Retail businesses are using Volopay for real-time expense management

Managing multiple vendors becomes increasingly challenging as your retail business scales across Singapore’s dynamic market. High-volume procurement, frequent supplier payments, and complex approval structures demand more than manual processes.

Without centralized retail expense management control, you risk delays, budget overruns, and strained vendor relationships. This is where Volopay's expense management platform delivers value by unifying payments, approvals, and visibility into one platform.

By modernizing how you manage supplier transactions and operational expenses, you gain consistency, speed, and control. This integrated approach ensures your finance teams can efficiently handle large-scale operations while maintaining transparency and operational agility.

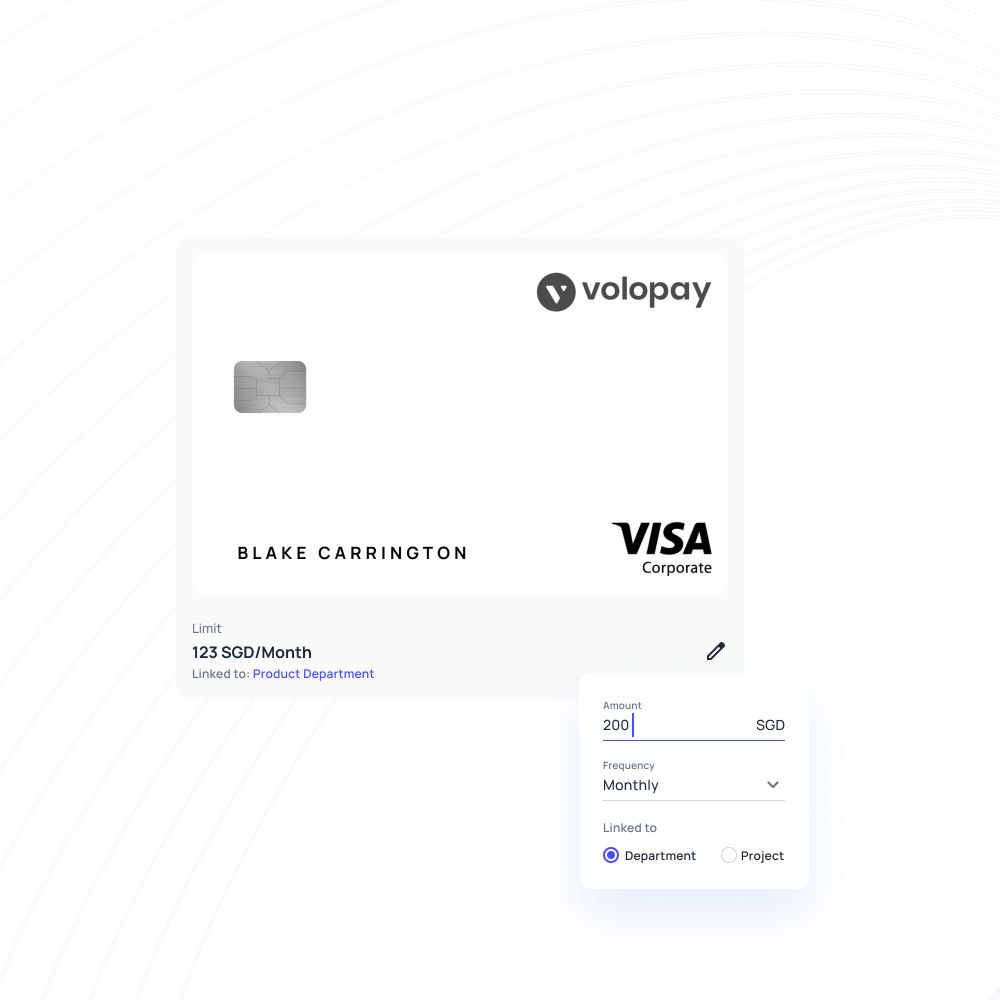

Corporate cards built for retail teams

Corporate cards tailored for retail environments help you manage bulk purchasing and operational spending across multiple teams and locations. With Volopay, you can issue cards with defined limits, category controls, and usage policies aligned to your procurement strategy.

