👋Exciting news! UPI payments are now available in India! Sign up now →

Bills receivable vs. bills payable: Meaning, differences & examples

It is important for any business to gain clarity on what is bills receivable and bills payable to manage your company's finances effectively. These financial instruments, rooted in credit transactions, help you navigate cash flow, compliance, and supplier-customer relationships.

Bills receivable represent money owed to you, while bills payable are your obligations to suppliers. Mastering these concepts helps you to optimize liquidity, ensure regulatory adherence, and drive growth within your business. This guide dives into definitions, differences, and strategies tailored for India, empowering you to streamline operations.

Understanding bills receivable

Take control of your finances by understanding bills receivable, which are key assets in your Indian business. Explore their role, benefits, and compliance needs to boost efficiency.

1. What are bills receivable?

Bills receivable are amounts customers owe you for goods or services sold on credit, formalized by a bill of exchange. Typically due in 30-90 days, these legally binding documents outline payment terms, ensuring clarity.

In India, you issue them to document credit sales, making them critical assets. They include details like amount, due date, and parties involved, giving you a clear record to track receivables confidently.

2. Benefits for cash flow

Strengthen your cash flow with bills receivable, which guarantee predictable inflows. When customers pay on time, you gain funds to invest in inventory, expansion, or daily expenses.

This reliability helps you plan budgets, avoid cash shortages, and seize growth opportunities in India’s dynamic market. Monitor due dates closely to ensure steady liquidity, keeping your business agile and ready to tackle financial demands effectively.

3. Common use cases

Leverage bills receivable in diverse sectors like retail, manufacturing, and services across India. If you run a store, issue them for bulk credit sales to wholesalers. Manufacturers use them for machinery or raw material sales on credit.

Service providers, like IT firms, rely on them for project payments. These tools help you extend credit confidently, ensuring customers commit to timely payments while scaling your operations.

4. Legal aspects in India

Comply with Indian laws to make bills receivable work for you. Align with Reserve Bank of India (RBI) guidelines on credit terms and foreign exchange if dealing internationally.

Claim GST input tax credit by ensuring bills include GSTIN, amount, and tax details. Maintain proper documentation to avoid legal hassles, keeping your business compliant and eligible for tax benefits under India’s regulatory framework.

Understanding bills payable

Manage your liabilities effectively by understanding bills payable—key obligations in Indian businesses. Discover their role, benefits, and compliance requirements to maintain creditworthiness and ensure smooth financial operations.

1. What are bills payable?

Bills payable are amounts you owe suppliers for goods or services bought on credit, documented via a bill of exchange. You accept these legally binding notes, committing to pay within a set period, often 30-60 days.

They detail the amount, due date, and parties, giving you a clear obligation record. Use them to formalize credit purchases, ensuring transparency in your transactions.

2. Impact on cash flow

Plan carefully, as bills payable affect your cash outflows. Timely payments prevent liquidity issues, letting you maintain operations without strain. Delaying payments risks penalties or supplier distrust, so prioritize scheduling to balance cash flow.

In a fast-paced market, proactive understanding of what is bills receivable and bills payable keeps your finances stable, ensuring you meet obligations without disrupting growth.

3. Common use cases

Bills payable are applicable in manufacturing, hospitality, and retail across India. If you’re in manufacturing, accept them for raw material purchases. Hotels use them for bulk supply orders, like food or linens, on credit.

Retailers rely on them for inventory from wholesalers. These tools help you secure goods now and pay later, supporting operations while managing cash effectively.

4. Regulatory compliance

Stay compliant with bills payable under Indian regulations. Adhere to RBI rules on payment timelines, especially for international deals. Ensure bills reflect GST details—tax amount, GSTIN, and rate—to claim output tax adjustments.

Timely payments avoid penalties, keeping your business aligned with GST and RBI standards. Maintain records to prove compliance, safeguarding your reputation and finances.

