Business prepaid debit cards for smart spending

Running a business comes with unique challenges—managing cash flow, tracking expenses, and ensuring team accountability without drowning in paperwork. Manual reimbursements, overspending, and a lack of visibility into spending can drain your time and resources.

Business prepaid debit cards, like those offered by Volopay, provide a smarter way to streamline expense management. With real-time controls, automation, and seamless integrations, you can focus on growth while keeping finances in check.

What are business prepaid debit cards?

Business prepaid debit cards are payment tools preloaded with funds, allowing you to spend only what’s available. Unlike traditional debit or credit cards, they’re not linked to a bank account or credit line.

You load funds via bank transfer, ACH, or other methods, and employees can use them for purchases or ATM withdrawals where major networks are accepted. This structure ensures tight control over spending, making them ideal for managing budgets.

Difference from credit and traditional debit cards

Prepaid debit cards for business differ significantly from credit and traditional debit cards. Credit cards rely on a line of credit, accruing interest if unpaid, while traditional debit cards draw directly from your bank account, risking overdrafts.

Prepaid cards limit spending to preloaded amounts, eliminating debt or overdraft risks. They also require no credit checks, making them accessible for businesses with limited credit history.

Why they suit businesses

Prepaid debit cards for businesses offer agility and control. They allow you to allocate funds for specific purposes, such as travel or office supplies, without exposing your main accounts. Real-time tracking ensures visibility into every transaction, fostering team accountability.

For startups or small teams, these cards simplify cash flow management, reduce reimbursement hassles, and provide a flexible solution that scales with your business.

Benefits of prepaid debit cards for businesses

No credit checks or interest payments

Business prepaid debit cards eliminate the need for credit checks, making them ideal for startups or businesses with limited credit history. Since you preload funds, there’s no risk of accruing interest or falling into debt, unlike credit cards.

This ensures financial discipline, allowing you to manage expenses without worrying about unexpected charges or credit score impacts. With prepaid debit cards for businesses, you maintain full control over your cash flow, ensuring every dollar is spent intentionally.

Real-time visibility and spend control

With business prepaid debit cards, you gain instant insights into every transaction. Platforms like Volopay offer real-time dashboards that track spending by employee, team, or category, empowering you to monitor budgets closely.

Receive alerts for unusual activity, such as large transactions or unapproved vendors, and take action immediately. This level of visibility prevents overspending, reduces financial risks, and ensures your business stays on track, all while simplifying expense management for business owners.

Set budgets by role or team

Prepaid debit cards for businesses allow you to assign specific budgets tailored to roles or teams. For instance, allocate $500 for your marketing team’s ad campaigns or $200 for sales reps’ client dinners.

With Volopay, you can customize limits per card, ensuring employees spend within approved boundaries. This granular control enhances accountability, prevents misuse, and aligns spending with your business goals, making it easier to manage diverse expense needs efficiently.

Reduce admin overhead

Manual expense tracking and reimbursements can overwhelm business owners. Prepaid debit cards streamline this process by automating expense categorization and providing digital transaction records.

Volopay integrates with accounting software, eliminating the need for manual data entry. Employees upload receipts instantly via mobile apps, saving hours of administrative work. This efficiency lets you focus on growing your business rather than managing expense reports.

Key use cases for business prepaid debit cards in Australia

Travel, meals, and per diem expenses

Equip your team with dedicated cards for business travel, meals, and per diem allowances. Establish daily or trip-specific spending limits to prevent budget overruns while ensuring employees avoid using personal funds for company expenses.

This approach simplifies compliance procedures and streamlines expense reporting processes. Prepaid debit cards for small business eliminate reimbursement delays, provide real-time spending visibility, and maintain strict adherence to established travel policies.

Marketing, digital ads, and freelancers

Prepaid cards excel at managing marketing budgets, including digital advertising campaigns and freelancer payments. Issue virtual cards with predetermined spending limits for platforms like Google Ads, Facebook Ads, or Upwork, ensuring controlled and trackable expenditures.

