7 benefits of virtual cards for your business growth

Managing business expenses and payments can be a complex challenge for companies of all sizes. Virtual cards are emerging as a powerful solution that's transforming how businesses handle their financial transactions.

In this guide, you'll discover the key benefits virtual cards offer for business payments, from enhanced security and control to streamlined expense management. Understanding these advantages can help you make informed decisions about modernizing your company's payment processes.

What is a virtual card?

A virtual card is a secure, digital payment solution that gives businesses instant control over expenses. Issued online with customizable limits, they eliminate the risks of physical cards while simplifying budget management, employee reimbursements, and vendor payments.

With real-time tracking and enhanced fraud protection, corporate virtual cards streamline financial operations, reduce costs, and empower teams to spend responsibly. For modern businesses, they offer a smarter, more efficient alternative to traditional corporate cards.

What are the benefits of virtual cards for your business?

Virtual cards are revolutionizing how businesses manage expenses and payments. These digital payment solutions offer unprecedented control, security, and efficiency compared to traditional corporate credit cards.

By eliminating physical cards and providing instant digital alternatives, virtual cards streamline your financial operations while reducing costs and administrative burden for modern businesses.

Enhanced spend control

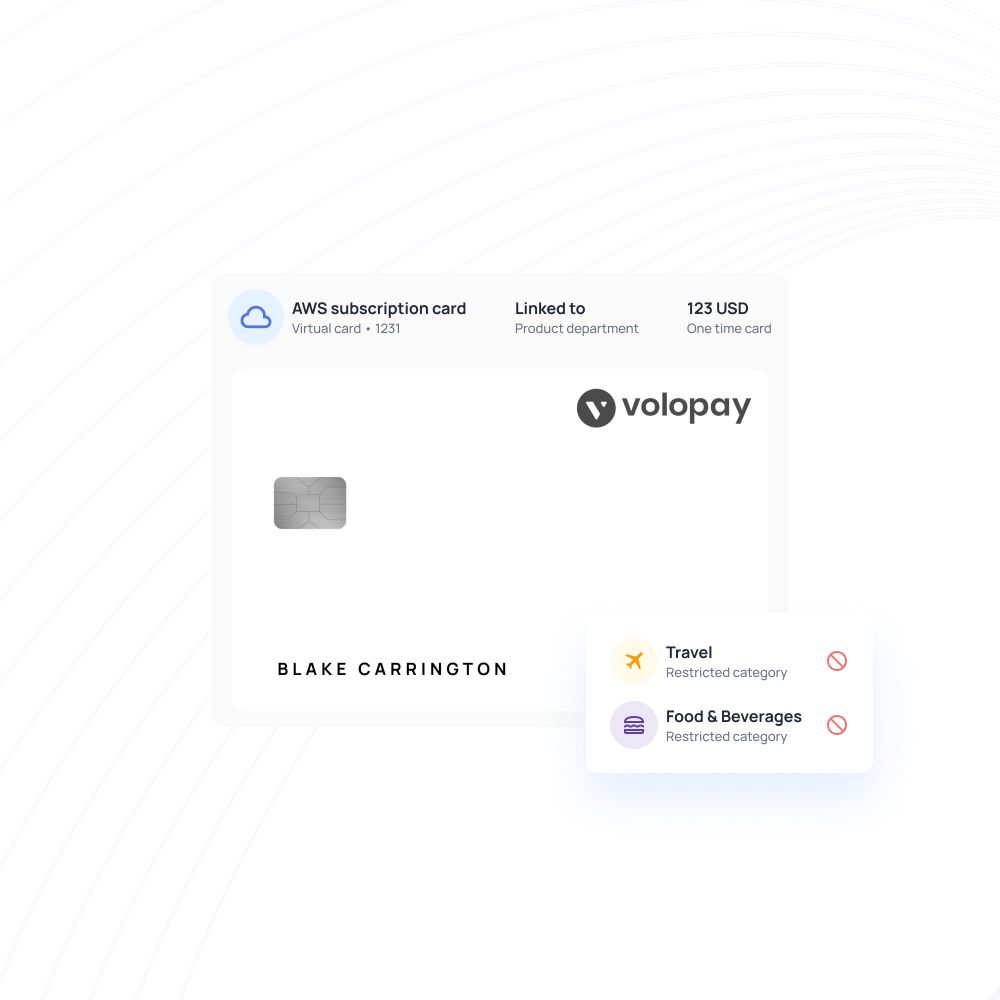

Virtual card benefits for businesses include precise spending limits and real-time controls that traditional cards can't match. You can set specific spending amounts, merchant restrictions, and expiration dates for each virtual card issued.

