Benefits of using Payment as a Service for your online payments

It would be an understatement to say that banking and payment practices have evolved so much in the last decades. From cash transactions to API-managed payment platforms, we have seen it all. But if we ask whether the accounts payable is doing a productive and efficient job, not all of them would be the answer.

As payments are the core activity of the accounting team, we can notice the need for an effective payment service to transact globally. With all these predictable and unpredictable struggles in accounting, it’s not surprising that the advent of Payment as a Service platform is gaining popularity. What exactly is this Payment as a Service, and how it’s streamlining the payment system in SMBs? Let’s get into it.

What is Payment as a Service?

Payment as a Service is when a company offers cloud-based automated payment services to its customers to manage their local business and cross-border payments. The emergence of cloud solutions has given rise to online payment services. Users can access these services from desktop or mobile apps through APIs (Application Programming Interface) to quicken business payments.

Everything happens online through the platform set up by the payment providers. And the AP team can make use of this to make online card payments, disbursements, vendor payouts & other miscellaneous expenses. The best thing about this is companies utilizing these solutions don’t have to set up the infrastructure needed to put the payment platforms into service.

As the applications are streamed directly from the cloud, all they require is a computer with internet access. Digitizing and automating payments is the way to bring transparency in accounting operations and better organization in bills, invoice & receipts management.

How do Payment as a Service work?

After a simple sign-up and documentation process, your payment services provider will onboard you. Within a few hours, you will get access to their payment suite, where you can see a payment options hosted by your provider.

These applications are designed to work in a highly secure and encrypted environment where your transactions are safely carried out. You can add admins and users who will be responsible for raising payment requests and approving and making payments.

You can customize the workflow of each tool as per your needs. Based on the pricing plan of PaaS payment providers, you will pay the platform usage fee.

Never worry about late or missed vendor payments

How will Payment as a Service be future of AP?

Accounts payable began with check and cash payments, but we can clearly see a shift in recent times, credits to the development of secure payment technologies. The Payment as a Service will indeed hold its space in the future by being an irreplaceable part of the accounts payable department of small and medium-sized businesses. Because these companies are constantly focusing on growth and scaling, they will spare no means to turn every function organized and streamlined.

For them, PaaS platforms will be like finding an ultimate treasure as they can considerably reduce the manual work and scale 5x times faster. PaaS will significantly increase global trading and transactions by enabling one to spend like a local in a foreign place.

Security issues concerning accounting data and media storage have been an alarming issue so far. PaaS will open doors to the world of cloud storage, which can eradicate any paper files or receipts from an accountant’s desk. In a nutshell, many businesses will join the bandwagon and embrace accounting digitization.

Make international payment with PaaS

Traditional banks won’t let you make cross border payments unless you have a qualified debit or credit card. Many companies are forced to upgrade the cards or bear high FX transactions fees. Now, payment providers have risen to the occasion and normalized international payments at nominal FX charges.

While regular wire transfers can take up to days to clear, digital payments solutions can accomplish that within a few hours.

Why do businesses need to adopt PaaS?

Accounts payable is always in a hurry juggling pending and upcoming payments, storing receipts, getting approvals, and sending weekly and monthly reports. To add to their misery, errors in payment details, duplicate payments, missed payments, late fees, and other substantial concerns occur here and there, attracting negative attention. Can they simplify this process and save time by adopting Payment as a Service platform?

Instant and quick payments

B2B businesses take anywhere from 3 hours to 2 days for their suppliers to receive payments once it’s cleared. Delayed or missed payments can hamper your business reputation and prevent you from enjoying exclusive deals and discounts. PaaS solutions are preferred already by many because it processes payments instantly and never let you miss any.

Data is the future

The more data we have, the more we can analyze and work on straightening and strengthening the future. Safely storing the correct accounting data allows for a robust accounting system with apparent anticipation about the future. The Payment as a Service platform ensures that you have your present and past disbursements data handy to make accurate predictions and the right decisions.

Keep eye on your spending

Spreadsheets or manual files don’t give you the clear visibility and transparency of the payment platform. As every payment is accomplished through the same system, it automatically gets recorded for your overview. These platforms also let you make effective budget plans and check if you stick to them. This is better than budgeting applications and feeding your financial data into them.

Benefits of Payment as a Service for businesses

Avoid frauds

Internal and external frauds are sure to happen when the payment methodologies are outdated and contain lots of loopholes. Micromanagement in each step of the payment process is required, which will be crying out for hiring more people to do this overscrupulous, manual work.

You will need technologically advanced solutions like PaaS to smash the double-dealing activities in their roots. With a transparent system to see every outgoing transaction and every minute detail, you will know without micromanaging.

Lower costs

You can ask how it saves costs when I have to pay the application fee. It’s still lower than how much businesses spend on business costs without the help of online payment services. There is a fee associated with the majority of the banking functions a business does through traditional banks.

For example, business owners should spend some money to buy additional check leaves. If they exceed their transaction limit or exhaust the minimum balance, that will also impose severe penalties. Manual tasks require more employees, which means more wages. Include the bills paid for using other accounting software for AP-related operations and late fees incurred for every delayed invoice.

