Corporate credit cards for employees - Guide for US businesses

Why businesses use corporate cards?

Corporate cards for employees help streamline spending by centralizing expense management. Instead of processing countless reimbursements, companies can directly monitor transactions in real time.

This boosts efficiency, reduces manual tracking, and improves budget oversight, making the employee credit card a smart financial tool for growing US businesses.

How corporate cards fit into US business operations

Managing large-scale spends

US businesses use corporate cards to handle high volumes of employee expenses efficiently. Whether it’s for nationwide travel, software renewals, or vendor payments, these cards provide better tracking and reduce reimbursement delays.

With built-in limits and reporting features, companies can gain clearer oversight of team spending across departments and regions. This level of control allows finance teams to make more informed decisions and ensure spending stays within budget.

Supporting diverse business sizes

From startups to large enterprises with $1 M+ budgets, corporate cards scale to fit business needs. Startups benefit from easier cash flow tracking, while SMEs gain better cost control. Large enterprises can manage distributed teams and vendor relationships.

Regardless of size, having access to streamlined financial tools like the employee credit card enhances operational efficiency and financial planning.

Enhancing expense management

Corporate credit cards for employees integrate seamlessly with platforms like QuickBooks, automating the entry and categorization of transactions. This reduces accounting errors and simplifies reporting.

By syncing card data with expense tools, businesses save time on manual reconciliations and improve visibility into spending patterns, helping ensure compliance and financial accuracy. These integrations also make audits and financial reviews much easier to manage.

Card formats for flexible employee use

1. Virtual cards for online purchases

Virtual cards are ideal for digital transactions, such as $5,000 software licenses or online advertising campaigns. These cards are generated instantly and can be assigned to specific employees or departments for better control. They reduce the risk of fraud by eliminating the need to share physical card details.

Virtual cards also allow companies to track individual online purchases in real time for improved accountability.

2. Physical cards for in-person expenses

Physical cards support in-person spending needs, like $10,000 in travel bookings or hosting client meetings. They are issued to employees who frequently incur on-the-go business expenses, such as sales or field teams. These cards streamline purchases and eliminate the need for reimbursement.

Having a dedicated employee credit card enhances trust and ensures teams have the resources they need when conducting business off-site.

3. Single-use cards for security

Single-use cards are designed for one-time payments, such as a $2,000 vendor invoice or short-term project cost.

Each card is generated with a unique number and automatically expires after the transaction, reducing fraud exposure. These cards are perfect for freelance work, testing new suppliers, or trial services.

Businesses using corporate credit cards for employees can better safeguard company funds without slowing down operations.

Take control of your expenses with corporate cards

Benefits of corporate cards for employee expense management

Real-time spend visibility

Corporate credit cards for employees offer real-time tracking of expenses, allowing finance teams to instantly monitor $100,000 in company-wide transactions. This visibility ensures better budget control and immediate action if spending trends go off course.

With dashboards and notifications, teams can stay on top of department-level or individual cardholder activity. Such transparency supports smarter decision-making and prevents overspending across business units.

Eliminating reimbursement delays

Using an employee credit card helps eliminate reimbursement cycles that often delay access to funds.

Instead of waiting for approvals, employees can directly charge up to $10,000 for legitimate business expenses without tapping into personal accounts. This improves cash flow for employees and reduces administrative overhead for finance teams. It also leads to better morale, as workers aren’t burdened with fronting company costs.

Related read: Corporate credit cards a modern alternative to traditional reimbursement

Fraud prevention measures

Corporate credit cards for employees are equipped with built-in security features that help safeguard large budgets from misuse. Businesses can set transaction limits, restrict merchant categories, and receive instant alerts for unusual activity.

These controls reduce the risk of unauthorized spending and internal fraud. They also ensure financial compliance and audit readiness across all departments.

With customizable permissions, companies can align card usage with internal policies.

Boosting employee efficiency

An employee credit card streamlines the process of managing and reporting business expenses.

Instead of filling out lengthy reports for $20,000 worth of transactions, employees can categorize and submit expenses with just a few clicks. This saves hours of manual work and speeds up the accounting process.

Ultimately, it enables staff to focus more on core job responsibilities rather than paperwork. Faster approvals also lead to quicker month-end closings.