This granular control prevents unauthorized purchases, reduces overspending, and ensures employees only spend within approved parameters, giving you complete oversight of every transaction.

Improved expense visibility

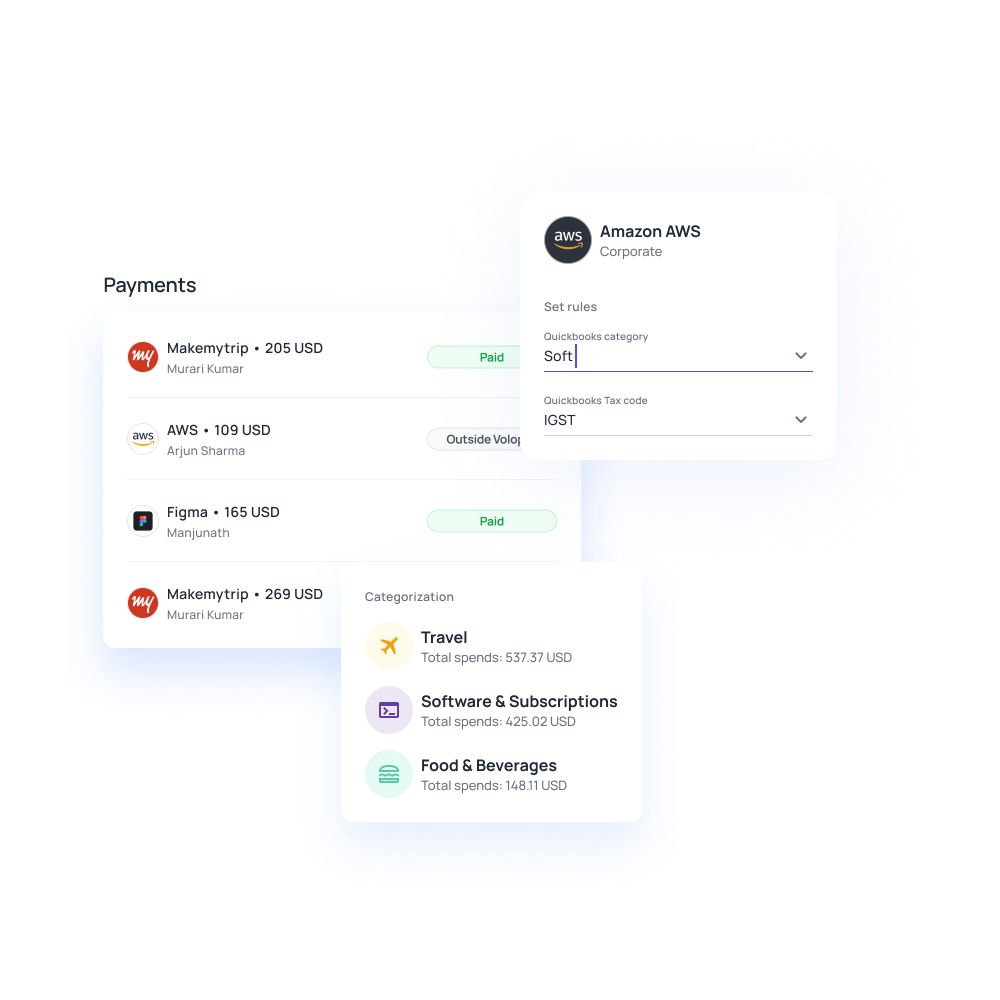

Virtual cards provide instant transaction notifications and detailed spending analytics that transform your expense tracking capabilities. Whether it’s marketing expense management using virtual cards or tracking day-to-day operational costs, you can monitor purchases in real-time, categorize expenses automatically, and generate comprehensive reports with just a few clicks.

This enhanced visibility eliminates guesswork from budget management and enables data-driven financial decisions that optimize your company's spending patterns effectively.

Increased security

Virtual cards offer superior security through unique card numbers for each transaction or vendor, eliminating single points of failure. If a virtual card is compromised, you can instantly freeze or delete it without affecting other payment methods.

This isolation prevents widespread security breaches and reduces fraud risk significantly compared to traditional cards that expose your entire account.

Instant issuance & scalability

You can generate virtual cards instantly without waiting for physical card delivery or bank approval processes. This immediate issuance capability scales effortlessly with your business growth, allowing you to provide payment access to new employees or projects within minutes. Whether you need one card or hundreds, virtual cards adapt to your changing business requirements seamlessly.

Easier subscription management

Virtual cards simplify recurring payment management by allowing you to assign dedicated cards to specific subscriptions or services. You can easily track subscription costs, prevent unwanted renewals by setting expiration dates, and maintain better control over recurring expenses. This dedicated approach eliminates confusion and ensures you only pay for services your business uses and values.

