MYOB vs QuickBooks - Review and comparison

Before exploring the options of which one is the better accounting software, let’s talk about accounting inefficiencies. Those hard-to-manage business areas or functions must be upgraded by adopting automated accounting software.

Errors in booking data entry, a colossal amount of time wasted on reconciliation and error resolving, immense manual labor to maintain compliance with tax laws, heavy money spent on creating audit trails, inaccurate payroll management, and many more.

When you see any of these problems persistently existing in your business, it is time to adopt an automated accounting management solution. We will discuss two of the most prominent accounting software available in the Australian market and compare their specifics: MYOB vs Quickbooks.

Overview of QuickBooks accounting software

1. GST-BAS payments

One of the most helpful and amazing facilities offered by QuickBooks is GST-BAS payments. With a QuickBooks account, you can track GST and directly submit BAS details. Along with this, you can easily forecast your tax liabilities and pay your BAS without facing any complications.

Plus, whenever you create an invoice, the system would automatically indicate if you must add GST. The system is comprehensive and gives detailed information through which you can effortlessly lodge your BAS. You also get a BAS summary and review report created by the platform.

2. Payroll

QuickBooks offers an inbuilt Single Touch Payroll feature. You just have to set the system according to your payroll days, policies, and other details, and the payroll dates get automated. The employees would receive their salary on time every month.

Plus, with the WorkZone app, employees can easily manage their timesheets and payslips. They can also manage their leave requests and log in their expenses. All the payroll payments done through QuickBooks are ATO approved.

3. Mobile app

The QuickBooks mobile app is easily accessible and helps in efficiently managing expenses from anywhere. Employees can easily click a picture of their receipts and upload them on the app for further processing.

Plus, all the expenses can be tracked in real-time. So if you are away from the office, you just have to upload the receipt on the app, or the managers can also approve expense requests with just one click.

4. Manage cash flow

With QuickBooks, your business can coherently manage its cash flow. Facilities offered for business cash flow management are custom cash flow tips, real-time financial data updates, and direct bank account connectivity.

Along with this, all transactions made through the platform automatically sync with your business expense policies and show on your dashboard. Sales numbers, invoices, GST, customer details, credit, and bank details. Everything can be managed and tracked using just one QuickBooks dashboard.

5. Insights and reports

Insights and report creation is a strong feature offered by QuickBooks. You can directly access your balance sheets and income statements from the dashboard. Along with this, you can create an expense undertaking roadmap to ensure that you reach your goals by tracking spending regularly.

Plus, get a professional financial summary that can be shared with partners and investors. Finally, all this happens while keeping accounting updated with the process.

Which businesses can use QuickBooks?

QuickBooks is the best fit for two major types of business groups. First are the Self-employed freelancers, contractors, and traders. Second is small businesses that have a higher employee number and deeper management complexity.

Industries for which QuickBooks would be most suitable would be Professional Services, Trade & Construction, Hospitality, E-commerce, Health & Social Care, and Retail.

Advantages of using QuickBooks accounting software

QuickBooks is an extremely easy-to-use software that can help you efficiently manage your expenses and taxes. You can easily file your taxes and stay compliant with tax laws and rules. Along with this, the software is flexible and is constantly being adapted to the new techniques and requirements of the business market.

Plus, Quickbooks ensure top-notch protection and safety along with fast-forward adaptation to new technological methods. Furthermore, the software is incredibly open to different kinds of integrations and connections with other software or ERP.

Disadvantages of using QuickBooks accounting software

Though QuickBooks is an extremely popular software, there are a few drawbacks to it. It lacks any reporting capabilities outside the accounting area, and there are various system crashes and instabilities. Absence of direct support and allows only a limited number of users.

Integrate QuickBooks with Volopay and sync transactions instantly!

Overview of MYOB accounting software

1. Invoicing and quotes

MYOB facilitates businesses with the ability to create and send invoices from any device. With customizable pre-designed templates available, you can easily change the details to give it your business’s touch.

Along with this, quotes can effortlessly be converted into ready-to-send invoices. These invoices can have automatically calculated GST numbers and auto-filled customer information.

Furthermore, with the eInvoicing feature, your customers would receive the invoices from your system directly in their inboxes. Plus, they can pay those invoices with just one click.

2. Payroll

The best service offered by MYOB business in terms of Payroll management is automatic compliance with the ATO requirements. You can generate and send Single Touch Payroll reports.

