👋 Exciting news! UPI payments are now available in India! Sign up now →

India's top 11 prepaid cards for businesses in India (2026)

Prepaid cards have gained significant popularity among individuals and businesses in India, revolutionizing the way people manage their finances. These cards, loaded with a predetermined amount, offer numerous benefits over traditional credit and debit cards.

With their convenience and flexibility, prepaid cards have become a preferred choice for budgeting, expense control, security, and international payments. In 2026, several prepaid card options are available in India, catering to various needs and preferences.

What are prepaid cards?

Prepaid cards are payment tools that allow users to load funds in advance, facilitating transactions up to the preloaded amount. Unlike conventional credit or debit cards, they aren't linked to a bank account and typically don't require a credit check.

These cards offer flexibility for various transactions, including online purchases, bill payments, and in-store shopping. With their prepaid nature, they offer users a sense of security and budgeting control, minimizing the risk of overspending and exposure to fraud.

Reloadable prepaid cards allow users to add funds as needed, while disposable cards are meant to be discarded once the balance is used up. Both are favored by individuals seeking financial management tools, travelers, and those without traditional banking services.

The Indian market for 2026 has some of the best prepaid cards out there, making a sound choice given so many options is critical for the financial success of any business.

Best prepaid cards for businesses in India: At a glance

11 Best prepaid cards in India

1. Volopay prepaid cards

Key features

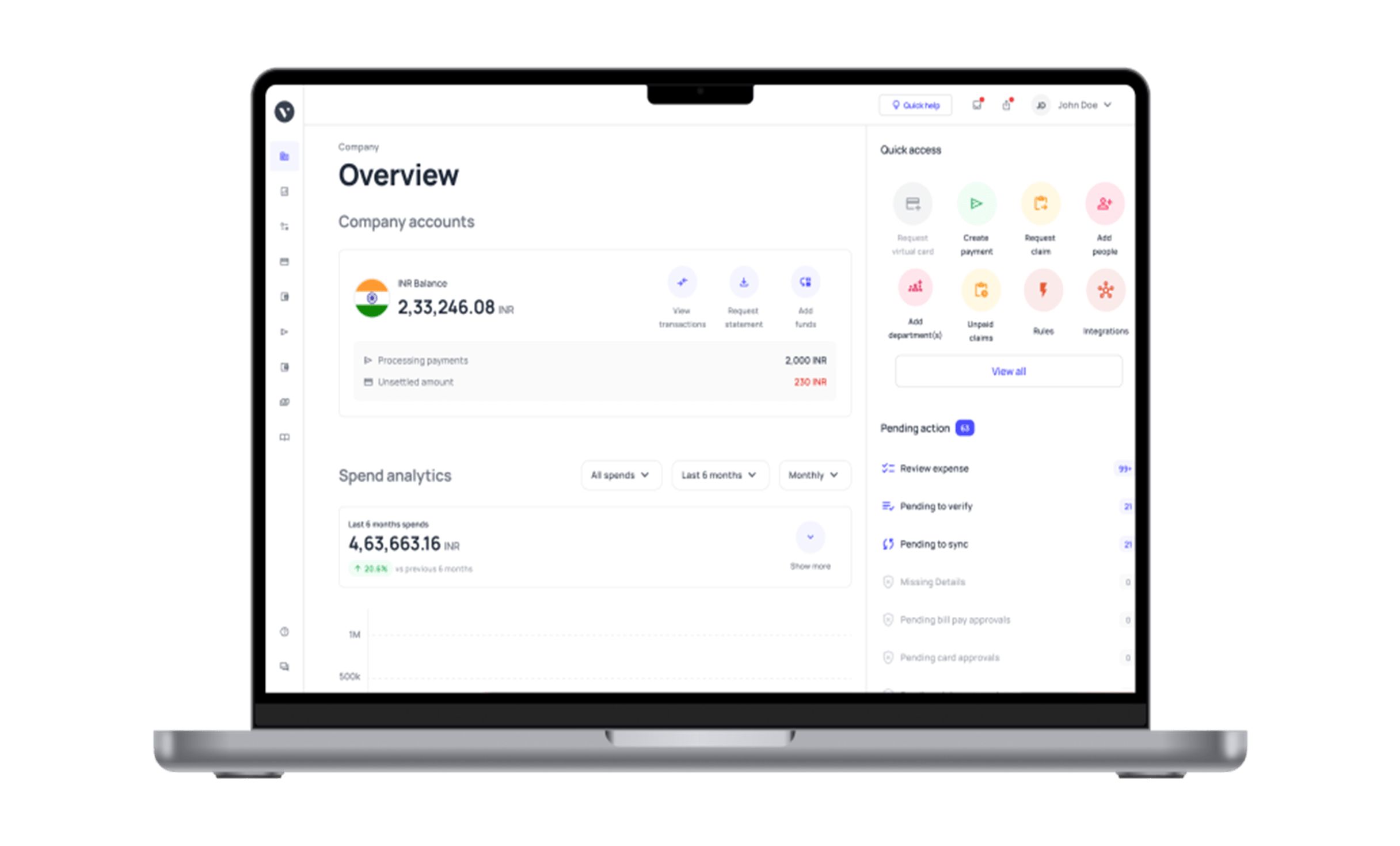

Volopay provides one of the best prepaid cards thanks to the host of features you get with it. You can issue one physical prepaid card for each of your employees and also create unlimited virtual prepaid cards.

