What is expense reimbursement? Everything you need to know

Understanding expense reimbursement helps you manage out-of-pocket costs your team incurs during business activities. So, what is expense reimbursement? It’s the process where your business pays back employees for approved spending—like travel, meals, or supplies.

This guide walks you through every step, making employee reimbursement straightforward and compliant. You’ll learn how to track expenses, set clear policies, and handle claims efficiently.

Adopting a smart reimbursement system reduces errors, improves transparency, and supports smooth financial operations. Whether you're building a policy from scratch or refining an existing one, this guide ensures you handle expense reimbursement professionally and responsibly.

What is expense reimbursement?

When your employees spend their own money on business-related costs, expense reimbursement allows you to repay them accurately and fairly. Understanding what is expense reimbursement helps you manage travel, meals, lodging, and office purchases efficiently.

A well-defined employee reimbursement process ensures timely repayments, prevents policy violations, and maintains transparency in your company’s financial records and internal workflows.

What are the expenses that can be reimbursed?

1. Travel expenses

You can reimburse costs like airfare, mileage, taxi fares, hotel stays, and parking fees when employees travel for work. These travel expenses must directly relate to business activities.

To ensure smooth expense reimbursement, ask your team to submit receipts and travel itineraries. A well-defined employee reimbursement policy for travel keeps your records accurate and prevents confusion or disputes over what qualifies for repayment.

2. Business meals and entertainment

When employees entertain clients or attend work-related meals, you can repay them for the cost of food, beverages, and service tips. Ensure the purpose is business-focused and receipts are attached to the claim.

Including these under expense reimbursement shows you value hospitality in business. Documented employee reimbursement requests help you comply with tax and audit regulations while supporting your team’s client engagement efforts.

3. Communication expenses

If your employees use mobile phones or internet services for business, you can cover a portion or the full cost of these expenses. Communication tools are essential for remote work or client contact.

You must define which services qualify under expense reimbursement and request monthly statements for verification. When you track employee reimbursement properly, it boosts transparency and encourages responsible use of communication resources.

4. Professional development expenses

You can reimburse costs for courses, certifications, workshops, and conferences that help your team grow professionally. Investing in learning supports company goals and employee satisfaction. Submit receipts, agendas, or registration details when applying for expense reimbursement.

A strong employee reimbursement policy for development encourages continuous improvement and makes sure the learning directly benefits your business operations or skill needs.

5. Office supplies and equipment

Your employees may need notebooks, printers, software, or even furniture to perform their jobs. Reimbursing these essential tools ensures productivity and comfort. Always ask for invoices and match items to business use.

When these fall under expense reimbursement, you must clarify what qualifies. Following a structured employee reimbursement process for office essentials avoids unnecessary spending and keeps your inventory in check.

6. Business-related subscriptions and memberships

Magazines, journals, digital platforms, or industry group memberships can help employees stay updated in their fields. You can cover these as long as they support business objectives.

Ask your team to include a description and cost breakdown when seeking expense reimbursement. Accepting relevant employee reimbursement claims ensures your team remains informed and connected to industry trends without financial strain.

7. Miscellaneous expenses

Some costs don’t fall under major categories but still support business operations, like shipping charges, tolls, or minor tools. You can cover these if they’re reasonable and documented.

Clarify which items are eligible under expense reimbursement to avoid misuse. When handling employee reimbursement for miscellaneous items, always verify the purpose and amount to maintain consistency and policy compliance.

What makes an employee’s business expense valid?

To ensure smooth expense reimbursement, you must understand what makes a business expense valid. Not every purchase qualifies, so setting clear standards is essential. From having a clear business purpose to providing receipts, your employee reimbursement process should promote accountability.

When you follow structured criteria, you avoid unnecessary costs, ensure fairness, and keep your finances organized while maintaining trust between you and your team.

1. The purpose of the expense

The expense must serve a direct business objective, such as client meetings, travel, or work-related purchases. If the purchase contributes to your company’s operations or goals, it qualifies as a valid claim.

Ensure your employees provide a brief explanation of how the item or service supports business needs when submitting a reimbursement request for review.

2. The necessity of the expense

To be valid, the expense should be essential for completing work tasks or attending required activities. Necessary expenses support daily duties or contribute to project success.