This targeted approach prevents marketing budget overruns, provides detailed campaign spending analytics, and enables quick access suspension when necessary, maintaining complete oversight of promotional investments and contractor payments.

SaaS and recurring subscriptions

Utilize prepaid cards specifically for managing essential SaaS subscriptions like Zoom, Slack, Adobe Creative Suite, or Microsoft Office. Virtual cards prevent costly service interruptions caused by expired shared payment methods and significantly reduce fraud risks by limiting vendor exposure.

This strategy ensures critical business applications remain operational, simplifies subscription management, and provides clear visibility into recurring technology costs, enabling informed decisions about service renewals and software investments.

Office supplies and procurement

Empower office managers with prepaid cards designed for purchasing supplies and essential equipment. Configure merchant-specific spending limits to ensure funds are exclusively used at approved vendors like Amazon, Staples, or Office Depot while maintaining comprehensive budget oversight.

This system eliminates petty cash management, streamlines procurement processes, and provides detailed transaction records for accounting purposes, enabling teams to acquire necessary supplies efficiently without complicated approval workflows.

Why Volopay’s prepaid debit cards are designed for businesses of all sizes

Instant issuance of virtual & physical cards

Volopay enables instant issuance of both virtual and physical prepaid debit cards, streamlining business operations.

Virtual cards become available for online purchases within minutes of creation, while physical cards are delivered rapidly for in-store transactions.

This dual-card system ensures your team maintains uninterrupted access to funds, whether conducting digital business or making face-to-face purchases, keeping operations running smoothly.

