Financial year in Australia: Important dates and information

Time frames—both quarterly and annually—are essential to any business trying to budget and set goals. This is why the financial year is key to Australian businesses.

A financial year is similar to the usual Gregorian year of 12 months; just the start and end of the financial year change.

Using the financial year Australia has set out, to create a framework for what is to come, allows businesses to easily budget, forecast, and report finances. A financial year also serves as a universally standard basis for the comparison of companies and industries.

What is a financial year?

The financial year Australia businesses adhere to is one calendar year, or 12 months, long. However, what sets a financial year apart from a normal calendar year is that at the start and end of financial year, Australia businesses will budget, create reports, and file taxes.

A financial year in Australia begins on 1 July and ends on 30 June. All businesses are supposed to wrap up their paperwork, taxes, and accounting by the end of every fiscal year.

A summary of all expenses and income made by the business in the financial year has to be submitted to the Australian Taxation Office (ATO) to calculate how much is owed in the form of taxes.

Knowing what the financial year is, sometimes referred to as the fiscal year, in Australia is crucial as it allows businesses to remain compliant with the Australian Taxation Office (ATO).

When does the financial year start and end in Australia?

The financial year Australia has set for businesses is from 1 July to 30 June of the following year. However, tax filing dates and requirements vary from business to business.

Sole traders have until 15 October to file their taxes after the end of the financial year (EOFY), while companies have until 15 May of the following year.

How does the financial year affect taxation?

It’s not just businesses that use the Australia financial year as a way to track finances, monitor performance, and budget for future time frames.

The ATO also uses financial years to monitor Australian businesses. They will calculate an organization’s taxes to ensure that they have all been filed and paid correctly.

Knowing when taxes are paid is also beneficial for the business. For example, businesses can purchase new assets or equipment close to the EOFY to reduce their tax bills.

Strategies for businesses to prepare for the end of the financial year

Manage debt wisely

Many businesses often fail to realize the extent of the debt they are in until it reaches a critical point.

Make sure that the finance team is on top of recording the company’s debts and managing them accordingly so they don’t get out of hand by the end of the financial year.

Invest in business growth

When business debts are managed well, other finance aspects, such as cash and investment opportunities, will also become easier to manage.

When a company makes enough money, it’s recommended the business invest back in its growth to reap future benefits.

Monitor cash flow closely

Cash is king. This is why it is very important for businesses to keep a close eye on their cash flow.

Making sure that there is enough cash on hand to make any last-minute payments before the end of the financial year Australia set will be helpful for effective financial management.

Establish a robust plan

Good planning equals good preparation, which in turn results in better execution. The Australia financial year will be overall easier to manage with a robust financial plan to start with. Put the needed care and attention into budgeting and planning for the year.

Conduct regular reviews

Don’t put everything off until the end of the financial year (EOFY). It’s good practice to conduct regular financial reviews even throughout the year, such as on a quarterly basis. Businesses will also want to do a year-end review annually.

Master your finances this financial year with Volopay!

Tax obligations and compliance for businesses

Handling intricate tax duties

It’s important for businesses to check what tax duties they have to complete before jumping into the tasks.

If there are tax changes or tax deductions, for example, these must be handled appropriately. Getting a tax agent to handle intricate tax duties is usually a good idea.

Ensuring prompt reporting and payment

One of the most important things to ensure tax compliance is to report and pay taxes on time.

Businesses that don’t take their tax obligations seriously could get penalized, sometimes severely. Make sure to provide ample time to accurately file tax returns and pay taxes.

Strict adherence to reporting standards

Like in other countries, Australia has its own standardized reporting format.

Make sure to research and be up to date with the latest reporting standards. It’s important to adhere to them and be strict and precise about it when submitting reports and tax filings.

Maintaining precise financial records

Don’t leave preparing financial records to the last minute.

To avoid the hassle, it’s good practice to regularly maintain financial records throughout the year, as this also ensures better accuracy and precision. It will be easier to refer back to them for tax obligations at the EOFY.

Meeting GST and PAYG requirements

Other than annual tax returns, businesses that have taxable sales must also comply with GST regulations.

If the company has pay-as-you-go (PAYG) installments or withholdings, these must also be settled correctly and meet the requirements, such as reporting it through the organization’s BAS.

Safeguarding business interests

Meeting tax obligations and staying compliant during the Australia financial year is in every business’ best interest. Doing this ensures that all finances are taken care of accordingly.

