What is a payroll card? Types, benefits & best practices

If you’re looking for a faster, more convenient way to pay your employees, payroll cards might be the solution. These cards work like prepaid debit cards and allow you to load wages directly onto them, eliminating the need for paper checks or bank transfers.

Many businesses are switching to employee payroll cards as a practical alternative to traditional payroll methods, especially when dealing with unbanked employees. Whether you're managing a small startup or scaling up, business payroll cards can simplify payment processing and reduce administrative overhead.

In this guide, you’ll learn how payroll cards for employees work, why they’re growing in popularity, and how they can streamline your payroll system.

What is a payroll card?

A payroll card is a prepaid card issued by an employer to distribute wages or salaries to employees electronically. Instead of receiving a paper check or direct deposit into a bank account, your employees receive their pay directly onto this reloadable card.

It functions much like a debit card, you can use it to withdraw cash at ATMs, make purchases, and even pay bills online. Employee payroll cards are particularly useful for workers who don’t have access to a traditional bank account.

For employers, payroll cards for employees offer a secure, paperless way to manage payroll, while reducing costs and increasing efficiency across the board.

How do payroll cards work?

Payroll cards function as reloadable prepaid cards that receive your employees’ wages every pay cycle. Once wages are loaded, employees can use their payroll cards for employees just like a debit card, to withdraw cash, pay bills, or make purchases. They offer a seamless alternative to traditional payroll systems, especially for unbanked workers.

1. Issue payroll card

As an employer, your first step is to partner with a provider that offers business payroll cards. Once set up, you’ll issue each employee their own card.

This physical card works like a bank debit card and is personalized for each staff member. Many providers offer instant card issuance, allowing you to distribute pay cards for employees quickly and efficiently.

2. Enroll employees in the system

To activate the card, you’ll need to enroll each team member in the payroll card system. You collect basic information such as name, employee ID, and Social Security number. Some providers also offer mobile portals where employees can self-enroll.

Once enrolled, the employee payroll card becomes part of your regular payroll process, ensuring everyone is ready to receive their wages electronically.

3. Load employee wages

Each payday, you’ll transfer employee wages onto their payroll cards via direct deposit. This process is typically managed through your payroll provider’s dashboard. You can automate this step, just like a standard bank transfer.

Using pay cards for employees helps eliminate check printing costs and ensures timely wage disbursement—even if an employee doesn’t have a traditional bank account.

4. Access available funds

Once wages are loaded, employees can access their funds immediately. Payroll cards for employees allow ATM withdrawals, in-store purchases, and bill payments, just like a regular debit card.

There’s no waiting period or need to visit a bank. It’s a flexible, convenient way for your team to manage their money, especially for employees who prefer cash or digital transactions.

5. Track card usage

Employees can easily track their payroll card activity through mobile apps or online dashboards provided by the card issuer. This lets them monitor spending, check balances, and set alerts for transactions.

As an employer, you can also access reporting tools to monitor disbursements. Employee payroll cards add transparency and real-time insights to your payroll and financial tracking process.

6. Reload on payday

Every payday, you reload funds onto your employees’ payroll cards. This can be done automatically through your payroll software or card provider. The process is secure and seamless—ensuring employees always get paid on time.

With business payroll cards, you reduce processing time and eliminate the risk of lost checks or incorrect bank transfers, making payroll a lot more efficient.

7. Replace if lost

If a card is lost or stolen, employees can request a replacement through your payroll card provider. Most issuers offer 24/7 support and freeze the card immediately to prevent fraud.

A new employee payroll card can be mailed out quickly or even printed on-site, depending on your provider. This ensures continued access to funds with minimal disruption.

8. Maintain legal compliance

Using payroll cards means staying compliant with state and federal labor laws. You must provide clear disclosures, offer alternative payment options, and avoid hidden fees that reduce take-home pay.

Ensure your pay cards for employees are backed by FDIC-insured institutions and meet all applicable wage and hour requirements. A good provider will help you stay aligned with legal standards.

What are the common use cases of payroll cards for businesses?

Payroll cards aren’t just for standard wages, they’re versatile tools that support multiple payment needs. Whether you're managing full-time employees, contractors, or remote staff, business payroll cards can simplify financial disbursements.

From bonuses to reimbursements, these cards offer a flexible, digital-first way to handle payments securely and efficiently across different employment types.

Employee payroll distribution

You can use employee payroll cards as your primary method for salary distribution. Instead of issuing checks or using bank transfers, funds are deposited directly onto each employee’s card.