You must evaluate whether the employee had other options or if the cost was required for job performance. Clear guidelines reduce confusion about what is truly needed for work purposes.

3. Relevant documents and receipts

A valid claim always includes proof of purchase, such as receipts, invoices, or transaction summaries. These documents confirm the amount spent and clarify the vendor, date, and type of expense.

Keeping such records allows you to approve or reject claims confidently. Proper documentation also protects your business during audits and keeps your financial records accurate and transparent.

4. Justifiability of the cost of expense

The amount spent should match what’s reasonable for the type of purchase. Extravagant or unusually high costs may require justification or approval in advance. Encourage employees to choose cost-effective options when possible.

This ensures you maintain financial discipline while still supporting necessary spending. When in doubt, set price limits for common expenses to help guide decisions.

5. Out-of-pocket expense by employee

A business expense is only valid for expense reimbursement if your employee personally paid for it. Charges must not be billed directly to the company or paid through company accounts.

Employees must include proof of personal payment, such as card statements or receipts. Verifying employee reimbursement requests helps ensure fairness and prevents duplicate or invalid claims.

6. Timely reporting of expenses

You must ensure your employees submit claims within your company’s specified timeframe. Delays can result in missing receipts or policy violations. Encourage timely reporting so you can process payments quickly and maintain accurate books.

Prompt submission also helps detect any irregularities early, making your expense reimbursement process more reliable and easier to manage for everyone involved.

What happens when an expense cannot be verified?

When an expense lacks proper proof or violates policy, you must address it carefully to maintain fairness and accountability. Your expense reimbursement process should include steps to handle unverified claims, helping you resolve issues without disrupting trust or transparency in your employee reimbursement system.

Employee is requested for a clarification

If an expense appears unclear or lacks details, ask the employee for clarification. They may need to explain the purpose, attach missing documents, or confirm the amount.

Giving them a chance to respond promotes fairness and allows legitimate claims to be reconsidered. A quick clarification often resolves minor issues and keeps the process smooth for both sides.

Denial of reimbursement

When verification fails even after clarification, you may deny the claim. Explain the reason clearly—such as missing receipts or ineligible purchases—so the employee understands what went wrong.

Denying reimbursement prevents invalid claims from affecting your company’s budget and keeps your expense reimbursement standards consistent and enforceable across departments and teams.

Partial reimbursement

If only part of the claim qualifies, you can approve that portion while denying the rest. For example, the meal cost may be valid, but added personal items may not.

Clearly explain the decision so the employee knows what’s covered. Handling these situations fairly helps you maintain trust while managing expenses responsibly.

Consequences for violation of company policies

Repeated or intentional violations of policy may result in disciplinary action. Depending on severity, consequences can include written warnings, loss of reimbursement privileges, or further review by management.

Make sure your team understands these risks. Reinforcing accountability discourages misuse and keeps your employee reimbursement practices fair and effective for everyone.

Re-training and education of expense policies

If unverified claims become frequent, consider providing training. Walk your team through your expense policy, claim process, and documentation standards. Educational sessions reduce confusion and help employees follow procedures.

Investing in training improves compliance, reduces errors, and ensures your expense reimbursement system works efficiently for both finance teams and employees.

Timely reporting of expenses

Late submissions make it harder to verify details, collect receipts, or confirm transaction accuracy. Enforce reporting deadlines and remind employees to submit claims promptly.

Timely filing improves approval speed and avoids policy breaches. When you reinforce deadlines, you protect your budget and ensure that your employee reimbursement process stays transparent and consistent.

What is an expense reimbursement policy?

An expense reimbursement policy outlines the rules, limits, and procedures for reimbursing your employees for business-related expenses. It explains what qualifies for reimbursement, how to submit claims, and the timeline for receiving payment. A clear policy ensures that your employee reimbursement process stays fair, transparent, and easy to follow.

It protects your business against policy violations and maintains financial consistency. The policy also encourages timely submissions and minimizes disputes. To create an effective policy, you must answer key questions that shape its structure, rules, and execution.

Questions to ask when creating an expense reimbursement policy

1. Who’s eligible for reimbursement?

Determine which employees qualify for submitting reimbursement claims. This includes full-time staff, part-time employees, contractors, or interns. Clarify whether eligibility extends to all departments or specific roles.

