Volopay for simplified multi-facility healthcare expense management

Healthcare expense management can be a distinctly complex discipline. Hospitals, clinics, and other such organizations involved in the health and pharmaceutical industry oversee thousands of daily transactions across departments, vendors, and facilities, all while working under strict GST compliance and audit requirements.

From medical supplies procurement and equipment purchases to staff reimbursements and vendor payments, scattered financial processes can quickly create cost leakage, delayed approvals, and limited visibility.

Volopay is a healthcare expense management software that has been designed to unify these financial workflows in one place. As a unified healthcare spend management platform, it allows healthcare finance teams to streamline approvals, apply consistent controls, and gain real-time visibility into operational costs, without disrupting critical care delivery or existing financial systems.

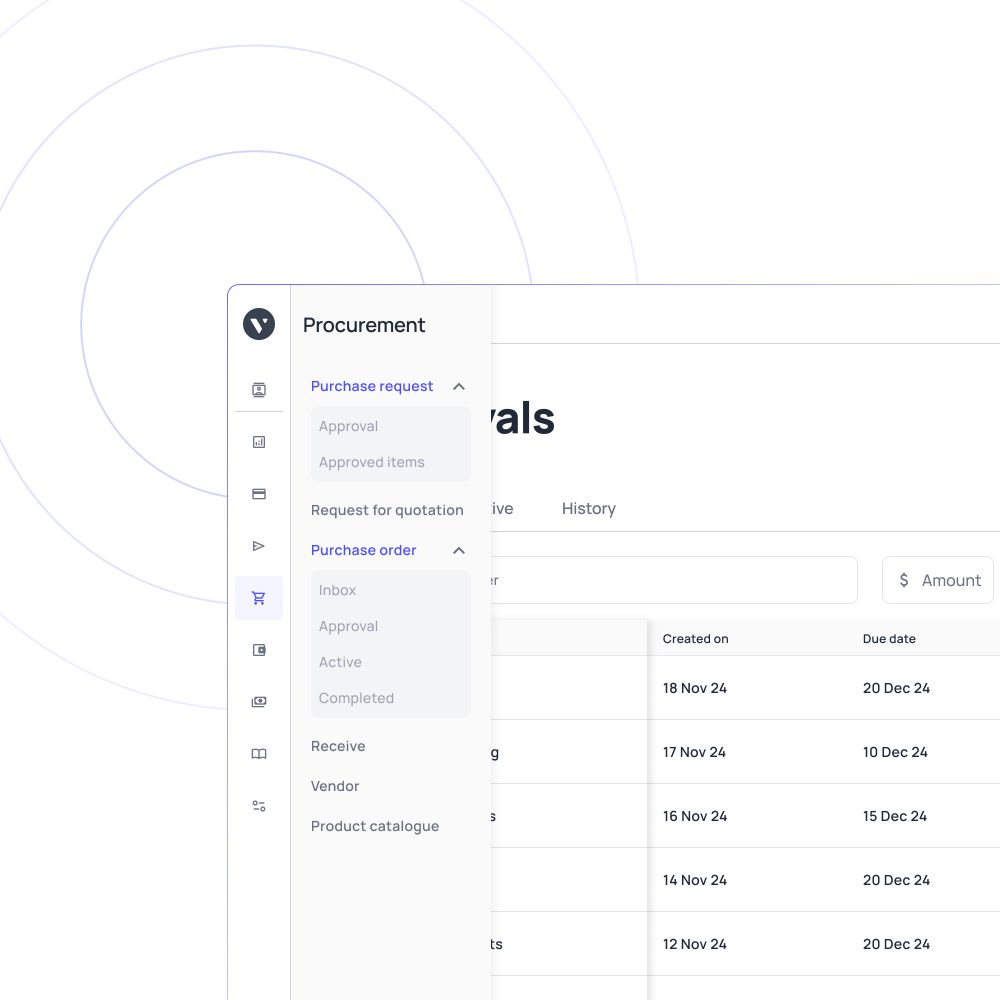

Simplify medical supply & equipment procurement

Managing procurement for medical supplies and high-value equipment requires both speed and discipline. In Singapore, healthcare providers often source supplies from a mix of domestic suppliers and international vendors, increasing the importance of accurate approvals and documentation.