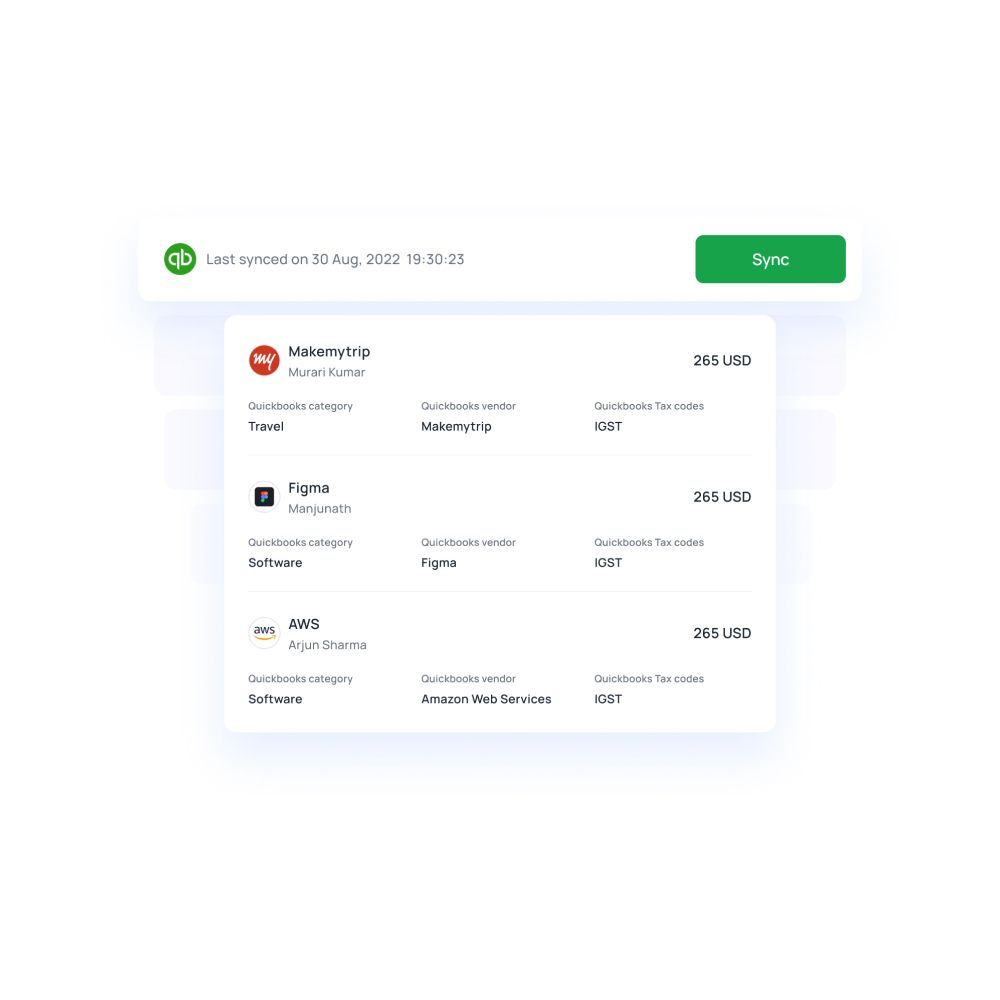

Faster reconciliation

Virtual cards streamline your accounting processes by automatically matching transactions with purchase orders and receipts. Each virtual card can be tagged with specific project codes, departments, or cost centers, making expense allocation effortless.

Virtual cards improve employee satisfaction by simplifying payment workflows, reducing reimbursement delays, and offering a smoother spending experience. This automated reconciliation reduces manual data entry, minimizes errors, and significantly speeds up your month-end closing processes for improved financial efficiency.

No reimbursements needed

Virtual cards eliminate employee expense reimbursements by providing direct payment capabilities for business purchases. Employees can make authorized purchases without using personal funds, removing the administrative burden of processing expense reports and reimbursement requests.

This direct payment approach improves employee satisfaction while reducing accounts payable workload and accelerating your overall expense management workflow.

How virtual cards empower every team in your business

Transform your vendor payment process with virtual cards that generate unique numbers for each transaction.

You'll eliminate check processing delays, reduce manual data entry, and gain real-time visibility into all payments.

The benefits of virtual card payments to the accounts payable team include automated reconciliation that matches transactions instantly.

Streamline employee-related expenses by issuing virtual cards for recruitment costs, training programs, and company perks.

You can set spending limits for each new hire's equipment purchases and manage remote work stipends seamlessly.

