Corporate credit cards for expense management

What are corporate credit cards for expense management?

What are corporate credit cards?

You might wonder how these cards fit into daily operations. A corporate credit card for expense management allows your employees to pay for travel bookings, client dinners, software tools, and more, without using personal funds. Each transaction is recorded in real time, ensuring accurate and consistent business expense tracking across departments.

Types of corporate cards

There are three main types of corporate card solutions to consider:

● Credit cards offer a revolving credit line with monthly repayments.

● Charge cards require the full balance to be paid monthly, often without spending limits.

● Prepaid cards are loaded with a set amount, offering strict control and eliminating the risk of debt.

Choosing the right expense management card depends on your business needs and how much flexibility you require in your spending controls.

Key business advantages

A well-implemented expense management card system reduces the need for reimbursement workflows, lowers the risk of fraud, and provides faster insight into where your company’s money is going. You save valuable time and effort on monthly reconciliations, helping you focus on scaling operations.

Who uses these cards?

From funded startups to mid-sized companies and large enterprises with budgets exceeding $1 million, businesses across industries are adopting corporate card solutions.

Whether you're managing a small team or hundreds of employees, a corporate credit card for expense management can streamline your spending processes and empower smarter financial decisions.

Why use corporate credit cards for expense management?

Simplifying expense tracking

When your team uses a corporate credit card for expense management, each transaction is automatically recorded, categorized, and synced with your business expense tracking software.

This eliminates the need for employees to collect receipts or input data manually, reducing the chances of mistakes and missed entries. Real-time visibility allows finance teams to focus on strategy rather than data entry.

Enhancing budget control

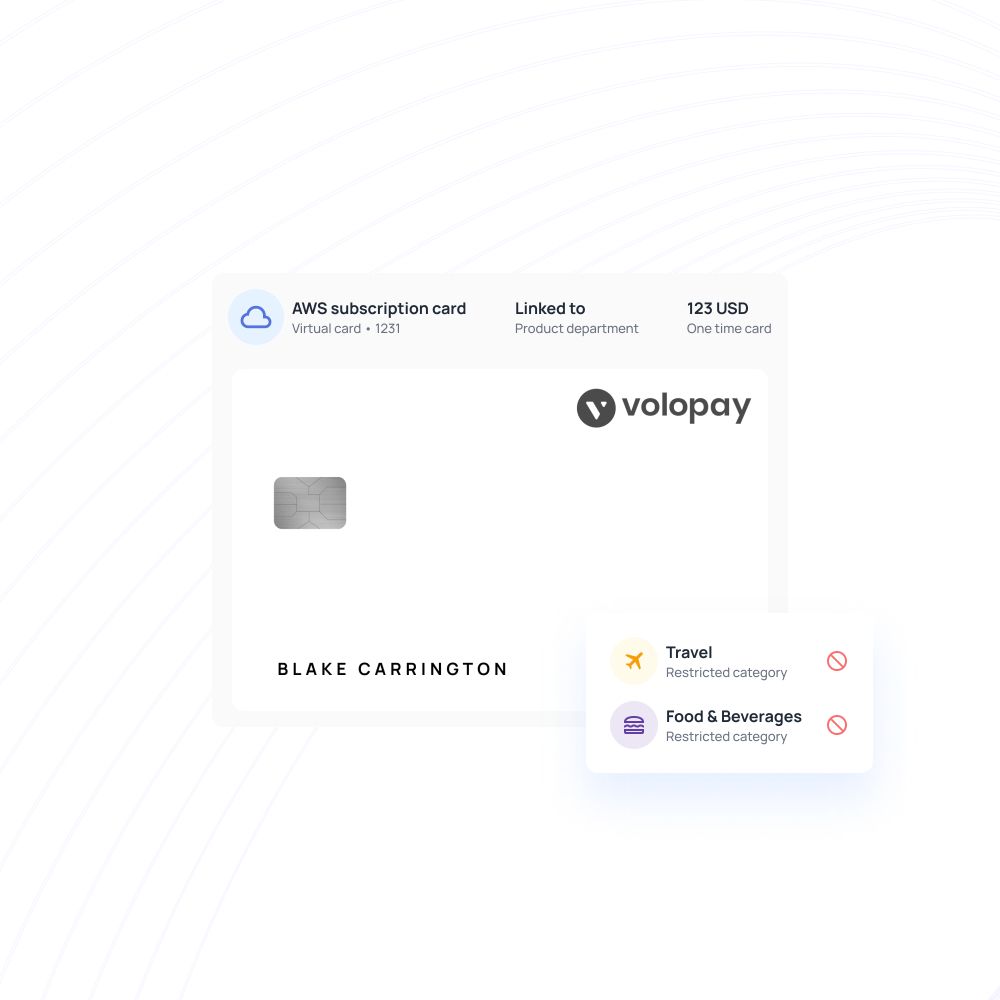

Setting spending limits becomes effortless with the right expense management card. You can assign individual or department-based limits, restrict categories, or even pause cards instantly when needed.

