Xero vs MYOB - Review and comparison

Two of Australia’s most popular accounting software are MYOB and Xero. It’s not a rare sight to see the two software being compared when it comes to picking the right accounting platform for businesses.

Both come with their own sets of features and have advantages and disadvantages over the other.

To help you make a more well-informed decision on which software you should use, here is an MYOB vs Xero review detailing what they each have to offer and what businesses could benefit from them the most.

Overview of Xero accounting software

Features of Xero accounting software

● Payroll management

Calculate payroll taxes and process salary payments with Xero. You can report your payroll details to the ATO for easy and ensured compliance.

● Track projects

Track your project costs and get paid for them on the same platform. Send quotes and invoices to customers to streamline project payments.

● Sending invoices

Generate invoices from your Xero dashboard or mobile app. Send them to your customers and follow up with automatic reminders to ensure there are no late payments.

● Inventory management

Track your inventory when you’re doing business. Add preset items to your invoices and orders, see which of your inventory is selling the best, and manage all your stock.

● Accounts payable & receivables

Manage both your accounts payable and receivable without having to switch platforms. You can accept payments from customers straight through Xero while also having the ability to record and pay your expenses on the same platform.

● Bank reconciliation

Ensure that your financial information is all accurate and up to date with Xero’s automated bank reconciliation. Easily reconcile your bank accounts every day.

• GST returns

You can make filling out your BAS easier using Xero’s automatic GST calculations. Get accurate GST return numbers and speed up your tax reporting process.

• Claim expenses

Xero allows you to make the expense process faster and easier. Record, manage, and approve your expenses with Xero. Settling reimbursement claims can also be done through Xero’s platform.

Other additional features of Xero

You can also connect your bank account to Xero for smoother payment processing and reconciliation. Not only that, but Xero also offers time tracking on your projects, making it easy to invoice billable hours to customers.

Supporting over 160 currencies, invoices generated through Xero can also factor in currency conversions automatically before they’re sent and settled.

Which businesses can use Xero?

Xero can be used by many different types of businesses. Delving deep into Xero in the MYOB vs Xero review, however, shows that Xero is most popular amongst sole traders and small businesses.

Many cafes, retail shops, and agriculture businesses, for example, utilize Xero to help ease their accounting processes. With a low starting cost, Xero is appealing to businesses that are still slowly emerging and growing.

They can also be utilized by bigger businesses with the many add-ons they offer to tackle different problems. Each plan will suit a different type of business.

Sole traders are likely to be content with the Starter plan while emerging small businesses might opt for the Standard plan. If you do business globally and have many foreign vendors and customers, however, you might want multi-currency functionality with the Premium plan.

Advantages of using Xero accounting software

One of the things that make Xero stand out is that they have a number of add-ons to help you customize what it is that you need from your accounting software plan. There are many levels and customization options, which can make it easier for you to personalize your plan according to your business needs.

Xero also offers training for new users, which is advantageous for many businesses. It can help you realize what exactly you need from an accounting platform to make your processes easier.

Moreover, Xero comes with a 30-day free trial to help you get acquainted with the platform. If used according to your business needs, Xero can easily make your accounting more streamlined.

Disadvantages of using Xero accounting software

While the add-ons can help you feel like your plan is suited exactly to your needs, the cost can also add up. This is especially true if you start on the lowest-tier plan.

With a limited number of invoices that you can process and bills you can enter, the Starter plan can get redundant real quick before you have to upgrade your plan. In an ideal situation, your business will scale proportionally with the need for add-ons and an upgraded plan, but this may not always be the case for more complex business structures.

Xero can help you solve these complex issues, but only if you’re willing to spend a little bit more money.

Market share of Xero accounting software in Australia

As of 2020, Xero is reported to have around 47% market share of the small business accounting software market in Australia. They have the biggest market share in their particular Australian market, even when comparing MYOB vs Xero. This number may vary globally and only reflects the Australian market.

