Prepaid cards built for smarter fleet expense control

Power smarter fleet operations with prepaid cards built for control and convenience. Easily manage fuel, tolls, maintenance, and travel costs.

Unlike traditional business fleet cards, Volopay prepaid cards let you set spending limits, automate payments, and track expenses in real time for complete visibility and seamless expense management across your entire fleet.

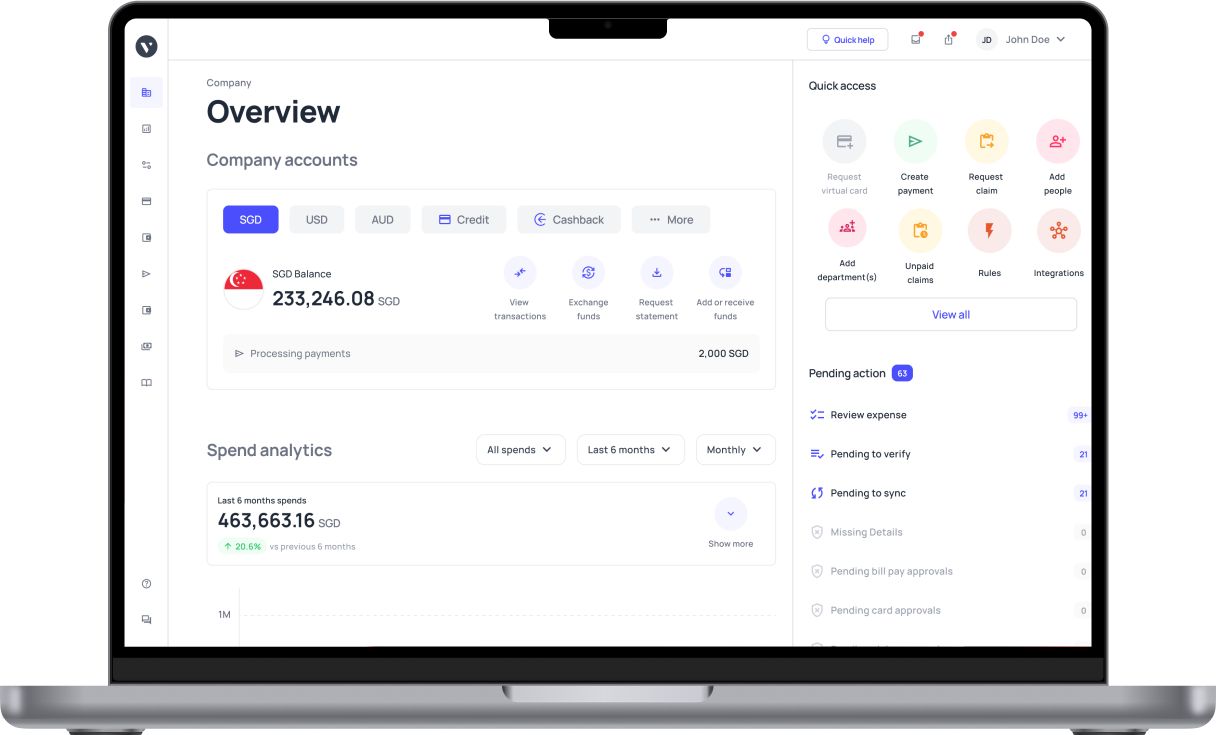

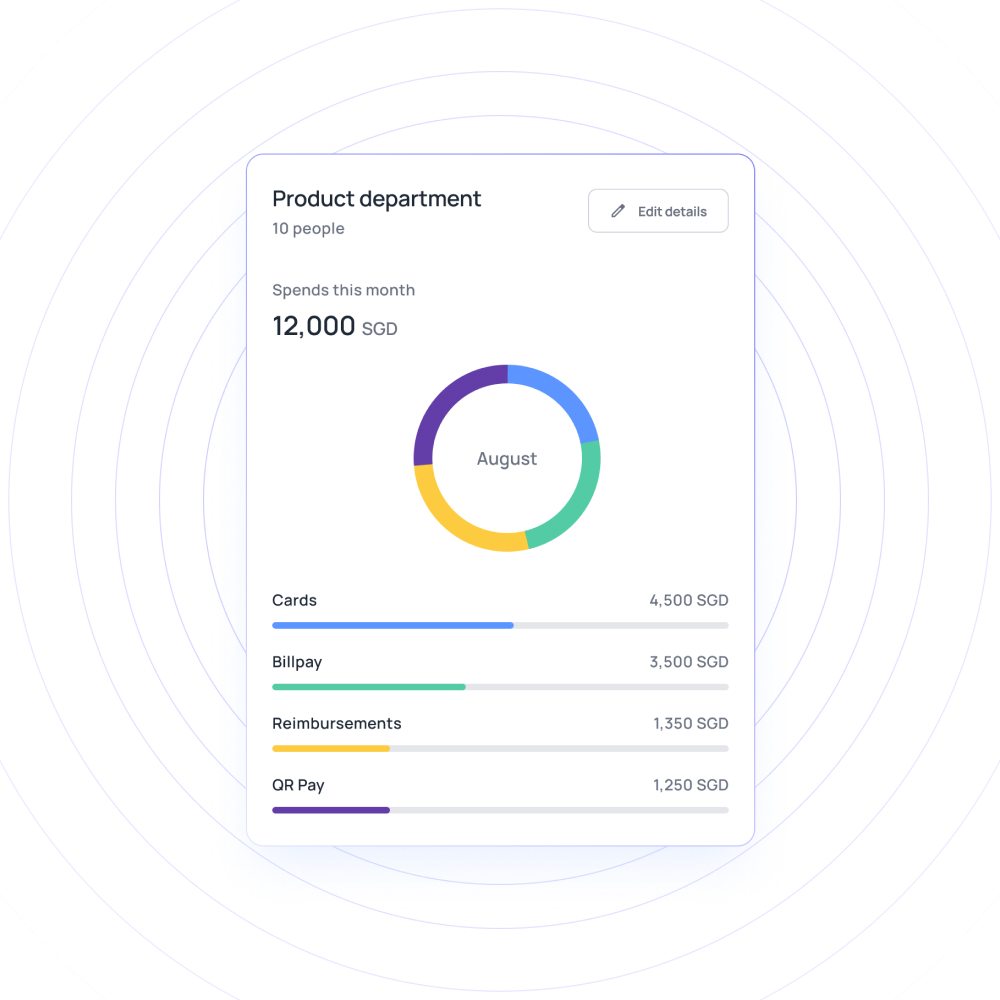

All expenses in one place for better control

Take charge of your fleet expenses using Volopay’s easy-to-use dashboard. Track spending on fleet related expenses by organizing them into clear categories for accurate reporting.

Monitor card activity in real time, identify any suspicious transactions, and leave notes for smooth tracking and approval processes.

Volopay goes beyond traditional prepaid fleet cards by linking every card to one intelligent dashboard. This centralized platform gives you full visibility and control over all fleet-related spending, making financial management simpler and more efficient.

Smooth payments for all fleet-related costs

Make fleet spending easier with corporate prepaid cards. Use them for everything from fuel and tolls to maintenance, ensuring smooth day-to-day operations. Setting up and activating cards is simple, and payments are processed quickly with full visibility for better control.