This level of control ensures your teams stay within budget and spend responsibly. With customizable controls in place, you can stop overspending before it happens.

Ensuring IRS compliance

Keeping clean and organized records is essential for tax reporting and audits. A corporate credit card for expense management helps you maintain a detailed trail of every business transaction.

Storing digital receipts, categorizing expenses, and generating audit-ready reports all contribute to IRS compliance. Come audit season, your books are already in order.

Improving cash flow

Corporate cards also support better cash flow planning. Unlike traditional reimbursement processes that delay visibility, these cards give you an up-to-date view of your spending.

With flexible payment options, you gain better control over outgoing funds. This makes it easier to forecast future expenses and ensure that your cash reserves align with real-time business needs.

Corporate credit card vs business credit card: What's the difference?

Many people mistakenly think of corporate credit cards and business credit cards as the same, but understanding the key differences between business and corporate credit cards is crucial for making the right choice for your organization. Here are the major differences.

Set spending limits and categories

With business credit cards, while it is easy to set spending limits on each authorized card, it is very difficult to set spending categories.

This lack of categorization can lead to unauthorized purchases and confusion. This gives your employees free rein to pay for different operations using the business credit cards which they weren’t supposed to.

On the other hand, with corporate expense cards, not only can you set spending limits, but you can also restrict spending categories so that the corporate cards are used by employees for activities they are authorized to do. This ensures that expenses are aligned with your company’s budget and guidelines.

Track real-time expenses

Who bought that $8 pumpkin spiced latte and chalked it up to a business expense? If you are using business credit cards, you’ll never find it out! Business credit cards do not provide the feature of expense tracking and reporting, and those who do provide this feature are average at best.

This lack of oversight can easily lead to financial mismanagement. The result? An increased risk of wasteful, uncontrollable expenditure can jeopardize the cash flow and credit score of your business.

With corporate credit cards, you get real-time expense tracking and spending alerts that let you know of any misuse instantly.

Safeguard your bank account

When using business credit cards, your cards must be linked to the company bank account which if not supervised closely, can lead to unforeseen expenditure, exhausting your credit limit earlier than expected, ultimately risking your business credit score.

