👋 Exciting news! UPI payments are now available in India! Sign up now →

Best travel and expense management software in India (2025)

Business travel plays a vital role in the growth and success of organizations. It allows companies to explore new markets, build client relationships, and attend conferences and meetings.

However, managing travel expenses can be a daunting task for businesses, leading to various challenges. This is where travel expense software applications for organizations come into the picture.

Effective travel and expense management is crucial to ensure cost control, accurate reporting, and streamlined processes. To address these challenges, businesses in India are turning to travel and expense management software, which simplifies the entire process and provides enhanced visibility, efficiency, and control over travel expenses.

Why is T&E management important?

Travel and expense management, commonly referred to as T&E management, is an important process for all businesses. It not only helps you stay within a budget but also aids in future budget forecasting and planning.

With efficient travel expense management, you’re improving your organization’s financial health, compliance, and general efficiency.

1. Budget planning

It’s no secret that budgeting is a complex and time-consuming process. T&E management is key to any business to help you with your budget planning. Employees will recognize that they must adhere to the budget.

Not only that, but you’ll also have an easier time forecasting and budgeting based on past travel expenses.

2. Financial visibility

Without travel expense management, you run into the risk of overspending due to a lack of financial visibility.

When you use travel and expense management software, however, you’ll be able to track exactly how, when, and where every penny is used during business trips. This helps you stay within budget.

3. Decision-making insights

The best business decisions are made with sufficient data and insights to back them up. By ensuring that your company’s T&E management is efficient, you’ll have more decision-making insights.

As a result, you will also have a clearer direction when it comes to making policies, guidelines, and other decisions regarding corporate travel.

4. Legal and tax compliance

Instead of having to calculate taxes manually, a travel and expense management solution can help you do it automatically. This ensures that all your taxes are accurate, guaranteeing that you comply with all tax regulations.

Built-in compliance features also help employees stay within the legal requirements of purchases for business travel.

5. Employee satisfaction

Proper travel and expense management helps your employees structure their work better. It also provides appropriate expectations regarding business trips.

With the help of travel and expense software, you’ll be able to automate administrative tasks and reduce your employees’ workload. They’ll be more satisfied with work in the office and during business trips.

What is travel and expense management software?

Travel and expense management software is a specialized solution designed to streamline and automate the process of managing travel expenses for businesses. It combines expense reporting, receipt management, travel booking, and reimbursement functionalities into a single platform.

This software empowers organizations to capture, track, and manage travel-related expenses efficiently, thereby reducing manual efforts, improving accuracy, and ensuring compliance with expense policies.

9 Best travel and expense management software

1. Volopay

Overview

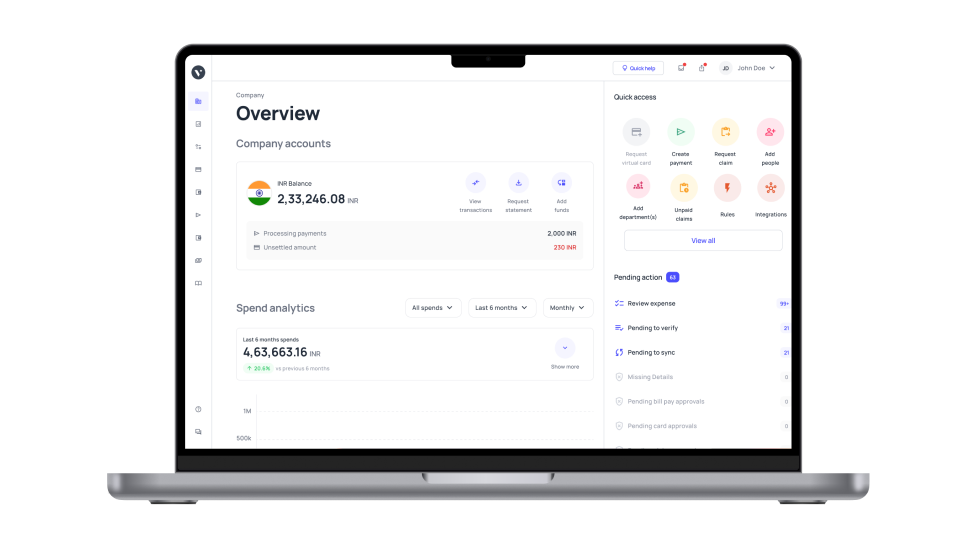

Volopay is a modern expense management platform that helps businesses automate their financial operations, including travel and expense management. With real-time tracking, corporate cards, and seamless integrations, Volopay simplifies the entire expense management workflow for companies of all sizes.