Using our web platform or mobile app, you can set up custom spending limits for each card and also keep track of all expenses in real-time. Transactions and your financial data are safe as we ensure the highest standards of security protocols with our platform being ISO certified and PCI DSS compliant.

Usage scenarios

The physical prepaid cards are great to provide employees when they are traveling for business purposes. It will help them pay for commuting, client meeting dinners or lunches, and other entertainment expenses. Virtual prepaid cards are great to manage any kind of online business expense as they are more secure due to their tokenized nature.

Types

One of the more modern, comprehensively equipped card providers in this list of best prepaid cards is Volopay. The Volopay prepaid cards come in various forms such as travel cards, gift cards, reimbursement cards, subscription cards and more.

These cards are available as both physical as well as virtual prepaid cards. In fact, the virtual cards can be issued without paying any additional charges.

Cons

Despite being one of the best prepaid cards in India Some of the cons of the Volopay prepaid cards may include being too feature-heavy, users may be apprehensive about the extensive list of features and highly updated platform.

Target audience

Volopay offers corporate cards for businesses that want to manage their employee expenses efficiently. They can be used by small, medium, and large businesses as per their requirements.

2. HDFC prepaid cards

Key features

HDFC offers a range of prepaid cards that provide convenience, security, and flexibility. These cards come with customizable spending limits, online account management, and attractive rewards programs. The two prepaid cards that HDFC suggests for corporate payments are the Millennia Prepaid Card and the MoneyPlus Card.

Usage scenarios

HDFC prepaid cards are ideal for individuals and businesses seeking a versatile payment solution for day-to-day expenses, online shopping, travel, and entertainment.

Types

HDFC Bank provides various prepaid card options catering to diverse requirements. Their offerings include the Millennia Prepaid Card for corporate use, food and medical payments; the GiftPlus and eGiftPlus Card for gifts; the FoodPlus Prepaid Card for food payments; the MoneyPlus Card for corporate payments and the reward card for rewards.

Cons

Despite being one of the best prepaid cards in India, some of the cons of HDFC prepaid cards may include issuance fees, reloading charges, and possible transaction fees for international usage. Users might also face limitations in terms of acceptance, particularly in areas where HDFC's network is not established.

Target audience

HDFC prepaid cards cater to a broad audience, including frequent travelers, online shoppers, and businesses of all sizes looking for efficient expense management tools.

3. SBI business debit cards

Key features

SBI business debit cards offer businesses the convenience of accessing funds from their bank accounts while enjoying the benefits of a prepaid card. They provide expense control, easy tracking, and cashless payment options.

Usage scenarios

SBI business debit cards are beneficial for businesses that require controlled spending for their employees, streamline expense management, and reduce paperwork.

Types

State Bank of India (SBI) offers a range of prepaid card options tailored to different needs. This includes the State Bank Gift Card for gifting convenience, State Bank EZ Pay Card for easy periodic payments, State Bank Foreign Travel for safe and convenient foreign travel, State Bank Achiever Card for instant gratification

It also includes SBI NMRC City1 Card for travel in Noida Metro and Buses, Nagpur Metro Maha Card for cashless travels in Nagpur Metro, and SBI MMRDA Mumbai1 Card for Cashless travels in MMRDA Metro.

Cons

A commonly known drawback of SBI services is its customer service issues. Additionally, users might encounter limited acceptance in certain regions or online platforms where SBI prepaid cards may not be supported.

Target audience

Small and large businesses that prefer a seamless integration of banking and expense management find SBI business debit cards valuable.

4. Axis Bank prepaid cards

Key features

Axis Bank offers prepaid cards with features like online shopping, utility bill payments, and global acceptance. These cards provide enhanced security through chip and PIN technology.

Usage scenarios

Axis Bank prepaid cards are suitable for individuals who frequently make online purchases, travel abroad, or want a safe alternative to carrying cash.

Types

Axis Bank offers some of the best prepaid cards in India; available in three variants, each card comes with a set of features to be used for a specific purpose. These include the Axis Bank Meal card, the Axis Bank Gift card, and the Axis Bank Smart Pay card.

Cons

Drawbacks of the Axis Bank card offerings in India could be the associated fees and lack of variety.

Target audience

Axis Bank prepaid cards cater to tech-savvy individuals, frequent travelers, and those seeking a secure payment option.

5. Yes Bank prepaid cards

Key features

Yes Bank prepaid cards offer benefits such as easy loading, online account access, and competitive exchange rates for international transactions. They also provide expense tracking and spend analysis tools.

Usage scenarios

Yes Bank prepaid cards are suitable for individuals traveling abroad, students studying overseas, and businesses managing cross-border payments.

Types

The Yes Bank prepaid card offerings in India come in four particular variants. These include the Yes Bank Jewellery Gift card, the Yes Bank Multicurrency Travel card, the Yes Gift card, and the Incredible India card.

