18 small business expense categories you need to know

If you’re managing a business, as a CEO, CFO, or finance head, you know how diverse an expense portfolio can be. You also know how difficult it is to consolidate and manage these business expenses. But, do you know how impactful business expense categories can be in making your as well as your teams’ lives easier?

Simply put, if you’re looking for ways to streamline cash flow you should definitely consider organizing company spending into clear-cut and well-thought-out business expense categories. Especially for startups and small and medium-sized enterprises (SMEs), categorization can do wonders for your cash flow and at the same time help you make tax savings.

What are business expenses?

Business expenses are the costs a company incurs while operating and generating revenue. These include everything from rent, utilities, and employee salaries to software subscriptions, marketing costs, and travel expenses.

Managing these expenses efficiently ensures financial stability and better profit margins. Proper tracking of business expenses also supports accurate accounting, tax deductions, and smarter budgeting decisions.

However, without structured expense management, businesses often face hidden costs and errors that impact cash flow. Implementing automated solutions helps maintain transparency, accountability, and control over spending—allowing companies to focus resources on growth and long-term success.

List of business expense categories for growing startup & small businesses

How you categorize your business expenses will not only determine how streamlined your cash flow is but can also help you benefit from small business tax deductions. To do this you need to have a comprehensive list of business expense categories. Some of the most commonly used and relevant categories include:

Payroll

Payroll is an important category to consider given the sizable amount of finances that are dedicated to it. This could include wages, bonuses, or commissions that you pay workers, whether they're full-time employees or contractors.

Rent or mortgage payments

Any money that you pay to either rent, mortgage, or own any office space should be recorded separately in a dedicated category. Especially because it can be included in your list of tax-deductible business expenses.

With the rise of remote work in 2020, the worth of actual office spaces has gone down, particularly for SaaS startups and other knowledge-based companies. However, retailers don’t have much of a choice and must stick with listing rent as a recurring business expense.

Utilities

Closely linked to rent, utilities could include your electricity, wi-fi, air conditioning, water, garbage, and recycling costs. These are closely related to the costs of running a physical office space and can all add up quite quickly.

As with rent or mortgage payments, utility bills can also be considered as tax-deductible business expenses. However, in some cases, utility costs are written into rent agreements and therefore cannot be considered a separate expense.

Software subscriptions

As the digital world goes even more digital, software subscriptions have become an expense as regular as paying for gas or rent. Everyone has them, even if it’s just Microsoft Office. Companies usually have multiple subscriptions at the same time. For SMEs or startups in particular these costs when added up could add up to a significant number.

Advertising and marketing

Your marketing expenditure will include not just paying for marketing personnel, which will fall under payroll. You’re also bound to spend money on the usual marketing channels such as social media and search advertising, physical leaflets, stickers, billboards, radio, and television, plus agency and freelancer help. All of which can be quite expensive and add up to a significant amount.

Because the fact that marketing has a direct relationship with growth, your spending will determine how fast you grow. In some countries, such as Singapore, Advertising and marketing can also be considered tax-deductible expenses. So, monitoring a big budget and a large range of marketing expenses in a separate category makes sense.

Travel and entertainment

Travel and entertainment expense is another business expense category that can be tax-deductible. These expenses might be of low value individually but can add up quite easily. For SMEs and startups, it is imperative to capitalize on the tax deductibility factor and ensure that they can earn as many savings as possible.

Depending on the business categories your company is involved in these expenses could include sales visits, conferences and networking events, or just traveling for purposes related to the business.

Servers and website maintenance

Again, depending on the business categories you are involved in, servers and website maintenance costs hit different businesses differently. Smaller companies with standard websites probably won’t have to worry about this much because general server costs are usually just a couple hundred dollars.

However, for tech companies especially, servers play a major role in business. When you’re hosting tonnes of customer data, company information on clouds, etc. these costs can balloon. Thankfully, website and server expenses, including software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) expenses, are also tax-deductible in countries like Singapore.

Tax

While we don’t usually think of tax as a separate expense (because it’s not exactly optional), it is still a candidate to be included in your list of business expense categories.

In most countries business expenses are tax-free. Keeping a close eye on your expenses and the amount of tax you’re paying, and making sure employees submit receipts and claim expenses on time, can go a long way in saving your business some serious money.

Business insurance

Like taxes, business insurance is not exactly an optional expense and can be quite expensive. Apart from mandatory government insurance schemes, there are also coverages for things like employment practices to product liability.