Primary features

You can issue physical and virtual corporate cards for your employees. This helps them manage their travel expenses without the need to make reimbursements. Real-time expense tracking and custom spending controls ensure that there is no overspending.

Setup process and requirements

Businesses need to sign up on the Volopay platform and provide essential company details. Corporate cards (virtual and physical) are issued based on company requirements.

Limitations

May not be ideal for very small businesses with limited expense management needs. Advanced features require a learning curve for new users.

Advantages

● Automated expense tracking: Real-time expense monitoring with receipt scanning and policy enforcement.

● Corporate cards: Instant issuance of virtual and physical corporate cards for employees.

● Seamless integrations: Works well with ERP and accounting systems.

● Multi-currency support: Ideal for companies with international transactions.

Target customers

Startups and mid-sized businesses looking for automated expense tracking. Large enterprises that need robust controls over employee spending. Companies with international operations requiring multi-currency support.

2. SAP Concur

Overview

SAP Concur is a global leader in travel and expense management, offering comprehensive solutions for tracking business expenses, automating approvals, and streamlining reimbursement processes. It provides AI-powered insights and compliance checks to help businesses maintain financial control.

Primary features

SAP Concur provides end-to-end travel and expense management solutions, including travel booking, expense reporting, receipt scanning, policy compliance, approval workflows, and travel reimbursement processes. It integrates with various systems and offers robust reporting and analytics capabilities.

Setup process and requirements

Businesses must subscribe to SAP Concur’s cloud-based solution. Requires integration with ERP systems like SAP, Oracle, and Microsoft Dynamics.

Limitations

SAP Concur is expensive compared to other solutions, making it less accessible for startups and small businesses. It also requires IT support for full integration and some users find the UI outdated and less intuitive.

Advantages

● Comprehensive travel management: Covers everything from bookings to reimbursements.

● Advanced policy enforcement: Ensures compliance with corporate travel policies.

● Comprehensive analytics: Helps businesses identify spending trends and cost-saving opportunities.

● Strong integrations: Works well with major ERP and accounting systems.

Target customers

Large enterprises with complex travel and expense policies and multinational corporations requiring an extensive reporting system.

3. Expensify

Overview

Expensify is a user-friendly expense management software known for its automation features, including receipt scanning, auto-categorization, and smart approval workflows. It is popular among small businesses and freelancers due to its affordability and ease of use.

Primary features

Expensify simplifies expense management through features like receipt scanning, automated expense categorization, mileage tracking, real-time expense reporting, and policy enforcement. It integrates with accounting software and offers features for corporate card management and reimbursement.

Setup process and requirements

Businesses need to create an account and configure their expense policies. The businesses must go through the required process to verify their business to use the platform.

Limitations

May not be ideal for large enterprises requiring complex policy enforcement. Some users report slow responses from the support team. Primarily focused on expense management rather than full travel solutions.

Advantages

● Easy to use: Intuitive mobile and web interfaces.

● Smart scanning: Modern tech use for receipt scanning and categorization.

● Affordable pricing: Budget-friendly for small businesses and freelancers.

● Real-time reimbursement: Employees can get reimbursed quickly.

Target customers

Expensify is an ideal solution for freelancers and self-employed professionals managing personal expenses, small and medium-sized businesses looking for a cost-effective expense solution, and companies that need a simple, easy-to-implement expense tracking system.

4. Zoho Expense

Overview

Zoho Expense is a cloud-based expense management solution designed for businesses of all sizes. It offers features such as automated expense reporting, mileage tracking, and direct reimbursement options, making it a strong choice for Indian businesses.