Volopay's procurement solution helps centralize procurement workflows by enabling structured approval flows, category-based spend controls, and clear documentation for every purchase.

Finance teams can track GST-inclusive supplier invoices, review approvals centrally, and ensure procurement spend aligns with internal policies. This supports a more predictable procurement process while improving coordination between clinical, procurement, and finance teams.

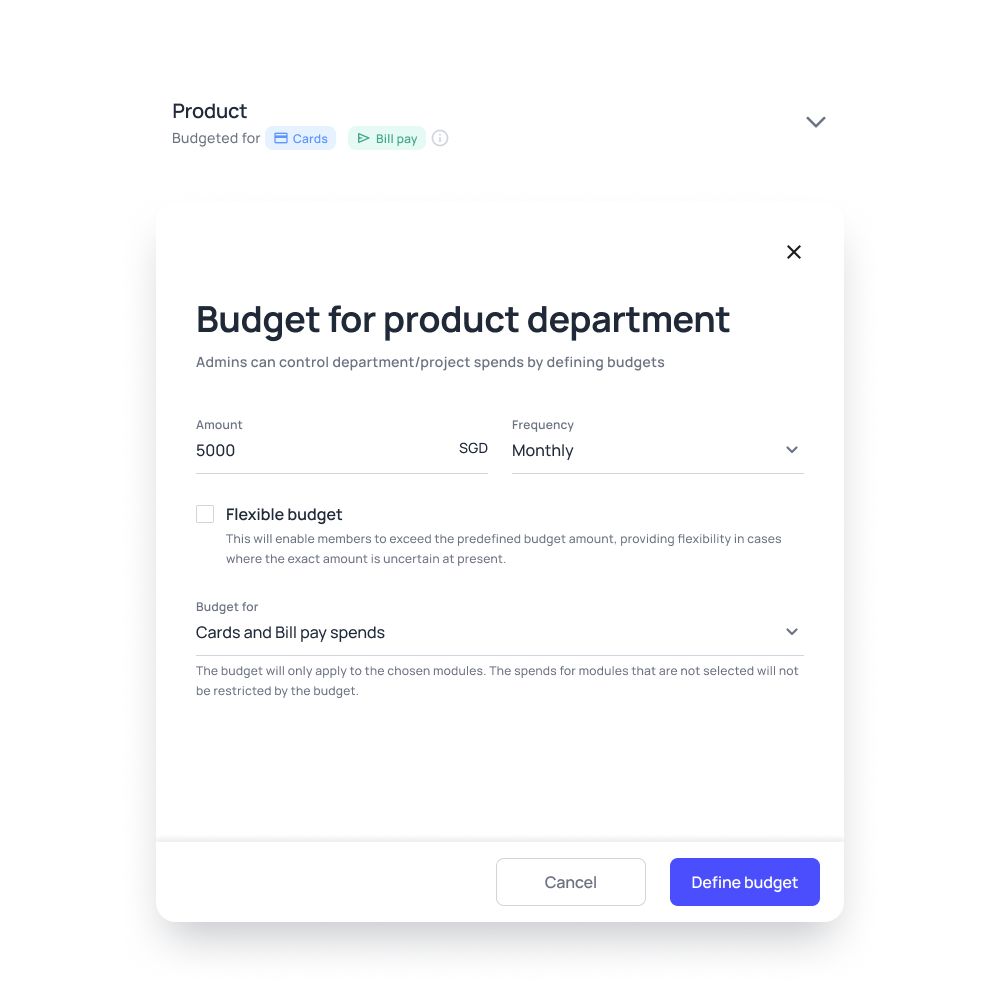

Manage multi-facility and department expenses

In Singapore, healthcare groups often operate across a combination of acute care hospitals, specialist outpatient clinics, ambulatory centres, and research or training facilities. Each entity may follow different operational budgets while still reporting into a centralized finance function.

Volopay's business budgeting software capabilties helps finance teams in Singapore apply standardized expense policies across facilities while still allowing flexibility at the department level.

Centralized oversight combined with department-specific controls enables healthcare organizations to maintain accountability without disrupting day-to-day clinical or administrative workflows. This helps healthcare groups manage both public-facing and private healthcare operations under a single financial framework.