This supports retail expense management by minimizing cash usage and manual reimbursements. You gain centralized oversight while enabling teams to transact efficiently with approved vendors.

For medium to large retailers, corporate cards simplify supplier payments, strengthen spend governance, and keep purchasing agile without compromising financial discipline. They also provide detailed transaction data that can be analyzed to optimize future spending and vendor relationships.

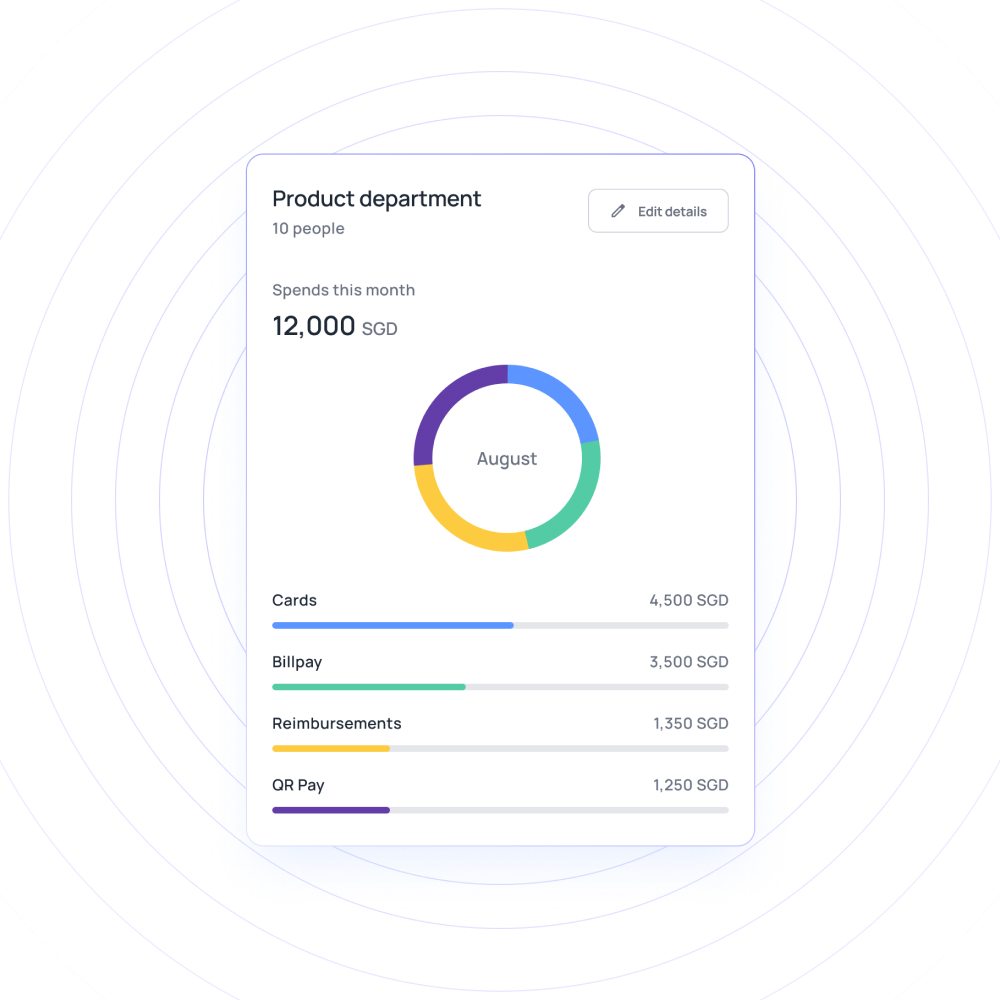

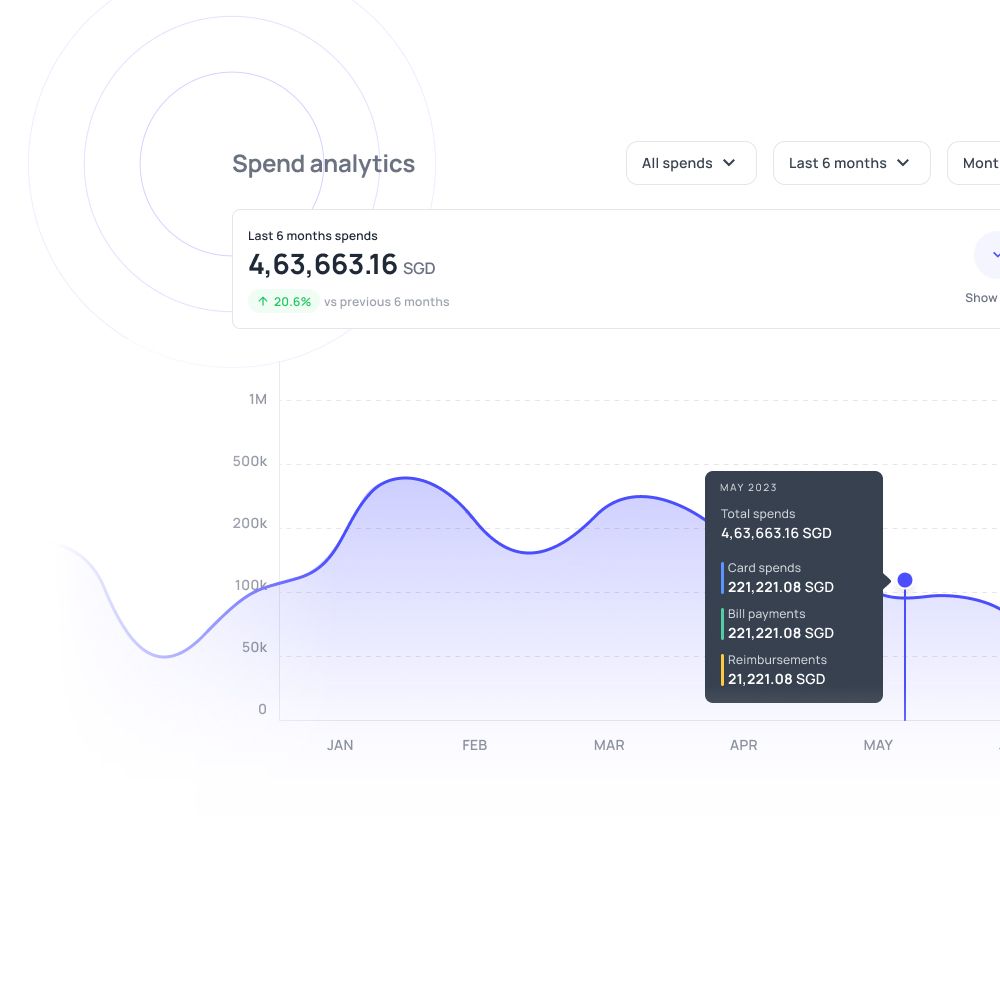

Real-time expense tracking and reporting

Real-time visibility is critical when managing high transaction volumes across multiple suppliers. Volopay’s retail spend management software provides instant insights into vendor payments, card usage, and procurement expenses as they occur.

You can monitor budgets, identify trends, and address cost overruns proactively. Automated reports replace fragmented data and manual tracking, giving finance teams clarity at scale.

For growing retail enterprises, real-time tracking supports better forecasting, faster decision-making, and tighter control over complex spending patterns. It also allows you to identify inefficiencies and implement corrective actions immediately, saving both time and operational costs.

