Virtual accounts for businesses in Singapore

You want to make payments as uncomplicated as possible. However, to achieve a streamlined payment process, you also have to rely on your customers to make their payments to you.

Ideally, you don’t want there to be a delay in receiving payments, so you can proceed and make your own payments on time, too. While cheques are still a popular payment method for some businesses, they can be tedious and take quite a bit of time to process.

Volopay offers a fix to that problem. With the help of business accounts, you can request your customers to send funds right to your Volopay account. This way, you can process your payments faster.

Introducing business accounts by Volopay

When you onboard with Volopay, you’ll have a wallet that you can load. From that pool of funds in your wallet, you can then make your payments accordingly. However, if your customers are paying to your other bank accounts before you load your funds into your Volopay wallet, that’s additional work for you and could prolong your payment cycle.

To mitigate that, Volopay offers you the ability to collect funds from your customers and other parties. Your customers can pay straight to your Volopay account, which will load your wallet on the platform without you having to transfer money yourself.

You will be issued a unique business account when you onboard. This business account can be used to fund your wallet yourself, but more importantly, it also opens the possibility of allowing you to collect funds from others.

The funds sent by your customers to your business account will be reflected in your Volopay wallet.

How business accounts can benefit your business

Streamlined payment process

Instead of having to rely on cheques or other forms of receiving payments that might take a while, your customers can send payments right to your Volopay business account.

There’s no need for your customers to send the money to another bank account and have you withdraw funds from it to top up your Volopay wallets.

With funds loaded straight to your Volopay account, you can immediately start using it to make payments and other expenses. This way, your payment process can all be done on one platform with ease.

Clearer communication with customers

Using your business account can help you eliminate several touchpoints in the payment process. When your customers send you money straight to your Volopay wallet, there are likely to be fewer people involved.

All you need to do is communicate with your customers that you want them to send their payment to your business account number. After the payment has been made, it will immediately be reflected in your account.

Therefore, collecting funds from your customers will be much easier and no one has to doubt whether a payment has been made or not.

Better financial transparency

When your customers pay you straight to your Volopay account, there’s no delay in receiving your payments. T

here’s no fear of forgetting to transfer money from one account to another or wondering when your cheque is going to be processed before you can load your Volopay wallet.

Eliminating this delay means that you’ll always know where your money is. The amount of money you have to spend on your account is reflected immediately on the dashboard. Having this transparency can help you plan your expenses better.

Conduct international business

The thing about the unique business accounts issued by Volopay is that you won’t be locked into a single currency.

If you have enabled your SGD, USD, AUD, EUR, and GBP wallets on your Volopay account, for example, you can collect funds in any of those currencies by utilizing your business account.

This means that you can conduct business with customers globally without having to worry about international transfers.

Instead, your customers can send you money in one of the currencies you have a wallet enabled for. You can hold or spend money in different currencies after you or your customers load funds into your account

How to make use of this feature?

