Guide to getting a virtual credit card in Singapore

In 2022, a survey by PYMNTS states that 55% of CFOs have started using virtual credit cards, or VCC, for business purposes more than before the pandemic. With the world shifting toward digital and fintech trends, it should be no surprise that card usage trends are shifting along with it. It is estimated that by 2026, transactions carried out through VCC will increase up to US$ 6.8 billion.

Virtual cards are designed to provide ease and convenience when doing business transactions, often offering more security and many other features that their physical counterparts may not have.

With this article, let us know how to use virtual cards in Singapore and streamline your expense processes.

What are virtual cards?

To put it simply, virtual cards are digital cards that are generated and stored in your devices, such as your computer or phone. Like physical cards, virtual cards also have a unique 16-digit card number, a CVV, and an expiration date. Ultimately, they function similarly to physical cards, with the most significant difference being that virtual cards have no physical forms.

They can be used in places where you would otherwise use a physical card, like when making online purchases. Virtual cards come with certain advantages over their physical counterparts. For example, you have the added safety of never having to worry about losing your card.

Virtual credit card vs traditional credit card - What are the differences?

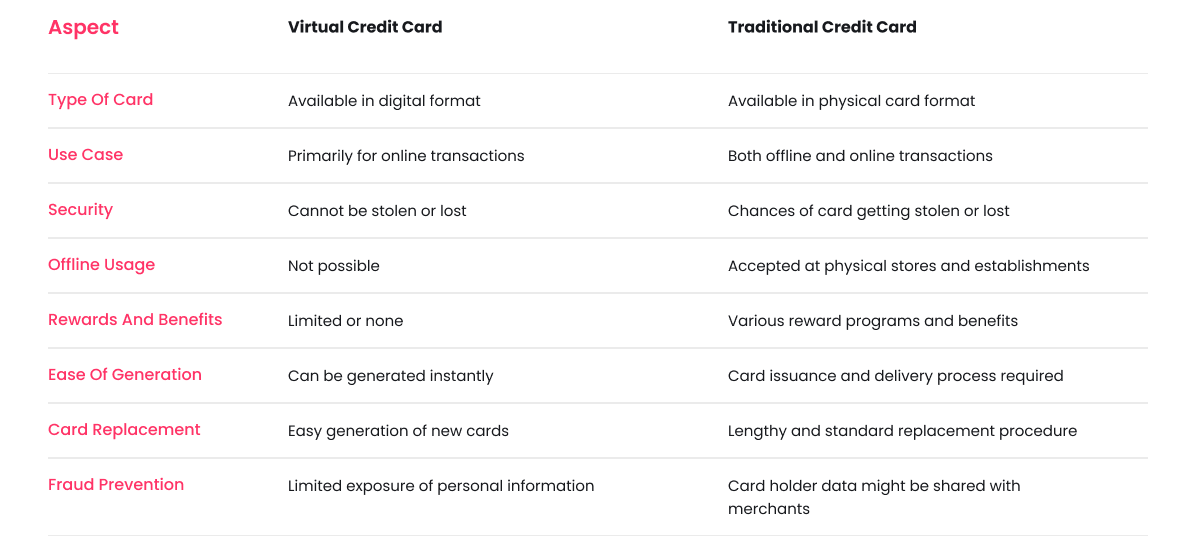

Eventhough traditional credit cards are still widely used for various business transactions, virtual credit cards have several advantages over traditional credit cards.

Here are some of the key differences between virtual credit card and a traditional credit card:

1. Usage

While a traditional credit card are used for multiple purposes or transactions, virtual cards are specifically used for a single purpose or for a single transactions.

Traditional credit cards can be used for both online and offline transactions while virtual cards are used mainly for online transactions.

2. Security

As traditional debit cards have to be carried around, there are chances that you might lose or it might get stolen. While on the other hand, virtual cards cannot be lost or stolen.

Also, virtual credit cards provide an extra layer of security for online transactions. In the event of any unauthorized transactions, virtual credit card can easily be blocked from the card dashboard.

3. Issuing process

To get a credit card, business is required to fill the credit card application and submit various other documents related to the business. Processing of the application will then take few more days before your card gets approved.

On the other hand, virtual cards can easily be activated through your banking application of service provider application. Once the card is generated you can immediately start using it.

4. Spend control

Virtual credit cards allow users to have a greater control over their spending. Users can set specific spend limits, expiration dates and even add transaction restrictions.

5. Reward programs

Only a few virtual credit card providers offers reward programs. While on the other hand, a traditional credit card offer rewards programs that allow cardholders to earn points, miles, or cashback on their purchases.

How do virtual credit cards work in Singapore?