Cons

Some of the drawbacks of these cards offered by Yes Bank that could be an obstacle in the future include acceptability across all merchant outlets and service issues.

Target audience

Individuals and businesses requiring international payment solutions and efficient expense tracking can benefit from Yes Bank prepaid cards.

6. Bank of Baroda prepaid cards

Key features

Bank of Baroda prepaid cards offer secure and convenient payment options, including contactless payments. These cards come with features like balance inquiry, mini statements, and ATM withdrawals.

Usage scenarios

Bank of Baroda prepaid cards are suitable for individuals who want an easy-to-use payment option for everyday transactions and ATM cash withdrawals.

Types

Bank of Baroda, another popular baking service provider in the country offers three prepaid debit card variants.

These include the Baroda Reloadable Card for all varieties of payment needs, the Bank of Baroda Gift Card for gifting purposes, and the Baroda Multi Currency Forex Card, which functions as a prepaid International currency card.

Cons

Some of the drawbacks of Bank of Baroda's card services could include the list of features available and accessibility across the country.

Target audience

Bank of Baroda prepaid cards cater to individuals seeking a simple and reliable payment method with wide acceptance.

7. Bank of India Cashit prepaid cards

Key features

Bank of India Cashit prepaid cards provide users with the convenience of contactless payments, online shopping, and mobile app access for card management. They also offer features like zero lost card liability and SMS alerts.

Usage scenarios

Bank of India Cashit prepaid cards are ideal for individuals who prefer a secure and accessible payment option for retail purchases, online transactions, and bill payments.

Types

The Bank of India also offers prepaid cards in three variants. These include the Bank of India Gift card, the Bank of India Cashit prepaid card, and the Bank of India International Travel card. Each of these cards has its own set of features and services for a general purpose.

Cons

Drawbacks commonly associated with Bank of India cards could include the lack of variation in offerings and branch availability.

Target audience

Bank of India Cashit prepaid cards cater to individuals looking for a versatile payment solution with enhanced security features.

8. SBM cards

Key features

SBM prepaid cards offer seamless online shopping, global acceptance, and attractive rewards programs. SBM has partnered with different brands such as ‘slice’ and ‘Open’ to provide their prepaid cards in India.

Usage scenarios

SBM prepaid cards are suitable for individuals who frequently shop online, travel, or want a reliable payment method for everyday purchases.

Target audience

Individuals who prioritize convenient and secure payment options with additional benefits find SBM prepaid cards valuable.

9. Happay prepaid cards

Key features

Happay prepaid cards offer businesses expense management features like real-time expense tracking, policy enforcement, automated expense reporting, and integration with accounting systems.

Usage scenarios

Happay prepaid cards are ideal for businesses that require effective control over employee expenses, simplified reimbursement processes, and accurate financial reporting.

Types

Happay offers a range of prepaid cards tailored to meet diverse financial needs. Their cards come in various types, including corporate expense cards, travel cards, and meal cards.

Cons

One limitation with Happay cards is the potential for fees associated with card issuance, loading, and usage. Additionally, the acceptance of prepaid cards may vary, particularly in regions or establishments where card payments are less common.

Target audience

Enterprises of all sizes looking for comprehensive expense management solutions can leverage the benefits of Happay prepaid cards.

10. EnKash prepaid cards

Key features

Enkash prepaid cards are designed specifically for businesses, offering features like expense management, budget control, real-time transaction tracking, and automated bookkeeping.

Usage scenarios

Enkash prepaid cards benefit businesses looking to streamline their expense management processes, control employee spending, and simplify accounting tasks.

Types

EnKash provides prepaid card solutions geared towards business expenses and vendor payments. Their offerings include virtual prepaid cards and physical prepaid cards. Both cards come with a comprehensive set of features that offer accessibility and ease of use.

Cons

As with any prepaid card, the acceptance and availability of EnKash cards is a considerable drawback to consider given that it may vary depending on the specific requirements and preferences of vendors and merchants.

Target audience

Small and medium-sized enterprises (SMEs) seeking efficient expense management solutions and better financial control can benefit from Enkash prepaid cards.

11. OmniCard

Key features

OmniCard offers you a versatile prepaid card solution that provides convenience, security, and control over your finances. You can create a RuPay-powered digital card instantly and order a personalized physical card for transactions.

OmniCard supports swipe, scan, tap, and online payments, ensuring smooth experiences across merchants.

You can set spending limits, track expenses, and manage multiple cards for family members. Additionally, you can withdraw cash from any ATM across India directly from your e-wallet.

Usage scenarios

OmniCard suits your day-to-day expenses, online shopping, travel, and entertainment needs. Its intuitive expense management tools allow you to control household spending.

For your business, OmniCard serves as an effective solution for corporate gifting and employee rewards, including exclusive ONDC Corporate Gift Cards. These cards provide access to a wide range of products across multiple categories, enhancing the gifting experience for your employees and partners.\

Types

OmniCard provides various prepaid card options tailored to your needs. You can use the standard OmniCard for managing daily expenses efficiently.

