Unlocking the benefits of prepaid cards for businesses

Prepaid cards are becoming a go-to financial tool for modern businesses. These reloadable cards let you streamline your expense management by offering greater control, security, and flexibility.

Businesses can issue prepaid cards to simplify spending, set limits, and track transactions in real time. Unlike traditional credit cards, they don’t require credit checks or bank account tie-ins, making them accessible for businesses of all sizes.

Whether you're managing travel budgets, day-to-day office purchases, or remote team expenses, prepaid cards serve as effective expense management cards that simplify the process. The benefits of prepaid cards go beyond just convenience—they give you the power to track spending in real-time and ensure employees stay within their limits without the risks associated with credit.

What are prepaid cards for businesses?

Prepaid cards for businesses work much like debit cards, except they’re preloaded with a set amount of funds. You can issue them to employees or departments and top them up as needed. This makes prepaid cards ideal for managing everyday expenses like employee travel, petty cash disbursements, client meals, office supplies, and even payroll stipends.

Because prepaid cards don’t rely on credit checks or linked bank accounts, they offer a safer and more inclusive option for startups, small businesses, or companies with remote or contract workers.

Key benefits of prepaid cards for financial management

Prepaid cards let you set clear spending limits for employees, so no one can go over budget. You preload each card with a specific amount, ensuring that every team or department sticks to what’s allocated.

The benefits of prepaid card systems are especially helpful when managing recurring spending categories like travel or supplies.

One of the biggest benefits of prepaid cards is that they operate solely on the funds you load onto them. That means there’s zero chance of accumulating debt or paying interest like you would with credit cards.

You stay in complete control of cash flow while empowering your team to spend responsibly, without affecting your company’s credit.

