End petty cash hassles with prepaid petty cash cards

Managing small business expenses with physical cash is slow, error-prone, and hard to track. Prepaid petty cash cards offer a smarter alternative—letting you allocate funds, set limits, and monitor spending in real-time.

These petty cash cards for business reduce the risk of misuse, eliminate manual logbooks, and keep every transaction digitally recorded. No more chasing receipts or worrying about cash leaks. Easy to issue across teams, prepaid petty cash cards simplify expense handling while improving control and visibility.

Why switch to prepaid cards for petty cash?

Traditional cash management is outdated, and cards for petty cash offer superior control and transparency. A petty cash card for business preloads designated funds while establishing clear spending boundaries and real-time transaction monitoring.

Say goodbye to chasing paper receipts or deciphering messy handwritten expense logs. Prepaid petty cash cards revolutionize how businesses handle small purchases, from office supplies to team lunches, without employees using personal funds. These innovative petty cash card solutions automatically generate digital expense records, ensuring seamless compliance with Australian taxation requirements and stress-free audit preparation.

The best prepaid cards for petty cash integrate seamlessly with existing accounting systems, eliminating hours of manual reconciliation work. Whether managing a growing startup or an established enterprise, cards for petty cash streamline administrative workflows while strengthening financial oversight.

Your team gains purchasing flexibility without compromising budget control. Modern petty cash card for business solutions deliver the perfect balance of convenience and accountability that traditional cash systems simply cannot match.

Limitations of manual petty cash handling

Manual petty cash handling often leads to inefficiencies, lack of transparency, and higher risk of errors or misuse. Without proper tracking or controls, businesses struggle to maintain accountability, making traditional systems outdated and impractical in today’s fast-paced financial environment.

Increased risk of theft or loss

Physical currency attracts theft and mysterious disappearances. Misplaced cash boxes or undocumented withdrawals quickly deplete petty cash reserves.

Australian retail businesses lose approximately $1,200 per theft incident, with employee-related losses representing 24% of total retail shrinkage. Petty cash cards completely eliminate physical currency risks through secure digital fund management.

Time-consuming manual reconciliation

Cash expense reconciliation consumes valuable administrative hours. Deteriorating receipts and illegible handwritten logs create matching nightmares, diverting attention from revenue-generating activities.

This antiquated process frustrates finance teams and delays monthly closing procedures. Petty cash card for business solutions automates transaction recording, instantly eliminating tedious manual reconciliation tasks.

Lack of real-time spending visibility

Cash transactions provide zero real-time visibility into spending patterns. Unauthorized purchases or budget overruns often go unnoticed until monthly reviews reveal the damage.

Without immediate spending alerts, maintaining strict budget discipline becomes virtually impossible. Cards for petty cash deliver instant transaction notifications and live spending dashboards for complete financial control.

Compliance and audit risks

Maintaining ATO-compliant documentation with physical cash creates significant challenges. Missing receipts and incomplete expense logs trigger costly audit complications and potential penalties.

Prepaid petty cash cards automatically generate comprehensive digital transaction histories, ensuring permanent record-keeping and effortless compliance verification. Every purchase receives proper documentation without additional administrative effort.

Inconvenient for employees to manage expenses

Cash-based systems frustrate employees through cumbersome request processes. Staff must formally request funds, meticulously track paper receipts, and endure lengthy reimbursement delays.

This outdated approach damages team morale and operational efficiency. Petty cash card solutions empower immediate purchases while eliminating bureaucratic friction, significantly improving employee satisfaction and productivity levels.

Benefits of Volopay prepaid cards for petty cash

Volopay’s prepaid cards offer a smarter, more secure alternative to traditional petty cash handling—enabling real-time tracking, spending controls, and simplified expense management across teams and departments.

Fraud protection

Volopay's petty cash card for business employs advanced encryption technology and robust security controls to protect your valuable business funds comprehensively.