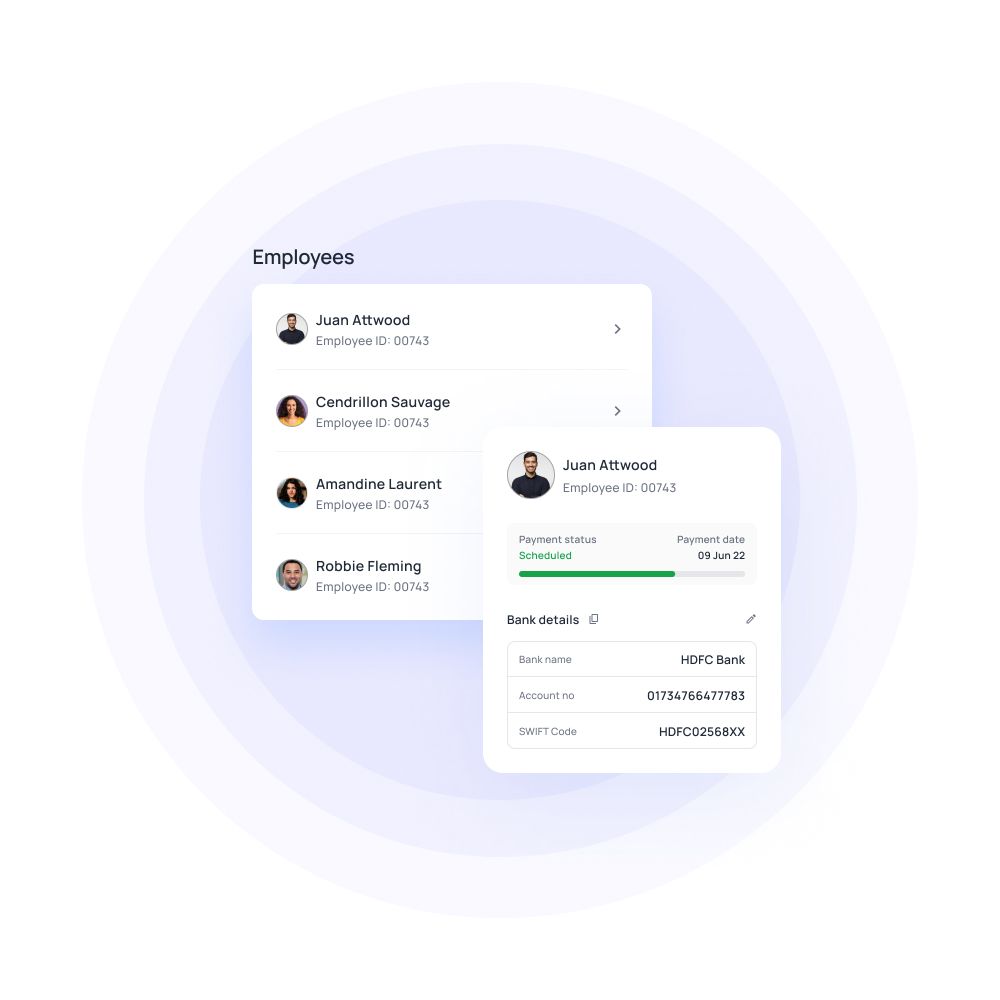

Medical staff expense & reimbursement control

Doctors, nurses, allied health professionals, and administrative staff in Singapore’s healthcare sector regularly incur expenses related to training, certifications, conferences, and travel. Manual reimbursement workflows often result in delays and inconsistent documentation.

Volopay simplifies staff expense management by enabling structured reimbursement workflows with defined approval paths and digital receipt capture aligned with local record-keeping requirements.

Finance teams can review, approve, and track reimbursements efficiently while maintaining clear documentation. This improves transparency, reduces processing time, and supports consistent policy enforcement across healthcare teams.