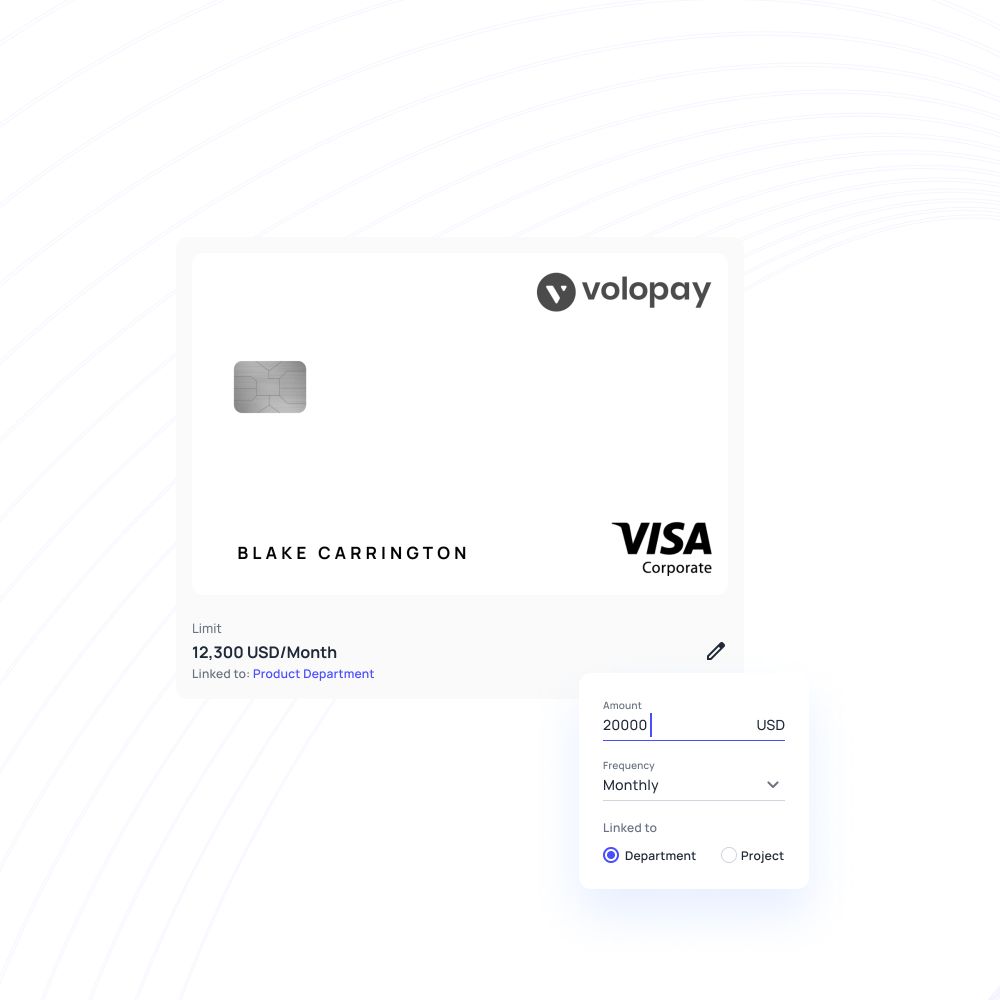

When using corporate credit cards, especially the ones provided by Volopay, your corporate expense cards are not linked to your bank account but are linked to the department budget you’ve set for each corporate credit card.

This ensures that your company bank account is not irreversibly affected by any unauthorized or personal spending by employees.

How do corporate credit cards work for expense management?

Card issuance process

Issuing corporate cards to your team doesn’t have to be time-consuming. With digital-first corporate card solutions, you can quickly issue physical or virtual cards to employees or departments.

Whether it's for travel, software, or office supplies, you assign cards for specific expense categories. This allows you to allocate budgets in advance and streamline expense approvals before spending even begins. The result? Faster access to funds with full visibility from day one.

Transaction monitoring systems

Once employees start using their cards, real-time transaction monitoring systems kick in. These dashboards give you a live feed of all spending activity, sorted by employee, vendor, or department.

Every swipe, tap, or online payment is automatically captured and categorized for efficient business expense tracking. These monitoring tools are especially helpful in catching anomalies early, helping you stay compliant and avoid end-of-month surprises.

Payment and reconciliation

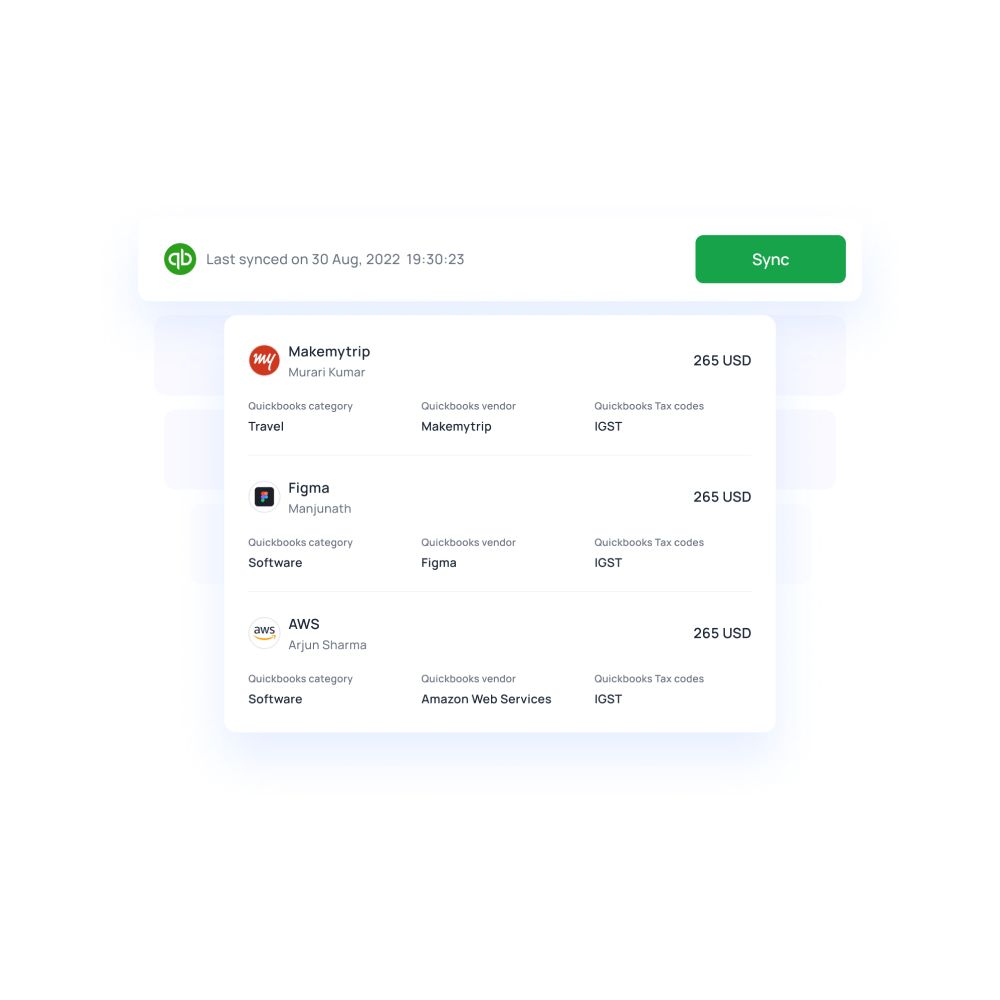

Reconciliation becomes a breeze when using a corporate credit card for expense management that integrates with your accounting software. Transactions sync directly into platforms like QuickBooks or Xero, matching receipts and auto-categorizing entries.