You can instantly freeze or cancel cards if lost or compromised, significantly minimizing fraud risks compared to traditional, vulnerable cash systems that offer absolutely no protection once stolen or misplaced by employees.

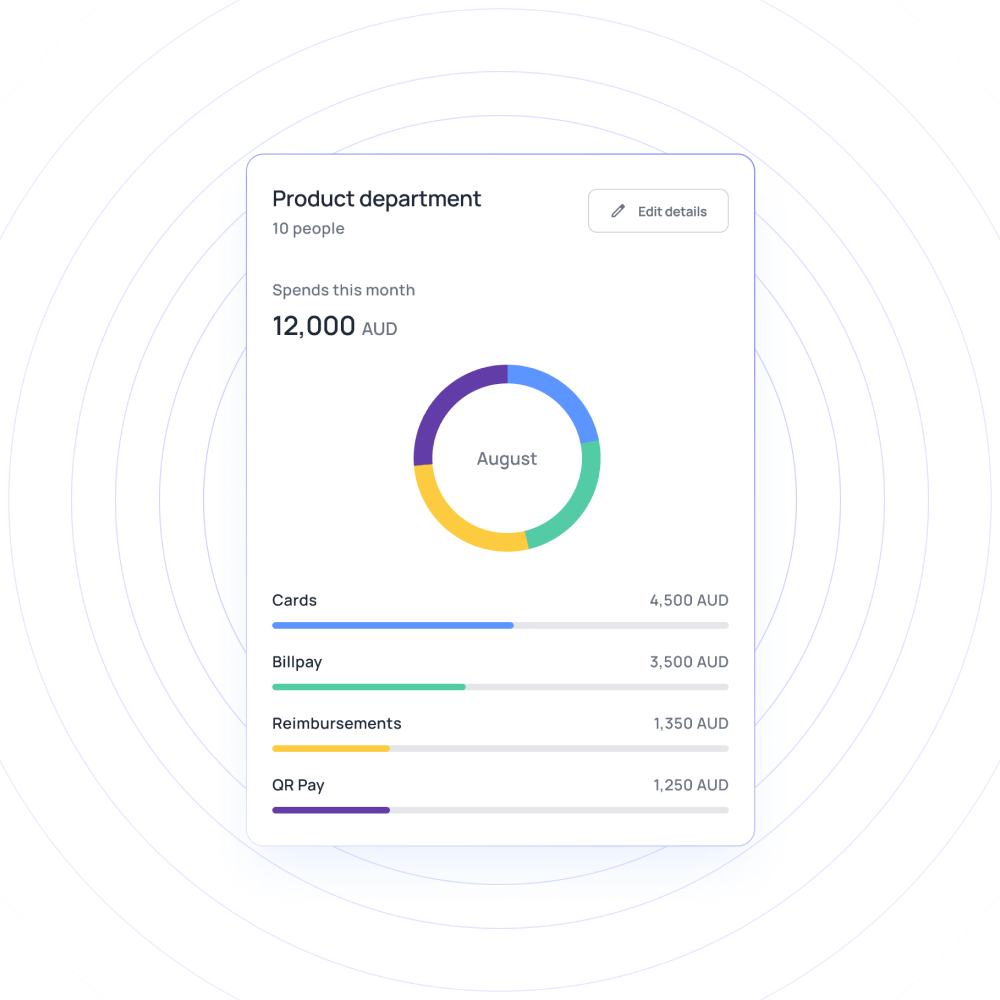

Real-time expense visibility

Volopay's intuitive dashboard delivers comprehensive live insights into every single transaction as it happens in real time. You can effortlessly track spending on office supplies, travel expenses, or other business needs, ensuring complete transparency and enabling quick identification of any policy violations or unauthorized purchases made by team members across departments.

Time savings

By automating comprehensive expense tracking and reconciliation processes efficiently, Volopay's petty cash card completely eliminates tedious manual logbooks and time-consuming paperwork entirely.