Defining this upfront ensures fairness and prevents unauthorized claims. It also aligns your expense reimbursement framework with your company’s employment structure and avoids confusion.

2. Which expenses are reimbursable and which are not?

You must list which expenses qualify—like travel, lodging, meals, and office supplies—and clearly outline excluded items. Non-reimbursable examples may include personal purchases or luxury upgrades.

This helps employees stay within limits and submit accurate claims. Transparency supports a smoother employee reimbursement process and reduces unnecessary follow-ups or denied submissions.

3. What are the limits on reimbursements?

Set spending limits by category or role to control costs. You may cap hotel stays, meal costs, or daily travel allowances. Limits help manage budgets while ensuring fairness across the team.

Define what requires pre-approval if the limit is exceeded. Clear financial boundaries reduce overspending and help maintain accountability across your organization.

4. What are the documents required for reimbursements?

You should require receipts, invoices, or transaction proofs with each claim. These documents validate the expense and provide clarity for auditors.

Make sure employees know how to attach files, what formats are accepted, and the level of detail needed. These standards help you ensure smooth processing and prevent disputes around employee reimbursement claims.

5. What is the submission procedure?

Clarify how and where employees should submit claims—whether through software, email, or a portal. Include steps for filling forms, attaching receipts, and submitting for approval.

Clear procedures avoid delays and reduce errors. If your expense reimbursement policy integrates digital tools, guide your employees through the tech process to maintain accuracy.

6. What is the approval process?

Define who approves claims—team leads, finance managers, or HR—and outline the steps involved. Specify what happens if an expense requires multiple approvals or policy exceptions.

This ensures your approval flow stays consistent, avoids delays, and keeps your employee reimbursement system aligned with internal controls and audit requirements.

7. What is the timeframe for reimbursement?

Explain how long employees should wait for payment after claim approval. You may offer a standard window, like 7 or 14 business days. Setting clear timelines builds trust and avoids payment-related frustration.

Timely reimbursements improve morale and reflect well on your company’s professionalism and approach to financial obligations.

8. How are expenses incurred in foreign currency handled?

You must clarify how you convert and process expenses paid in foreign currency. Define acceptable exchange rates, conversion methods, and if currency fees are covered.

Clear rules help your team manage international spending without confusion. This protects your business from inconsistent claims and strengthens your global expense reimbursement procedures.

9. How will employees receive their reimbursements?

State the payment methods—bank transfers, payroll adjustments, or prepaid cards. Explain where employees should submit their banking details and how to update them if needed.

Knowing the payout method helps employees track payments easily and ensures no disruptions in the employee reimbursement flow.

10. What are the consequences for policy violations?

Define how you’ll handle fraudulent claims, repeated errors, or unapproved purchases. Consequences may include denied reimbursement, written warnings, or further disciplinary action.

Reinforcing policy rules maintains fairness and discourages abuse. This strengthens your company’s financial integrity while protecting the transparency of your expense reimbursement process.

What is the need for a clear expense reimbursement policy?

1. Compliance

When your policy follows local tax, labor, and financial laws, you protect your business from legal trouble. Regulatory bodies may audit your reimbursement system, so staying compliant helps you avoid penalties or investigations.

A policy that reflects regional and industry-specific rules gives you peace of mind and builds a solid legal foundation.

2. Clarity and understanding

Your team needs to know exactly what’s expected when submitting claims. A clear policy removes guesswork and reduces the number of rejected submissions.

When you define eligible expenses, limits, and documentation needs, employees feel more confident about what they’re allowed to claim, leading to faster and more accurate submissions every time.

3. Financial accountability

A structured policy ensures employees spend company money responsibly. When you set rules around allowable expenses and cost caps, you protect budgets and eliminate waste.

Financial accountability also builds a strong culture of ownership and transparency. Employees understand their spending power and respect the boundaries set by your organization.

4. Risk mitigation and fraud prevention

A strong policy prevents misuse of funds and stops questionable claims from being approved. When every expense is tracked, reviewed, and backed by proof, fraud becomes harder to commit.

Clear rules and required documentation deter dishonest activity and protect your business’s financial resources from being misused or exploited.

