👋 Exciting news! UPI payments are now available in India! Sign up now →

What is a comparative balance sheet?

If you want to track your business’s financial journey, a comparative balance sheet is your key tool. It reveals how your assets, liabilities, and equity shift over time, offering clarity for growth and compliance with Indian regulations. Whether you’re a startup or an established firm, understanding the comparative balance sheet empowers you to make smarter financial decisions.

This guide walks you through its basics, creation, and analysis, helping you leverage the comparative balance sheet for strategic planning. Dive into master this essential tool and drive your business forward in India’s dynamic market.

Understanding the basics of a comparative balance sheet

1. What is a comparative balance sheet?

A comparative balance sheet displays your financial position across multiple periods say, two fiscal years side by side. You see assets, liabilities, and equity for each period, making it easy to spot changes. For Indian businesses, the comparative balance sheet aligns with accounting standards like Ind AS, ensuring compliance.

It’s not just a snapshot; it’s a tool to compare your financial standing over time. By presenting data in columns, the comparative balance sheet helps you track progress, assess stability, and plan ahead with confidence in India’s competitive landscape.

2. Core elements you need to know

Your comparative balance sheet includes key components: assets, liabilities, and equity. Assets cover current items like cash and inventory, and non-current ones like property. Liabilities are split into short-term debts (e.g., payables) and long-term loans. Equity reflects your capital and retained earnings. In a comparative balance sheet, you list these for multiple periods, revealing shifts.

For instance, if your cash grows or debt drops, you’ll see it clearly. Understanding these elements helps you grasp your financial health, crucial for navigating India’s regulatory and market demands effectively.

3. How it provides a dynamic financial overview

Unlike a single-period balance sheet, a comparative balance sheet gives you a dynamic view. You compare data across years—say, 2023 and 2024—to spot trends like rising revenue or shrinking liabilities. This approach shows how your business evolves, highlighting strengths and weaknesses. For example, a comparative balance sheet might reveal consistent asset growth, signalling stability.

In India, where market conditions shift fast, this dynamic perspective helps you adapt. You gain insights beyond static numbers, empowering you to make informed decisions for growth and sustainability.

4. Historical context in financial reporting

The comparative balance sheet evolved from basic ledger records to a modern accounting staple. Decades ago, businesses in India and beyond relied on single-period reports, but globalization and regulations like Ind AS pushed for better tools.

Now, the comparative balance sheet lets you track financial shifts over time, meeting stakeholder and regulatory needs. Its rise reflects the demand for transparency in financial reporting. By using a comparative balance sheet, you tap into this history, aligning your business with best practices for clarity and compliance.

5. How it supports business transparency

A comparative balance sheet boosts transparency by showing your financial changes clearly. You present assets, liabilities, and equity across periods, so stakeholders investors, partners, or regulators see how your business performs over time. For example, if liabilities drop or equity rises, the comparative balance sheet highlights this progress.

In India, where trust drives partnerships, this clarity builds accountability. You share a comparative statement of balance sheet to reveal trends, ensuring everyone understands your financial story. This openness strengthens your credibility and supports sound decision-making.

Why a comparative balance sheet matters to your business

1. Tracking financial health over time

A comparative balance sheet helps you monitor your business’s financial stability. You compare assets, liabilities, and equity across years to see if cash reserves grow or debts shrink. For instance, a steady rise in assets signals strength.

In India, where economic shifts impact businesses, the comparative balance sheet keeps you on track. You spot patterns say, consistent profit retention ensuring your firm stays solvent.

Regularly reviewing this tool empowers you to address weaknesses early and maintain a healthy financial foundation.

2. Identifying growth opportunities

With a comparative balance sheet, you uncover areas for expansion. You might notice rising cash reserves, suggesting room to invest in new equipment or markets. By comparing periods, the comparative balance sheet reveals trends like increased inventory turnover, hinting at demand growth.

In India’s dynamic economy, this insight helps you seize opportunities perhaps opening a new branch or boosting production. You use these findings to prioritize resources, ensuring your business scales effectively and stays competitive in a fast-paced market.

