👋Exciting news! UPI payments are now available in India! Sign up now →

7 best invoice processing software in India in 2026

Efficient invoice processing is the backbone of smooth financial management for businesses, especially in a dynamic and diverse market like India. As companies increasingly embrace digital transformation, the demand for reliable and feature-rich invoice processing software has soared in 2026.

These tools are designed to tackle common challenges such as manual errors, delayed approvals, and compliance with India's complex tax regulations, including GST. From automating invoice capture to streamlining workflows and improving transparency, the best invoice processing software solutions cater to businesses of all sizes and industries.

Whether you’re a startup looking to simplify accounts payable or a large corporation aiming to optimize operational efficiency, choosing the right software can significantly enhance your financial processes.

What is invoice processing software?

Invoice processing software is a digital tool designed to streamline and automate the management of invoices within an organization. It simplifies tasks such as capturing invoice data, validating information, routing invoices for approval, and recording transactions in financial systems. Traditionally, invoice processing is a time-intensive, manual activity prone to errors and delays.

However, with advanced invoice processing automation software, businesses can significantly reduce these challenges, ensuring greater accuracy and efficiency. Key features often include automated data extraction through OCR (Optical Character Recognition) invoice processing, integration with accounting or ERP systems, and real-time tracking of invoice statuses. Many solutions also include compliance features to adhere to tax regulations, such as GST in India.

By automating repetitive tasks, invoice processing software not only reduces administrative overhead but also enhances payment accuracy and ensures timely approvals. It’s an essential tool for businesses aiming to improve financial workflows, save costs, and maintain strong vendor relationships.

7 best invoice processing software in India in 2026

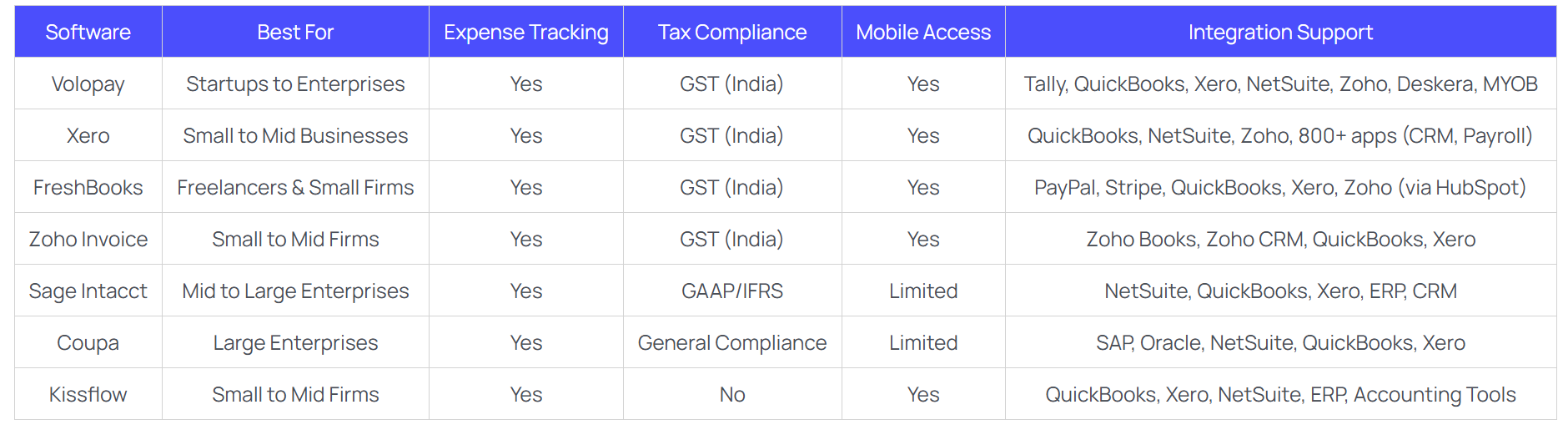

Selecting the best invoice processing software for a business can improve financial management by automating manual tasks, reducing errors, and enhancing workflow efficiency. In India, several invoice processing solutions cater to various business sizes and industries. Here's an in-depth look at some of the leading software options in the country:

1. Volopay

Overview

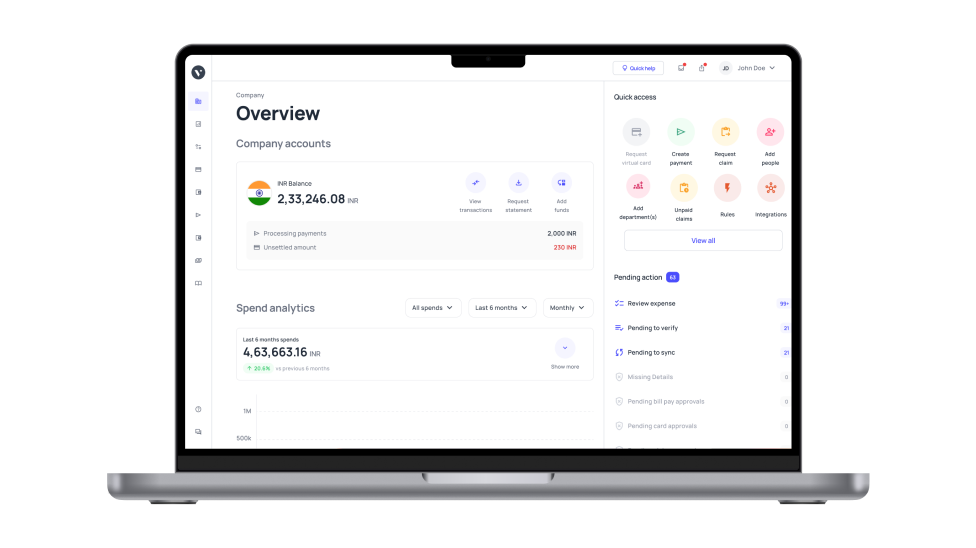

Volopay is an advanced expense management and invoice processing platform aimed at streamlining financial workflows for businesses of all sizes. Customized to address the specific requirements of Indian businesses, Volopay provides a unified solution for handling accounts payable, corporate expenses, and reimbursements.

Featuring GST-compliant invoicing and real-time tracking, the software assists organizations in minimizing manual effort, avoiding errors, and ensuring compliance with Indian tax regulations.

Features

● Automated invoice capture using OCR technology for seamless data extraction.

● Real-time tracking of invoices and payments, improving visibility into financial processes.

● GST-compliant invoicing designed specifically for Indian businesses.

● Customizable approval workflows to ensure proper checks before payment processing.

● Integration with accounting platforms like QuickBooks, Xero, and NetSuite for smooth data synchronization.

Pros

● All-in-one platform for expense and invoice management.

● Easy-to-use interface with minimal learning curve.

● Multi-currency support for businesses dealing with international vendors.

● Helps maintain compliance with local tax laws, including GST.

Cons

● Advanced reporting features are somewhat limited compared to larger enterprise solutions.

● Primarily designed for small and mid-sized businesses, making it less suitable for complex enterprise-level operations (however, customizations are available for tailor-made solutions).

Pricing

Volopay utilizes a customized pricing model, designing plans to align with the size and unique requirements of each business. Its pricing is generally competitive and appeals to startups, SMEs, mid-sized organizations, and larger enterprises looking for scalable solutions for invoice and expense management.

Target customers

Volopay is one of the best automated invoice processing software for a wide range of businesses, including small and medium enterprises (SMEs), startups, and mid-sized to large-scale companies that seek a cost-effective and user-friendly platform for automating invoice processing and managing overall expenses.

2. Xero

Overview

Xero is a cloud-based accounting platform that offers some of the best invoice processing software features, making it highly favored among small and medium-sized businesses globally. Its user-friendly interface, extensive integrations, and automation capabilities streamline financial workflows.

Xero also ensures compliance with Indian tax regulations, including GST, rendering it particularly relevant for businesses operating in India.

Features

● Automated invoice creation with customizable templates.

● GST-compliant invoicing to adhere to Indian tax laws.

● Real-time tracking of invoice statuses and payment reminders.

● Integration with over 800 third-party applications, including inventory, payroll, and CRM tools.

● Cloud access from any device, ensuring flexibility and scalability for remote work.

Pros

● Intuitive and easy-to-use interface, ideal for businesses without prior accounting expertise.

● Extensive integration options to connect with various business tools.

● Scalable features that adapt to growing business needs.

● Strong mobile app functionality for invoicing on the go.

Cons

● Some advanced features, like multi-currency support and detailed inventory management, are only available in higher-priced plans.

● Heavily reliant on cloud access, which may be a limitation for businesses requiring offline functionality.

● For smaller businesses with basic invoicing needs, it may feel expensive compared to simpler alternatives.

Pricing

Xero offers three global pricing tiers:

● Starter Plan: $29 per month, ideal for small businesses needing basic invoicing and bank reconciliation.

● Standard Plan: $46 per month, which includes bulk reconciliation and additional reporting features.

● Premium Plan: $69 per month, offering advanced features like multi-currency support and detailed analytics.

*Please check the respective provider's website for accurate pricing information, to ensure you have the most up-to-date details

Target customers

Xero is ideal for small and medium-sized businesses, independent professionals, and accounting firms that require an intuitive platform to manage invoices, financial workflows, and integrations with other business tools. Its scalable features make it especially appealing to businesses planning for long-term growth.