This approach eliminates reimbursement delays, improves employee satisfaction, and provides complete transparency into your human resources budget allocation.

Take control of your marketing investments with dedicated virtual cards for each campaign or platform.

You'll prevent overspending by setting precise limits for Google Ads, Facebook campaigns, and influencer partnerships.

Real-time notifications alert you when budgets approach limits, while detailed analytics help you track ROI across all marketing channels and optimize future spending decisions.

Empower your sales representatives with virtual cards designed for travel and client entertainment expenses.

You can establish individual spending limits, categorize expenses automatically, and monitor real-time usage across your entire sales organization.

This eliminates the need for personal credit card advances, speeds up expense reporting, and ensures compliance with your company's travel policies.

Secure your software subscriptions and digital services with virtual cards that offer enhanced fraud protection.

You'll gain complete visibility into recurring payments, prevent unauthorized charges, and easily cancel subscriptions by deactivating specific card numbers.

Virtual card business benefits include simplified vendor management, automated expense categorization, and reduced security risks from data breaches.

Optimize your operational spending with virtual cards that automate recurring payments for utilities and supplier invoices.

You can schedule automatic payments, set monthly spending thresholds, and receive detailed reports on all key operational costs for better decision-making.

This approach reduces late payment fees, improves vendor relationships, and provides valuable insights into spending patterns that help you negotiate better terms.

How virtual cards make spending easier for employees

Virtual payment solutions are transforming how you handle business expenses. The benefits of virtual cards for business payments extend far beyond traditional corporate cards, offering you unprecedented control, security, and convenience.

These digital tools streamline your spending process while providing your company with enhanced oversight and financial management capabilities.

Instant access to pre-approved company funds

You no longer need to wait for physical card delivery or approval delays. Virtual cards provide immediate access to pre-allocated budgets, allowing you to make necessary purchases the moment they're approved.

This instant availability means you can respond quickly to urgent business needs, whether it's booking last-minute travel, purchasing essential supplies, or securing time-sensitive vendor services without bureaucratic delays.

Eliminate out-of-pocket reimbursements

Say goodbye to fronting your own money for business expenses. Virtual cards ensure you never have to use personal funds and wait weeks for reimbursement. This eliminates the cash flow burden on your finances and removes the administrative hassle of submitting receipts and expense reports.

You can make authorized purchases directly through company accounts, maintaining a clear separation between personal and business spending.

Track expenses in real time via mobile app

You gain instant visibility into your spending through intuitive mobile applications. Every transaction appears immediately in your expense tracking dashboard, allowing you to monitor budgets, categorize purchases, and maintain accurate records on the go.

This real-time tracking helps you stay within allocated limits while providing automatic documentation for accounting purposes, making expense management effortless and transparent.

Use virtual cards for secure online purchases

Your online business purchases become significantly more secure with virtual cards. Each card generates unique numbers for every transaction, protecting your company's financial information from data breaches and fraud.

Among the key benefits of virtual cards for HR teams is the ability to manage employee-specific spending securely, ensuring that compromised card details won't affect other accounts. You can shop confidently on various platforms knowing that this enhanced security gives you peace of mind when making digital purchases for business needs.

Reduce delays with instant card issuance

You can obtain new payment credentials within minutes rather than days. Virtual cards eliminate shipping delays and lost mail issues associated with physical cards.

When you need additional payment methods for specific projects or vendors, new virtual cards are generated instantly through your company's platform. This rapid issuance ensures business operations never stall due to payment method availability.

Better transparency around budgets and limits

You always know exactly how much you're authorized to spend and on what categories. Virtual cards provide clear spending limits and restrictions that are visible in real-time through your management interface.

This transparency helps you make informed purchasing decisions while staying compliant with company policies. You can see remaining budgets, approved vendors, and spending categories before making any transaction.

Empower remote and on-the-go teams

Your location never limits your ability to make necessary business purchases. Virtual cards work seamlessly across different time zones and geographical locations, enabling you to handle expenses whether working from home, traveling, or operating in field locations.

This flexibility ensures remote team members have equal access to company resources and can maintain productivity regardless of their physical location.

Why choose Volopay's virtual cards for your business

When you're looking to modernize your business payments, Volopay's virtual cards deliver comprehensive financial control that transforms how you manage expenses.

The benefits of virtual cards extend far beyond simple transactions. They provide complete visibility, security, and automation that traditional payment methods simply cannot match for growing businesses.