It also protects the brand, signaling that the organization is trustworthy and can be counted on to comply with laws.

What must businesses submit by the end of the financial year?

Sole traders

All businesses need to file and lodge tax returns at the EOFY. For sole traders, however, this is done as part of their individual tax returns even if business income and expenses are viewed as a separate category when filing these returns.

Sole traders can personally file tax returns on paper or online, but individuals who own a business are advised to consult a tax agent to ensure that everything they submit is accurate.

Company/partnership

Submitting tax returns by the end of the Australia financial year is fairly straightforward for companies, as all taxes must be filed and submitted on behalf of the company.

At the end of the financial year, Australia businesses must also submit a summary of their earned income and expenses.

Partnership tax obligations at the EOFY look more similar to sole traders. Keep in mind that each partner must report their share of net income on their individual tax returns.

Submission deadlines for small businesses at the EOFY

Sole traders

Reporting annual business taxes for sole traders is part of the business owner’s personal tax returns. According to the regulations, after the end of the fiscal year, Australia citizens must report taxes by 15 October (or 15 May of the following calendar year with a tax agent).

Company

Companies get an even longer time frame to finish their tax filings, allowing them adequate time to gather necessary documentation.

While EOFY is on 30 June, companies don’t have to submit their tax returns until 15 May of the following year. This is separate from personal tax returns.

Partnership

Like sole traders, partnership businesses will also need to report their business income as part of their personal tax returns. This means that each partner will have to report their share of the net income and pay taxes accordingly on 15 October of the following fiscal year.

Quarterly Business Activity Statement (BAS)

The Business Activity Statement, or BAS, is a report detailing taxes as such GST and PAYG. These reports must be submitted for each quarter of the fiscal year.

Australia adheres to the following quarter durations:

● Q1: 1 July to 30 September

● Q2: 1 October to 31 December

● Q3: 1 January to 31 March

● Q4: 1 April to 30 June

However, if the business’ annual GST turnover comes out to lower than AUD 75,000, then the BAS can be lodged annually by 31 October after the end of a particular financial year. Australia has a series of different requirements and circumstances for BAS, so make sure to check what is applicable to the organization.

Due dates for quarterly BAS

There are four different quarters in one fiscal year. Australia has its financial year starting on 1 July, so the first quarter stretches out for 3 months after. Q1 is between 1 July and 30 September, and so on.

Each quarter will have later due dates for their quarterly BAS. These are important dates to know outside of the EOFY.

With an accountant or tax agent, here are the dates:

● Q1: 28 November

● Q2: 28 February

● Q3: 28 May

● Q4: 28 August

Elevate your financial management with Volopay

What actions are required to be taken by businesses at the end of the financial year?

1. Lodge BAS statement

Businesses that are required to pay goods and services tax (GST) will have to lodge a Business Activity Statement (BAS) every quarter.

This is entirely separate from the EOFY tax filing. These statements are how businesses report and pay quarterly taxes such as GST and pay-as-you-go holdings.

2. Compile financial reports

To ensure that tax return filings go smoothly, businesses should compile financial reports from the past fiscal year.

This will also come in handy should the ATO require further information from the business. Investors may also want reports at the end of the Australia financial year.

3. Assess insurance and business structure

Before filing tax returns, assess the business structure to determine taxes accordingly.

At the end of the financial year, Australia businesses should also review whether the business structure and insurance are feasible for the organization or if they should do a revamp moving forward.

4. Complete tax return

Completing the business’ tax returns is crucial for all Australian businesses to comply with tax regulations.

Depending on the business structure, this can be part of the owner’s personal income tax return (sole traders and partnerships) or a tax return filed on behalf of the company.

5. Review finances and business plans

Just because the financial year has come to a close, that does not mean the business is done.

Businesses must review their finances and start planning for the upcoming year. Thorough budgets help businesses stay afloat, grow, and thrive.

Role of budgeting for businesses

Ensuring financial control

The biggest role that budgeting serves for businesses is to ensure financial control within the organization.

Having a clearer overview of the business finances helps make sense of the current financial health. Based on this information, businesses will be able to determine the necessary steps to better control their finances.

Managing cash flow

Budgeting is key to managing cash flow and maintaining that it remains positive.

When businesses set budgets and plan for the financial year, forecasting is a part of the progress. This allows finance teams to estimate how much income and expenses will occur throughout the year, enabling them to maintain positive cash flow better.