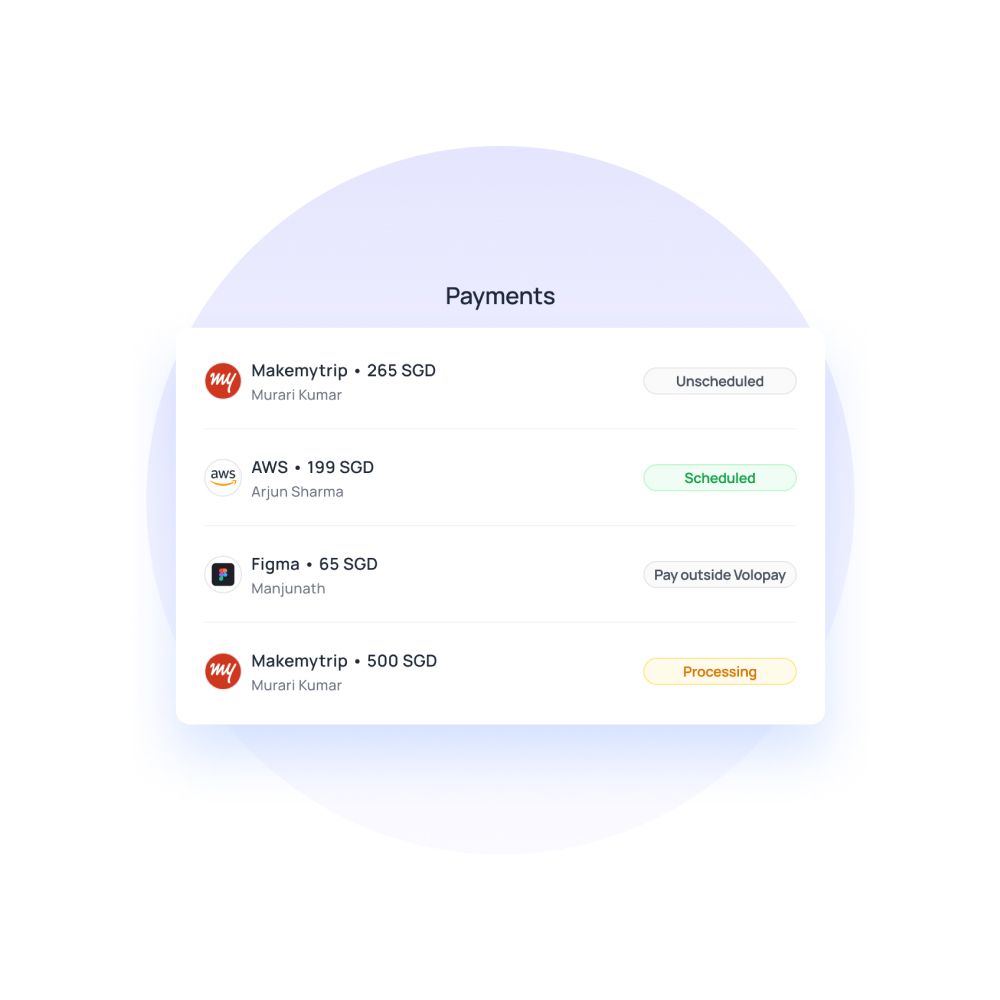

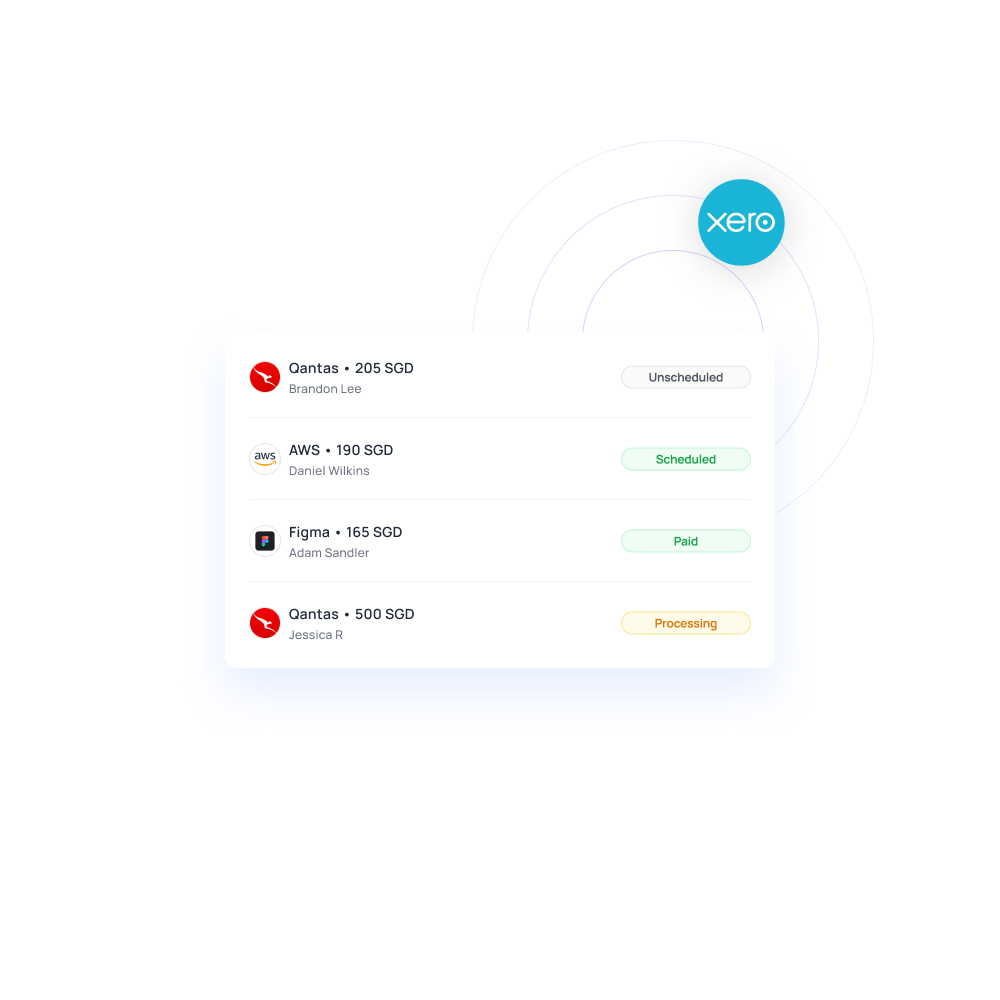

AP automation for vendor payments

Healthcare providers in Singapore often work with a diverse vendor ecosystem that includes local service providers, regional distributors, and overseas suppliers for medical equipment and pharmaceuticals. Managing approvals, documentation, and payment timelines across this mix can place strain on finance teams if handled manually.

Volopay supports structured accounts payable workflows that help finance teams manage vendor payments consistently, even when dealing with varying contract terms and payment schedules.

Centralized approval records and payment visibility reduce the risk of missed deadlines and improve coordination between procurement, operations, and finance teams. This is especially important in healthcare environments where vendor reliability directly impacts service continuity.

Track pharmaceutical and medical subscriptions

Healthcare organizations in Singapore rely on a wide range of pharmaceutical vendors, diagnostic service providers, and recurring medical software subscriptions. These expenses often span multiple departments and locations, making it difficult to track renewals, usage, and overall cost impact.

Volopay enables healthcare finance teams to consolidate recurring pharmaceutical and medical subscription payments in one system, with clear tagging by vendor, category, or department.

This visibility helps teams review recurring spend patterns, monitor renewals, and identify cost escalation early. By bringing recurring expenses under consistent oversight, organizations can make more informed budgeting decisions and reduce unnecessary or overlapping spend.