Additionally, all the payroll variables can also be automatically calculated by the system. Variables like leaves, tax, superannuation, etc.

3. Business insights

MYOB business provides automated reporting and budget insights facility. From the simple basics like daily expenditure reports to larger complex data analyses like tax and cash flow numbers and trends. These report sheets are, by default, filled with transactions, employee, and receipts numbers.

All this is available in just a few clicks. These reports are further customizable; you can add and remove numbers, columns, and data ranges to make the report.

4. Mobile app

MYOB offers three mobile applications. MYOB Capture, MYOB Invoice, and MYOB Team. With the MYOB teams app, you can easily maintain employee timesheets and create employee roasters.

The MYOB Capture app has been designed to take pictures of receipts and upload them directly to the software, so you don't have to enter invoice data manually.

Lastly, the MYOB Invoice app allows you to create, track and send invoices and also see how much your customer owes you right on the app.

5. Bills and expenses

Businesses can manage all their bills and expenses easily through the MYOB software. Get direct back transactions reconciliation, eliminate duplicate and flawed expenses data.

Moreover, you can assign the expense to particular customers, employees, or categories to create expense categories or groups. All this eases the end-minute tasks of sending an invoice; you would just have to add or check the costs and simply send it.

6. Tax and GST

One challenge the MYOB software eases up most is tax compliance and BAS lodging. You do not have to sit down every time and put in double the effort to make your books GST complaint; the system automatically tracks everything, enters all data categorically, and creates an audit trail for GST compliance.

Plus, you also get pre-filled BAS reports which you just simply have to go through and send to the ATO from the system.

7. Receive payments and cash flow management

You can effortlessly create invoices using the default customizable templates. These can then be directly forwarded to the customers, who can then use the “Pay Now” option to send payments immediately.

With the inline payments facility, your business can get paid instantly. Furthermore, with the comprehensive MYOB dashboard, you get all the data and analytics. Also, the pre-filled reports of budgets and expenditures all help you effectively manage cash flow.

Which businesses should use MYOB?

MYOB Business software is an effective automation solution for individual or sole traders, startups, small and medium-sized businesses, enterprises, and selectively for accountants.

Advantages of using MYOB accounting software

There are various benefits of adopting the MYOB accounting software for your business. Some of them are automatic reconciliation, real-time reports and budgets, invoice creation and customization, expense tracking from various devices, automatic tax calculator and compliance, inbuilt payroll management workflow, efficient inventory tracking, multi-currency accounting, and automated audit trail creations.

Using MYOB, your business would step up the game with increased efficiency, the absence of extra manual labor, and accurate data reports and analysis.

Disadvantages of using MYOB accounting software

Yes, MYOB is an excellent automation software; however, the most significant challenge with the system is the comparative need for manual data entry. In comparison to other accounting automation software, there is a little extra requirement for manual data entry into the system.

Plus, canceling the software subscription can be an immensely difficult task, and reports can only be converted to PDFs, no other format.

Which accounting software is a better option for your business?

The best accounting software for your business highly depends on what factors and problems you are looking to solve. Different businesses, different challenges. So, we suggest analyzing the areas which are responsible for the money drain from your business. Then determine the exact problem and research the solution.

For example, QuickBooks is a software that provides almost all the features to handle your business finances. So problems related to reconciliation, bank account integration, asset and inventory management, invoice and purchase order administration, etc., can be effectively handled. The cheapest version of this software starts from 12.50AUD/month for basic features of invoices and expense tracking.

On the flip side, MYOB is also an excellent software for solving all the above-mentioned challenges; however, the cheapest plan of the MYOB software begins from 14.00AUD/month, but comparatively, they offer more varied features even in the simplest plan. So, research and choose wisely.

Integrate QuickBooks and MYOB seamlessly into Volopay

Now, whichever platform you choose; how about you get all their features along with many other beneficial financial management ones? Yes, this is actually possible with Volopay.