Primary features

Zoho Expenses provides features for receipt scanning, expense tracking, policy compliance, approval workflows, and reimbursement management. It integrates with Zoho's suite of applications and offers comprehensive reporting and analytics.

Setup process and requirements

To use the Zoho Expenses platform, businesses must sign up for a Zoho account and choose a subscription plan. Admins can configure policy settings and set up approval workflows.

Limitations

It is best suited for companies already using Zoho products. Some advanced users may find it less flexible compared to SAP Concur. Many users have also reported issues in the approval workflow system for larger teams.

Advantages

● Seamless integration with Zoho products: Ideal for businesses using Zoho Books and Zoho CRM.

● Expense tracking: Automated receipt scanning and categorization.

● GST compliance: Built-in tax compliance for Indian businesses.

● Multi-currency support: Suitable for businesses handling international transactions.

Target customers

The target customers for this platform include small and mid-sized businesses, companies looking for an affordable and GST-compliant expense management solution, and businesses that need a straightforward expense reporting system with mobile access.

5. TravelPerk

Overview

TravelPerk is a travel management platform designed for businesses to book, manage, and track corporate travel expenses efficiently. It provides real-time travel policy enforcement, automated expense tracking, and integrations with various accounting software.

Primary features

TravelPerk combines travel booking capabilities with expense management features, offering a unified platform for managing travel and expenses. It provides options for flight, hotel, and transportation bookings, expense tracking, policy enforcement, and integrations with accounting systems.

Setup process and requirements

To set up TravelPerk, you need to first create an account, then fill in your company details, establish your travel policy with approval workflows, and add users, ensuring you define their access levels; key requirements include company information, user details, and a well-defined travel policy to manage booking restrictions and approvals within the platform.

Limitations

Focuses more on travel bookings than expense tracking. The customer support services may not be as strong in India compared to global markets and the free version has limited capabilities; premium plans can be costly.

Advantages

● End-to-end travel booking: Employees can book flights, hotels, and transport from a single platform.

● Automated travel policy enforcement: Ensures compliance with company travel guidelines.

● Real-time travel insights: Provides data on travel spending trends and optimizes budgets.

● Seamless expense reporting: Automatically categorizes expenses and integrates with accounting software.

Target customers

Medium to large businesses with frequent business travel needs. Companies looking for a centralized travel booking and expense management system, and organizations that need real-time travel policy enforcement.

6. Fyle

Overview

Fyle is a modern expense management platform that focuses on automating expense tracking and reporting. It offers AI-driven receipt scanning, real-time spend monitoring, and seamless integrations with accounting software.

Primary features

Fyle provides features for receipt scanning, automated expense categorization, policy compliance, approval workflows, and reimbursement management. It integrates with accounting software and offers advanced analytics for expense data.

Setup process and requirements

Setting up Fyle involves creating an account, adding employees, configuring expense categories, defining approval workflows, integrating with your accounting software, and optionally setting up corporate credit card feeds.

Limitations

The platform is primarily an expense tracking tool rather than a full travel management solution. Advanced automation and analytics come at a higher price and businesses may need to invest a lot of time in configuring policies and integrations.

Advantages

● Automated receipt scanning: Auto-extracts details from receipts and categorizes expenses.

● Real-time policy compliance: Detects policy violations instantly and alerts admins.

● Credit card reconciliation: Syncs corporate card expenses for real-time tracking.

● Easy integrations: Works with major ERP and accounting platforms.

Target customers

Small to mid-sized businesses looking for automated expense tracking, enterprises needing real-time compliance checks on expenses, and companies using corporate credit cards and requiring automatic reconciliation.

7. Finly

Overview

Finly is an expense management and payments automation platform designed for Indian businesses. It helps organizations track expenses, manage vendor payments, and streamline financial workflows.

Primary features

Finly provides features for expense management, budgeting, approval workflows, reimbursement processes, and policy compliance. It offers integrations with accounting systems and supports multi-level approval hierarchies.