3. Freshbooks

Overview

FreshBooks is a comprehensive accounting and invoice processing automation software tailored for freelancers, small businesses, and service-based professionals. Known for its simplicity and ease of use, it automates time-consuming financial tasks, enabling businesses to focus on their core operations. With GST-compliant invoicing and robust time tracking features, FreshBooks is an excellent choice for Indian businesses that need efficient and reliable invoicing solutions.

Features

● Customizable and professional invoice templates

● Automated recurring billing and payment reminders

● Time tracking and project-based billing

● Expense tracking with receipt capture

● Multi-currency and multi-language support

● Mobile app for invoice management on the go

● Payment gateway integrations, like PayPal and Stripe

Pros

● Intuitive interface, requiring minimal setup and training.

● Built-in time tracking and project management, perfect for service-based businesses.

● Excellent customer support and extensive help resources.

● Multi-currency support for businesses working with international clients.

Cons

● Limited scalability for larger enterprises with complex workflows.

● Premium plans can become costly for small businesses as they grow.

● Lacks some advanced financial features found in enterprise-focused solutions.

Pricing

FreshBooks offers several pricing plans tailored to different business needs. As of February 2025, the available plans are:

● Lite: Priced at $19 per month, this plan includes basic invoicing and expense tracking features.

● Plus: At $32 per month, this plan offers additional functionalities such as payment reminders and recurring billing.

● Premium: For $60 per month, this plan provides advanced features suitable for growing businesses. user access. There is also a free trial available to help businesses evaluate the software before purchasing.

*Please check the respective provider's website for accurate pricing information, to ensure you have the most up-to-date details

Target customers

FreshBooks is best suited for freelancers, small businesses, and service providers, such as consultants or creative professionals, who need an easy-to-use platform for invoicing, time tracking, and expense management.

4. Zoho Invoice

Overview

Zoho Invoice is part of the Zoho suite of business applications. It is a cloud-based automated invoice processing software designed to help businesses manage invoicing, billing, and payment collection. Known for its user-friendly interface, Zoho Invoice is ideal for small to medium-sized businesses seeking a cost-effective solution.

Features

● Customizable invoice templates

● Automatic invoice scheduling and recurring invoices

● Multi-currency and multi-language support

● GST-compliant invoicing

● Payment reminders and automated payment follow-ups

● Integration with Zoho Books, CRM, and other platforms

● Mobile app for on-the-go invoice management

Pros

● Simple and intuitive interface

● Strong integration with other Zoho applications

● GST compliance for Indian businesses

● Free version for businesses with basic needs

● Excellent customer support

Cons

● Lacks advanced functionalities required by large enterprises.

● Customization capabilities are not as robust compared to other enterprise-grade solutions.

Pricing

Zoho Invoice offers a free plan suitable for small businesses, providing access to all features without any cost.

*Please check the respective provider's website for accurate pricing information, to ensure you have the most up-to-date details

Target customers

Zoho Invoice is ideal for freelancers, small businesses, startups, and mid-sized organizations that require a cost-effective and user-friendly invoicing solution with basic automation.

5. Sage Intacct

Overview

Sage Intacct is a powerful cloud-based solution for financial management, tailored for expanding businesses and large enterprises. It provides various modules, such as automation for accounts payable processes, financial reporting, and invoice management, with an emphasis on advanced data analytics and scalability.

Features

● Automated invoice entry and approval workflows

● Real-time financial reporting and analytics

● Multi-entity and multi-currency support

● Integration with ERP and CRM platforms

● Compliance with global accounting standards (GAAP and IFRS)

● Extensive customization options for financial operations

Pros

● Highly scalable and suitable for large enterprises

● Comprehensive financial reporting tools

● Strong security and data protection measures

● Customizable workflows to match complex organizational structures

Cons

● Steep learning curve for new users

● Expensive for small businesses

● Implementation and customization require time and technical expertise

Pricing

Sage Intacct follows a modular pricing structure that varies depending on factors like the number of users, the complexity of business entities handled, and the inclusion of advanced features. Pricing information is not publicly available; businesses are encouraged to reach out to Sage Intacct for a personalized quote.

Target customers

Designed for mid-sized to large enterprises that require sophisticated financial management and accounting solutions.

6. Coupa

Overview

Coupa is an enterprise-grade spend management platform that includes comprehensive invoice processing capabilities. It helps businesses manage procurement, expense tracking, and invoicing, providing visibility and control over financial operations.

Features

● End-to-end procurement and invoice automation

● Real-time expense tracking and spend analytics

● AI-driven fraud detection and compliance monitoring

● Supplier collaboration tools for faster invoicing and payment processing

● Integration with ERP systems such as SAP and Oracle

● Support for multi-level approval workflows

Pros

● Excellent for managing procurement and accounts payable in large enterprises

● Advanced spend analytics and fraud prevention tools

● Integration with major ERP platforms

● Strong support for compliance and audit requirements

Cons

● High cost, making it less suitable for small and medium-sized businesses

● Complex implementation process

● Requires dedicated training for effective use

Pricing

Coupa's pricing is customized based on the organization's size, requirements, and selected modules. Interested businesses should contact Coupa directly for a tailored quote.