5. Efficient expense reimbursement process

A well-defined policy speeds up the entire reimbursement cycle. Employees know how to file claims, and managers know how to review them.

Delays are minimized, errors are reduced, and everyone knows what’s next. Efficiency saves time for both finance teams and employees, making the expense reimbursement process easier for everyone.

6. Audit preparation

During an audit, you must show documentation and prove compliance with policies. A clear and enforced expense policy simplifies this task.

When every claim follows a consistent structure, you can respond confidently to external or internal audits. Proper documentation and approval history support smooth audits and reflect well on your organization’s practices.

7. Employee satisfaction

When employees are reimbursed fairly and on time, it boosts morale. A transparent system builds trust and shows your organization respects their efforts.

If your employee reimbursement process is simple, consistent, and timely, it contributes to a positive work experience. Satisfied employees are more likely to follow the rules and remain loyal.

8. Efficient budget control

Controlling how money is spent starts with setting clear rules. When departments and roles follow the same policy, budgets stay predictable.

Approvers can flag overspending early and make informed financial decisions. A strong policy ensures every expense contributes to business goals while keeping costs manageable.

How can you customise your expense reimbursement policy for different roles?

Structured department budgets

Assigning tailored budgets to departments helps you align expenses with team goals. Sales may travel more, while IT may need equipment. Structure the policy around each department’s functions and expected costs.

Role-based budgeting allows flexibility while keeping your company’s overall spending under control through a unified expense reimbursement framework.

Role-specific expense categories

Different roles incur different types of costs. Executives may claim hotel upgrades, while field staff may claim mileage. Categorizing expenses by role ensures employees have access to relevant claim options without confusion.

Role-specific tracking also helps you analyze spending trends, making your employee reimbursement review process smarter and more data-driven.

Category-based approval workflows

You can assign approval workflows based on expense types. For example, travel claims may go through HR, while training claims may route to department heads.

This specialization makes approvals faster and more accurate. Category-based routing ensures claims reach the right decision-makers and that your internal controls remain intact at every stage.

Role-specific spending limits

Setting spending limits by role helps you manage costs without disrupting operations. Senior roles may receive higher allowances, while junior staff have tighter caps.

Role-based limits reflect the level of responsibility and typical expenses for each position. This helps you maintain fairness and control in your expense reimbursement strategy.

Customizable expense reporting tools

Choose digital tools that support role-based configurations. Employees should see relevant fields, expense types, and limits based on their profile.

Custom dashboards simplify submissions and reduce errors. These tools adapt your employee reimbursement process to your company structure, improving both user experience and reporting accuracy.

What is an expense report?

You use an expense report to document and track business-related expenses for reimbursement. This report plays a key role in expense reimbursement and helps validate each transaction.

Most reports typically include employee information, transaction details, supporting evidence, and approval records to ensure smooth employee reimbursement.

To make the process easier, it’s important to understand how to create an expense report correctly — ensuring every section is filled out accurately and supported with the right documentation.

Employee’s personal information

You need to fill in your name, department, and unique employee ID. This section ensures that the report links accurately to your profile and helps finance teams trace the origin of the expense reimbursement claim without confusion.

Expense details

Include the expense date, category, and a short description explaining why you incurred the cost. These details make your employee reimbursement request more transparent and aligned with your company’s expense policy.

Supporting expense for proof of expense

Always attach relevant bills, receipts, or invoices as proof. These documents verify your claims and protect your request during audits or reviews, strengthening your case for expense reimbursement.

Total charges

Mention the complete amount spent. Double-check figures to avoid miscalculations, as your employee reimbursement depends on accurate total charges, whether they’re in local or foreign currency.

Bank details for reimbursement

Provide your bank name, account holder’s name, account number, branch, and IFSC code. This ensures your reimbursement is credited to the correct account without delays or payment failures.

Approval details

Include the name of your supervisor or approver, along with the date of approval. This confirms internal validation and shows the expense reimbursement complies with the company’s hierarchy and rules.

Additional details

If applicable, provide travel itineraries, project codes, or cost center information. These entries help categorize the employee reimbursement request properly within broader business activities or departments.

Employee declaration

You must affirm that all expenses listed are accurate and in line with the company policy. This declaration protects your employer legally and builds trust in your claims process.

