👋Session Alert! How the Top 1% Finance Leaders Think - 11th Feb. Register Now→

What are bills payable? Examples, accounting & best practices

Understanding bills payable and their business role

What are bills payable?

Bills payable are written promises your business makes to suppliers, agreeing to pay a specific amount by a set date. These arise when you purchase goods or services on credit.

As a current liability, bills payable impact your cash flow and must be settled promptly to maintain a healthy financial standing and build trust with vendors.

Key characteristics

Bills payable typically have a fixed due date, involve formal documentation, and appear under current liabilities in your balance sheet. They represent short-term obligations that require prompt payment.

Managing them well ensures your business avoids late fees, preserves creditworthiness, and maintains a professional relationship with your suppliers.

Importance of tracking

Tracking bills payable ensures financial transparency, compliance with Australian regulations, and strong supplier relationships. It helps you manage cash flow, avoid penalties, and maintain creditworthiness.

Accurate tracking prevents missed payments, supports budgeting, and fosters trust with suppliers, ensuring your business operates smoothly and maintains a positive reputation.

Why bills payable management is critical for success

1. Cash flow optimization

Effective bills payable management ensures you balance outgoing payments with available funds, optimizing liquidity. By prioritizing timely payments and negotiating favorable terms, you maintain cash flow stability, avoid costly penalties, and support operational needs, keeping your business financially healthy and resilient.

Planning payment schedules lets you align outgoing funds with incoming revenue, helping you stay operational without compromising your ability to invest in growth or cover essential expenses.

2. Supplier relationships

Timely bills payable management builds trust with suppliers, fostering strong relationships. Consistent payments secure better credit terms, discounts, or priority service. This reliability enhances your reputation, ensures supply chain stability, and strengthens partnerships critical for your business’s long-term success and growth.

Consistent payment behaviour also gives you negotiation power, ensuring smoother operations and priority access to essential goods or services.

3. Regulatory compliance

Managing bills payable ensures compliance with ATO and ASIC regulations in Australia. Accurate record-keeping and timely payments prevent penalties, audits, or legal issues.

Staying compliant protects your business’s reputation, avoids financial strain, aligns with local tax and reporting requirements, safeguards your financial reputation, and builds trust with stakeholders and authorities.

4. Strategic forecasting

Tracking bills payable enables accurate budgeting and cash flow forecasting. By analyzing payment obligations, you make informed strategic decisions, plan investments, and avoid financial shortfalls.

This foresight empowers you to plan confidently and respond to market or operational changes without jeopardising your financial health.

Practical examples of bills payable in Australian businesses

Manufacturing supplies

As an Australian manufacturer, you purchase $10,000 in raw materials on credit from a supplier, issuing a bill payable due in 30 days. This formalizes your obligation to pay by the deadline, ensuring a steady supply chain while you manage cash flow, allowing production to continue without immediate upfront costs.

This is a typical case of what is bills payable in accounting—recording a liability to pay later, while keeping your production line running without interruption.

Retail inventory

Running a retail store in Australia, you buy $15,000 of inventory on credit with a 45-day payment term, creating a bill payable. This allows you to stock shelves and generate sales before payment is due, optimizing cash flow while ensuring you meet supplier terms to maintain trust and secure future credit.

IT services

Your Australian consultancy engages an IT firm for software upgrades on credit, issuing a bill payable for $8,000 due in 60 days.

This formal agreement lets you access critical services without immediate payment, enabling operational efficiency while you track the obligation to ensure timely payment and compliance with supplier terms.

Hospitality sector

Operating a café in Australia, you purchase $5,000 in bulk coffee and ingredients on credit, with a bill payable due in 30 days.

This allows you to maintain inventory and serve customers while deferring payment, helping manage cash flow effectively, and ensuring strong supplier relationships for consistent, quality supplies.

Timely management of these payables enables you to maintain good supplier terms, avoid late fees, and keep your operations flowing during peak service hours.

Construction industry

Running a construction business, you often buy machinery and tools on credit. These purchases create bills payable, formalised through invoices with fixed due dates.

Efficiently managing them helps you allocate funds to projects, track expenses accurately, and maintain vendor trust across long-term builds and short-term contracting jobs.