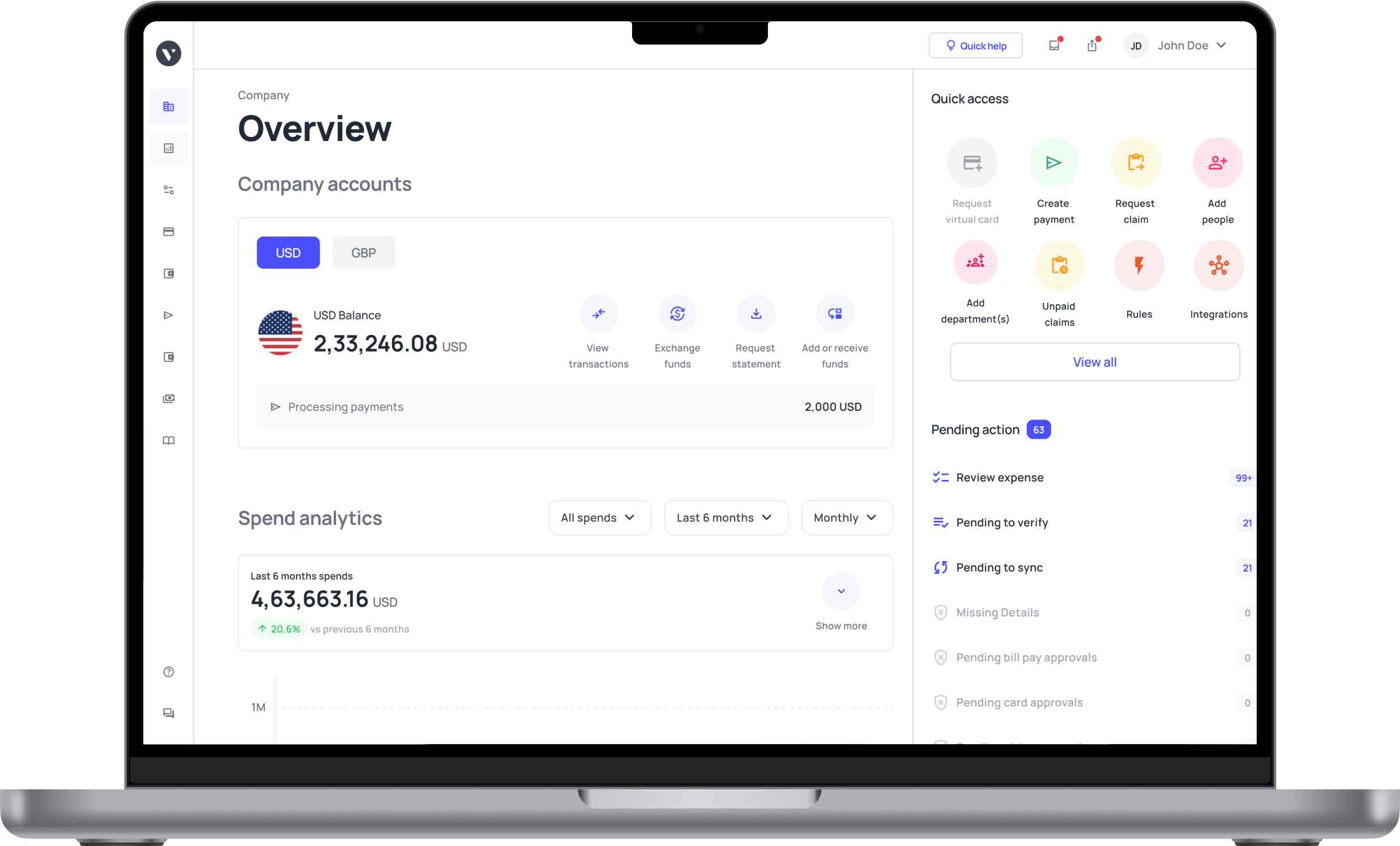

All-in-one spend platform

Your business deserves a unified payment solution that eliminates the complexity of managing multiple financial tools.

Volopay’s corporate cards integrate seamlessly with expense management, accounting, and approval workflows to create a centralized hub for all your spending activities.

This comprehensive approach reduces administrative overhead while providing complete financial visibility across your entire organization.