Employee signature

Sign at the end to certify all details provided are true. Your signature authorizes the expense reimbursement process and signals that you're accountable for the listed transactions.

Understanding the expense reimbursement process

1. Establishing a clear and comprehensive expense policy

Start by creating a detailed policy that defines acceptable expenses, limits, and reporting procedures. Outline expectations for documentation and submission timelines. A clear structure avoids confusion and simplifies the employee expense reimbursement process.

Make sure the policy aligns with internal controls and legal compliance. Your team will find it easier to follow when expectations are transparent and consistently enforced across all departments.

2. Educating employees about the reimbursement process

Train your team to understand how to handle business expenses from the start. Provide orientation materials or workshops to explain the steps involved. Emphasize the importance of timely documentation and accurate claims to ensure smoother employee reimbursement.

When employees understand the full process, they’re more likely to follow procedures correctly, which improves reporting accuracy and reduces delays or errors in reimbursement cycles.

3. Providing necessary expense documentation requirements

Clearly state what documents are mandatory for processing claims. Let your employees know that receipts, invoices, travel tickets, and written justifications may be required. This reduces back-and-forth during claim review.

Standardize formats or templates to simplify submissions. By clarifying these documentation needs in advance, you improve the overall success rate and speed of processing each expense reimbursement claim.

4. Capturing expenses

Encourage employees to log their expenses as they occur. This helps avoid forgotten items and ensures that all relevant information is captured promptly. You can recommend mobile apps or tools that simplify real-time entry.

When you prioritize accurate, timely recording of expenses, the entire employee reimbursement process becomes more efficient, reducing potential compliance risks and improving reimbursement turnaround time.

5. Organizing and categorizing expenses

Group expenses based on type, such as travel, meals, supplies, or training. Proper categorization helps with both internal budgeting and tax reporting.

This also simplifies the review process and ensures expenses are charged to the right departments or projects. When you keep this step systematic, your expense reimbursement reports stay clean, accurate, and aligned with policy limits.

6. Submitting the expense report for reimbursement

Use the preferred reporting method your company provides, whether it’s through a digital platform or a manual form. Make sure all details are complete—include personal info, proof of expense, and banking details.

Timely submission shows accountability and avoids delays in employee reimbursement. Double-check each field before submission to maintain data accuracy and prevent rejection or revision.

7. Review and approval

Once submitted, your expense report goes to a reviewer—usually a manager or the finance team. They verify accuracy, ensure policy compliance, and validate attached receipts. If anything seems off, you may be asked to clarify.

A smooth expense reimbursement cycle depends on a well-defined review process that includes multiple checks without being overly bureaucratic or slow.

8. Timely reimbursement

After approval, the final step is to credit the reimbursed amount to the employee’s account. Ensure your finance team processes it within the timeline set in the policy. Prompt action builds trust and encourages employees to stay compliant.

Timely employee reimbursement also supports morale, demonstrates professionalism, and avoids any negative financial impact on your team members.

What are the challenges in expense reimbursement?

1. Policy compliance

Ensuring that employees adhere to the expense reimbursement policy is one of the primary challenges. Misunderstandings or a lack of knowledge about the rules can lead to inconsistent submissions or unapproved claims.

It’s vital to have clear, accessible guidelines that all employees follow. When employees don't comply with the set standards, it can delay the employee reimbursement process and create unnecessary confusion.

2. Manual processes

Relying on manual processes for expense reimbursement can be time-consuming and prone to errors. Whether it's submitting receipts or approving reports, paper-based systems are inefficient and can slow down the overall workflow.

To avoid these pitfalls, implement automated systems that reduce human error and ensure faster employee reimbursement processing, improving accuracy and speed.

3. Lack of clarity and communication

A lack of clear communication between employees and management about expense reimbursement policies can lead to confusion. If employees don't understand the process or know what qualifies for reimbursement, it can result in delays or disputes.

Ensure that the guidelines and steps for submitting expenses are easy to follow, helping employees navigate the system efficiently and avoid frustrations.

4. Receipt management

Managing receipts for expense reimbursement can be a logistical challenge. Losing receipts or failing to capture them at the time of purchase can delay reimbursements.

