Best expense management software for businesses in the US in February 2026

Managing business expenses efficiently has become a critical priority for organizations. The best expense management software transforms how businesses track, approve, and reconcile employee spending by automating manual processes that traditionally consume valuable time and resources.

Modern platforms eliminate paper receipts, spreadsheet reconciliations, and delayed reimbursements that frustrate employees and finance teams alike.

With features including automated receipt capture, real-time spend visibility, corporate card integration, and seamless accounting synchronization, these solutions deliver measurable improvements in accuracy, compliance, and operational efficiency.

For U.S. businesses facing increasing regulatory requirements and competitive pressure to optimize costs, selecting the right expense management software represents a strategic investment that impacts both financial control and employee satisfaction.

What is an expense management software?

Expense management software for businesses is a digital solution that automates and streamlines the process of tracking, submitting, and reimbursing employee expenses.

This technology eliminates manual paperwork by allowing you to capture receipts digitally, submit expense reports electronically, and route approvals through automated workflows.

By centralizing expense data, you can enforce policy compliance, detect fraudulent claims, and gain insights into spending patterns. This automation saves time, reduces errors, and enhances financial control while improving the employee reimbursement experience.

How does an expense management software work?

Expense management software operates through a systematic digital workflow that simplifies expense handling. You start by capturing receipts using mobile apps or email forwarding, where OCR technology automatically extracts relevant data like merchant name, date, and amount.

You then categorize expenses according to your company's chart of accounts and submit them through the platform. The system routes your submission through predefined approval workflows based on your organizational hierarchy and spending policies. It automatically flags policy violations or duplicate claims for review.

Once approved, the software integrates with your accounting and payroll systems to process reimbursements and update financial records. Throughout this process, you have access to real-time dashboards that display spending analytics, helping you monitor budgets, identify cost-saving opportunities, and generate compliance reports for auditing purposes.

Comparing the best expense management software providers in the US

Best expense management software in the US in 2026

The expense management software landscape in 2026 offers diverse solutions designed to streamline financial operations, reduce manual workload, and provide real-time spending visibility.

This comprehensive guide examines the leading platforms available to help you identify the solution that aligns with your organizational requirements and financial management objectives.

1. Volopay

Overview

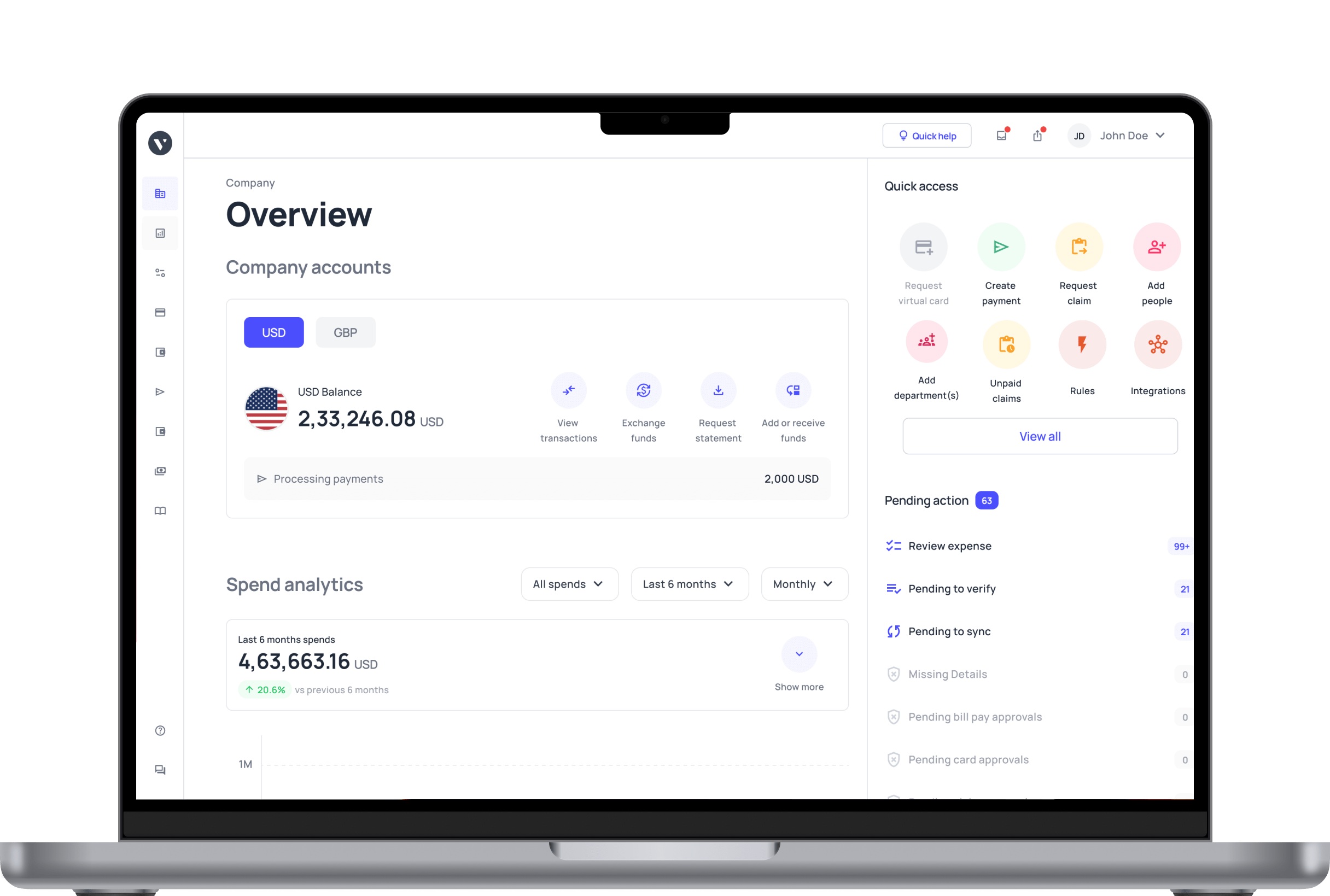

Volopay is the best expense management software provider offering an AI-powered, all-in-one financial management platform that combines corporate cards, expense tracking, bill payments, and accounting automation.

Designed for growing businesses, it provides comprehensive spend management capabilities with multi-currency support across 50+ currencies. Our platform delivers real-time visibility into company spending while streamlining approval workflows and reconciliation processes for finance teams.

Key features

Volopay provides physical and virtual corporate cards with customizable spending limits and controls. The platform features automated expense tracking with OCR-based receipt capture, multi-level approval workflows, and vendor bill payment capabilities supporting ACH, wire, and international transfers.

It offers seamless integrations with major accounting software, including QuickBooks, Xero, and NetSuite, along with robust reporting dashboards and budget management tools for comprehensive financial oversight.

Benefits

You gain complete control over company spending through real-time monitoring and automated policy enforcement. The platform significantly reduces manual data entry and reconciliation time, improving accounting accuracy.

Multi-currency support facilitates global operations, while integrated bill payments eliminate the need for separate vendor management systems, creating operational efficiency across your finance department.

Limitations

The platform may present a learning curve for organizations transitioning from basic expense systems. Pricing can be higher compared to standalone expense reporting tools. Some advanced features require custom setup and configuration.

Best for

Growing businesses and mid-market companies require integrated expense management, corporate cards, and bill payment capabilities in a single platform.

2. Ramp

Overview

Ramp delivers expense management combined with corporate card programs focused on helping businesses reduce spending. The platform leverages machine learning to identify cost-saving opportunities and automate expense categorization.