This makes payday faster and more consistent, especially helpful for unbanked staff. With payroll cards for employees, you streamline operations and reduce the administrative load of managing multiple payment channels.

Employee bonus disbursements

When it’s time to reward your team with bonuses, payroll cards provide a convenient channel. You can instantly load performance-based bonuses or year-end rewards onto employees’ cards.

This ensures timely delivery while keeping your accounting clean. It’s a simple way to handle ad hoc payments without altering your regular payroll structure or issuing separate transactions through bank accounts.

Commission-based payments

If your business includes commission earners, like sales reps, payroll cards for employees let you issue payments right away after the close of a sale or performance period.

With automated transfers, you ensure timely commission payouts without errors or delays. This keeps morale high and helps your employees access their earnings faster than traditional methods like mailed checks.

Temporary staff compensation

Temporary or seasonal staff often don’t stay long enough to justify setting up direct deposit accounts. With business payroll cards, you can pay temp workers easily and securely.

Each worker receives a reloadable card for the duration of their employment, and you can deactivate or repurpose it after their term ends, saving both time and paperwork on short-term contracts.

Travel expense reimbursements

Instead of reimbursing out-of-pocket travel costs via payroll or checks, you can preload employee payroll cards with per diem amounts or travel reimbursements. This gives employees instant access to funds and reduces the need for expense claims.

It's particularly helpful when you want to control spending limits while still offering flexibility to cover lodging, meals, and transportation.

Overtime pay distribution

When employees put in extra hours, pay cards for employees allow you to reward them quickly and transparently. Overtime pay can be separated from base wages and loaded onto the same card or a separate one for tracking.

Employees appreciate the prompt access to their earnings, and you avoid the delay of bundling overtime with the next pay cycle.

Remote worker payments

For fully remote or geographically dispersed teams, employee payroll cards are a hassle-free payment method. You don’t need to deal with complex bank transfers or cross-border systems.

Just load their wages digitally to their card, and they can access their funds from anywhere. It’s a modern solution for managing payroll in an increasingly remote-first business environment.

Employee incentive payouts

Incentives like referral bonuses, wellness rewards, or recognition payouts can be loaded instantly onto payroll cards. This not only motivates employees but also keeps these occasional payments separate from their regular salary.

Business payroll cards give you a flexible channel to push short-term rewards without waiting for the next pay cycle or complicating your standard payroll process.

Contractor wage settlements

Paying independent contractors can sometimes involve delays or banking complexities. Payroll cards for employees (or specially designated contractor cards) let you handle one-time or recurring contractor payments without issuing paper checks or processing wire transfers.

It also helps you maintain accurate records while giving contractors instant access to their earnings, streamlining gig and freelance payments.

What are the different types of payroll cards?

Payroll cards come in several forms to fit different business needs and employee preferences. Whether you’re offering long-term payment solutions or short-term wage access, choosing the right payroll cards for employees helps streamline payroll operations.

Some payroll solutions also overlap with expense management cards, giving your team added flexibility in how they receive and manage both wages and work-related expenses.

1. Branded payroll cards

Branded payroll cards feature your company’s logo and design, offering a more personalized and professional feel. They help reinforce your brand identity while giving employees a sense of exclusivity.

These business payroll cards are often issued by major card networks like Visa or Mastercard, ensuring broad usability and a familiar banking experience for employees.

2. Personalized cards

Employee payroll cards can be personalized with the cardholder’s name and individual account number. This increases security and reduces the risk of unauthorized use.

Personalized cards are great for long-term staff or salaried employees who receive recurring payments. They also enhance the professional experience for employees managing their finances through a branded company solution.

3. General-purpose cards

These pay cards for employees function like standard prepaid debit cards and aren’t always tied to a specific payroll provider. You can use them for multiple types of disbursements, from wages to bonuses and stipends.

They’re ideal for employers seeking a versatile, one-size-fits-all solution to accommodate various employee payment needs beyond standard payroll.

4. Reloadable cards

Reloadable payroll cards are designed for repeated use. Employers can deposit wages every pay cycle without needing to issue new cards. This type is ideal for long-term employees and reduces the overhead associated with card management.

5. Non-reloadable cards

These payroll cards are designed for one-time use and cannot be reloaded after the initial deposit. They’re ideal for paying temporary workers, issuing final wages, or delivering incentives.

Because they’re disposable, they simplify administrative tasks for short-term engagements, while offering a secure and convenient way to disburse single-instance payments.

6. Virtual payroll cards

Virtual employee payroll cards offer a digital-only format, allowing employees to access funds online or via mobile wallets. These are great for remote teams or digital-first companies.