Target customers

Coupa is one of the best invoice processing software that has been designed for large enterprises and multinational corporations that require an integrated platform for procurement, invoicing, and spend management.

7. Kissflow

Overview

Kissflow is a cloud-based process automated invoice processing software platform that offers customizable workflows for various business processes, including invoice processing. With its no-code interface, businesses can create and automate invoice approval workflows without the need for extensive technical expertise.

Features

● Drag-and-drop workflow builder for invoice automation

● Real-time tracking of invoice status

● Integration with ERP, accounting, and payment systems

● Automated approval routing based on predefined rules

● Detailed reporting and analytics for process optimization

● Customizable notifications and alerts for key milestones

Pros

● Easy to set up and use, thanks to the no-code interface

● Highly flexible and customizable workflows

● Ideal for businesses looking to automate multiple processes beyond invoicing

● Strong customer support and documentation

Cons

● Limited financial reporting tools compared to dedicated accounting platforms

● May require integration with other systems for advanced financial management

● Features may be too basic for enterprises with complex financial structures

Pricing

Kissflow offers tiered pricing plans, starting at around ₹5,000 per month for basic automation features. Custom pricing is available for enterprises with extensive process automation needs.

*Please check the respective provider's website for accurate pricing information, to ensure you have the most up-to-date details

Target customers

Kissflow is suited for small to mid-sized businesses and organizations looking for a customizable process automation platform that can streamline not just invoicing but other business operations as well.

Streamline your invoice processing and save time

Comparison criteria for selecting the best invoice processing software

Selecting the best invoice processing software can make or break a company’s financial workflows. From managing invoice accuracy to ensuring compliance with local regulations, the choice of software impacts your business’s efficiency, compliance, and bottom line.

Here's why the following criteria are essential for making the right decision:

1. User-friendliness of the system interface

A user-friendly interface is the cornerstone of any software’s success. Whether your team consists of seasoned finance professionals or individuals with minimal technical expertise, the software must be intuitive to use.

A cluttered or complex interface increases the learning curve, leading to inefficiencies and errors. Simple navigation, logical layouts, and clear instructions help your team focus on strategic tasks instead of wasting time understanding the system.

Businesses in India, especially those with high invoice volumes, benefit significantly from software that can be operated seamlessly by employees at all levels.

2. Accuracy in invoice data extraction

Invoice processing involves capturing data from various formats, such as PDFs, emails, or scanned documents. Errors in data extraction—such as incorrect amounts, tax details, or vendor information—can cause significant financial and reputational risks.

High accuracy, supported by AI and optical character recognition (OCR) technologies, is non-negotiable. Software with robust data validation processes ensures fewer errors, minimizes human intervention, and speeds up processing.

For Indian businesses that often deal with GST invoices, this feature is particularly crucial for maintaining compliance and avoiding penalties.

3. Integration capabilities with existing systems

A major advantage of modern invoice processing software is its ability to work seamlessly with the tools you already use, such as accounting software, ERP systems, or other operational platforms.

Instead of manually transferring data between systems, an integrated solution ensures smooth data flow, eliminating errors and saving time. For businesses in India, compatibility with widely used platforms like Tally or SAP is particularly important.

Well-integrated software boosts productivity by centralizing data, streamlining workflows, and reducing the complexity of handling multiple systems.

4. Scalability & customization capabilities

Businesses grow, and their needs evolve. Invoice processing software should be scalable to accommodate higher transaction volumes without compromising performance.

Customization options are equally important, as no two businesses have the same invoice formats, approval workflows, or compliance requirements. Indian businesses—ranging from SMEs to large corporations—benefit from software that adapts to their unique operational demands.

Scalable and customizable software ensures you aren’t forced to switch systems as your business expands.

5. After sales support from provider

Even the best automated invoice processing software isn’t immune to glitches or unexpected challenges. Reliable after-sales support ensures that you can resolve issues quickly and keep operations running smoothly.

Indian businesses, often working across multiple time zones, need prompt and accessible support through various channels, such as email, chat, and phone. Providers that offer dedicated account managers or priority support plans gain a competitive edge. This criterion is essential to reduce downtime, optimize usage, and build trust with the software vendor.

6. Security & compliance features

In the digital age, data breaches and compliance violations can have devastating effects on businesses. Invoice processing software must have robust security features, such as encryption, access controls, and regular audits, to safeguard sensitive financial information.