With a strong emphasis on financial intelligence, Ramp provides businesses with actionable insights to optimize their spending patterns while maintaining stringent controls and automated workflows for expense processing.

Key features

The platform offers virtual corporate cards with instant issuance and granular spending controls. Ramp's AI automatically captures receipts, categorizes transactions, and reconciles expenses in real-time.

It features automated bill payment capabilities, price intelligence that alerts you to savings opportunities, and seamless integrations with QuickBooks, NetSuite, and Sage. Advanced analytics dashboards provide spend visibility across departments and categories.

Benefits

You benefit from significant time savings through automation that eliminates manual expense report creation. The AI-driven insights help identify redundant subscriptions and negotiate better vendor rates.

Real-time spend tracking prevents budget overruns. The platform's user-friendly interface ensures high employee adoption rates, while automated policy enforcement reduces compliance issues and fraudulent expense submissions.

Limitations

Ramp primarily focuses on USD transactions with limited multi-currency functionality for international operations. The platform is optimized for US-based businesses, which may restrict global companies. Credit approval requirements can be stringent for newer businesses.

Best for

US-based startups and technology companies seeking AI-powered expense automation with strong cost-saving analytics and simplified corporate card management.

3. Brex

Overview

Brex provides comprehensive spend management software combining corporate cards, expense management, and bill payment in an integrated platform. Originally designed for startups, Brex has expanded to serve businesses of all sizes with flexible credit solutions that don't require personal guarantees.

The platform emphasizes streamlined workflows, automated reconciliation, and rewards programs tailored to business spending categories.

Key features

Brex offers both physical and virtual corporate cards with customizable controls and instant card issuance for employees. The platform features automated expense tracking, receipt matching through mobile app capture, and multi-level approval workflows.

It provides ACH and wire transfer capabilities for vendor payments, integrations with QuickBooks and NetSuite, and built-in rewards programs offering points on business purchases redeemable for travel and statement credits.

Benefits

You receive immediate access to corporate credit without personal guarantees, making it attractive for startups and growing companies. The rewards program provides tangible value for business expenses.

Automated reconciliation reduces month-end closing time significantly. Real-time spending visibility helps prevent budget overruns, while integrated bill payments consolidate financial operations within a single platform.

Limitations

Credit limits and approval are based on cash reserves and company metrics, which may restrict access for some businesses. International currency support, while available, is less comprehensive than specialized global platforms.

It also might be less suitable for traditional, bootstrapped businesses compared to larger, venture-backed startups and mid-sized companies.

Best for

Venture-backed startups and high-growth technology companies need flexible credit solutions combined with modern expense management and rewards programs.

4. Zoho Expense

Overview

Zoho Expense is part of the comprehensive Zoho suite of business applications, offering expense reporting and management capabilities with strong integration across the Zoho ecosystem.

The platform provides automated expense tracking, mileage tracking, and multi-currency support designed for businesses already utilizing Zoho products. It emphasizes affordability and ease of use while delivering essential expense management functionality for organizations of various sizes.

Key features

The software features OCR-based receipt scanning through mobile apps, customizable approval workflows, and automated expense report generation. Zoho Expense includes mileage tracking with GPS integration, per diem calculations, and corporate credit card reconciliation.

It integrates seamlessly with Zoho Books, QuickBooks, and other accounting platforms. The system supports multiple currencies and provides configurable policy compliance rules with violation alerts.

Benefits

You gain cost-effective expense management that integrates naturally with other Zoho business applications you may already use. The platform offers straightforward implementation with minimal training requirements.

Multi-level approval workflows ensure proper expense authorization. Mobile accessibility enables employees to submit expenses immediately, improving reimbursement speed and reducing lost receipts while maintaining accurate financial records.

Limitations

Zoho Expense does not offer corporate card programs, requiring integration with external card providers. The automation level is less sophisticated compared to AI-powered competitors. Advanced analytics and reporting capabilities are more limited than enterprise-focused solutions.

Best for

Small to mid-sized businesses already utilizing the Zoho ecosystem seeking affordable, straightforward expense reporting and management functionality.

5. Expensify

Overview

Expensify is an established expense management platform known for its SmartScan technology that automatically extracts receipt data and creates expense reports. The mobile-first solution emphasizes user experience and simplicity, making expense submission effortless for employees.

With widespread adoption across various industries, Expensify offers both individual and corporate expense management solutions with flexible pricing tiers to accommodate different organizational needs.

Key features

Expensify's SmartScan technology uses OCR to automatically capture receipt details and categorize expenses. The platform offers virtual corporate cards, automated expense report creation, and customizable approval workflows.

It features mileage tracking with GPS, per diem management, and integration with QuickBooks, Xero, NetSuite, and other accounting systems. Multi-currency support accommodates global operations, while policy compliance features flag violations automatically.

Benefits

You experience exceptional ease of use with minimal training required for employee adoption. The mobile app's intuitive design encourages timely expense submission, reducing administrative follow-up. SmartScan technology dramatically reduces data entry time.

Flexible pricing options accommodate businesses of various sizes. Direct reimbursement capabilities through the platform expedite payment processing and improve employee satisfaction with the expense process.

Limitations

The virtual card program has more limitations compared to comprehensive spend management platforms. Advanced spend analytics and reporting capabilities are less robust than enterprise solutions. Some users report occasional OCR accuracy issues requiring manual corrections.

Best for

Organizations of all sizes are prioritizing mobile-first expense submission with powerful receipt scanning technology and straightforward implementation.

6. Aspire

Overview

Aspire is a comprehensive financial operations platform serving businesses across Southeast Asia and expanding into broader markets. The solution combines expense management, corporate cards, bill payments, and business accounts with multi-currency capabilities.

Designed for businesses operating across multiple countries, Aspire emphasizes international payment facilitation, competitive foreign exchange rates, and integrated financial management tools for companies with regional or global operations.

Key features

Aspire provides physical and virtual corporate cards with real-time spending controls and limits. The platform features automated expense tracking with receipt capture, multi-level approval workflows, and comprehensive vendor bill payment capabilities, including international transfers.

It offers multi-currency business accounts with competitive FX rates, integrations with accounting software, and detailed spending analytics. Budget management tools enable department-level financial control and monitoring.

Benefits

You gain significant advantages in managing multi-currency operations with competitive exchange rates. The platform consolidates corporate cards, expense management, and bill payments into a unified system, reducing vendor management complexity.

Real-time visibility into cross-border transactions improves financial planning. Automated reconciliation reduces month-end closing time, while integrated payment capabilities streamline international vendor management for regionally focused businesses.

Limitations

Aspire's primary market focus is Southeast Asia, which may limit support and features for businesses operating primarily in other regions. Integration options with US-specific accounting software may be more limited. The feature set, while comprehensive, may not match the depth of specialized enterprise solutions.

Best for

Businesses with significant operations in Southeast Asia or companies requiring strong multi-currency capabilities and international payment facilitation.

7. Concur Expense

Overview

Concur Expense, part of SAP Concur, is an enterprise-grade travel and expense management solution serving large organizations with complex requirements. The platform provides comprehensive expense reporting, travel booking integration, and sophisticated compliance management capabilities.

With decades of market presence, Concur offers extensive customization options, robust audit trails, and integration with major enterprise resource planning systems, making it the preferred choice for Fortune 500 companies.

Key features

The platform features automated expense report creation, receipt capture through mobile apps and email, and advanced OCR technology. Concur Expense integrates with corporate card programs from major issuers, providing automatic transaction import and reconciliation.