This automation reduces human error, saves hours of manual input, and ensures every transaction is accounted for. You can also schedule payments to avoid late fees while maintaining healthy cash flow.

Employee access controls

Managing who can spend—and how much—is crucial. These cards offer granular employee access controls.

You can define role-based permissions, set daily or monthly limits, block specific merchant categories, and even freeze cards instantly. These access controls prevent misuse and ensure every dollar spent aligns with your budget.

Using a corporate credit card for expense management gives you the visibility and control needed to run smarter, more efficient financial operations.

How corporate credit cards make expense management easier for businesses?

In the battle of corporate credit card vs business credit card, we know who the clear winner is. Corporate expense cards are not just safer and more secure than business credit cards, even the management of corporate credit cards is much simpler & streamlined.

They are also extremely beneficial to have both for the employer and the employees, whether you have a well-established business or an SME. Here are some of the umpteen benefits of having a corporate credit card for expense management:

Centralized expense tracking

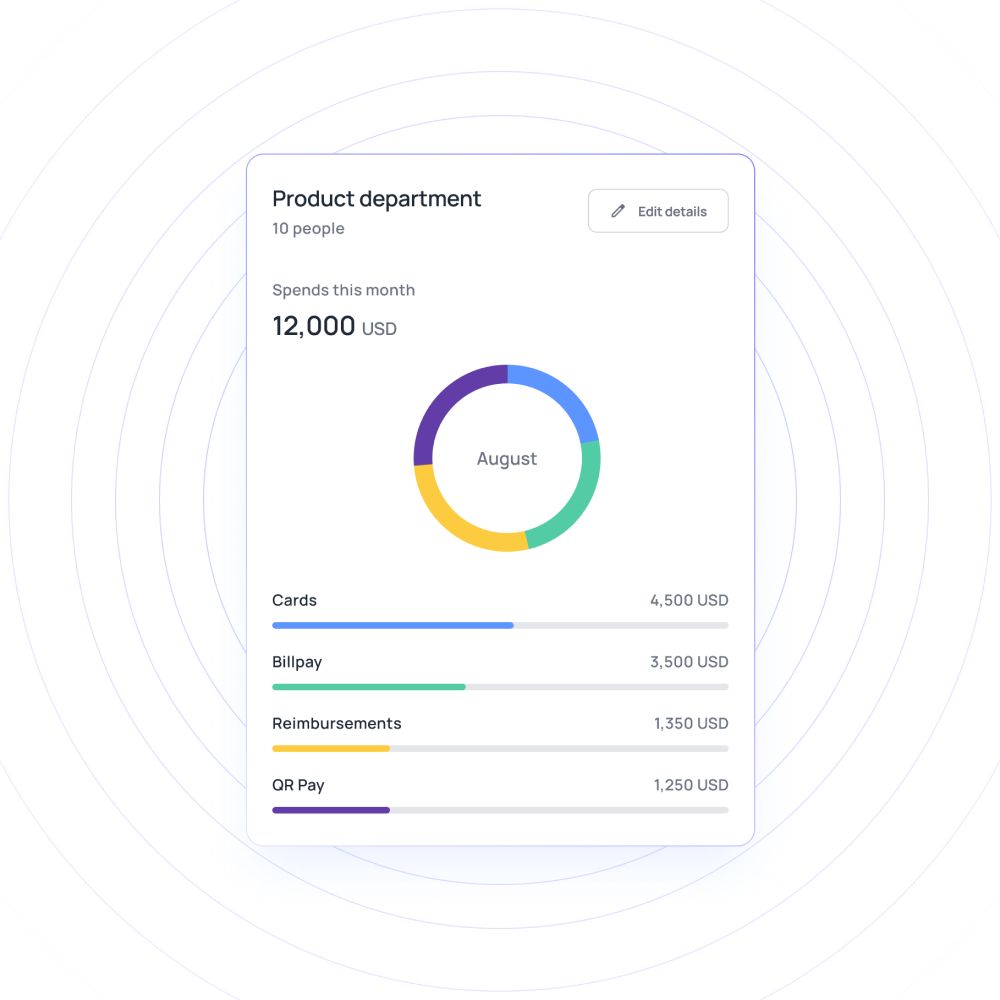

With corporate cards offered by expense management platforms like Volopay, you can see a live expense tracking dashboard, that keeps a note of all transactions so that you can exercise full control over how and where your money is being utilized.