How much risk you are willing to take will determine which of these you will go for, and how likely you are to need them, of course. But at the very least, categorizing them separately can save you a lot of admin work.

Consultants and professional services

Outsourcing non-essential parts of your business to experts or consultants can be a big boost, especially for SMEs and startups. There are professional services that even larger corporations choose to outsource simply because it is more efficient than having to keep people in-house. Advertising and PR agencies, for example, are often kept by big companies full time.

Expert advice does obviously come at a fair cost and can be a recurring one as well. So, it makes sense to list it as a separate business expense category.

Training and learning

This is a category that has existed for quite some time in big companies and is now gaining traction in the startup world as well. Training is a particularly effective method of ensuring uniformity of service, especially for companies that have branches in different parts of the world.

The quality of your training program will determine how well your employees perform and how consistent your service is. It’s clearly an important part of business expenses and should be a part of a small business expenses list as well.

Equipment and furniture

At first glance, you’d probably expect equipment and furniture to be a part of office supplies. Yet, there is a distinction between the two. The equipment and/or furniture you buy for your business is more permanent than office supplies. This includes chairs and sofas, computers, television screens, fridges and storage units, printers and scanners, and other obvious office furniture.

Moreover, these objects and items, after a point in time, are also classified as business assets and can be used to generate income, through programs like asset-based or inventory financing. Their resale value is another factor that can add value to your business.

Office supplies

A smaller expense than most others, office supplies are one of the more common types of expenditures to include in your business expense categories.

When we think of office supplies, the first things that come to mind are stationery, hygiene products, coffee, and similar essentials. These can also include larger purchases, especially when bought in bulk.

However, tracking such ad hoc purchases can be challenging due to the lack of a structured process. This is where business expense cards, especially virtual cards, can help by providing real-time tracking and categorization, making expense management more efficient and transparent.

Home office setup

A few years ago home office setups might have been an employee’s personal responsibility; but, like so many other things, this too has faced the impact of Covid-19. With almost half the world working from home, home office setups have become increasingly important and are climbing higher on the list of business expenses.

Fuel and mileage

When employees travel by car for work, not to work, their fuel costs are usually reimbursed. Moreover, employees using their own car for work can claim a mileage allowance, a cost set owed due to the wear and tear the car is to face. These expenses are universally treated as a separate expense category because of their tax-saving attributes.

Employee perks

Everybody loves appreciation and so do employees. Smaller perks such as snacks and drinks, t-shirts and hoodies, team-building activities and retreats, and stickers can easily put a smile on anyone’s face, including your employees. Letting them know your appreciation towards their hard work is only going to boost morale and indirectly benefit the company itself.

There are also bigger perks such as health insurance, paid time off, maternal leave, etc. These could be wrapped up in both payroll and business insurance, but you could provide specific perks and benefits that don’t fit those categories.

Business licenses and permits

It’s also a wise move to include the costs of any occupational licenses, health permits, and other required certifications that you or your business has had to acquire. Getting licenses and permits can be quite expensive depending on your industry and ought to be logged as a separate business expense category.

Interest payments and bank fees

Any borrowed funds or ongoing credit lines that your company has will obviously come with interests or some form of bank fees. If you have to pay for things like minimum balance fees or overdraft fees, ensure you record those, too.

Interesting read: 8 expense management best practices for small business

Why expense categorization matters for small businesses

Expense categorization for small businesses is a strategic way to control costs and strengthen decision-making. When you categorize each expense accurately, you gain real-time visibility into spending patterns, uncover inefficiencies, and manage resources more effectively. This process empowers you to make informed, data-driven financial decisions for sustainable growth.

Monitor financial health effectively

By categorizing expenses for small business operations, you can track financial performance with clarity. Organized expense records reveal how funds are allocated and highlight any deviations from planned budgets.

This allows you to analyze profitability, assess cost structures, and maintain healthier cash reserves, ensuring your business remains agile and financially stable throughout varying market conditions.

Improve budgeting and cash flow

Small business expense categorization helps you plan budgets with precision and maintain steady cash flow. Understanding which categories consume the most funds enables better allocation of resources.

You can anticipate recurring costs, manage seasonal fluctuations, and identify areas to reduce discretionary spending, leading to improved financial planning and stronger long-term liquidity management.