Setup process and requirements

To use the Finly platform, users must book a demo of the platform and go through the process of understanding the software, after which they can choose a subscription plan with the sales team. The major requirements are to fulfil the necessary conditions and verify their business as per Finly’s SOPs.

Limitations

Finly has less comprehensive travel booking features and it is best suited for businesses operating within India. It works best with Indian banking and financial systems but may lack integrations with global accounting software.

Advantages

● Strong financial control: Automates vendor payments and employee reimbursements.

● GST-compliant expense tracking: Helps businesses comply with Indian tax regulations.

● Corporate card integration: Offers real-time tracking of business spending.

● Custom approval workflows: Businesses can enforce company-specific spending policies.

Target customers

Indian businesses needing a GST-compliant expense management solution. Companies looking to automate vendor payments and employee reimbursements, and mid-sized businesses wanting strong financial policy enforcement.

8. Happay

Overview

Happay is a cloud-based travel and expense management solution designed to automate and simplify corporate spending. It offers corporate cards, real-time expense tracking, automated approvals, and GST-compliant reimbursements, making it a popular choice among Indian businesses.

Primary features

The primary features of Happay include prepaid and credit cards for employee expenses with automated receipt scanning and categorization for expenses. The platform also has integrated travel request and approval workflows and automated tax calculations with GST invoicing.

You can set customizable spend limits with real-time policy checks. The platform can also be integrated with popular accounting systems like SAP, Tally, QuickBooks, and other platforms.

Setup process and requirements

Like all other platforms on this list, businesses must sign up and provide company details for onboarding. Once the onboarding is complete, admins can configure corporate spending policies and approval workflows.

Limitations

The platform has limited global support and is primarily designed for Indian businesses with INR-based transactions. Some users may find it complex to configure approval workflows initially. It also does not provide an extensive in-house travel booking system.

Advantages

● Complete expense control: Real-time monitoring, budgeting, and automated expense reporting.

● GST-compliant expense tracking: Helps businesses stay tax-compliant.

● Integrated corporate cards: Reduces the need for reimbursements.

● Seamless ERP and accounting integrations: Works well with Indian financial systems.

Target customers

Indian businesses needing a comprehensive T&E solution with corporate cards. Mid-sized to large enterprises looking for real-time policy enforcement and GST compliance. Companies that require automated expense tracking with seamless ERP integration.

9. MakeMyTrip

Overview

MakeMyTrip (MMT) is a well-known travel booking platform that also offers MMT for Business, a corporate travel management solution. It helps businesses book, manage, and track business travel expenses while providing negotiated fares and real-time expense reporting.

Primary features

MakeMyTrip’s business platform MyBiz has many features including corporate travel booking(lights, hotels, buses, and trains), exclusive corporate discounts, multi-user access that allows employees to book and manage travel within company policies, automated expense tracking, and approval workflows with custom travel approval settings based on company policies.

Setup process and requirements

To use MyBiz, a company creates a corporate account with MMT. Once completed, admins can set up travel policies and approval workflows so that employees can book flights, hotels, and transport via the platform. The expenses are automatically recorded and can be exported to accounting systems.

Limitations

MyBiz isn’t a full-fledged expense management solution but is primarily focused on travel bookings. It has limited automation for reimbursements as it requires integration with separate expense management tools. The platform is ideal for travel bookings but lacks broader expense tracking capabilities.

Advantages

● Easy travel booking and management: Single platform for corporate travel needs.

● Corporate discounts and negotiated fares: Helps businesses save on travel costs.

● Pre-configured approval workflows: Ensures compliance with travel policies.

● Seamless integration with expense tracking tools: Works with third-party accounting and T&E.

Target customers

Small to mid-sized companies looking for an easy and cost-effective corporate travel booking solution. Businesses that want exclusive corporate travel discounts and a user-friendly booking system.

Organizations that already use separate expense management tools, but need integrated travel bookings.

Simplify your travel expense management

Common challenges in managing business travel expenses

1. Lack of visibility into expenses

One of the significant challenges faced by businesses is the lack of visibility into travel expenses. Manual processes and disparate systems make it difficult to track and analyze expenses in real-time. This can lead to overspending, inaccuracies, and difficulties in budget planning.