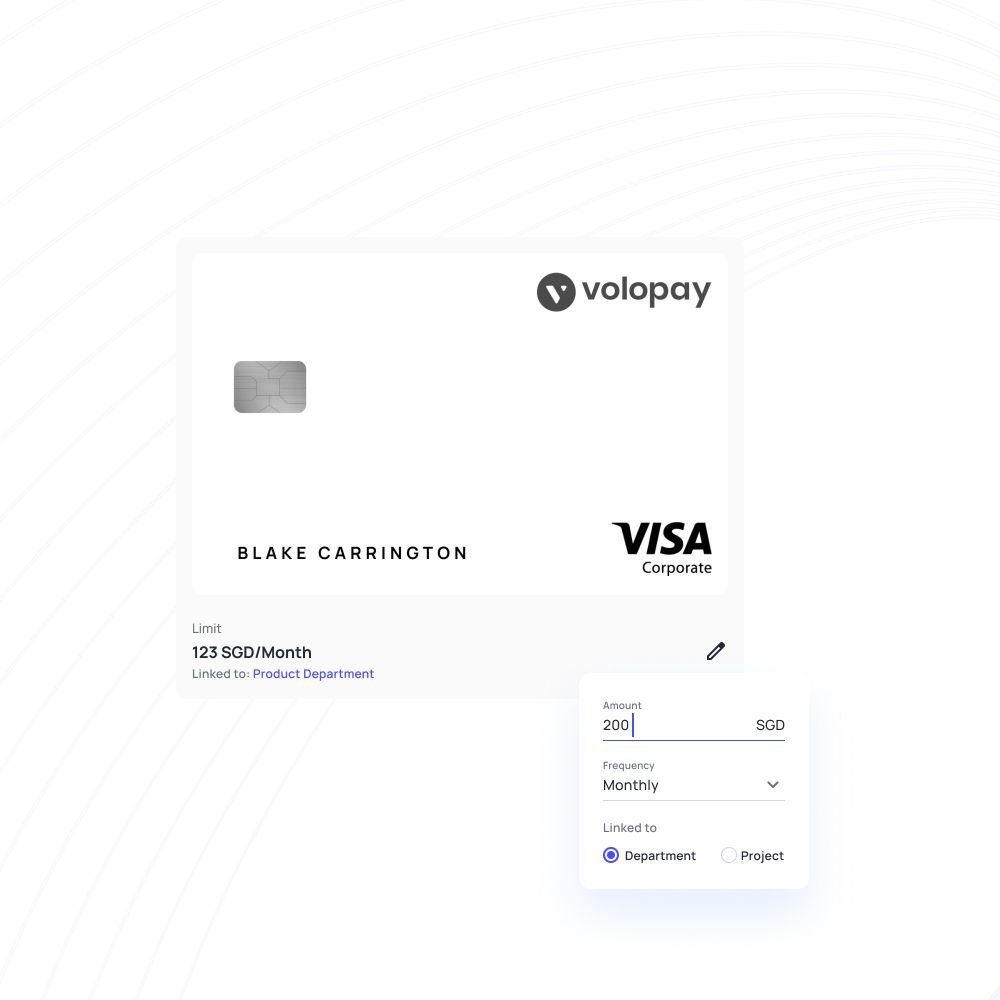

Use virtual or physical cards as needed

Easily create and customize physical cards for drivers and team members to handle everyday expenses such as fuel, tolls, repairs, and other travel-related costs.

For regular payments like fuel top-ups, vehicle maintenance, or accommodations, instantly generate virtual cards and avoid the delays of manual reimbursements.

Unlike conventional business fleet cards, these prepaid options provide stronger control and clearer oversight of every transaction linked to your fleet.

Prepaid cards for seamless fleet travel

Managing fleet related expenses is easier with Volopay’s prepaid cards. Whether it's fueling up or covering vehicle maintenance during trips, these cards are accepted worldwide, allowing for quick and convenient payments wherever your fleet operates.

Gain real-time insights into spending, avoid the wait for employee reimbursements, and keep tighter control over your costs. Compared to conventional business fleet cards, Volopay’s prepaid cards offer greater flexibility, clearer visibility, and a more intelligent way to manage your fleet expenses.

Easily track and manage fleet expenses

Take complete control of your fleet spending with corporate cards built for smarter financial management. With a smart dashboard that delivers detailed insights and analytics, you can make more informed decisions and improve operational efficiency, something traditional business fleet cards don’t offer.

Keep your expense records organized by sorting payments by project or department. This improves financial visibility and makes tracking fleet-related costs simpler and more accurate.