Bills receivable vs. bills payable: Understanding key differences

Nature and classification

Bills receivable are classified as current assets, representing money customers owe you from credit sales. Conversely, bills payable are treated as current liabilities, reflecting your debts to suppliers for credit purchases.

On your balance sheet, receivables boost your asset value, while payables increase obligations. Understanding this split helps you assess your business’s financial position accurately in India’s context.

Transaction perspective

Bills receivable arise when you sell goods or services on credit to customers, generating future inflows. In contrast, bills payable emerge when you purchase from suppliers on credit, creating future outflows.

Understanding the opposite dynamic of what is bills receivable and payable shapes how you manage cash, prioritize collections, and time payments in your Indian operations.

Accounting treatment

Record bills receivable by debiting the receivable account and crediting sales when issued. Upon payment, debit the cash, and credit the bills receivable. For bills payable, debit purchases, and credit bills payable when accepted.

When settling, debit bills payable, credit cash. This distinct accounting for bills receivable and bills payable ensures your books reflect accurate financial activity.

Impact on financial strategy

Drive revenue by focusing on bills receivable, pushing for timely collections to fuel growth. For bills payable, plan payments carefully to maintain cash flow and supplier trust.

Receivables demand strong credit policies, while payables require budgeting to avoid liquidity issues. Tailor your strategy in India to balance these, optimizing financial health and operational success.

Risk and management focus

Tackle risks in bills receivable by monitoring late payments, enforcing credit controls to secure cash. For bills payable, avoid late settlements that harm supplier ties or incur penalties. Focus on collecting receivables promptly and paying payables on time.

Effective management and understanding of what is bills payable and receivable minimizes financial risks, keeping your Indian business robust.

Legal and compliance implications

Ensure bills receivable comply with GST for input tax credit, requiring proper documentation. For bills payable, align with GST and RBI payment rules to avoid fines.

Receivables tie to revenue compliance, while payables link to expenditure rules. Stay diligent to meet India’s legal standards seamlessly.

Real-world examples in Indian businesses

1. Bills receivable example

Imagine running a textile business and selling fabric on credit to a retail customer. Issue a bill receivable that specifies the credit terms and due date, and get it signed by the customer, acknowledging the obligation. Record this bill in the books as a current asset.

Track the maturity date closely to ensure timely payment. Rely on the expected inflow from this bill receivable to purchase new stock, manage ongoing expenses, and maintain competitiveness in the textile industry.

2. Bills payable example

In case you are operating a factory and purchasing essential machinery on credit from a trusted supplier. Accept the bill payable that confirms the debt and specifies the payment timeline. Record the bill as a current liability to acknowledge the upcoming financial commitment.

Ensure funds are available before the bill matures to maintain strong supplier relationships and avoid late fees or operational disruptions. Honoring such obligations keeps production consistent and supply chains intact.

3. Retail industry application

As a retail store owner, you can offer credit sales to wholesalers by issuing bills receivable for confirmed transactions. At the same time, accept bills payable when purchasing inventory from large distributors on credit terms. Recording both bills in the accounting system under appropriate headings.

Use bills receivable to manage expected inflows while relying on bills payable to secure goods in advance without immediate cash outflows. Maintain a balance between these instruments to stabilize liquidity and operate smoothly in a competitive retail space.

4. Manufacturing sector use

In the case of a manufacturing unit that supplies equipment on credit and receives bills receivable from clients. For material procurement, you can accept bills payable from vendors supplying raw materials. Enter both instruments in the books, tracking each bill’s lifecycle.

Rely on the timely collection of bills receivable to finance raw material payments and production costs. Keep a close eye on bills payable due dates to avoid penalties and preserve supplier confidence—key to staying efficient in the industrial economy.

5. Hospitality sector example

Imagine operating a hotel and obtaining bulk supplies such as food and beverages on credit by accepting bills payable. For corporate bookings or event services, issue bills receivable to clients who pay after a set period. Maintain proper documentation and accounting entries for each bill.