For your company, OmniCard offers exclusive ONDC Corporate Gift Cards, ideal for rewarding employees or gifting partners. These cards are accepted across multiple ONDC Buyer Apps, including Paytm and Magicpin, giving access to products in categories like groceries, fashion, electronics, and more.

Cons

While OmniCard offers many advantages, you may encounter fees for card issuance, reloading, or specific transactions, especially for international usage. Acceptance may be limited with merchants that don’t support RuPay cards.

Before choosing OmniCard, review its fee structure to ensure it suits your financial needs and spending habits.

Target audience

OmniCard caters to tech-savvy individuals, young professionals, and families seeking secure, manageable payment solutions. Its digital-first features appeal to those who prefer real-time expense tracking.

Your business can also benefit from OmniCard’s corporate offerings, using them for employee rewards and corporate gifting, which can enhance employee satisfaction and simplify financial operations.

Importance of prepaid cards in modern financial management

1. Budgeting and expense control

Prepaid cards empower individuals to set strict spending limits, enabling better budgeting and expense management.

Due to the card’s prepaid nature, there is no chance of overspending by employees intentionally or unintentionally. This helps finance teams stay worry-free and know that company expenses will not go beyond the limits that have been set by them.

2. Convenience and flexibility

With prepaid cards, users enjoy the convenience of making payments at various establishments and online platforms, while the flexibility to reload the card ensures uninterrupted transactions.

Whether it is physical or virtual prepaid cards, it is also very convenient for a company to issue new prepaid cards with the help of their provider.

3. Security and fraud prevention

Prepaid cards in India reduce the risk of fraud and identity theft, as they are not linked to personal bank accounts. In case of loss or theft, the cardholder's financial exposure is limited to the amount loaded on the card.

If the cardholder finds out soon enough that their card has been stolen or lost, they can also freeze or block the card through the provider's mobile app to ensure the money isn’t misused.

4. Travel and international payment

Prepaid cards eliminate the hassle of carrying large amounts of cash and worrying about currency exchange rates when traveling abroad.

Users can make payments easily and securely, with the card automatically converting the currency. They are also widely accepted at different places depending on the payment network linked to your card.

Is your business struggling to keep travel expenses under check? Explore our in-depth article on travel and expense management to unlock the secrets to streamline your travel and expense management process.

5. Expense tracking

Prepaid cards often come with built-in expense tracking features, providing users with detailed insights into their spending habits and helping them make more informed financial decisions.

Each transaction is tracked and recorded in real-time. This gives the company and the user complete visibility and ensures transparency between them.

6. Subscription services

Many prepaid cards allow users to set up recurring payments for subscription services, ensuring seamless payments without the need for manual intervention.

You can also use virtual prepaid cards for handling specific subscriptions. You can set spending limits of just that one subscription so that there is no chance of accidental double payments in a month.

Common types of prepaid cards in India

1. Travel prepaid cards

Travel prepaid cards provide a secure and convenient method for employees to handle their travel expenses. These cards can be preloaded with a predetermined amount, typically matching the per diem allowance. This ensures effective budget management during business trips, all while offering the flexibility of cashless transactions.

2. Meal and food prepaid cards

Meal and food prepaid cards in India have gained popularity, especially in urban settings. They serve as a convenient alternative to cash for dining out or ordering food.

Users can load a specific amount onto the card, ensuring budgetary control and often unlocking discounts or loyalty rewards at affiliated eateries.

3. Salary and payroll prepaid cards

Salary and payroll prepaid cards streamline financial transactions for businesses and employees. Companies load employees' salaries onto these cards, providing a cashless and efficient payroll system.

Employees can easily withdraw cash, make purchases, or pay bills using the card. This method not only simplifies financial processes but also offers financial inclusion to those without traditional bank accounts.

Business prepaid card vs. business debit card: Key differences

1. Definition

Business prepaid cards

When you use prepaid business cards, you load funds onto them before spending. They are not linked directly to a business checking account, making them distinct from debit cards.

You can issue multiple cards to employees, track expenses efficiently, and streamline budgeting while ensuring better financial control over everyday operations and business-specific transactions.

Business debit cards

Business debit cards connect directly to your business bank account, pulling funds instantly with every transaction. You do not need to pre-load money, but transactions reduce your account balance immediately.

These cards are typically provided by banks and allow businesses to make purchases, ATM withdrawals, or online payments conveniently while maintaining access to real-time funds.

2. Funding source and reloading

Business prepaid cards

With prepaid cards for business, you must first load a set amount before employees can spend. Reloading can be done digitally through transfers or automatically based on company needs.

This setup helps you maintain strict budget limits, track all transactions in one platform, and reduce overspending risks across different spending categories.

Business debit cards

Business debit cards draw money directly from your primary account, so reloading is unnecessary. While this provides seamless transactions without pre-planning, it also exposes your account balance to all spending activity.

If multiple employees share access, overspending or mismanagement can occur unless additional controls are established, making monitoring more challenging for finance teams.

3. Spending controls and flexibility

Business prepaid cards

The best prepaid business cards give you strong spending controls. You can set custom limits, restrict merchant categories, and instantly block or freeze cards if misuse occurs. Employees gain flexibility for approved purchases without unrestricted access.