It offers sophisticated multi-level approval workflows, policy compliance engines with detailed rule configuration, and integration with SAP, Oracle, and other major ERP systems. Comprehensive travel booking integration streamlines the entire travel and expense process.

Benefits

You receive enterprise-level functionality with extensive customization capabilities to match complex organizational requirements. The platform handles high transaction volumes efficiently across global operations.

Robust audit trails and compliance features satisfy stringent regulatory requirements. Deep integration with major ERP systems ensures financial data accuracy. Dedicated account management provides personalized support for implementation, training, and ongoing optimization of your expense management processes.

Limitations

Implementation complexity and timeline can be substantial, often requiring months for full deployment. The platform represents a significant financial investment with higher costs than mid-market alternatives. User interface design may feel less intuitive compared to modern, mobile-first competitors.

The system's extensive features can create a steeper learning curve for employees. Small to mid-sized businesses may find the solution over-engineered for their needs.

Best for

Large enterprises and multinational corporations require comprehensive travel and expense management with deep ERP integration and sophisticated compliance capabilities.

8. Coupa

Overview

Coupa is an enterprise spend management platform offering comprehensive procurement, invoicing, and expense management capabilities within a unified business spend management suite. The cloud-based solution serves large organizations seeking to optimize their entire spend lifecycle from requisition through payment.

Coupa emphasizes spend visibility, supplier management, and process automation across procurement and expense categories, providing finance teams with powerful analytics and control.

Key features

Coupa provides automated expense capture and reporting with mobile receipt submission and OCR technology. The platform features integration with corporate card programs, sophisticated approval workflows with policy enforcement, and comprehensive vendor management capabilities.

It offers spend analytics with AI-powered insights, budget management tools, and integration with major ERP systems, including SAP, Oracle, and NetSuite. The solution includes contract management and supplier information management functionality.

Benefits

You gain comprehensive visibility across all spending categories, including procurement, expenses, and invoicing within a single platform. Advanced analytics provide actionable insights for cost optimization and supplier consolidation.

Automated workflows reduce manual processing time significantly. The platform scales effectively for large, complex organizations with multiple entities. Supplier management capabilities streamline vendor relationships and improve negotiating leverage through consolidated spend visibility.

Limitations

Coupa represents a substantial investment appropriate primarily for large enterprises with significant spending volume. Implementation requires considerable time and resources, often spanning several months.

The platform's comprehensive functionality creates complexity that may overwhelm smaller organizations. User interface navigation can be challenging due to the breadth of features. Customer support and training resources are essential for successful adoption and ongoing utilization.

Best for

Large enterprises seek unified spend management across procurement, expenses, and invoicing with sophisticated analytics and supplier management capabilities.

9. Fyle

Overview

Fyle is a modern expense management platform emphasizing real-time expense tracking and seamless integration with existing business tools. The solution focuses on eliminating manual expense report creation through text message-based expense submission and automated receipt forwarding.

Designed for businesses seeking user-friendly expense management without extensive training requirements, Fyle prioritizes employee experience while providing finance teams with necessary controls, approvals, and integration capabilities.

Key features

Fyle enables expense submission via text message, email, or mobile app with automatic receipt extraction through OCR technology. The platform features real-time expense tracking, automated categorization based on historical patterns, and customizable approval workflows.

It integrates with QuickBooks, Xero, NetSuite, Sage Intacct, and HR systems for seamless data synchronization. Corporate card reconciliation automates transaction matching, while mileage tracking with GPS provides accurate reimbursement calculations.

Benefits

You benefit from exceptional ease of use that drives high employee adoption with minimal training investment. Text-based expense submission removes friction from the reporting process. Real-time visibility enables proactive budget management rather than retrospective analysis.

Automated categorization reduces employee burden and improves accuracy. The platform's integration capabilities ensure smooth data flow to accounting systems, reducing manual data entry and reconciliation time for your finance team.

Limitations

Fyle does not provide corporate card programs, requiring integration with external card issuers. Advanced analytics and reporting capabilities are less comprehensive than enterprise-focused solutions. While integration options are solid, they may not cover all niche accounting or ERP systems.

Best for

Small to mid-sized businesses seeking user-friendly expense management with minimal employee training requirements and strong accounting system integration.

10. Sage

Overview

Sage offers the best expense management software as part of its comprehensive accounting and business management suite, providing expense tracking and reporting capabilities integrated with Sage's financial management products.

The solution serves businesses already utilizing Sage accounting software, offering native integration that eliminates data synchronization challenges. With a focus on accuracy, compliance, and financial control, Sage Expense Management delivers essential functionality for organizations prioritizing seamless accounting integration.

Key features

The platform provides mobile receipt capture with OCR technology, automated expense report generation, and customizable approval workflows. Sage Expense Management features mileage tracking, per diem calculations, and corporate card reconciliation with automatic transaction import.

Native integration with Sage Intacct, Sage 50, and Sage 100 ensures seamless financial data synchronization. The system supports multi-currency expenses, policy compliance enforcement, and comprehensive audit trails for financial review.

Benefits

You gain seamless integration with Sage accounting products, eliminating manual data transfer between systems. The platform provides reliable expense tracking with strong financial controls and audit capabilities. Implementation is straightforward for organizations already using Sage software.

Compliance features help enforce corporate policies and identify violations. The solution offers stable, proven technology backed by Sage's established reputation in business financial management.

Limitations

The platform is optimized primarily for Sage ecosystem users, limiting appeal for organizations using alternative accounting software. User interface design may feel less modern compared to newer, mobile-first competitors. Advanced automation capabilities and AI-powered features are limited relative to specialized expense platforms.

Best for

Organizations currently utilizing Sage accounting software seeking native expense management integration with their existing financial systems.

11. Rippling

Overview

Rippling is a comprehensive workforce management platform that includes expense management as part of its broader HR, payroll, and IT administration suite. The solution enables businesses to manage employee expenses alongside other workforce functions within a unified system.

With emphasis on automation and integration, Rippling connects expense data with payroll processing, enabling direct reimbursement through regular payroll cycles while providing finance teams with necessary visibility and control.

Key features

Rippling provides expense submission through mobile apps with receipt capture and OCR technology. The platform features automated expense categorization, customizable approval workflows based on organizational hierarchy, and corporate card integration with automatic reconciliation.

It offers seamless payroll integration for reimbursement processing, policy compliance enforcement with violation alerts, and integration with accounting software, including QuickBooks and Xero. Multi-level approvals ensure proper expense authorization based on company policies.

Benefits

You benefit from unified employee data management across HR, payroll, and expenses within a single platform, eliminating data silos. Direct payroll integration streamlines reimbursement processing without separate payment runs.

The platform's comprehensive approach reduces vendor management complexity by consolidating multiple business functions. Automated workflows minimize administrative overhead. Employee onboarding automatically provisions expense management access along with other system permissions.

Limitations

Expense management functionality is less comprehensive than specialized platforms focused exclusively on spend management. The solution requires adoption of Rippling's broader workforce management platform, which may not suit organizations satisfied with existing HR and payroll systems.

Advanced expense analytics and reporting capabilities are more basic than dedicated expense solutions. Corporate card programs are integrated rather than proprietary, limiting control and customization options.

Best for

Businesses seeking unified workforce management, including HR, payroll, and basic expense management within a single integrated platform.