They eliminate the need for physical card issuance, lower costs, and provide instant, secure access to pay, especially for employees who prefer digital banking.

7. Prepaid debit cards

Prepaid debit payroll cards function much like traditional debit cards but aren’t linked to a checking account. Instead, you load funds directly from your payroll system.

They’re accepted at most retailers and ATMs. These pay cards for employees are especially useful for those without bank accounts or those seeking more spending control.

8. Instant issue cards

Instant issue payroll cards can be created and distributed on the spot, perfect for onboarding new hires or paying short-term contractors.

They give employees immediate access to their wages and remove the wait associated with custom-printed cards. This quick turnaround makes them a practical tool in fast-paced or high-turnover environments.

9. Travel expense cards

Use payroll cards specifically allocated for travel-related expenses to manage business trip budgets more effectively. These cards can be preloaded with per diem amounts or approved limits, helping employees manage lodging, meals, and transportation.

It simplifies reimbursements and expense tracking, making them a valuable tool for companies with frequent business travel needs.

What are the benefits of payroll cards for employers?

By switching to payroll cards, employers can streamline payroll operations, reduce costs, and adopt a more modern, efficient payment system. These cards aren't just practical—they also enhance employee satisfaction and minimize payroll-related errors.

Using employee payroll cards helps maintain operational efficiency while ensuring employees receive reliable, fast payments—keeping your workforce engaged and well-supported.

Cost-effective payroll management

Switching to payroll cards for employees reduces your reliance on paper checks, postage, and bank fees. That means fewer costs for printing, mailing, and check reissuance.

It’s especially beneficial if you manage a large or distributed workforce. By minimizing overhead and processing expenses, business payroll cards help you create a leaner, more cost-efficient payroll system without compromising on payment reliability.

Simplified compliance tracking

With payroll cards, you gain better oversight of wage disbursements and can track compliance with labor laws more easily.

Most providers offer tools that help you stay aligned with federal and state regulations, such as wage reporting and fee transparency. This reduces legal risk and ensures your pay cards for employees meet all required employment and payroll standards.

Improved employee satisfaction

When employees have quick, easy access to their pay via employee payroll cards, they feel more secure and valued. There's no need to cash checks or wait for bank transfers.

Plus, cards often come with perks like ATM access and online tools. Providing convenient pay options shows your commitment to their financial well-being, and that goes a long way.

Enhanced company reputation

Offering business payroll cards positions your company as forward-thinking and employee-focused. It demonstrates that you care about delivering flexible, efficient payment options for your workforce.

This can boost your employer brand, attract top talent, and even help with retention. By embracing modern tools like payroll cards, you show that you’re keeping up with today’s workplace expectations.

Reduced administrative burden

Manual payroll processing is time-consuming. With employee payroll cards, you reduce paperwork, eliminate lost checks, and cut down on errors.

You won’t have to worry about managing multiple direct deposit forms or bank account updates. A centralized card system simplifies the entire payroll cycle, freeing up your HR and finance teams to focus on more strategic tasks.

Modernized payment processes

Payroll cards for employees reflect a shift toward digital-first solutions in business finance. Whether you have on-site or remote staff, using these cards keeps your payroll operations aligned with tech-forward practices.

You get real-time fund transfers, automated reloading, and better control over disbursements, all while offering your workforce a fast and secure way to access their pay.

Efficient financial record-keeping

When you use pay cards for employees, every transaction is digitally logged. This provides clean, accurate records for payroll auditing, tax filing, and internal reporting.

Many card platforms integrate with accounting systems, streamlining your reconciliation process. That means fewer discrepancies and a more transparent view of your wage-related spending, making compliance and forecasting easier to manage.

What are the benefits of payroll cards for employees?

As an employee, using payroll cards gives you more control over your money, without needing a bank account. You’ll get faster access to wages, greater convenience, and added financial tools that help you stay on top of your spending.

Employee payroll cards bring flexibility and modern banking features right to your wallet.

Instant access to funds

With payroll cards for employees, you don’t have to wait for checks to clear or bank deposits to process. Your wages are loaded onto the card on payday, and you can use the funds right away.

Whether you're withdrawing cash, shopping online, or paying bills, employee payroll cards give you immediate, uninterrupted access to your hard-earned money.

Secure payment method

Payroll cards are protected with PINs, encryption, and fraud monitoring, making them a safe alternative to carrying cash or handling paper checks.

If your card is lost or stolen, it can be frozen and replaced easily. As an employee, you’ll benefit from these built-in protections that help keep your wages and spending data secure.