Your finance team saves countless hours on administrative tasks daily, allowing them to redirect their valuable focus toward strategic financial planning and critical business growth initiatives that drive company success.

Regulatory compliance

Volopay ensures your business remains fully audit-ready with comprehensive digital transaction logs that include detailed timestamps and complete vendor information for every purchase.

These meticulous records fully meet strict ATO standards and regulatory requirements precisely, significantly simplifying compliance processes and reducing the stress and anxiety associated with financial audits and regulatory reviews.

Scalability for teams

Volopay's cards for petty cash scale effortlessly and seamlessly as your business continues to grow and expand operations.

You can easily issue multiple cards for different teams or departments instantly, while flexibly adjusting spending limits to suit your evolving business needs without complicating existing workflows or processes, ensuring smooth operational continuity throughout organizational growth phases.

How to manage petty cash with Volopay prepaid cards

Managing petty cash with Volopay’s prepaid cards offers a smarter, more secure alternative to traditional cash handling. Easily allocate budgets, set spending limits, and track every transaction in real time from one platform.

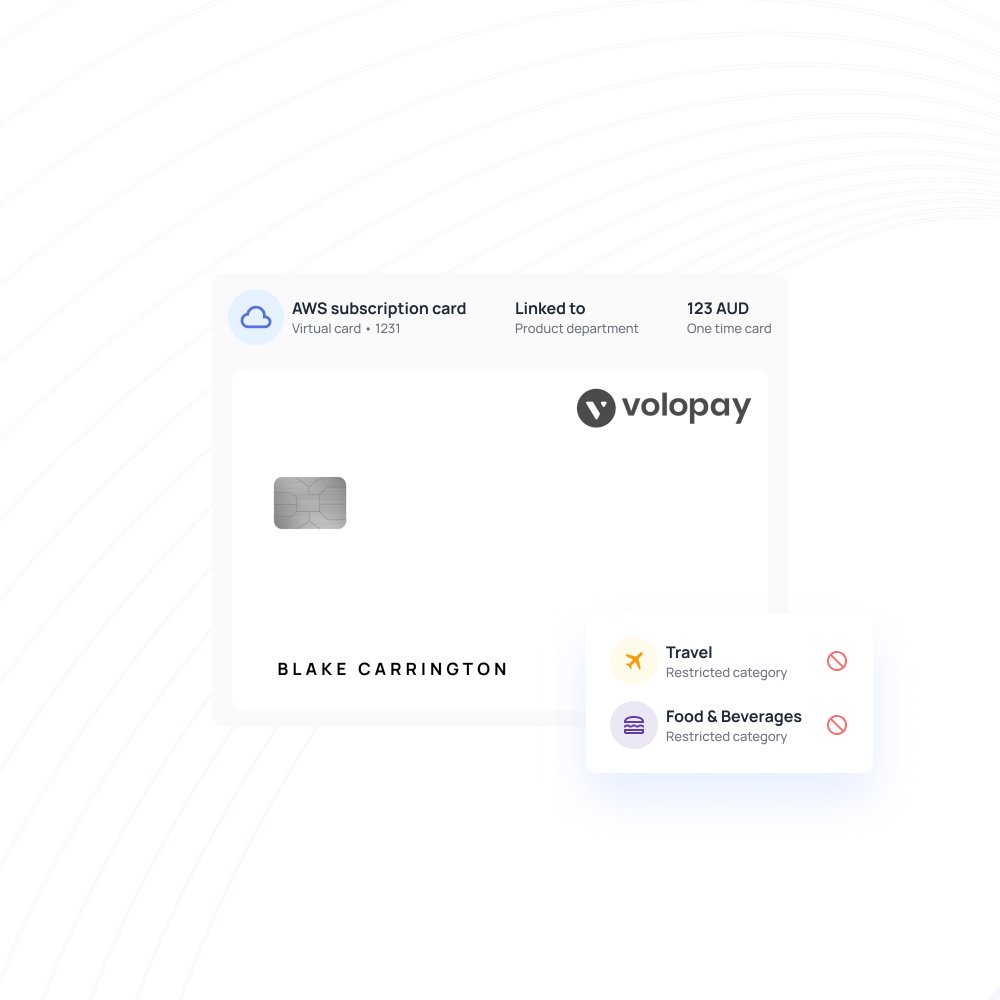

Create and issue cards

Onboard your team onto Volopay and generate corporate cards—virtual or physical—for petty cash within seconds using the intuitive dashboard.