For Indian businesses, compliance with local regulations like GST rules is critical. The software must offer features such as automated GST calculations, e-invoicing capabilities, and real-time tax updates to ensure adherence to legal requirements.

7. Essential features

When evaluating invoice processing software, businesses should pay close attention to the features offered. These include automated invoice matching, real-time tracking, multi-level approvals, and GST-ready functionalities.

Refer to the next section to explore the key features in detail and understand how they can address common pain points in invoice management.

8. Pricing structure & overall affordability

For businesses, particularly startups and SMEs with tight budgets, cost is a key consideration. Transparent pricing and flexible models, such as subscription plans or pay-as-you-go options, help companies assess affordability.

Indian businesses often prefer solutions that provide essential features without excess costs. It’s important to select software whose pricing aligns with your business needs to avoid paying for unnecessary features.

Customer reviews & testimonials

Customer feedback is an invaluable resource when selecting software. Reviews and testimonials shed light on how well the software performs in real-world situations and help identify potential challenges. Focus on feedback from companies that are similar to yours in terms of size and industry to get a relevant perspective.

For businesses in India, trusted reviews on platforms like G2 or Capterra are often a guiding factor, offering insights into usability, efficiency, and support quality. Positive testimonials provide assurance, while constructive criticism helps you weigh the software’s pros and cons effectively.

Steps for implementation of an invoice processing software

Determine clear objectives

The first step is to define what you want to achieve with the new invoice processing software. Are you looking to reduce processing time, minimize errors, enhance visibility across departments, or automate manual tasks?

Understanding and prioritizing your goals provides a clear roadmap for the project. These priorities will help guide decisions during the implementation and serve as benchmarks for measuring the system’s effectiveness after deployment.

Conduct needs assessment

Evaluate your existing invoice management processes to pinpoint areas for improvement. This might involve mapping out each step of your current workflow, identifying bottlenecks, and recognizing recurring issues.

Are there delays due to manual approvals? Are invoice errors causing payment disputes? By diagnosing these inefficiencies, you can determine which features and capabilities the software needs to address. Involving stakeholders in this assessment will ensure you have a complete picture of the system's requirements.

List key considerations for your business

Every business has unique needs that influence the choice of invoice processing software. Create a list of key considerations, such as:

● The volume of invoices processed monthly.

● Industry-specific compliance requirements.

● Integration with existing financial and ERP systems.

● Security and data protection standards.

● Scalability to accommodate business growth.

Tailoring these considerations to your business ensures the software aligns with your long-term goals.

Research and evaluate invoice processing software providers

With your objectives and needs assessment in hand, research potential software providers. Seek solutions that align with your business requirements, such as automation, advanced reporting features, or cloud-based accessibility. Investigate software options through vendor websites, whitepapers, and industry publications. Compile a shortlist of providers that appear to meet your needs.

Consider user reviews and testimonials

One of the most reliable ways to gauge a software’s performance is by examining the experiences of other users. Explore online reviews on platforms like Capterra, TrustRadius, or G2. Look for feedback from companies in industries similar to yours, as they may have faced comparable challenges.

Pay close attention to both praise and criticism to identify any consistent patterns regarding performance, reliability, or customer support. These insights can help narrow down your options and highlight potential red flags.

Analyze vendors’ support & training services

Software implementation is rarely a plug-and-play process. Assess the level of support and training offered by each vendor. Does the provider offer 24/7 customer support? Are there onboarding resources, such as video tutorials, webinars, or knowledge bases? Adequate training and responsive support are critical for ensuring a smooth implementation and long-term success.

Consider the total cost of ownership

When assessing potential automated invoice processing software solutions, it’s important to think beyond the sticker price. The full cost of implementation includes various factors, such as licensing or subscription fees, training costs, integration efforts, and future system upgrades.

Additionally, there may be ongoing expenses for technical support or customizations. By calculating the total cost of ownership (TCO), you can determine whether a software solution is a viable long-term investment and plan your budget accordingly.

Book demos & opt for trial periods

Many vendors provide live demonstrations or trial periods for their software. Utilize these opportunities to assess the software's user interface, functionality, and usability. Involve your accounts payable team in testing the software during the trial phase and collect their feedback. This practical experience will assist you in making an informed decision.

Purchase the invoice processing software

Once you’ve identified the best software for your needs, move forward with the purchase. Negotiate pricing and licensing terms, and ensure that the agreement includes all necessary features and support services.

Secure a contract that protects your business interests and outlines the vendor’s responsibilities during the implementation phase.

Configure and customize the software

After purchasing the software, the next step is configuration and customization. Work with the vendor to tailor the system to your specific requirements. This might include setting up workflows for invoice approvals, defining user roles and permissions, and configuring notification settings. Customization ensures the software aligns with your existing processes and organizational structure.