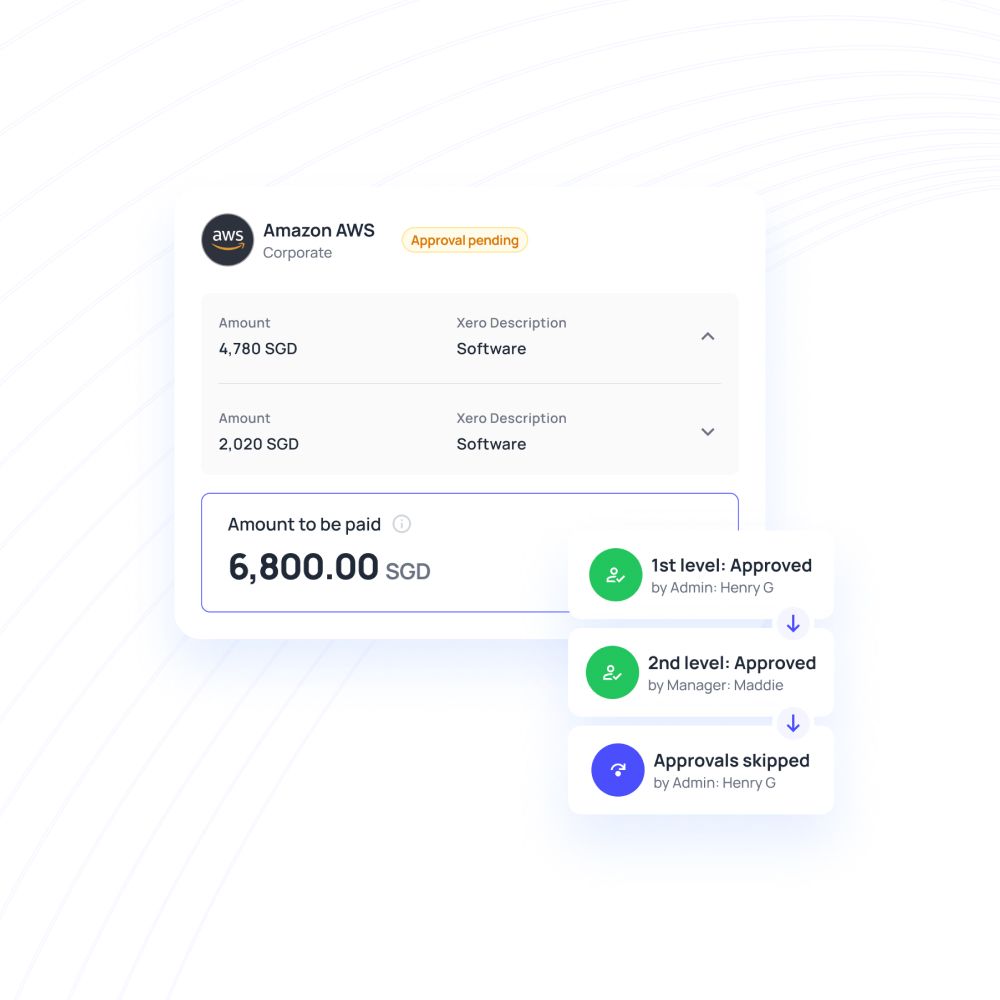

Multi-level approvals to to oversee spending

Take full control of your fleet expenses with a customizable and flexible approval system. Set up multi-level workflows based on specific rules to prevent unauthorized transactions and ensure all payments align with your company’s policies.

Easily manage card settings and include comments to improve transparency and accountability. Unlike conventional business fleet cards, prepaid cards offer enhanced visibility and greater control over every transaction, helping you manage spending more effectively.