Assign cards directly to specific employees, departments, or individual projects with customized spending parameters. Physical cards arrive via courier within days, while virtual cards activate immediately for online purchases.

The streamlined onboarding process requires minimal setup time, allowing businesses to implement petty cash card solutions quickly without disrupting existing operations or requiring extensive staff training sessions.

Set budget limits

Configure precise spending limits for each petty cash card, preventing unauthorized budget overruns and maintaining strict financial control. Establish daily, weekly, or monthly spending caps tailored to specific business requirements and employee responsibilities.

Modify these limits instantly through the Volopay mobile application or web-based dashboard as business needs evolve. Automated spending alerts notify administrators when approaching preset thresholds, enabling proactive budget management.

These flexible controls make prepaid petty cash cards ideal for businesses requiring granular expense oversight across multiple departments and spending categories.

Track transactions live

Monitor all expenses in real-time using Volopay's comprehensive analytics dashboard featuring detailed transaction histories and spending insights. Every purchase displays complete vendor information, precise timestamps, geographic locations, and purchase categories for thorough visibility.

Prepaid petty cash cards provide unprecedented transparency that helps businesses maintain tight budget control while identifying cost-saving opportunities. Automated spending reports generate valuable insights for strategic financial planning and departmental budget optimization across organizations.

Automate receipt collection

Volopay's advanced OCR technology captures receipt information digitally, eliminating manual data entry requirements. Employees simply photograph receipts using the mobile application, and intelligent systems automatically extract relevant transaction details.

This streamlined process ensures accurate record-keeping while reducing the administrative burden on finance teams significantly. Digital receipt storage prevents lost documentation that often complicates expense reconciliation processes.

Petty cash card for business solutions maintains comprehensive expense records automatically, ensuring compliance and simplifying audit preparation through organized digital documentation systems.