Scalability for growing businesses

As companies expand, managing $1M in annual spending becomes more complex. Corporate credit cards for employees are scalable tools that adapt to business growth, supporting new departments, regions, and cost centers.

They simplify card issuance and spend control without overwhelming finance teams. This flexibility makes the employee credit card an essential asset for any scaling organization. It also provides a consistent framework for managing expenses across a growing workforce.

Who relies on corporate credit cards in the US?

Startups

Startups in the US use corporate credit cards for employees to support lean operations with minimal overhead. These cards allow founders and small teams to manage business essentials like digital tools and travel without relying on personal funds.

With better spend visibility and built-in controls, startups maintain tighter financial discipline while staying agile. This helps them operate efficiently during early-stage growth.

Small businesses

Small businesses benefit from employee credit card programs that help manage limited budgets more effectively. By assigning cards to team members, they can track daily expenses like supplies or client lunches in real time. This minimizes reimbursement delays and improves cash flow.

Small business owners gain greater control over outgoing funds, enabling smarter spending decisions that align with tight financial plan.

Medium enterprises

Medium-sized companies rely on corporate cards to scale expense management as operations grow. With expanding teams and increasing vendor relationships, these businesses need clear oversight of where and how money is spent.

Corporate credit cards for employees simplify tracking across departments while supporting integration with accounting platforms. This ensures smooth financial workflows and better compliance as the business scales.

Large corporations

Large corporations often issue corporate cards to manage extensive employee spending across multiple locations. These cards support purchases related to travel, client entertainment, and departmental needs, sometimes totaling millions annually.

Centralized management tools ensure policy adherence and spending visibility at scale. An employee credit card system is essential for streamlining processes and maintaining financial control in complex organizational structures.

Which employees should receive corporate credit cards?

1. Sales teams

Sales professionals frequently travel for client meetings, product demos, and networking events. Providing corporate credit cards for employees in sales roles ensures they can book transport, accommodations, and meals without using personal funds.

It also improves tracking of field expenses, allowing finance teams to monitor costs tied to revenue-generating activities in real time.

2. Marketing teams

Marketing teams manage ad campaigns, events, and promotional purchases, requiring quick spending decisions. An employee credit card gives marketers autonomy to handle costs for digital ads, printing, and influencer partnerships.

With proper controls, businesses can monitor marketing budgets closely while enabling faster execution of strategies that drive brand visibility and engagement.

3. IT and tech staff

IT departments need to purchase software licenses, cloud subscriptions, and development tools. Issuing corporate credit cards for employees in tech roles allows seamless procurement of digital services. This supports uninterrupted project development and system maintenance.

It also ensures that IT spend remains transparent and within approved categories for compliance purposes.

4. Senior management

Executives often manage high-value expenses such as business travel, partner engagement, or strategic planning activities.

Providing an employee credit card to senior leaders simplifies the handling of large transactions while offering detailed oversight.

With advanced spend controls, companies can monitor high-level purchases and maintain accountability without slowing down decision-making processes.

5. Remote employees

Remote staff need access to office essentials like internet upgrades, equipment, or co-working spaces. Corporate credit cards for employees working off-site offer a flexible way to cover necessary costs.

This enables distributed teams to stay productive and ensures remote operations are supported with minimal administrative delays or reimbursement hassles.

6. Project-based contractors

Contractors working on short-term or specialized assignments often incur costs tied to specific deliverables. Issuing an employee credit card with pre-set limits ensures contractors can pay for project-related tools, materials, or travel efficiently.

It also allows companies to maintain spend transparency without processing numerous individual claims or reimbursements.

7. Logistics staff

Logistics and delivery staff regularly incur transport, toll, and fuel expenses while managing supply chains. Corporate credit cards for employees in logistics simplify day-to-day operations by enabling direct payments.

This ensures timely dispatch and reduces cash handling risks. It also allows for real-time tracking of transport costs across routes and regions.

Simplify spending with Volopay corporate cards

Corporate cards vs. business credit cards - Key differences

1. Approval process differences

Corporate cards are approved based on a company’s financial standing, such as revenue and cash flow, rather than an individual’s credit score. This makes them ideal for established businesses with consistent income.

In contrast, business credit cards often require a personal guarantee and may involve a credit check on the owner, linking business debt to personal financial history. This difference impacts how quickly a business can obtain credit access.