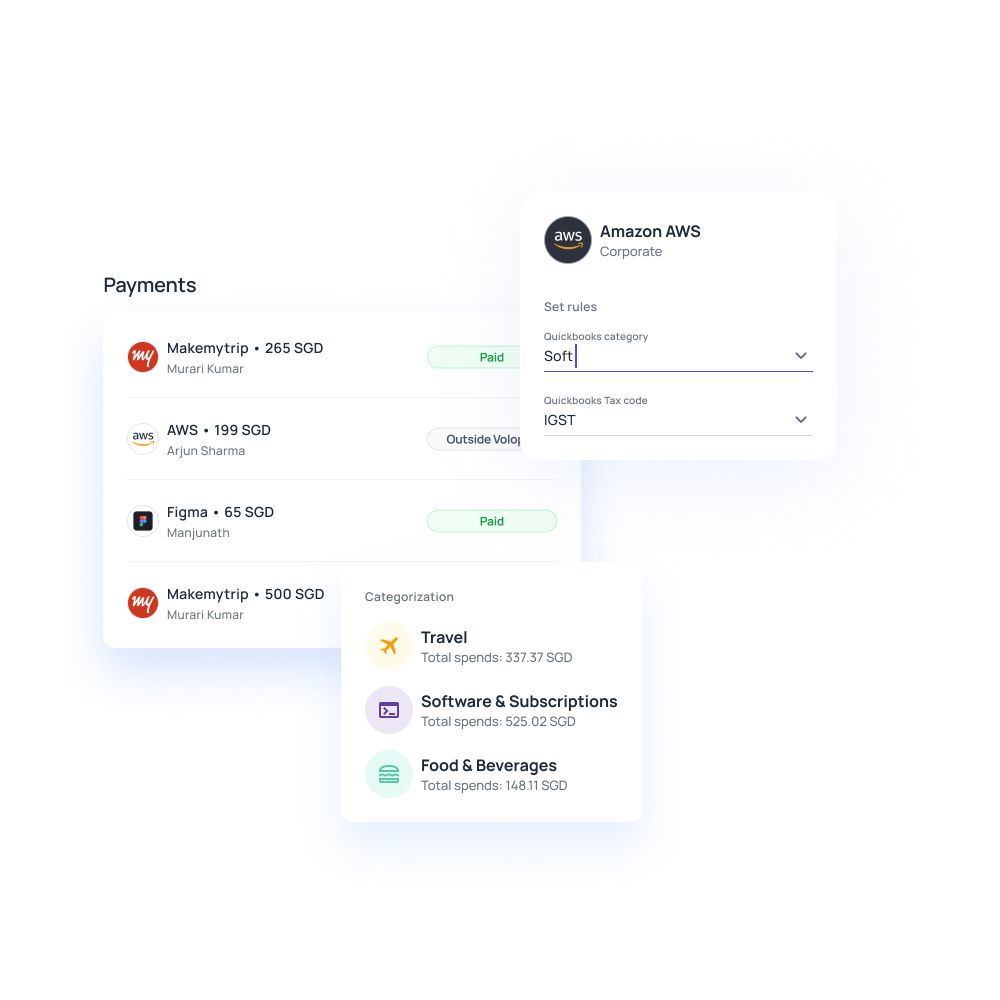

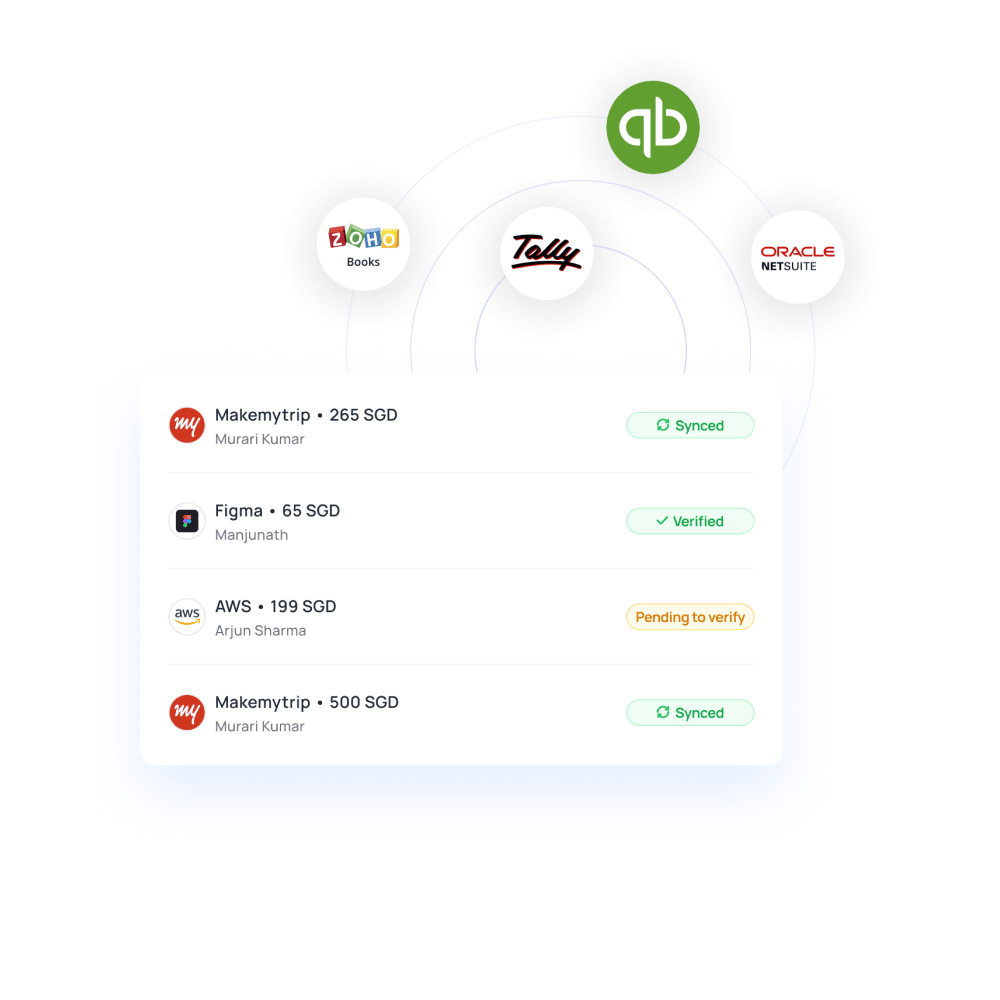

Instant synchronization of fleet costs

Simplify your accounting process by integrating fleet expenses directly with your financial system through smart corporate prepaid cards. Use automated rules to accurately categorize expenses and split transactions across different cost centers for easier reconciliation.

