Credit card vs. debit card vs. prepaid card

Corporate cards are here to take away the stress of spending management. Any company of any size can make use of a credit card and debit card to manage their day-to-day business expenses. Using corporate cards for business expense ensures a streamlined and more transparent process, reducing the hassle of manual tracking and reimbursements.

Before you begin your journey with payment cards, you need to compare different types of payment cards available.

They are usually categorized into credit cards, debit cards, and prepaid cards based on how the fund transfer happens between the card and the bank account. Understanding the nature, uses, and benefits of corporate cards can help you pick what is best for your business.

What is a debit card?

A debit card is a financial tool linked directly to your bank account. When you use a debit card for purchases or ATM withdrawals, the money is deducted directly from your bank account. This means you can only spend what you have.

This helps people avoid debt accumulation. Debit cards are widely accepted for transactions and offer a convenient way to access your funds without carrying cash.

They also come with security features such as PIN protection and fraud monitoring, making them a safe choice for spending on daily requirements.

Advantages of using debit cards

Expense control

You are not given access to an infinite amount of credits, but only the amount available in your bank account.

This helps you to budget, since every time you transact, the money is deducted from your account and you cannot go into debt.

Easy application

Banks aren’t stiff when it comes to sanctioning a corporate debit card. All you need is to apply for one through the bank portal or app.

To procure a credit card, you will have to produce a whole list of documents, including your statement and earning proof.

Easy to maintain

You aren’t indebted when you pay with a debit card, and there's no need to allocate cash to clear settlements at the end of the month.

When it's not cleared on time, you will pay a late fee too. When there is a need for hard cash, it transforms into an ATM card.

What is a prepaid card?

A prepaid card is a pre-loaded payment card with a specific amount of money. The difference between a debit card vs. a prepaid card is that prepaid cards are not linked to a bank account. Instead, you load funds onto the card, which you can then use for purchases or cash withdrawals until the balance is depleted.

Prepaid cards are often used for budgeting, travel, or as gifts, offering a secure and convenient way to manage spending. These cards come with various features, such as online access and reload options, but may also include fees for activation, transactions, and reloading.

Advantages of using prepaid cards

Overdraft protection

Prepaid business credit cards spare you from overdraft charge, which happens when you pay from a debit card.

In most cases, the payment gets processed, and you will be requested to pay back the amount with interest.

No interest

There is no interest associated with any transaction like credit cards. You use your own money that you have loaded.

So there is no hassle around repaying the money or paying interest for the loaned amount.

Smart budgeting

You can load only the projected expense amount of the month into the card. This way, you spend based on what you planned, and the expenses are under control.

Prepaid employee expense cards are better than a credit card and debit card.

Drawbacks of using prepaid cards

1. Chances of losing money

High probability of losing money if the account is left unattended and money is not spent.

2. No chance of earning interest

There is no likelihood of earning interest as the money stored in a prepaid card is not linked to the bank account.

3. Extra charges

Prone to charges like maintenance fee, deposit fee, paper statement fee.

What is a credit card?

A credit card is a financial instrument that allows you to borrow funds up to a certain limit for purchases or cash advances. When it comes to understanding the difference between a credit card vs. a prepaid card vs. a debit card, a credit card works on the principle of credit, meaning you borrow money from the card issuer and repay it later, either in full or in installments.

Credit cards come with interest rates and fees, but they also offer benefits such as reward points, cash back, and travel perks. They are widely used for building credit history, providing a line of credit for emergencies, and offering fraud protection and consumer rights for purchases.

Advantages of using credit cards

This is the universally known and accepted mode of payment. They come with a line of credit that you can use to repay the expenses once the pay cycle is over. Around 50 to 60% of businesses use credit cards worldwide, and they see this as a backup option for their business funding.

Credit cards have become the most convenient way to cover unexpected expenses for medium and large-sized businesses. You can compare business credit cards available in your region to choose the best plan suitable for you.

Cash flow management

Without cash flow, there is no procurement, and no procurement means no business.

This creates a sudden demand for additional funding sources. So, businesses need a trustworthy and reliable payment system that lends credit whenever asked.

Cards for your employees

Employees have business expenses too, like buying a work from home furniture setup or going on business trips.

Empowering them with credit cards can show that you trust and care about them. A corporate credit card allows you to perform this.

Exciting rewards

Debit or prepaid cards don’t bestow you with rewards and cashbacks, but credit cards do.