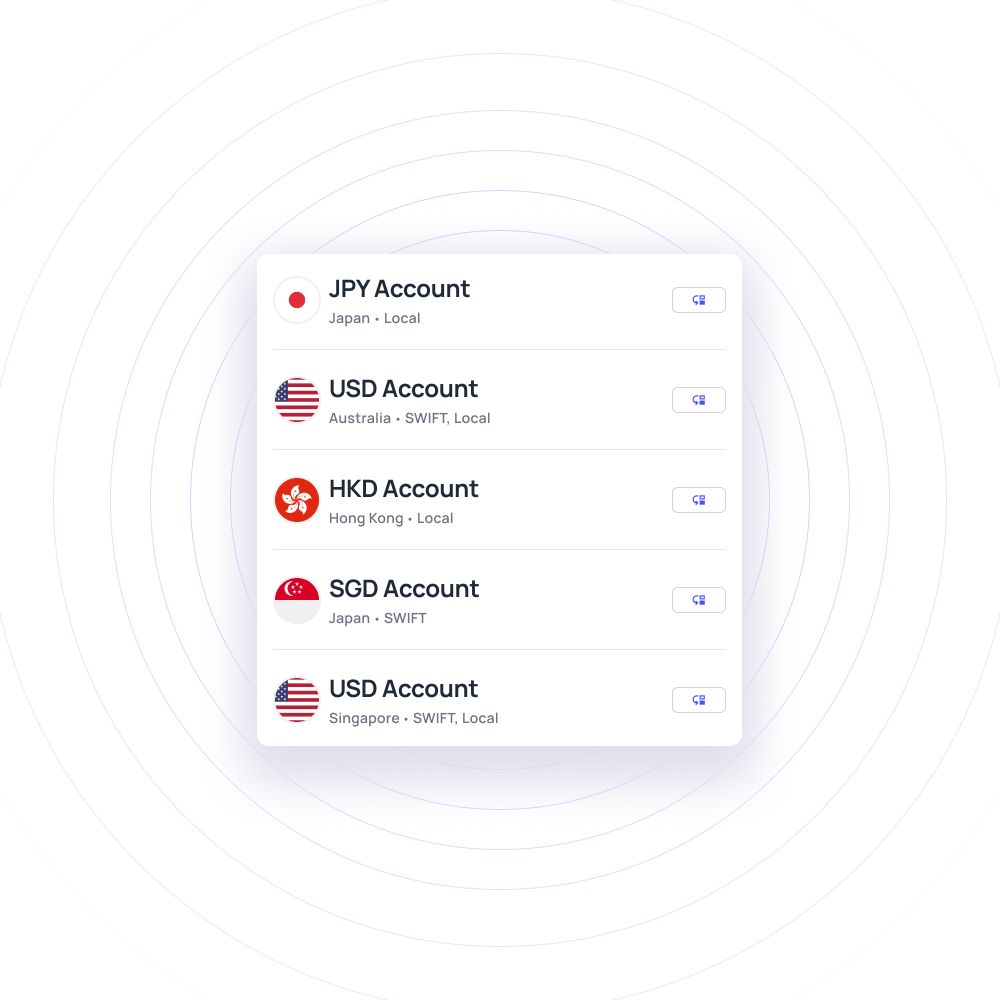

Multi-currency support for global teams

Expand your business globally without worrying about currency conversion hassles or international payment restrictions.

Volopay's virtual cards support multiple currencies, enabling your teams to make payments in local currencies while you maintain centralized control and real-time visibility.

This global capability eliminates foreign exchange complications and reduces transaction costs for international operations.

Instant issuance with unlimited cards

Generate virtual cards instantly whenever your team needs them, without waiting for physical card delivery or bank approvals.

Create unlimited cards for different departments, projects, or employees, each with specific spending parameters.

This flexibility ensures your business operations never slow down due to payment limitations, while maintaining strict financial control and accountability.