Prepaid cards offer real-time tracking and a fully integrated approach, delivering faster, more efficient financial management compared to traditional business fleet cards.

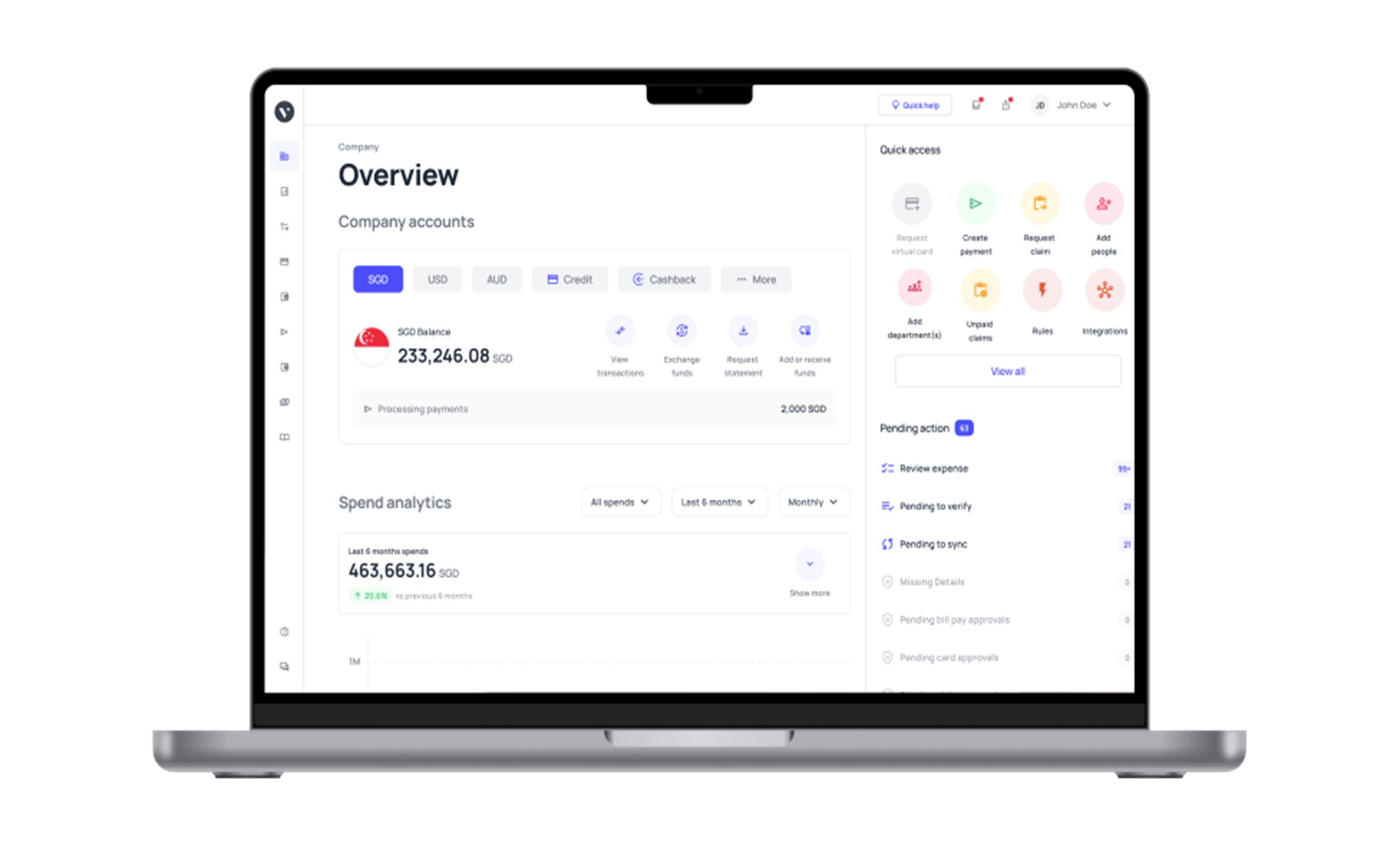

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Maximized fuel efficiency for your fleet

Improved card protection

With globally recognized ISO and PCI DSS certifications, your information stays safeguarded around the clock.