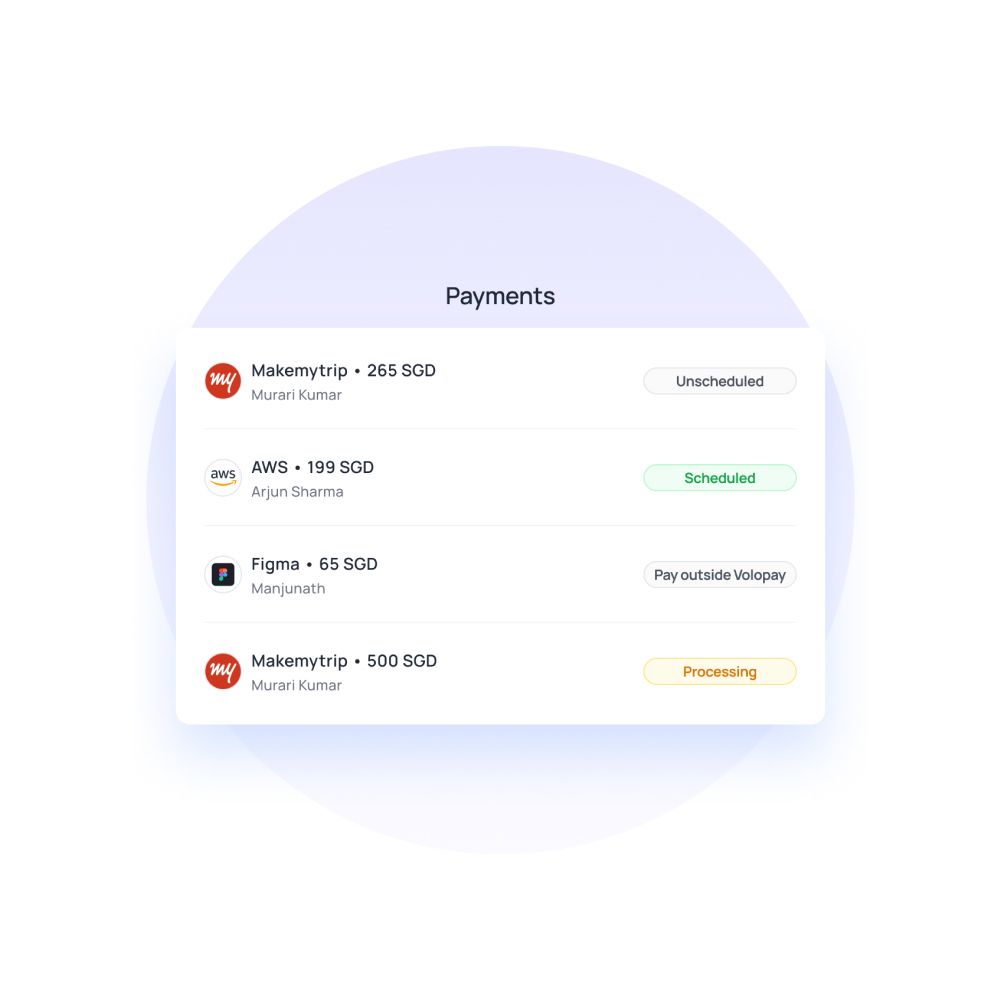

Streamlined automated vendor payments

Handling large volumes of supplier invoices manually increases risk and slows operations. Volopay simplifies this with retail accounts payable automation that streamlines invoice capture, purchase order matching, and scheduled payments.

You reduce errors, accelerate payment cycles, and improve vendor confidence. Centralized workflows also enhance audit readiness and cash flow planning.

For retailers managing extensive B2B vendor networks, automated accounts payable ensures consistency, accuracy, and scalability as procurement operations expand. This system also frees your finance team to focus on strategic initiatives rather than repetitive administrative tasks.