No bank account needed

One of the biggest perks of employee payroll cards is that you don’t need a bank account to receive your pay. This is especially helpful if you’re unbanked or prefer not to use traditional banking services.

Your wages are deposited directly onto your payroll card, letting you manage your money digitally without depending on a financial institution.

Reward and cashback programs

Many payroll cards for employees are issued by major card networks like Visa or Mastercard, which means you might gain access to rewards, discounts, or cashback offers. These perks can help you stretch your earnings further.

Using your employee payroll card for everyday purchases not only adds convenience but can also provide financial incentives you wouldn’t get with paper checks.

Safe and quick card replacement

If your card gets lost or damaged, it can be deactivated immediately and replaced quickly, often within a few business days. Some payroll card providers even offer emergency cash access in the meantime.

For you, this means minimal disruption and peace of mind, knowing your wages are still protected and accessible during unexpected situations.

What are the limitations of payroll cards?

While payroll cards offer convenience, they’re not without drawbacks. As an employee, you may encounter certain fees, transaction restrictions, or security concerns.

Understanding these limitations helps you make the most of your employee payroll card and avoid surprises when accessing or spending your wages.

Associated fees

Some payroll cards for employees come with hidden or unexpected fees. These can include ATM withdrawal charges, monthly maintenance fees, balance inquiry costs, or inactivity penalties.

It's important to review the fee schedule from your card provider. Knowing how and when you might be charged helps you manage your wages more efficiently and avoid unnecessary deductions from your payroll card balance.

Limited merchant acceptance

While most payroll cards are backed by major networks like Visa or Mastercard, a few may have limited acceptance—especially with smaller merchants or international retailers.

If you frequently shop at local vendors or need to make international purchases, always check whether your employee payroll card is accepted. Not every merchant is equipped to process prepaid or payroll-based cards.

Withdrawal limits

Pay cards for employees often come with daily ATM withdrawal limits. This can be inconvenient if you need to access a large amount of cash at once.

Some cards also have spending caps or transaction limits. Make sure you're aware of these restrictions, so you can plan accordingly and avoid delays or declined transactions when accessing your wages.

Risk of fraud or theft

Although employee payroll cards are generally secure, they’re not immune to fraud or theft. If your card falls into the wrong hands and your PIN is compromised, unauthorized charges could occur.

It’s important to report suspicious activity immediately and use strong passwords and card protections. Some providers offer zero-liability policies, but response times can vary based on the issuer.

Difficulties with disputes

If a fraudulent or incorrect transaction occurs, resolving the issue with a payroll card can be more complex than with a traditional bank. Some providers have slower dispute resolution timelines or limited support.

This can leave you temporarily without access to those funds. Understanding your card issuer’s dispute process is key to protecting your finances and recovering any losses quickly.

What features to look for when getting payroll cards for your business?

When choosing payroll cards for your company, it’s important to prioritize features that benefit both you and your employees. The right business payroll cards should be cost-effective, easy to manage, and secure, ensuring smooth payroll operations and a positive experience for your team.

1. Low or no fees

Always look for payroll cards for employees that come with minimal fees. Some cards charge for ATM withdrawals, monthly maintenance, or even customer service calls.

Opting for a card with transparent, low-cost—or no-cost—structures helps reduce friction for your staff and shows that you value their take-home pay. Fee-friendly cards also support better adoption and fewer employee complaints.

2. Easy employee enrollment

Choose a payroll card provider that makes it simple to onboard employees. The best systems offer streamlined digital enrollment, bulk upload options, and quick card issuance.

Whether you're managing full-time staff or temporary workers, easy enrollment ensures everyone gets paid on time without manual paperwork. A smooth setup process also reduces the administrative load on your HR or payroll teams.

3. Multiple withdrawal options

Look for employee payroll cards that allow withdrawals through ATMs, over-the-counter services, and even cashback at retail stores.

The more ways your team can access their funds, the better their experience will be. This flexibility is especially important for employees without local banking access or those in remote areas where ATM access may be limited or inconsistent.

4. Strong fraud protection features

Fraud prevention should be a top priority. Choose payroll cards with EMV chips, real-time alerts, and fraud monitoring systems. Some providers also offer zero-liability protection in the event of unauthorized use.

These features protect your employees’ earnings and your company’s reputation. Ensuring the cards are secure builds trust and adds peace of mind for everyone involved.

5. Real-time transaction tracking

A good payroll card platform should offer real-time transaction visibility for both employers and employees. This allows your staff to track spending and stay financially informed.

On your end, it helps you monitor disbursements and quickly resolve issues. Having access to live data improves transparency and supports better financial management throughout your payroll process.