Virtual credit card is essentially a digital version of a traditional credit card. Virtual credit cards for businesses operate on the money borrowed by the business. Banks and fintech platforms offer a business line of credit, and also the option of getting a connected virtual credit card.

Virtual credit card number is generated by your card issuer. Each virtual card number is unique and cannot be used again.

Just like how you do with traditional credit card, you only have to enter the virtual card number into the payment form to make any online transactions.

You also have other options to set an expiry date, specifying if the card is recurring or a burner card, set a limit on the card spend, etc.

Understanding virtual card payments

At first glance, transactions carried out with virtual cards aren’t that different from ones that utilize physical cards. Just like a physical credit card, you’ll have to make your virtual card first before you can use it.

However, the difference with a virtual card is that you can generate a virtual card right before you make a payment without having to wait days to get access to your card. Typically, this will involve signing into your bank account or another provider’s dashboard to create a card.

You’ll have to decide some details and parameters such as which employee is the card going to be assigned to, what the spending limits may be, and whether it’s a one-time or recurring use card. When you have successfully entered all the details, you’ll get a randomly generated 16-digit card number that you can use to make payments.

Credit cards, physical and virtual alike, are tied to a credit card network that enables you to make transactions using your credit card. Two major credit card networks are Visa and Mastercard.

The virtual credit card that you create with your card provider will work within these networks when you make a payment, allowing the receiving end of the payment to collect their funds.

When a payment is made using virtual credit cards, the payee will be able to collect the payment from your card provider. They won’t have to wait until you repay your credit to get the funds.

Instead, at a later agreed-upon date, you’ll repay your card provider the amount of outstanding credit that you used in the billing cycle. This is all made possible thanks to the digital infrastructure created by the credit card network your cards are tied to.

Say you own a small business that wants to scale but is facing several roadblocks along the way. You have to purchase some costly subscriptions to help your business grow, but you’re facing some cash flow challenges because your clients are on 30-day invoice terms.

Interest-free credit can help you purchase and manage these subscriptions on multiple virtual credit cards to ensure that you have controlled spending. You get to make purchases according to your budget and you can repay your credit card provider at the end of your billing cycle.

Check out our article on virtual card uses cases to understand how virtual cards can help businesses in managing advertising expenses, procurement and much more.

Looking for virtual cards to manage your business expenses?

What are the benefits of using virtual credit card?

1. Hassle-free payments

Unlike a physical credit card, you don’t need to carry your card wherever you go. This means that you can make payments from anywhere at any time you need to without having to worry about where you last stored your card.

There’s no more fear of dropping your card or accidentally leaving it behind whenever you pull it out to make a payment. You can simply use your device, enter the necessary details, and make payments easily with virtual credit cards.

2. Control your expenses

It can be difficult to have control over all your business expenses, especially when you have many different employees having to make them. Not only does it get tedious to track everything, but you also run into the risk of having unauthorized payments.

Virtual credit cards help you control your expenses better by allowing you to set limits on your cards before employees start using them. If your cards are linked to expense management software, you can also get real-time visibility of what your cards are used for.

3. Easy approvals

When it comes to card expenses, approvals usually happen after the transaction has been made instead not before it. Your employees typically will input the details of their card transactions and wait for higher-ups to check and approve or reject them.

Using virtual cards in Singapore can help reduce the amount of rejected transactions by pre-approving a budget. When you link an expense management platform to your cards, your employees will also have an easier time filing out their expenses for you to approve.

4. High-level security

Giving out your card details to multiple vendors and suppliers can be risky. On top of that, you could misplace your card and have it fall into the wrong hands.

Virtual credit cards can mitigate that risk and offer you more security by generating random 16-digit card numbers for you whenever you want to use your cards.

It also offer you the added benefit of allowing you to set controls like spending limits and giving you the ability to freeze your cards straight from a dashboard.

5. Manage your subscriptions

It may seem convenient to use one card to pay for all your business subscriptions. However, there are many downsides that come with it. It’s easy to forget to cancel your free trials before they turn into bills.

If you have multiple free trials that have ended and billed to your account, you could be spending a lot of money that you didn’t want to. Having multiple virtual cards will allow you to easily track which free trials still need to be canceled. You can set limits and expiry dates for each card.

6. Employee accountability

Assigning individual virtual cards to your employees hold them accountable for their respective spending. But more than that, virtual cards can empower your employees.

Say there’s a new project in your company. By giving the project owner a virtual card, you’re emphasizing their role and giving them autonomy to make the necessary expenses. It gives them equal parts ownership and responsibility.

How to get a virtual credit card for your business in Singapore?