You get valuable rewards or offer coupons for every payment made through a credit card.

Credit score improvement

When you clear out your credit card dues on time, you maintain a good payment history.

This will consistently fetch your company an astounding credit score.

Drawbacks of using credit cards

1. Chargeable interest

Once your payment is due on credit card, you are required to pay back with an interest amount.

2. Complex paperwork

The paperwork involved in issuing credit card is huge compared to a debit or prepaid card unless you choose the right provider.

Switch to Volopay for the best corporate cards for your business today!

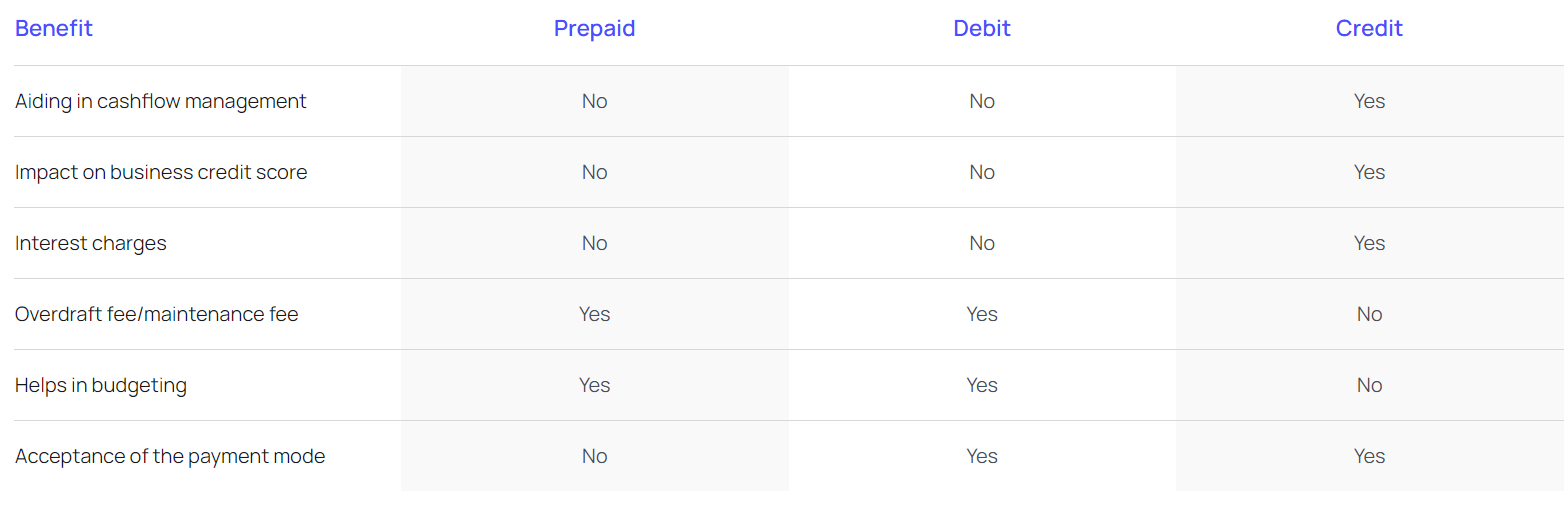

Credit card vs. debit card vs. prepaid card

1. Assisting with cash flow control

● Credit card

A credit card helps manage cash flow by providing a revolving line of credit, allowing you to make purchases and pay for them later. This can be beneficial for managing short-term cash needs or emergencies.

However, it requires disciplined repayment to avoid high-interest charges and debt accumulation. Credit cards often offer interest-free periods if the balance is paid in full each month.

● Debit card

A debit card assists with cash flow control by limiting spending to the available balance in your linked bank account. This helps prevent overspending and accumulating debt, making it easier to stick to a budget.

However, it may not provide the same flexibility as credit cards in managing unexpected expenses, since you can only spend what you have.

● Prepaid card

A prepaid card offers excellent cash flow control, requiring you to pre-load funds before use. This ensures you can only spend the amount loaded onto the card, making it a useful tool for budgeting and preventing overspending.

Prepaid cards can be particularly helpful for those who want to avoid debt and manage expenses within a fixed limit.

2. Spending capacity

● Credit card

Credit cards typically offer higher spending capacities compared to debit and prepaid cards, as they provide a line of credit up to a pre-approved limit set by the issuer.

