8 expense management best practices for small business

Traditionally, business expense management was a function of business that used to require heavy resource utilization, was time-consuming and was highly cumbersome. Finance teams would have to go through piles of paper and follow an unending list of protocols before completing simple processes such as expense reconciliation, invoice processing, reimbursement, etc.

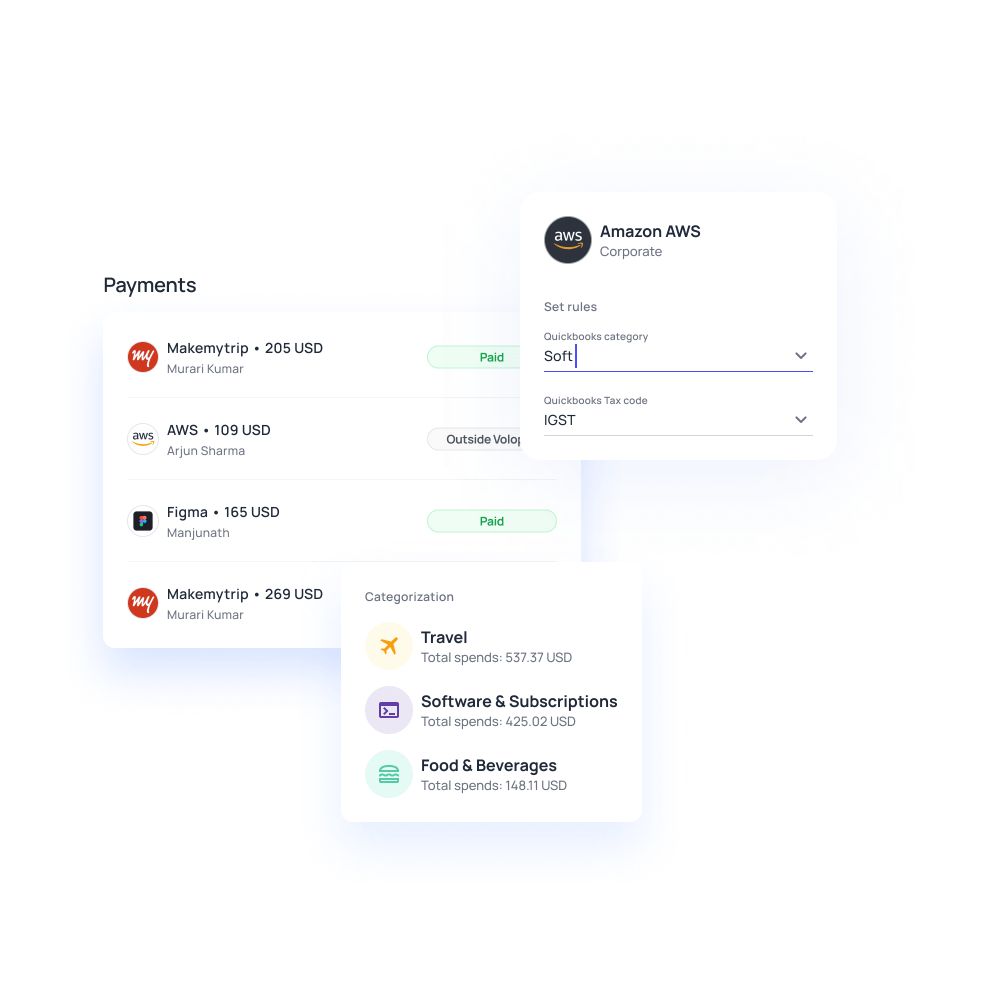

Most, if not all, of these processes, can now be done by business expense management software in much lesser time, with a fraction of the effort required. The expense or spend management software of today is capable of streamlining a company’s entire financial management system.

They can perform multiple tasks at the same time, automate a significant percentage of your system and keep your expenses air-tight. However, getting software that can do all this is only half of the job.

Why use expense management software?

Manual business expense management is not only time-consuming but also expensive and highly labor-intensive. We all know how tedious using spreadsheets, paper documents, forms, etc. can be. There are long lists of mundane administrative steps to follow. In comparison, the benefits of expense management software heavily outweigh those of traditional expense management.

