A new and improved Volopay for your business

It took a while, but users already experiencing the new version of our platform can attest that it was all worth the wait. Introducing Volopay 2.0, the new and improved financial control centre for your business. Get the best tools to manage your business expenses efficiently and effectively with these brand-new and upgraded features.

Here’s a quick overview of the overhauls we’ve made and what you can expect from the platform going forward.

The spending control side of things

Being able to control how the company budget is spent, who has access to the budget, and how much of it will always be an important factor for users. Here’s how we’ve updated some features and added new ones to make it even easier for finance teams.

Companies can now set specific limits to control reimbursement claims within specific spending categories. By setting limits on each category, admins can prevent over-claiming and maintain budgetary discipline.

Admins can now completely block or only allow specific merchant or category-based expenses through Volopay corporate cards. This approach ensures that spending aligns with company policies and budgetary limits, and it also helps prevent unauthorized expenditures.

Each user on Volopay will now have a specific role assigned to them that clearly defines their level of authority and access to features on the platform. This customization will help ensure that the experience of each user is catered to what they need to use the platform for the most also that there isn’t any unauthorized activity or payment by any team member.

The expense management side of things

The Volopay corporate cards you use can now be linked to a specific department or multiple projects within the platform. You can associate a card expense with a department or project, with the option to switch between them even after the expense is incurred. This essentially helps you further sort expenses and make sure that you know which expense is linked to which operation within the company.

Paying salaries to your employees can now be completely managed from within the platform. You can also easily manage payroll payments by using a downloadable CSV template to input payment details and process bulk payments.

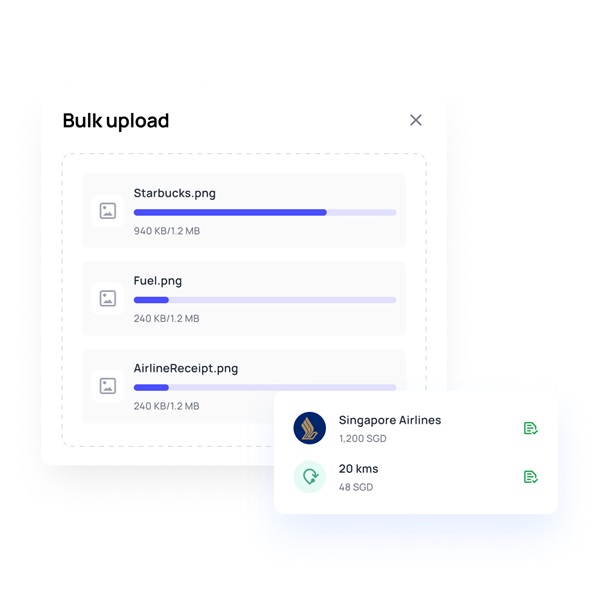

Employees can now bulk upload receipts, and also get paid in the same currency the money was spent in. Finance teams can set up an auto-payment date for all the approved reimbursement claims. This is especially useful for companies that have a huge volume of reimbursements to be processed.

Additionally, “Optical Character Recognition” technology is integrated with Volopay’s Magic Scan feature to help users reduce the burden of manual data entry in instances such as receipt uploads for card expenses, reimbursement claims, and invoice details for payments.

The 'Rules and Advanced Rules' feature provides users with an advanced form of setting up triggers and rules for applying accounting tags or custom tags to transactions. This feature enables users to automate the tagging process based on predefined conditions, making it easier to categorize and organize transactions for accounting purposes.

The user experience side of things

The UI and functionalities across the web platform and our mobile app have been revamped for a smoother and much more cohesive experience for all users.

The comments section is a feature within the Volopay system that can be seen in places like Bill Pay and Reimbursements to initiate conversations regarding transactions or to leave a note about an expense to gain clarity. These comments start a thread of communication channels that stay linked to the expenses and help in future clarification and communication.

The new Volopay 2.0 app lets you add trusted devices and activate multi-factor authentication for a secure financial management experience. You can also perform many of the functions that were previously only available through the web platform such as comprehensive card management, real-time company expense insights, card linkage, an enhanced action center to oversee tasks, alerts, & approvals, OCR receipt uploads, requesting of physical & virtual cards, and engaging in discussion threads among many others.

Volopay 2.0 users are experiencing much better spend control and expense management than ever before. We can’t wait for you to try our updated platform and feel the difference yourself.

Bring Volopay to your business

Get started now