Facilitating decision-making

If there are several business opportunities and the company must pick one to prioritize, budgeting helps with decision-making.

The finance team will be able to forecast how profitable each move a business makes will be. With accurate budgets, it is easier for upper management to determine what should be the utmost priority.

Allocating resources efficiently

Business resources are finite, which is why it’s crucial for companies to allocate them efficiently.

Forecasting and determining business priorities allow the management team to decide where resources should go. Budgets can serve as a guideline as to where business resources will be the most profitably allocated until the EOFY.

Enhancing cost control

Overspending is a problem that many, if not all, organizations will face at one point during the course of the business.

With set budgets, businesses are able to determine how much they can reasonably spend. Controlling costs is much easier when there is already a benchmark in the form of budgets.

Growth planning

Running a business is not just about ensuring that business operations stay running smoothly. Owners and upper management will want to come up with a plan to grow their business.

It’s easier to plan growth realistically when there is a budget made specifically for that purpose. Each financial year, Australia businesses should set aside a growth budget.

Improving stakeholder confidence

Businesses that have plans and budgets that are backed up with accurate data will easily inspire confidence in stakeholders.

Both internal and external stakeholders will want to know what has been budgeted between the start and end of financial year. Australia businesses that budget accordingly are more likely to do well.

Communication of business priorities

Let employees know what the budget for the upcoming financial year is.

When employees are aware of the Australia financial year and what the company’s plans are for it, promoting accountability and ensuring that there is a degree of financial control is achievable.

Teams will also know what the business priorities are and can align with them.

Team engagement for budgeting insights

It’s unwise to budget without consulting the different departments in the organization.

By engaging with multiple teams, the finance team is able to gain insights into how much each department needs. This also provides an opportunity for regular team engagement to ensure that no data silos are being formed.

Financial planning tips for businesses in the new financial year

1. Examining financial statements

It’s not enough to just generate financial statements. Given that their purpose is to provide businesses with accurate information, make sure to examine past financial statements.

These can be the basis of a framework for the new financial year.

2. Evaluating cash flows

Similarly, examining the business cash flow is also key. If there are any adjustments that must be made to ensure that the cash flow remains positive, it should be done as soon as possible.

Better cash flow helps businesses stay on top of their payments.

3. Exploring financing alternatives

It can be difficult for a business to rely solely on cash during the financial year. Australia offers a number of financing alternatives that companies can consider to lighten the cash flow burden.

Thorough research is important when exploring these alternatives.

4. Arranging documentation

To make organizing new finances easier, make sure that there is a system in place for arranging and managing documents.

The previous year’s documents should first be properly arranged before moving into the new fiscal year. Manage the new year’s documents accordingly.

5. Fulfilling tax responsibilities

When heading into a new financial year, Australia businesses must remember to fulfill the previous year’s tax obligations.

Keep all financial records and start filing tax returns as needed. Make sure to lodge quarterly BAS statements accordingly in the new financial year, too.

6. Examining expenditures

Review the previous fiscal year’s business expenses. This helps to determine how much money for the coming end of financial year Australia businesses need.

It also allows companies to double-check for any suspicious transactions that need to be investigated further.

7. Assessing business framework

What works for a company’s finances will differ from business to business.

Make sure that there is a system in place that allows the organization to review and assess the business framework regularly. If updates or new tools and technology are needed, they should be sorted immediately.

Accessible resources and support programs for businesses

1. Government advisory programs

● Digital Solutions - Australian small business advisory services

-Small businesses looking to streamline their finances, taxes, and other processes can look into the Digital Solutions program.

-This is offered by the Australian government to sole traders and small businesses with fewer than 20 employees free of charge. These workshops advise businesses on how to use digital tools accordingly.

● Get help for your business

-To support small businesses, the government also has a support team that business owners can speak to directly to get advice.

-Get access to information and assistance on how to start and run a business.

-These are also networking opportunities to help businesses grow, as well as opportunities to find grants and other forms of financial help.

2. Professional advice

● Small Business Development Corporation (SBDC)

-For those in Western Australia, business owners can seek professional advice from the Small Business Development Corporation (SBDC).

-Services from this agency are either free of charge or can be obtained at a low cost.

-Get business information, advisory services, and tools or guides for various business-related topics, such as tax return templates for the EOFY.

