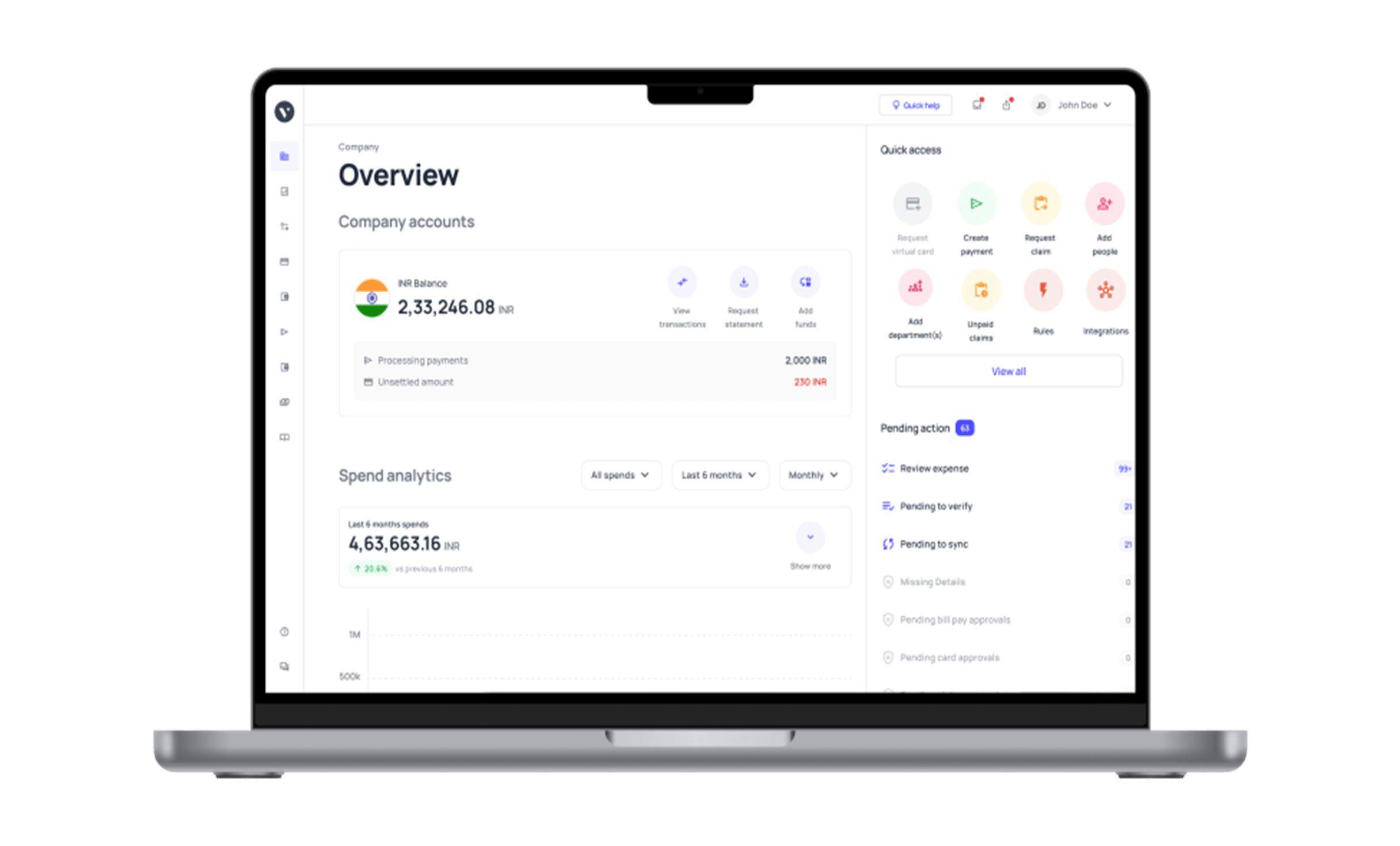

How Volopay simplifies cost and financial accounting with automation

Managing your business finances shouldn't be a constant juggling act between cost tracking and financial reporting. While cost accounting focuses on internal decision-making and operational efficiency, financial accounting ensures compliance and external reporting.

You need both working seamlessly together, and Volopay's accounting automation platform makes this possible by eliminating manual processes and reducing errors.

Real-time expense tracking and categorization

Your expenses are automatically captured, categorized, and synced to your accounting system the moment they occur. No more manual data entry or delayed reconciliations. Every transaction is instantly recorded with proper categorization, ensuring your financial records are always current and accurate for both internal cost analysis and external reporting requirements.

Seamless integration with accounting software

You can connect Volopay directly with your existing accounting platforms like Tally, Xero, and NetSuite without disrupting your current workflows.

This integration eliminates data silos and ensures consistent information flows between your expense management and accounting systems, reducing the time you spend on manual data transfers and reconciliation tasks.

Automated vendor payments and reconciliation

Your invoice processing becomes effortless as Volopay automatically matches payments with corresponding bills and vendor invoices. This automation reduces payment errors, ensures timely vendor settlements, and creates audit-ready documentation. You'll spend less time on manual reconciliation and more time on strategic financial analysis and decision-making.

Customizable cost center allocation

You can automatically assign expenses to specific departments, teams, or projects based on predefined rules and spending patterns. This automated allocation gives you precise visibility into where your money is going, enabling better internal cost control and more accurate project profitability analysis without manual intervention or guesswork.

Spend controls and policy enforcement

Your spending policies are automatically enforced through pre-configured budgets, approval workflows, and spending limits. The system prevents unauthorized expenses before they occur and ensures compliance with your company's financial policies. This proactive approach reduces policy violations and gives you better control over your organization's financial health.

Centralized dashboard for financial visibility

You get a comprehensive view of your entire financial landscape in one unified dashboard. Track company-wide spending, monitor vendor liabilities, and analyze budget utilization across all departments and projects. This centralized visibility helps you make informed decisions quickly and maintain better oversight of your organization's financial performance.

Faster, error-free reporting

Your financial reports and audit documentation are generated automatically with complete accuracy and compliance standards. The system eliminates manual report preparation, reduces human error, and ensures your financial summaries are always ready for internal reviews, external audits, and stakeholder presentations without the usual time-consuming preparation process.

Bring Volopay to your business

Get started now

FAQs

Cost accounting tracks direct costs (materials, labor), indirect costs (overhead, utilities), fixed costs (rent, salaries), variable costs (raw materials), and opportunity costs for comprehensive expense analysis.

Cost accounting excels at budgeting and forecasting because it provides detailed cost breakdowns, variance analysis, and predictive insights that help management make informed financial planning decisions.

Financial accounting produces four main statements: balance sheet (assets/liabilities), income statement (revenues/expenses), cash flow statement (cash movements), and statement of retained earnings (equity changes).

Manufacturing, construction, healthcare, retail, and service industries benefit most from cost accounting due to complex operations, multiple cost centers, and need for precise profitability analysis.

Yes, modern accounting software integrates both systems, allowing seamless data flow between cost tracking and financial reporting while maintaining separate analytical capabilities for each function.

Volopay uses AI-powered receipt scanning, automatic expense categorization, real-time spend tracking, and integrates with accounting systems to eliminate manual data entry and reduce errors.

Yes, Volopay automatically enforces spending limits, approval workflows, merchant restrictions, and policy compliance checks before transactions are processed, ensuring adherence to company guidelines.

Volopay employs bank-grade encryption, multi-factor authentication, role-based access controls, regular security audits, and compliance with international financial data protection standards for maximum security.