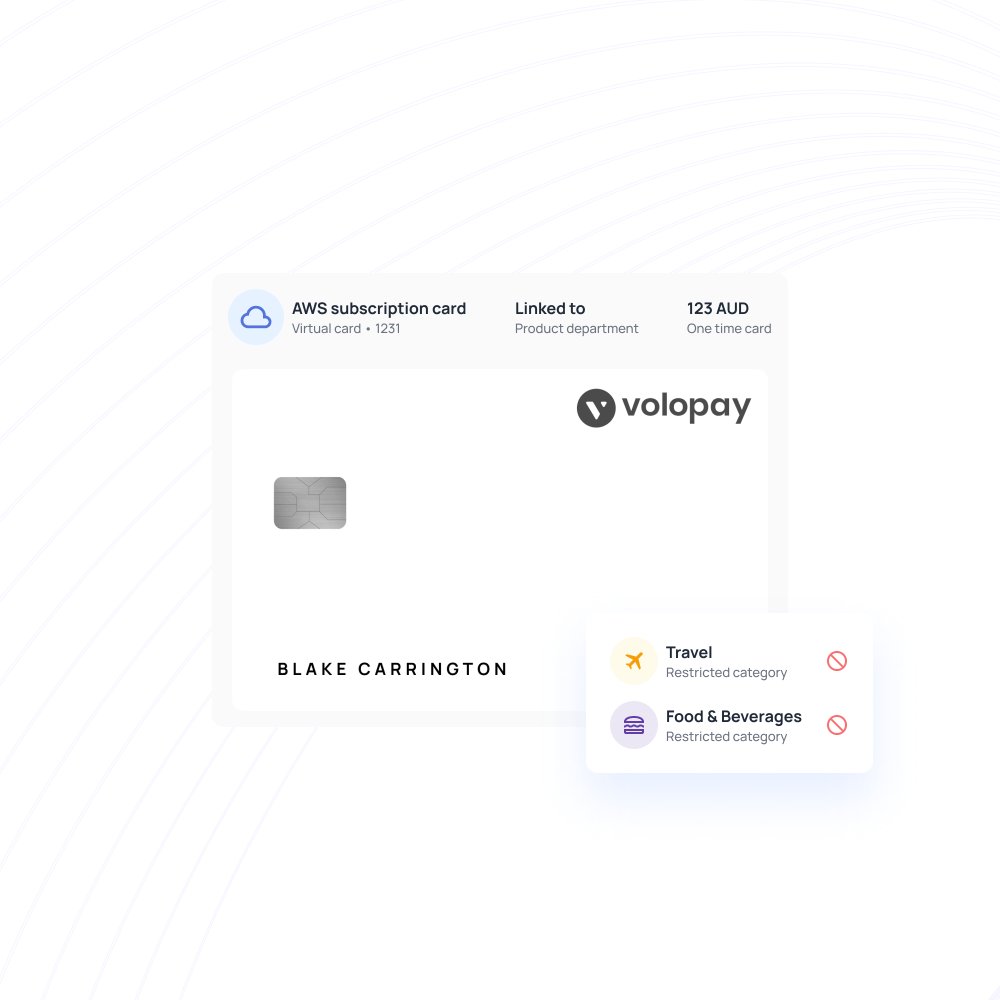

Custom roles, limits, and merchant controls

Volopay's corporate cards provide comprehensive customization options for card permissions, allowing businesses to tailor access according to specific team requirements.

Administrators can establish spending limits, restrict particular merchants, or confine transactions to designated categories such as travel expenses or software subscriptions.

This granular control system ensures every dollar is spent purposefully while maintaining strict oversight over company expenditures and preventing unauthorized purchases.

Real-time dashboards and budget tracking

Volopay's sophisticated real-time dashboard visibility delivers comprehensive live spending visibility across your entire business operation.

The platform enables continuous budget monitoring, detailed transaction tracking, and automated alerts for suspicious or unusual activity patterns.

This immediate access to financial data empowers business owners to make informed decisions instantly, maintain strict budget adherence, and quickly identify potential issues before they impact operations.