This can be advantageous for making larger purchases or covering emergencies. However, it's important to monitor spending to avoid exceeding the limit and incurring high-interest charges.

● Debit card

Debit cards have spending capacities limited to the available balance in your bank account. This ensures you cannot spend more than you have, promoting financial discipline.

While this can prevent debt, it also means you may not have access to additional funds in case of emergencies or large, unexpected expenses.

● Prepaid card

Prepaid cards have spending capacities limited to the amount pre-loaded onto the card. This makes them ideal for budgeting and controlling spending, as you can only use the funds you have loaded.

They do not offer the flexibility of additional credit, but they also eliminate the risk of debt, providing a clear spending limit.

3. Fraud protection standards

● Credit card

Credit cards generally offer robust fraud protection standards, including zero-liability policies for unauthorized transactions and advanced monitoring systems to detect suspicious activity.

Credit card issuers often provide additional consumer protections, such as dispute resolution services and extended warranties on purchases, making them a secure choice for transactions.

● Debit card

Debit cards also offer fraud protection, but the standards may vary by issuer. Most debit cards come with zero-liability policies for unauthorized transactions, but recovering stolen funds can take longer compared to credit cards.

It's important to report any suspicious activity promptly to minimize potential losses. Debit cards also provide some consumer protections, though they may be less comprehensive than those offered by credit cards.

● Prepaid card

Prepaid cards offer basic fraud protection, typically including zero liability for unauthorized transactions. However, the level of protection may vary depending on the card issuer and type of prepaid card.

Prepaid cards may not offer the same extent of consumer protections and dispute resolution services as credit or debit cards, making it crucial to choose a reputable issuer and monitor transactions closely.

4. Credit-building power

● Credit card

Credit cards are an effective tool for building credit history and improving your credit score. By making timely payments and maintaining a low credit utilization ratio, you demonstrate responsible credit behavior to credit bureaus.

This can lead to better loan terms, lower interest rates, and higher credit limits in the future. Regular use and on-time payments are reported to credit bureaus, making credit cards a powerful instrument for establishing and enhancing creditworthiness.

● Debit card

Debit cards do not contribute to building credit history because they are linked directly to your bank account and do not involve borrowing. Transactions made with debit cards are not reported to credit bureaus, so they have no impact on your credit score.

While debit cards are useful for managing daily expenses and avoiding debt, they do not help in building or improving your credit profile.

● Prepaid card

Prepaid cards, like debit cards, do not aid in building credit history. Since they are not linked to a credit line or a bank account, transactions made with prepaid cards are not reported to credit bureaus.

They are primarily used for budgeting and controlling spending, but they offer no benefit in terms of establishing or improving your credit score.

5. Convenience

● Credit card

Credit cards offer high convenience with widespread acceptance, both online and offline. They provide the ability to make purchases, book travel, and access emergency funds easily.

Credit cards also offer benefits such as rewards, cash back, and purchase protection, enhancing their overall convenience. Additionally, they enable quick access to a line of credit without the need for immediate funds in your bank account.

● Debit card

Debit cards are convenient for everyday transactions, providing direct access to your bank account. They are widely accepted and can be used for in-store, online purchases, and ATM withdrawals.

The immediate deduction of funds from your account helps in the real-time tracking of expenses. However, they may not offer the same level of rewards or benefits as credit cards, and they require sufficient funds in your account for transactions.

● Prepaid card

Prepaid cards offer convenience by allowing users to load and spend a predetermined amount, making them useful for budgeting and controlling spending. They are widely accepted and can be used similarly to debit and credit cards for purchases and withdrawals.

Prepaid cards are particularly convenient for those without bank accounts or those looking to avoid debt. However, they may come with fees for reloading and transactions, which can affect their overall convenience.

6. Control and budgeting

● Credit card

Credit cards offer less control and budgeting capabilities since they provide a line of credit that can lead to overspending and debt if not managed carefully. However, many credit cards come with tools and apps to help track spending and set budgets.

Responsible use and paying off the balance in full each month can help maintain control over finances, but discipline is required to avoid interest charges and debt accumulation.

● Debit card

Debit cards provide strong control and budgeting features as they limit spending to the available balance in your linked bank account. This prevents overspending and promotes financial discipline.

Real-time transaction tracking and balance updates help you stay within your budget. However, they lack the flexibility to borrow additional funds, which may be a limitation in certain situations.