Use credit terms on both ends to manage operating costs and incoming revenues. Monitor due dates of bills receivable and bills payable to avoid cash flow mismatches, which is critical for ensuring profitability in the hospitality market.

Accounting for bills receivable and payable

Recording bills receivable

When making a credit sale, issue a bill receivable and record the transaction by debiting the bills receivable account and crediting the sales account. This entry confirms recognition of revenue and an asset.

Upon receiving payment on or before the due date, debit cash or bank and credit bills receivable to close the entry. Maintain accurate logs to ensure all bills receivable are properly tracked, and payments reflect actual inflows. This transparency supports reliable financial reporting and cash flow forecasting.

Recording bills payable

When purchasing goods or services on credit, accept a bill payable and record it by debiting the purchases or expense account and crediting bills payable. On settlement, debit bills payable and credit cash or bank.

Document this cycle clearly to avoid missing due dates and interest charges. Keeping these liabilities visible in the books helps ensure financial commitments are met and reflects professionalism in financial records.

Balance sheet classification

List bills receivable under current assets, showing amounts expected to be received within the financial year. Place bills payable under current liabilities, representing obligations that must be paid shortly.

This classification helps assess short-term liquidity and solvency. Accurate placement of these bills supports better decision-making and enables cleaner reporting when presenting financial statements to auditors, banks, or stakeholders.

Interest-bearing bills

When a customer delays payment beyond the agreed period, recognize the extra amount paid as interest by debiting interest income. For delays in settling a bill payable, record the additional charge as interest expense.

These entries reflect the cost or gain associated with time value of money. If a supplier includes interest in a bill payable, separate it from the principal amount during recording. This adjustment helps maintain precision and complies with financial disclosure norms.

Reconciliation process

At the end of each month, reconcile bills receivable and bills payable with customer and supplier statements. Match amounts, due dates, and payment records to detect mismatches or fraudulent entries.

Confirm that every payment received or made aligns with the corresponding bill. This process ensures data integrity, catches clerical errors early, and maintains clean records that align with best accounting practices.

Effective management strategies

Optimize bills receivable and bills payable with smart strategies. Use these tips to streamline your business operations effectively.

Negotiate clear terms

Set precise payment terms with customers and suppliers upfront. For bills receivable, agree on 30-60-day deadlines; for bills payable, secure favorable credit periods.

Clear terms in your agreements prevent confusion, align with cash flow, and reduce disputes. In India, this clarity strengthens your financial control and operational smoothness significantly.

Schedule payments/collections

Track due dates diligently using calendars or software. For bills receivable, remind customers before the 60-day mark to collect them. For bills payable, plan to settle the amount on time.

Scheduling ensures timely inflows and outflows, keeping your cash flow steady and your business running without hiccups.

Regular reconciliation

Compare bills receivable and payable with statements monthly. Check a bill receivable against customer records and a bill payable against supplier data. This catches errors, prevents fraud, and keeps your books accurate.

In India, regular reconciliation aligns with accounting standards, ensuring your financial records stay reliable and clear.

Leverage automation

Adopt digital tools to manage bills efficiently. Use software to track, approve, and process bills receivable and payable, cutting manual errors.

Automate reminders for certain bills receivable and payable amounts. Automation saves time, boosts accuracy, and lets you focus on growing your business effectively.

Maintain supplier relationships

Communicate proactively with suppliers to build trust. If a bill payable is due, discuss delays or terms early. Resolve issues quickly to secure better credit deals.

Strong ties ensure reliable supplies and favorable terms, helping your business thrive in competitive markets with confidence.

Challenges in managing bills receivable and payable

Tackle hurdles in handling bills payable and receivable head-on. Address these common issues to keep your Indian business on track.

1. Cash flow disruptions

Delays in collecting bills receivable stall your cash inflow, and lead to a struggle with bill payable deadlines, draining liquidity.

Plan schedules tightly—monitor bills receivable early and budget for upcoming payables. This keeps cash flowing, ensuring your business stays stable and ready for growth without financial strain.