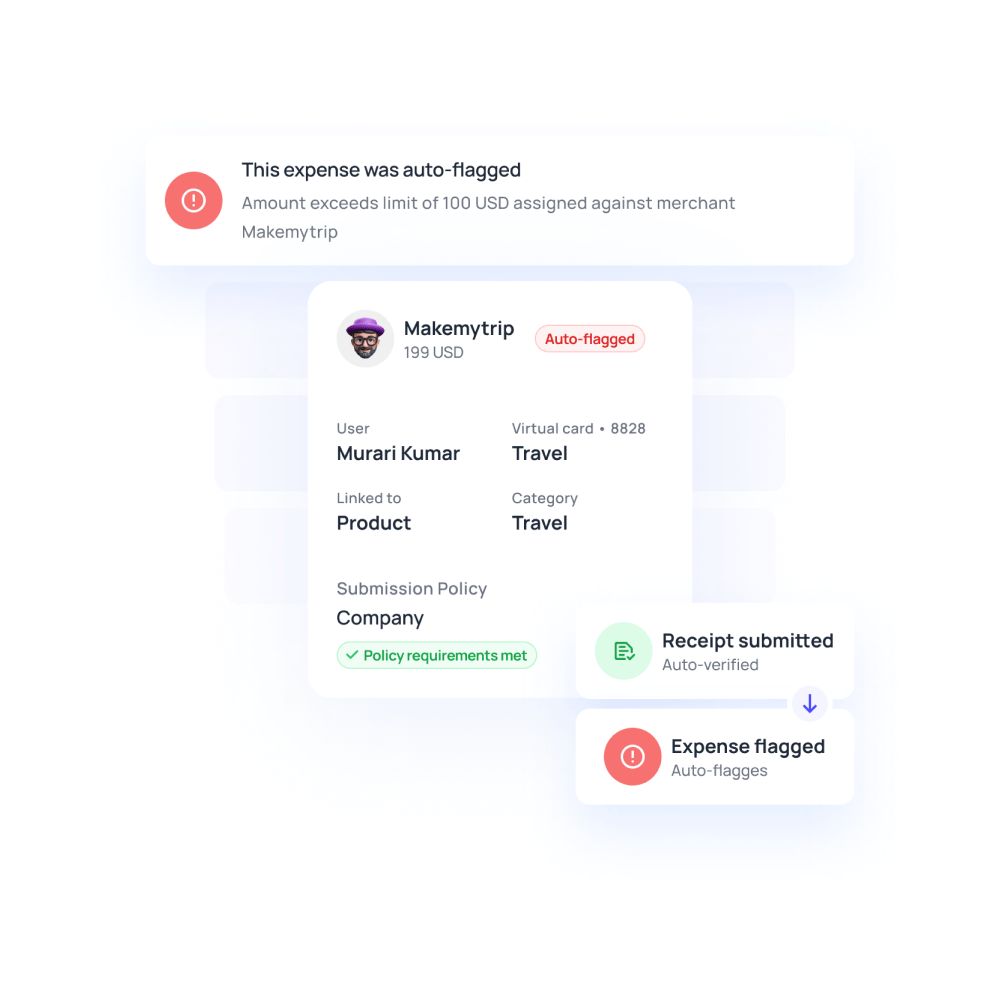

Corporate expense cards also come equipped with features such as real-time spending alerts to notify you if and when any expense policy set by you for a corporate card is being violated.

Individual card limit

With corporate credit cards, you can not only put a spending limit on every single card, you can even go ahead and restrict corporate cards under certain spending categories as well. This ensures that every corporate card is being used for the exact purpose it was created for.

For instance, if a corporate card is being created for travel purposes, creating the corporate credit card for specifically that purpose will avoid any possibility of wasteful or personal spending by the cardholder.

Limit fraud and misuse

Having corporate cards for business expenses created with a fixed budget limits the possibility of fraud or misuse.

In case you fear that an employee might be using the corporate credit card for personal spending, you can choose corporate credit cards with reconciliation software that can quickly distinguish between a business and personal expense automatically.

Access real-time data – whenever, wherever

One of the main issues with expense reports is the delay in receiving expense claims that can take a couple of weeks up to several months to be displayed. With business credit cards, the irregular nature of delayed or recurring payments can make your budgets go haywire. The solution?

Corporate expense cards provide real-time logging reports with the added convenience of purchase proof, eliminating the need for long-winded employee reimbursement hassle and a clear record of all company expenses, broken down into categories, team, cardholder, etc. This data is again stored in a cloud-based storage platform making it accessible, no matter where you are.

Easily issue instant virtual cards

Business credit cards, due to their access to your company bank account, are given to only the high-ranking authorities such as the CEO, VPs, other executives, and office administrator.