Accounting for bills payable in Australia

Issuance journal entries

When you issue a bill payable in Australia, record it by debiting Purchases (or relevant expense account, e.g., $10,000) to reflect goods/services received, and crediting Bills Payable ($10,000) in your ledger. This entry reflects what is bills payable in accounting—a liability created when you commit to paying a supplier later.

Proper classification ensures your financial statements stay accurate and compliant with Australian standards. This recognizes the liability under Australian Accounting Standards (AASB), ensuring accurate tracking of your business’s obligations to suppliers.

Payment journal entries

When you pay a bill payable, debit Bills Payable (e.g., $10,000) to reduce the liability, and credit Cash/Bank ($10,000) to reflect the payment. This entry, compliant with AASB standards, ensures your Australian business’s ledger accurately records the settlement of supplier obligations, maintaining clear financial records and cash flow accuracy.

Understanding what is bills payable helps you track outgoing payments and maintain financial transparency, especially during audits or supplier reconciliations.

Balance sheet classification

Classify bills payable as current liabilities on your balance sheet, as they’re typically due within one year, per AASB standards. For example, a $15,000 bill payable due in 60 days appears under current liabilities, reflecting your Australian business’s short-term obligations and aiding stakeholders in assessing liquidity and financial health.

Knowing the bills payable meaning helps you clearly present your financial position to stakeholders, lenders, or investors, reinforcing accountability and operational efficiency.

Interest-bearing bills

For interest-bearing bills payable, record interest by debiting Interest Expense (e.g., $500) to capture the cost of borrowing, and crediting Cash ($500) or Bills Payable if unpaid, per AASB standards.

This ensures your Australian business accurately reflects financing costs, maintains compliance and transparency in financial statements for stakeholders.

Reconciliation process

Reconcile bills payable monthly by comparing your ledger’s Bills Payable account with supplier statements. At the end of each month, reconcile your bills payable ledger with supplier statements.

This process ensures all payables are accounted for, preventing duplicate entries or missed payments. Staying consistent with reconciliation gives you better control over cash flow and keeps your vendor relationships strong and transparent.

Early payment discounts

If a supplier offers an early payment discount, record the reduced cost by debiting bills payable and purchase discount, and crediting cash. This lowers your overall expenses and improves profitability.

Knowing what is bills payable in accounting equips you to take advantage of such opportunities without compromising your reporting accuracy.

Legal and tax considerations for bills payable

1. GST compliance

Ensure bills payable align with GST input credit requirements and Business Activity Statement (BAS) filings. Accurately record GST on invoices to claim credits and meet Australian Taxation Office (ATO) deadlines.

Proper documentation supports compliance, minimizes errors, and ensures you maximize eligible tax credits while avoiding penalties.

2. ATO payment regulations

Adhere to ATO regulations for timely bill payments and tax reporting. Follow guidelines on payment schedules and reporting obligations to avoid fines.

Ensure your payment processes comply with ATO’s requirements for withholding taxes and reporting supplier payments, maintaining legal and financial integrity in your operations.

3. Audit-ready recordkeeping

Maintain clear, organized records for bills payable to ensure audit readiness. Store invoices, payment confirmations, and related documents systematically to comply with ATO requirements.

Proper recordkeeping supports transparency, facilitates smooth audits, and helps you avoid penalties by demonstrating compliance with legal requirements.

Overcoming common bills payable management challenges

1. Cash flow disruptions

Late or unplanned payments can disrupt your business’s cash flow. To avoid liquidity problems, schedule bills payable around forecasted income and expenses. Understanding what is bills payable helps you plan proactively and keep operations smooth.

Accurate timing ensures you're financially ready to meet obligations without affecting daily expenses or growth initiatives. Prioritize high-value bills and negotiate extended terms with suppliers to maintain cash reserves, ensuring your Australian business operates smoothly without financial bottlenecks.

2. Manual processing errors

Manual data entry often leads to duplicate entries, missed payments, or incorrect amounts. By understanding what is bills payable in accounting, you can switch to automated systems that improve accuracy.

Use digital invoice capture, approval workflows, and alerts to reduce human error and streamline the entire accounts payable process. Automation reduces errors, saves time, and aligns with AASB standards for reliable financial reporting.

3. Fraud and security risks

Without proper oversight, your business is vulnerable to unauthorized payments and internal fraud. Implement dual-approval workflows, role-based permissions, and audit logs to ensure payment security.