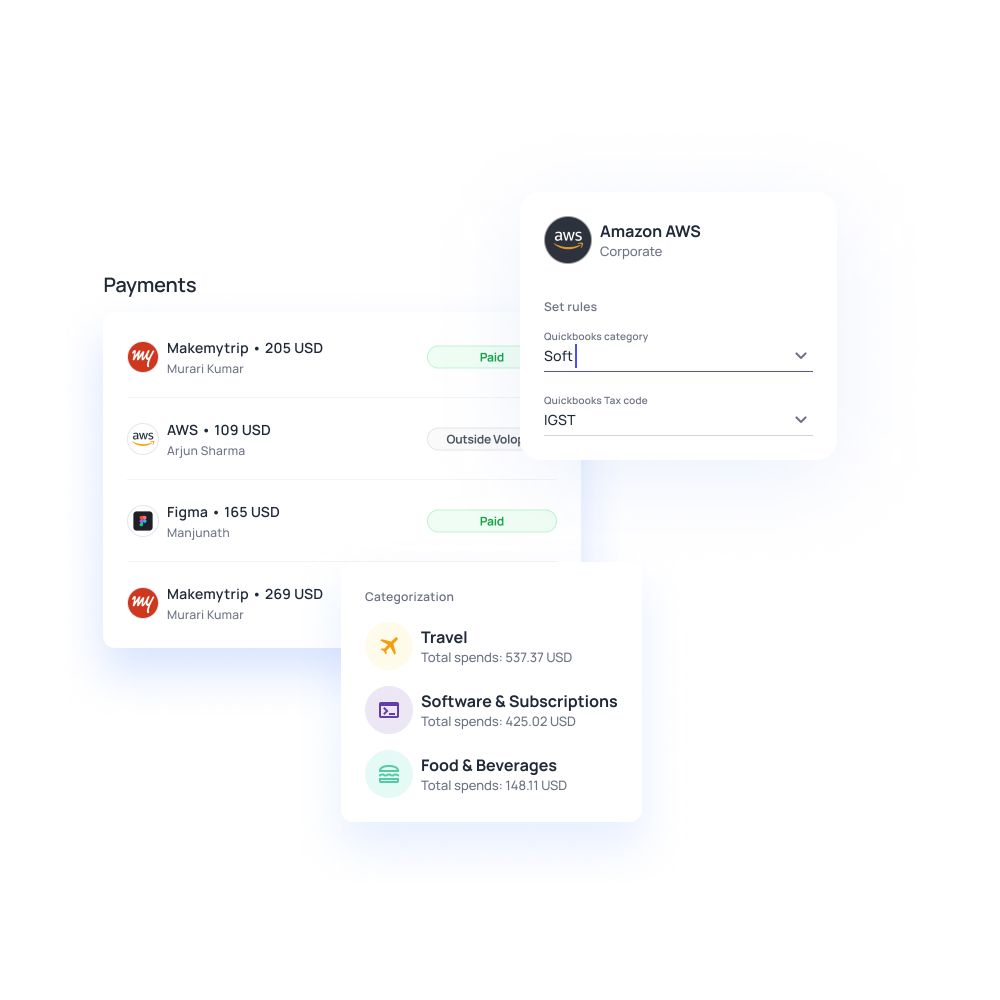

You can track card activity instantly through online dashboards or mobile apps. This gives you immediate visibility into who’s spending what and where, helping you catch anomalies before they become issues.

Among the top benefits of prepaid debit cards is the ability to stay ahead of financial data without waiting for statements or updates.

Say goodbye to endless paperwork and manual reconciliation. Prepaid cards automate the expense management process by consolidating transaction data in one place. This makes it easier for your finance team to categorize expenses and close books faster.

If cutting down on admin hours is your goal, the benefits of prepaid card systems in reducing operational friction are significant.

Prepaid cards offer strong security features like PIN protection, instant freeze, spending limits, and fraud monitoring. Lost or stolen cards can be deactivated instantly, reducing misuse and giving you more control over your available funds and spending habits.

The benefits of prepaid debit cards in fraud prevention make them a safer choice than traditional corporate cards or petty cash.

Benefits of prepaid cards for employee expenses

Managing employee expenses can be one of the most time-consuming parts of business finance. Fortunately, the benefits of prepaid cards extend directly to how your employees spend and report costs. These cards streamline everything from travel spending to petty cash, making life easier for both your staff and your finance team.

Simplified travel expenses

With prepaid cards, you can issue travel funds to employees in advance—no need to give them cash or deal with delayed reimbursements. This ensures smoother business trips, fewer out-of-pocket claims, and more controlled spending.

One of the key benefits of prepaid card solutions for travel is eliminating financial bottlenecks that slow down your operations.

Petty cash replacement

Traditional petty cash is prone to errors, theft, and paperwork headaches. By switching to prepaid cards for petty cash, you can allow small purchases while maintaining tight control. Employees simply swipe the card for approved items, and you retain full oversight.

The benefits of prepaid debit cards in this area are clear: safer, smarter, and more traceable spending.

Employee empowerment

Prepaid cards empower your team by giving them the tools to make essential purchases without going through lengthy approval processes. You control the limits and categories, while they gain the freedom to act quickly when needed.

This balance of autonomy and control is one of the most valuable benefits of prepaid cards in today’s agile work environments.

Fast reimbursements

Forget paper receipts and reimbursement delays. When employees need funds, you can instantly load prepaid cards with the exact amount required. It saves time and boosts employee satisfaction.

This speed and flexibility are among the top benefits of prepaid card programs, especially for businesses managing remote or field-based teams.

Reduced expense fraud

By setting predefined limits and usage restrictions, you dramatically lower the risk of fraudulent or unauthorized purchases. Each transaction is recorded in real time, and cards can be locked or frozen at any moment.

This makes fraud prevention one of the strongest benefits of prepaid debit cards for companies that prioritize security.

If you're ready to take advantage of these benefits for your own organization, don’t miss our in-depth guide on the best prepaid business cards in the US —featuring top picks, key features, and expert tips to help you choose the right solution for smarter employee expense management.