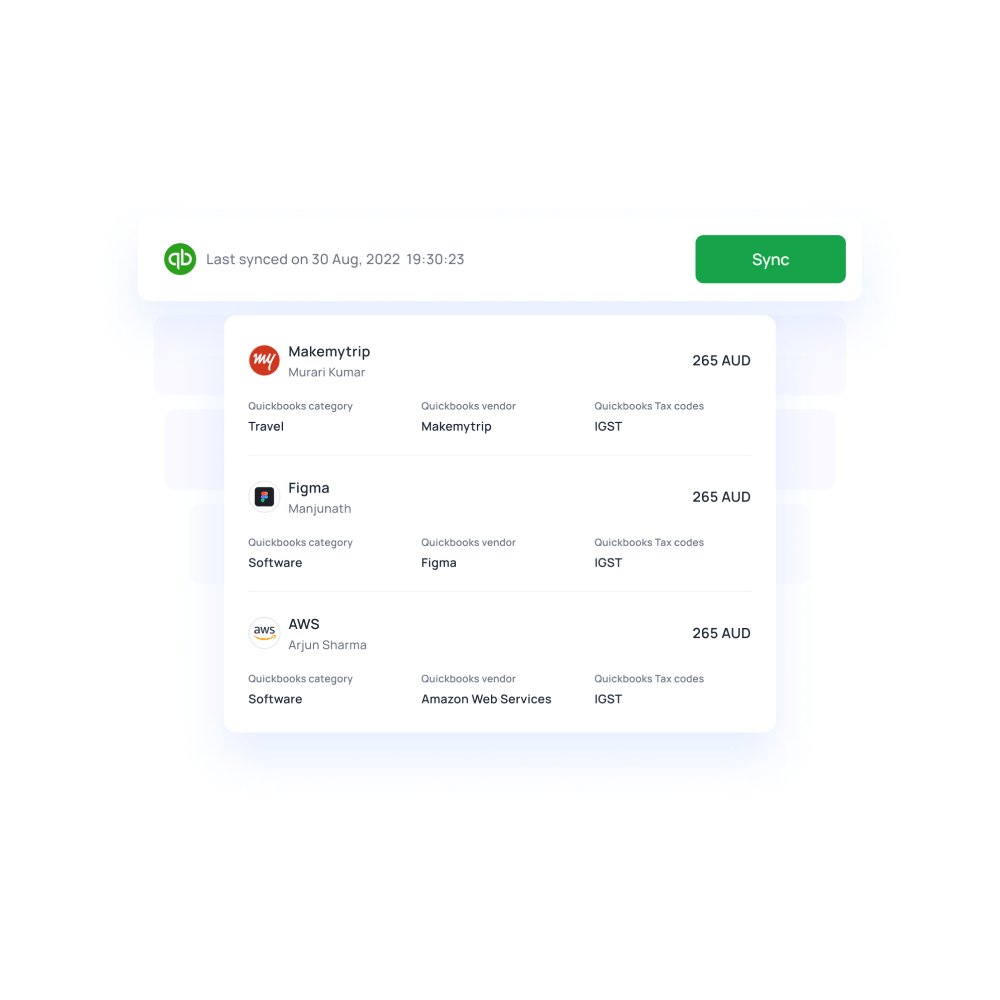

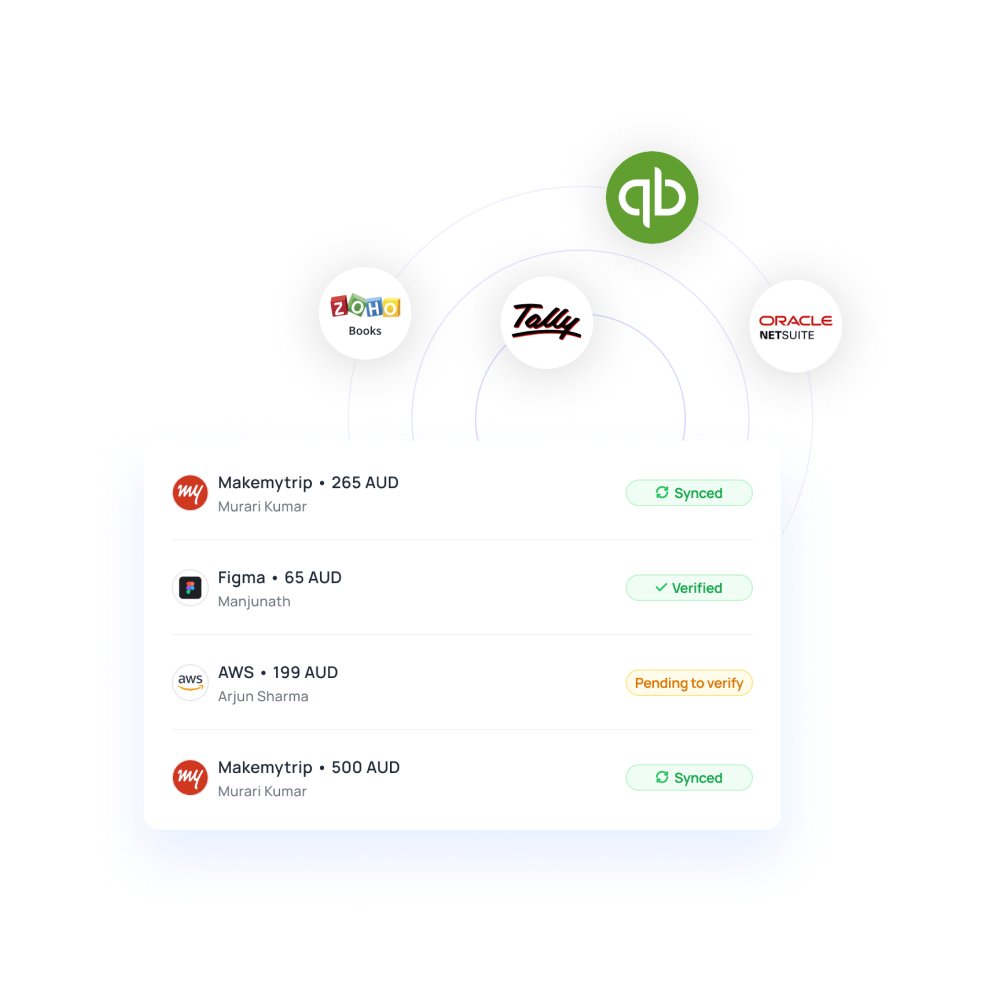

Sync with accounting tools

Seamlessly integrate Volopay with popular accounting platforms, including QuickBooks, Xero, MYOB, and other financial management systems for automated reconciliation processes.

Transaction data synchronizes automatically, eliminating manual entry errors while saving countless administrative hours each month. Real-time data transfer ensures accounting records remain current and accurate at all times.

This integration capability makes cards for petty cash powerful tools for streamlined financial management and reporting. Automated synchronization reduces reconciliation time, allowing finance teams to focus on strategic analysis rather than routine data entry tasks.

Prepaid cards vs. other payment methods

Prepaid cards offer businesses a modern alternative to traditional payment methods like cash advances, checks, bank transfers or credit cards. They provide greater control, reduce financial risk, and simplify expense tracking—making them ideal for managing team spending with built-in limits and transparency.

1. Security vs. cash

Physical cash remains vulnerable to theft and complete loss without any recovery possibilities. Volopay's petty cash cards utilize advanced encryption protocols and offer instant freezing capabilities when cards are misplaced or compromised.

This digital security approach provides comprehensive fund protection that traditional cash management simply cannot match, ensuring business assets remain secure at all times.

2. Efficiency vs. checks

Traditional check writing and processing create significant delays and administrative burdens for businesses. Volopay offers the best prepaid cards for petty cash, enabling immediate transaction processing, completely eliminating waiting periods and paperwork requirements.

This streamlined approach accelerates business operations while reducing administrative overhead, making expense management significantly more efficient than conventional check-based payment systems.