You can get a virtual credit card for business with many different providers in Singapore. This can be through banks, neo-banks, or other providers that offer cards. However, most, if not all, providers of virtual cards in Singapore will require that you own a registered business when you apply for a card.

When applying for a credit card, the provider or issuer will likely start with checking your business’ eligibility for credit by checking your business credit score, which can be determined by things such as your company’s annual revenue. This is separate from your personal credit score.

All you will need to do is submit the required information and supporting documents. Once you’re deemed eligible, you’ll be able to create virtual credit cards for your business.

Best virtual card providers in Singapore

A good number of virtual card providers exist in Singapore, especially with the growing popularity of virtual cards. Here are some of the best providers of virtual card for business.

1. Volopay

Volopay virtual card will help you manage your expenses better and save time. You can manage all your subscriptions through the use of multiple virtual cards on one platform.

All cards issued by Volopay are linked to expense management software that gives you the ability to set spend controls like budgeting and freezing cards, receive transaction reports from your employees, as well integrate your expenses with your accounting software.

2. Aspire

Virtual cards issued by Aspire help ensure that all your payments are secure. You can also get unlimited business virtual cards issued for your employees to help manage your business expenses better. Anyone with a registered business can apply for Aspire corporate cards.

3. DBS

DBS’ virtual cards are offered only to its corporate banking clients. Cards by DBS will be issued in the name of your company.

DBS cards boast an added layer of security, putting an emphasis on employee travel management by offering Travel Accident Insurance coverage in the case of any misuse of cards.

4. Wise

You can get a multi-currency virtual card with Wise for a small cost. However, Wise only offers virtual cards when you have placed an order for a physical card as well.

You don’t have to wait for your physical card to arrive, but your virtual cards can’t exist without being tied to a physical card.

5. HSBC

Customers who have signed up on the HSBC app can get access to HSBC virtual cards. Their cards allow you to control your business spending by setting limits on each virtual card.

HSBC also gives you access to real-time reporting for better expense management.

For a more detailed comparison of the virtual card providers, check out article on "best virtual cards for businesses in Singapore"

Issue unlimited virtual cards for your employees instantly

Tips for using virtual credit cards effectively

1. Set spending limits

Take advantage of the control features that comes with a virtual credit card. Set specific spend limits or maximum transaction amount for each virtual card to keep your business expenses under control.

2. Regularly review transaction history

Monitor your virtual credit card transaction regularly. You card management platform will automatically record all the transactions your employees make on the virtual card.

Make sure that you are making full use of this feature to track for any unauthorized or suspicious activity. In the event of any such incidents block your card immediately and report it to your virtual card provider or issuer immediately.

3. Categorize expenses

Categorizing your purchases will make it easy to monitor and reconcile your transactions. Most of the virtual card provider offers this feature which allow you to categorize transactions automatically.

All your employees need to do when reporting expenses is click on a category, which will then be reflected in your ledger.

4. Set transaction notifications

It is always a good practice to set notifications for very transactions happening on your virtual card. Even if you don't want alerts for every single transactions, you can set up alerts for transactions that are above a certain amount.

5. Enable two-factor authentication

The only way to generate a virtual card is through your card management platform. For this reason, it is advised to have a two-factor authentication enabled on your platform. This makes sure that only authorized people will have access to the platform.

Factors to consider when getting a virtual card for your business

1. Ease of integration

You want a virtual card provider that offers you integration with the accounting software that you use.

Some providers, like Volopay, allow you direct sync with popular accounting software like Xero and Netsuite as well as use Universal CSV to integrate your virtual card transactions with your accounting software of choice.

2. Security

While virtual cards can’t be stolen, you still want to make sure that your data is safe with your card provider. Pick a provider that is known and trusted.

You want to make sure that they follow all the necessary security protocols. It’s also a good idea to pick a provider that has security certifications.

3. Perks and privileges

Different card providers will offer different rewards and perks with their virtual cards. In Singapore, there are a number of providers that you can choose from.

Make sure to align your business needs with the perks and privileges that your chosen card provider offers. Maximize the value of your cards to help grow your business.

4. Real-time spend tracking

Using virtual cards can enable you to track and control your expenses. Considering picking a provider that gives you this feature and allows you to take advantage of automated spend tracking to control your business spending better.

The ideal provider will notify you when your cards have reached their limits.

5. Currency support

If your business operates internationally or you have foreign vendors, you will want to know that you can use your virtual credit cards for payments in different currencies.

Ideally, you want to be able to hold different currencies and use them for payments in those respective currencies or have the ability to convert them whenever you need.

6. Ease of applying

Applying for and creating virtual credit cards is easier than their physical counterparts. But there are still requirements that you have to fulfill when applying for virtual cards.