Benefits of prepaid cards for small businesses

Prepaid cards don’t require a credit history, minimum revenue, or a lengthy application process. You can access cards quickly and begin using them right away. This makes them ideal for startups or small businesses without established credit.

One of the most important benefits of prepaid card solutions is how easily they open financial access to younger or underserved companies.

Unlike credit or business bank cards, prepaid cards come with lower fees and fewer hidden costs. There are no interest charges, late fees, or annual fees to worry about. For budget-conscious owners, this makes prepaid cards a smarter, more affordable choice.

The benefits of prepaid debit cards here lie in eliminating the financial burden that often comes with traditional business banking.

Your business may be small today, but it won’t stay that way forever. Prepaid cards let you adjust budgets as you grow—no need to apply for higher limits or new cards. This flexibility supports business scaling while keeping spending under control.

One of the long-term benefits of prepaid cards is how well they adapt to your company’s changing needs.

Many prepaid card platforms integrate with tools like QuickBooks, making it easy to automate accounting tasks. Transactions are categorized and synced in real time, so you save hours on manual data entry and reconciliation.

If your goal is smoother financial reporting, this is one of the strongest benefits of prepaid card adoption for small businesses.

Simplify vendor payments with prepaid cards. Load the funds and instantly pay suppliers, freelancers, or one-time vendors without needing checks or bank transfers. This is useful if you’re working with vendors who don’t accept traditional payment methods.

Among the top benefits of prepaid debit cards is the ability to handle diverse payment needs without hassle.

Benefits of prepaid cards for compliance and security

Managing business finances isn't just about efficiency—it's also about staying compliant and protecting sensitive data. Prepaid cards offer built-in tools to help you meet regulatory requirements and reduce fraud risks.

Whether you're preparing for an audit or safeguarding against misuse, the benefits of prepaid cards in this area are crucial for keeping your operations clean and secure.

Audit-ready records

Prepaid card platforms automatically log every transaction, giving you a clear, time-stamped trail of spending activity. These records make it easy to demonstrate compliance with IRS regulations and internal financial policies.

One of the most practical benefits of prepaid card usage is having audit-ready documentation without extra effort from your team.

Policy enforcement

You can define and enforce spending policies directly within prepaid card systems—set limits by category, restrict merchant types, or assign card permissions by department. This ensures every dollar aligns with your budget strategy.

Among the benefits of prepaid debit cards, this level of control ensures your business stays aligned with internal financial policies.

PCI DSS compliance

Leading prepaid card providers follow PCI DSS standards to protect cardholder data with end-to-end encryption and secure storage. This shields your financial information from breaches and meets strict industry security requirements.

If you're concerned about data protection, the benefits of prepaid cards in achieving compliance with these protocols are invaluable.

Fraud mitigation tools

Worried about lost cards or misuse? You can freeze or deactivate prepaid cards instantly, preventing any unauthorized access. Many platforms also include suspicious activity alerts and location-based restrictions.

These proactive fraud controls are among the strongest benefits of prepaid card programs designed for high-security needs.

Transparent reporting

Accessing detailed reports is simple with prepaid card dashboards. You get real-time visibility into every card’s activity, which is categorized and searchable for faster audits and internal reviews.

The benefits of prepaid debit cards extend here into complete financial transparency, making compliance reviews easier and more accurate.

Streamline business spending with prepaid cards that work

Prepaid cards vs other payment methods

When choosing how your business handles spending, it's important to weigh the options. Prepaid cards stand out for their control, security, and simplicity. Let’s compare the benefits of prepaid cards with more traditional payment methods like credit cards, debit cards, and cash.

Prepaid vs credit cards

Unlike credit cards, prepaid cards carry no risk of debt. You’re not borrowing—you’re spending funds you’ve already loaded. That means no interest charges, no late fees, and no impact on your credit score.