Data migration and transfer

Data migration is a critical phase of implementation. Transfer historical invoice data from your existing system to the new software. This process must be carefully planned to avoid data loss or corruption. Clean and validate your data before migration to ensure accuracy. Collaborate with your IT team and the software vendor to execute the migration securely and efficiently.

Integration with existing systems

For the software to function effectively, it must seamlessly connect with your current business systems, such as accounting, ERP, or procurement tools. Integration allows for real-time data exchange, which eliminates redundant data entry and prevents errors caused by manual updates.

Achieving this connectivity may require technical assistance, either from your in-house IT team or from integration experts. Once set up, the integration should enable a smoother, more efficient workflow across departments.

Conduct employee training

Introducing new software can only succeed if your employees understand how to use it effectively. Organize training sessions tailored to various roles within your organization—such as accounts payable clerks, managers, and administrators—so that each group learns the features relevant to their responsibilities.

Hands-on practice, combined with resources like user guides and help centers, will boost confidence in using the system. Offering continuous support ensures users can adapt to updates and refine their skills over time.

Conduct system testing

Before deploying the software, conduct rigorous testing to identify and resolve any issues. Test all features, such as invoice capture, workflow automation, reporting, and integrations, to ensure they function as expected.

Simulate real-world scenarios to evaluate the system’s performance under typical business conditions. Address any bugs or glitches before proceeding to deployment, this will help ensure you choose the best invoice processing software fit.

Deploy the invoice processing software

After testing and final adjustments, the software is ready to be rolled out to your organization. Consider a phased deployment to minimize disruptions. For example, you could begin with one department or a pilot group before expanding to the entire company.

Closely monitor the system’s performance and user experience in these early stages. Swiftly addressing any technical or operational challenges will smooth the transition and build trust in the new system.

Monitor and evaluate

After deployment, monitor the software’s performance and its impact on your business processes. Track key performance indicators (KPIs), such as invoice processing time, error rates, and cost savings.

Collect feedback from employees to identify any pain points or areas for improvement. Regular evaluation ensures the system delivers the desired outcomes.

Continuous improvement

Implementing software is not a one-time effort. As business needs change, regular updates and process improvements are essential to maintaining efficiency. Stay informed about software updates, including new features or performance enhancements offered by the vendor. Periodic training sessions help employees stay up to date and make full use of the system’s capabilities.

Consistently reviewing your workflows and gathering user feedback will help identify areas for improvement, ensuring your investment continues to deliver value.

Simplify invoice management and boost efficiency

Essential KPIs to measure the performance of invoice processing software

Tracking essential KPIs for automated invoice processing software is crucial to evaluate its efficiency and effectiveness. These metrics, such as processing time, error rates, and automation levels, provide insights into performance. By monitoring KPIs, businesses can identify bottlenecks, optimize workflows, reduce costs, and ensure smooth financial operations for better overall productivity.

1. Invoice processing time

● Description

This KPI measures the average time taken to process an invoice from receipt to final approval and payment. Reducing processing time is crucial for maintaining vendor relationships, capturing early payment discounts, and optimizing cash flow.

● Formula

Invoice processing software = Total processing time for all invoices / Number of invoices processed

● Example

If your business processes 500 invoices in a month and the total processing time for all invoices is 5,000 hours, the invoice processing time is:

5,000 hours / 500 invoices = 10 hours per invoice

A goal might be to reduce this time to 5 hours per invoice through automation and improved workflows.

2. Invoice error rate

● Description

This metric tracks the percentage of invoices with errors, such as incorrect amounts, missing information, or misclassifications. High error rates can cause payment delays, increase administrative work, and harm vendor relationships.

● Formula

Invoice Error Rate = (Total Number of Invoices Processed / Number of Invoices with Errors) × 100

● Example

If 30 out of 1,000 invoices have errors, the error rate is:

(30 / 1000) x 100 = 3%

Reducing the error rate to below 1% might be an achievable target after implementing invoice automation.

3. Rate of duplicate invoices

● Description

This KPI measures the occurrence of duplicate invoices, which can lead to double payments and financial discrepancies. Automation and data validation features in software can help reduce duplicate entries.

● Formula

Duplicate Invoice Rate = (Number of Duplicate Invoices / Total Number of Invoices) × 100

● Example

If your system flags 5 duplicate invoices out of 2,000 processed, the rate of duplicate invoices is:

(5 / 2,000) × 100 = 0.25%

A well-functioning software system should keep this rate close to zero.

4. Days payable outstanding

● Description

DPO calculates how long a company takes to settle payments with its suppliers. While extending payment timelines may improve short-term cash flow, prolonged delays can damage supplier relationships. Maintaining a balanced DPO is essential to both financial stability and vendor trust.