2. Liability structures

With corporate cards, the liability typically rests with the business entity, protecting employees and owners from personal risk.

Business credit cards, however, often assign liability to the individual who applies, meaning they’re personally responsible for any unpaid balances. This distinction impacts how companies manage risk and determines which option offers better protection in case of financial disputes.

Choosing the right liability structure is key to aligning with company policies.

3. Spending control advantages

Prepaid corporate cards provide strong control features by operating on a no-debt basis.

Businesses can preload up to $100,000 in funds, ensuring employees spend only within allocated limits. This structure prevents overspending, promotes budgeting discipline, and removes the risk of interest charges. It also simplifies reconciliation since all transactions are pre-funded and tracked in real time.

4. Suitability by business size

Corporate cards are well-suited for mid-sized to large enterprises with consistent spending and structured departments. Startups or small businesses often prefer prepaid business cards, which offer easier approval and spend control without the risk of debt.

Matching card type to business size ensures financial tools align with operational needs and administrative capacity. This alignment helps optimize financial efficiency as the business grows.

5. Cost and reward trade-offs

Prepaid corporate cards usually come with low or no annual fees, making them cost-effective for managing routine business expenses. Business credit cards, on the other hand, may offer cashback or reward points, but they often carry higher fees and interest rates.

Companies must weigh long-term costs against potential perks to determine the most beneficial solution. Careful evaluation helps avoid unnecessary expenses while maximizing financial benefits.

Must-have features in corporate card programs

1. Flexible spending limits

Corporate card programs should allow businesses to set custom spending limits tailored to departmental budgets, such as $50,000 caps for marketing or sales teams. This flexibility helps control expenses and prevents overspending within specific areas.

It also allows finance teams to enforce budget discipline while accommodating the varying needs of different departments across the organization. Adjustable limits can be updated easily as business needs change, ensuring ongoing financial control and adaptability.

2. Advanced analytics dashboards

Comprehensive analytics dashboards provide businesses with clear visibility into spending patterns and trends across all employee cards. These tools help monitor and analyze $250,000 or more in company expenses, enabling proactive budget management.

They also support identifying cost-saving opportunities and detecting unusual transactions quickly to maintain financial control. Customizable reports can be generated to meet specific management needs, improving decision-making and transparency.

3. Seamless accounting integrations

Corporate card solutions must integrate smoothly with popular accounting platforms like QuickBooks, Xero, and NetSuite. This connection automates data syncing and simplifies reconciliation, reducing manual entry errors.

By linking $250,000+ of spend data directly to accounting systems, businesses can streamline month-end closing and improve financial accuracy. Such integration also enhances real-time visibility into company finances, enabling faster financial reporting and compliance.

4. Mobile and web accessibility

Employees and finance teams benefit from mobile apps and web portals that allow management of corporate card transactions anytime, anywhere. This accessibility supports oversight of $100,000 worth of expenses on the go, making it easier to track spending and approve transactions promptly.

User-friendly interfaces enhance adoption and overall program efficiency. Push notifications and instant updates keep teams informed about spending activity, reducing delays and errors.

5. Automated receipt capture

Tools that automatically capture and store receipts reduce administrative burden by linking expense documentation to corporate card transactions. This feature is crucial for tracking $5,000 in smaller purchases, ensuring compliance and simplifying audits.

It also speeds up expense reporting and helps maintain organized records without manual paperwork. Integration with mobile cameras and email forwarding further streamlines the submission and verification of receipts.

Best practices for managing employee corporate cards

When you're looking to streamline your business operations and improve financial management, corporate credit cards present a compelling solution that addresses multiple operational challenges simultaneously.

For a deeper dive into overall strategies and techniques, explore our comprehensive guide to corporate credit card management.

1. Establishing clear policies

Businesses should create detailed corporate credit card policies outlining acceptable use, spending limits, and consequences for violations regarding employee spending up to $20,000. Clear guidelines help employees understand their responsibilities and reduce unauthorized expenses.

Well-documented policies also protect companies from financial risks and improve overall compliance. Regularly updating these policies ensures they stay relevant with evolving business needs and regulatory requirements.

2. Conducting regular audits

Monthly audits of employee transactions totaling around $100,000 can help detect discrepancies, unauthorized charges, and potential fraud early.