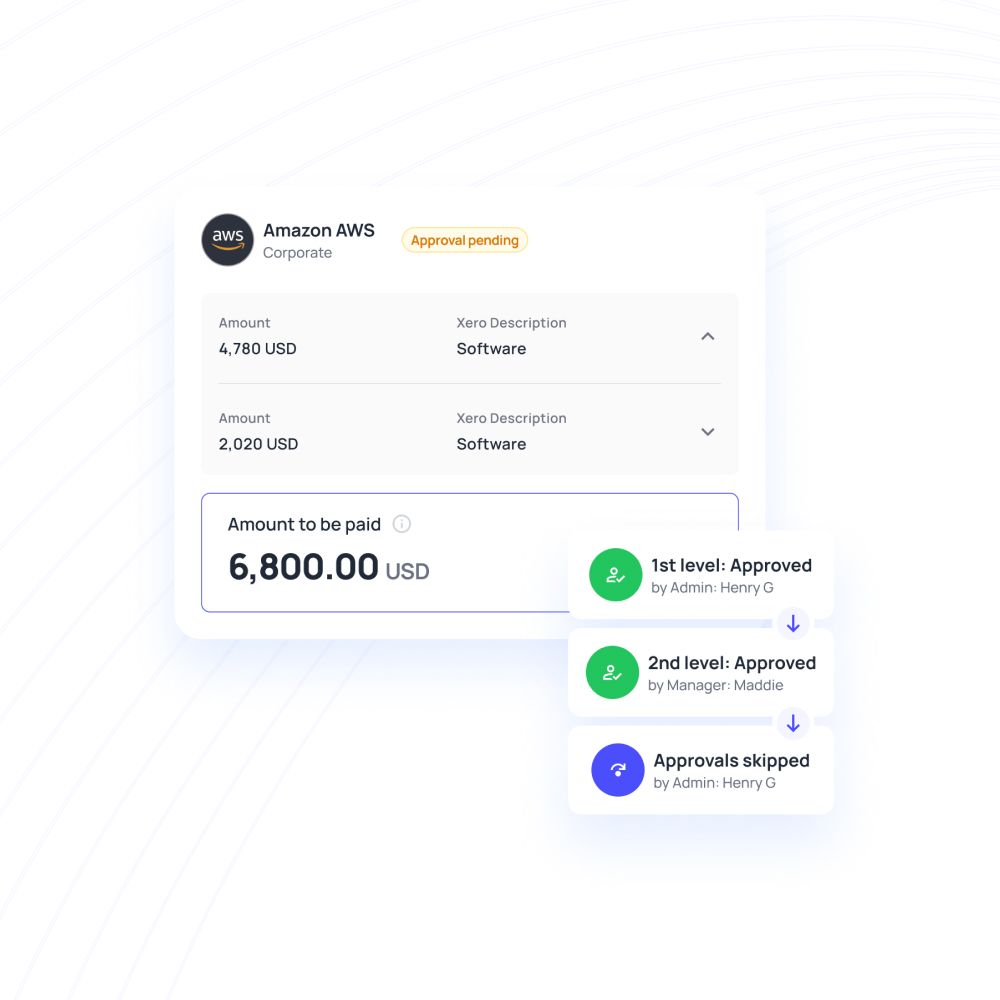

Custom limits and multi-level approvals

Set precise spending limits for each virtual card based on employee roles, project budgets, or department allocations.

Implement multi-level approval workflows that automatically route high-value transactions through appropriate managers before processing.

This granular control prevents overspending while ensuring legitimate business expenses are approved quickly without bureaucratic delays that hinder productivity.

Real-time tracking & automated reporting

Monitor every transaction as it happens with real-time spending alerts and detailed transaction data.

Automated expense categorization and reporting eliminate manual data entry while providing instant insights into spending patterns.

This transparency enables proactive financial management and simplifies monthly reconciliation processes, saving your finance team countless hours of administrative work.

Vendor & subscription controls

Assign dedicated virtual cards to specific vendors or recurring subscriptions, making it easy to track spending by supplier and prevent unauthorized charges. Set expiration dates and spending limits for vendor relationships, ensuring contracts stay within budget.

This targeted approach provides clear audit trails for vendor payments while protecting against subscription creep and unwanted charges.

