Smart expense management cards for Australian businesses

Managing business expenses across Australian teams has evolved significantly with the introduction of modern financial tools. Expense management cards have become essential for businesses, offering streamlined control over corporate spending.

These innovative payment solutions help Australian companies maintain compliance with local tax regulations while providing real-time visibility into employee expenditures. As businesses adapt to hybrid work models and expanded operations, employee business expense cards serve as crucial tools for maintaining financial oversight.

Whether you're running a startup or managing a large corporation, these cards simplify expense tracking and approval processes. The integration of technology with traditional expense management creates opportunities for improved efficiency and reduced administrative burden across all business sectors.

What are expense management cards?

Expense management cards are corporate payment solutions designed specifically for Australian businesses to control and monitor employee spending in real-time. These cards function as pre-funded payment tools that replace traditional expense reimbursement processes, allowing companies to set spending limits, track purchases, and maintain compliance with Australian Taxation Office (ATO) requirements.

Unlike personal credit cards, employee business expense cards come with built-in controls that prevent unauthorized spending while automatically capturing transaction data for GST compliance. Australian businesses benefit from these cards through simplified expense reporting, reduced fraud risk, and streamlined reconciliation processes.

The cards integrate seamlessly with local accounting software like Xero and MYOB, ensuring that all transactions align with Australian financial reporting standards. This modern approach to expense management eliminates the need for manual receipt collection and reduces the administrative burden on both employees and finance teams.

Key benefits of expense management cards for Australian businesses

Real-time tracking of employee spending

Monitor every transaction as it happens across your Australian operations, from office supplies in Adelaide to client dinners in Darwin.

Expense management cards provide instant visibility into spending patterns, allowing finance teams to identify budget variances immediately.

This real-time insight helps prevent overspending and ensures compliance with company policies.

Speed up monthly account reconciliation

Accelerate your month-end closing process by automatically matching transactions with receipts and coding expenses to the appropriate accounts.

Employee business expense cards eliminate the need for manual reconciliation, reducing accounting workload and improving accuracy.

Australian businesses can complete reconciliation in hours rather than days, enabling faster financial reporting.

Automate expense reporting seamlessly

Eliminate manual expense reports by automatically capturing transaction and receipt data through integrated mobile apps.

Employee business expense cards sync directly with your accounting systems, reducing data entry errors and speeding up month-end closing processes.

Australian businesses save hours of administrative work while maintaining accurate financial records.

Stay on budget with custom spend limits

Set precise spending controls for different departments, projects, or individual employees based on your Australian business needs.

Expense management cards allow you to establish daily, weekly, or monthly limits that automatically prevent overspending.

These controls adapt to your business cycles and help maintain budget discipline across all teams and departments.

Prevent fraud with role-based controls

Implement security measures and controls that restrict card usage based on merchant categories, locations, and time.

Expense cards for employees include fraud detection systems that monitor unusual spending patterns and alert admins to misuse.

This protection is crucial for Australian businesses operating across multiple states and territories.

Streamline employee expense approvals

Replace lengthy approval processes with automated workflows that route expenses to the appropriate managers based on amount thresholds and department structures.

Expense management cards enable instant approval or rejection of transactions, reducing approval cycles from days to minutes.

This efficiency improves cash flow management and employee satisfaction.

How Volopay's expense management cards simplify spending for Australian businesses