3. Supporting strategic planning in India

The comparative balance sheet aids strategic planning by showing financial trends. You navigate India’s unique challenges GST compliance, inflation, or market shifts with clear data. For example, if liabilities rise, you rethink borrowing strategies. The comparative balance sheet highlights strengths, like growing equity, to guide expansion plans.

You align decisions with India’s regulatory landscape, ensuring compliance and growth. This tool empowers you to craft strategies that tackle local hurdles and capitalize on opportunities, keeping your business agile and future ready.

4. Enhancing accountability with stakeholders

A comparative balance sheet builds trust by showing financial trends to stakeholders. You present clear shifts in assets or liabilities, so investors and partners grasp your progress. For instance, a comparative statement of balance sheet might reveal reduced debt, proving sound management. In India, where relationships drive business, this transparency strengthens ties.

You share the comparative balance sheet to demonstrate accountability, reassuring stakeholders of your commitment to growth and stability, fostering confidence for long-term collaboration.

5. Aligning with long-term business goals

Use a comparative balance sheet to set and achieve financial objectives. You track metrics like equity growth or debt reduction over time, aligning with goals like profitability or expansion. For example, if assets rise steadily, you’re on track for investment targets.

The comparative balance sheet guides you in India’s complex market, ensuring decisions support your vision. You adjust strategies based on trends, keeping your business focused on sustainable, long-term success and steady progress.

Building a comparative balance sheet: Step-by-step guide

Collecting data across financial periods

Start by gathering balance sheet data for at least two periods say, 2024 and 2025. You need records of assets (cash, inventory), liabilities (loans, payables), and equity from your ledger or trial balance.

For Indian businesses, ensure data aligns with Ind AS standards. A comparative balance sheet relies on accurate, complete figures, so check your financial statements carefully.

You might pull reports from accounting software or past filings. This step sets the foundation for a reliable comparative balance sheet, giving you a clear base for comparison.

Structuring your comparative balance sheet

Arrange your comparative balance sheet for clarity. You list assets, liabilities, and equity in rows, with columns for each period—e.g., 2023 and 2024. Place current assets (cash, receivables) first, then non-current (property). Follow with current and long-term liabilities, then equity.

This layout makes your comparative balance sheet easy to read. In India, align with standard formats for compliance. You ensure each period’s data is side by side, helping you spot changes quickly and present a clear financial picture.

Calculating period-over-period changes

Add columns to your comparative balance sheet for absolute and percentage changes. For absolute change, subtract the prior year’s figure from the current year—e.g., 2024 assets minus 2023 assets.

For percentage change, use the comparative balance sheet formula: (Change / Prior Year) × 100. If cash was ₹10 lakh in 2023 and ₹12 lakh in 2024, the change is ₹2 lakh, or 20%.

You apply this comparative balance sheet formula to each line item, revealing growth or decline, crucial for informed decisions in India.

Ensuring accuracy and validating data

Double-check your comparative balance sheet for accuracy. You cross-verify figures with source documents ledgers, trial balances, or bank statements to catch errors. A typo in assets or liabilities skews your analysis. For Indian businesses, ensure compliance with Ind AS and GST records.

You review each entry, confirming that amounts match the original data. Use accounting software to minimize manual mistakes. This step ensures your comparative balance sheet is reliable, giving you confidence in the insights it provides for planning and reporting.

Interpreting trends and identifying anomalies

Analyze your comparative balance sheet to spot trends and anomalies. You look for patterns—say, steady asset growth or declining debt—signalling financial health. A sudden spike in liabilities or a drop in cash might flag issues like overspending. Use the comparative balance sheet formula to quantify changes, helping you understand shifts.

In India, watch for market-driven anomalies, like inflation impacts. You dig into unusual figures, ensuring your comparative balance sheet guides smart adjustments and early action for stability.