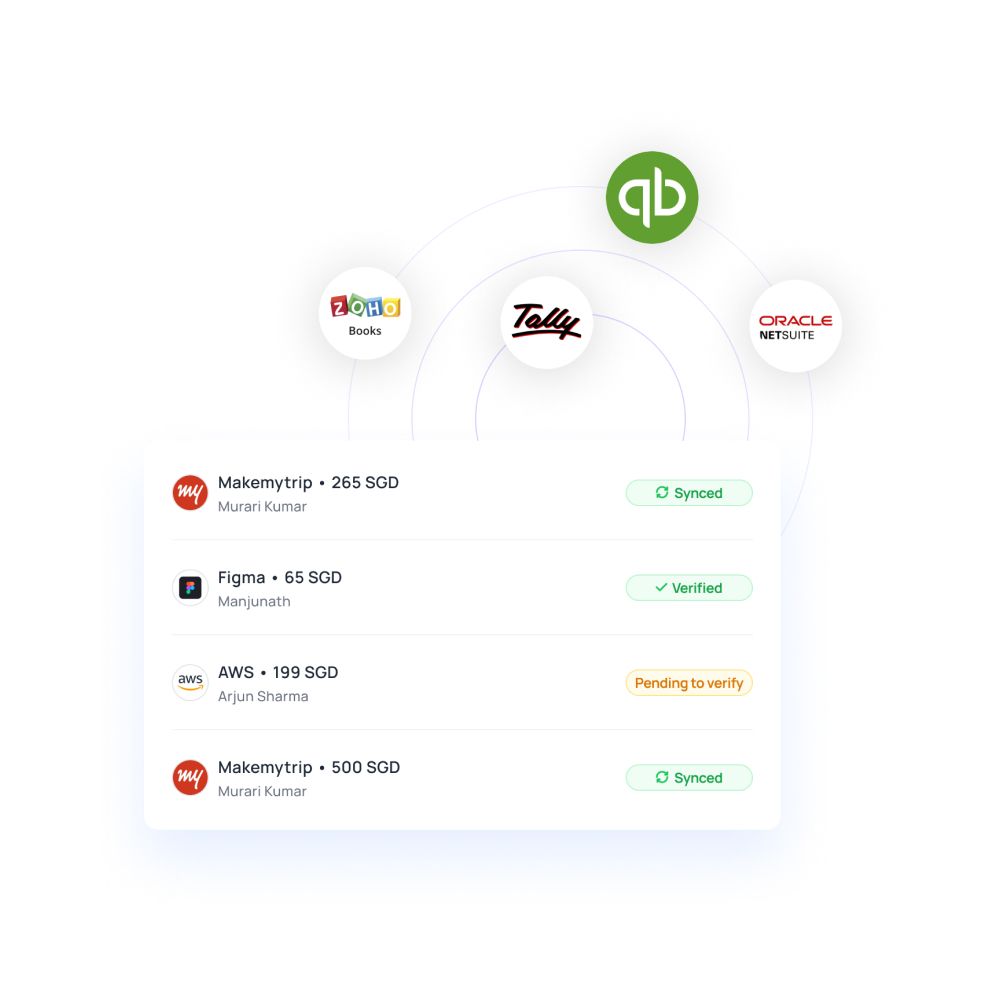

Integrate with healthcare accounting systems

Healthcare finance teams in India depend on accurate, compliant data flowing into their accounting and ERP systems to meet statutory audit and GST filing requirements. Manual reconciliation between expense systems and accounting platforms often slows down reporting cycles.

Volopay integrates with accounting platforms to ensure expense data, vendor payments, and reimbursements sync consistently. This indirect integration approach allows healthcare organizations to continue using their existing financial systems while improving data accuracy and reducing manual reconciliation.