What about the others? Other employees have to ask for these cards time and again whenever they need to make a business expense. It feels like you’re back in school, asking your teacher for the hall pass.

That’s why corporate expense cards are the ideal choice, as they can be given to anybody since they are allotted on a predetermined budget and are not linked to your company’s bank account.

Benefits of using corporate credit cards for small businesses

Contrary to popular belief, small businesses too can reap the benefits of a corporate credit card program for small businesses and streamline their expense management workflow swiftly and efficiently. Here are a few ways you can use corporate credit cards for small businesses to your advantage:

Keep personal and business expenses separate

Sometimes you might feel the urge to put a business expense on your personal card, or your employee may feel the same sentiment to get some reward points, but it’s best to not blur the line between your personal and business expenses.

Having a dedicated corporate credit card allows you to restrict yourself and your employees from making any business purchases personally, keeping your financial records clean and your credit history pristine.

Monitor employee spending habit

A corporate expense card is the best way to keep track of any individual employee’s or team’s spending habits, providing tangible proof and records to identify who might be indulging in wasteful expenditure of precious company resources. With corporate credit cards and streamlined expense reimbursements in place, businesses can not only simplify tracking but also address fraudulent activities, embezzlement, or blatant misuse. These tools work hand in hand to safeguard your assets and ensure financial transparency.

Advanced security measures

One of the best features about corporate credit cards is the multiple levels of security they provide in terms of multi-level approval for every expense, thereby protecting your company against theft, fraud, and any possible misuse of corporate credit cards. You can set multiple authority channels according to the value of the business expense, whether it’s a low-cost expense or a high-cost one.

Cash rebates

One of the best benefits of using corporate expense cards is the ability to earn cash rebates on purchases while also simplifying corporate credit card reconciliation through automated tracking and reporting. Cashback rebates differ for each provider, depending on the type of purchase made.

For example, a company that generates an overall expense of USD 3 million paid through a corporate expense card can rake in as much as USD 50,000 as a cash rebate!

This rebate can be further invested into an all-in-one financial spend management platform such as Volopay that provides auto-reconciliation with your accounting software along with various other features.

Empower your employees

When employees have to incur out-of-pocket expenses on business operations such as work trips, they can end up accumulating thousands of dollars worth of employee reimbursements, which is in itself a long and tedious process.

Corporate expense cards eliminate this problem by providing them the freedom to pay for stuff on the go using the company’s resources and digitally attach their receipt as proof of purchase. Not only the monetary benefit for the employees, equipping them with corporate credit cards instills in them a feeling of mutual trust and admiration that further improves collective team happiness.

What features define a top corporate expense management card?

Customizable spending limits

Setting customizable spending limits on your corporate credit card for expense management gives you powerful control over team budgets.

You can assign spending caps per department, project, or individual, which helps reduce unnecessary costs.

For example, limit travel to $3,000 per team or cap SaaS subscriptions at $500 per month.

These controls make your expense management card more than just a payment tool—it becomes a budgeting system that enforces discipline and accountability across your organization, preventing overspending before it starts.

Real-time analytics tools

The best corporate credit card for expense management comes with real-time analytics that offer instant insights into spending behavior.

These tools let you track purchases, categorize expenses, and flag outliers as they happen.

Instead of waiting for end-of-month reports, you can monitor transactions live and adjust budgets on the fly.

A smart expense management card helps you identify trends, reduce waste, and make data-driven financial decisions—putting you in full control of every dollar leaving your business in real time.

Accounting software integrations

Efficient accounting is easier when your expense management card integrates directly with tools like QuickBooks, Xero, or NetSuite.

Each transaction from your corporate credit card for expense management syncs automatically, eliminating the need for manual data entry. This not only saves hours of work but also reduces the risk of errors.

Seamless integration simplifies reconciliation and accelerates month-end closing. With categorized transactions ready in your accounting system, you improve accuracy, ensure compliance, and create a streamlined financial workflow from swipe to statement.

Mobile management capabilities

Managing expenses on the move is essential for today’s fast-paced businesses.

A reliable expense management card offers mobile access, allowing you to track spending, issue cards, freeze accounts, and receive real-time alerts—all from your smartphone.

With a few taps, you control every feature of your corporate credit card for expense management without logging into desktop systems.

This flexibility ensures you never miss a beat, whether you’re in the office or on the road. Mobile-friendly platforms make managing finances simpler, faster, and more secure.

How can you ensure compliance when using a corporate card for expense management?

Create clear expense policies

To use your corporate credit card for expense management compliantly, start by creating clear expense policies for all employees.

Outline approved spending categories, daily limits, and required documentation. Specify which purchases qualify as business-related, including travel, client meetings, and subscriptions.