You want to be sure that your provider of choice makes the application process easy for you. Look for providers that allow you to apply online without a fee.

Why should you choose Volopay virtual cards?

1. Card security

Volopay cards are issued by Visa and governed by the Monetary Authority of Singapore. They have the same level of security as bank-issued cards without having to be tied to any bank account, eliminating any hacking risks. You also don’t have to worry about data leaks that may happen from sharing card information among many people. You can also freeze your cards immediately if needed.

2. No hidden fees

There are no hidden transaction fees that come with Volopay cards. Any fees that you are subject to, such as late credit payment fees, will be stated upfront. When you choose Volopay virtual cards, you don’t have to worry about hidden bank fees that you might not be aware of until after you make the transaction.

3. Multi-currency wallet

Volopay offers currency flexibility with your virtual cards. You can make allocate limits to your cards in SGD or USD and make transactions in the aforementioned currencies. You can also repay your card bills using your Volopay multi-currency wallet. This way, foreign transactions are less of a hassle.

4. No need for any personal guarantees

The virtual cards that you create with Volopay are tied to your business. This means that you don’t need any personal guarantees. You can use them for business expenses without having to worry that they may impact your personal expenses.

5. In-built spend controls

Because your virtual cards are connected with Volopay’s expense management platform, you can easily track and manage all your cards through the dashboard. Control your business expenses with Volopay’s spend control features, which allow you to set limits and expiration dates. You can also apply your company policies to reject any virtual card transactions that are over the pre-approved limit or don’t comply.

6. Ease of applying

You have automatic access to Volopay virtual cards as long as you have a Volopay account. The team will assist you with the onboarding process. Once you have a dashboard set up, all you need to create a virtual card are a few clicks and some necessary details put into a form. You’ll immediately get your Volopay virtual card within just a few minutes.

7. Unlimited cards

There is no limit to how many virtual cards you can generate with Volopay. You can effectively equip all your employees with cards to empower them and allow them to make necessary business expenses. Moreover, this means that you can assign one card to every subscription to manage your subscription payments better. Generate Volopay virtual cards whenever you need them.

As trends begin to shift toward digital payments, it’s no surprise that many companies have benefited from using business virtual cards. They make business payments more convenient and secure. You can save time, streamline your processes, and grow your business when you have access to virtual cards with a credit line.

Volopay offers virtual cards that are not only secure but also easy to create and use. Be in control of your expenses with in-built spend controls, and start using your cards for business expenses to save time.

Benefit your business with smart virtual cards from Volopay

FAQ's

There are many different corporate virtual credit card providers in Singapore. Starting from banks, neo-banks, to other fintech providers, you have a number of options available to you. Keep in mind that each individual provider might have their own set of requirements. Typically, you’ll need to have a registered and licensed business to apply for a virtual credit card for business. You’ll also want a good business credit score.

Having a virtual card for subscriptions can ensure timely payments for all your subscription-based purchases. More importantly, you can also generate individual virtual cards for each of your subscriptions. In the unfortunate event that a virtual card for subscriptions becomes compromised, you’ll still be able to use your other cards. If each subscription has its individual card, the rest of your subscriptions won’t be affected.

You can get unlimited virtual cards with Volopay. Assign individual cards for every project or subscription you have. Each card can have its specific use.

When you’ve been onboarded with Volopay on a card plan, creating a virtual card for business is free. You can generate as many virtual cards as you need through your Volopay account in just a few clicks.

Given the ability to create unlimited virtual credit cards, you can use this to track and control your business spending better by assigning a corporate virtual credit card to each specific objective, project, or subscription. Keeping track of your budget and ensuring that you and your employees don’t overspend become easier. When your virtual credit cards are linked to a dashboard, you’ll also gain more visibility over your expenses, hence providing you with better insights. Making actionable decisions based on these insights is easier than ever with virtual credit cards.

While physical cards are restricted by their physical forms, virtual cards aren’t. You’ll have to carry your physical card everywhere in order to use them. There’s also a greater risk of them being stolen or lost. With a corporate virtual credit card, however, you can use your card from anywhere without having to worry about misplacing it. Not only that, but you can create as many virtual cards as you need. This makes it easy to have objective-specific cards for better spend tracking.

Virtual cards are very secure. There’s no risk of misplacing a corporate virtual card as you would with physical cards. Additionally, you can generate one-time virtual cards, meaning that your card information won’t be usable after the one-time use.

Every virtual card for business issued by Volopay is linked to your Volopay account. Card expenses can be easily viewed from your dashboard. Every time a virtual card expense has been made, the expense will automatically be reflected on your account. Employees will then have to fill out mandatory details according to company policies. This way, you’ll have a complete view of your virtual card spending at all times.