3. Tracking vs. bank transfers

Standard bank transfers provide minimal real-time expense tracking and detailed transaction information. Volopay's petty cash card for business automatically logs every purchase with comprehensive details, including vendor information, timestamps, and spending categories.

This superior visibility and control enable proactive budget management that traditional banking methods cannot deliver effectively for business operations.

4. Flexibility vs. other cards

Conventional credit cards create overspending risks and impose high transaction fees on businesses. Volopay's cards for petty cash allow precise spending limit configurations and customizable usage restrictions tailored to specific business requirements.

This flexibility ensures spending control while eliminating unexpected fees, providing superior financial management compared to standard corporate credit card solutions.

5. Cost comparison

Traditional cash handling generates hidden expenses, including theft losses and extensive administrative time requirements. Volopay's prepaid petty cash cards feature transparent, competitive pricing structures without hidden charges, delivering long-term cost savings.

The elimination of cash-related risks and administrative burdens makes digital expense management significantly more economical than traditional cash handling approaches.

Best practices for petty cash management with prepaid cards

Define clear policies

Establish comprehensive usage guidelines for cards for petty cash, including approved vendor categories and acceptable expense types.

Communicate these policies clearly to all employees to ensure consistent compliance and prevent unauthorized usage.

Well-defined policies create accountability while maintaining spending control across departments, ensuring effective expense management throughout the organization.