Make tax filing faster and easier

Categorizing your expenses correctly ensures tax filing becomes smoother, faster, and less stressful for your business. You’ll know exactly which costs are deductible and how to justify them during audits.

Organized expense records minimize confusion and save hours of reconciliation. Ultimately, proper categorization ensures compliance with tax regulations while maximizing legitimate deductions for your business.

Identify cost-saving opportunities

When expenses are categorized properly, spotting inefficiencies becomes simpler. You can identify high-cost areas, negotiate better vendor terms, or eliminate redundant subscriptions.

These insights allow you to redirect funds toward growth initiatives. Effective expense categorization also helps benchmark your spending patterns against industry standards to find actionable opportunities for cost optimization and financial improvement.

Prevent overspending and errors

Without a clear system, overspending and duplicate entries can go unnoticed. Expense categorization provides structure and transparency, ensuring every transaction is reviewed and verified.

You can detect anomalies faster, reduce reporting inaccuracies, and avoid financial mismanagement effectively and proactively. This level of control prevents small errors from compounding into costly financial setbacks over time.

Smart, actionable tips to simplify expense categorization for small businesses

For small businesses, simplifying expense categorization is the first step toward stronger financial control. A clear and consistent system ensures you understand spending behavior, minimize waste, and maintain compliance.

When you simplify expense categorization, you empower your business to make faster, more accurate financial decisions while keeping overall costs well-managed and transparent.

Use automated tools to categorize expenses faster

Leverage technology to automate repetitive expense tracking tasks. Automated expense management tools can scan receipts, classify transactions, and sync data with accounting software in seconds.

This not only accelerates processing but also minimizes human error. Automation ensures consistent accuracy, freeing your time to focus on strategy rather than manual bookkeeping duties.

Set clear spending policies to prevent errors

Establishing well-defined spending policies helps employees categorize transactions correctly. Create rules specifying which expenses belong to each category and outline approval processes.

When guidelines are transparent, your team can spend responsibly and report consistently. This reduces confusion, ensures accountability, and keeps your financial records accurate and audit-ready at all times.

Regularly review and update your expense categories

Your business evolves, and so should your categories. Schedule quarterly or biannual reviews to refine your expense list, merge redundant categories, and add new ones as operations expand.

Regular updates ensure your financial tracking remains relevant, accurate, and aligned with current business goals, improving both analysis and budget control efficiency.

Train employees to tag expenses correctly

Employee awareness is crucial for accurate reporting. Conduct short training sessions on how to categorize expenses properly within your expense management system.

When your team understands the reasoning behind each category, they make fewer mistakes. This collaborative approach ensures smoother workflows and reliable expense data that supports accurate financial reporting.

Maintain consistent labels across all departments

Consistency across departments eliminates confusion and promotes accurate comparisons. Standardized labels ensure everyone follows the same structure when recording expenses, whether for travel, marketing, or supplies.

This unified system improves visibility across all cost centers and simplifies company-wide reporting, helping you maintain accuracy, efficiency, and control in expense management processes.

Leverage expense data to optimize categories

Use analytics to gain actionable insights from your expense data. Identify spending trends, analyze category performance, monitor employee behavior, and spot underutilized resources to optimize overall financial efficiency.

By reviewing detailed reports, you can refine your categories for better clarity and efficiency. This data-driven approach enables continuous improvement and ensures your categorization system supports informed financial decisions.

How can startups and SMEs manage their business expenses?

Volopay provides corporate expense management cards that come with extensive spend management capabilities. You can use these cards to consolidate your payments and expenses in one place from where you can get any data, metrics, or other information you may need in just a few clicks.

Small businesses can particularly benefit from this because Volopay’s corporate expense management software can be used as an all-in-one control center from where you can track, manage and control your small business expenses list. You can also use Volopay for money transfers, both domestic and international.