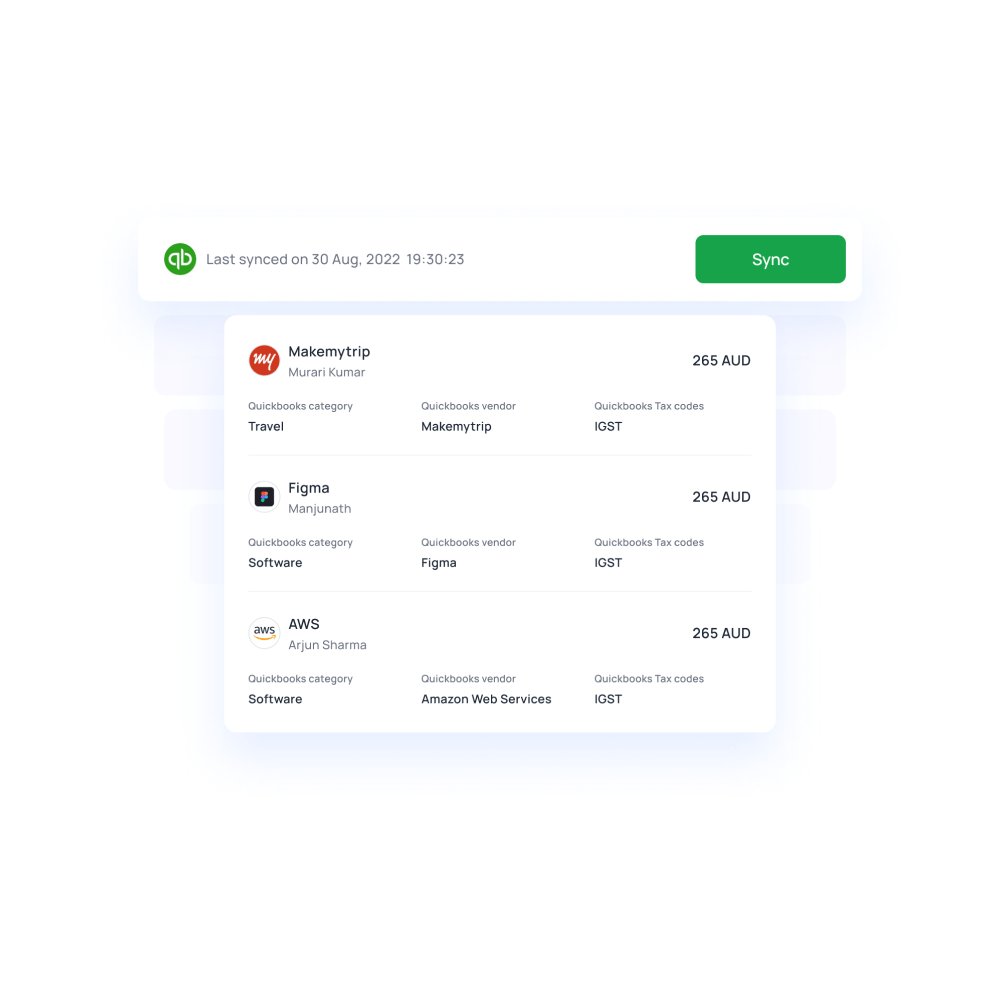

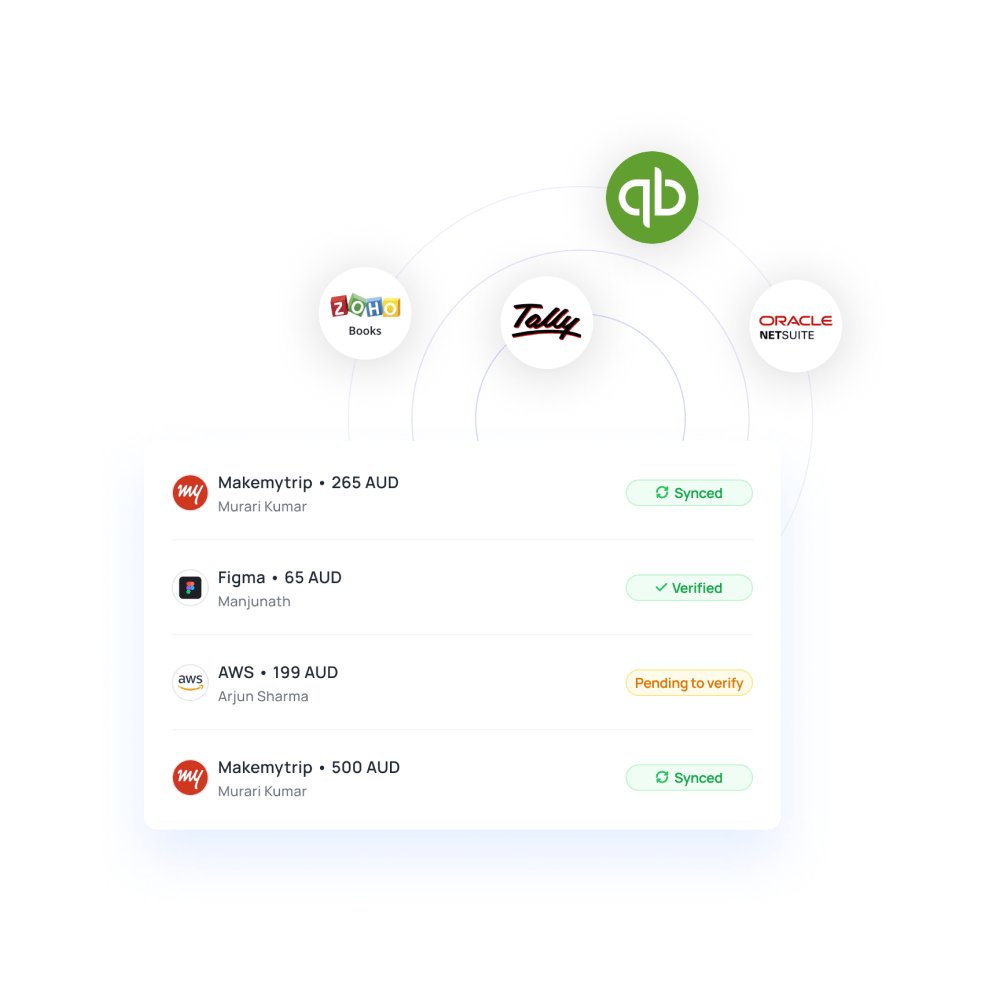

Seamless accounting integrations

Volopay seamlessly integrates with popular accounting platforms, including QuickBooks and Xero, automating expense categorization and reconciliation processes.