Employees must be trained to capture receipts digitally or use apps that store them automatically. By organizing and ensuring proper documentation, the employee reimbursement process becomes smoother and more transparent.

5. Approval bottlenecks

Approval bottlenecks are a common issue in expense reimbursement systems. When managers or finance teams are slow to review and approve claims, it delays reimbursements and can cause frustration for employees.

To speed up the process, establish clear approval workflows and make sure all approvers understand the importance of timely action for employee reimbursement.

6. Manual audit and compliance checks

Relying on manual audits and compliance checks for expense reimbursement increases the risk of human error and inefficiencies. These processes are time-consuming and can delay reimbursements.

Automation in auditing and compliance checking speeds up the review process, ensures accuracy, and allows for more efficient employee reimbursement handling without compromising on policy enforcement.

7. Fraud prevention

Preventing fraud in expense reimbursement requires a solid internal control system. Employees may attempt to submit falsified or exaggerated claims, leading to financial losses.

A system that flags unusual claims or requires verification through receipts and other documents can prevent fraud. Ensure your employee reimbursement system includes checks to identify suspicious activity and protect company finances.

8. Limits employee's personal cash flow

Expense reimbursement can be a challenge for employees, as they often need to cover business-related costs out of pocket before receiving reimbursement. This limits their personal cash flow and may create financial strain.

To reduce this burden, implement more frequent reimbursement cycles or offer prepaid accounts to improve expense reimbursement timelines and reduce employee stress.

9. Lack of spending visibility

A lack of visibility into expense reimbursement can make it difficult to track spending patterns and control costs. When employees submit expenses without clear oversight, it becomes harder to enforce policies and ensure spending stays within budget.

Utilize software that tracks and categorizes expenses in real time, providing both management and employees with insight into employee reimbursement processes.

How to streamline the employee expense reimbursement process

1. Establish clear expense policies and guidelines

To streamline the expense reimbursement process, start by setting clear, comprehensive guidelines. Ensure employees know exactly what qualifies for reimbursement, what documentation is needed, and the timeframes for submitting claims.

Clear communication helps prevent confusion and reduces errors. Having a well-defined policy in place ensures smoother employee reimbursement and increases efficiency across the board.

2. Communicate and train employees

Communication and training are essential for a successful expense reimbursement system. Ensure employees understand the guidelines, the required documentation, and how to submit their claims.

Regular training sessions help reduce mistakes and ensure that everyone is on the same page. Proper employee education will lead to faster employee reimbursement and minimize delays or confusion in the process.

3. Implement an automated expense management system

Implementing an automated expense management system helps to reduce human error, save time, and improve accuracy in the expense reimbursement process.

With an automated system, employees can easily track and submit expenses, and finance teams can efficiently review and approve claims. Automation speeds up the employee reimbursement process, making it seamless and efficient for all parties involved.

4. Make use of a mobile expense management system

Using a mobile expense reimbursement system allows employees to submit expenses on the go, enhancing flexibility and convenience. With mobile apps, employees can capture receipts, categorize expenses, and track spending directly from their phones.

This ensures a faster, more streamlined process, improving the overall employee reimbursement experience and reducing paperwork.

5. Rely on digital receipts and electronic documentation

Encouraging the use of digital receipts and electronic documentation simplifies the expense reimbursement process. Employees can easily upload receipts and documents through an app or portal, reducing the risk of losing paper receipts.

Going paperless also speeds up the employee reimbursement process and ensures that all records are accessible and organized.

6. Streamline approval workflows

To make the expense reimbursement process more efficient, streamline the approval workflows. Designate specific approvers for different types of expenses, set automated reminders for pending approvals, and set clear timelines.

An efficient approval workflow will minimize bottlenecks and speed up the employee reimbursement process, ensuring employees receive timely reimbursements.

7. Regularly review and audit expense reports

Regularly reviewing and auditing expense reports ensures that all claims align with company policies. It helps identify any discrepancies or patterns of misuse, ensuring compliance and accuracy in the expense reimbursement process.

By maintaining a robust review process, you can improve transparency and efficiency, ultimately enhancing the employee reimbursement experience.

8. Make use of corporate cards

Using corporate cards for business expenses can help streamline the expense reimbursement process. By directly linking company credit cards to employee purchases, you reduce the need for employees to pay upfront.

