How to file tax return for small business in Australia?

One of the most dreaded and eagerly awaited times of the fiscal year is tax season. Correctly filing taxes is a difficult task, especially for small business owners who must complete numerous forms and filings.

Our beginner's guide is the ideal tool if you're eager to learn all about small business tax filing and want to sail through the challenges of the Australian tax season. Continue reading to learn more about the complexities of filing Australian corporate taxes for small businesses.

What are small business taxes?

All of your earnings as a small business owner are subject to taxation, which is managed by the Australian Taxation Office (ATO). These taxes must be paid by all forms of small businesses, including solopreneurs and SME owners with a small staff.

Since SME owners are more prone to commit tax fraud or file their taxes wrongly, it is critical to understand that small businesses are subject to greater scrutiny for corporate tax filing than large organizations.

Taxes for small businesses might differ significantly based on their structure, level of income, and other elements.

What type of small businesses are required to file taxes in Australia?

If you are aware of the structure of your firm, it will be easier for you to collect the necessary papers and comply with the relevant rules and regulations. Tax filing requirements for small business entities fall into three categories.

1. Sole trader

The simplest and least expensive type of business form in Australia is sole proprietorship. Legally speaking, you are in charge of the entire enterprise.

Losses and debts cannot be shared with other people. In your firm, you can hire employees, but not yourself.

2. Partnership

This business structure is formed on the association of two or more people, where income, losses, and control of the business are shared among the partners.

On the taxation front, the partnership must be registered for GST if its annual GST turnover is $75,000 or more.

3. Company

A company or firm is a more significant legal entity with formal administrative expenses. In contrast to sole proprietorships and partnerships, it is composed of owners, shareholders, and managers and has a correct legal structure.

Why is small business tax filing important?

As a small business owner, it could also be challenging to remember all the deadlines for filing business taxes. But you still need to file your taxes. The illegal and serious violation of tax evasion can have an adverse effect on both your personal and professional lives.

Financial and legal repercussions might result from a missing or inaccurately reported business tax filing. Additionally, your business can be the target of an audit, which can take a lot of time and persist for several months at a time.

You must pay for certified public accountants (CPAs), attorneys, and other specialists due to the cost of audits. An official audit harms the reputation of a business and, as a result, the owner's reputation.

What type of taxes do small businesses have to pay in Australia?

Small business taxes vary greatly in terms of their structure, staff numbers, revenue levels, etc., as was already mentioned. Australia frequently ranks as one of the top business-friendly nations in the world.

Here are some instances of ATO taxes that small business owners should be aware of. Keep in mind that the Australian government reserves the right to change these values. As a result, make sure to frequently examine the taxes that apply to your company.

ATO taxes for small business owners

- Corporate Tax

- Branch Tax

- Capital Gains Tax

- Income Tax

- Withholding Tax (Dividends, Interests, Royalties)

- GST

- Foreign Sourced Income Tax

Steps to file company tax returns in Australia

It is time to file your tax return now that you know what type of taxes apply to your business. Use these steps to guarantee a stress-free, quick, and structured tax filing procedure.

1. Organize the data and documents related to your finances

Keeping things organized is essential throughout tax season. Ensure that you have access to and control over all of your financial records. In Australia, proprietors of small businesses must keep their financial records for up to five years.

Throughout the fiscal year, you should prepare ahead of time for the following financial needs:

● Taxpayer ID

● Bank account and credit card

● The previous year's tax return for your business

● Accounting information, such as GST and FBT returns, that is essential for proper filing.

Learn more about the specific record-keeping obligations for Australian small businesses by visiting the ATO's Business Records page, where you can also find resources like a checklist. Given the enormous volume of transactions and statements that take place throughout the year, manually categorizing these records may seem challenging.