Better reliability

Reliability is essential when your accounts payable team works non-stop to clear out invoices and bills. Online banking, check or cash payment, or bank deposit cannot be relied on all the time. For a functioning and productive accounting system, reliable Payment as a Service platform is much-needed.

Faster payments

A check takes a minimum of two days to process and clear the amount from the moment its sanctioned. A wire transfer can take anywhere between 3 hours to 3 days, depending on the location and the bank. Cross border payments can take more than three days.

Both sender and receiver can get anxious if the money is not received even after the transaction is initiated. To avoid answering unwanted emails regarding payments, upgrade to faster payments like online payment services and Payment as a Service platform. With this, you can make swift local and cross border payments.

More efficient

A streamlined payment process saves much time and effort every time while increasing efficiency. By bringing in automated and efficient payment services, you can reduce the odds of errors and inaccuracies in the expense management system. Accountants lose it when mistakes occur, and the balance sheet columns don’t add up.

As payment systems store every record and automatically sync themselves with other ledgers, human errors are prevented to a greater extent. Settle your bills and sync your bank statements right away with online payment platforms.

More security

This one is a no-brainer. Payment as a Service platform are safer in both front-end and background frameworks to not let any predator steal your valuable data. They make use of sophisticated and high-level security protocols to give the right level of access to the users and safeguard the payment information at all levels. PaaS operates at the cloud level, which means no one can get close to your data or make copies except you.

Improve cash flow

Lack of cash flow can tie your hands when you have made an important financial decision. You can predict the cash flow and schedule the expenses accordingly when you have better control over the costs and know what’s happening.

Another privilege the online payment system presents is being able to pay closer to when the bill is due. Paying bills way before the expected time sometimes can get in the way of maintaining cash flow. Since online payments guarantee instant delivery, you can postpone paying a few costs on its due date based on your current reserve.

More visibility on payables

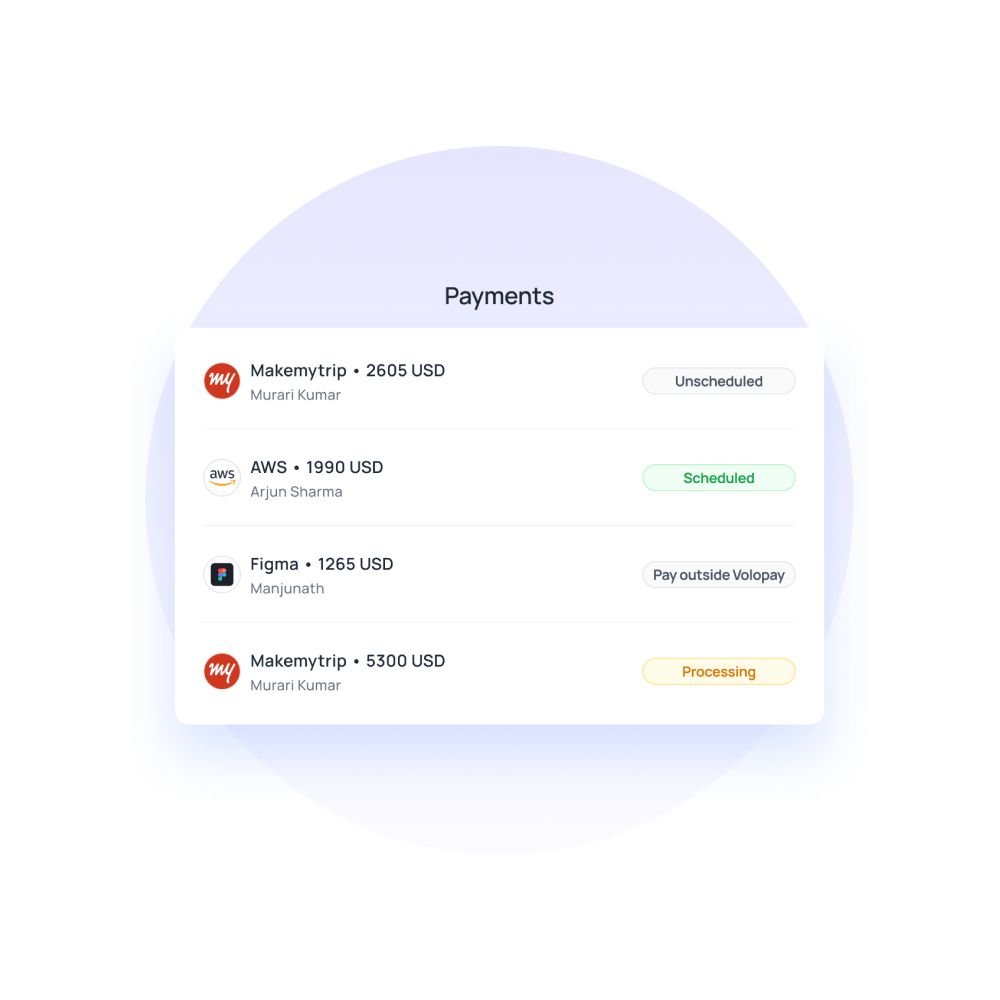

To keep track of payments and check how much is going out every day is crucial to predict your profit margin. Online payment platforms come with user-friendly interfaces where you can track every payment and its status.