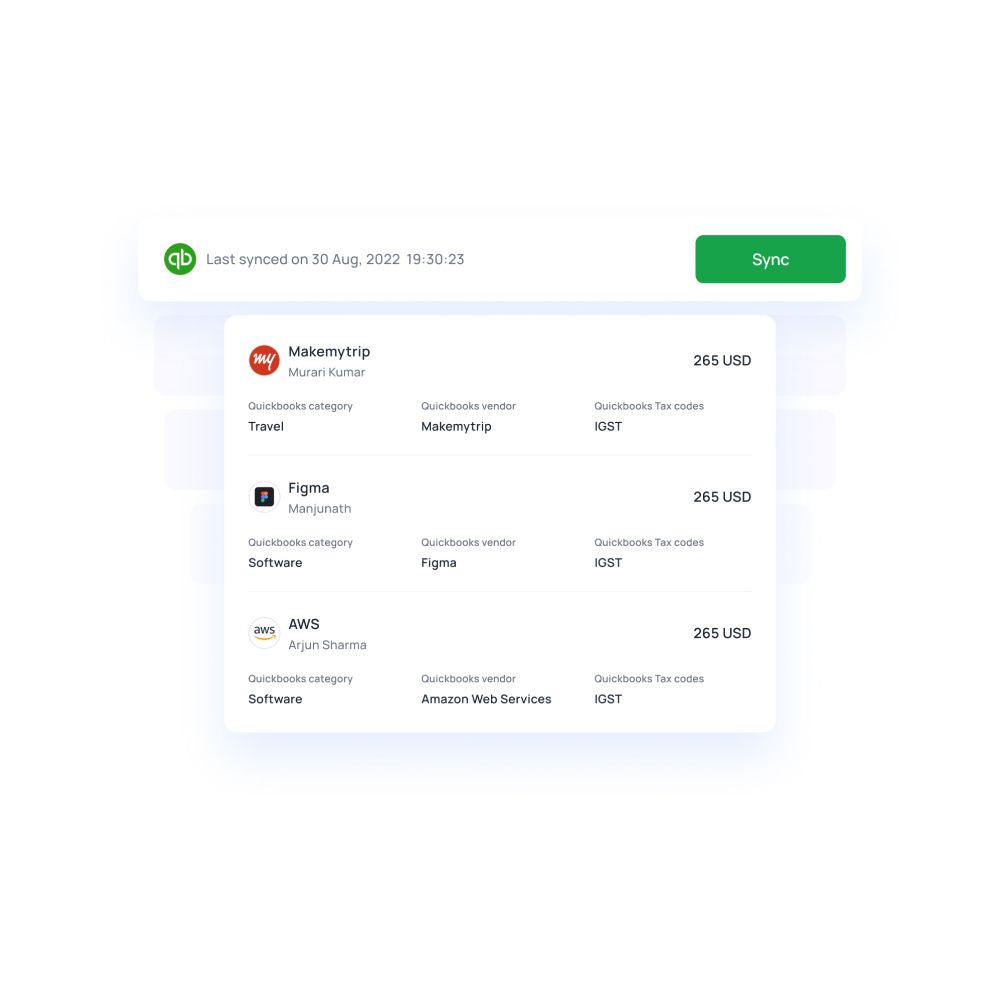

The software is also capable of real-time expense reporting. This means that your expenses will be recorded as and when they happen, not through the usual laborious manual entry process at the end of the month and integrate all your expense data with the accounting tool of your choice. You can use this feature to preset some business expense categories and let the software do the filtering and sorting for you.

To conclude, we have seen how SMEs and startups can go about sorting their list of business expense categories with the business expense management software. We have also seen how by using these categories wisely small businesses can reap the benefits of tax-deductible business expenses. So, if you are an entrepreneur currently in charge of the finances of a company, big or small, you should look into capitalizing on the tax-saving abilities of business expenses.

How Volopay simplifies expense categorization for small businesses

Volopay makes expense management effortless by automating how expenses are tracked, categorized, and reported. You gain complete visibility into your company’s financial activities, ensuring accuracy and control.

With advanced accounting automation, seamless integrations, and audit-ready reports, Volopay simplifies expense categorization, helping small businesses manage budgets efficiently and make confident, data-driven financial decisions every day.

Automate categorization for maximum accuracy

Volopay automates the categorization of every transaction using intelligent rules and machine learning. This ensures that each expense is automatically sorted into the correct category without manual intervention.

By reducing human error and maintaining consistency, your business gains accurate financial data, saving valuable time while improving compliance and operational efficiency across all spending processes.

Track all business expenses in real time

With Volopay, you can track every business expense instantly as it occurs. Real-time reporting software capabilities give you immediate visibility into spending patterns and budget utilization.

This level of transparency allows you to identify unusual transactions quickly, monitor departmental costs, and make timely financial adjustments, ensuring tighter control over your company’s overall cash flow.