By leveraging the power of automation this software significantly reduces the amount of time, effort, and resources you would otherwise require to manage expenses. Basic tasks such as expense reporting, tracking, reconciliation, auto-approvals & many others can be easily handled by Volopay's expense management software.

8 expense management best practices for business

Collect relevant expense information

Incorrect or incomplete recording of information will only increase your finance teams’ workload. Say, for example, your employees make expenses without submitting the required documents or information correctly. This will mean that your finance people responsible for reconciling these expenses will have to track down these employees and manually verify the scrupulous expenses.

To reduce workload ensure you collect all the relevant information related to your expenses accurately. The best expense management software come equipped with features like Optical Character Recognition (OCR) and custom expense information categories that can help you make sure relevant information is collected and stored correctly.

Have clear expense policy

Your expense management policy is the backbone that supports your spend management software. Without clearly defined, enforceable policies it is hard to have your employees follow them diligently. A 20-page document is no use if nobody can read or understand it. Ensure your business expense management software is capable of conducting regular policy checks. Some basic information that all expense management policies should include are:

List of reimbursable expenses or categories

1. Expense claim limits

2. Date or time specifications

3. Role or purpose-specific criteria

4. Mileage rates for T&E expenditures

Automate payment processing

Processing payments manually is now a thing of the past. One of the many benefits of expense management software is its ability to process payments automatically, at lightning-fast speeds. With this software, you can set up recurring payments for your subscriptions, set limits on spending with corporate cards for your employees, and process vendor payments with just a few clicks. Also, make sure you use the auto-approvals feature of your expense management software to automate low-level expense processing.

Enable automated audits

Audits are integral to maintaining an effective expense management system. Through regular audits, you can identify aspects of your business that require improvement while, at the same time, highlighting the variances that could be leading to increased costs. Establishing an audit trail is also important to protect your business from fraud and legal penalties. Use your expense report management software to flag anomalous transactions, catch duplicate payments and keep your business audit-ready.

Establish accountability

Building accountability amongst your employees is a good practice when establishing an ideal expense management system. To ensure your expense management policy is adhered to you must first make sure the people following it are held accountable. Start by making sure your managers and supervisors have a thorough knowledge of your policies.

Give these individuals an easy way of tracking their teams’ expense behavior so that they, in turn, can hold their subordinates accountable. An expense tracking software can be especially useful in helping you do this. This software provides real-time updates and in-depth visibility into each expense your employees make.

Process reimbursement on time

Employees like working in a company that respects their finances. At the same time, an effective employee reimbursement system also helps companies manage their cash flow. Processing reimbursements efficiently and on time creates a win-win situation for both you and your employees. Automated business expense management software is equipped with state-of-the-art features like OCR, invoice processing, and auto-approvals that make the reimbursement process so much easier. This software can record, verify and roll out reimbursements all on its own.

Assess expense analytics

Utilizing the in-depth analytics and insights provided by your online expense management software is another way of maximizing the software’s efficacy. This software is built to automatically process your expense reports to give you actionable insights on expense data. You can use this feature to inspect past performance, highlight important metrics or trends, and pinpoint the areas that can be improved. Act on the analytical trends provided by this software to keep your policies updated and company expenditure in check.

Streamline expense reporting

Traditionally, expense reporting used to involve an extremely time and labor-intensive process. Finance teams would have to manually record each expense in spreadsheets, attach receipts or documents to these reports and compile the same. Now, however, you can have this entire process done automatically by an expense report management software. These platforms are especially useful as expense software for small business because are capable of tracking, recording, and compiling each expense made by your employees in minutes.

Interested read: How to streamline business expense reporting process?

Volopay - All in one expense management for small business

Wondering how you’re going to get your hands on a business expense management software that is capable of doing all this? You could weigh your options. But, if you’re looking for something that’s top-shelf, look no further. At Volopay, we’ve built an expense management platform that is right up there with the best of the best.

Volopay works as a financial control center for your business. The software is capable of handling all the small business expenses. It works as an all-inclusive platform from where you can track and record expenses, approve purchase requests, reimburse employees, and create expense reports.

The software is also capable of processing enormous amounts of expense data to create in-depth, actionable spend analytics. All in all, the system works as an expense tracking software small business can use.

Trusted by finance teams at startups to enterprises.