Recognizing the bills payable meaning also helps you identify red flags in vendor transactions and prevent misuse of funds. Use secure platforms with encryption to protect data, ensuring compliance with regulations and safeguarding your business’s finances from fraudulent activities or security breaches.

4. Compliance with ATO/ASIC

Failing to follow ATO or ASIC regulations can lead to audits, fines, or reputational damage. Stay compliant by maintaining accurate records, verifying ABNs, and recording GST properly.

Knowing what is bills payable in accounting ensures your practices align with Australian accounting standards and legal frameworks. Regularly review tax obligations to avoid fines, maintain legal compliance, and protect your business’s reputation.

5. Supplier payment disputes

Misaligned payment terms spark disputes with suppliers. Disputes arise when suppliers and businesses aren’t aligned on payment terms, amounts, or schedules. Avoid issues by setting clear agreements, confirming deliveries, and keeping documentation. A strong understanding of the bills payable meaning enables you to manage supplier expectations professionally and resolve conflicts effectively.

Clarify agreements upfront and document in writing. Regular communication via email or vendor prevents misunderstandings, ensuring smooth supplier relationships and avoiding costly delays or conflicts for your business.

6. Managing high transaction volumes

Processing a large number of bills manually can lead to missed deadlines and disorganization. Adopt bills payable software to consolidate data, automate approvals, and track due dates efficiently. Once you understand what is bills payable in accounting, scaling your system becomes easier without compromising accuracy or compliance.

Automated categorization and real-time dashboards streamline management, ensuring timely payments and accurate records, keeping your business efficient and supplier relationships intact.

Benefits of streamlined bills payable management

Improved cash flow

Streamlined bills payable management optimizes your cash flow by aligning payments with revenue cycles. When you manage bills payable effectively, you maintain healthier cash flow. Timely and planned payments help you avoid shortfalls, keep reserves intact, and meet other financial obligations without disruption.

Liquidity becomes predictable, allowing your business to operate smoothly even during tight revenue cycles. This supports financial stability, enabling your Australian business to fund operations and seize growth opportunities.

Stronger supplier relationships

Reliable, timely payments via streamlined processes build supplier trust. Meeting terms secures better credit terms and discounts. This reliability often leads to better credit terms, priority service, and long-term partnerships.

Efficient bills payable management helps you maintain professional relationships that can be invaluable during supply chain disruptions or when negotiating pricing. Strong relationships ensure priority service and supply chain stability, enhancing your business’s reputation with suppliers.

Enhanced financial reporting

Proper tracking of bills payable ensures your financial reports reflect real-time liabilities. This accuracy enhances forecasting, budgeting, and decision-making. Knowing exactly where your money is going lets you stay audit-ready and compliant, while also giving investors and stakeholders confidence in your financial transparency.

Clear records of liabilities improve balance sheet accuracy, transparency for stakeholders in your business, support strategic planning, and audits.

Reduced administrative burden

Automating your bills payable workflow cuts down on time-consuming tasks like manual data entry, paper filing, and invoice chasing. By reducing clerical effort, you allow your finance team to focus on strategic financial planning rather than repetitive processing work.

This reduces errors and frees up time for strategic work, allowing your business to focus on growth and efficiency rather than administrative overhead.

Scalable business operations

As your business grows, manual systems can’t keep up. Streamlined bills payable solutions scale with you, handling higher volumes without increasing administrative overhead. Understanding what is bills payable early on helps you implement systems that support long-term growth efficiently and sustainably.

Automated workflows and real-time tracking support growth, ensuring your business scales efficiently, maintains supplier payments, and adapts to higher transaction demands without compromising financial control or accuracy.

Best practices for optimizing bills payable management

Clear supplier terms

Negotiate precise payment terms with suppliers to align with your Australian business’s cash flow needs.

Define due dates, discounts, penalties, and invoicing procedures upfront to avoid misunderstandings and ensure smoother processing.

When your terms are well-structured, managing bills payable becomes more predictable and controlled, allowing you to prioritize payments and preserve vendor relationships.

Budget alignment

Track bills payable against your monthly or quarterly budget to avoid overspending.

Aligning payables with planned expenses gives visibility into upcoming cash needs, enabling smarter decisions, better reserve management, and stable growth.