Saving templates for future use

Create reusable templates for your comparative balance sheet to save time. You design a format with columns for periods, changes, and key categories assets, liabilities, equity. Use spreadsheets like Excel or accounting software to store this. In India, ensure the template fits Ind AS standards.

You update it with new data each period, streamlining comparisons. This approach keeps your comparative balance sheet consistent, letting you focus on analysis rather than setup, boosting efficiency for ongoing financial tracking.

The layout and design of a comparative balance sheet—best practices

You craft a comparative balance sheet to be clear and impactful. A well-designed layout helps you understand financial shifts quickly.

Follow these best practices to ensure your comparative balance sheet is readable and effective for your Indian business. From organizing data to adding visuals, these tips enhance clarity and usability for decision-making and stakeholder reviews.

1. Crafting a clear and effective format

Design your comparative balance sheet with simplicity in mind. You use columns for each period e.g., 2023 and 2024 listing assets, liabilities, and equity in rows. Keep fonts clean and consistent. Add clear headings and align numbers for easy scanning. In India, ensure your format meets Ind AS guidelines.

You aim for a comparative balance sheet that’s uncluttered, letting you and stakeholders quickly grasp financial changes and trends.

2. Organizing financial categories logically

Group items logically in your comparative balance sheet. You start with current assets (cash, inventory), then non-current (equipment, property). Follow with current liabilities (payables), long-term debts, and finally equity. This order mirrors standard accounting practices in India. You ensure each category is clearly labeled, making the comparative balance sheet intuitive.

A logical flow helps you compare periods effectively, spotting shifts in financial health with ease and precision for better planning.

3. Visual aids for better interpretation

Enhance your comparative balance sheet with visuals. You add charts like a bar graph for asset growth or a line chart for liability trends to highlight key shifts. Use color coding, such as green for increases and red for declines, to draw attention. These aids make your comparative balance sheet easier to interpret.

In businesses, where quick insights matter, visuals help you and stakeholders grasp financial patterns fast, boosting decision-making power.

4. Customizing for stakeholder presentations

Tailor your comparative balance sheet for stakeholders. For investors, you highlight equity and profit trends; for banks, focus on debt and liquidity. Use simple language and bold key figures in the comparative balance sheet for clarity.

Further, adapt to regulatory needs or lender expectations. You might add summary notes or charts for presentations, ensuring your comparative balance sheet meets their needs, builds trust, and supports funding or partnership goals.

Analyzing a comparative balance sheet: Formula and techniques

1. Calculating year-over-year changes

Compute changes in your comparative balance sheet to understand shifts. You calculate absolute change by subtracting the prior year’s figure from the current, e.g., 2024 cash minus 2023 cash. For percentage change, apply the comparative balance sheet formula: (Change / Prior Year) × 100.

If inventory rises from ₹5 lakh to ₹6 lakh, that’s a 20% increase. You use this in your comparative balance sheet to quantify growth or decline, guiding decisions in India’s market.

2. Identifying trends with ratio analysis

Use ratios in your comparative balance sheet to spot trends. You calculate debt-to-equity (total liabilities / equity) to assess risk. If it drops over time, your business gains stability. Other ratios, like current ratio (assets / liabilities), show liquidity. In a comparative balance sheet, you track these across periods, revealing patterns.

For Indian firms, this helps you gauge financial health, ensuring you adapt to market and regulatory shifts effectively.

3. Spotting red flags in financial data

Your comparative balance sheet helps you catch issues. You look for red flags like rising liabilities or falling cash across periods. A sudden drop in assets might signal sales issues, while spiking debt could mean overborrowing.

In India, watch for inflation-driven distortions. You analyze the comparative balance sheet to spot these early, letting you act fast—cut costs or adjust plans—to protect your business from risks.

4. Using insights to adjust business strategies

Apply your comparative balance sheet insights to refine plans. If you see growing assets but static revenue, you might boost marketing. A rise in liabilities could push you to cut debt.

For the Indian market, use the comparative balance sheet to navigate market shifts or GST demands. You tweak strategies—reallocating funds or adjusting goals—based on trends, ensuring your business stays agile and competitive in a dynamic environment.