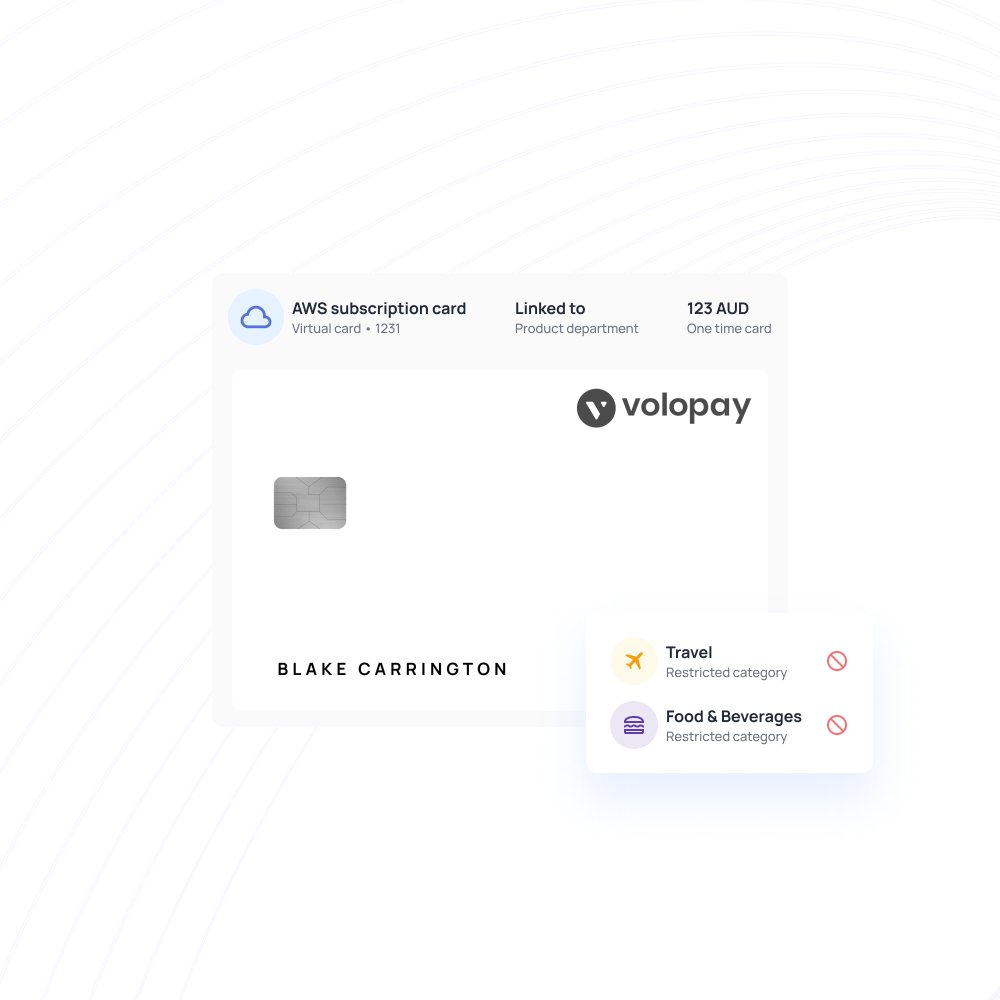

Volopay’s corporate expense management cards simplify spending for Australian businesses by offering real-time control, automated tracking, and category-based restrictions. They streamline approvals, reduce manual work, and help companies maintain financial discipline while giving teams the flexibility to spend responsibly.

Get a complete overview of business expenses

Access comprehensive dashboards that display all company spending across Australia in real-time, from major urban headquarters to regional offices.

Expense management cards provide detailed analytics that help CFOs understand spending patterns, identify cost-saving opportunities, and make informed budget decisions. The platform consolidates all expense data into actionable insights.

Access in-depth reports for every expense made

Generate detailed expense reports that meet Australian compliance requirements, including GST breakdowns and category-wise spending analysis.

Employee business expense cards capture transaction-level data that supports audit requirements and tax filings. These reports provide the granular detail needed for strategic business planning and cost optimization.

Create custom expense categories for your teams

Design expense categories that align with your Australian business structure, whether you're tracking travel expenses for sales teams or equipment purchases for technical departments.

Expense management cards allow unlimited customization of expense categories to match your chart of accounts and reporting needs. This flexibility ensures accurate expense classification and meaningful financial analysis.

Set precise spend controls on every card

Configure individual card controls that reflect each employee's role and spending authority within your Australian organization. Expense cards for employees support multiple control layers, including merchant restrictions, spending limits, and approval thresholds. These controls ensure spending stays within authorized parameters while maintaining operational flexibility.

Reconcile employee expenses in just minutes

Automate the reconciliation process by matching transactions with receipts and applying appropriate expense codes instantly. Expense management cards eliminate manual data entry and reduce reconciliation time from hours to minutes. This automation improves accuracy and allows finance teams to focus on strategic activities rather than administrative tasks.

Get 24/7 local support anytime you need help

Access dedicated customer support during Australian business hours, with experts who understand GST requirements and banking regulations.

Employee business expense cards come with comprehensive support, including onboarding assistance, training resources, and ongoing technical help. This support ensures smooth operations across all Australian time zones.

Manage access with role-based permissions

Implement sophisticated permission structures that control which employees can view, approve, or manage different aspects of expense management.