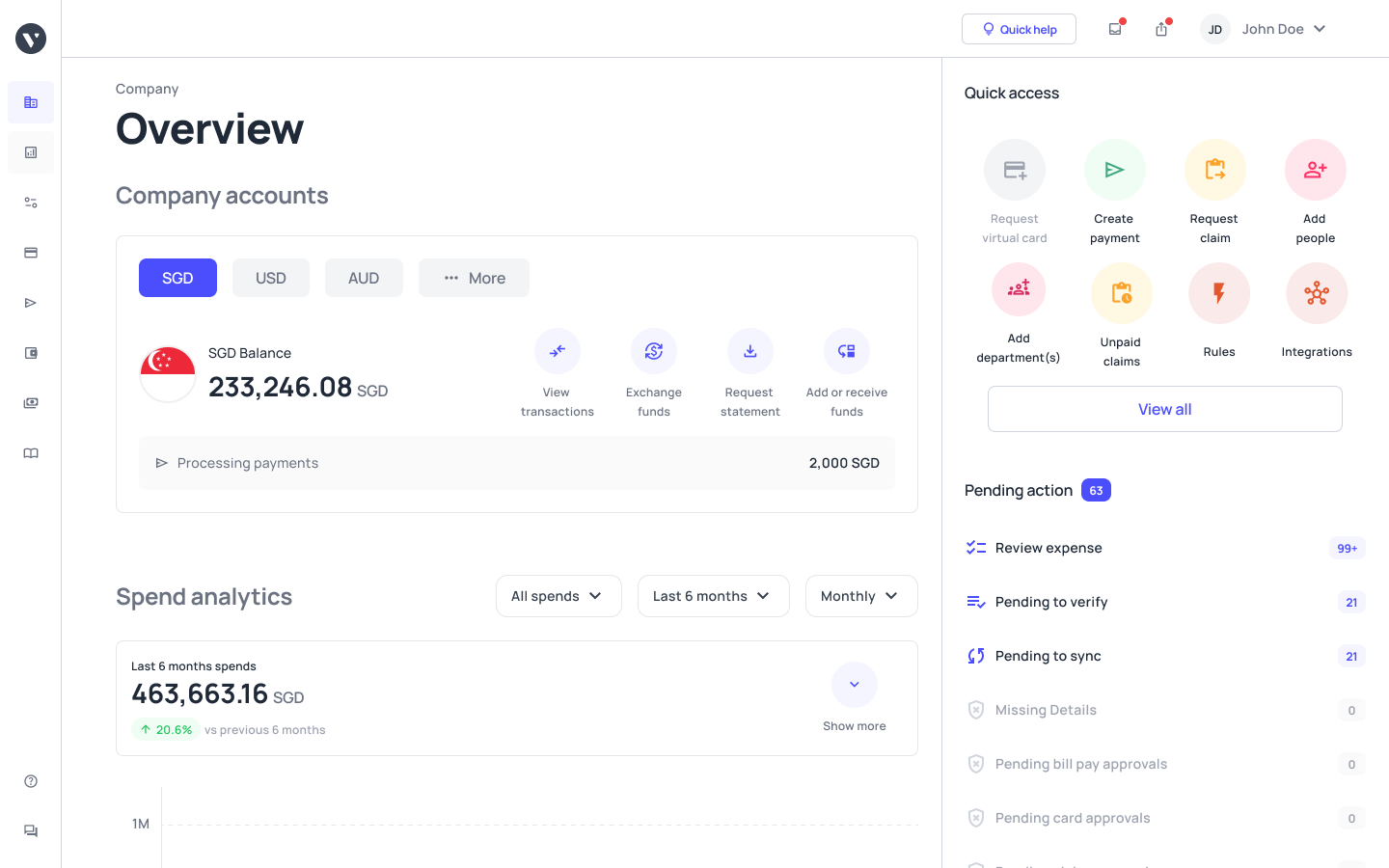

View your account details

On your Volopay dashboard, select the currency account that you want to collect funds in.

Volopay offers wallets in more than 10 currencies, including SGD, USD, AUD, EUR, and GBP. Once you’ve selected the account you want to load, click on “Add or receive'' and view your unique business account details.

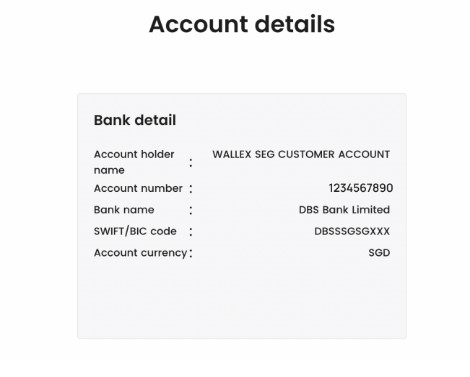

Collect money from your customers

Send your business account details to customers or other parties that you want to collect funds from. Once they have transferred funds in the currency you requested them to, the amount will be loaded into the appropriate currency wallet and reflected on your account.

Depending on the transfer method used, the money will arrive in your account within 1-3 days.

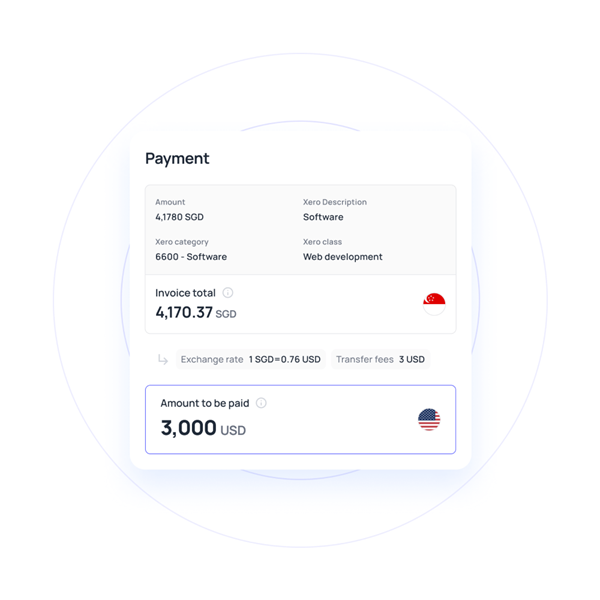

Make payments with the funds in your wallet

After your wallet has been loaded, you can use your funds to make payments on the Volopay platform.

All you have to do is click on “Create payment” and use the funds that you have collected through your business account to make your expenses.

Who is eligible to make use of business accounts?

If you’re based in Singapore or have a Singapore entity that has been onboarded with Volopay, you can make use of the unique business accounts issued by Volopay.

You can view your account details through your dashboard and get access to your business account information.

Then, you can easily collect funds by transferring them to your business account.

You can collect funds according to the currency accounts you have enabled on Volopay. This means that so long as you’re based in Singapore and have a Volopay account, you can request your customers to send funds to you in any of the currency wallets you have enabled.

Wrapping up

With Volopay’s business account, you can collect funds easily from your customers. You no longer have to rely on cheques or redirect customers to another bank account.

Instead, you can get paid and make your own payments all through one platform. All you have to do is send your business account details to your customers, wait for them to send you funds, and utilize the money that has been transferred to your Volopay account.

Avoid unnecessary steps in your payment process and allow all your finances to be taken care of with Volopay.