Each corporate card is equipped with top-tier security measures, ensuring transactions are secure. You can confidently manage fleet expenses while we protect your business payments.

Mobile expense tracking

Employees can easily handle their expense tasks right from a mobile app, whether it's uploading receipts, submitting reimbursement claims, or viewing card balances.

Built-in two-factor authentication keeps your financial data secure, while managers can review and approve spending from anywhere, anytime.

Individual cards for employee

Assign each employee their own card to automate routine payments and maintain tighter control over business finances.

This makes expense tracking easier and gives you a clearer view of spending with prepaid cards designed to match your company’s unique needs.

Transparent pricing

Forget about hidden charges. What you see is what you get, upfront pricing with no unexpected fees.

Smart controls and complete transparency mean you can confidently oversee fleet expenses without surprise costs. It’s simple, reliable, and designed for financial peace of mind.

Live spend tracking

Stay on top of employee spending with real-time updates that offer complete visibility and help you avoid unnecessary expenses across your fleet.

Manage fleet costs with advanced tracking tools, set limits, instantly review activity, and streamline payments to create a smoother financial workflow.

Dedicated customer support

Your business benefits from personalized assistance through a dedicated customer success manager who’s with you every step of the way.

With prepaid fleet cards, streamline expense handling, maintain budget control, and make confident decisions backed by expert support.

What types of fleet expenses can be handled using prepaid cards?

Control fuel spending more effectively with prepaid fuel cards. Automate your transactions at the pump, monitor usage in real time, and apply spending limits to maintain complete visibility and stay on budget.

Handle toll expenses smoothly by using prepaid cards at booths, cutting down on delays and eliminating cash handling. Keep toll costs aligned with budgets and skip the manual reimbursement process.

Use business fleet cards to cover costs related to vehicle upkeep, including servicing, repairs, and spare parts. Assign these expenses to specific vehicles for easier tracking and streamlined operations.

Prepaid fleet cards offer a convenient way to manage trip-related expenses like flights, ground transport, and travel incidentals. Maintain full control and real-time visibility over all travel spending.

Easily manage accomodation and food expenses for drivers during long-distance travel. Set daily limits, track every transaction instantly, and eliminate the need for out-of-pocket payments or reimbursements.

Prepaid fleet cards can be used to pay insurance premiums on time, helping you avoid lapses in coverage. Automate regular payments and ensure full compliance with both internal policies and legal standards.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Corporate cards

Equip your team with powerful corporate cards and advanced spend controls. Distribute company funds securely across departments, oversee operational costs, and manage business expenses effortlessly, anytime, from anywhere.