This structured control enhances accountability while allowing efficient expense distribution across projects, teams, or departments within your organization.

Business debit cards

Business debit cards offer limited flexibility compared to prepaid options. Since they are linked to your bank account, you cannot set individual employee spending caps directly.

While some banks provide transaction alerts or monitoring features, the lack of detailed control can make managing company-wide expenses harder, particularly when multiple users need independent access to funds.

4. Risk and security considerations

Business prepaid cards

Prepaid cards for business minimize risks by isolating spending from your main account. Even if fraud occurs, exposure is limited to the loaded amount rather than your total account balance.

Security features like instant freezing, two-factor authentication, and real-time notifications strengthen control. This makes them highly secure for distributed teams and digital-first companies.

Business debit cards

Business debit cards involve higher risk since transactions access your business bank account directly. Fraudulent charges or data breaches can compromise all available funds.

While banks provide fraud protection, recovery can take time, potentially disrupting cash flow. Employee misuse is also harder to control, making debit cards less secure compared to prepaid alternatives for businesses.

5. Suitability for businesses

Business prepaid cards

Prepaid business cards are ideal if you need strict budget controls, expense tracking, and flexible distribution of funds across employees or departments.

They suit startups, SMEs, and growing companies that prioritize transparency, real-time visibility, and scalability. By isolating funds, you reduce financial exposure while enabling streamlined corporate expense management and operational accountability.

Business debit cards

Business debit cards suit companies that want quick, unrestricted access to account funds. They work best when financial oversight is centralized and employee card distribution is limited.

Larger firms with established banking infrastructure may prefer debit cards for convenience, but smaller or fast-scaling businesses might struggle with limited control and potential risks.

How prepaid cards work for Indian businesses

Loading funds onto prepaid cards

You load money onto prepaid cards through digital transfers, corporate accounts, or payment gateways. This process ensures employees spend only the pre-approved balance.

Unlike debit cards, funds are not drawn directly from business accounts, giving you better oversight of expenses and greater flexibility in managing company-wide financial allocations with improved control.

Spending and transaction process

Once funds are loaded, employees can use prepaid cards for POS purchases, ATM withdrawals, or online payments. Each transaction deducts from the available balance rather than from a central account.

You maintain visibility across all transactions, ensuring authorized spending while avoiding risks tied to unrestricted bank account access or unmanaged company finances.

Integration with business accounts

Prepaid cards can be seamlessly integrated with your business expense platforms, accounting software, or ERP systems. This integration allows automatic synchronization of payments, receipts, and expense categories.

You can easily reconcile company accounts without manual tracking, reducing errors, improving accuracy, and ensuring transparency in financial records for audits and reporting requirements.

Monitoring and controlling expenses

You can monitor transactions in real time, categorize expenses, and set spending limits by department or employee. Advanced dashboards allow detailed visibility into spending patterns, helping you identify inefficiencies or overspending.

Instant notifications and blocking features provide greater control over corporate finances while ensuring employees spend responsibly within approved budget frameworks.

Recharge and top-up options

Recharge options include online banking, UPI transfers, corporate account top-ups, or automated reloading based on company rules. These features allow uninterrupted employee access while maintaining budget restrictions.

You can schedule recurring top-ups, reduce administrative tasks, and ensure continuous business operations without delays, making the process convenient, reliable, and highly efficient.

Compliance and RBI regulations

Prepaid cards in India function under Reserve Bank of India regulations, ensuring compliance with KYC norms, reporting standards, and spending limits. This framework helps you operate legally while protecting against misuse.

Following RBI guidelines also assures businesses of system integrity, secure transactions, and consistent oversight for maintaining transparent financial practices.

Advantages of prepaid cards over other payment methods

Better expense control

Prepaid cards let you assign fixed balances to employees or teams, ensuring expenses remain within approved budgets. Since money is preloaded, overspending is prevented.

Centralized dashboards further provide detailed insights into spending categories, allowing you to maintain accurate financial discipline and improve budget allocation across projects, departments, or business operations.

Reduced risk of overspending

Because prepaid cards carry only preloaded balances, employees cannot exceed set limits. This approach safeguards you from unplanned or unauthorized expenses, unlike credit or debit cards linked to broader accounts.

The predefined control improves accountability, keeps business cash flow secure, and simplifies managing financial activities without constant manual monitoring from finance managers.

Enhanced security features

Prepaid cards include advanced protections such as instant freezing, real-time transaction alerts, and multi-factor authentication. If misuse occurs, exposure is limited to the loaded funds.

This adds another safeguard compared to other methods, allowing you to mitigate fraud risks, maintain control, and build trust in daily corporate payment practices effectively.

Simplified employee expense management

By assigning cards to employees, you can streamline expense processes and eliminate reimbursement paperwork. Instead of using personal cards, employees directly access allocated funds.

This improves transparency, reduces delays in expense settlements, and fosters accountability. Prepaid solutions also minimize disputes while giving you centralized visibility of employee-related business transactions anytime.