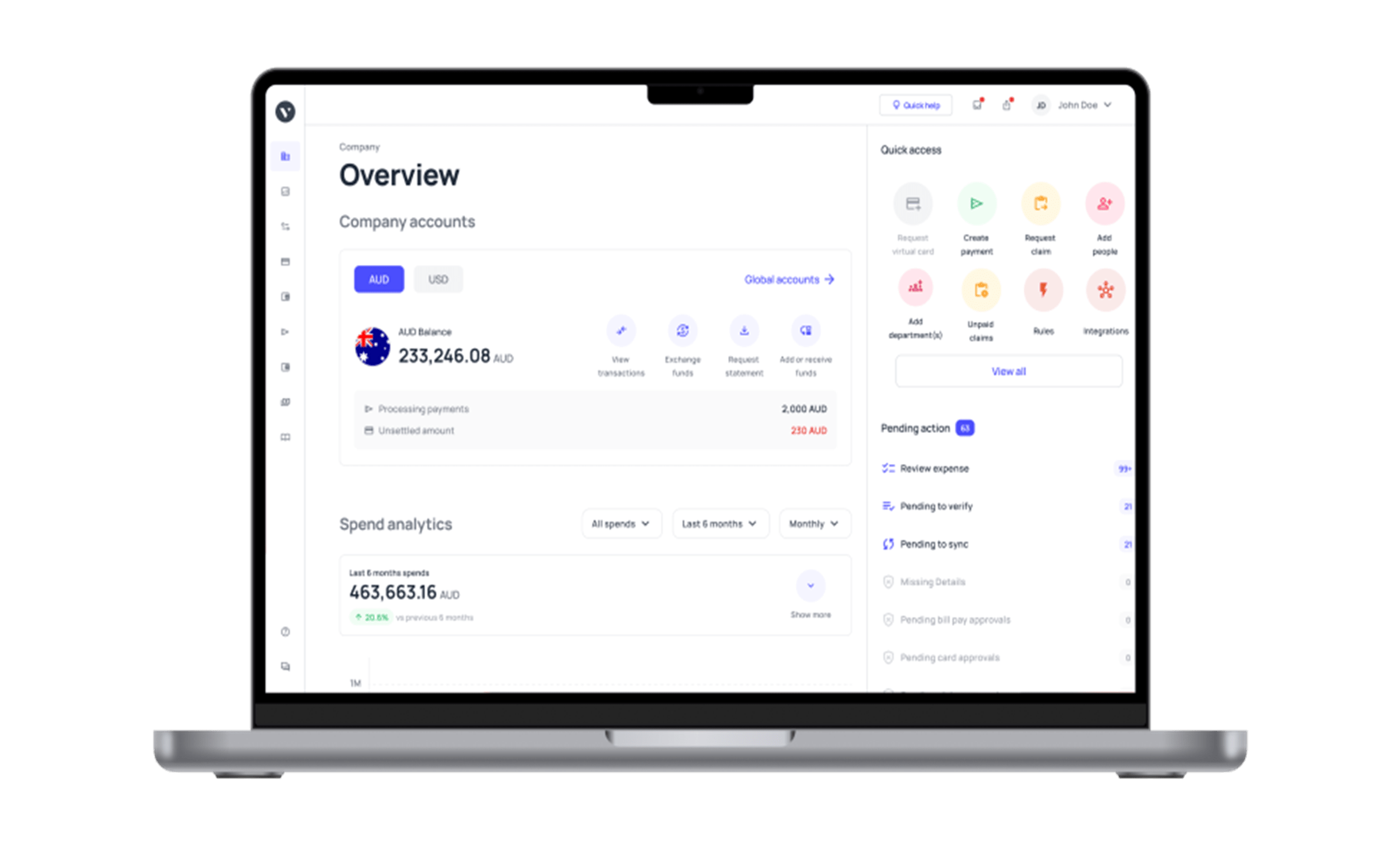

Volopay is an all-in-one expense management platform that offers all kinds of facilities and tools that a business would need to administer, organize and track all its expenses. From direct accounting integration with MYOB, QuickBooks, and other major accounting software to global business accounts for storing and managing company funds, you get everything.

With Volopay tools like multi-currency digital wallets, corporate cards, unlimited virtual cards, individual vendor accounts, reimbursement workflow, multi-level approval, and more, many come into easy access for your business.

Integrate MYOB with Volopay and sync transactions instantly!

FAQs

From 31 May 2023 onwards, QuickBooks will discontinue access to add-on services for QuickBooks Desktop for Windows 2020.

QuickBooks is a popular software because it offers all features which a business needs to handle its finances at cheaper prices.

With the MYOB AccountRight version, businesses can keep their data offline.

There are online courses available for you to learn how to use MYOB essential dashboard. Plus, the software is built to be an easy-to-use system.

QuickBooks training classes help you understand the software intricately and enjoy all the benefits possible.