This integration eliminates time-consuming manual data entry, reduces human error, and ensures financial records remain consistently current and audit-ready.

Businesses can focus on growth rather than administrative tasks, knowing their financial documentation is automatically synchronized and professionally maintained.

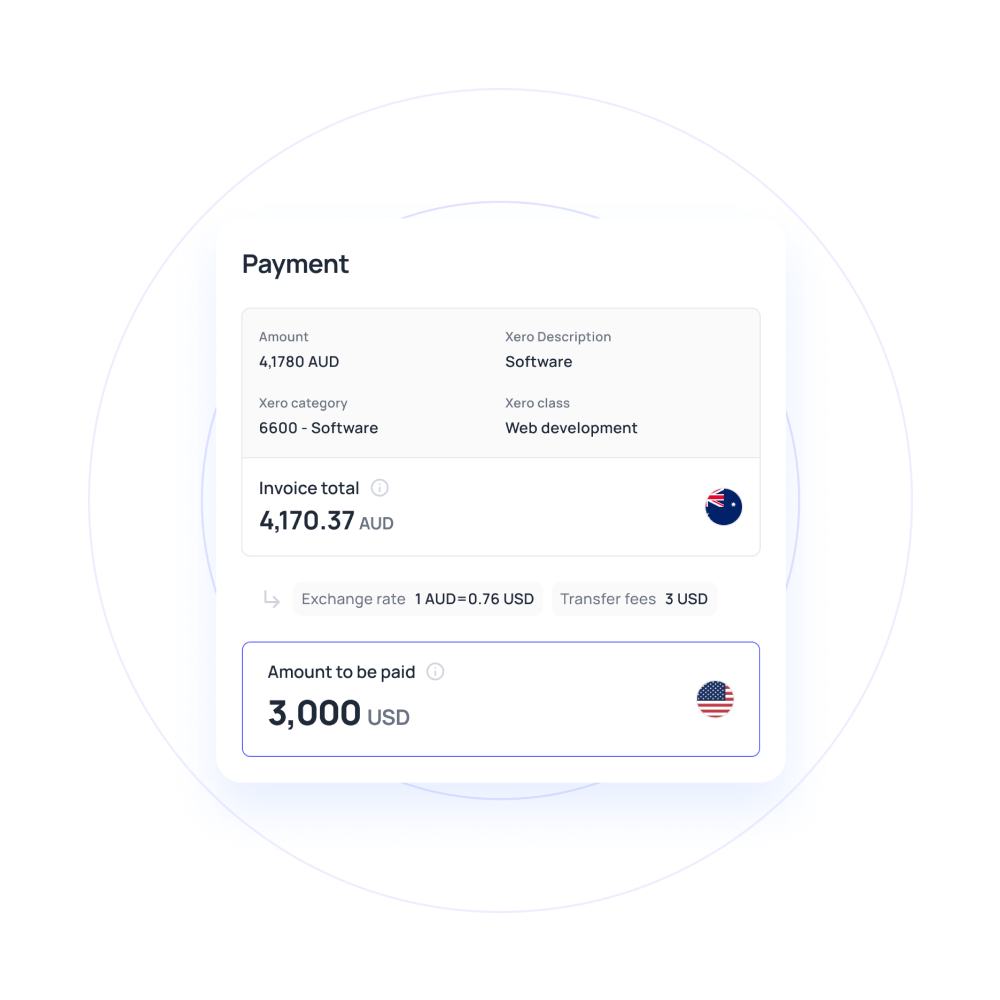

Multi-currency support for global use

Volopay's prepaid cards support multiple international currencies, making them ideal for businesses with global operations. The platform significantly reduces foreign transaction fees while simplifying international payment processes.

Users can preload cards with USD, EUR, or other major currencies, effectively avoiding unpredictable exchange rate fluctuations and maintaining consistent budgeting.