● Formula

DPO = (Accounts Payable / Cost of Goods Sold) × 365

● Example

If your accounts payable balance is $100,000 and your annual cost of goods sold (COGS) is $1,200,000, the DPO is:

(100,000 / 1,200,000 ) × 365 = 30.42 days

Monitoring DPO helps ensure that payment terms are optimized without harming supplier relationships.

5. Payment error rate

● Description

This metric tracks the proportion of payments with errors, such as incorrect amounts or payments sent to the wrong recipients. Reducing payment errors helps businesses maintain accurate financial records and minimizes the risk of financial losses or disputes.

● Formula

Payment Error Rate = (Number of Incorrect Payments / Total Number of Payments) × 100

● Example

If 8 payments out of 500 are flagged for errors, the payment error rate is:

(8 / 500) × 100 = 1.6%

Implementing automated payment validation can significantly lower this rate, a feature typically found in any best invoice processing software.

6. Exception invoice rate

● Description

This KPI indicates the percentage of invoices that require manual intervention due to discrepancies or missing information. A high exception rate can lead to inefficiencies and increased processing time.

● Formula

Exception Invoice Rate = (Number of Exception Invoices / Total Number of Invoices) × 100

● Example

If 40 invoices out of 1,000 require manual review, the exception invoice rate is:

(40 / 1,000) × 100 = 4%

Reducing this rate through automation can free up staff time for higher-value tasks.

7. Discount capture rate

● Description

This KPI measures how effectively a company captures early payment discounts offered by vendors. Missing out on discounts can result in unnecessary costs, while optimizing payments can improve cash savings.

● Formula

Discount Capture Rate = (Number of Discounts Captured / Number of Discounts Offered) × 100

● Example

If your business successfully captures 30 discounts out of 40 offered, the discount capture rate is:

(30 / 40) × 100 = 75%

Improving discount capture can generate significant savings over time.

8. Cost-per-invoice

● Description

This KPI calculates the average cost to process a single invoice, including labor, technology, and other operational expenses. Lowering this cost is a key goal for businesses aiming to increase efficiency.

● Formula

Cost-per-Invoice = Total Processing Costs / Total Number of Invoices Processed

● Example

If your company spends $50,000 to process 5,000 invoices, the cost-per-invoice is:

50,000 / 5,000 = $10 per invoice

Automation can reduce manual labor and lower this cost significantly.

9. Percentage of automated invoices

● Description

This metric shows the proportion of invoices processed automatically without manual input. A higher percentage of automation typically correlates with reduced processing times and fewer errors.

● Formula

Percentage of Automated Invoices = (Number of Automated Invoices / Total Invoices Processed) × 100

● Example

If 3,500 out of 4,000 invoices are processed automatically, the automation percentage is:

(3,500 / 4,000) × 100 = 87.5%

Increasing this percentage can improve overall efficiency and reduce operational costs.

10. Invoice approval cycle time

● Description

This KPI measures how long it takes for an invoice to go through the approval process, from submission to final authorization. Reducing this time helps prevent delays in payment and can improve supplier relationships.

● Formula

Invoice Approval Cycle Time = Total Time for All Invoice Approvals / Number of Invoices Approved

● Example

If the total time spent on approving 600 invoices is 1,200 hours, the approval cycle time is:

1,200 hours / 600 invoices = 2 hours per invoice

Improving approval workflows can significantly reduce cycle time and enhance efficiency.

How does Volopay help streamline invoice processing?

Efficient invoice processing is essential for maintaining strong vendor relationships, optimizing cash flow, and ensuring accurate financial management. Using the best invoice processing software fit is key to achieving this. Volopay, an advanced AP automation platform, simplifies this process through automation, integration, and real-time data tracking.

Here’s how Volopay helps businesses streamline invoice processing with its key features:

1. Automated invoice capture and data extraction

Volopay automates the capture and extraction of invoice data, eliminating the need for manual data entry. When invoices are uploaded, the system automatically retrieves essential details such as vendor name, invoice number, payment terms, and due dates. This process minimizes human error, speeds up invoice entry, and ensures that invoices are ready for approval and payment without delays.

By reducing manual tasks, businesses can improve efficiency and focus on higher-priority tasks like vendor negotiations and financial planning.

2. One-click sync with accounting software

Integrating financial data across platforms can be challenging when relying on manual input. Volopay addresses this by offering direct synchronization with accounting tools like QuickBooks, Xero, and NetSuite.

Once an invoice is processed, relevant data, including payment details, is automatically updated in the connected system, improving data consistency and efficiency. This eliminates duplicate entries, improves data consistency, and ensures financial records are updated in real time.

By automating this process, businesses reduce administrative workloads and can trust that their accounting system reflects accurate and up-to-date financial information.