5. Benchmarking against industry standards

Compare your comparative balance sheet to industry averages. You check metrics like asset growth or debt levels against Indian sector norms—e.g., retail or tech standards. If your equity lags, you rethink capital strategies.

Sources like trade reports provide benchmarks. This use of the comparative balance sheet gives context, helping you gauge performance and align with competitors, strengthening your position in India’s market.

6. Documenting findings for future reference

Record insights from your comparative balance sheet for later use. You note trends—say, steady cash growth or rising debt—in a log or report. This helps you track progress over time, especially in India’s fast-changing economy. You store notes with your comparative balance sheet, ensuring you revisit key findings.

This practice supports consistent analysis, letting you refine strategies and stay on course for growth and stability.

Benefits of leveraging a comparative balance sheet

Gaining clarity on financial performance

A comparative balance sheet clarifies your financial shifts. You see how revenue, expenses, or assets change over periods—e.g., rising cash from sales. This insight helps you gauge performance clearly.

In India, where markets fluctuate, the comparative balance sheet reveals if profits grow or costs spike. You use this to assess your business’s health, making informed moves to boost efficiency and profitability.

Improving resource allocation decisions

Use your comparative balance sheet to guide fund distribution. You spot trends—say, excess cash or low inventory—across periods. This shows where to invest, like in marketing or equipment.

In India, efficient allocation drives growth. The comparative balance sheet helps you prioritize departments, ensuring resources fuel expansion or cut waste, keeping your business competitive and lean.

Strengthening financial forecasting accuracy

Your comparative balance sheet boosts forecasting. You analyze historical trends—asset growth or debt reduction—to predict future outcomes. If equity rises steadily, you project stronger profits.

In India, where economic shifts like inflation matter, the comparative balance sheet grounds your estimates. You refine budgets and plans, ensuring your forecasts align with real data for better accuracy.

Building confidence for loan applications

A comparative balance sheet strengthens loan applications. You show lenders stable trends—say, growing assets or shrinking debt—proving financial health. In India, banks value this clarity.

A solid comparative balance sheet demonstrates repayment ability, boosting confidence. You present clear data, increasing your chances of securing funds for expansion or operations.

Supporting cost-cutting initiatives

Identify savings with your comparative balance sheet. You spot rising expenses or stagnant assets across periods, flagging waste. For example, if liabilities grow unchecked, you target cuts.

In businesses, where margins matter, the comparative balance sheet guides you to trim unnecessary costs—say, excess inventory—freeing resources for growth and efficiency.

Challenges you might face with a comparative balance sheet

1. Dealing with inconsistent accounting practices

Inconsistent methods challenge your comparative balance sheet. If you switch accounting rules—say, from cash to accrual—data across periods misaligns. This distorts trends in your comparative balance sheet.

In India, align with Ind AS consistently. You must review past records, adjust entries, and standardize practices to ensure your comparative balance sheet remains reliable and comparable.

2. Adjusting for economic factors in India

Economic shifts impact your comparative balance sheet. Inflation or rupee fluctuations in India alter asset or liability values, skewing comparisons.

You should adjust figures for real terms—e.g., account for inflation in cash values. This keeps your comparative balance sheet accurate, helping you interpret trends fairly and plan effectively in India’s dynamic economy.

3. Overcoming data quality issues

Poor data hurts your comparative balance sheet. Missing or wrong figures—say, unrecorded liabilities—lead to errors. You tackle this by verifying records against ledgers or bank statements. In India, cross-check GST filings too.

You should ensure complete, accurate data, making your comparative balance sheet a trustworthy tool for analysis and decisions.

4. Balancing complexity with usability

A comparative balance sheet can get complex with too many periods or details. You keep it manageable—limit to two or three years and key items. In India, focus on essentials like assets and debts for clarity.

You ought to simplify the comparative balance sheet, ensuring it’s useful for quick, effective decision-making without overwhelming you.