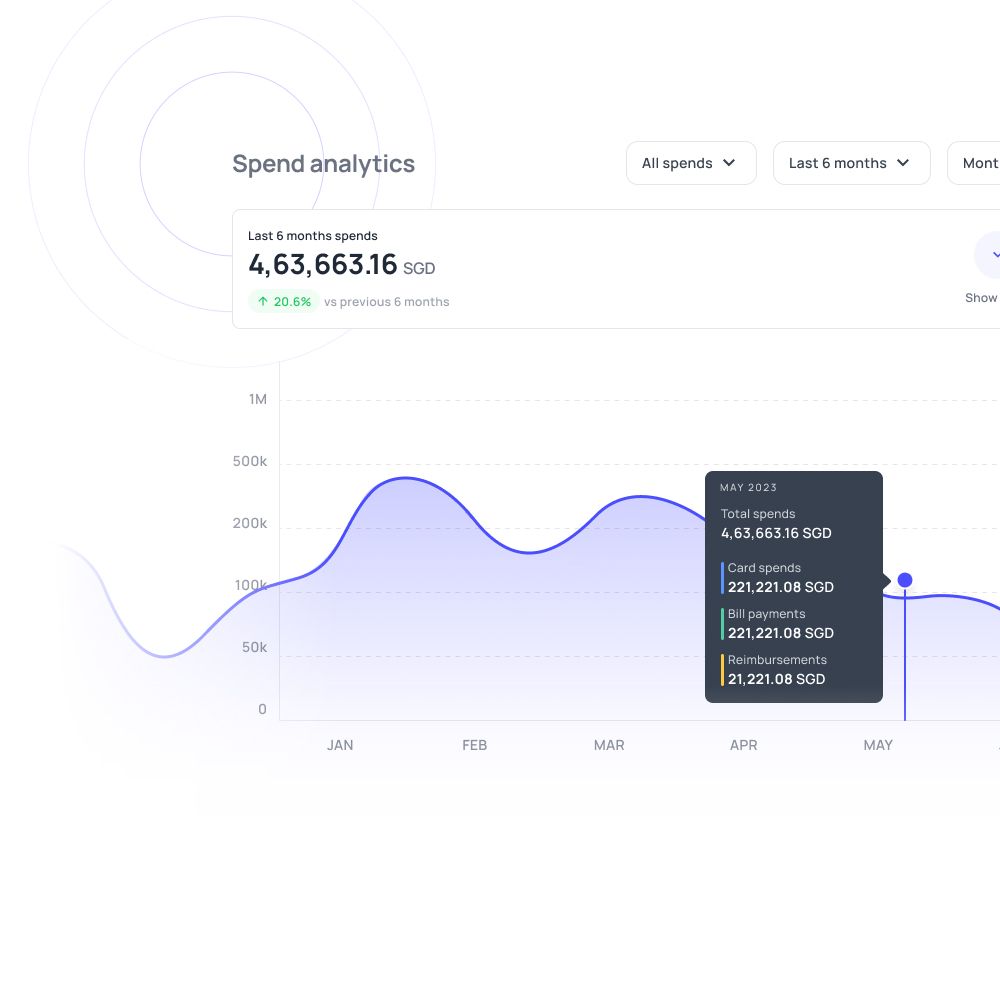

Gain visibility into cash flow & operational costs

For healthcare organizations in Singapore, maintaining clear visibility into cash flow is critical due to high operating costs, long procurement cycles, and delayed receivables in certain care segments.

Volopay provides finance teams with consolidated real-time visibility into outgoing payments, pending reimbursements, and department-level spend. This allows healthcare leaders to identify trends early, anticipate funding requirements, and make informed decisions around budget allocation.

Improved visibility supports more disciplined financial planning while helping organizations respond quickly to changing operational demands.

Bring Volopay to your business

Get started now

FAQs

Volopay’s fully equipped expense management system is designed to support structured, audit-ready financial workflows. While it does not handle clinical data, it helps healthcare organizations maintain organized expense records, approval logs, and documentation that align with internal compliance and audit requirements.

Yes. Volopay supports controlled procurement workflows. Working as a comprehensive healthcare spend management platform, the system manages procurement workflows by enabling approvals, spend categorization, and documentation for medical supplies and equipment purchases, helping finance teams maintain oversight and policy adherence.

Volopay allows expenses to be tracked by facility, department, or cost center. This categorization capability helps finance personnel by providing both consolidated and location-specific visibility, a feature that is particularly useful for healthcare organizations that have the need to manage multiple facilities.

Healthcare staff can submit expenses with digital receipts through structured reimbursement workflows, making it easier for finance teams to review, approve, and document CME and travel-related expenses.

Volopay’s expense management system has the ability to integrate indirectly through accounting and ERP systems. It focuses on financial operations rather than clinical data and does not directly connect to EMR or EHR platforms.

Volopay centralizes vendor payment workflows with approvals and audit trails. Centralized workflows go far in helping healthcare organizations maintain organized records for vendor payments and internal compliance reporting.

Yes, Volopay allows setting different, nuanced expense policies for different departments. Finance teams can define department-specific controls and approval workflows to reflect different operational needs across surgical, diagnostic, pharmacy, administrative, and various other teams.

Volopay provides real-time visibility into outgoing payments, reimbursements, and recurring expenses. Equipped with a full suite of cash control features, Volopay’s platform helps finance teams monitor cash flow and plan expenditures more effectively.

Volopay maintains detailed records of approvals, payments, and expense documentation, enabling finance teams to generate audit-ready reports when required.

Implementation timelines vary based on organizational complexity, but Volopay is designed to integrate into existing financial workflows without major operational disruption.