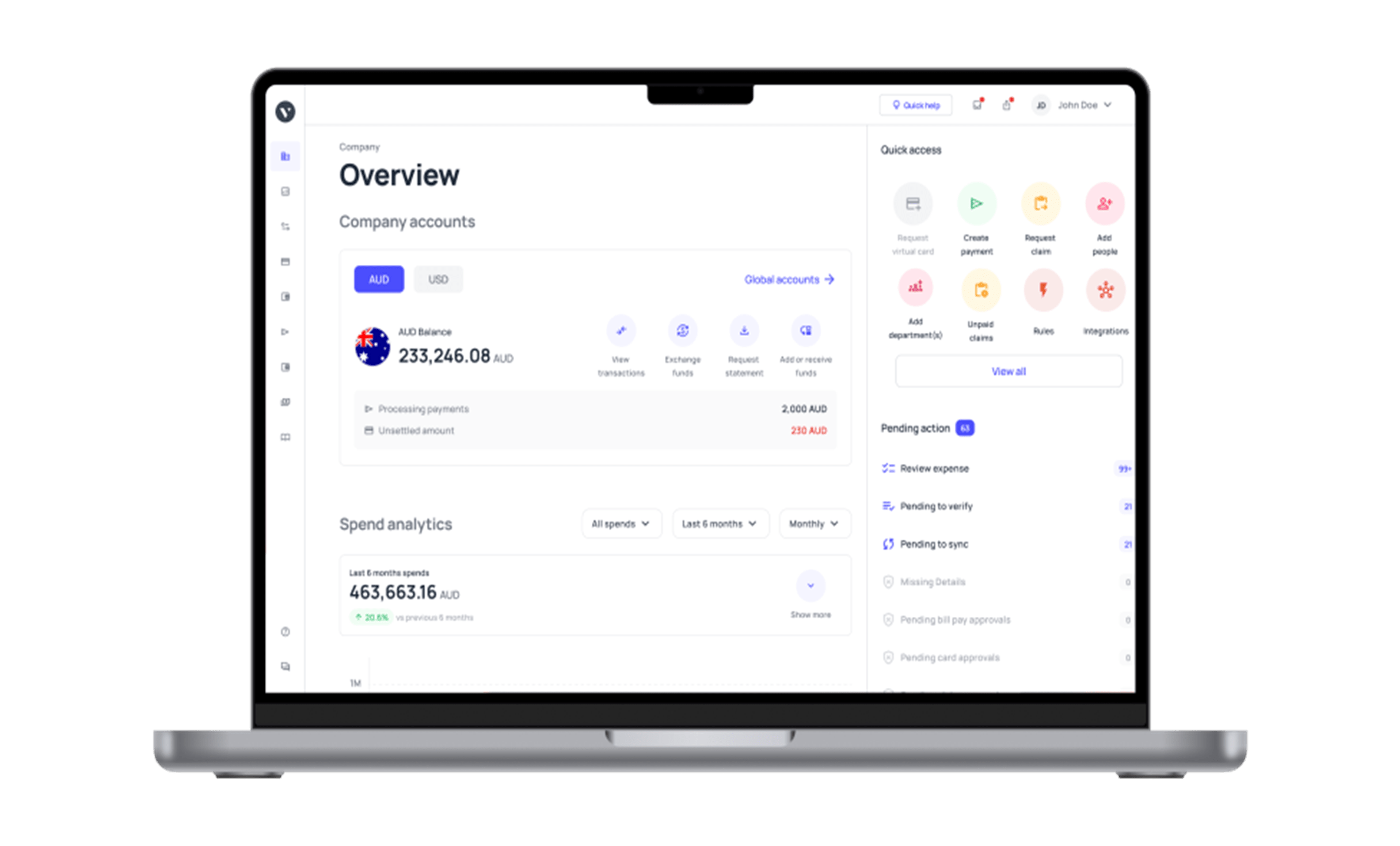

In order to streamline and accelerate your tax filing process and help you have a stress-free tax season, think about investing in an automated cost management solution like Volopay.

2. Know your small business tax deductions

Knowing all the tax deductions you are eligible to claim can save you a ton of money by preventing you from having to pay obscene amounts in taxes.

Here are some typical tax deductions you can claim to reduce your taxes, albeit they depend on the type of business you have and the sector it operates in.

● Rent for a commercial or office space

● Office supplies, equipment, and machinery

● Insurance relating to businesses

● Business lunches (for eg., client lunches, etc.)

● Automobiles and auto-related costs

You can locate business write-offs with ease if you have a well-organized overview of your spending. It is vital for business owners to be knowledgeable about both their tax liabilities and strategies for reducing their tax obligations.

Read ATO’s extensive list of assessable income and business tax deductions here.

3. Know your business tax return forms and the laws

Different business structures require different business tax return forms and adherence to laws made specifically for relevant business entities. Therefore, be fully familiar with the forms needed for your business organization.