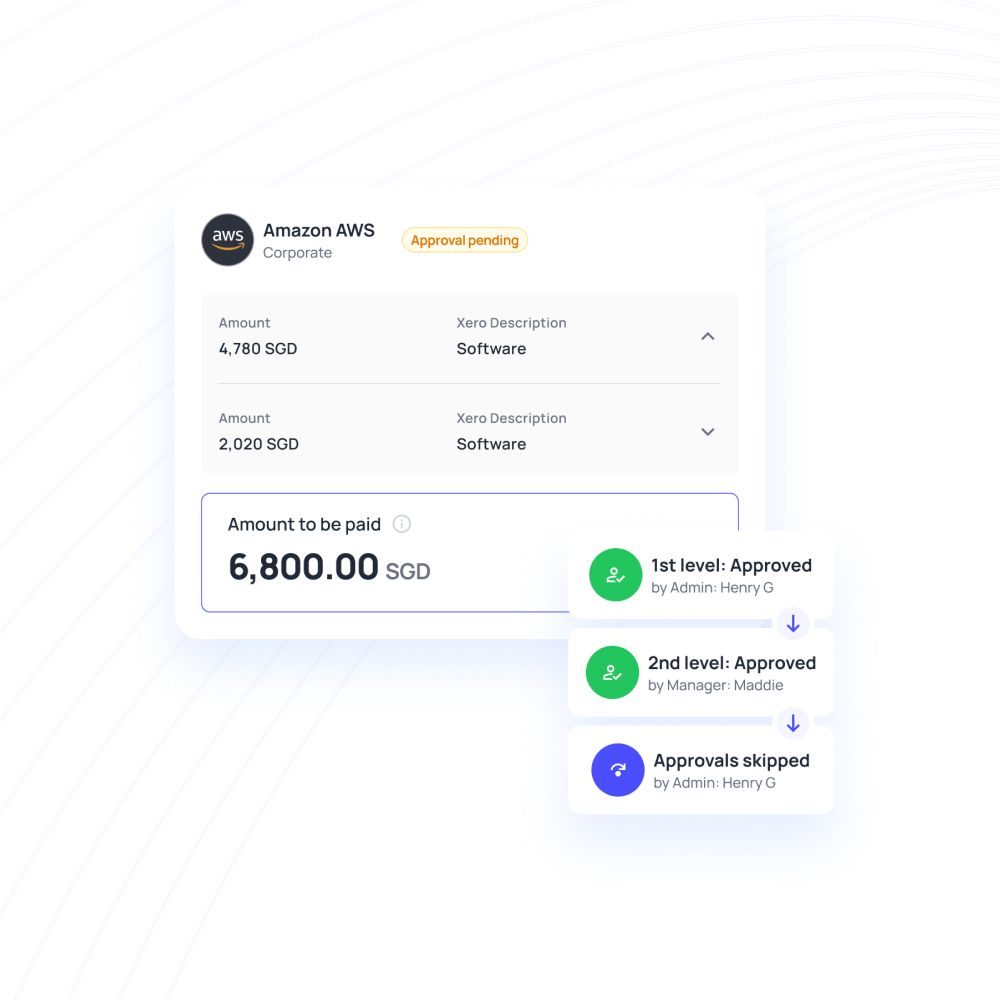

Advanced purchase order approval workflows

Structured approval workflows are essential for controlling spend across complex retail organizations. Volopay enables configurable, multi-level approvals that align purchase orders with budgets, roles, and procurement policies.

Expense management for retail businesses benefits from automated approvals that balance operational speed with governance. For medium to large retailers, these workflows ensure every vendor commitment is reviewed, compliant, and aligned with broader financial objectives.

Additionally, automated notifications and audit trails provide full visibility for senior management, reinforcing compliance and operational confidence.

Centralized control with decentralized spending

Centralized control with decentralized spending allows your finance team to define budgets, spending rules, and approval policies from a single platform, while individual stores or teams make purchases independently within those limits.

This approach ensures compliance and reduces bottlenecks, enabling operational speed across multiple retail locations.

With Volopay, every transaction is tracked in real time, providing full visibility into retail expense management and departmental spending. You can quickly identify anomalies, enforce policies consistently, and empower managers to make timely purchasing decisions without compromising governance or financial oversight.