12. Airbase by Paylocity

Overview

Airbase, now part of Paylocity, is a comprehensive spend management platform combining expense management, bill payments, corporate cards, and procurement in an all-in-one solution.

The platform emphasizes control and visibility across all business spending categories, enabling finance teams to manage budgets, enforce policies, and streamline approvals. With a focus on modern finance operations, Airbase provides accounting automation and integration capabilities designed to eliminate manual processes.

Key features

Airbase offers virtual and physical corporate cards with customizable spending limits and controls. The platform features automated expense tracking with receipt capture, procurement request management, and comprehensive vendor bill payment capabilities, including ACH and wire transfers.

It provides multi-level approval workflows, budget management with real-time tracking, and integration with QuickBooks, NetSuite, Sage Intacct, and Xero. Automated accounting synchronization eliminates manual journal entries and reconciliation work.

Benefits

You gain unified visibility and control across all spending categories, including expenses, procurement, and vendor payments within one platform. Automated workflows reduce manual approval and processing time significantly. Real-time budget tracking prevents overspending before it occurs.

Integration with accounting systems eliminates manual data entry and month-end closing delays. The platform provides comprehensive audit trails and reporting capabilities that strengthen financial controls and simplify compliance requirements.

Limitations

Implementation complexity may require several weeks for proper configuration and employee training. The comprehensive feature set can be overwhelming for organizations seeking simple expense reporting functionality.

Pricing reflects the platform's all-in-one capabilities, which may exceed budgets for smaller businesses. Integration options, while solid for major accounting platforms, may not cover specialized or legacy systems.

Best for

Mid-market companies seeking comprehensive spend management, consolidating expenses, procurement, corporate cards, and bill payments into a single integrated platform.

13. Emburse

Overview

Emburse provides expense management and accounts payable automation solutions serving businesses of various sizes across multiple industries. The platform, which includes products like Emburse Spend and Emburse Certify, offers flexible deployment options to match different organizational requirements.

With emphasis on automation, policy compliance, and integration capabilities, Emburse delivers expense tracking, corporate card management, and reporting functionality designed to reduce administrative burden for finance teams.

Key features

The platform features mobile receipt capture with OCR technology, automated expense report creation, and customizable approval workflows. Emburse provides corporate card integration with automatic transaction reconciliation, mileage tracking with GPS, and per diem management.

It offers integration with major accounting systems, including QuickBooks, NetSuite, and Sage, along with comprehensive policy compliance engines that flag violations automatically. Multi-currency support accommodates international operations and reporting requirements.

Benefits

You receive flexible solutions that can be configured to match your specific business requirements and processes. Automation capabilities significantly reduce manual data entry and processing time. The platform's policy engine helps enforce compliance and identify fraudulent submissions.

Integration with major accounting systems ensures accurate financial records. Emburse offers multiple product tiers, allowing you to select functionality that matches your organizational needs without paying for unnecessary features.

Limitations

User interface design may feel less intuitive compared to modern, mobile-first competitors. Implementation timelines can extend longer than simpler alternatives, particularly for enterprise configurations. Advanced features require higher-tier subscriptions, increasing costs.

Best for

Mid-market to enterprise organizations seeking flexible expense management solutions with strong policy compliance and integration capabilities across various accounting systems.

14. Spendesk

Overview

Spendesk is a Europe-based spend management platform expanding into international markets, offering expense management, corporate cards, and invoice processing in a unified solution. The platform emphasizes proactive spending control through pre-approval workflows and real-time visibility into company spending.

With a focus on modern user experience and financial control, Spendesk provides finance teams with tools to manage budgets, enforce policies, and streamline approval processes across all spending categories.

Key features

Spendesk provides physical and virtual corporate cards with granular spending controls and real-time limits. The platform features automated expense tracking with receipt capture, pre-approval workflows for purchases, and comprehensive vendor invoice management.

It offers integration with accounting software, including QuickBooks, Xero, and NetSuite, along with multi-currency support for international operations. Budget management tools enable department-level spending control, while automated reconciliation reduces month-end closing time significantly.

Benefits

You gain proactive spending control through pre-approval workflows that prevent unauthorized expenses before they occur. Real-time visibility enables immediate budget adjustments and informed financial decisions. The platform's intuitive interface drives high employee adoption with minimal training.

Unified management of expenses, cards, and invoices reduces vendor complexity. Automated accounting synchronization eliminates manual data entry and improves financial accuracy across your organization.

Limitations

Spendesk's market presence is stronger in Europe than in North America, which may affect feature prioritization and support availability for US-based businesses. Integration options may be more limited for US-specific accounting software and banking systems.

Pricing can be higher than basic expense reporting tools while offering fewer features than comprehensive enterprise solutions.

Best for

Growing businesses and mid-market companies seeking modern spend management with strong pre-approval workflows and unified expense, card, and invoice management.

Why expense management tools matter today

Digital transformation and the shift to remote work have fundamentally altered how businesses handle expenses. Traditional paper-based processes are no longer viable when employees operate from multiple locations and submit expenses digitally.

Expense management software has become essential for maintaining control over distributed spending while ensuring compliance with evolving tax regulations and internal policies. Rising business complexity, increased scrutiny on financial controls, and the need for real-time spend visibility have elevated these platforms from optional tools to critical infrastructure.

Modern organizations require automated workflows, instant approval capabilities, and integrated financial systems to remain competitive. The ability to track spending across departments, enforce budgets proactively, and generate compliance-ready reports has transformed expense management from an administrative burden into a strategic advantage that directly impacts profitability and operational efficiency.

Importance of expense management software for U.S. businesses

1. Controlling rising business costs

Expense management software enables you to identify spending patterns, eliminate redundant subscriptions, and negotiate better vendor rates through consolidated spend visibility.

Real-time tracking prevents budget overruns by alerting you to unusual expenditures before they escalate.

Automated regulatory policy enforcement reduces fraudulent expense claims and non-compliant purchases, directly protecting your bottom line while providing actionable insights for cost optimization initiatives.

2. Streamlining expense approvals

Automated approval workflows route expense reports to appropriate managers based on predefined rules, eliminating email chains and manual routing.

You can configure multi-level approvals based on expense amount, category, or department, ensuring proper authorization without administrative delays.

Mobile approval capabilities enable managers to review and authorize expenses from anywhere, accelerating the entire process and reducing employee frustration with reimbursement delays.

3. Improving spend visibility

Real-time dashboards provide immediate visibility into company-wide spending across departments, categories, and employees.

You can track business budget utilization as it happens rather than discovering overruns during month-end closing.

Comprehensive expense reporting capabilities enable you to analyze spending trends, identify cost-saving opportunities, and make informed financial decisions based on accurate, up-to-date data rather than outdated financial statements.

4. Ensuring IRS compliance

An expense management system maintains detailed audit trails with timestamps, approval records, and receipt documentation that satisfy IRS substantiation requirements.

Automated categorization ensures expenses are classified correctly for tax reporting purposes.

The system enforces IRS mileage rates, per diem limits, and receipt requirements automatically, reducing audit risk while ensuring your organization maintains compliant records for the required retention periods.

5. Speeding up reimbursements

Automated processing eliminates manual data entry and reconciliation delays that traditionally slow reimbursements.

Payroll system integration enables direct deposit reimbursements on regular pay cycles, improving employee satisfaction.

Real-time expense submission through mobile apps means employees can report expenses immediately rather than accumulating receipts for month-end submission, accelerating the entire reimbursement lifecycle from submission to payment.

6. Unifying cards and payments

Modern platforms consolidate corporate card management, expense reporting, and vendor bill payments within a single system.