Align bills pcyable with your business’s budget to support accurate financial forecasting. This prevents cash flow shortfalls, supports strategic planning, and keeps your business financially prepared for growth and opportunities.

Timely payment execution

Execute payments on or before the due date to maintain trust and avoid late fees. Use reminders or automation tools to keep track of deadlines.

Timely payments help you qualify for early payment discounts, enhancing savings.

Consistency in payment behavior strengthens your reputation and simplifies your vendor negotiations over time.

Monthly statement reconciliation

Reconcile your bills payable with supplier statements monthly to ensure utmost accuracy. Reconcile your accounts payable ledger carefully with supplier statements at the end of each month.

Regular reconciliation ensures your records reflect actual liabilities, protecting your business from financial inaccuracies and making audit preparation much easier.

Proactive supplier communication

Engage suppliers regularly via email or calls to address payment issues, clarify terms, or negotiate extensions. Proactive communication builds trust, resolves disputes early, and strengthens partnerships.

Maintain open and regular communication with your suppliers. Reach out in advance if delays are expected or disputes arise.

A proactive approach prevents last-minute surprises and fosters long-term business partnerships. It also helps suppliers trust your process, leading to flexible terms and support.

Internal payment controls

Implement internal controls such as dual approvals, role-based access, and audit trails for all payments. These measures prevent unauthorized transactions, reduce fraud risk, and ensure policy compliance.

Well-structured controls protect your business financially and legally, while reinforcing a disciplined payment environment that enhances trust internally and externally.

These controls reduce errors, prevent fraud, and maintain financial integrity, safeguarding your business’s reputation and resources.

Reduce errors, automate payables using Volopay

Emerging technology trends in accounts payable management

AI-powered automation

Leverage AI to predict payment schedules, streamline workflows, and enhance efficiency. By automating repetitive tasks, you reduce errors and free up time for strategic financial planning, ensuring your accounts payable processes are optimized for accuracy and speed.

Cloud-based AP platforms

Adopt cloud-based platforms for real-time, accessible bill management. These tools enable seamless collaboration, centralized data storage, and instant updates, allowing you to monitor and process payments efficiently from any location, improving overall operational agility.

Blockchain for secure payments

Implement blockchain for secure, transparent payment records. This technology ensures immutable transaction ledgers, reducing fraud risks and enhancing trust with suppliers. By streamlining payment verification, you can achieve faster, more reliable accounts payable processes.

Mobile payment solutions

Utilize mobile apps to manage bills on the go. These solutions offer convenience, allowing you to review, approve, and process payments anytime, anywhere. Mobile access ensures timely responses, improving supplier relationships and operational efficiency in your accounts payable tasks.

Data analytics for insights

Harness data analytics to gain insights into payment trends. By analyzing spending patterns and cash flow, you can make informed decisions, optimize budgets, and plan strategically. These tools empower you to enhance financial forecasting and drive better accounts payable outcomes.

Tools to streamline bills payable processes

Payment scheduling software

Use payment scheduling software like Xero or MYOB to automate and schedule bills payable. These tools optimize cash flow by aligning payment dates with your Australian business’s revenue cycles, improving financial planning, and maintaining supplier trust.

These solutions help you avoid late fees, manage working capital, and stay compliant. Understanding what is bills payable in accounting makes it easier to align payment timing with cash flow for smooth financial operations.

Approval workflows

Integrate approval workflows into your accounts payable system to ensure each bill payable goes through a verification process. These platforms ensure structured, error-free approval processes, reducing delays and ensuring compliance with Australian accounting standards. They enhance efficiency by routing bills to the right stakeholders for your business.

Multi-currency tools

If your business works with global suppliers, multi-currency tools allow you to pay bills in various currencies while tracking exchange rates and fees. These platforms handle currency conversions and compliance with Australian regulations, reducing exchange rate risks and ensuring accurate, timely payments to global suppliers, enhancing your business’s financial efficiency.

These tools simplify cross-border payments and ensure accurate accounting entries aligned with the bills payable meaning in international transactions.

Automation platforms

If your business works with global suppliers, multi-currency tools allow you to pay bills in various currencies while tracking exchange rates and fees.

These tools automate invoice processing, data entry, and payment execution, saving time and ensuring compliance with AASB standards for your Australian business’s accounts payable processes.