Travel and expense management software provide comprehensive dashboards and reports that offer a holistic view of travel expenses, enabling businesses to make informed decisions and identify areas for cost optimization.

2. Manual expense reporting and reconciliation

Traditional paper-based expense reporting is time-consuming and error-prone. Employees often struggle with manual data entry, searching for receipts, and reconciling expenses with corporate policies.

Travel and expense management software automate these processes, allowing employees to capture expenses digitally, attach receipts, and automatically categorize expenses. This eliminates the need for manual reconciliation, saves time, and ensures accurate reporting.

3. Receipt management and documentation

Managing and storing paper receipts can be a cumbersome task for businesses. Receipts can get lost, damaged, or misplaced, making it challenging to provide supporting documentation during audits or reimbursement claims.

Travel and expense management software offer features like mobile receipt scanning, OCR (optical character recognition) technology, and cloud storage, enabling employees to capture and store digital receipts securely. This ensures easy access to receipts when needed and simplifies the documentation process.

4. A complex expense approval process

The traditional expense approval process often involves multiple layers of manual review and time-consuming back-and-forth between employees and managers. This can cause delays in reimbursement and create frustration for employees.

Travel and expense management software streamline the approval workflow by automating routing, notifications, and reminders. Managers can review and approve expenses digitally, reducing processing time and ensuring timely reimbursements.

5. Expense fraud

Expense fraud is a significant concern for businesses, leading to financial losses and unethical practices. Manual expense management processes are susceptible to fraudulent activities, such as submitting false receipts or inflated expenses.

Travel and expense management software mitigate this risk by implementing robust expense policies, automated expense validation, and advanced fraud detection algorithms. This helps organizations identify suspicious patterns, enforce compliance, and minimize fraudulent activities.

6. Difficulty accessing funds

When employees are on business trips, they often face challenges related to accessing funds for travel expenses. Delayed reimbursements or limited access to corporate credit cards can impact their ability to make necessary payments promptly.

Travel and expense management software address this issue by integrating with corporate banking systems, allowing employees to request and receive funds in a timely manner. This ensures smooth cash flow during business trips and enhances employee satisfaction.

7. Lack of freedom in choosing travel options

In traditional expense management approaches, employees may have limited freedom in choosing travel options, such as flights, accommodation, or transportation. This can result in higher costs, inconvenience, and dissatisfaction among employees.

Travel and expense management software provide integrated travel booking capabilities, enabling employees to compare prices, choose preferred options, and make bookings within travel policy guidelines. This enhances flexibility, improves employee experience, and reduces travel expenses.

Benefits of using a travel expense management software

1. Increased efficiency and time savings

Utilizing travel expense management software offers a key advantage in significantly enhancing efficiency and saving time.

By automating the expense reporting process, the necessity for manual data entry and reliance on paper-based documentation is eliminated. This enables employees to effortlessly record expenses while on the move, submit electronic reports, and allows managers to promptly review and approve expenses.

The resulting streamlined workflow alleviates administrative burdens, enabling employees to concentrate on more strategic tasks and delivering time savings for both employees and finance teams.

2. Enhanced compliance and policy adherence

The best travel management software always plays a crucial role in ensuring compliance with company policies and industry regulations.

The software typically incorporates features that allow organizations to establish and enforce expense policies. This helps prevent overspending, ensures adherence to approved guidelines, and mitigates the risk of non-compliance.

By automating the application of policies, the software promotes consistency and accuracy in expense reporting.

3. Reduction in errors and frauds

Manual entry of expenses is susceptible to errors and increases the risk of fraudulent activities. Travel expense management software minimizes the likelihood of mistakes by automating calculations and cross-referencing data.

Additionally, the system often includes built-in fraud detection mechanisms, flagging irregularities or suspicious transactions. This reduction in errors and fraud contributes to the overall integrity of the expense management process.

4. Real-time visibility into expenses

Another notable advantage is the real-time visibility into expenses that these software solutions provide. Finance teams and decision-makers can access up-to-date information on spending patterns, allowing for more informed decision-making.