Corporate cards also simplify tracking expenses and reduce the manual effort involved in processing employee reimbursement claims, saving time for both employees and the finance team.

How can corporate cards solve the challenges of expense reimbursement?

Simplified expense capture

Corporate cards simplify the expense reimbursement process by automatically recording all transactions. This eliminates the need for employees to manually track and report expenses, reducing errors.

By directly linking purchases to the company's card system, employees only need to submit their receipts and supporting documents, streamlining the employee reimbursement process and improving overall accuracy.

Enhanced policy compliance

Using corporate cards helps ensure expense reimbursement compliance with company policies. Since all transactions are directly tied to the company's card, it’s easier to monitor and enforce spending limits.

Employees can only make purchases within approved categories, ensuring adherence to guidelines. This helps prevent unauthorized expenses, improving the efficiency of employee reimbursement.

Budget allocation

Corporate cards can assist in managing budget allocation by providing real-time tracking of expenditures. As each transaction is processed through the system, it automatically updates budget figures and categorizes expenses.

This allows managers to monitor spending in different areas and ensure expenses stay within designated limits, enhancing the expense reimbursement process and maintaining budget control.

Improved receipt management

Corporate cards help improve expense reimbursement by digitizing and organizing receipts. When an employee uses a corporate card, the receipt is automatically captured and matched with the transaction.

This eliminates the need for employees to retain physical receipts, which can get lost. The digital record ensures faster, more accurate employee reimbursement processing.

Streamlined reconciliation

Corporate cards streamline the reconciliation process for expense reimbursement by directly linking all transactions to the company’s accounting system. Finance teams can quickly match purchases with receipts and categorize expenses, reducing the time spent reconciling.

This automation accelerates the approval and reimbursement process, ensuring employees are reimbursed on time.

Enhanced data analytics

Corporate cards offer enhanced data analytics capabilities that improve the expense reimbursement process. With detailed transaction data, finance teams can easily track spending patterns, identify cost-saving opportunities, and ensure compliance with company policies.

Analytics also help identify trends that can lead to more efficient employee reimbursement management, providing valuable insights for future planning.

Reduced incidents of expense fraud

Corporate cards help reduce the likelihood of expense reimbursement fraud by offering better tracking and monitoring of transactions. Each card is linked to an employee, making it easier to detect any unauthorized charges.

Fraud prevention measures such as limits on card usage, real-time transaction alerts, and automated reports improve security, ensuring safe and accurate employee reimbursement processing.