● Prepaid card

Prepaid cards excel in control and budgeting by allowing you to load a specific amount of money and spend only what is available on the card. This helps in avoiding debt and overspending, making them ideal for budgeting purposes.

They are especially useful for managing discretionary spending and setting limits for specific expenses. However, they may come with fees for loading and using the card, which should be considered in budgeting plans.

7. Acceptance of payment mode

● Credit card

Credit cards are widely accepted globally, both online and offline, making them a highly versatile payment method. They are accepted at most retail stores, restaurants, hotels, and service providers.

Credit cards are particularly useful for international travel, as they offer the ability to pay in different currencies and provide better exchange rates. Their extensive acceptance and the added benefits like rewards and protections make them a preferred choice for many consumers.

● Debit card

Debit cards are also widely accepted, both domestically and internationally. They can be used at retail stores, online shops, and ATMs for cash withdrawals.

Most businesses that accept credit cards also accept debit cards, providing similar convenience. However, certain services, such as car rentals and hotel reservations, may require a credit card rather than a debit card for security deposits, which can be a limitation.

● Prepaid card

Prepaid cards are accepted at most places that accept debit and credit cards, making them a convenient option for transactions. They can be used for both in-store and online purchases and at ATMs for cash withdrawals.

However, acceptance can vary depending on the issuer, and some merchants may not accept certain types of prepaid cards. Prepaid cards are often used as an alternative for those without bank accounts or to manage spending limits.

8. Maintenance fee/overdraft fee

● Credit card

Credit cards often come with various fees, including annual maintenance fees, late payment fees, and cash advance fees. While many credit cards offer no annual fee options, premium cards with additional benefits may charge a yearly fee.

Overdraft fees do not apply to credit cards; however, interest charges on outstanding balances can accumulate quickly if not managed properly, leading to significant costs.

● Debit card

Debit cards typically have lower fees compared to credit cards. Some banks offer no monthly maintenance fees, especially if certain conditions, such as maintaining a minimum balance, are met.

However, overdraft fees can be significant if you opt into overdraft protection, which allows transactions to go through even if the account lacks sufficient funds. These fees can add up, so monitoring account balances is essential to avoid unnecessary charges.

● Prepaid card

Prepaid cards often come with various fees, including activation fees, monthly maintenance fees, reload fees, and transaction fees. Unlike debit cards, prepaid cards do not have overdraft fees, as spending is limited to the pre-loaded amount.

However, the accumulation of these smaller fees can add up, making prepaid cards more expensive over time. It’s important to compare different prepaid card options to find one with minimal fees.

9. Impact on business credit score

● Credit card

Business credit cards can significantly impact a business credit score. Responsible use, such as making timely payments and keeping credit utilization low, helps build a positive credit history, improving the business credit score. This can lead to better financing options and terms for the business in the future. Conversely, late payments and high balances can negatively affect the credit score.

● Debit card

Debit cards do not impact a business credit score, as they are not linked to a line of credit. Transactions made with a debit card are not reported to credit bureaus, so they do not affect the business’s credit history. While debit cards are useful for managing daily expenses and maintaining financial discipline, they do not contribute to building or improving a business credit score.

● Prepaid card

Prepaid cards do not affect a business credit score because they are not linked to a line of credit or a business bank account. Transactions and balances on prepaid cards are not reported to credit bureaus, so they have no impact on credit history. Prepaid cards are mainly used for budgeting and controlling spending but do not help in establishing or improving a business credit profile.

10. Interest charges

● Credit card

Credit cards accrue interest on outstanding balances if not paid in full by the due date. The interest rates can be quite high, typically ranging from 15% to 25% APR. Cash advances and balance transfers may incur even higher interest rates.

To avoid interest charges, it is advisable to pay the full balance each month. Failure to do so can result in substantial interest accumulation, increasing the overall cost of credit.

● Debit card

Debit cards do not incur interest charges because they are linked directly to your bank account, and transactions are completed using available funds.

Since you are spending your own money rather than borrowing, there are no interest rates associated with debit card use. This makes debit cards a cost-effective option for managing everyday expenses without the risk of accruing debt.

● Prepaid card

Prepaid cards do not have interest charges, as they operate on a pre-loaded amount basis. You are using your own money that you have already loaded onto the card, so there is no borrowing involved. This eliminates the risk of incurring interest charges.

However, prepaid cards may come with various fees that can add to the cost of using the card, so it’s important to be aware of these when choosing a prepaid card.