It avoids the troublesome process of responding to vendors’ emails and calls if payment has not been received on their side. Businesses feel at great control over their expense system with a Volopay's expense management software.

Get started with Volopay

Volopay is a automated expense management software created for businesses that are busy scaling. With this, you can handle your business expenses, reimbursements, online payments, and many more on time.

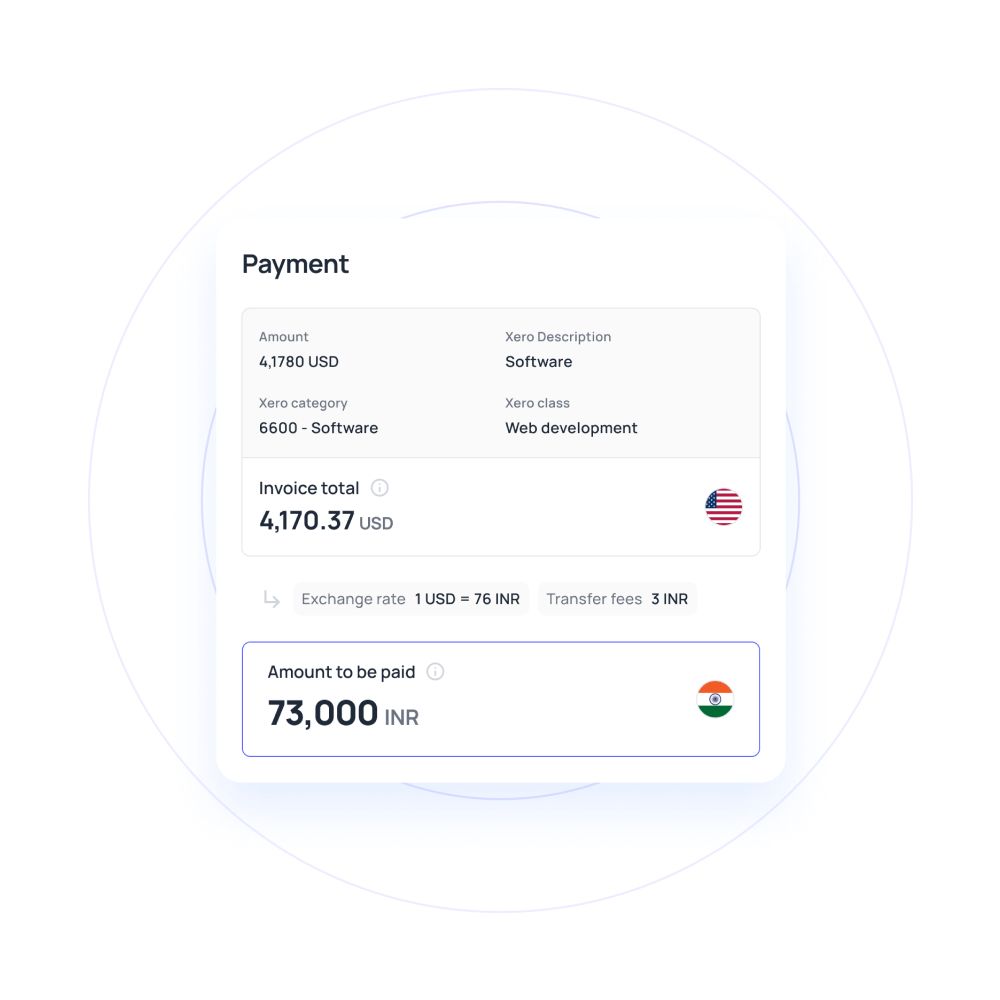

Here is how Volopay makes cross border payments management a breeze for its customers. First of all, it lets the users pay cross-border payments without any delay, just like local transfers. Secondly, with its multicurrency wallet, you can load money in different currencies and shop like a local in international lands. Low FX charges can be beneficial if you want to expand globally and seize overseas markets.

Our FX transactions rates are very reasonable too, and before even you proceed with making a transaction, you can view the current FX charges in the application: no surprise or last-minute costs. At any point, while using, you will never be compromising with your security as Volopay uses high-end encryption technology.

Sync with your accounting software

Volopay integrates well with other bookkeeping systems such as Netsuite, Quickbooks, Xero, Deskera, MYOB, Zoho, and Tally. Every outgoing transaction will be captured and synced instantly with your accounting books.

Other exciting features include physical and unlimited virtual cards, instant reimbursement platforms, automated budgeting, etc. Get Volopay now to strengthen your accounting department and streamline your payment system and enjoy the convenience of the best Payment as a Service platform.

Trusted by finance teams at startups to enterprises.