Flexibility for online and offline payments

Prepaid cards can be used across online platforms, retail stores, travel bookings, and vendor payments. This dual capability ensures convenience for employees managing diverse business expenses.

You gain freedom to distribute cards for different functions, ensuring smooth financial workflows both online and offline, without dependency on a single payment channel.

Easy tracking and reporting

With prepaid cards, transactions are recorded in real time and easily exported into reports. You can categorize payments, generate summaries, and analyze spending trends with minimal effort.

This simplified reporting enhances transparency and accountability while giving you data-driven insights for financial decision-making and long-term company budgeting strategies effectively.

No need for direct bank account access

Employees do not need direct access to your main bank account when using prepaid cards. This setup reduces potential risks of unauthorized withdrawals or exposure of sensitive account details.

You maintain tighter security while ensuring employees still complete necessary purchases efficiently, aligning with modern business finance management standards in practice.

How to choose the best prepaid card?

There is no one-size-fits-all way to select a prepaid card. Everything depends on the requirements and capacities of your business.

However, the following factors can be used as general guidelines:

1. Determine the purpose

Selecting the best prepaid cards begins with a clear understanding of your purpose. Identify whether you need it for travel, everyday expenses, or a specific financial goal.

Different prepaid cards cater to distinct needs, so aligning your purpose with the card's features ensures optimal utility.

2. Analyze the fee structure and charges

Thoroughly examine the prepaid card's fee structure, including assessments like issuance fees, monthly maintenance charges, and ATM withdrawal costs.

Make comparisons among various choices to select a card that fits well within your budget and spending patterns, preventing any undue financial burdens.

3. Check usage limitations

Be aware of usage limitations imposed by the prepaid card. Understand daily spending limits, transaction restrictions, and any other constraints that may impact your intended use.

Choose a card that accommodates your spending patterns without hindering your financial flexibility.

4. Reload options

Consider the reload options available for the prepaid card. Assess the convenience, associated charges, and processing time for reloading funds.

Opt for a card that provides flexible and cost-effective reload methods to ensure seamless access to funds when needed.

5. Security offered

Prioritize the security features of the prepaid card. Look for options with robust security measures such as PIN protection, transaction alerts, and the ability to lock or unlock the card.

A secure prepaid card safeguards your finances and personal information from potential threats.

6. Additional features

Explore additional features that enhance the overall value of the prepaid card. Some cards offer rewards, cashback, or exclusive discounts.

Consider your preferences and choose a card that aligns with your lifestyle, providing additional perks that complement your financial goals.

7. Read reviews and testimonials

Tap into the experiences of other users by reading reviews and testimonials. Real-world feedback provides insights into the card's performance, customer service, and overall satisfaction.

A well-reviewed prepaid card is more likely to meet your expectations and deliver a positive user experience.

8. Understand the terms and conditions

Before making a final decision, carefully read and comprehend the terms and conditions linked to the prepaid card. Focus on particulars like expiration dates, dispute resolution procedures, and any undisclosed clauses.

A thorough understanding of the terms guarantees a transparent and hassle-free usage experience.

Best practices in using prepaid cards

1. Choose the right card provider

Choosing a trustworthy and dependable card issuer is essential. Evaluate and meticulously compare various providers considering aspects like fees, features, customer service, and security measures. Opt for a provider that suits your organization's requirements and provides clear terms and conditions.

2. Customize your card

Numerous providers of prepaid cards provide customization features, enabling businesses to incorporate their logo or branding onto the cards. This customization not only boosts brand exposure but also aids employees in quickly recognizing company-owned cards, thereby minimizing the potential for misuse.

3. Integrate into existing system

Integrating prepaid card systems into existing accounting and expense management systems streamlines processes and ensures accuracy. Syncing card transactions with accounting software eliminates manual data entry and minimizes errors, improving efficiency and transparency.

4. Establish clear policies and procedures

Develop comprehensive policies and procedures governing the use of prepaid cards within your organization. Outline guidelines for card issuance, spending limits, permissible expenses, and reporting requirements.

Clear policies help prevent misuse and ensure compliance with regulatory standards. The best prepaid cards in India typically offer a high degree of customization in this particular aspect.

5. Train employees

Provide thorough training to employees on how to use prepaid cards effectively and in accordance with company policies. Educate them on the purpose of the cards, spending limits, documentation requirements, and proper record-keeping practices.

Training sessions foster understanding and accountability among employees, reducing the likelihood of errors or policy violations.

6. Continuously monitor and review expenses

Regularly monitor card transactions and review expense reports to identify any anomalies or discrepancies promptly. Implement systems for real-time monitoring of spending patterns and alerts for unusual activity.

Regular reviews enable proactive management of expenses and help identify areas for cost optimization.

7. Automated reconciliation

Employ automated reconciliation tools to simplify the matching of card transactions with relevant expense reports or invoices.

This automation decreases the time and labor needed for manual account reconciliation duties, decreasing errors and guaranteeing precision in financial documentation.

Common use cases for prepaid cards for businesses

Travel expenses

Prepaid cards are an ideal choice for managing travel expenses. Employers can load funds onto cards specifically designated for business travel, allowing employees to cover expenses such as accommodation, meals, transportation, and incidental costs.