Suggested read: Business credit card vs debit card: Which one to choose for business

Elevate your business today with Volopay's corporate cards!

Which is the right card for your business?

Ultimately, credit card wins as it offers the best of both worlds for SMBs and even large companies. Credit card users can reap many benefits in the form of value, better security, rewards, etc. Establishing a credit score and maintaining a decent cash flow is always prevalent among small businesses. Credit cards tick off these two and are an excellent backup expense resource.

They are also accepted almost everywhere. You get a one-month duration to pay back the due, which you can easily manage with the incoming cash flow of your business. Though debit cards seem like an uncomplicated option, corporate credit cards aren't the same as normal credit cards where you just spend and spend until you go broke. Corporate credit cards come with smart money management features which efficiently let you handle cash flow and expenses without breaking the bank.

Streamline your business finances with Volopay’s corporate cards

Volopay’s corporate cards, including both virtual and physical prepaid cards, are designed to simplify business finances with features that enhance control, security, and efficiency.

These cards offer real-time expense tracking, multi-level approvals, seamless integration with accounting systems, multiple card issuance for employees, automated expense categorization, and quicker, smoother payments.

Real-time expense tracking

Volopay’s corporate cards provide real-time expense tracking, allowing businesses to monitor transactions as they occur. This feature ensures transparency and helps in managing budgets more effectively.

Multi-level approvals for security

With multi-level approval workflows, Volopay enhances security by ensuring that expenses are reviewed and authorized by multiple stakeholders, reducing the risk of fraud and unauthorized spending.

Seamless integration with accounting systems

Volopay’s corporate virtual cards integrate seamlessly with popular accounting systems, automating the synchronization of transactions and reducing manual data entry, which streamlines financial reporting and reconciliation.

Multiple card issuance for employees

Volopay allows businesses to issue multiple corporate cards to employees, enabling controlled spending across various departments and projects. Each card can have customizable spending limits and usage restrictions.

Automated expense categorization

Automated expense categorization with Volopay’s corporate cards simplifies bookkeeping by categorizing transactions automatically. This feature ensures accurate financial records and saves time on manual entry.

Quicker and smoother payments

Volopay’s corporate cards facilitate quicker and smoother payments, enhancing cash flow management. Businesses can make payments promptly and efficiently, improving vendor relationships and operational efficiency.

Get Volopay for your business

Get started now

FAQs

You can use the Volopay corporate card for making repetitive payments like application subscription charges, online purchases, and employee business spending.

Volopay corporate card only helps you to strengthen your business credit score. It doesn't involve or get reflected in your personal credit score in any way.

The maximum credit limit is determined based on the cash flow state of your business, repayment history, bank balance statements, etc.

No more manual entries in other accounting applications, as Volopay allows you to integrate with them seamlessly. Some examples include Quickbooks and Xero.

You can assign budgets to each virtual card created and set up customized approval methods for each card if one has to exceed budgets.

No, prepaid cards for business do not help build credit history. Since prepaid cards are not linked to a line of credit or a bank account, transactions are not reported to credit bureaus. Therefore, using a prepaid card does not contribute to establishing or improving a business’s credit profile.

Yes, prepaid cards for business can be used internationally, provided they are part of a major card network like Visa or Mastercard. These cards can be used for purchases and cash withdrawals in foreign countries, making them convenient for business travel. However, be aware of any foreign transaction fees that may apply.

Yes, there may be fees associated with using debit cards for business depending on your provider. Common fees include monthly maintenance fees, ATM withdrawal fees, and overdraft fees if overdraft protection is enabled.

Some banks offer business debit cards with minimal fees if certain conditions, such as maintaining a minimum balance, are met.

Yes, credit cards and prepaid cards have different liability protections for unauthorized transactions. Credit cards typically offer stronger protections, including zero-liability policies and advanced fraud monitoring.

Prepaid cards also offer zero-liability protection, but the level of security and consumer protections may vary by issuer and card type. It’s important to review the specific terms and conditions of each card.

The reloading options for a prepaid card vs. a debit card are quite similar. Prepaid cards can be reloaded through various methods, including direct deposit, bank transfers, and cash reloads at participating retailers.

Debit cards are linked to a bank account and are automatically funded by the available balance in the account. Additional funds can be added to the account through direct deposits, bank transfers, and cash deposits at ATMs or bank branches.