Regular reviews promote accountability and ensure spending aligns with company budgets and policies. This ongoing oversight strengthens internal controls and supports financial accuracy.

Audits also provide valuable insights for optimizing expense management processes.

3. Comprehensive employee training

Providing thorough training educates employees on proper corporate card use and helps prevent misuse of amounts up to $5,000. Training sessions should cover company policies, expense reporting, and security best practices.

Well-informed staff contribute to smoother expense management and reduced compliance risks. Ongoing training refreshers keep employees updated on any policy or procedural changes.

4. Streamlined approval workflows

Using automated approval systems speeds up authorization for transactions, including those near $10,000, ensuring timely processing without bottlenecks. These workflows allow managers to review and approve expenses efficiently while maintaining control.

The result is faster reimbursements and better oversight of spending. Customizable approval paths can adapt to different teams or expense types for greater flexibility.

5. Leveraging automation tools

Automation reduces manual work associated with processing $15,000 in expenses by automatically capturing receipts, categorizing transactions, and syncing data with accounting software. This minimizes errors and frees finance teams to focus on higher-value tasks.

Implementing automation improves accuracy and accelerates financial reporting. It also enhances compliance by ensuring consistent documentation and audit trails.

Challenges of employee corporate card programs

Risk of card misuse

Preventing unauthorized spending of up to $10,000 remains a significant challenge in managing corporate card programs. Without proper controls, employees may unintentionally or deliberately overspend. This can lead to financial losses and complicate budgeting efforts.

Establishing clear usage policies and conducting frequent transaction reviews are essential to mitigate misuse. Additionally, real-time monitoring tools help detect suspicious activities early.

Complexity in large teams

Handling $500,000 in expenses across 100 or more employees can create administrative difficulties. Tracking and reconciling transactions require robust systems and oversight. The complexity increases as the number of cards and expense categories grows.

Without efficient processes, finance teams may face delays and errors that impact reporting accuracy. Effective delegation and automation can help manage this complexity better.

Integration gaps

Syncing $50,000 in corporate card transactions with outdated legacy accounting systems often leads to inefficiencies. Data mismatches and manual entry are common problems. These integration gaps can cause delayed financial insights and increased administrative burdens.

Upgrading to modern platforms or middleware solutions is crucial for smooth data flow. Regular system audits ensure ongoing compatibility and accuracy.

Employee adoption barriers

Underused cards with $5,000 in potential spend can result from resistance to adopting new corporate card programs. Employees may be hesitant due to unfamiliarity or concerns over compliance.

Lack of training and unclear guidelines also contribute to low adoption rates. Proactive communication and support help encourage proper usage and maximize benefits. Incentivizing usage and demonstrating value also improve engagement.

Cost management

Controlling $25,000 in annual fees and administrative costs associated with corporate card programs can be challenging. Without careful monitoring, expenses may escalate unnecessarily.

Unexpected fees, such as late payments or card replacements, can add to the total cost.

Regularly reviewing contracts and negotiating better terms can reduce overall program expenses. Transparency in fee structures helps prevent surprises and budget overruns.