● Income tax return

For small businesses, you must lodge a company tax return. This includes taxable income, tax offsets, credits, etc. You can do that through Standard Business Reporting software, with a registered tax agent, or through paper.

● Fringe Benefits Tax (FBT) Return

It is a form of tax that companies paid in lieu of benefits they offered their employees in addition to the compensation paid to them. Learn how you can lodge FBT Return here.

● GST annual return

If you are eligible for a GST return, it will be lodged on the same day as your Income Tax Return. If you have no activity in a period, you still need to phone ATO services to record a “Nil” return.

Learn more about completing and lodging your GST return on the official ATO website.

4. File your business taxes by the correct deadline

● The Income Tax Return and GST Annual Return lodgment and payment date for small companies are 28 February.

● If you have any prior year income tax returns outstanding, the due date will be 31 October.

● The fringe benefits tax (FBT) year runs from 1 April to 31 March.

● If you have an FBT liability during that year, you must lodge an FBT return and pay the total FBT amount you owe for the year by 21 May.

The implications of not filing for an extension and missing the deadline can be a big dent in your company’s finances: penalties can be in the form of legal summons and bankruptcy notice, to severe jail time.

Make sure you adhere to the guidelines and keep documentation up to date and ready to avoid any delay.

How to calculate business tax payments for Australian businesses?

To help small business owners reduce their tax payable income by up to $1000 per year, ATO offers Small Business Income Tax Offset Calculator. This calculator is specially designed for small business structures, such as partners in small partnership businesses and sole traders.

While the calculator might ask for details such as losses mentioned in your income tax return, your share of small business income from your distribution statement, etc., none of the information is stored on ATO systems.

What are the benefits of regularly filing your business taxes?

Waiting until the due date for your business taxes can be a serious error. This not only makes tax time very stressful, but it also increases the likelihood that your business will file inaccurate taxes.

Since incorrect tax filing may be mistaken for tax evasion, fines may apply. Therefore, filing quarterly estimated taxes is regarded as wise financial planning.

1. Avoid penalties

Tax fraud and neglecting to file taxes without notifying the ATO as required can result in a $30,000 fine or a 10-year prison term. It is therefore recommended that you constantly under-estimate your quarterly taxes by up to 5%. The government will refund you for any amounts you overpay.

2. Better budgeting and financial planning

Financially speaking, paying as you go each quarter is preferable to taking a one-time deduction at the conclusion of the fiscal year. Paying smaller sections also enables you to conduct more thorough analysis, which reduces the likelihood that you will make a tax-related error.

By including a tax estimate each quarter, you can develop a comprehensive quarterly budget and manage your spending.

3. Cashflow planning and management

Your business needs cashflow to cover expenses like payroll, taxes, and daily operational expenditures. You may easily calculate how much cash flow you'll need for the entire fiscal year without worrying about making a mistake on your tax return by breaking your tax lump sum into four smaller quarterly payments.

Naturally, a systematic tax filing system requires a well-organized database for all of your transactions and accounting processes. For all of these and many more reasons, an automated expense management service like Volopay may make your tax season straightforward and stress-free.

How automated expense management software can help in filing small business taxes?

Even though tax season only lasts a few months, planning for it takes place all year round. When done manually, compiling transactions and verifying bank and credit card statements is a laborious operation.

With the use of automated expenditure management software, you can quickly update your tax information every quarter by organizing and categorizing all of your business spending according to employee, department, and even projects.

Volopay does more than any other platform to get you ready for the dreaded tax season. You may maintain thorough records with Volopay by adding receipts to a centralized database for all of your business spending.

All of your transactions, whether they include a corporate card spend or a vendor payout, are methodically structured in the cloud where you can easily access them for bookkeeping and auditing needs. Speaking of bookkeeping, Volopay instantly and effortlessly interfaces with any accounting software currently in use, removing the need for manual data entry between different platforms.

You may concentrate the efforts of your financial team on identifying more tax-saving opportunities than ever before with less manual tax filing work to do.

With Volopay, you get access to extensive, current, and comprehensive spend analytics data and insights regarding overspending, enabling you to manage your costs and make better business decisions.

Note: The information provided in this article doesn't constitute legal or fiscal advice and is for general instructional purposes only. Please check with an attorney or financial counsel to gain advice with respect to the content of this article.