Vendor management apps

Use vendor management apps to track supplier contracts, payment terms, and outstanding bills payable. These platforms centralize communication, simplify record-keeping, and ensure all obligations are met.

A clear understanding of the bills payable meaning helps you better categorize and handle vendor transactions. These tools centralize supplier data, ensuring timely payments and strong relationships, helping your Australian business maintain trust and secure favorable credit terms with suppliers.

Real-time dashboards

With real-time dashboards, you can monitor bills payable metrics like due dates, outstanding amounts, and payment status instantly. These provide instant insights into outstanding liabilities, due dates, and enable better oversight and decision-making for your business, ensuring financial transparency and control.

These insights offer better control over cash flow and strategic planning, especially when you know what is bills payable in accounting and how it reflects in your business’s financial health.

The future of bills payable management in Australia

1. Digital payment transformation

Digital solutions are revolutionizing how you manage bills payable in your business. Automated platforms like Volopay reduce manual input, speed up approvals, and ensure timely payments.

With streamlined workflows and integrated accounting tools, you can expect greater transparency, accuracy, and efficiency in handling payables.

2. Sustainable payment practices

Eco-conscious businesses in Australia are adopting sustainable bills payable practices. By going digital, you eliminate paper invoices and cheques, reducing your environmental impact.

Cloud-based platforms not only cut down on waste but also improve efficiency, making it easier to align your payment process with sustainability goals.

3. Global payment integration

Managing international supplier payments is now simpler with modern AP tools. With Volopay, you can handle multiple currencies, automate FX conversions, and ensure timely payments abroad.

This flexibility allows your business to expand globally while maintaining a centralized, efficient, and compliant accounts payable process.

Streamlining bills payable with Volopay’s AP solution

Automated bill processing

Volopay eliminates the need for manual data entry by automating invoice management, approval workflows, and payment scheduling.

You can upload invoices or receive them directly into the platform, where they are automatically categorized and routed for approval—saving you time and ensuring timely payments without errors or delays.