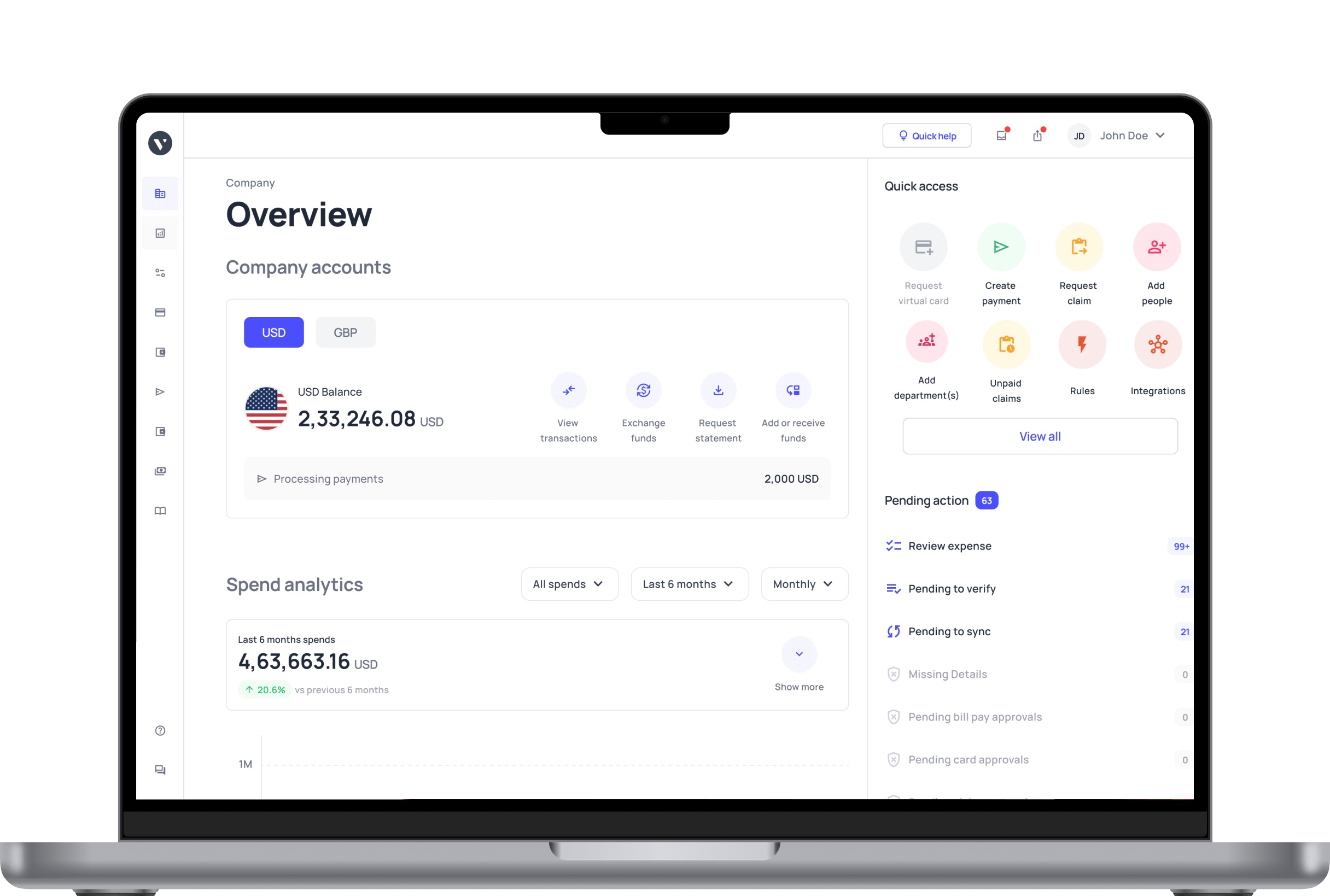

Why choose Volopay’s prepaid corporate cards?

Effortless card issuance

Volopay simplifies issuing corporate cards for employees with a quick, seamless process. Businesses can create and distribute Volopay prepaid cards instantly, reducing administrative delays.

The platform supports multiple card types, including virtual and physical cards, tailored to varied expense needs. This flexibility ensures employees get timely access to funds while maintaining company controls. It also allows companies to scale card issuance effortlessly as they grow.

Real-time transaction monitoring

Volopay’s system offers instant tracking of all employee card spending, providing businesses with complete visibility.

Finance teams receive real-time alerts for unusual activity, helping prevent unauthorized expenses. This proactive approach enables quick intervention and improved budget management.

Transparent monitoring enhances financial control and reduces reconciliation errors. It also supports audit readiness by maintaining a clear transaction history.

Robust accounting integrations

Volopay’s prepaid corporate cards integrate smoothly with popular accounting software like QuickBooks, Xero, and NetSuite. This synchronization automates expense reporting, eliminating manual data entry and reducing errors.

Businesses gain a unified view of finances, streamlining month-end closing processes. Seamless integration ensures accuracy and saves valuable time for finance teams. It further facilitates compliance with internal financial policies and external regulations.

Enhanced security controls

Volopay offers advanced security features, including the ability to freeze cards instantly and set customizable spending limits. These controls protect company funds from misuse or fraud.

Admins can also restrict merchant categories and monitor transactions closely. Such safeguards ensure that employee cards are used responsibly and securely, safeguarding business finances at all times.