6. Compatibility with payroll software

Your business payroll cards should integrate seamlessly with your existing payroll or HR systems. Look for providers that support automated syncing, real-time data exchange, and easy-to-use dashboards.

This cuts down on manual entry, reduces errors, and keeps your accounting accurate. Software compatibility makes it easier to scale payroll card usage as your business grows.

7. Customizable card controls

Opt for employee payroll cards that offer customizable settings like spending limits, merchant restrictions, and card lock features. These controls let you tailor usage based on employee type or business need.

Whether it’s limiting withdrawals or preventing overseas purchases, custom settings give you added oversight and help protect your funds from misuse or accidental overdraws.

8. Nationwide or global usability

If your team includes remote workers, frequent travelers, or international contractors, you need payroll cards with broad acceptance. Choose cards backed by major networks like Visa or Mastercard that work across the U.S. and globally.

This ensures employees can access their funds from anywhere—whether they’re withdrawing cash, paying online, or using a mobile wallet while traveling.

9. Regulatory compliance support

Pick a payroll card provider that helps you stay compliant with federal and state wage laws, including fee disclosures and card access rights. The right partner will guide you through the legal requirements and provide documentation tools.

This protects your business from penalties and ensures your payroll cards for employees are issued and used legally and ethically.

10. 24/7 customer service

Reliable support is essential. Choose payroll card providers that offer round-the-clock customer service for both employers and employees.

Whether someone needs to report a lost card or has trouble with a transaction, access to live assistance ensures issues are resolved quickly. Good support reflects well on your company and keeps your payroll system running smoothly.

How to implement payroll cards in your organization?

Rolling out payroll cards in your business requires planning, communication, and legal awareness. By taking the right steps, you’ll create a smooth onboarding experience for your team and ensure your employee payroll card system supports long-term payroll efficiency and employee satisfaction.

1. Research payroll card providers

Start by researching reputable payroll card providers. Look for vendors with a proven track record, low fees, fraud protection, and strong customer support.

Make sure their services are designed for business payroll cards and meet regulatory requirements in your state. A good provider will also offer tools to simplify implementation, integrate with your systems, and support employees throughout the card lifecycle.

2. Choose a suitable card plan

Select a card plan that aligns with your business structure and employee needs. Consider whether you need reloadable, virtual, or branded payroll cards for employees.

Review features like ATM access, mobile wallet compatibility, and reporting tools. Your chosen plan should balance cost-efficiency for your business with usability for your employees to ensure high adoption and satisfaction rates.

3. Communicate with employees

Before rollout, educate your team about how employee payroll cards work, their benefits, and any associated fees. Provide printed materials or host info sessions.

Transparency builds trust and encourages participation. Emphasize that using pay cards for employees is a secure and fast alternative to traditional checks or direct deposit, especially for those without bank accounts.

4. Integrate with your payroll system

Work with your payroll card provider to integrate the card system into your existing payroll software. Automation ensures wages are loaded accurately and on time.

Seamless integration minimizes manual data entry, reduces errors, and saves your payroll team hours of repetitive work. This step is essential for long-term scalability and data accuracy.

5. Set up employee enrollment

Create a straightforward enrollment process for staff. Allow employees to sign up digitally or through HR with minimal paperwork. Make sure they understand the setup timeline and what information is required.

Once enrolled, your team can receive their employee payroll cards quickly and start using them by the next payroll cycle—avoiding payment delays or confusion.

6. Train HR and payroll teams

Ensure your HR and payroll staff are trained to manage the payroll card program. Cover tasks like enrolling employees, processing card loads, handling disputes, and issuing replacements.

Training should also include how to answer employee questions and use the provider's dashboard or tools. Well-prepared internal teams keep operations running smoothly and increase employee confidence in the system.

7. Ensure legal compliance

Make sure your payroll card program meets all relevant federal and state regulations, such as fee disclosures, opt-out options, and equal access. Work with legal counsel if necessary to review provider contracts and usage policies.

Maintaining compliance not only protects your business from legal risk but also builds trust among employees using payroll cards for employees.

8. Monitor card usage and feedback

After implementation, regularly monitor how employee payroll cards are being used. Track usage trends, withdrawal patterns, and help desk queries.

Collect feedback from employees to identify any recurring issues or areas of confusion. This information helps you optimize card features and enhance user experience, ensuring the program continues to meet both business and employee needs.

9. Address employee concerns

Be proactive in addressing concerns about fees, usage restrictions, or card security. Maintain an open-door policy for questions or complaints.