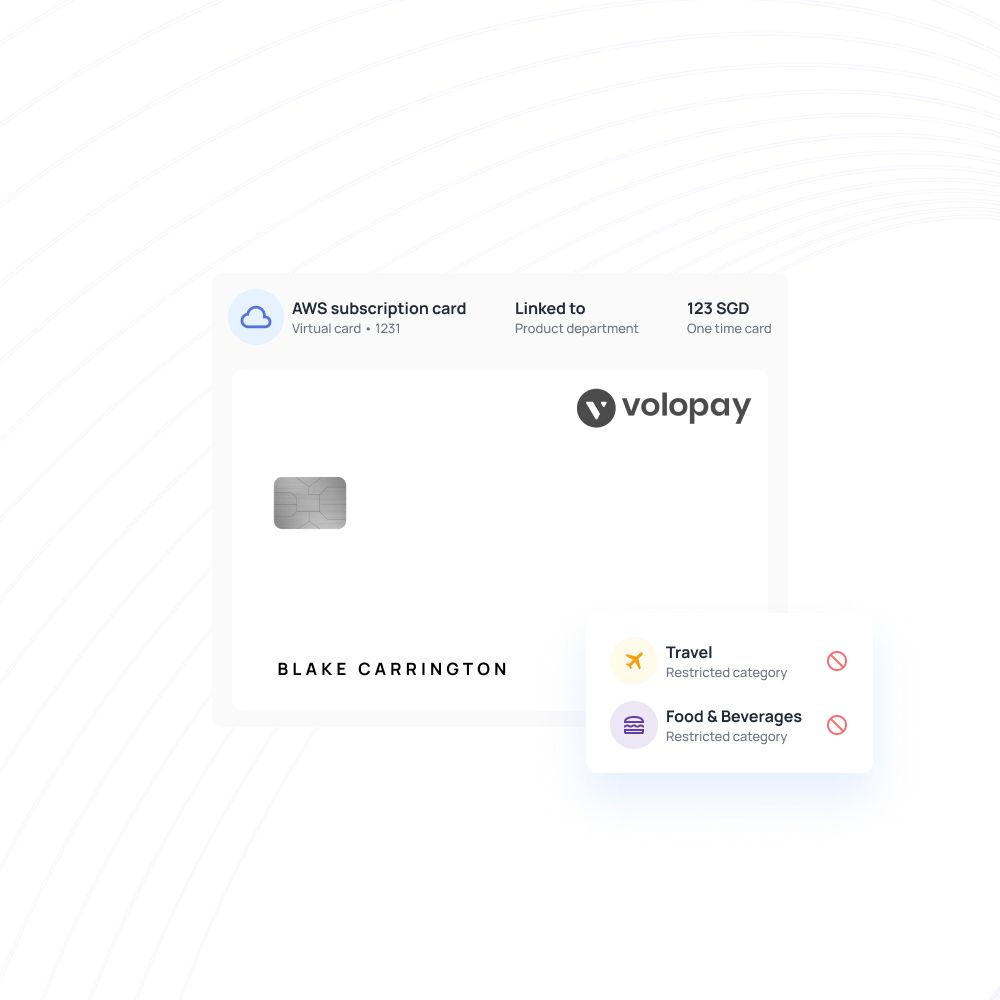

Virtual cards

Generate instant virtual corporate cards for one-time and recurring payments. Set up the recurring frequency and expiry dates to automate all your subscription payments.

Get the highest protection against fraud by allowing you to block or freeze your virtual cards to protect your funds against online threats.

Physical cards

Is using a single business credit card for all expenses creating a bottleneck situation for your company? Streamline your cash flow with a smarter spending option.

Entrust your team with sleek physical corporate cards for effortless payments. Set customized expense rules on every card per your policy and we’ll help you enforce them.

FAQs on business fleet cards

Yes, prepaid cards can be a flexible and effective alternative to traditional business fleet cards. They allow employees to cover a range of fleet-related expenses, while providing businesses with more visibility, greater control, and automated payment features for streamlined and efficient expense management.

Providing employees with prepaid fuel cards offers a secure and convenient method for covering fuel expenses during work-related travel. These cards allow businesses to track and manage fuel spending more efficiently, while also removing the burden of out-of-pocket payments for employees.

Yes, businesses can set spending limits and implement usage controls on prepaid fleet cards. These cards provide real-time tracking and can be tailored to permit only specific expense categories, such as fuel, tolls, or maintenance.

Prepaid cards enhance financial management for logistics companies by offering real-time expense tracking, spending controls, and automated payments. This reduces manual processes and promotes transparency, enabling more accurate budgeting and smoother financial operations across the fleet.

Yes, prepaid cards are widely accepted at fuel stations and toll booths, offering a convenient, cashless payment option. They also help businesses track fleet related expenses and manage fleet spending with greater efficiency.

Volopay prepaid cards ensure secure fleet spending through fraud protection, instant card freezing, and customizable spending controls. They also offer real-time tracking to help monitor and manage expenses effectively.

Yes, businesses can assign individual Volopay prepaid cards to each driver, simplifying the management of fuel, tolls, and travel expenses. With real-time tracking, spending controls, and improved oversight, these cards support more efficient fleet operations.

Yes, Volopay prepaid cards are fully compatible with accounting software. They enable automatic transaction syncing, minimizing manual work and enhancing accuracy. With customizable rules for expense categorization, they help streamline and simplify financial management.

Bring Volopay to your business

Get started now