Real-time visibility enables organizations to identify trends, monitor budget adherence, and respond promptly to any deviations from the set financial plan.

5. Improved employee satisfaction

Implementing travel expense management software has the potential to enhance employee satisfaction as well.

The interfaces, designed for user-friendliness, and the accessibility of the system on mobile devices via the travel expense management app empower employees to effortlessly handle and submit their expenses.

Automated procedures diminish the time and effort needed for expense reporting, thereby creating a more favorable experience for employees. The transparency introduced in expense management further nurtures a sense of trust between employees and the organization.

6. Better decision-making with data analytics

Travel expense management software often comes equipped with advanced analytics and reporting capabilities.

Decision-makers can leverage these tools to gain deeper insights into spending patterns, identify cost-saving opportunities, and optimize the overall expense management strategy.

Access to actionable data allows organizations to make informed decisions that positively impact financial health and efficiency.

When should businesses use travel and expense management software?

Businesses should consider implementing travel expense management software under the following circumstances:

1. Increase in travel volume

As the volume of business travel grows, manual expense management becomes impractical and time-consuming.

Travel and expense management software help businesses cope with the complexity and scale of managing a large number of travel expenses. It makes booking and handling the logistics of travel for all employees easier and more straightforward.

2. Managing remote or global teams

For organizations with remote or global teams, tracking travel expenses and ensuring policy compliance can be challenging. There is also the complication of multiple currencies being involved in the payments you make for your employees who stay in different countries.

Travel expense management software provides a centralized platform for managing expenses across multiple locations, enabling better control and visibility.

3. Difficulty in tracking travel expenses

Tracking and categorizing travel expenses manually can lead to errors, delayed reimbursements, and lost receipts. It is cumbersome for both the employee and the admin to handle all the receipts for reimbursements in physical form.

Implementing travel and expense management software simplifies the expense tracking process, improves accuracy, and ensures all expenses are accounted for.

4. To control costs and optimize expenses

Businesses aiming to gain better control over their travel expenses and optimize costs should consider adopting travel expense management software. These solutions offer cost-saving features, such as policy enforcement, vendor negotiation, and spend analytics, to help businesses optimize their travel budgets.

You would be able to prevent an unwarranted or unauthorized expense to occur and seamlessly control spending as much as possible.

5. To get real-time visibility and detailed reporting

Companies following the manual way of handling travel expenses will only be able to see the expenses long after they are made in an expense report.

Organizations seeking real-time visibility into their travel expenses and comprehensive reporting capabilities can benefit from travel and expense management software.

Such software provides detailed insights into spending patterns, identifies cost-saving opportunities, and facilitates data-driven decision-making.

6. Improving employee experience and productivity

Manual expense management processes can frustrate employees, leading to reduced productivity and dissatisfaction. Implementing travel expense management software simplifies expense reporting, streamlines reimbursement processes, and improves the overall employee experience.

Experience hassle-free reimbursements

Key features to look for in a travel and expense management software

1. User-friendly interface

A crucial feature to consider in travel and expense management software is a user-friendly interface. The ease of navigation and intuitive design significantly impact the user experience.

An interface that is straightforward and visually appealing enhances efficiency and encourages employees to embrace the software.

A well-designed interface simplifies the process of submitting expenses and ensures that users can quickly grasp the functionalities of the software.

2. Expense reporting and tracking

Efficient expense reporting and tracking are fundamental features of all the best travel management software out there. The software should streamline the process of capturing and categorizing expenses, making it easy for employees to submit accurate and timely reports.

Automated tracking mechanisms enable real-time visibility into spending patterns, helping organizations monitor and control expenses effectively.

3. Integration capabilities with company systems

Integration capabilities are vital for seamless data flow between the travel and expense management software and other company systems.

Integration with accounting, ERP (Enterprise Resource Planning), and HR systems ensures that financial data is synchronized across the organization. This reduces manual data entry, minimizes errors, and enhances overall workflow efficiency.

4. Policy compliance and customization

The ability to enforce and customize expense policies is a key feature for maintaining compliance and controlling costs.