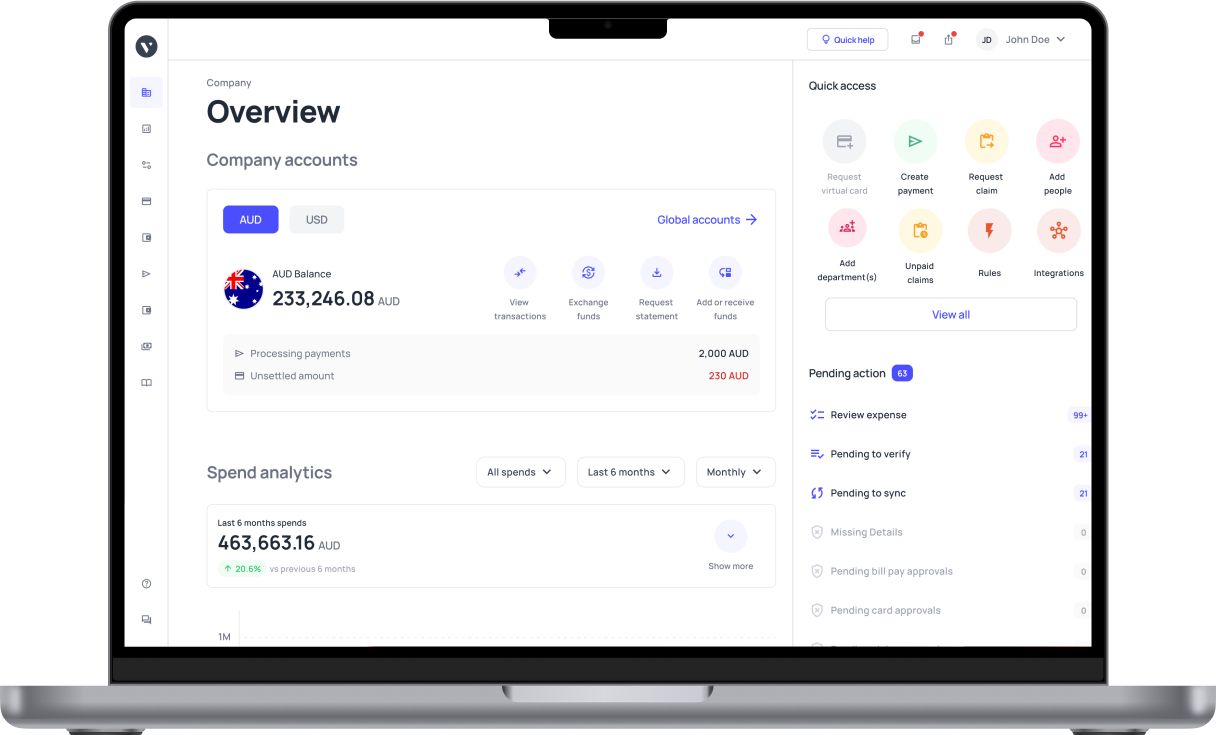

Real-time transaction tracking

Gain full visibility over your accounts payable with Volopay’s real-time dashboard. You can monitor pending, approved, and completed transactions at a glance, enabling better cash flow planning.

This transparency ensures that you’re always informed about your financial obligations and can act proactively to maintain business stability.

Secure and compliant payments

Volopay offers bank-grade security, SOC 2 compliance, and adherence to Australian regulatory standards to keep your payment processes safe.

Role-based access and multi-level approval layers help prevent fraud, while audit trails ensure every transaction is tracked and verifiable, giving you peace of mind and compliance confidence.

Seamless accounting integration

Volopay integrates with leading accounting software such as Xero, MYOB, and QuickBooks, allowing you to reconcile bills payable with minimal effort.

This integration ensures your general ledger is always up to date, reducing manual entry and the risk of discrepancies across financial reports.

Scalable AP management

Whether you’re a startup or an enterprise, Volopay's comprehensive accounts payable platform grows with your business. Its features are designed to handle increasing invoice volumes without operational friction.

Understanding what is bills payable and managing it with scalable tools like Volopay prepares your finance team for long-term success.

Conclusion: Take control of your bills payable processes

Key takeaways

Understanding what is bills payable and managing it effectively is essential for your business's financial health. Bills payable affect cash flow, supplier relationships, compliance, and long-term planning. By implementing best practices—like timely payments, clear terms, and monthly reconciliations—you gain greater control over your liabilities.

Streamlining your accounts payable process reduces errors, improves transparency, and positions your business for scalable growth. Tools like Volopay help automate and secure the entire workflow.

Next steps for your business

To strengthen your financial operations, it’s time to adopt a digital-first approach to accounts payable. Volopay’s automation platform empowers you to schedule payments, track invoices in real-time, and integrate seamlessly with your accounting systems.

With multi-currency capabilities and robust security, it’s built to support Australian businesses navigating modern finance challenges. Explore Volopay today to simplify bills payable, improve cash flow, and foster better supplier relationships—giving you the edge to grow confidently in a competitive landscape.

FAQs about bills payable

In accounting, bills payable are recorded as a credit when a liability is created and as a debit when the payment is made. On your balance sheet, they fall under current liabilities, reflecting the amounts your business owes to suppliers within a short-term period.

Delaying bills payable can lead to late fees, strained supplier relationships, and damaged creditworthiness. It may also disrupt your cash flow planning and lead to compliance issues. Maintaining a disciplined payment schedule is crucial to preserve trust and ensure smooth business operations.

Volopay automates the entire bills payable process—from invoice capture to approval workflows and scheduled payments. You can set payment rules, streamline multi-level approvals, and generate real-time reports. This reduces manual effort, improves accuracy, and accelerates processing times for better financial control.

Yes, Volopay supports multi-currency transactions, making it ideal for businesses working with international vendors. You can send payments in various currencies, manage FX rates, and reconcile accounts easily—all from a single platform. This functionality helps you stay efficient and compliant when handling cross-border payments.

Volopay is SOC 2 compliant and uses bank-grade encryption to safeguard transactions. You can configure approval hierarchies, monitor user activity, and track all payments with detailed audit trails. These measures ensure that your bills payable process remains secure, transparent, and protected from internal and external risks.

Volopay integrates seamlessly with popular accounting tools like Xero, QuickBooks, MYOB, and NetSuite. These integrations allow you to sync transactions automatically, simplify reconciliation, and maintain an accurate ledger. By connecting your accounting stack, you reduce manual data entry and eliminate the risk of reporting errors.