You eliminate the need for separate card reconciliation processes by automatically matching transactions with receipts.

Virtual cards with transaction-specific limits provide enhanced security and control. This unification reduces vendor management complexity, streamlines accounting workflows, and provides comprehensive visibility across all payment methods.

7. Supporting remote & hybrid teams

Cloud-based platforms enable remote employees to submit expenses from anywhere using mobile devices. Digital receipt capture eliminates the need for physical documentation storage and mailing.

Virtual cards give remote workers instant purchasing power without upfront cash.

Real-time synchronization ensures finance teams maintain visibility and control regardless of employee location, making distributed workforce management seamless.

8. Enhancing financial forecasting

Historical spending data and trend analysis improve budget accuracy for future periods. Real-time visibility into current spending enables more precise cash flow projections. Category-level spending patterns help you anticipate seasonal variations and plan accordingly.

Integration with accounting systems ensures forecast models incorporate actual expense data rather than estimates, resulting in more reliable financial planning and improved strategic decision-making capabilities.

Key features of modern expense management software

Receipt capture and OCR scanning

Optical character recognition technology automatically extracts merchant names, dates, amounts, and tax information from receipt images captured through mobile apps or email forwarding. This eliminates manual data entry, reduces errors, and accelerates expense report creation.

Advanced OCR systems recognize multiple receipt formats and currencies, handling crumpled or low-quality images while maintaining high accuracy rates for seamless expense processing.

Automated approval workflows

Configurable workflow engines route expense reports to appropriate approvers based on amount thresholds, expense categories, departments, or custom business rules. Multi-level approval chains ensure proper authorization for significant expenditures.

Automatic escalation prevents bottlenecks when approvers are unavailable. Policy violation flags alert reviewers to non-compliant expenses, enabling informed approval decisions while maintaining audit trails for compliance and financial control purposes.

Integration with accounting systems and ERP

Seamless connectivity with QuickBooks, Xero, NetSuite, Sage Intacct, SAP, and Oracle eliminates manual data transfer between systems. Automated synchronization updates general ledger accounts, cost centers, and project codes in real-time.

Bidirectional integration ensures the chart of accounts, vendor lists, and employee data remain consistent across platforms. This integration reduces month-end closing time, improves financial accuracy, and eliminates reconciliation discrepancies.

Real-time analytics and dashboards

Interactive dashboards display current spending against budgets across departments, categories, and time periods. Customizable reports provide insights into spending patterns, policy violations, and cost-saving opportunities.

Drill-down capabilities enable detailed transaction analysis. Scheduled report delivery keeps stakeholders informed without manual report generation. Executive summaries present key metrics while detailed analytics support in-depth financial analysis for strategic decision-making.

Multi-currency and global support

Platforms supporting a larger number of currencies enable international operations with automatic exchange rate application at transaction time. Consolidated reporting converts all expenses to your base currency for unified financial analysis.

Compliance with regional tax regulations and receipt requirements ensures proper documentation across jurisdictions. Multi-entity support accommodates complex organizational structures with subsidiaries operating in different countries and regulatory environments.

Benefits of expense management software for businesses

Reduces time spent on manual data entry and reconciliation

Automated receipt capture and OCR technology eliminate the need for employees to manually type transaction details into expense reports. Automated categorization applies historical patterns to new expenses, reducing review time.

Integration with accounting systems eliminates redundant data entry, allowing your finance staff to focus on strategic analysis rather than administrative processing tasks.

Improves accuracy and compliance

Automated systems eliminate human errors associated with manual data transcription and calculations. Policy engines enforce spending limits, receipt requirements, and approval hierarchies consistently across all submissions.

Real-time validation flags duplicate expenses, missing documentation, and policy violations before reports reach approvers. Comprehensive audit trails with timestamps and approval records ensure compliance with tax regulations and internal controls, reducing audit risk and potential penalties.

Provides better insights for budgeting and decision-making

Expense management software for businesses delivers real-time analytics that transform spending data into strategic intelligence. Comprehensive dashboards reveal spending patterns across departments, vendors, and categories, enabling informed budget allocation decisions.

Trend analysis identifies cost-saving opportunities and seasonal spending variations. Predictive insights help you anticipate future expenses more accurately.

Enhances employee experience with faster reimbursements

Mobile expense submission enables employees to report expenses immediately rather than accumulating receipts for weeks. Automated workflows accelerate approval processes, reducing reimbursement cycles from weeks to days.

Integration with payroll systems enables direct deposit reimbursements on regular pay schedules. Clear policy communication within the platform reduces confusion and rejected submissions.

Who should use an expense management software

1. Small and medium-sized businesses

Small and medium-sized businesses gain immense value from expense automation due to limited finance staff resources.

These platforms remove manual bottlenecks, enabling lean teams to manage growing transaction volumes efficiently. Affordable pricing make enterprise-grade functionality accessible to smaller organizations.

Early implementation establishes proper financial controls and processes that scale as your business grows, preventing the need for disruptive system migrations later.

2. Enterprises with large, multi-location expenses

Large organizations with hundreds or thousands of employees require sophisticated expense management to maintain control and visibility.

Complex approval hierarchies, multiple cost centers, and diverse expense categories demand automated workflow engines and robust reporting capabilities.

Multi-location operations require consolidated visibility across geographies, currencies, and legal entities while maintaining compliance with regional regulations.

3. Remote and hybrid workforces

Distributed workforces require cloud-based expense management that functions seamlessly regardless of employee location.

Mobile-first platforms enable remote workers to submit expenses immediately using smartphone cameras. Virtual corporate cards provide purchasing power without requiring physical card distribution.

Digital workflows eliminate the need for physical receipt submission, making expense management as efficient for remote employees as office-based staff.

How to choose the best expense management software for your business

Identify your business needs

Begin by documenting your current expense management pain points, transaction volumes, and specific requirements.Determine whether you need corporate cards, bill payment capabilities, or solely expense reporting functionality.

Consider your approval hierarchy complexity, policy enforcement requirements, and reporting needs. Assess whether multi-currency support, travel integration, or mobile capabilities are essential.

Evaluate automation capabilities

Assess how comprehensively each platform automates expense workflows from receipt capture through accounting integration. Compare OCR accuracy, automatic categorization intelligence, and policy enforcement sophistication.

Evaluate whether approval routing adapts dynamically based on expense characteristics. Examine reconciliation automation for corporate cards and the extent of accounting system integration.

Assess integration with existing systems

Verify that prospective platforms integrate seamlessly with your accounting software, ERP system, payroll provider, and HR management tools. Examine whether integrations are native, API-based, or require third-party middleware.

Evaluate synchronization frequency, data mapping flexibility, and bidirectional update capabilities. Poor integration creates manual data transfer requirements that negate automation benefits.

Prioritize ease of use and adoption

User-friendly platforms drive higher employee adoption and reduce training requirements. Evaluate mobile app intuitiveness, receipt capture simplicity, and expense submission workflow clarity.

Consider whether the interface feels modern and responsive compared to the existing tools your employees use. Request trial access for representative employees to gather feedback on usability.

Check compliance, security, and reporting

Verify that platforms maintain audit trails meeting IRS substantiation requirements and support your industry-specific compliance needs. Evaluate data encryption standards, access controls, and security certifications such as SOC 2 compliance.

Assess reporting flexibility, including custom report creation, scheduled delivery, and export options. Confirm the platform supports your required retention periods and provides the necessary documentation for tax audits.