The benefits of prepaid card usage here include total financial control without the stress of repayment or credit liabilities

Prepaid vs debit cards

While both allow spending from existing funds, prepaid cards don’t require a linked bank account. This offers more flexibility, especially for businesses that want to limit exposure or segment budgets.

One of the distinct benefits of prepaid debit cards is the ability to manage company spending independently of your business’s primary bank account.

Prepaid vs cash

Prepaid cards offer security and traceability that cash simply can’t. You can monitor each transaction in real time, freeze cards if lost, and prevent unauthorized purchases.

Compared to theft-prone and untraceable cash handling, the benefits of prepaid cards for transparency and control are unmatched.

Cost efficiency

Prepaid cards typically come with fewer fees than credit cards or business bank accounts. There are no interest charges, overdraft fees, or hefty maintenance costs.

For budget-conscious companies, this is one of the most valuable benefits of prepaid card solutions—keeping more money in your business.

Control and flexibility

With prepaid cards, you can set spending limits, restrict merchant categories, and issue cards by department or employee. Unlike rigid traditional methods, this gives you total control over how and where money is used.

The benefits of prepaid debit cards shine when you need adaptable tools to support your growing, dynamic operations.

Common use cases for prepaid cards in businesses

Prepaid cards aren’t just versatile—they’re practical across many areas of your business. Whether you're managing travel, payroll, or vendor payments, the benefits of prepaid cards become clear when applied to everyday operational needs.

Here are some common ways you can use them effectively:

Payroll for unbanked employees

If you have workers without bank accounts—such as temporary staff or gig workers—you can still pay them efficiently using prepaid cards. Load their wages directly onto cards for secure and timely payments.

This is one of the lesser-known but highly valuable benefits of prepaid debit cards, especially for industries with flexible or short-term staffing needs.

Employee travel

Business trips often involve unpredictable expenses. With prepaid cards, you can fund travel in advance while setting clear spending limits. Employees can pay for flights, hotels, and meals without dipping into personal funds.

One of the major benefits of prepaid card use in travel is reducing the need for reimbursements and keeping costs under control.

Payroll for unbanked employees

If you have workers without bank accounts—such as temporary staff or gig workers—you can still pay them efficiently using prepaid cards. Load their wages directly onto cards for secure and timely payments.

This is one of the lesser-known but highly valuable benefits of prepaid debit cards, especially for industries with flexible or short-term staffing needs.

Marketing and event expenses

From promotional merchandise to event space rentals, marketing budgets can spiral if not tightly managed. Prepaid cards let you assign fixed amounts to teams or campaigns, so spending stays within budget.

Among the benefits of prepaid cards is the ability to enforce financial discipline in departments that typically deal with high variable costs.

Contractor payments

Working with freelancers or independent contractors? Prepaid cards allow you to pay them quickly without needing to collect sensitive banking info. Just load the card and hand it off—it’s simple, secure, and avoids delays.

The benefits of prepaid card systems here include faster payments and easier expense tracking.

Emergency expenses

Sometimes, unplanned costs arise—equipment failures, last-minute purchases, or urgent repairs. Prepaid cards let you fund these needs immediately without pulling from your main accounts or issuing reimbursements.

The benefits of prepaid debit cards in emergency scenarios lie in the speed, flexibility, and security they provide when time is of the essence.

Challenges of using prepaid cards and solutions

While the benefits of prepaid cards are extensive, it’s important to be aware of challenges. Fortunately, each can be addressed with the right tools and planning. Here’s how you can overcome common obstacles and still enjoy the full benefits of prepaid card programs.

Limited acceptance

Some prepaid cards may not be accepted everywhere. To ensure broad usability, choose cards backed by major networks like Visa or Mastercard.

These are widely accepted by vendors, both online and offline, allowing your team to make purchases without restrictions. This enhances the benefits of prepaid debit cards in real use.

Reload fees

Certain providers charge fees every time you reload a card, which can add up. Look for prepaid card platforms that offer free or low-cost reloading options.