Providing prompt, clear responses shows you care about your team’s financial experience. Having a designated point of contact for payroll card inquiries makes employees feel supported and encourages broader participation in the program.

10. Review and adjust as needed

Conduct periodic reviews of your payroll card program to ensure it's still meeting your business goals. Evaluate provider performance, cost savings, compliance, and employee satisfaction.

If necessary, renegotiate terms or explore other providers. A flexible, responsive approach allows you to continuously improve the use of payroll cards for employees and adapt to your company’s evolving needs.

Best practices to follow when using payroll cards in a business

For the employer

● Introduce payroll cards gradually

When implementing payroll cards in your business, roll them out gradually. Start with a pilot group before expanding to the entire workforce.

This allows you to address any issues early on and make adjustments based on employee feedback. A phased introduction ensures smoother transitions and helps employees become comfortable with the new payment method.

● Create a dedicated payroll card team

Designate a team within HR or payroll to manage payroll cards for employees. This team should handle card enrollment, troubleshooting, and overseeing card distribution.

A dedicated team ensures all issues are addressed promptly and employees receive consistent support. It also allows for a focused effort on improving and maintaining your payroll card system.

● Set clear performance standards

Set clear expectations for the use and management of business payroll cards. Define performance standards such as timely payroll loading, card security, and proper enrollment procedures.

Communicate these standards to employees so they understand the importance of following the guidelines. Clear standards help ensure the success and efficiency of the payroll card program across your business.

● Train employees on card use

Provide training for employees on how to use their employee payroll cards effectively. This includes explaining card features, fees, and how to check balances.

Offering clear guidance ensures that employees understand the system and can maximize the benefits of their payroll cards. The better they understand their card, the fewer mistakes and issues will arise.

● Identify and manage inactive cards

Monitor for payroll cards that remain unused over extended periods. Inactive cards can be a sign of employee dissatisfaction or non-engagement.

Implement a process to deactivate or replace unused cards. Regularly review card activity to ensure that all issued cards are actively used and that employees are benefiting from the payroll card program as intended.

● Audit payroll card usage regularly

Conduct regular audits of payroll card transactions to ensure there are no discrepancies, fraudulent activity, or unauthorized use.

These audits also help you assess the program’s efficiency, identify areas for improvement, and ensure that cards are being used according to company policies. Regular checks also help maintain financial control and reduce the risk of errors or misuse.

● Analyze payroll card providers carefully

Before selecting a provider, thoroughly analyze different payroll card providers. Look for ones with transparent fee structures, solid customer support, and security features.

Compare their compatibility with your payroll system and review customer feedback. Carefully evaluating your options ensures that you choose a provider that can scale with your business and provide excellent service to your employees.

● Choose trusted payroll card providers

Work with reputable, well-established providers of business payroll cards. A trusted provider ensures that your employees have access to secure, reliable, and efficient card services.

Additionally, a reputable provider offers customer support, fraud protection, and legal compliance, which are essential for maintaining trust and security in your payroll program.

For the employee

● Follow payroll card rules strictly

Always adhere to the rules and guidelines associated with your payroll card. This includes understanding fee structures, spending limits, and card activation procedures.

By following the established rules, you ensure your card works as intended and avoid unnecessary issues. Staying compliant with the rules helps maintain a smooth, problem-free experience with your payroll card.

● Avoid overspending

Be mindful of your spending when using your employee payroll card. Since the card is preloaded with your wages, it’s important not to exceed your balance.

Overspending can result in declined transactions or unexpected fees. Keep track of your expenses to ensure you are within your budget and to avoid running out of funds before your next payday.

● Use the card responsibly

Treat your payroll card like a personal debit card. Use it for necessary purchases and manage your spending habits.

Avoid using it for non-essential or impulse buys, as this can affect your financial health. By using the card responsibly, you can make the most of your wages while keeping financial stress to a minimum.

● Keep track of receipts and expenses

Always keep receipts for purchases made with your payroll card. Tracking your expenses helps you stay within your budget and makes it easier to monitor how much of your earnings are being spent.

Keeping organized records can also be helpful when managing your finances and ensuring you’re using the card within its limitations.

● Report lost or stolen cards right away

If your payroll card is lost or stolen, report it to your provider immediately. Most providers offer 24/7 customer support and can freeze your card to prevent unauthorized transactions.

Promptly reporting a lost or stolen card ensures that your wages are protected and minimizes the risk of fraud or theft.

● Stay informed about card features

Stay up to date on any changes or updates to your employee payroll card. Familiarize yourself with new features, rewards programs, or fee adjustments.