Consider scalability and flexibility

Select platforms that accommodate your projected growth in employee count, transaction volume, and organizational complexity. Evaluate whether pricing models scale affordably as usage increases.

Assess configuration flexibility for policy modifications, approval workflow changes, and custom expense categories. Determine whether the platform supports multi-entity structures if future acquisitions or international expansion are anticipated.

How to implement an automated expense management platform

1. Assess current expense processes

Conduct a comprehensive audit of your existing expense workflows, documenting each step from submission to reimbursement and accounting entry. Interview employees across departments to identify pain points, bottlenecks, and inefficiencies in current processes.

Measure baseline metrics, including average processing time, reimbursement cycles, error rates, and administrative costs. Analyze expense volumes by category, department, and employee to understand usage patterns.

2. Define automation goals and metrics

Establish specific, quantifiable objectives such as reducing expense processing time by fifty percent, achieving three-day reimbursement cycles, or decreasing policy violations by specific percentages.

Define key performance indicators, including submission-to-approval time, reconciliation accuracy rates, employee satisfaction scores, and finance team hours saved. Determine how you will collect data and measure progress against these metrics.

3. Choose the right software partner

Evaluate expense management software for businesses based on your specific requirements, budget constraints, and technical infrastructure. Request demonstrations focused on your use cases rather than generic presentations.

Verify integration capabilities with your existing accounting, payroll, and banking systems through technical discussions. Assess vendor stability, customer support quality, implementation assistance, and training resources.

4. Integrate with accounting and payroll systems

Work with your IT team and software vendor to establish seamless data connections between the expense platform and existing financial systems. Configure field mapping to ensure expenses flow to appropriate general ledger accounts, cost centers, and projects automatically.

Test bidirectional synchronization to verify employee data, approval hierarchies, and the chart of accounts remain consistent across platforms.

5. Train teams for smooth adoption

Develop role-specific training programs addressing the needs of employees, approvers, finance administrators, and executives separately. Combine live training sessions with recorded tutorials, written guides, and interactive demonstrations, accommodating different learning preferences.

Schedule training close to launch rather than weeks in advance to maximize retention. Create quick reference guides for common tasks and establish clear support channels for questions.

6. Monitor usage and optimize continuously

Track adoption metrics, including submission rates, mobile app usage, and feature utilization during initial rollout phases. Gather user feedback through surveys, focus groups, and support ticket analysis to identify friction points requiring attention.

Review system-generated reports highlighting policy violations, approval bottlenecks, and processing delays. Adjust workflows, policies, and configurations based on actual usage patterns rather than initial assumptions.

Expense management software implementation: Best practices

Involve key stakeholders early

Engage finance leadership, IT teams, department managers, and representative employees from the beginning of the selection process through implementation planning.

Solicit input on requirements, workflow design, and policy configurations to ensure the solution addresses real organizational needs.Assign clear roles and responsibilities for implementation tasks, training delivery, and ongoing administration.

Customize your workflows

Recognize that different departments have unique expense patterns and approval requirements necessitating tailored workflows.Sales teams may require higher spending limits and expedited approvals for client entertainment, while operations need equipment purchase workflows.

Configure the best expense management software provider's platform with department-specific rules, approval hierarchies, and policy exceptions that reflect actual business needs.

Ensure data accuracy & security

Establish data governance protocols ensuring employee information, approval hierarchies, and financial data remain accurate across integrated systems.Implement role-based access controls, limiting system access to appropriate personnel based on job responsibilities.

Enable multi-factor authentication for enhanced security, particularly for users with administrative privileges or approval authority.Regularly audit user access rights, removing permissions for terminated employees or role changes.

Set up clear approval hierarchies

Define approval chains based on expense amount, category, department, and organizational structure that balance control with efficiency. Establish escalation rules preventing bottlenecks when primary approvers are unavailable due to vacation or other absences.

Configure delegation capabilities allowing managers to temporarily assign approval authority to designees.Clear hierarchies ensure proper financial controls while preventing delays that frustrate employees waiting for reimbursement and reducing the administrative burden on approvers.

Establish a feedback loop for users

Create multiple channels for users to report issues, suggest improvements, and share experiences, including surveys, dedicated email addresses, and regular user group meetings. Respond promptly to feedback, demonstrating that user input drives meaningful changes. Track common questions and pain points to identify areas requiring additional training or process refinement.

Continuous feedback mechanisms foster engagement, identify optimization opportunities, and demonstrate organizational commitment to user experience.

Measure ROI post-implementation

Compare post-implementation metrics against baseline measurements established during initial assessment, including processing time reductions, reimbursement cycle improvements, and error rate decreases.

Calculate hard cost savings from reduced administrative labor, eliminated manual processes, and improved policy compliance. Assess soft benefits, including employee satisfaction improvements, better financial visibility, and enhanced decision-making capabilities.

How expense management software solves common business expense challenges

The human cost of poor expense processes

Manual expense management extends far beyond inefficiency. It can profoundly impact employee well-being and organizational health. Finance professionals spend countless hours on repetitive data entry, receipt matching, and error correction, creating chronic stress and diminishing job satisfaction.

Employees waiting weeks for reimbursements experience financial strain and feel undervalued by their organization. The mental burden of tracking receipts, remembering submission deadlines, and navigating unclear policies creates persistent low-level anxiety that erodes morale.

Finance teams face decision fatigue from processing hundreds of expense reports, leading to inconsistent policy application and approval decisions. This cognitive exhaustion reduces capacity for strategic financial planning and analysis. The psychological toll manifests in burnout, increased turnover, and decreased productivity across the organization.

The true value of automated expense management lies not merely in cost savings but in restoring dignity to work, reducing organizational stress, and enabling employees to focus their talents on activities requiring human judgment and creativity rather than mechanical data transcription.

The psychological toll of manual data entry on small business owners

Stress and burnout from repetitive tasks

Manual data entry transforms expense management into soul-crushing, repetitive work that provides no intellectual stimulation or sense of accomplishment. Small business owners experience burnout when valuable time disappears into mechanical tasks that feel meaningless compared to their entrepreneurial vision.

The psychological weight of knowing this work never ends—receipts continuously accumulate regardless of how many hours are spent processing—creates hopelessness and exhaustion that extends beyond expense management into general business operations.

Cognitive load and decision fatigue

Managing expenses manually requires continuous micro-decisions about categorization, receipt organization, and data entry timing that deplete cognitive resources needed for strategic business decisions.

Small business owners experience decision fatigue from hundreds of mundane choices during expense processing, reducing their capacity for important judgments about hiring, investments, and business direction. This mental exhaustion diminishes decision quality across all business functions, potentially impacting the company's trajectory and success.

Anxiety over errors and compliance risks

The fear of miscategorized expenses, mathematical errors, or inadequate documentation for tax audits creates persistent anxiety for small business owners who lack accounting expertise. This worry intensifies during tax season when the consequences of poor expense tracking become tangible.

Business owners lie awake worrying about potential IRS penalties, missed deductions, or inaccurate financial statements that could affect loan applications. This anxiety undermines well-being and creates avoidance behaviors that worsen the underlying problem.

Opportunity cost of time spent on manual entry

Every hour devoted to manual expense entry represents time unavailable for customer acquisition, product development, or strategic planning that directly drives business growth. Small business owners viscerally understand this trade-off, creating resentment and frustration toward administrative tasks that feel like obstacles to success.

The psychological burden of constantly choosing between critical business activities and necessary bookkeeping creates guilt regardless of which receives attention, undermining satisfaction with entrepreneurial endeavors.