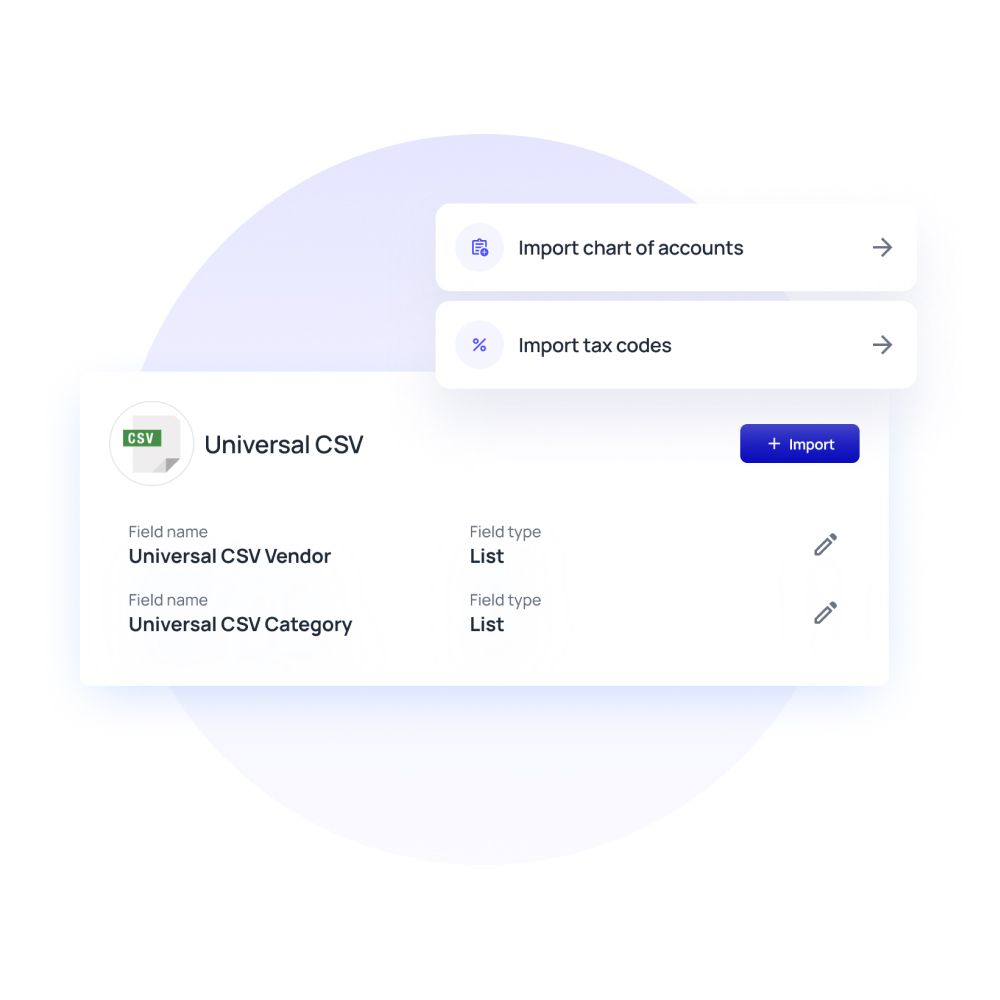

Seamless integration with accounting platforms

Volopay integrates seamlessly with leading accounting software like Xero, QuickBooks, and NetSuite. These integrations ensure all categorized expenses automatically sync with your accounting records.

This eliminates redundant manual entries, maintains data consistency, and simplifies financial reporting, allowing your team to focus on strategic growth rather than administrative expense management tasks.