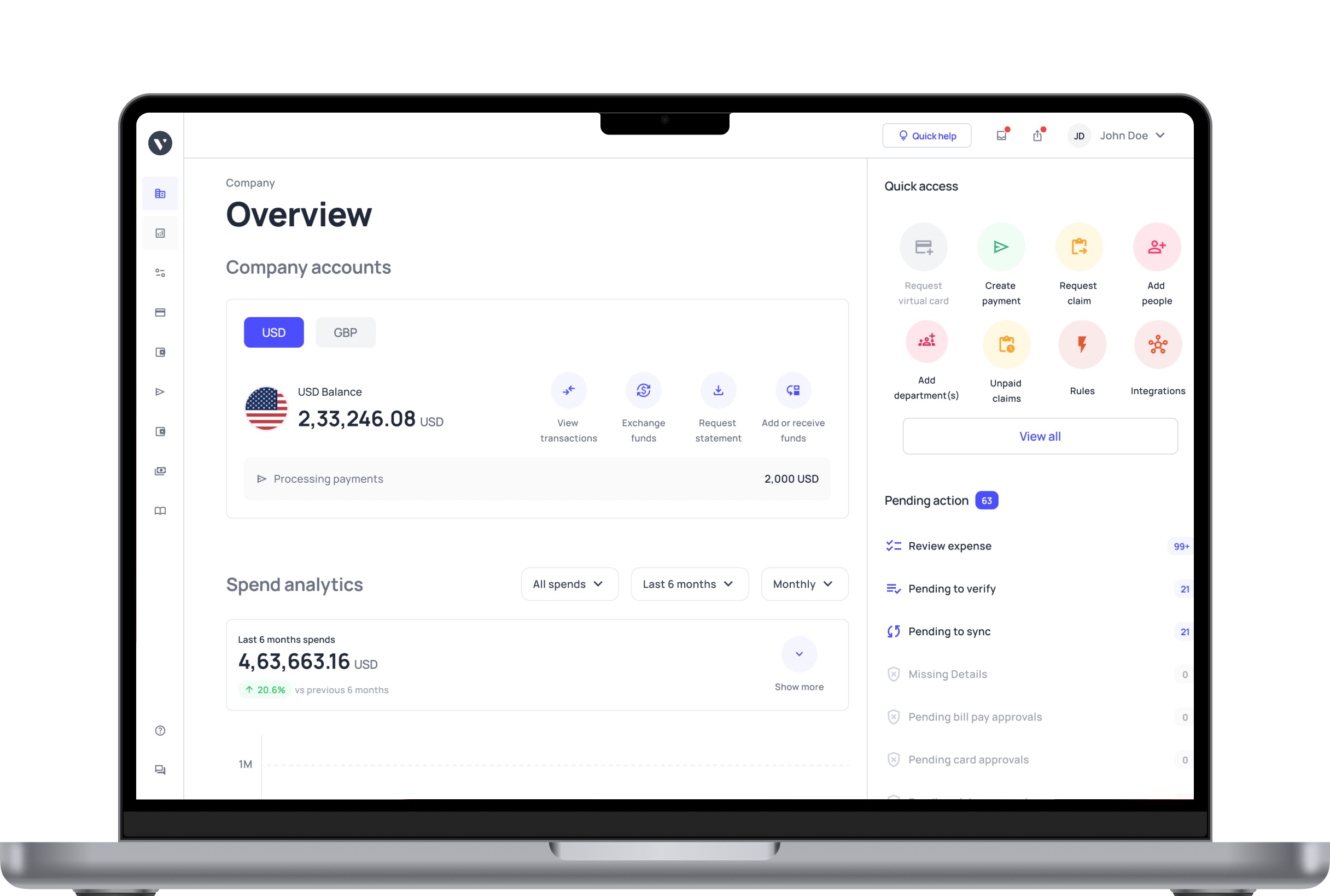

Volopay: Your all-in-one expense management solution

Real-time expense tracking

Volopay offers expense reimbursement features that allow you to track employee spending in real time. With detailed transaction data instantly available, you can easily monitor expenses and ensure they align with company budgets. This level of visibility ensures smooth employee reimbursement and a more efficient management process.

Corporate cards, both virtual and physical

Volopay provides both physical and virtual corporate cards, allowing employees to make purchases in compliance with company policies. Virtual cards are ideal for online transactions, while physical cards offer flexibility for in-person spending. This comprehensive solution improves the expense reimbursement process, ensuring accurate and timely employee reimbursement.

Unlimited virtual cards

With Volopay, you can issue unlimited virtual cards for various team members or departments. This flexibility ensures employees have access to the necessary funds for business-related expenses while maintaining control over spending limits. It simplifies the expense reimbursement process, enhancing employee reimbursement efficiency and policy compliance.

Direct accounting integration

Volopay integrates directly with your accounting system, automating the transfer of transaction data. This integration eliminates the need for manual entry, reducing the risk of errors and speeding up the expense reimbursement process. With seamless employee reimbursement integration, your finance team can handle all reimbursements efficiently and accurately.

Automatic expense report creation and analytics

Volopay automatically generates detailed expense reports with real-time analytics, offering you full transparency. This tool streamlines the expense reimbursement process, providing clear data for decision-making. With comprehensive analytics, you can easily track spending patterns and manage employee reimbursement in an organized and timely manner.

Reimbursement workflow with 4-5 levels of approvers

Volopay’s reimbursement workflow supports multiple levels of approvers, ensuring that each expense is thoroughly reviewed. With up to five approval levels, this feature ensures compliance with company policies, making the expense reimbursement process more transparent. It also allows for smoother employee reimbursement management, ensuring proper checks are in place.

Fraud protection and much more

Volopay provides enhanced fraud protection features, including transaction monitoring, two-factor authentication, and spending limits. These measures safeguard against unauthorized activity, ensuring secure expense reimbursement processes. With these tools in place, you can minimize fraud risks while improving the overall employee reimbursement experience.