This feature particularly benefits companies with international suppliers, remote teams, or frequent business travel requirements.

Simplify compliance and spend governance with business prepaid debit cards

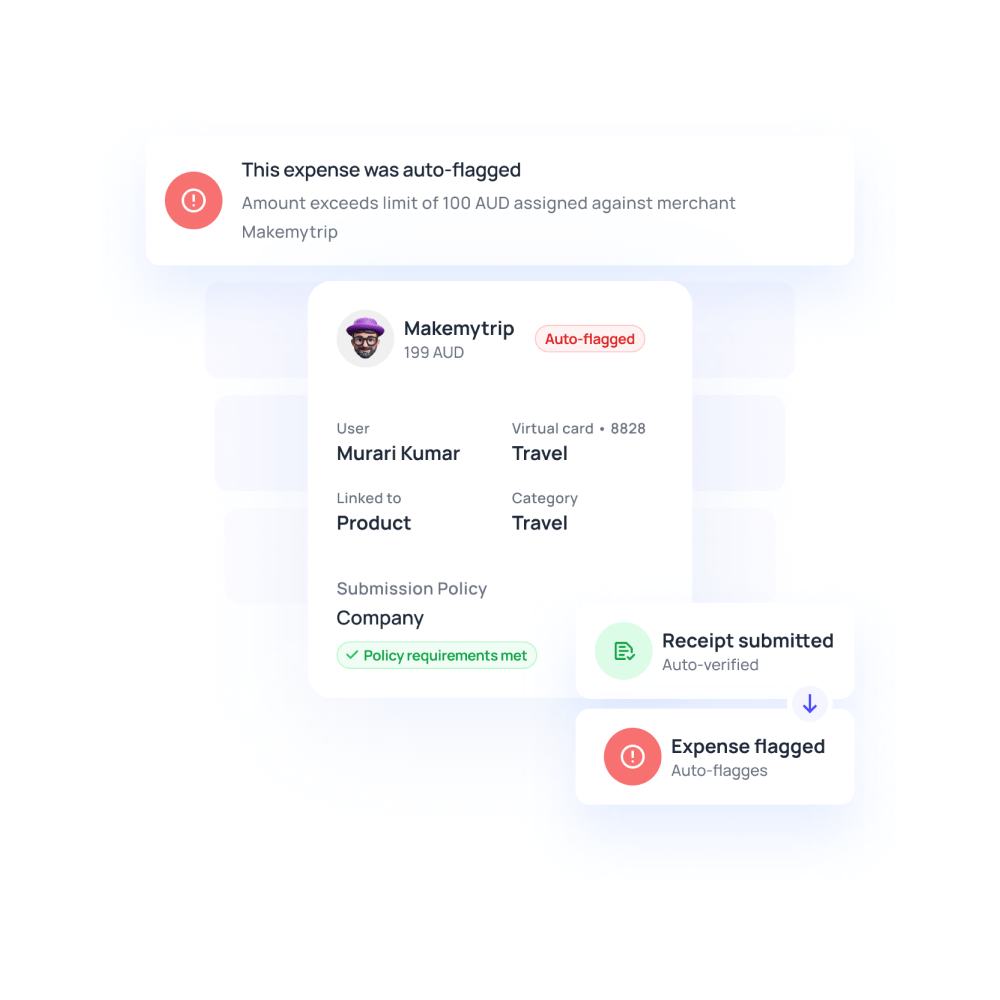

Enforce spend policies automatically

Volopay's prepaid debit cards for business automatically enforce spend policies in real time.

The platform enables businesses to set rules that block out-of-policy purchases and unauthorized vendor transactions, ensuring complete compliance without requiring constant management oversight.

This automated enforcement protects company budgets while maintaining operational efficiency and reducing administrative burden.