Decreased employee morale and retention risks

When small business owners are visibly stressed and overwhelmed by administrative burdens, including expense management, this anxiety permeates the organization and affects employee morale.

Team members observe their leader drowning in paperwork rather than leading strategically, creating doubt about business stability and direction. Some employees may even feel guilty submitting legitimate expenses, knowing it adds to the owner's burden, potentially leading to unreported costs.

5 ways to reduce time spent on manual bookkeeping

Centralize receipt capture & submission

Implement mobile receipt capture, allowing employees to photograph and submit receipts immediately after purchase rather than accumulating paper documents.

Centralized digital repositories eliminate lost receipts, reduce follow-up requests, and enable immediate expense processing. Email forwarding options accommodate various submission preferences while ensuring all documentation flows to a single system.

Automate approval and reimbursement workflows

Configure automated routing that delivers expense reports to appropriate approvers based on predefined business rules without manual intervention. Eliminate email chains and manual tracking by enabling one-click approvals through mobile notifications.

Integrate approvals with reimbursement processing so approved expenses automatically trigger payment through payroll or direct deposit.

Use corporate cards & pre-set spending rules

Issue corporate cards to employees with predefined spending limits and category restrictions that prevent non-compliant purchases at the point of sale, rather than discovering violations during expense review.

Automatic transaction feeds eliminate manual expense report creation for card purchases. Real-time spending visibility enables proactive budget management rather than reactive corrections.

Integrate expense data with your accounting stack

Establish seamless connections between expense management platforms and accounting software to automatically transfer approved expenses into appropriate general ledger accounts, eliminating manual journal entries.

Bidirectional integration ensures the chart of accounts, vendor lists, and employee data remain synchronized across systems without duplicate maintenance. Real-time data flow enables current financial reporting without waiting for month-end expense processing.

Leverage analytics & insights to reduce future work

Utilize automated spend analytics to identify patterns enabling proactive policy adjustments that reduce exceptions requiring manual review. Analyze recurring expenses to establish vendor payment schedules or corporate accounts that eliminate individual transaction processing. Review category-level spending to identify opportunities for consolidated purchasing or negotiated contracts.

Data-driven insights transform reactive expense processing into strategic spend management that systematically reduces future bookkeeping volume and complexity while optimizing organizational spending.

Common mistakes businesses make with expense management

1. Relying solely on spreadsheets

Organizations persisting with spreadsheet-based expense tracking face significant scalability limitations, error susceptibility, and compliance risks. Spreadsheets require manual data entry for every transaction, lack automated controls to enforce policies, and provide no audit trails documenting approval chains. Version control issues create confusion about which spreadsheet contains the current data.

Avoid it by: Transitioning to dedicated expense management software that provides automated data capture, built-in controls, comprehensive audit trails, and seamless accounting integration, eliminating the limitations and risks inherent in spreadsheet-based processes.

2. Poor adoption among employees

Implementing sophisticated expense management software delivers minimal value when employees continue using old processes or submit expenses sporadically. Poor adoption stems from inadequate training, complicated user interfaces, unclear communication about process changes, or failure to address employee concerns during implementation.

Avoid it by: Prioritizing user experience during vendor selection, providing comprehensive role-specific training, communicating benefits clearly, establishing feedback mechanisms, designating department champions, and celebrating early adopters to create momentum that drives organization-wide adoption and engagement.

3. Ignoring policy enforcement and compliance rules

Organizations implementing expense management systems without configuring robust policy controls and compliance rules fail to prevent violations, resulting in continued manual review burdens and compliance exposure. Generic policy settings don't reflect specific organizational requirements, approval hierarchies, or regulatory obligations.

Avoid it by: Investing time to configure detailed policy rules reflecting your organizational requirements, spending limits, approval hierarchies, and compliance obligations. Enable automated violation flagging, establish clear escalation procedures, and regularly audit policy effectiveness, adjusting configurations based on actual compliance patterns and business needs.

4. Choosing a tool without integration capabilities

Selecting expense management platforms that don't integrate with existing accounting software, payroll systems, and banking partners creates data silos requiring manual information transfer between systems. This negates automation benefits and introduces reconciliation errors. Lack of integration prevents real-time financial visibility and extends month-end closing processes.

Avoid it by: Thoroughly evaluating integration capabilities during vendor selection, requesting technical demonstrations of actual data flow between your existing systems and prospective platforms, verifying integration depth beyond basic export-import functionality, and confirming the vendor's commitment to maintaining integrations as your software ecosystem evolves.

Measuring ROI of expense management software

Saves time on bookkeeping and approvals

Automated expense management dramatically reduces administrative hours spent on data entry, receipt matching, and approval coordination. Finance teams reclaim time previously consumed by manual processes, redirecting effort toward strategic financial analysis and planning.

Organizations typically experience fifty to seventy percent reductions in expense processing time, translating to substantial labor cost savings and enabling lean finance teams to manage growing transaction volumes without additional headcount.

Example: A mid-sized consulting firm can reduce expense processing time from 40 hours to 12 hours monthly after implementing automated workflows and OCR receipt capture, saving upwards of $1,500 per month in finance process costs while enabling the same team to support thirty percent business growth without additional hiring.

Reduces error rates and audit issues

Manual data entry and calculation errors create reconciliation nightmares, inaccurate financial statements, and audit complications that consume excessive time to resolve. Automated systems eliminate transcription errors, enforce mathematical accuracy, and maintain comprehensive audit trails.

Organizations report error rate reductions of eighty to ninety percent post-implementation, directly reducing audit preparation costs and minimizing the risk of tax penalties from miscategorized expenses or inadequate documentation.

Example: A manufacturing company can reduce expense report errors from 18% to only 2% after automation, eliminating an average of 25 hours monthly spent correcting mistakes and preventing thousands of dollars spent on potential IRS penalties from improved tax deduction documentation and substantiation.

Employee satisfaction and retention impact

Faster reimbursements, simplified submission processes, and reduced administrative friction significantly improve employee satisfaction with expense management. Organizations implementing modern expense management systems report measurably higher Net Promoter Scores and reduced turnover among expense-submitting roles.

When employees feel valued through prompt reimbursements and efficient processes, overall organizational morale improves, reducing costly turnover that impacts business continuity and institutional knowledge retention.

Example: A technology startup can reduce average reimbursement cycles from 21 days to 4 days after implementing an expense management system, resulting in a fifteen-point increase in employee satisfaction scores and preventing an estimated $45,000 in turnover-related costs by retaining, say, two sales representatives who previously cited reimbursement frustrations during exit interviews.

Saves cost from optimized spending

Real-time visibility into spending patterns enables proactive budget management and identification of cost-saving opportunities, including redundant subscriptions, vendor consolidation possibilities, and negotiation leverage from spend analytics.

Organizations discover unauthorized spending, policy violations, and inefficient purchasing patterns previously hidden in manual processes. Automated insights drive strategic decisions that systematically reduce overall company spending beyond direct expense management cost savings.

Example: A marketing agency could identify thousands of dollars in monthly redundant software subscriptions and negotiate savings on its largest vendor contract using consolidated spend data. If this negotiated saving is above 15%, it could generate ~$50,000 in annual cost reductions, which exceeds the expense management platform's annual subscription cost by more than 300%.

Security and compliance considerations

1. Data privacy regulatory compliance

Expense management platforms handle sensitive financial information, including employee banking details, personal identification numbers, and corporate spending patterns, requiring stringent data protection.