Travel prepaid cards often come with features like currency conversion, travel insurance, and spending limits tailored for international trips.

Petty cash expenses

While businesses can load a set amount onto prepaid petty cash cards for small expenses like office supplies or coffee runs, prepaid cards offer broader functionality. These cards can be used for a wider range of business expenses, provide greater flexibility for employees, and offer enhanced control over spending with real-time tracking and customizable limits.

The best prepaid cards streamline petty cash management by eliminating the need for physical cash handling and providing detailed transaction records for accountability.

Incentives and rewards

Prepaid cards are an effective tool for incentivizing and rewarding employees or customers. Businesses can issue prepaid cards as bonuses, performance incentives, or loyalty rewards.

These cards offer recipients the flexibility to use the funds as they choose, whether for personal purchases, dining experiences, or entertainment, enhancing motivation and engagement.

Employee perks and benefits

Prepaid cards can be utilized to administer employee perks and benefits efficiently. Companies can offer prepaid cards as part of employee benefit packages for expenses like healthcare reimbursements, wellness programs, or commuter benefits.

Prepaid cards simplify the distribution of benefits and empower employees to manage their expenses effectively.

Online purchases

Prepaid cards serve as a convenient option for conducting online transactions and purchases. Companies have the option to distribute prepaid cards to their staff members, facilitating the acquisition of office essentials, software subscriptions, or services related to business operations online.

These cards come with security measures such as limited liability protection and virtual card capabilities, which effectively minimize the chances of online transaction fraud.

Vendor payments

Prepaid cards streamline vendor payments and accounts payable processes. Businesses can issue prepaid cards to vendors or contractors for payment of goods or services rendered.

Prepaid cards offer a faster and more convenient alternative to traditional payment methods like checks or bank transfers, reducing processing times and administrative burdens.

How to reload a prepaid business card

Bank transfers and NEFT/IMPS/RTGS

You can reload prepaid cards directly from your company’s bank account using NEFT, IMPS, or RTGS transfers. These channels ensure quick, secure, and traceable fund movement.

By selecting the appropriate method, you balance speed, cost, and convenience, ensuring employees have access to funds without delays in business operations.

Linking with corporate bank accounts

Prepaid business cards can be linked with corporate accounts for seamless reloading. This integration allows instant transfers from your primary bank account to the card balance.

It reduces manual intervention, speeds up fund distribution, and ensures smoother cash flow management while giving you tighter control over employee-related or department-specific spending activities.

Using payment gateways or wallets

Many issuers allow reloading prepaid cards through online payment gateways or business wallets. This method offers flexibility and convenience for topping up cards anytime.

You can manage multiple cards at once, reduce dependency on traditional transfers, and enable faster access for employees, ensuring uninterrupted business spending without operational slowdowns.

Automated recurring top-ups

Automated reloading options let you schedule recurring top-ups for specific employees or departments. This ensures uninterrupted access to necessary funds, eliminates manual monitoring, and supports predictable workflows.

You maintain better efficiency by setting predefined intervals or thresholds for top-ups, ensuring employees have resources while keeping expenses within budgetary limits consistently.

Setting spending limits while reloading

When reloading, you can set transaction or monthly limits to regulate spending behavior. Predefined caps ensure employees use funds responsibly while aligning with organizational budgets.

Limits also reduce the risk of misuse, fraud, or unplanned costs. This proactive control makes prepaid cards a secure and reliable business payment solution.

Compliance checks during reloads

Every reload undergoes compliance checks as per RBI guidelines and KYC requirements. These checks confirm the source of funds and prevent misuse.

For businesses, this ensures transparency, lawful operation, and security. Adhering to compliance standards minimizes risks of fraud while aligning financial practices with regulatory expectations and business accountability.

What are the alternatives to prepaid business cards?

1. Business credit cards

Business credit cards offer revolving credit, letting you spend first and repay later. They are useful for managing cash flow, building credit history, and earning rewards.

However, they can lead to higher debt risks if misused. Unlike prepaid cards, credit cards extend borrowing power while carrying potential interest liabilities.

2. Business debit cards

Business debit cards provide direct access to your company’s bank balance. Transactions deduct funds instantly, making them simple and widely accepted.

They eliminate the need for preloading but expose your full account balance to risks. Debit cards suit businesses seeking straightforward payments, though they lack the detailed controls prepaid cards provide.

3. Corporate charge cards

Corporate charge cards allow businesses to make large purchases without preset spending limits. However, balances must be cleared monthly, preventing debt accumulation.

These cards are useful for enterprises with strong cash flows. While offering high flexibility, they lack preloading discipline, making them better suited for large corporations than smaller businesses.

4. Petty cash systems

Petty cash systems involve keeping physical currency available for small or urgent expenses. While convenient for minor transactions, it lacks transparency, security, and tracking compared to card-based systems.

Mismanagement and theft risks are higher. Digital alternatives like prepaid or corporate cards now replace petty cash in modern businesses seeking accountability.