3. Optical character recognition (OCR)

Invoices often come in various formats, making manual data entry inefficient and prone to errors. Volopay addresses this challenge with its built-in Optical Character Recognition (OCR) technology. This feature scans both digital and physical documents to extract critical information such as invoice numbers, amounts, and vendor details.

The system processes documents regardless of their format—whether PDF, image, or scan—reducing the need for human intervention. Automating data capture with OCR not only accelerates processing but also enhances accuracy by minimizing the risk of errors that occur during manual input. This is particularly useful for businesses managing large volumes of invoices from diverse suppliers.

4. Spend analytics

To make informed financial decisions, businesses need insights into their spending patterns. Volopay provides advanced spend analytics that offer a detailed breakdown of expenditures by category, department, or vendor. This data helps businesses identify areas where costs can be reduced and provides greater visibility into cash flow.

With real-time access to spending data, finance teams can forecast expenses more accurately, optimize budget allocation, and develop strategies to control costs.

5. Multi-level approval workflows

Complex approval chains can create bottlenecks in invoice processing. Volopay allows businesses to set up multi-level approval workflows that match their organizational policies and payment thresholds. These workflows enable invoices to be routed automatically to the appropriate approvers based on criteria such as invoice amount or department.

Once all required approvals are completed, invoices can proceed to payment without delays. Customizable approval rules help businesses maintain control over expenditures while ensuring that the process remains efficient.

6. Real-time expense tracking & alerts

Volopay offers real-time tracking of invoice-related expenses, giving businesses greater control over their financial operations. Users can monitor the status of invoices, payments, and approvals at any time.

Additionally, the system sends automated alerts for key events, such as pending approvals or approaching payment deadlines. These alerts reduce the risk of missed payments, which can lead to late fees or strained vendor relationships. Real-time tracking ensures that finance teams can quickly respond to issues and maintain accurate records.

7. Multi-currency wallet

For businesses that operate globally, currency conversion and international payments can be a challenge. Volopay’s multi-currency wallet simplifies these processes by enabling users to hold and manage multiple currencies in a single platform. This feature allows businesses to pay vendors in their local currencies without the need for separate accounts or third-party services.

Real-time exchange rate visibility also helps businesses plan payments more effectively, reducing currency conversion fees and improving cash flow management.

8. 3-way invoice matching

Accurate invoice validation is crucial to maintaining financial control and preventing payment errors. Volopay’s automated 3-way matching system cross-checks an invoice against the related purchase order (PO) and goods receipt. This ensures that the quantities, prices, and other invoice details align with what was ordered and delivered.

If any discrepancies are detected—such as overcharges or missing items—the system flags the issue for further review before payment approval. By automating this verification process, Volopay reduces the risk of overpayments, enhances compliance, and strengthens procurement oversight, helping businesses maintain better accuracy and control over their accounts payable processes.

Automate your accounts payable with Volopay

FAQs on invoice processing software

During a demo or trial, evaluate the software’s ease of use, automation capabilities, integration with existing systems, and customization options. Pay attention to key features like approval workflows, real-time tracking, and data capture efficiency. Ensure the invoice processing automation software supports scalability and compliance with your business requirements.

Volopay provides various support options, including live chat, email assistance, and phone support. Additionally, users can access an online knowledge base with guides and FAQs. Volopay also offers a dedicated account management and support for faster resolution of complex issues.

Yes, Volopay offers advanced analytics and reporting features that help businesses monitor and optimize their accounts payable (AP) operations. Users can generate reports on spend patterns, processing times, error rates, and more, enabling data-driven decisions for improved cash flow management and expense control.

Invoice processing tools designed for Indian businesses can support GST compliance by automatically capturing key details like GSTIN, tax rates, and invoice formats. These tools ensure that invoices meet regulatory requirements, generate GST-compliant reports, and facilitate timely filing of tax returns, thereby reducing compliance risks.

Invoice processing software equipped with Optical Character Recognition (OCR) technology can scan and digitize paper invoices. OCR extracts critical details such as vendor names, invoice amounts, and dates, converting the document into a searchable digital format. This automation minimizes manual data entry and errors, significantly improving the efficiency of invoice management.

Volopay supports both two-way and three-way matching processes. Two-way matching verifies invoices against purchase orders, while three-way matching adds a comparison with goods receipts. This ensures that quantities, prices, and received items align, helping businesses prevent overpayments and unauthorized transactions.

Volopay allows businesses to customize notifications and alerts for invoices based on specific triggers. Users can set alerts for pending approvals, payment due dates, or discrepancies. These notifications help improve visibility, prevent missed deadlines, and keep stakeholders informed of important actions in the invoice lifecycle.

Volopay stores invoices in a secure digital archive, making them easily retrievable through search functions. Users can filter invoices by date, vendor, amount, or status to quickly locate records. This streamlined access to historical data supports audits, compliance checks, and financial reporting.