Many business-focused services bundle reloading into their pricing plans, helping you maximize the benefits of prepaid cards without extra financial strain.

Employee training

Not all employees are familiar with how prepaid cards work. Providing a short training on responsible prepaid card usage can eliminate confusion and misuse.

Clear instructions help ensure your team uses the cards properly and understands the spending rules, reinforcing the benefits of prepaid card usage across departments.

Integration complexity

Integrating prepaid card data with accounting or ERP systems can be tricky without the right tools. Choose a platform that offers native integrations with QuickBooks, Xero, or NetSuite

This way, you maintain the key benefits of prepaid debit cards while keeping financial data in sync.

Card management

Managing multiple cards manually can become time-consuming. Use a centralized software dashboard to automate tracking, control limits, and monitor spending in real-time.

Such automation powers business growth and keeps the benefits of prepaid cards consistent as you scale up.

Smarter spending starts here — use prepaid cards the right way

Best practices for maximizing prepaid card benefits

To get the most out of your prepaid card program, it’s important to go beyond just issuing the cards. By following a few smart strategies, you can fully unlock the benefits of prepaid cards and make them a seamless part of your financial workflow.

Set clear policies

Establish clear guidelines on how prepaid cards should be used. Define what types of purchases are allowed, set spending limits, and outline consequences for misuse.

This clarity ensures employees stay compliant and supports the long-term benefits of prepaid card use across your organization.

Monitor transactions

Keep a regular eye on card activity—weekly reviews can help catch anomalies early and provide insights into spending patterns.

This ongoing oversight helps you maintain control while reinforcing the accountability that’s central to the benefits of prepaid debit cards.

Automate reloads

Avoid funding delays by scheduling automatic reloads based on spending patterns or project timelines. This ensures employees always have access to what they need, without manual intervention.

Automation helps you enjoy the benefits of prepaid cards without administrative headaches.

Integrate with accounting

Sync prepaid card data directly into your accounting software, such as Xero, QuickBooks, or NetSuite. This reduces errors, speeds up reconciliation, and supports cleaner financial reporting—key advantages when maximizing the benefits of prepaid card systems.

Educate employees

Make sure your staff understands how to use their prepaid cards properly. Short training sessions or onboarding documents can go a long way toward preventing misuse and promoting efficient spending.

Empowering your team with knowledge enhances the benefits of prepaid debit cards throughout your organization.

Unlock prepaid card benefits with Volopay

To experience the full benefits of prepaid cards, Volopay offers an all-in-one solution designed for modern businesses. With customizable spending limits, real-time transaction tracking, and advanced fraud protection, you stay in total control of your finances. Volopay’s prepaid cards integrate seamlessly with QuickBooks, Xero, and NetSuite, making expense reporting and reconciliation effortless.

Whether you're managing employee spending, paying vendors, or streamlining approvals, Volopay helps you unlock the true benefits of prepaid card programs—efficiency, security, and scalability all in one platform.

Manage your business expenses in one place with Volopay

FAQ's

Prepaid cards offer budget control, spending transparency, and security—without the risk of debt. You preload funds, so there’s no borrowing involved. One of the core benefits of prepaid card use is the ability to manage finances proactively and responsibly.

Yes, they’re ideal for small businesses thanks to low fees, no interest charges, and no credit check requirements. These cost savings are among the key benefits of prepaid debit cards for startups and lean operations.

They provide audit trails, enforce spending policies, and offer real-time tracking—all of which make it easier to stay compliant with tax laws and internal controls. These features highlight the benefits of prepaid cards for regulatory adherence.

Absolutely. Prepaid cards are trackable, reloadable, and more secure than cash. They prevent theft and misuse while offering the flexibility to spend as needed—some of the most practical benefits of prepaid card adoption.

Prepaid cards come with encryption, PIN protection, and instant lock features. These fraud prevention tools ensure that your funds and data stay safe, making security one of the top benefits of prepaid debit cards for any business.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now