Spend less time on closing books & more time on growing your business

Overview of MYOB accounting software

Features of MYOB accounting software

• Invoicing and quotes

You can create customized quotes and invoices easily at any time. Track which invoices have been paid and which haven’t and send payment reminders to customers who haven’t settled their invoices.

• Payroll

Automate payroll taxes and superannuation calculations, allow employees to fill out timesheets, and generate salary payments through MYOB. File your payroll reports to submit to the ATO easily.

• Business insights

Gain insights into your business finances through robust reporting with MYOB. You can compare your income and expenses to your budgets to ensure that you’re on the right track.

• Mobile app

The MYOB mobile app offers you MYOB functionality and features that you can access on the go. Not only can you send invoices, but you also can use the MYOB Capture App to take photos of and scan receipts.

• Bills and expenses

Make expense management easier by using AI technology that allows employees to simply scan receipts to capture their information. Forward your bills to the platform for a more streamlined process.

• Tax and GST

MYOB can automatically calculate GST for you. Prepare your BAS directly from the MYOB software for faster and more accurate reporting and send it off to the ATO hassle-free.

• Receive payments

Enable online payments and give customers the ability to pay online directly from the invoice. Receive payments on MYOB and reduce the chances of late payments.

• Cash flow management

Get better visibility of your finances in real-time. View your income, expenses, and even profits presented as structured data to make budgeting and managing your cash flow easier.

Other additional features of MYOB accounting software

An MYOB vs Xero review would not be complete without mentioning that MYOB also has similar functionalities with Xero. Like Xero, you can manage your inventory with MYOB.

Manage your projects better with features that allow you to track profits and losses by project and view what your best-sellers are. You also have access to multi-currency accounting to support you in growing your business globally.

Which accounting software is a better option for your business?

The short answer is that it depends. After conducting an MYOB vs Xero review, it’s clear that the better option for your business depends largely on what your business is looking for. MYOB has robust features and an excellent payroll suite to boast. With simpler business models, MYOB could easily be the more straightforward choice. This is especially true if you have a large workforce, as MYOB could help you in your payroll management and save you a lot of time with it.

However, as Xero is more customizable, it could be the more suitable accounting software for businesses that are more complex. Some automated processes with Xero can seem easier and more complete, as they can be adjusted to your business needs. Xero also offers better interactions between employees, bookkeepers, and customers.

At the end of the day, you should analyze your own business model before picking which accounting software to use for your business. If you have a non-complex business model but a large number of employees, MYOB might be the better choice. Conversely, if you have fewer employees but run a complex business, then Xero might be the software for you.