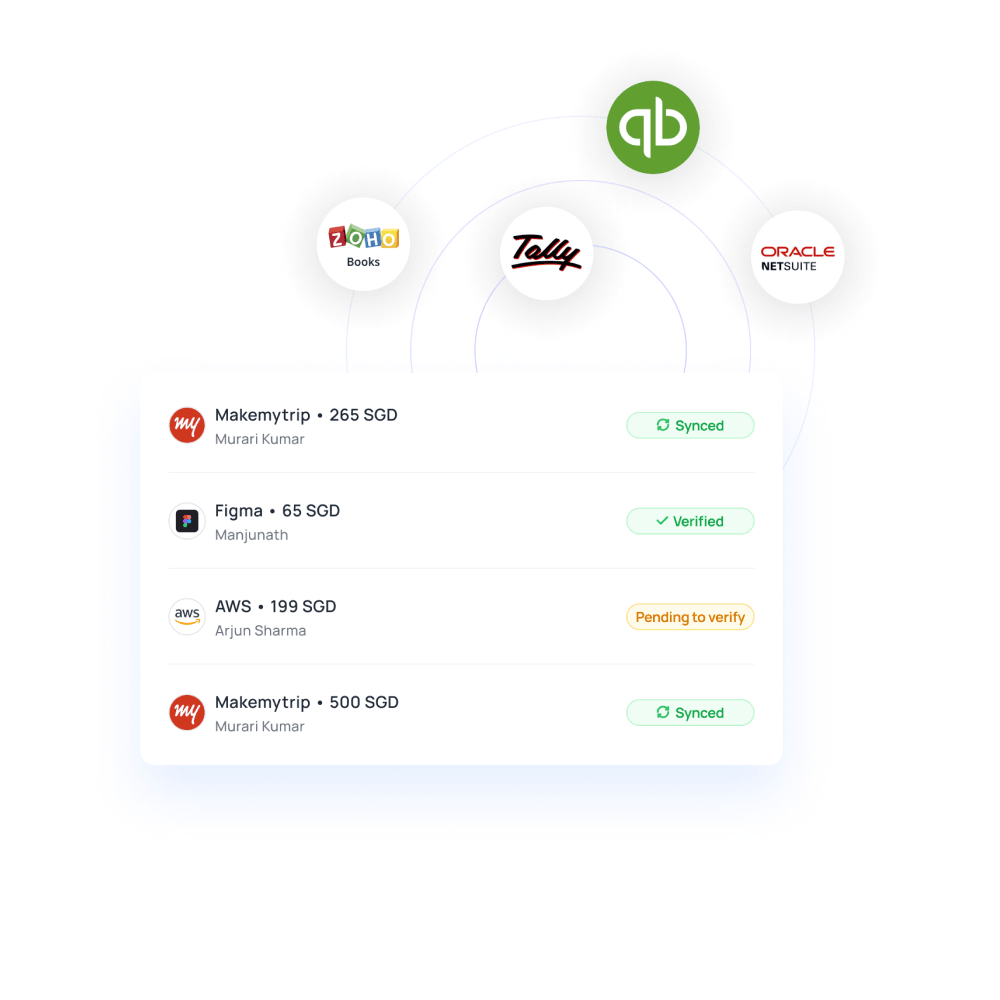

Retail ERP and accounting integration

Seamless integration with retail accounting and ERP systems allows you to consolidate financial data and simplify reporting across multiple platforms. Volopay connects directly with your existing systems, automating transaction posting, invoice matching, and reconciliations.

This reduces manual effort and errors, enabling more accurate retail vendor payment management. You can maintain a unified view of expenses, monitor cash flow, and ensure compliance while keeping accounting teams informed in real time.

By bridging operational and financial systems, you streamline workflows, enhance efficiency, and make informed decisions across your entire retail organization.

Bring Volopay to your business

Get started now

FAQs

Volopay centralizes vendor payments, invoices, and approvals in one platform, helping you streamline communication, avoid payment delays, and maintain consistent processes across suppliers, locations, and procurement teams.

Yes, you can assign customized spending limits by store, department, or role, allowing local teams to operate independently while ensuring all spending stays aligned with centrally defined budgets.

Volopay automates bulk purchase order approvals using predefined rules, routing requests to appropriate approvers based on value, category, or supplier, ensuring speed, accountability, and full audit visibility.

Implementation is typically fast and scalable, allowing you to onboard multiple locations quickly without complex infrastructure changes, ensuring minimal disruption to ongoing retail procurement and payment operations.

Yes, Volopay tracks vendor payments and employee expenses in one dashboard, giving you unified visibility into procurement costs, operational spending, reimbursements, and card transactions across teams.

Volopay improves cash flow control by providing real-time insights into outgoing payments, scheduled liabilities, and spending trends, helping you plan vendor settlements and avoid unexpected budget strain.

Volopay adapts easily to seasonal demand by allowing flexible budgets, temporary limit adjustments, and real-time monitoring, helping you manage peak procurement periods without losing financial control.

You can fully customize approval workflows based on purchase type, amount, vendor, or department, ensuring the right stakeholders review transactions while maintaining speed and policy compliance.

Volopay provides real-time dashboards instead of delayed reports, giving you instant visibility into spending, approvals, and vendor payments, enabling faster decisions and proactive cost control.