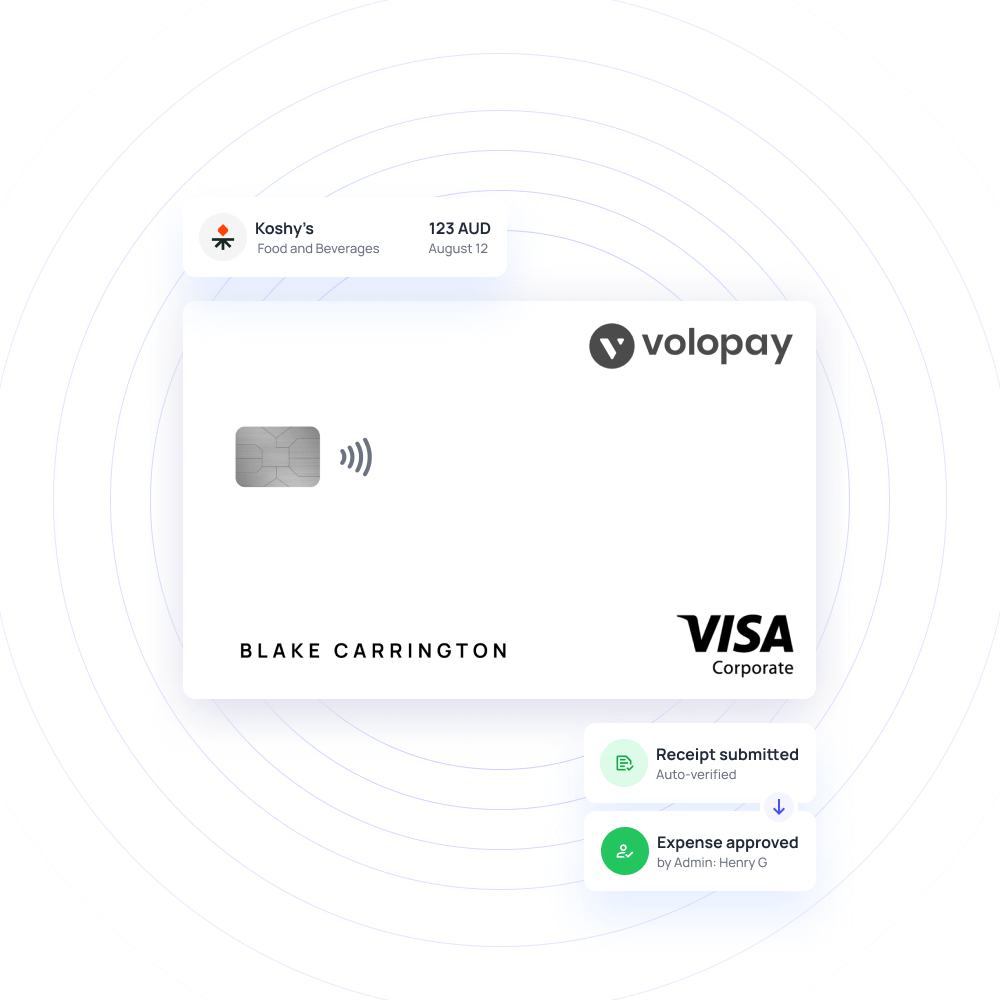

Capture receipts and audit trails instantly

Employees can seamlessly upload receipts through Volopay's intuitive mobile application, creating instant, comprehensive audit trails for all transactions.

This automated receipt capture system eliminates missing documentation issues, streamlining audit processes and tax preparation.

Prepaid debit cards for business become powerful compliance tools, ensuring every expense is properly documented and readily accessible.

Role-based access and approval layers

Define sophisticated finance workflows using role-based access controls with prepaid debit cards for business.

Assign specific approval rights to managers, establish employee spending limitations, and create multi-layered approval processes that maintain strong governance standards.

This structured approach ensures financial oversight scales effectively as your business grows, maintaining control without hampering productivity or operational flexibility.

Why Volopay is the ideal prepaid debit card solution for businesses

Unified platform for expense management

Volopay combines cards, workflows, and comprehensive reporting into one integrated platform. Businesses can manage all expenses—including cards, reimbursements, and budgets—through a single, intuitive dashboard.