A formal policy ensures everyone uses their expense management card responsibly. When expectations are clearly defined, you reduce the risks of misuse, simplify reporting, and help your business stay compliant with IRS and internal audit requirements.

Set user-specific card limits

To reinforce compliance, set user-specific limits on your corporate credit card for expense management. Tailor spending caps based on employee roles, departments, or typical purchase needs.

For example, a sales executive might have a higher travel allowance than an intern. Most platforms allow daily, monthly, or per-transaction limits to prevent overspending and restrict misuse.

Custom limits help maintain control, ensure policy adherence, and reduce the chance of budget overruns—all while keeping expense tracking streamlined and compliant.

Maintain transaction records

One key step in managing your corporate credit card for expense management is maintaining accurate transaction records. Require employees to upload receipts or invoices for every expense.

Most expense management card platforms support automated receipt capture and storage, making it easier to remain IRS-compliant.

Keeping digital records of purchases allows you to track spending, verify business relevance, and prepare for audits. These practices help ensure tax deductions are valid and protect your business from costly penalties.

Monitor for unauthorized use

Unauthorized transactions can derail your business compliance efforts. Set up alerts and real-time notifications with your expense management card to flag suspicious activity instantly.

A robust corporate credit card for expense management offers dashboard tools for finance teams to review purchases and block or freeze cards when needed.

Monitoring ensures every transaction aligns with policy, preventing fraud or accidental misuse. Regular oversight also keeps your business prepared for financial audits and maintains trust across departments.

Train employees on compliance

Proper training is crucial for maintaining IRS compliance with your corporate credit card for expense management.

Conduct regular sessions to educate employees on approved usage, documentation requirements, and how to report issues. Ensure users understand how to properly use the expense management card platform for submitting receipts and categorizing expenses.

Well-trained staff are less likely to make errors, which reduces non-compliant purchases and audit risks. Consistent training builds a culture of financial accountability and transparency.

What are the potential risks of poor corporate card management for businesses?

Employee spending misuse

Poor control over a corporate credit card for expense management can lead to employee misuse. Without clear limits or monitoring, staff may make non-compliant purchases, harming budgets and raising compliance issues.

An expense management card with real-time tracking helps prevent this by flagging out-of-policy transactions.

Enforcing spending rules and using smart card platforms reduces the risk of unauthorized expenses and ensures accountability across all departments, regardless of company size or transaction volume.

Audit and compliance failures

Inadequate oversight of a corporate credit card for expense management may lead to audit red flags and IRS penalties. Missing receipts, misclassified expenses, or late reports can result in fines or denied tax deductions.

Using an expense management card with automated tracking ensures accuracy and timeliness in reporting.

Ensuring compliance through proper card usage protects your company from legal risks and builds a trustworthy financial system suitable for audits and regulatory checks.

Inefficient manual processes

Relying on spreadsheets and manual tracking for a corporate credit card for expense management drains time and invites errors. These outdated methods complicate reconciliations, increase admin burden, and delay reporting.

An automated expense management card system simplifies the process with real-time syncing, digital receipt capture, and categorization.

Efficient processes not only save time but also improve overall accuracy and transparency, creating a stronger financial foundation and freeing teams to focus on core business functions.

Scaling limitations

As your business grows, poor practices for corporate credit card (for expense management) can hinder scalability. Manual workflows break down with increased transaction volume, leading to confusion and delays.

A smart expense management card platform offers scalable tools—custom limits, user controls, and integrations—that support larger teams and complex structures.

Failing to adapt your expense management system puts operations at risk and limits your ability to grow efficiently while maintaining financial control and compliance.

Why are corporate cards better than alternatives?

No personal expense mixing

Using a corporate credit card for expense management keeps business and personal expenses separate, which is vital for accurate bookkeeping.

Unlike personal cards or cash, an expense management card prevents the mixing of transactions, reducing confusion during audits or tax filing.

Clear separation simplifies accounting, and ensures all business expenses are correctly categorized, helping you maintain clean financial records and avoid compliance issues effortlessly.

Faster expense processing

A corporate credit card for expense management speeds up expense reporting and reimbursement processes.

Unlike manual cash advances or personal cards, an expense management card automates transaction tracking and reporting. Employees don’t have to wait for reimbursements, and finance teams get real-time visibility into spending.

Faster processing reduces administrative workload and improves employee satisfaction, making your expense management more efficient and less prone to errors or delays.

Streamlined audit reporting

Using a corporate credit card for expense management simplifies audit preparation and IRS compliance.

The digital trail from an expense management card includes detailed transaction records and receipt attachments, making tax reporting straightforward. This transparency reduces audit risks and ensures you meet regulatory requirements.

Compared to other payment methods, corporate cards offer organized, automated reporting that supports compliance and helps your business avoid penalties or costly errors.