5. Managing stakeholder expectations

Stakeholders may interpret your comparative balance sheet differently. Investors might focus on equity, banks on debt. You address this by explaining trends clearly—e.g., why assets dipped.

In businesses, tailor reports to their needs, using your comparative balance sheet to align views, build trust, and meet diverse expectations effectively.

Using a comparative balance sheet to optimize financing strategies

1. Assessing your business’s credit profile

Use your comparative balance sheet to evaluate loan eligibility. You check trends—rising assets or falling liabilities—showing stability. A strong comparative statement of balance sheet proves creditworthiness to Indian banks.

If equity grows, you signal reliability. You should review debt levels and cash flow, ensuring your comparative balance sheet positions you well for loans or credit lines to fuel growth.

2. Planning for capital investments

Your comparative balance sheet guides capital spending. You spot excess cash or steady equity growth, signaling room for big purchases—say, equipment. In India, where costs vary, analyze trends to allocate funds wisely.

The comparative balance sheet shows if you can invest without straining liquidity, helping you expand operations or upgrade tech effectively.

3. Managing debt levels effectively

Track debt with your comparative balance sheet. You compare liabilities across periods—e.g., 2023 vs. 2024—to spot rises. If debt climbs, you plan to refinance at better rates or cut borrowing.

For businesses, use the comparative balance sheet to monitor trends, ensuring you manage debt smartly to maintain financial health and flexibility.

4. Supporting vendor payment strategies

Your comparative balance sheet aids vendor payments. You review cash and liability trends to ensure timely payouts. If cash grows, you settle dues faster, strengthening ties.

For businesses, supplier trust matters; therefore, a comparative balance sheet helps you plan, avoiding delays and keeping vendor relationships solid for smooth operations.

5. Evaluating lease vs buy decisions

Decide to lease or buy with your comparative balance sheet. You analyze cash and debt trends—e.g., strong liquidity favors buying equipment. In India, weigh costs against trends in your comparative balance sheet.

If liabilities are high, leasing might save cash. You use this to make cost-effective choices for assets.

6. Preparing for seasonal financing needs

Anticipate seasonal needs with your comparative balance sheet. You spot cash flow patterns—say, dips during slow months in India’s retail cycle.

Use the comparative balance sheet to plan loans or reserves for peak times. This ensures you cover costs like inventory or wages, keeping your business steady year-round.

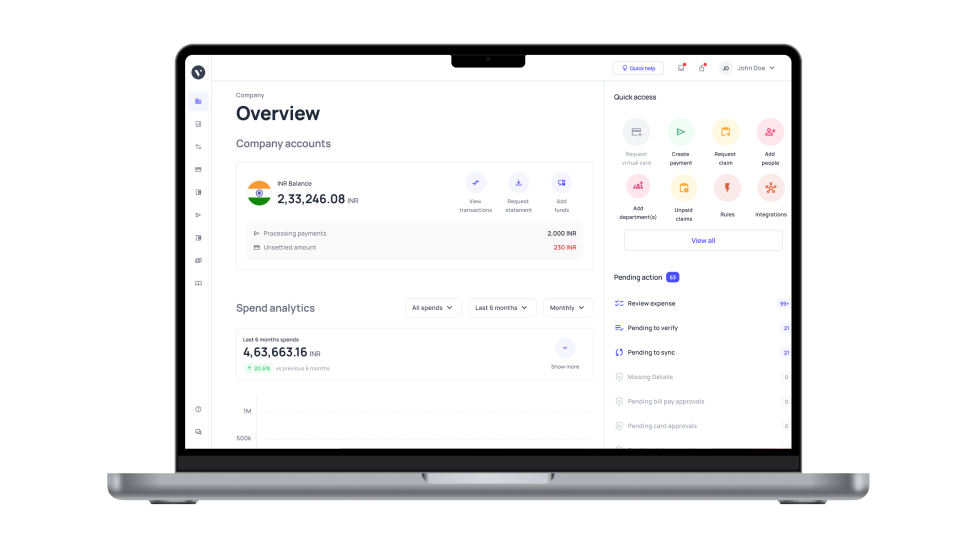

Experience hassle-free business expense tracking with Volopay

How comparative balance sheets fit into broader financial analysis

1. Linking with profit and loss statements

Pair your comparative balance sheet with profit and loss statements. You see how revenue and expenses tie to assets and liabilities. For example, rising profits might boost cash in your comparative balance sheet. In India, this combo reveals full financial health.