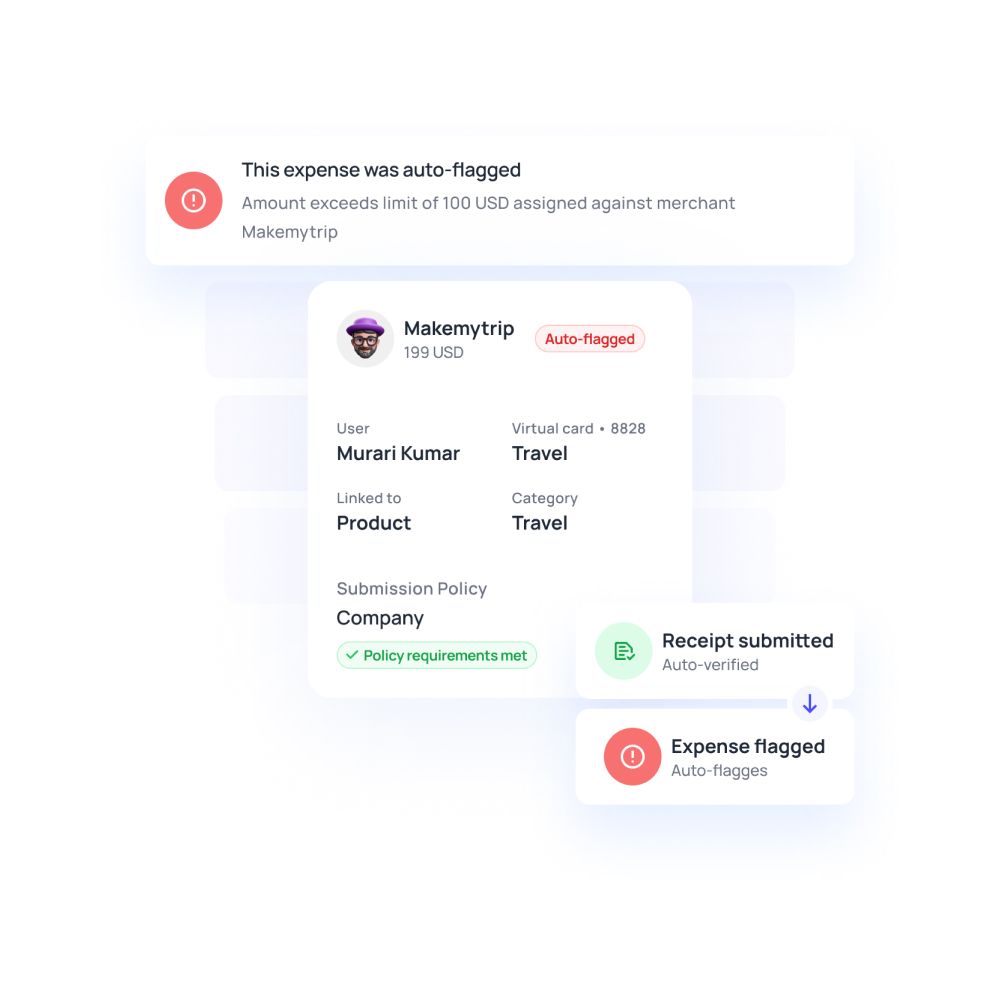

Advanced security & fraud prevention

Protect your business with enterprise-grade security features, including real-time transaction monitoring, instant card blocking, and merchant category restrictions.

Each virtual card operates independently, so compromised cards won't affect your entire payment system.

Advanced fraud detection algorithms identify suspicious activities immediately, while customizable security settings ensure payments align with your business policies and risk tolerance.

Why Volopay's virtual cards work for businesses of all sizes in the US

Scalable solution for startups and enterprises

Whether you need one card or a thousand, Volopay's platform grows seamlessly with your expanding team. Start small with basic virtual cards for your startup's essential purchases, then scale effortlessly as you hire more employees and departments.

The benefits of virtual cards multiply as your business grows, maintaining simplicity without compromising essential features and overall functionality.

Cost control for small teams, clarity for large ones

You get the perfect balance of employee empowerment and financial oversight. Small teams enjoy streamlined purchasing while finance maintains complete visibility into every transaction.

Large organizations benefit from detailed reporting across departments, ensuring your employees have the access they need while keeping spending transparent and controllable at every level.

Custom workflows to match your business structure

Your approval processes should reflect how your team works. Configure flexible policies that suit flat startup structures or complex enterprise hierarchies.

Set up automated workflows that route requests through the right channels, ensuring compliance while maintaining the speed your business needs to stay competitive and agile.

Budgeting that fits any business stage

From bootstrapped startups watching every dollar to enterprises managing complex departmental budgets, Volopay adapts to your financial reality. Set precise spending limits, allocate funds across teams, and track expenses in real-time.

Whether you're managing tight cash flow or coordinating multi-million dollar budgets, you maintain complete control over your finances.

Related pages

Unlock the benefits of virtual cards for eCommerce businesses, from stronger security and smarter budgeting to faster, hassle-free transactions.

Learn how virtual card payments enhance business travel spending with better expense tracking, and simplified transaction management.

Discover how virtual cards streamline B2B payments, offering enhanced security, precise control, and simplified reconciliation for your transactions.

Simplify your expense processes with Volopay’s corporate virtual cards

FAQ's

The only difference between a physical and a virtual card is that the formal one has a physical appearance, but the latter doesn’t. You can create virtual cards online from your card provider’s platform. It looks exactly like a physical card with a card number, name, and other details. They can be used while making online purchases and payments.

A virtual credit card work very similar to regular credit cards. The only difference is that the former exists in electronic forms. It can be created online through your card provider platform. Each card will have its own card number and CVV. Using that, you can schedule or make online payments.

Virtual cards can be created for each expense category. Expense management can’t get easier than this for businesses with numerous ranges of expenses. All the expenses can be tracked within the same platform. As cards are linked with departmental budgets, monitoring departmental spending is feasible. Without importing expenses to a sheet or making graphs, you can see how much each department is spending.

Virtual cards are extremely safe to use for business purposes. Each virtual card acts independently and is not related to other cards created together. If a card's details are exposed, it can be safely expelled from the system without affecting other cards. As it’s possible to track centrally, no employee can use them for unauthorized purposes.

Volopay offers unlimited virtual cards that you can create, use, and distribute. No matter how many cards you have, you can manage them from the same dashboard. You can tag each card to a budget and department for clear tracking purposes.