● Business Enterprise Centres Australia (BEC Australia)

-Business Enterprise Centres (BEC) Australia is a network of not-for-profit organizations that offer their services to aid businesses in the country.

-Business owners can get access to mentoring support and training programs.

-A detailed analysis of the business can also be gained by contacting a local BEC Australia branch.

3. Financial assistance programs

● Export Finance Australia

-Those who aim to conduct business internationally can find support services with Export Finance Australia.

-This organization aims to help companies finance their export plans in order to grow their business.

-From loans, bonds, and guarantees to other tailored finance solutions, making plans to export and expand internationally becomes less daunting.

● Grants and programs finder

-The Australian government’s business portal has a tool that businesses can use to find grants and support programs that are suited to their needs.

-With comprehensive filters that make it easy to search by location, industry, business type, and more, this search tool also lets businesses apply on the spot in less than 5 minutes.

Unlock funding opportunities for your business! Check out our Guide to small business grants in Australia and find the right support you need.

4. Industry-specific support

● Industry Capability Network (ICN)

-With its aim to support small and local businesses, the Industry Capability Network (ICN) is a network of industry procurement and supply chain specialists.

-ICN can connect businesses to each other to help them grow.

-Business owners can get in contact with their local ICN office to get the right tools to help them with procurement.

● Australian Industry Group (Ai Group)

-Businesses that want to get specific industry sector information can get further support from the Australian Industry (Ai) Group.

-Support services are offered to a range of industries including but not limited to energy, manufacturing, retail, and printing.

-The Ai Group offers support in the form of workplace advice, health and safety consulting, business improvement strategizing, and more.

5. Legal and regulatory assistance

● Australian Securities and Investments Commission (ASIC)

-The Australian Securities and Investments Commission (ASIC) is an independent body that regulates business compliance.

-Its website has plenty of information on how to register a company, register a business name, run a company, and even close a company.

-Any business owners in doubt about how to remain in legal compliance can benefit from ASIC as a source.

● Fair work ombudsman - Small business helpline

-It’s crucial for businesses to comply with all laws regarding fair work. That’s where the Fair Work Ombudsman comes in.

-The organization ensures that employers, employees, and even contractors are all treated fairly.

-Businesses can get education and training on the Fair Work Act and how to remain compliant with related regulations.

6. Taxation assistance

● Australian Taxation Office (ATO) - Small Business Assistance

-The Australian Taxation Office (ATO) also provides assistance for businesses in the form of several different programs.

-Rather than stressing at the end of the fiscal year, Australia businesses can reach out to the ATO.

-Businesses affected by COVID-19 may also get assistance and further support regarding their tax obligations.

How can Volopay support your business at the end of financial year?