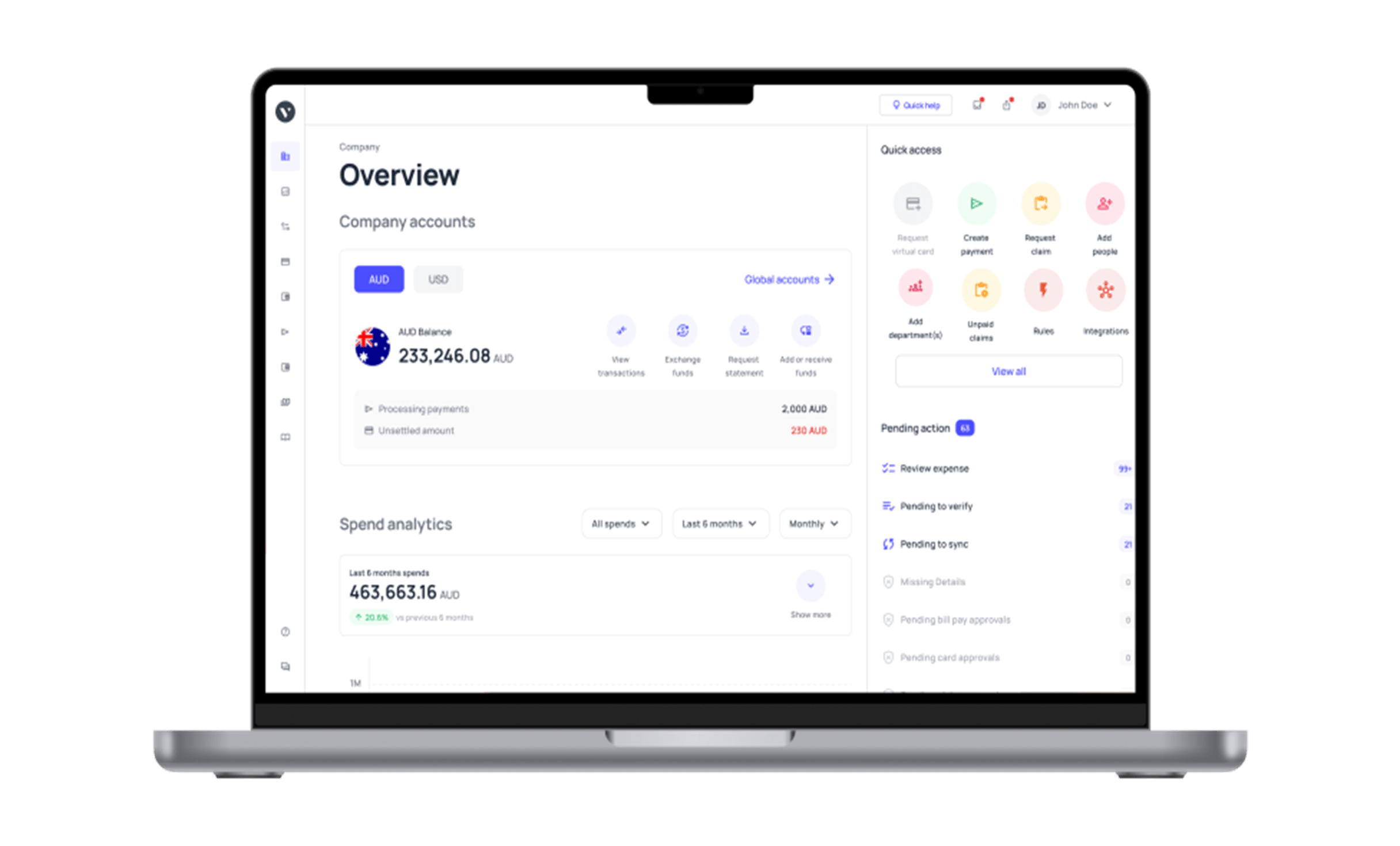

Integrate MYOB and Xero seamlessly into Volopay

After a thorough MYOB vs Xero review, it’s obvious that both software are useful in their own ways. Regardless of which accounting software you choose for your business, however, accounting software is not the only tool that your business might need.

Instead, you can optimize their usage by fitting them into a larger ecosystem of software and platforms to aid your business.

As an expense management platform, Volopay offers accounting integration with MYOB, Xero, and many more. You can ensure that you are on top of your accounting while keeping track of all your expenses.

Pairing Volopay with MYOB or Xero means that you can manage your expenses better while making sure that they’re all recorded in your books. When an expense is made through Volopay’s platform, you can automatically categorize it in your ledger through the use of triggers. Not only that, but you can also perform two-way reconciliation to ensure that everything on both software match perfectly.

FAQs

Both software offer functionality that makes them user-friendly. However, as MYOB has a lot of advanced features but with less customization, Xero can be easier to digest. For people who have not been trained in using either software, it’s often easier to have a good grasp on Xero first.

Having accounting software to automate your processes is useful for small businesses as it will free up your time and reduce the amount of manual administrative work that you have to do. MYOB specifically is good for small businesses as it is built with sole traders and growing businesses in mind. Its functionalities fit businesses of that scale and you have the option of choosing which plan will fit the scale of your business.

MYOB can be a bit complex and takes some time to learn. However, accounting software is meant to ease the accounting workload and processes, and MYOB takes this into account. With a bit of the right training, MYOB can be easy to use by accountants and business owners alike.

It’s a good idea to train your staff to use Xero. Xero offers resources that your staff can use to familiarize themselves with the platform and make the most of it. While Xero is very user-friendly, it’s also easier to use and optimize after some training.