The travel expense management app or software should allow organizations to define and enforce spending policies, ensuring that employees adhere to approved guidelines.

Additionally, customization features enable organizations to tailor the software to match specific business processes and policies.

5. Mobile accessibility

In today's dynamic business environment, mobile accessibility is non-negotiable. A travel and expense management system should offer a mobile application or a responsive mobile interface.

This allows employees to capture expenses on the go, submit reports from anywhere, and stay connected with the expense management process in real-time, improving overall efficiency and reducing delays.

6. Currency and tax support

For organizations operating globally, robust currency and tax support are essential features. The software should be capable of handling multiple currencies and provide accurate currency conversion.

Additionally, it should support tax compliance by allowing users to capture relevant tax information and generate reports that meet local tax regulations.

7. Receipt capture and management

Efficient receipt capture and management streamline the expense reporting process. The software should support various methods of receipt capture, such as photo uploads, email integrations, or direct imports.

Optical Character Recognition (OCR) technology can be a valuable addition, automatically extracting relevant information from receipts and reducing manual data entry.

8. Advanced analytics and reporting

Comprehensive analytics and reporting features provide organizations with valuable insights into spending patterns and trends.

Advanced reporting tools should offer customizable dashboards, detailed expense breakdowns, and the ability to generate insightful analytics.

This enables organizations to make informed decisions, identify cost-saving opportunities, and optimize their overall expense management strategy.

How to choose the right travel expense management software?

1. Understand the business needs

Choosing the best travel management software for your business begins with a thorough understanding of your organizational needs.

Evaluate the specific requirements of your organization, considering factors such as the size of your workforce, the frequency of travel, and the complexity of your expense management process.

Identifying these needs will guide you in selecting a software solution that aligns seamlessly with your business objectives.

2. Research and compare

Conduct thorough research on potential software providers and evaluate the features they provide. Seek a provider with a reputable standing, positive feedback from clients, and a history of successful implementations.

Compare essential features like user interface, expense reporting functionalities, integration capabilities, and mobile accessibility. This process is vital to ensure that the selected software aligns effectively with the distinctive requirements of your organization.

3. Consideration of security and compliance

Prioritize security and compliance when choosing travel expense management software. Verify that the software complies with industry standards and regulations to safeguard sensitive financial and personal information.

Seek features like encryption, secure data storage, and adherence to data protection laws. A dependable software solution should reinforce security measures to protect against potential threats and breaches.

4. Implementation and support

Evaluate the implementation process and the level of support provided by the software provider. A smooth implementation is essential for a successful transition to the new system.

Consider the availability of training resources for your team and the level of ongoing support provided by the provider. A responsive support system ensures that any issues are addressed promptly, minimizing disruptions to your expense management workflow.

Why should you choose Volopay?

Volopay is a comprehensive travel and expense management software that allows businesses to manage all their expenses through modern tools like corporate cards and a robust system filled with automation capabilities to streamline travel expense management.

● Book travel and accommodation through our integration with the TruTrip platform

● Make offline travel expenses with corporate travel cards

● Easily sync all expense data to your accounting software with native integrations

● Easily submit receipts, track expenses, and manage controls through our mobile app

Simplify your expense management

FAQs on travel expense management

Travel and expense management software is a technological solution designed to automate and streamline the processes associated with managing travel expenses for businesses. It encompasses expense tracking, receipt scanning, reimbursement management, travel booking, and reporting functionalities.

There are several reputable travel and expense management software options available, such as Volopay, Expensify, and Concur. The best software choice depends on the specific needs and budget of each business.

Volopay is a comprehensive expense management platform that offers features such as automated expense tracking, virtual corporate cards, and expense approvals. It streamlines travel and expense management processes, enhances financial visibility, and provides real-time insights into expenses.

Businesses choose Volopay for its user-friendly interface, robust expense management features, seamless integration with accounting software, and dedicated customer support. Volopay also offers a cost-effective integration with TruTrip(one of South Asia’s biggest travel booking platforms) that simplifies travel and expense management for businesses in Singapore.