Monitor spending

Monitor transaction reports weekly through a comprehensive dashboard to identify spending patterns and potential issues.

Address budget overruns promptly and adjust spending limits as needed to maintain optimal petty cash card system performance.

Regular expense reviews enable proactive financial management while ensuring expenses remain aligned with business objectives and budget constraints.

Train staff on card use

Provide comprehensive employee education on proper prepaid petty cash cards usage and receipt uploading procedures.

Thorough training minimizes errors while ensuring consistent policy adherence across all staff members.

Well-trained employees contribute to system efficiency and reduce administrative burden, making expense management smoother and more effective for the entire organization.

Leverage accounting integrations

Synchronize Volopay with QuickBooks, MYOB, or Xero to automate reconciliation processes completely.

This integration maintains an accurate petty cash card for business data while ensuring audit-ready financial records.

Automated synchronization eliminates manual data entry errors and saves significant admin time, streamlining financial management and improving accounting accuracy.

Adjust budgets dynamically

Modify spending limits flexibly as business requirements evolve throughout different seasons or projects.

Volopay's adaptable platform allows easy adjustment of cards for petty cash to accommodate changing operational demands.

This flexibility ensures expense management systems remain effective and relevant, supporting business growth while maintaining appropriate spending controls.

Ensuring compliance with Volopay prepaid cards

Ensuring compliance is effortless with Volopay prepaid cards. These smart cards come with built-in controls, real-time tracking, and customizable spend limits, helping businesses in Australia enforce policies, reduce misuse, and maintain accountability without manual oversight or complicated approval processes.