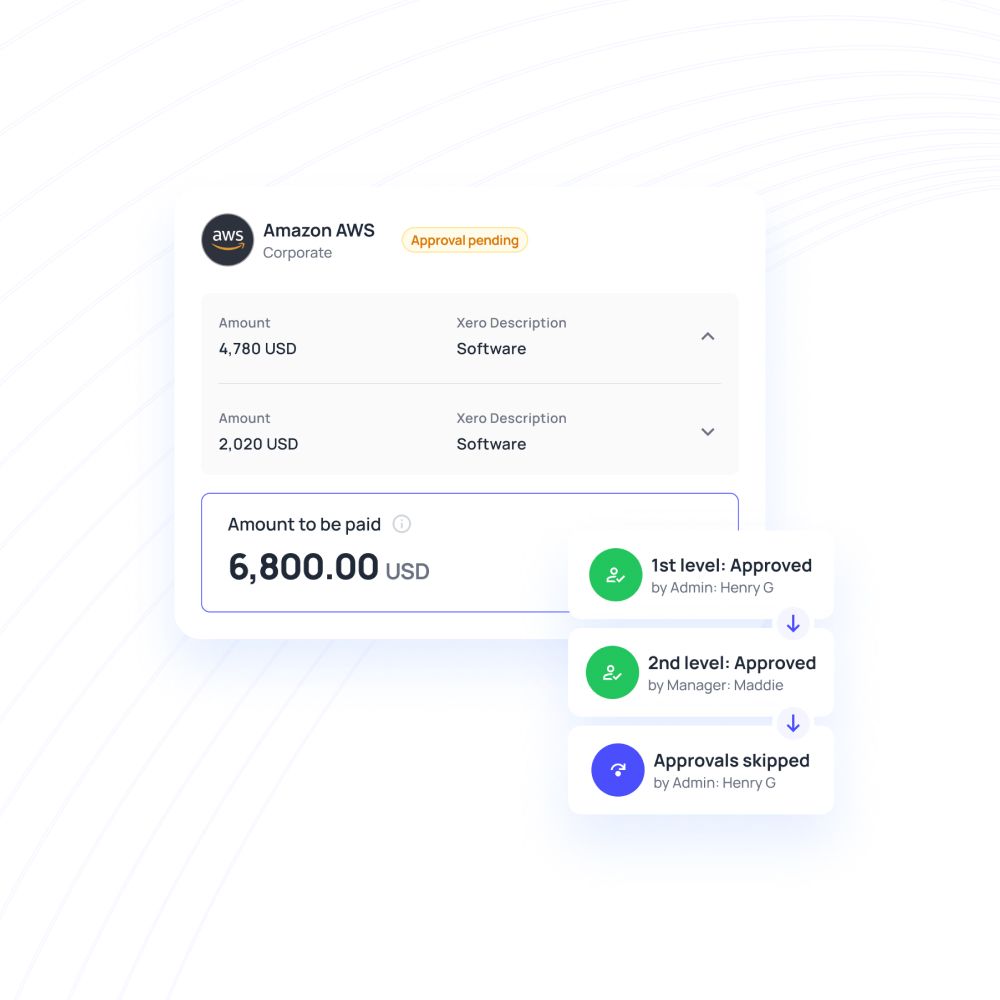

Streamline approvals for faster expense management

Volopay offers customizable approval workflows that simplify expense management from submission to payment. You can assign multi-level approvers, set automated reminders, and approve expenses directly within the platform.

This system reduces delays, enhances accountability, and ensures that all expense claims are verified efficiently, which creates a faster and more transparent approval process for everyone.

Ensure compliance with audit-ready records

Volopay stores every transaction with digital receipts and timestamps, creating complete audit-ready trails. You can retrieve detailed records anytime for tax filing or audits without worrying about missing data.

This level of documentation ensures compliance with financial regulations and makes financial reporting smoother, more accurate, and fully transparent for your business.

Trusted by finance teams at startups to enterprises.

FAQs

Begin by creating key expense categories like travel, supplies, and utilities. Use clear labeling and consistent tracking methods to ensure each transaction fits accurately into its respective category for analysis.

Using automated software like Volopay helps startups record, categorize, and monitor expenses in real time. It minimizes manual effort, prevents data errors, and gives a clear overview of all company spending.

Key categories include rent, utilities, payroll, marketing, travel, and office supplies. Tracking these areas helps you manage costs, plan budgets efficiently, and ensure smooth financial operations throughout the business year.

Yes, Volopay automates categorization through custom rules and AI-based tagging. Your team’s transactions are automatically classified into appropriate categories, saving time while ensuring accuracy and compliance across all departments.

You should review expense reports monthly to detect spending trends, ensure accuracy, and adjust budgets. Regular reviews also help you identify wasteful expenses and optimize resource allocation effectively.

Volopay simplifies tracking by automating expense entry, syncing receipts, and generating real-time reports. You can view spending by category instantly, ensuring accurate monitoring, control, and better financial decision-making.

Volopay provides automated categorization, virtual cards, multi-level approvals, and seamless accounting integrations. These features streamline workflows, reduce manual work, and deliver full visibility into all company spending activities efficiently.