Organizations must ensure selected platforms comply with relevant regulations, including GDPR for European data subjects, CCPA for California residents, and industry-specific requirements such as HIPAA for healthcare organizations.

2. Role-based access and internal controls

Implement granular permission structures, ensuring employees access only the expense data relevant to their responsibilities. Finance administrators require comprehensive system access, while individual employees should view only personal submissions.

Configure the distribution of duties, preventing individuals from both submitting and approving their own personal expenses. Establish detailed approval authority limits requiring necessary escalation for high-value business transactions.

3. Audit-ready reporting and record retention

Expense management systems must maintain comprehensive documentation, including original receipts, approval chains, policy exception justifications, and transaction timestamps, satisfying IRS substantiation requirements and internal audit standards.

Configure automatic record retention to meet regulatory requirements, typically seven years for tax-related documents. Ensure the platform generates detailed audit reports documenting policy violations, unusual spending patterns, and complete transaction histories.

Finding the right partner for long-term financial efficiency

Selecting an expense management partner requires looking beyond immediate feature requirements to evaluate long-term strategic alignment and platform evolution capabilities. Unified platforms that combine expense management, corporate cards, bill payments, and accounting automation deliver superior value compared to standalone tools requiring multiple vendor relationships and complex integrations.

These comprehensive solutions eliminate data silos, reduce vendor management overhead, and provide holistic spending visibility that standalone tools cannot achieve.Ongoing support quality and platform scalability prove critical as your organization grows and requirements evolve.

Evaluate vendor responsiveness, implementation assistance depth, training resource quality, and commitment to continuous product innovation. Partners who invest in customer success through dedicated account management, regular business reviews, and proactive optimization guidance deliver exponentially greater value than transactional vendors providing minimal post-sale support.

Smart partners future-proof your expense management by anticipating regulatory changes, expanding integration ecosystems, and evolving platform capabilities to address emerging financial management challenges.

The right partnership transforms expense management from a solved problem into a continuously improving competitive advantage that adapts to your changing business needs, ensures compliance with evolving regulations, and leverages technological advances to maintain operational efficiency as your organization scales and market dynamics shift.

Why choose Volopay as your ultimate expense management partner

Volopay delivers a comprehensive financial operations platform that unifies expense management, corporate cards, bill payments, and accounting automation into a single solution.

Organizations choosing Volopay gain seamless control over business spending with real-time tracking, customizable approval workflows, and integration capabilities that transform financial workflows through intelligent automation and complete visibility, empowering better business decisions and sustainable growth.

Automated expense capture

Volopay's best expense management software tool is its OCR technology. Through its Magic Scan feature, our platform can automatically extract merchant names, transaction amounts, dates, and vendor information from receipt images.

Employees simply photograph receipts via the mobile app, and the system handles data entry and expense categorization automatically, eliminating manual typing. Additionally, payments made via the platform or through Volopay corporate cards are automatically recorded into the ledger without needing manual data entry.

Multi-level approval workflows

Configure sophisticated approval chains with up to 5 levels of approvers for payments of different ranges to verify and authorize expenses before processing. Volopay supports customizable workflows that automatically route expenses to appropriate managers based on amount thresholds, expense categories, departments, or custom business rules.

Mobile notifications enable approvers to review and authorize expenses instantly from anywhere, with automatic submission escalation ensuring that primary approvers are unavailable.

Integration with accounting and ERP tools

Volopay integrates seamlessly with QuickBooks, Xero, NetSuite, Deskera, and MYOB, featuring a two-way sync that automatically transfers approved expenses to the appropriate general ledger accounts. The integration ensures the chart of accounts, tax codes, and tracking categories remain synchronized across platforms with automatic categorization and mapping rules.

Real-time data synchronization provides current financial visibility, accelerates month-end closing, and eliminates reconciliation discrepancies between disconnected systems, improving overall accounting accuracy.

Real-time spend visibility

Volopay's real-time visibility feature tracks all corporate card and bill pay transactions instantly, providing complete visibility with detailed breakdowns of business expenses across departments, categories, and employees.

Track budget utilization as transactions occur with immediate updates and push notifications from the mobile app, enabling proactive budget management. Customizable reports deliver actionable insights into spending patterns, policy violations, and optimization opportunities, transforming expense data into strategic intelligence for informed financial decisions.

Streamlined invoice payment workflows

Volopay consolidates vendor bill payments within the same platform, managing employee expenses, featuring automated approval workflows that ensure no funds leave without authorization.

Magic Scan captures invoice details automatically, routes them through customizable approval workflows, and performs 3-way matching to verify invoices against purchase orders before payment authorization. Schedule recurring payments for regular vendors and receive automated reminders for upcoming payouts, ensuring timely bill payments with comprehensive audit trails.

Multi-currency payments & global transfers

Volopay supports transactions in multiple currencies with the ability to send money to multiple countries through both SWIFT and non-SWIFT payment options. The platform enables international vendor payments in 50+ major currencies with transparent fees and competitive FX conversion rates.

Multi-currency wallets allow you to hold and manage funds in multiple currencies, while expense reporting automatically converts all transactions to your base currency for consolidated financial analysis, while still maintaining original currency documentation for compliance and audit requirements.

FAQ's

Automated expense management technology eliminates manual data entry errors while enforcing policy rules that flag violations in real-time. The system detects duplicate submissions, unusual spending patterns, and missing payments automatically.

Reputable cloud-based platforms implement bank-level encryption for data transmission and storage, along with SOC 2 compliance certifications demonstrating rigorous security standards. Multi-factor authentication, role-based access controls, and regular security audits protect your financial data. Cloud providers maintain redundant backups and disaster recovery capabilities exceeding what most organizations can achieve with on-premise solutions.

Implementation timelines vary based on organizational complexity, typically ranging from one week for small businesses with straightforward requirements to several months for large enterprises requiring extensive customization. Basic setup, including employee onboarding, policy configuration, and accounting integration, often completes within two to four weeks.

Modern platforms offer extensive customization, including configurable approval workflows, custom expense categories, department-specific policies, and tailored spending limits. You can establish unique business rules reflecting your organizational structure, industry requirements, and operational preferences.

Comprehensive platforms seamlessly handle both corporate card transactions and employee out-of-pocket expenses within unified workflows. Corporate card purchases automatically import into the system for receipt matching and categorization, while employees submit cash expenses through mobile apps.

Volopay consolidates expense tracking, corporate cards, bill payments, and accounting automation into a single integrated platform, eliminating multiple vendor relationships. Automated receipt capture, intelligent categorization, and seamless approval workflows reduce manual processing.

Volopay integrates seamlessly with QuickBooks, Xero, NetSuite, and other major accounting platforms through native connections and APIs. These integrations automatically synchronize approved expenses to appropriate general ledger accounts, cost centers, and projects without manual data entry.

Yes, Volopay provides both physical corporate cards for regular business expenses and virtual cards for online purchases or specific transactions. You can issue cards instantly with customized spending limits, merchant category restrictions, and transaction controls tailored to individual employee roles.

Volopay maintains robust security certifications and implements comprehensive data protection measures, including encryption, secure data centers, and regular security audits. The platform generates audit-ready reports with complete documentation satisfying substantiation requirements.

Volopay supports transactions in several currencies with competitive foreign exchange rates, making it ideal for organizations with international operations or vendor relationships. You can execute cross-border payments, manage multi-currency expenses, and consolidate reporting in your base currency.

Bring Volopay to your business

Get started now