Expense management cards support multi-level access controls that align with your organizational hierarchy and approval workflows. These permissions ensure sensitive financial data remains secure while enabling appropriate operational access.

Leverage advanced security measures

Use Volopay's strong security measures to safeguard your business expenditures. Every expense management card is protected by encryption technologies, virtual card production, and real-time fraud detection.

Secure, closely watched transactions are advantageous to employees who use employee business spending cards. Employee expense cards greatly lower the possibility of data breaches or illegal use, guaranteeing that your business's finances are constantly safeguarded to the greatest standards.

Start streamlining your expenses with Volopay's corporate cards

How Volopay helps Australian businesses stay compliant and enforce spending policies

Align with Australian tax and GST rules

Ensure all expense transactions comply with Australian Taxation Office requirements, including proper GST documentation and tax-deductible expense classification.

Expense management cards automatically capture the necessary details for tax compliance, reducing audit risks and simplifying tax preparation. The platform maintains detailed records that support ATO requirements and business expense deductions.

Create enforceable spend policies per department

Establish department-specific spending policies that automatically prevent non-compliant purchases while allowing legitimate business expenses.

Employee business expense cards enforce these policies at the point of transaction, eliminating the need for post-expense policy violations. This proactive approach maintains budget discipline while supporting business operations.

Enable audit-ready expense documentation

Maintain comprehensive expense documentation that meets Australian auditing standards, including receipt images, transaction details, and approval histories.

Expense management cards create an audit trail that satisfies internal and external audit requirements. This documentation reduces audit preparation time and ensures compliance with financial reporting standards.

Restrict usage by merchant category or geography

Configure spending restrictions that prevent card usage at unauthorized merchant types or locations outside approved geographical areas. Expense cards for employees support granular controls that align with company policies and risk management requirements. These restrictions help prevent misuse while maintaining operational flexibility for legitimate business expenses.

Stay compliant with employee expense caps

Implement and enforce spending limits that comply with Australian employment law and company policies regarding employee expenses. Expense management cards automatically prevent spending that exceeds authorized limits, ensuring compliance with fringe benefits tax requirements and employment agreements. This automation reduces compliance risks while maintaining fair expense policies.

How to set up Volopay's expense management cards in Australia

Pick the right card type for your needs

Select from various card options designed for different Australian business requirements, including virtual cards for online purchases and physical cards for in-person transactions.

Expense management cards offer flexibility to match your needs, whether you're managing remote teams or office-based employees.

The selection process considers spend patterns, security requirements, and integration needs.

Set card rules, limits, and usage conditions

Configure comprehensive card controls that reflect your business policies, including spending limits, merchant restrictions, and time-based controls.

Employee business expense cards support multiple rule sets that can be applied to different employee groups or departments.

These controls ensure spending stays within authorized parameters while maintaining operational efficiency.

Configure approval workflows for each department

Design approval processes that match your organizational structure and compliance requirements, with different workflows for various expense types and amounts.

Expense management cards support complex approval hierarchies that ensure proper authorization while maintaining processing speed.

These workflows can be customized for different Australian business units or subsidiaries.

Sync seamlessly with your accounting software

Integrate with popular Australian accounting platforms to ensure automatic data synchronization and eliminate manual data entry.

Employee business expense cards integrate with your existing financial systems, maintaining data consistency and reducing processing errors.

This integration streamlines your existing accounting workflows while adding expense management capabilities.

Enable real-time expense tracking and reporting

Activate comprehensive tracking systems that provide real-time visibility into spending patterns and budget utilization across your Australian operations.

Expense management cards offer real-time dashboards and automated reporting that keep finance teams informed of spending trends.

This visibility enables proactive budget management and strategic decision-making.

Apply role-based spend controls across the team

Implement sophisticated permission systems that control spending authority based on employee roles, departments, and seniority levels within your Australian organization.

Expense cards for employees support multi-layered access controls that ensure appropriate spending limits while maintaining operational flexibility.

These controls align with your organizational hierarchy and business processes.

Issue cards to employees, contractors, or departments

Distribute cards to your workforce based on their roles and spending requirements, including full-time employees, contractors, and managers.

Expense management cards can be issued instantly for urgent requirements or scheduled for new hires and seasonal staff.

The issuance process includes proper onboarding and training to ensure effective usage.