2. Manual processing errors

Relying on manual tracking risks errors in bills receivable or payable records. A mislogged bills receivable disrupts your books.

Switch to digital tools to automate entries, approvals, and tracking. This cuts mistakes, saves time, and ensures your financial data remains accurate and reliable for operations.

3. Regulatory compliance issues

Missing GST or RBI rules leads to facing penalties for bills receivable or payable. Ensure a bill receivable includes GSTIN for input credit; whereas align a bill payable with payment timelines. Stay updated on Indian regulations, document properly, and avoid fines, keeping your business compliant and financially secure.

4. Supplier/customer disputes

Unclear terms cause conflicts, like a customer disputing a bill receivable, or a supplier contesting a certain bill payable.

Define terms clearly upfront, like due dates and amounts, in writing. This prevents misunderstandings, ensuring smooth transactions and strong relationships for your business moving forward.

5. High transaction volumes

Rather than juggling multiple bills like receivables and payables, use software to organize, track, and prioritize transactions efficiently.

Automate reminders and reports to stay on top of volumes. This streamlines management, letting you handle high activity without losing control or accuracy.

Benefits of efficient management

Reap rewards by mastering bills receivable and payable. Streamline processes to boost your business’s success and stability.

Optimized cash flow

Collect bills receivable on time to boost inflows and pay bills payable promptly to avoid strain.

Efficient management ensures liquidity, letting you fund operations, invest in growth, and navigate the market confidently. Steady cash flow keeps your business resilient and ready.

Stronger relationships

Build trust by settling bills payable promptly and collecting receivables reliably. Pay bills to suppliers on time, and monitor receivables courteously.

Strong ties with customers and suppliers in India secure better terms, reliable supplies, and repeat business, driving your success.

Improved financial reporting

Track bills receivables and payables accurately to enhance reports and for clear balance sheets.

Precise records aid decision-making, impress stakeholders, and simplify audits, giving you a solid financial picture to strategize effectively.

Reduced administrative burden

Cut manual tasks by automating bills receivable and payable processes. Use tools to handle receivable or payable efficiently.

Automation frees time, reduces errors, and lets you focus on growth. This streamlines operations, boosting productivity for your business.