You gain insights, blending income trends with balance shifts for smarter decisions.

2. Integrating with cash flow analysis

Combine your comparative balance sheet with cash flow statements. You track liquidity shifts—cash changes across periods—alongside assets and debts. If cash drops despite asset growth, you investigate.

For businesses’ growth, cash is king, and thus this link via the comparative balance sheet ensures you monitor and maintain strong liquidity.

3. Role in comprehensive financial audits

Your comparative balance sheet shines in audits. You provide period-over-period data, showing trends for accuracy and compliance. In India, regulators like tax authorities value this.

The comparative balance sheet simplifies checks, ensuring figures align with ledgers and Ind AS, helping you pass audits with confidence and ease.

4. Combining with budget variance reports

Use your comparative balance sheet with budget variance reports. You compare actual assets and liabilities to planned figures, spotting gaps. If spending exceeds budget, you adjust.

For businesses, this ties the comparative balance sheet to goals, helping you refine plans, control costs, and stay on track financially.

5. Supporting scenario planning

Model outcomes with your comparative balance sheet. You use trends—say, asset growth—to test scenarios like expansion or cost cuts. In India’s shifting market, this helps you plan.

The comparative balance sheet grounds your what-if models, letting you prepare for risks or growth with data-driven confidence.

6. Enhancing financial dashboards

Boost dashboards with your comparative balance sheet. You can add trends—liability shifts or equity gains—for real-time views.

For businesses, quick decisions matter and therefore integrate the comparative balance sheet into tools like Excel or software. You monitor key metrics live, ensuring you act fast to steer your business effectively.

Industry-specific applications of a comparative balance sheet

1. Financial planning for Indian retail businesses

In retail, use your comparative balance sheet to manage inventory and costs. You track rising stock or cash dips across seasons, common in India.

A comparative balance sheet shows trends, helping you stock up for festivals or cut excess. Financial planning ensures your retail business thrives in a competitive market.

2. Insights for tech startups in India

Tech startups benefit from a comparative balance sheet. You monitor burn rates, cash drops, and funding needs across periods. If assets shrink, you seek investment.

In India’s startup scene, the comparative balance sheet guides you, aligning spending with growth to secure funds and scale fast.

3. Strategic uses in manufacturing sectors

In manufacturing, your comparative balance sheet tracks costs. You compare equipment or inventory shifts, spotting rises in production expenses.

In businesses, where margins are tight, the comparative balance sheet helps you invest wisely—say, in machinery—ensuring you boost output and stay profitable.

4. Benefits for service-based businesses

Service firms optimize with a comparative balance sheet. You track cash or payables, cutting unneeded costs like excess staff.

For businesses, where operations vary, the comparative balance sheet reveals trends, helping you streamline expenses and boost efficiency for better service and profits.

5. Applications in hospitality industry

Hotels use a comparative balance sheet for occupancy-driven finances. You compare cash or debt across peak and lean seasons in India.

The comparative balance sheet shows trends, letting you plan for renovations or staff costs, ensuring your hotel manages cash flow and grows.

6. Supporting e-commerce financial strategies

E-commerce thrives with a comparative balance sheet. You track sales growth or logistics costs across periods.

In India, where online demand soars, the comparative balance sheet helps you manage inventory or shipping expenses, ensuring you align finances with rising orders and stay competitive.

Advanced tips for maximizing comparative balance sheet value

Automating data collection with software

Streamline your comparative balance sheet with tools. You can use software like Tally or Zoho Books to pull assets, liabilities, and equity data automatically.

In India, these integrate with GST portals, saving time. You reduce manual errors, ensuring your comparative balance sheet is accurate and ready for quick analysis and decisions.