Start spending and managing expenses effortlessly

Begin operations with comprehensive training and support resources that help your Australian teams adapt to the new expense management system.

Employee business expense cards come with user-friendly interfaces and mobile apps that simplify expense management for employees.

The transition process includes ongoing support to ensure successful adoption and optimal usage.

Top features of Volopay's expense management cards for Australian businesses

Load funds with direct deposit

Transfer funds to cards instantly using Australian banking systems, including direct deposits from your business accounts with major banks. Expense management cards support various funding methods that integrate with your existing banking relationships. This flexibility ensures cards are always funded when employees need them for business expenses.

Access your cards anytime, anywhere

Manage your expense cards through mobile apps and web platforms that work seamlessly across Australia, from urban centers to regional areas. Employee business expense cards provide 24/7 access to card management features, balance checks, and transaction history. This accessibility ensures your teams can manage expenses effectively regardless of location or time zone.

Manage expenses on the go with mobile app

Use the comprehensive Volopay mobile app that allows employees to capture receipts, track spending, and submit expense reports from anywhere in Australia. Expense management cards integrate with smartphone cameras and GPS systems to automatically capture transaction details and location data. This mobile capability supports the growing trend of remote work and travel-based roles.

Reload cards instantly, anytime you need

Add funds to cards immediately when business needs arise, whether for urgent travel expenses or unexpected project costs. Employee business expense cards support instant reloading through automated systems that don't require manual intervention. This immediacy ensures business operations continue smoothly without expense-related delays.

24x7 customer support in your time zone

Access dedicated support teams that understand Australian business hours and local requirements, providing assistance during standard business hours across all states. Expense management cards include comprehensive support resources, including phone, email, and chat support options. This local support ensures quick resolution of issues and proper guidance for Australian-specific requirements.

Global card acceptance for international needs

Use cards internationally when your Australian business requires travel or international suppliers, with global acceptance at millions of merchants worldwide. Expense cards for employees work seamlessly across different countries while maintaining spending controls and reporting capabilities. This global functionality supports businesses with international operations or frequent business travel.

Enterprise-grade security for every transaction

Protect your Australian business with advanced security features including fraud detection, transaction monitoring, and secure authentication systems. Expense management cards employ bank-level security measures that comply with Australian financial regulations and industry standards. These security features protect against unauthorized usage while maintaining user convenience.

Integrated with payroll and accounting tools

Connect seamlessly with popular Australian business software, including payroll systems, accounting platforms, and expense management tools. Employee business expense cards support API integrations that automate data flow between systems, reducing manual work and improving accuracy. This integration creates a unified financial management ecosystem for your business.

How Volopay expense cards work for Australian teams

Make a business payment

Process payments efficiently using Volopay cards that automatically capture transaction details, merchant information, and purchase categories for Australian businesses.

Expense management cards streamline the payment process while ensuring all necessary data is collected for compliance and reporting purposes.

Employees can make authorized purchases without complex approval processes for routine expenses.

Upload GST-compliant receipts

Capture and store receipts that meet Australian GST requirements, including tax invoices and receipt documentation required by the ATO.

Employee business expense cards integrate with mobile apps that automatically extract relevant information from receipts, ensuring proper documentation for tax purposes.

This process simplifies GST compliance while maintaining accurate expense records.

Match and validate expense receipts

Automatically match receipts with card transactions using advanced algorithms that verify amounts, dates, and merchant information.

Volopay expense management cards eliminate manual matching processes while ensuring accuracy and completeness of expense documentation.

This automation reduces processing time and improves the reliability of expense reporting.

Route transactions to the right approvers

Send expense approvals to appropriate managers based on predetermined workflows that consider expense amounts, categories, and organizational hierarchy.

Volopay automates the approval routing process, ensuring timely processing while maintaining proper authorization controls.

This system reduces approval delays and improves expense processing efficiency.

Approve or reject expense claims in seconds

Enable managers to quickly review and approve business expenses through mobile apps or web interfaces that provide all necessary transaction details.

Expense management cards streamline the approval process with clear information display and one-click approval options.

This efficiency reduces administrative burden while maintaining proper expense oversight.

Sync every payment to your accounting software

Automatically transfer approved expenses to your Australian accounting system, ensuring accurate recording and proper expense categorization.

Employee business expense cards maintain real-time synchronization with popular accounting platforms, eliminating manual data entry and reducing errors.