Stronger budget oversight

Corporate cards when used for expense management, provide superior control over spending compared to alternatives like petty cash or personal cards.

With an expense management card, you can set customized spending limits and monitor expenses in real time. This prevents overspending and keeps departments accountable.

Unlike cash or manual approvals, corporate cards offer automated alerts and clear reports, enabling you to maintain tighter budget control and avoid unexpected costs across your organization.

Why choose Volopay’s prepaid corporate cards for expense management?

Easy card issuance

Volopay’s corporate card for expense management offers effortless card issuance for your team. You can quickly deploy prepaid cards tailored for employee expenses like travel, software, and supplies.

This streamlined process reduces administrative delays and ensures your team has instant access to funds without hassle. Using Volopay’s expense management card means faster, smoother expense handling and better control over corporate spending from day one.

Instant spend tracking

With Volopay’s prepaid cards, you get real-time spend tracking to monitor every transaction instantly. The corporate card for expense management integrates live dashboards that show employee purchases as they happen.

This real-time spend visibility helps you catch irregular spending, manage budgets effectively, and reduce the risk of errors. Instant tracking ensures your expense management card program stays transparent and efficient, improving financial oversight across your business.

Seamless software integration

Volopay’s prepaid corporate cards seamlessly sync with popular accounting software like QuickBooks and Xero. This integration automates expense reconciliation, reducing manual data entry and errors.

Your corporate card for expense management effortlessly connects with your existing finance tools, enabling smooth reporting and bookkeeping. Automated syncing of your expense management card transactions helps maintain accurate financial records and supports compliance with minimal effort.

Enhanced security features

Security is key with Volopay’s prepaid corporate cards. You can set spending limits, freeze cards instantly, and restrict usage by category or merchant type. This level of control prevents misuse and unauthorized charges.

The corporate card for expense management safeguards your business finances while allowing employees the freedom to spend within set boundaries. Enhanced security features help you protect your company’s funds and maintain audit-ready records.

Scalable for growth

Volopay’s prepaid corporate cards grow with your business needs, easily scaling from startups to enterprises with expanding teams. Whether you manage 10 cards or 100, the expense management card system adapts to your changing requirements.

Its flexible platform supports multiple currencies, departments, and spending policies, ensuring your corporate card for expense management evolves alongside your company, providing consistent control and transparency.

Trusted by finance teams at startups to enterprises.

FAQs about corporate credit cards for expense management

Using a corporate credit card for expense management boosts financial control, allowing businesses to efficiently manage employee spending and enhance overall budget oversight without compromising on accuracy or transparency. These cards improve compliance by providing clear audit trails, helping companies meet IRS regulations.

Volopay enhances expense management by offering prepaid corporate cards that provide real-time monitoring of expenses. This feature ensures businesses can track spending instantly, preventing overspending and enabling faster reconciliations. Volopay’s platform also automates reporting and integrates with accounting software, making it easier to manage corporate expenses seamlessly while maintaining control and visibility over all company spending in one centralized system.

Volopay prepaid corporate cards are versatile and cover a wide range of business expenses. These cards simplify expense management by consolidating spending on one platform, ensuring companies control their budgets effectively while providing employees the flexibility to make necessary purchases without using personal funds or dealing with reimbursements.

As an admin, you enjoy complete control over your corporate expense card. You can set up a departmental budget for the card, set the spending limit, restrict spending categories, create customized corporate credit card policies, set the card to a one-time use or recurring (for subscriptions), block and freeze any card in case of dubious activities.

IRS compliance requires storing receipts and documentation for expenses made using corporate credit cards for expense management. Volopay supports this with automatic receipt capture and secure storage, making it easier to maintain records for audits involving around $10,000 or more. These corporate card solutions enhance business expense tracking, ensuring companies meet tax regulations and avoid penalties through clear, accessible audit trails.

Volopay’s corporate card solutions offer customizable spending limits, such as $20,000 caps, to prevent overspending. This budget control feature strengthens business expense tracking by enforcing real-time restrictions aligned with company policies. Employees receive the right spending authority without exceeding budgets, enabling businesses to maintain financial discipline and improve overall expense management efficiency.

Yes, Volopay’s prepaid corporate cards sync automatically with accounting software like QuickBooks and Xero. This integration streamlines reconciliation of up to $30,000 in expenses, reducing manual errors. By connecting corporate cards with accounting platforms, Volopay enhances business expense tracking and ensures accurate financial reporting, simplifying month-end closing and improving expense transparency for businesses.

Volopay’s corporate card solutions protect spending with advanced security controls, including spend limits, instant freezes, and merchant restrictions. Real-time monitoring detects unauthorized charges early, safeguarding company finances. These features enhance business expense tracking by ensuring every transaction complies with policy, minimizing fraud risk, and providing peace of mind for businesses managing their corporate expenses efficiently.