Incorporating predictive analytics

Boost your comparative balance sheet with predictive analytics. You analyze trends—say, asset growth—to forecast cash or debt levels. Tools like Excel or Power BI help.

Predict market shifts with your comparative balance sheet, and plan budgets or investments with data-driven insight for the future.

Customizing formats for your business needs

Tailor your comparative balance sheet to fit your needs. Focus on key metrics—cash for retail, debt for startups. Adjust columns or categories for clarity.

Align with your sector’s demands via the comparative balance sheet, ensuring you track what matters most for effective planning.

Regularly updating for real-time insights

Update your comparative balance sheet often. Add new data—monthly or quarterly—for current views.

In India’s fast market, real-time trends from the comparative balance sheet help you spot shifts like cash drops early. You stay agile, making timely moves to drive growth and stability.

Training your team on interpretation

Train your team to read the comparative balance sheet. Teach them to spot trends—rising equity or debt spikes—using workshops or guides.

In India, a skilled team uses the comparative balance sheet effectively, ensuring everyone aligns on financial goals, boosting decisions, and business success.

Using cloud-based solutions for collaboration

Leverage cloud tools for your comparative balance sheet. Use simple tools like Google Sheets or more dynamic accounting tools like QuickBooks to share data live with your team.

Cloud access speeds updates and collaboration. Thus, the comparative balance sheet stays current, letting you and your staff analyze trends together for smarter strategies.

Regulatory considerations for Indian businesses

1. Ensuring compliance with Indian accounting standards

Align your comparative balance sheet with Ind AS. You follow standards like Ind AS 1 for presentation, ensuring assets, liabilities, and equity are clear.

In businesses, compliance avoids penalties. Use your comparative balance sheet to meet these rules, keeping data consistent and ready for regulatory scrutiny.

2. Meeting GST reporting requirements

Your comparative balance sheet tracks GST impacts. You monitor liabilities like output tax or assets like input credits across periods.

In India, GST compliance is key. The comparative balance sheet helps you report accurately, ensuring you reconcile figures and avoid issues with tax authorities.

3. Preparing for audits and inspections

Simplify audits with your comparative balance sheet. You show clear trends in assets and debts, aligning with Ind AS for regulators.

In India, audits demand precision. The comparative balance sheet organizes data, helping you pass inspections by proving accuracy and compliance easily.

4. Addressing cross-border financial reporting

Manage multi-currency impacts in your comparative balance sheet. You adjust for rupee fluctuations in overseas deals, converting values consistently.

For Indian markets, global trade grows, so use the comparative balance sheet to report accurately, ensuring clarity for international partners or regulators.

5. Navigating SEBI regulations for listed entities

For listed firms, your comparative balance sheet aids SEBI compliance. You present transparent trends equity or debt shifts for reporting. In India, SEBI demands clarity.

The comparative balance sheet helps you meet disclosure rules, ensuring investors and regulators trust your financial story.

6. Handling tax authority requirements

Support tax filings with your comparative balance sheet. You track assets and liabilities, ensuring accurate income tax or GST returns.

In India, tax authorities scrutinize records. Use the comparative balance sheet to verify data, streamlining filings and audits for compliance and peace of mind.

Enhance your financial control with Volopay corporate cards

1. Why Volopay aligns with your financial goals

A comparative balance sheet clarifies your financial trends assets, liabilities, and equity shifts. You gain insight for smarter decisions. Pair this with Volopay corporate cards to streamline expense management.

Volopay helps you control spending, track costs, and align with goals. Sign up to boost efficiency, using your comparative balance sheet alongside Volopay for robust financial control.

2. Simplify expense tracking with Volopay

Streamline costs with Volopay and your comparative balance sheet. You automate expense tracking, approvals, and integrations, saving time.

In India, where cash flow matters, Volopay enhances control. Use your comparative balance sheet to monitor trends, then sign up for Volopay to simplify spending and strengthen financial management.

Bring Volopay to your business

Get started now