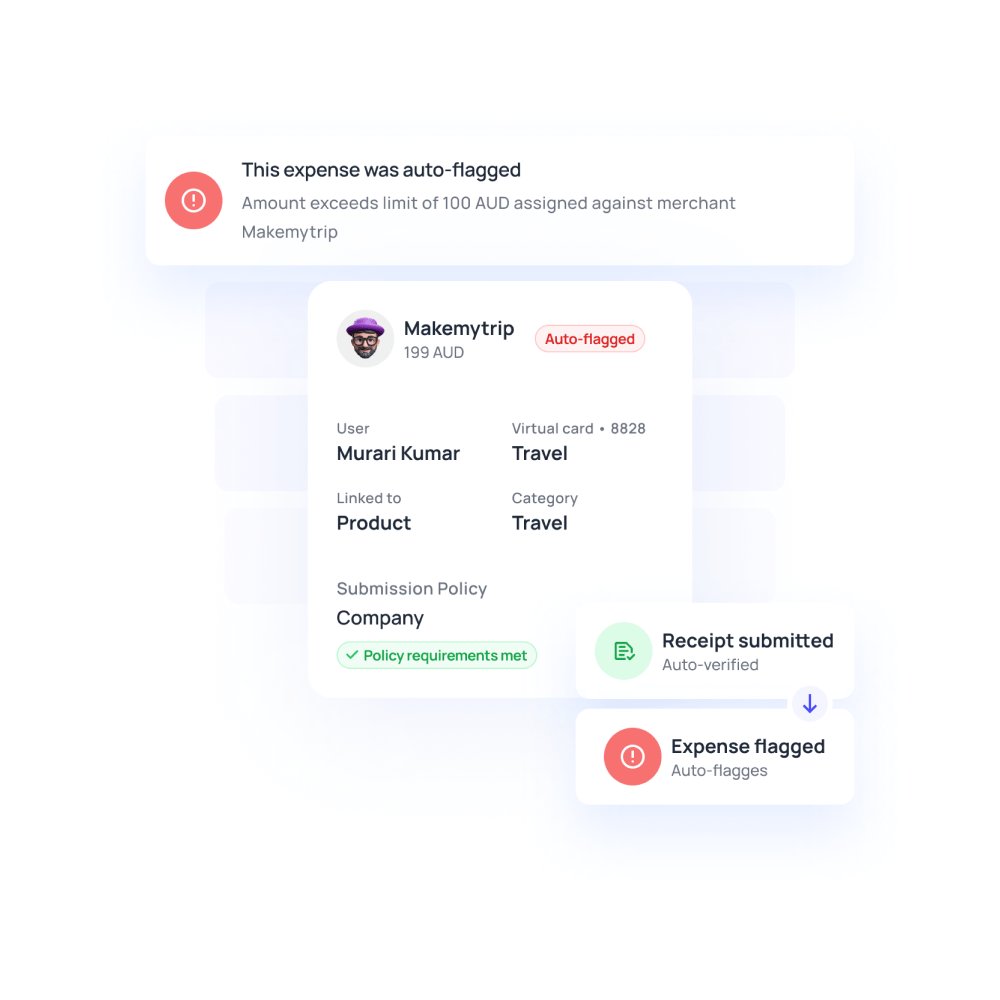

Automated policy checks

Volopay automatically identifies expenses violating established spending guidelines, including transactions with unapproved vendors or exceeding category limits.

This proactive monitoring ensures petty cash card usage remains compliant with company policies while preventing unauthorized spending. Automated oversight reduces administrative burden while maintaining strict financial controls across all business operations.

Audit-ready transaction logs

Every petty cash card for business transactions generates comprehensive digital records, including timestamps, receipts, and detailed transaction information. These complete records satisfy ATO audit requirements while simplifying compliance verification processes.

Digital documentation eliminates lost receipt concerns and ensures permanent record-keeping that traditional cash systems cannot provide effectively.

Multi-level approvals

Configure approval workflows for high-value transactions to add oversight layers for cards for petty cash usage. Multiple approval requirements prevent unauthorized spending while ensuring appropriate authorization for significant expenses.

This structured approach maintains financial control while accommodating different spending thresholds across various departments and employee levels within organizations.

Data security standards

Volopay maintains SOC 2 and PCI DSS compliance standards, providing enterprise-grade protection for sensitive financial information. These security certifications make prepaid petty cash cards a trusted choice for businesses requiring robust data protection. Advanced security measures ensure financial data remains secure while meeting industry standards for sensitive information handling.

Multi-currency compliance

For international business expenses, Volopay's petty cash card supports multiple currencies while formatting records to meet diverse international tax law requirements.

This global compliance capability ensures accurate record-keeping across different jurisdictions while simplifying international expense management for businesses operating in multiple countries and regulatory environments.

Bring Volopay to your business

Get started now

FAQs about prepaid petty cash cards

Volopay's cards for petty cash replace physical currency with secure digital funds while automating expense tracking and receipt collection processes. This comprehensive digitization streamlines expense management workflows, eliminates manual reconciliation tasks, and saves countless administrative hours, making financial management significantly more efficient than traditional cash-based systems.

Absolutely. Volopay's petty cash card for business employs advanced encryption technology, real-time fraud alerts, and instant card freezing capabilities to protect business funds from unauthorized access. These comprehensive security measures provide superior protection compared to physical cash, ensuring business assets remain secure throughout all transactions.

Yes, Volopay's corporate cards include some of the best prepaid cards for petty cash, which support comprehensive multi-currency functionality, making them ideal solutions for businesses managing international expenses. This global capability simplifies cross-border transactions while maintaining accurate record-keeping across different currencies, ensuring seamless expense management for internationally operating businesses.

Volopay integrates seamlessly with QuickBooks, MYOB, Xero, and other accounting platforms, automatically synchronizing transaction data without manual intervention. This automated integration simplifies reconciliation processes for your petty cash card while ensuring accounting records remain accurate and current, eliminating time-consuming manual data entry tasks.

Volopay offers transparent, competitive pricing structures without hidden fees or surprise charges. Prepaid petty cash cards provide exceptional value through reduced administrative costs and enhanced security features. Book a demo with our team to explore all the solutions for your business, tailored to your specific business requirements and usage patterns.