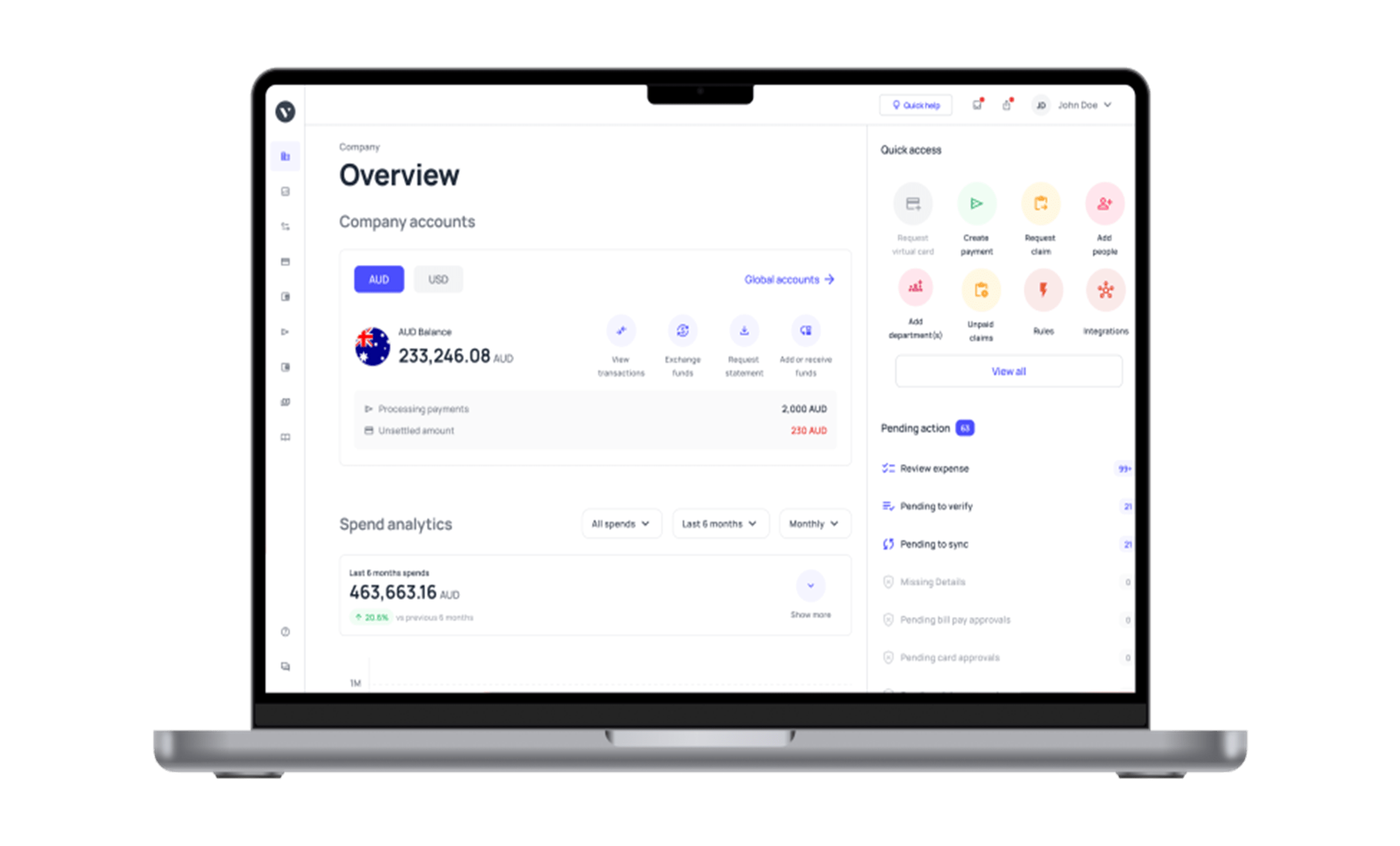

Don’t make the end of the Australia financial year more complicated than it should be. With Volopay, you can centralize all your financial information and business expenses on a single platform.

Every transaction made through Volopay, whether it be via bank transfer or corporate cards, will be logged and sorted automatically on your dashboard.

Get access to business insights and neatly organized financial data with automated accounting features like filters and categorizations.

Paired with Volopay’s robust accounting integration capabilities, there’s no need for manual data entry and reconciliation when everything can be done for you automatically in just a matter of minutes.

When the EOFY comes, everything is ready at your fingertips.

Do hassle-free accounting and bookkeeping for your business with Volopay

FAQs

The EOFY in Australia is on 30 June.

However, keep in mind that there are other important dates, such as tax filing deadlines, quarterly BAS deadlines, and more. 30 June just marks when the financial year records should end.

The financial year is a key feature that Australian businesses must understand and adhere to for tax compliance purposes.

After a particular financial year is over, businesses must report their finances from that year and file their taxes. Paying and reporting taxes on time ensures that your business complies with Australian regulations.

There are several dates in the financial year Australia businesses should be aware of.

Depending on the structure of the business and whether or not it has a tax agent, sole traders, and partnerships must file annual tax returns on 15 October or 15 May. Companies will have to file their tax returns on 15 May.

Aside from annual tax returns, businesses must also lodge quarterly BAS reports on 28 November (Q1), 28 February (Q2), 28 May (Q3), and 28 August (Q4).

Australian businesses must make sure that they have organized bookkeeping processes, as this will help significantly at the end of financial year. Australia requires accurate tax returns, which can be filed at a later date, but businesses will benefit from having all the necessary information readily available.

Stronger organization during the fiscal year will lead to less hassle during the EOFY.

Just like any other country, Australia requires businesses to file tax returns after the end of each financial year.

Australia also has quarterly Business Activity Statements (BAS) that businesses must file for every quarter, which is unique to the country.

A number of resources, both provided by professionals and by the government, are available to Australian businesses to help them with financial planning.

From workshops and training programs to getting grants and loans, there are many different forms of support. Businesses can also access templates and guides for EOFY tasks.