Being informed about your card's capabilities helps you maximize its benefits and avoid unexpected fees or limitations. It also empowers you to make better financial decisions with your payroll card.

Simplify global payroll in one platform

How does Volopay streamline payroll management for businesses?

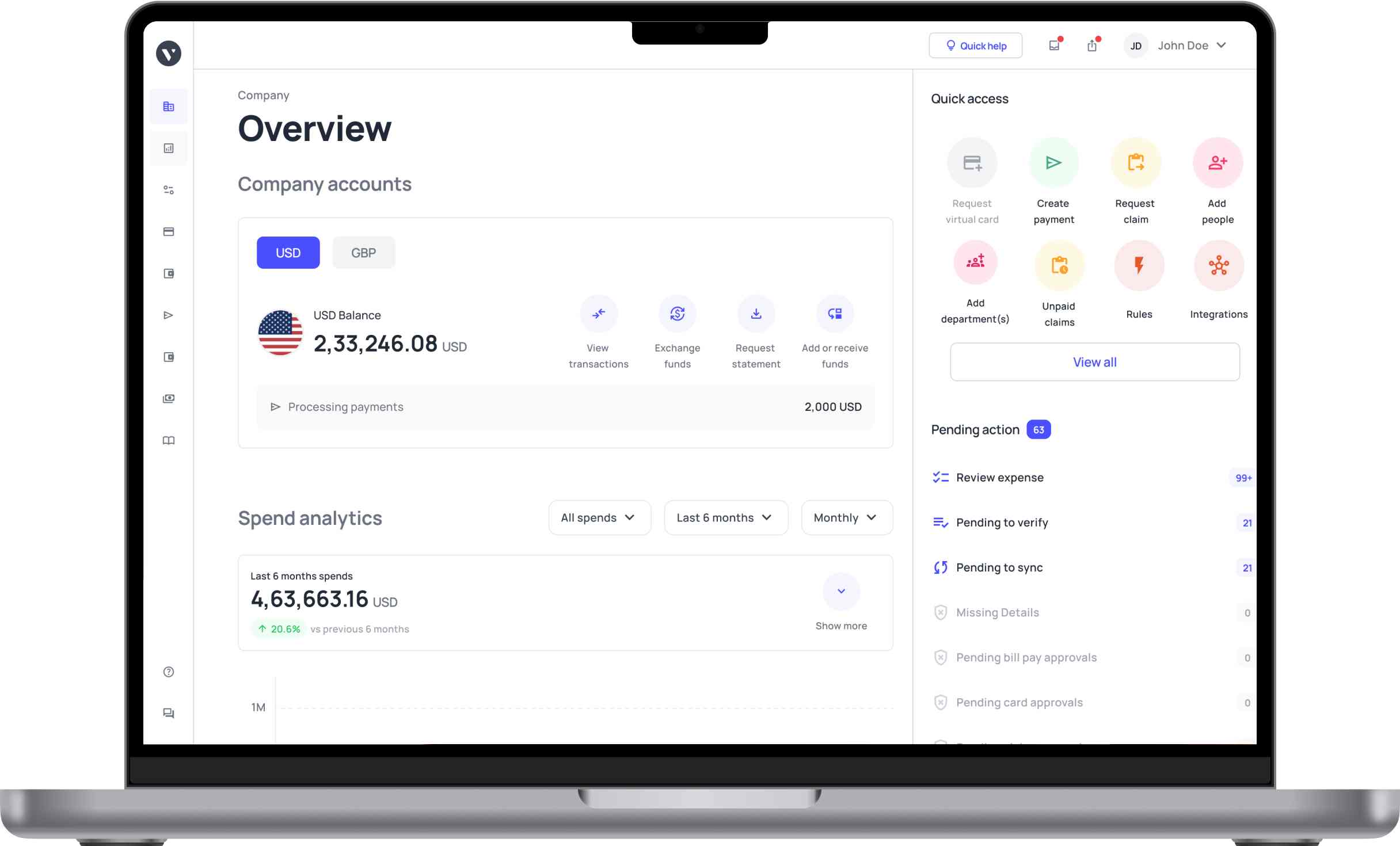

Volopay's advanced payroll software revolutionizes payroll management by offering a fully automated, customizable platform. With its comprehensive features, businesses can easily manage employee payroll, streamline approvals, ensure compliance, and simplify reporting.

By integrating seamlessly with accounting software, Volopay takes the complexity out of payroll and expense management. With Volopay's corporate cards, companies gain real-time control over spending, enabling them to focus on growth and efficiency.