This unified approach eliminates the need for multiple tools and reduces operational complexity, streamlining financial management while providing complete visibility into company spending patterns and budget allocations across all departments.

Built for scaling operations

Whether managing 5 or 500 employees, Volopay scales effortlessly with your business growth. Add new cards, teams, or budgets seamlessly as operations expand, without requiring complex setup procedures or incurring additional costs.

This scalable architecture ensures that prepaid debit cards for small business remain effective as companies grow, maintaining consistent functionality and user experience regardless of organizational size.

Dedicated onboarding and success support

Volopay provides comprehensive hands-on onboarding services to ensure quick implementation and optimal results. The dedicated support team guides businesses through initial setup, platform customization, and scaling strategies, ensuring maximum utilization of all available features.

This personalized approach minimizes learning curves, accelerates adoption, and helps businesses immediately realize the platform's full potential for streamlined financial management and operational efficiency.

Trusted by fast-growing startups globally

Volopay has earned trust from startups worldwide through consistent reliability and continuous innovation. The platform's user-friendly interface, combined with robust features, makes it the preferred choice for businesses seeking to streamline financial operations.

This global recognition demonstrates Volopay's effectiveness in addressing diverse business needs while maintaining high standards of security, functionality, and customer satisfaction across different markets.

Instant rfeeze and unfreeze capabilities

Volopay provides complete control through instant freeze and unfreeze functionality. If cards are lost, stolen, or misused, businesses can immediately pause them through the mobile application, protecting funds without delays or complex procedures.

This real-time control feature enhances security, reduces financial risks, and provides peace of mind, allowing businesses to respond quickly to potential threats or suspicious activities.

Unlimited virtual cards for every use case

Issue unlimited virtual cards tailored for specific teams, vendors, or individual projects. Each card can be configured with unique spending limits and merchant restrictions, enhancing both security and operational flexibility.

This capability allows businesses to create purpose-specific payment solutions, maintain strict budget controls, and ensure appropriate fund allocation while simplifying vendor management and project-based expense tracking throughout the organization.

How to get started with Volopay

1. Quick setup and instant card activation

Sign up for Volopay, and once your account is onboarded, you can issue your first card within minutes. The intuitive platform seamlessly guides users through account creation, funding processes, and card issuance without requiring any technical expertise.

This streamlined onboarding ensures businesses can begin using prepaid debit cards for small business operations immediately, eliminating lengthy setup delays.

2. Customize roles, teams, and controls

Easily map your organization's structure within Volopay's comprehensive management system. Assign specific roles to team members, establish departmental budgets, and configure precise spending limits that align perfectly with your unique business requirements.

This customization process requires only a few clicks, enabling businesses to implement tailored financial controls quickly and efficiently.

3. Book a demo and explore Volopay

Ready to transform your expense management approach? Book a personalized demo with Volopay to discover how their advanced platform can streamline your business finances effectively.

Experience the comprehensive power of their prepaid card solutions first-hand, exploring features designed specifically for growing businesses seeking better financial control, transparency, and operational efficiency in expense management.

Bring Volopay to your business

Get started now

FAQs about business prepaid debit cards in Australia

Prepaid debit cards limit spending to preloaded funds, allowing you to set budgets per employee or team. Real-time tracking and customizable limits prevent overspending and ensure accountability.

Yes, Volopay’s cards support multiple currencies, reducing foreign transaction fees. You can load USD, EUR, or other currencies for seamless global payments.

Absolutely. Volopay lets you set spending limits and restrict transactions to specific merchants or categories, like travel or software, for precise control.

With Volopay, you can instantly freeze a lost or compromised card via the app, preventing unauthorized use. Replacement cards are issued quickly to minimize disruption.

Volopay’s real-time dashboards and automated spend controls ensure you stay within budget. Set limits, receive alerts, and block out-of-policy purchases to prevent overspending.

Yes, Volopay allows you to issue unlimited virtual and physical cards to employees. Customize limits and permissions for each card to suit individual roles or teams.