This integration ensures your financial records are always current and accurate.

Reconcile all expenses with ease

Complete monthly reconciliation processes quickly using automated matching between bank statements, card transactions, and expense receipts.

Expense management cards provide reconciliation tools that identify discrepancies and streamline the month-end closing process.

This automation significantly reduces the time required for financial reconciliation.

Access reports for tax filing and strategy

Generate comprehensive reports that support Australian tax filing requirements and provide insights for strategic business planning.

Employee business expense cards offer various reporting options, including GST reports, category analysis, and spending trend reports.

These detailed reports provide the data needed for Australian tax compliance and informed business decision-making.

Volopay: The ideal expense management card program for every Australian business

Whether you're launching a startup or managing a multinational corporation across Australia, choosing the right expense management solution is crucial for financial success.

Volopay offers scalable solutions that grow with your business, adapting to changing needs and operational requirements. The key is selecting the platform that understands Australian business environments and regulatory requirements while providing the flexibility needed for growth.

1. Startups

● Simple UI for fast team adoption

New startups benefit from Volopay’s intuitive interfaces that require minimal training, allowing small teams to quickly adopt expense management processes.

Expense management cards designed for startups feature clean, simple designs that don't overwhelm users with complex features. This simplicity ensures rapid implementation and high adoption rates among early employees.

● Quick onboarding process

Volopay’s streamlined setup procedures get startup teams operational within days rather than weeks, supporting fast-paced business environments.

Employee business expense cards for startups include guided onboarding that walks teams through essential features and setup requirements. This quick implementation supports the agile nature of startup operations.

● Reduces time on admin tasks

Automation features eliminate manual expense processing, allowing startup teams to focus on core business activities rather than administrative work.

Volopay handles routine tasks like receipt matching and expense categorization, freeing up valuable time for strategic initiatives. This efficiency is crucial for resource-constrained startup environments.

2. Small-sized businesses

● Get visibility into every employee expense

Growing businesses need comprehensive spending visibility to maintain budget control as teams expand across Australian markets.

Volopay’s employee business expense cards provide detailed spending analytics that help small business owners understand expense patterns and identify cost optimization opportunities. This visibility supports informed decision-making during growth phases.

● Scales alongside business growth

Flexible systems adapt to increasing employee counts and expanding operational requirements without requiring system changes or migrations.

Expense management cards by Volopay support growing businesses by adding users, card controls, and features as needed. This scalability ensures the expense management system remains effective as the business expands.

● Automates recurring payments and reporting

Established processes for regular expenses like subscriptions and vendor payments reduce administrative burden while ensuring consistency.

Volopay automates routine payments and generates regular reports that support business planning and compliance requirements. This automation is essential for maintaining efficiency as operations become more complex.

3. Medium-to-large sized businesses

● Advanced insights and analytics for CFOs

Sophisticated reporting capabilities provide strategic insights that support executive decision-making and financial planning across Australian operations.

Volopay offers advanced analytics, including predictive spending models, budget variance analysis, and cost center performance metrics. These insights enable CFOs to make data-driven decisions that impact business performance.

● Custom workflows for complex teams

Large organizations require flexible workflow systems that accommodate diverse departments, approval hierarchies, and business processes.

Volopay’s dashboard supports complex organizational structures with customizable workflows that can be tailored to specific business requirements. This flexibility ensures the system works effectively across different departments and business units.

● Global acceptance for cross-border teams

International operations require expense management solutions that work seamlessly across different countries while maintaining centralized control and reporting.

Expense management cards by Volopay provide global acceptance with local compliance features that support multinational operations. This capability is essential for Australian businesses with an international presence or remote teams.

Bring Volopay to your business

Get started now

FAQs

Yes, dedicated support teams operate during standard Australian business hours across all time zones, providing local expertise and immediate assistance for urgent issues.

Absolutely, the cards work seamlessly for remote employees throughout Australia, with mobile apps and online platforms that support distributed teams effectively.

All business expenses, including travel, meals, office supplies, software subscriptions, and vendor payments, can be tracked with comprehensive categorization and reporting features.

Yes, Volopay integrates with popular Australian accounting systems, including Xero, MYOB, and QuickBooks, ensuring seamless data flow and eliminating manual entry.

Yes, the cards are accepted globally at millions of merchants worldwide, supporting international travel and cross-border business operations while maintaining spending controls.