Automates complete payroll process

Volopay automates the entire payroll process, reducing manual intervention and minimizing human errors. From calculating employee salaries to distributing payments, Volopay handles it all seamlessly.

Payroll tasks such as tax deductions, bonuses, and overtime are processed automatically, ensuring efficiency and accuracy. This saves your HR and finance teams time, allowing them to focus on more strategic initiatives rather than getting bogged down with routine payroll tasks.

Unlimited virtual cards for employees

With Volopay, businesses can issue unlimited virtual cards to employees for payroll management. These virtual cards allow employees to access their wages instantly, enabling fast and secure payments.

You can set up specific spending limits, making it easy to manage how funds are used. Virtual cards also offer greater flexibility for employees working remotely or internationally, ensuring they can access their pay from anywhere without needing physical cards.

Customizable, multi-level approval workflows

Volopay allows you to create customizable, multi-level approval workflows for payroll and other financial processes. These workflows ensure that every step, from payroll processing to expense approvals, goes through the appropriate hierarchy of approval.

This increases accountability, reduces errors, and ensures that payroll is handled efficiently. The system allows for tailored workflows that match your company’s unique structure, improving both security and transparency in payroll management.

Ensures compliance and security

Volopay ensures your payroll is fully compliant with local and international regulations, including tax laws and labor requirements. The platform’s security measures, such as encryption and multi-factor authentication, keep sensitive payroll data safe from unauthorized access.

By automating compliance checks and providing real-time updates on regulations, Volopay reduces the risk of costly mistakes and ensures that your payroll processes meet all legal standards.

Simplifies payroll deductions handling

Managing payroll deductions can be complex, especially when dealing with taxes, retirement contributions, and other benefits. Volopay simplifies this by automatically calculating and applying deductions based on pre-set rules.

Whether it’s for health insurance, tax withholdings, or savings plans, the platform ensures that all deductions are handled correctly and efficiently. This automated process reduces the risk of errors and ensures that employees’ pay reflects accurate deductions every pay period.

Automates payroll reconciliation

Volopay’s payroll system automatically reconciles payroll data with your financial records. This eliminates the need for manual matching of payroll reports with bank statements or accounting records.

The platform ensures that all transactions are correctly recorded and aligned, making auditing easier and more accurate. Automated reconciliation improves financial transparency and simplifies your year-end processes, helping you maintain accurate financial records without unnecessary delays or discrepancies.

Provides real-time payroll tracking

With Volopay, you gain real-time visibility into payroll status. You can track the progress of payroll processing, see when payments are made, and monitor any discrepancies immediately.

This transparency allows you to address issues quickly and ensure that employees are paid on time, every time. Real-time tracking also improves communication between departments, helping HR, finance, and management stay aligned throughout the payroll cycle.

Integrates with accounting software

Volopay seamlessly integrates with popular accounting software like Xero, QuickBooks, and others, ensuring that payroll data is automatically synced with your financial records. This integration eliminates the need for manual data entry, reducing the risk of errors and saving time.

By linking payroll directly to your accounting system, Volopay streamlines financial reporting and ensures consistency across your organization’s financial management tools.

Offers advanced reporting and analytics

Volopay provides advanced payroll reporting and analytics, giving you actionable insights into payroll trends, employee compensation, tax liabilities, and more. These customizable reports help you make informed decisions and improves the overall payroll strategy.

With comprehensive data at your fingertips, Volopay's reporting software helps you analyze payroll expenses, ensure budget compliance, and identify areas for optimization. Detailed analytics simplify strategic planning and budgeting for your company’s payroll management needs.

FAQs on payroll cards

Payroll cards function similarly to bank accounts, allowing employees to access and spend their wages. However, they don’t offer all bank services, such as savings or credit features.

Yes, some payroll cards may charge fees for transactions like ATM withdrawals or card maintenance. These fees vary depending on the card provider, so employees should review terms carefully.

Yes, payroll cards for employees can be used online for purchases, just like a regular debit card, as long as the merchant accepts prepaid cards. This provides flexibility for employees.

Unlike direct deposit, which transfers funds into a bank account, payroll cards provide a prepaid card that employees can use for purchases or ATM withdrawals, without needing a traditional bank account.

Yes, business payroll cards can often be customized with company branding, card designs, and specific spending restrictions, allowing for more control over how employees use their wages.

Businesses of all sizes, including startups, SMEs, and large enterprises, can benefit from Volopay’s corporate payroll cards by streamlining payroll processing and providing easy access to employee wages.

Yes, Volopay’s payroll software is highly customizable, allowing businesses to tailor workflows, approval processes, and reporting features to suit their specific payroll needs and operational requirements.