5. Digital wallets and UPI solutions

Digital wallets and UPI platforms enable fast, contactless payments for small business expenses. They are convenient for online transactions, vendor payments, or quick reimbursements.

However, they lack enterprise-level controls, reporting, and multi-user management. For structured expense management, businesses may prefer prepaid cards or advanced financial solutions with integrated tracking.

6. Corporate expense management platforms

Corporate expense management platforms combine prepaid cards, accounting integrations, and advanced reporting. They help you centralize expenses, automate reconciliations, and maintain compliance.

Unlike standalone alternatives, these platforms improve visibility, streamline approvals, and prevent overspending. With Volopay, you access an all-in-one solution offering real-time monitoring, automated workflows, and smarter financial control.

How Volopay prepaid cards empower Indian businesses

Volopay prepaid cards help you simplify corporate finances by offering full visibility, customizable spending limits, and better control. With advanced integrations and security features, they reduce risks, improve accountability, and support compliance.

Whether you manage startups or larger enterprises, Volopay enables seamless financial operations while empowering teams with smarter expense management tools.

Centralized control of business expenses

Volopay prepaid cards give you centralized expense management. Instead of tracking payments across multiple platforms, you control everything from one dashboard. This system reduces errors, improves accountability, and ensures faster decision-making.

By consolidating expenses, you achieve stronger oversight, minimize leakage, and enforce company-wide financial discipline without cumbersome manual processes.

Real-time tracking and reporting

With Volopay, you can track transactions in real time and generate automated real time reports. This helps you monitor cash flow, identify unusual activity, and optimize spending patterns.

Immediate visibility into every transaction ensures transparency across departments, streamlines audits, and provides actionable insights for better forecasting, expense control, and long-term strategic financial planning.

Customizable spend limits for teams and employees

Volopay prepaid cards allow you to assign customizable budgets for employees, teams, or projects. You can set limits per transaction, daily, or monthly, ensuring strict compliance with company policies.

These controls improve accountability, reduce misuse, and empower employees with the freedom to spend responsibly while aligning with organizational financial objectives.

Seamless integration with accounting tools

Volopay integrates with popular accounting tools and ERP systems, eliminating manual reconciliations. Transactions automatically sync with expense categories, saving time and reducing errors.

This integration streamlines bookkeeping, enhances data accuracy, and provides real-time financial insights. As a result, you reduce administrative workload while maintaining compliance and improving decision-making efficiency for finance teams.

Multi-currency support for global transactions

Volopay prepaid cards support multiple currencies, making global business transactions easier. You can pay international vendors, manage subscriptions, or cover travel expenses without costly conversions.

This flexibility helps you expand internationally, avoid hidden fees, and empower employees to conduct seamless cross-border transactions with greater financial control and cost savings.

Enhanced security and fraud protection

Volopay prioritizes security through features like instant card freezing, multi-factor authentication, and fraud detection alerts. By limiting exposure only to loaded balances, risks are minimized.

You gain peace of mind knowing funds are safeguarded. This proactive protection ensures secure business payments both online and offline, enhancing trust and operational continuity.

Simplified compliance and GST management

Volopay simplifies compliance by automatically recording transactions with GST-ready invoices. Expense data aligns with statutory requirements, ensuring error-free tax filing. You save time during audits and eliminate manual entry.

This automation ensures transparency, reduces compliance risks, and streamlines financial reporting while supporting accurate GST management for Indian businesses effectively.

Scalability for startups and growing enterprises

Volopay prepaid cards are designed to scale with your business. Startups gain tighter controls and transparency from day one, while growing enterprises benefit from advanced reporting and integrations.

As your company evolves, Volopay adapts to increased transaction volumes and complex requirements, ensuring reliable financial management without operational bottlenecks or inefficiencies.

FAQs

Yes, Volopay prepaid cards are highly customizable payment control tools. Users can tailor a number of features to their own requirements, including approval workflows, spend limits, user controls and so much more.

Prepaid card fees typically include issuance, reload, transaction, foreign transaction, inactivity, replacement card, customer service, and balance inquiry fees. These charges vary by provider and card type. It's essential for users to review the fee schedule and terms before obtaining a prepaid card to manage costs effectively.

Yes, businesses can typically monitor and restrict certain types of purchases or industries from their prepaid cards. They may implement controls such as spending limits, category restrictions, and merchant blocking to manage expenses and ensure compliance with company policies and regulations.

When generating Volopay prepaid cards you can choose to set daily or monthly transaction limits on spending. The best prepaid cards allow a high degree of flexibility in this particular context.

Volopay prepaid business cards are highly secure, offering instant freezing, real-time notifications, and two-factor authentication. Since only loaded funds are exposed, risks remain limited, protecting your business from fraudulent or unauthorized activities effectively.

Yes, Volopay prepaid cards integrate seamlessly with accounting and ERP software. Transactions automatically sync, reducing manual reconciliations and errors. This feature saves you time, increases transparency, and enhances overall financial efficiency across departments.

Absolutely. Volopay lets you allocate prepaid cards to specific projects or departments. You can track transactions separately, assign tailored budgets, and ensure spending aligns with goals, enhancing accountability and financial clarity company-wide.