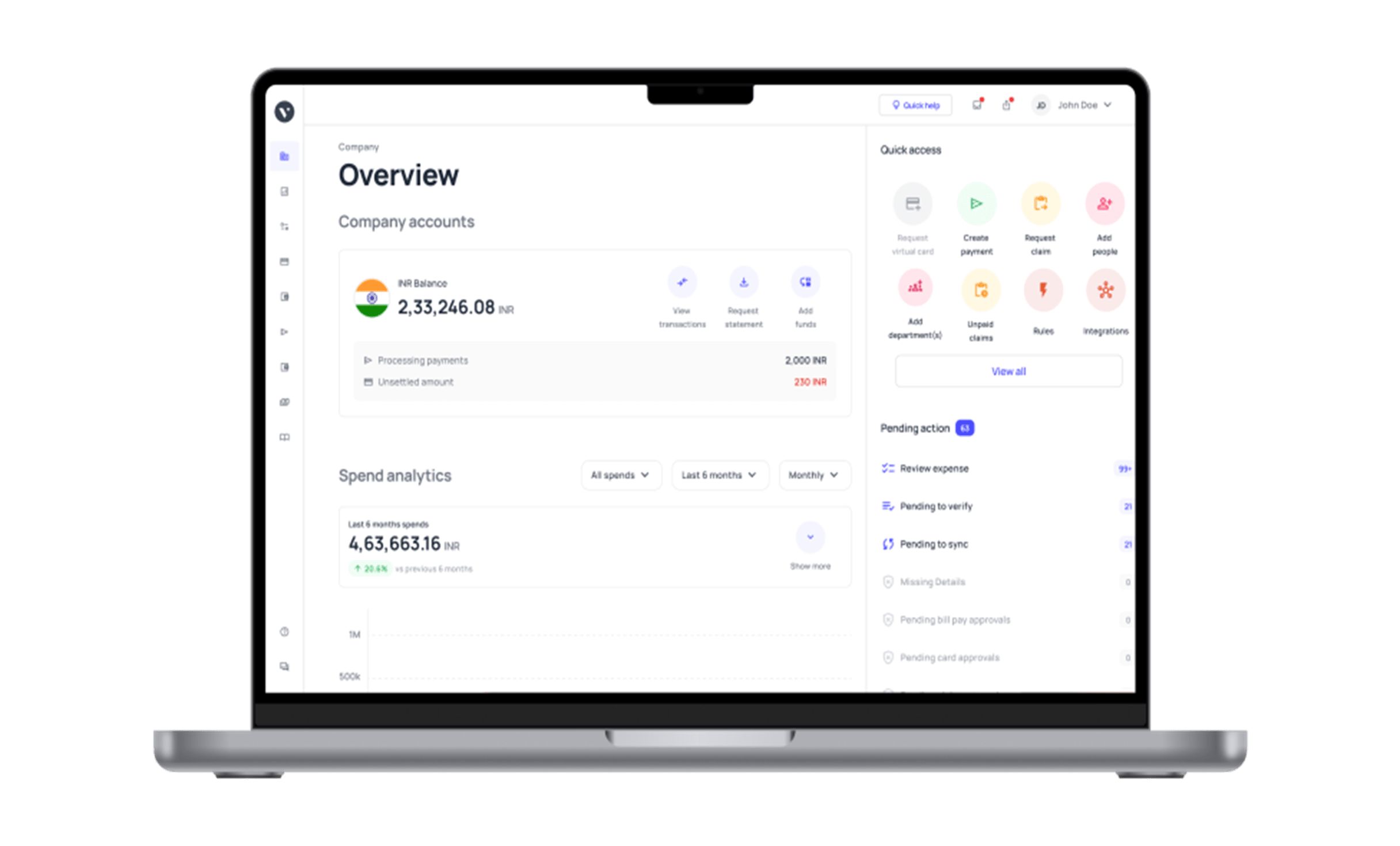

Streamline payables with Volopay’s AP solutions

Simplify your bills payable management with Volopay’s advanced accounts payable software. Volopay provides automated tracking, approvals, and enables scheduled payments, cutting manual effort.

Furthermore, it integrates GST compliance, ensuring your records align with Indian rules. Use the platform to schedule payments to maintain cash flow and supplier trust.

Volopay’s platform offers real-time insights, helping you understand and manage bills receivable and payable efficiently, which leads to a boost in accuracy, saving time, and allows you to focus on scaling your business with this powerful tool.

Conclusion: Master your bills management

Take charge of bills receivable and bills payable to transform your business. Bills receivable fuel cash inflows, while bills payable demand careful outflow planning.

Identify key differences to guide your accounting, strategy, and compliance with GST and RBI rules. Use case study analyses, accounting tips, and strategies to further optimize processes.

Overcome challenges like delays and disputes with automation and clear terms. Lastly, adopt Volopay’s AP solutions to streamline payables, enhance cash flow, and drive growth confidently.

FAQs

Bills receivable is recorded as a debit when issued for a credit sale since it represents an asset. Debit the bills receivable account and credit the sales account to reflect revenue. When the customer pays, credit the bills receivable account and debit the cash or bank account. This keeps your records accurate and allows clear tracking of incoming payments.

Bills payable is recorded as a credit when accepting a bill for a credit purchase, indicating a liability. Debit the purchases or expense account to note the cost incurred. On settlement, debit the bills payable account and credit cash or bank. This ensures liabilities are accurately recorded and the books stay balanced.

Volopay simplifies payable management by automating tracking and payments. It helps you avoid missed deadlines and reduces manual effort with real-time visibility into all payables. You can also stay compliant with built-in GST support and plan cash flow better with actionable insights. The system reduces errors, saves time, and lets you manage bills payable and receivable more effectively.