What is a proforma invoice and how to create one?

Invoice payments and invoice management are crucial parts of the everyday operations of a business. Invoices are fundamental documents that businesses have to work with on a regular basis.

Knowing what an invoice is, what its types are and its uses are important knowledge to have for any business owner. Specifically, you need to understand and get a grip on the differences between an invoice and a proforma invoice.

While both have the word invoice in their nomenclature they are not, however, the same. They are issued at different times and both serve different purposes.

What is a proforma invoice?

The proforma invoice meaning essentially says that it is a pre-sale document that is issued by a supplier to a buyer as an agreement of “good faith”, as a guarantee of the future sale.

This document is issued before the sale so that the buyer knows what to expect. A proforma invoice is also commonly referred to as an estimated invoice or preliminary bill.

Typically, this document should include information such as the total amount payable, a brief description of goods or services supplied, and other important details pertaining to the transaction.

Keep in mind that a proforma invoice is not a legally binding document, you must not use it for accounting purposes or as a binding commitment.

Proforma invoice vs invoice: How are they different?

Generally speaking, a proforma invoice is a kind of quotation describing the goods to be sold that sellers provide to buyers to give them a guarantee of exactly what is being sold. This type of invoice acts as a kind of ‘dummy invoice’ that is intended to provide a good faith estimate of goods or services being sold to the buyer.

The buyer can use this document to determine whether or not they want to issue the purchase order. In a sense, a proforma invoice is the next step to a quotation and the step previous to the purchase agreement.

An invoice, on the other hand, is a formally binding document that a seller issues to a buyer with the intention of collecting payment for the sale of certain goods or services. Invoices are detailed documents that contain important information related to the goods or services being sold.

This includes a detailed description of the quality or quantity of goods or services being sold such as terms and conditions of sale, date of sale, price, and so on. The invoice is the next step to a purchase agreement and the step previous to the actual payment for the purchase.

What are the benefits of a proforma invoice for business?

1. Notifies estimations

A proforma invoice is a useful tool that sellers can use to notify their buyers of the price, quantity, and other relevant estimations related to the sale. It ensures buyers have all the relevant information they need before the sale is made.

2. Records purchases

Another benefit of using a proforma invoice is that it helps keep a record of the product purchases made by all the customers a buyer serves. It is a convenient way of keeping a record of all the sales made by the buyer in question.

3. Keeps room for changes

Given that a proforma invoice is not legally binding and is issued before a sale is completed it ensures that there is room for changes if there are any required.

For example, in cases of damaged goods delivered, change in customer requirements, or project scope the proforma invoice can be edited to accommodate the new requirements.

4. Helps with internal purchasing process

The internal purchasing processes of a client company can benefit a lot from a proforma invoice. In fact, internal purchasing processes typically require a proforma invoice to be issued so that records can be kept in order as the delivery comes in.

Key elements of a proforma invoice

Contact information

As the proforma invoice is for both parties, i.e., seller and consumer, the contact information of both sides is essential. Such as name, official email address, phone number, etc.

VAT

Value Added Tax causes alterations in the total amount. Hence, it is essential to mention the expected VAT amount clearly. It isn’t a mandatory thing, but it still helps to maintain transparency.

Shipping and billing information

The official address of the business center and the legitimate address of the consumer is important information in the invoice. Under the shipping address will be the business’s address, and under the billing address will be the consumer’s address.

Description of goods or services

As a proforma invoice is used to set clear terms of expectations between the parties, a brief description of the services or goods being sold has to be included in the invoice. This can include type, material, characteristics, etc.

Applicable terms or conditions

Once all the product-related information is mentioned, next comes the terms and conditions of the relationship. What kind of behavior and communication is expected from both sides is mentioned.

Payment terms and conditions

One of the most important pieces of information in the proforma invoice is writing down the payment terms and conditions. The total amount, payment channel, due date, if applied, then installment division, and payment cycle details.

Unit prices and total cost

Along with the product description, the quantity and price per unit should also be mentioned. A clear bifurcation and then the total cost.

Validity period

The date on which the proforma invoice was issued and the time till which it is valid.

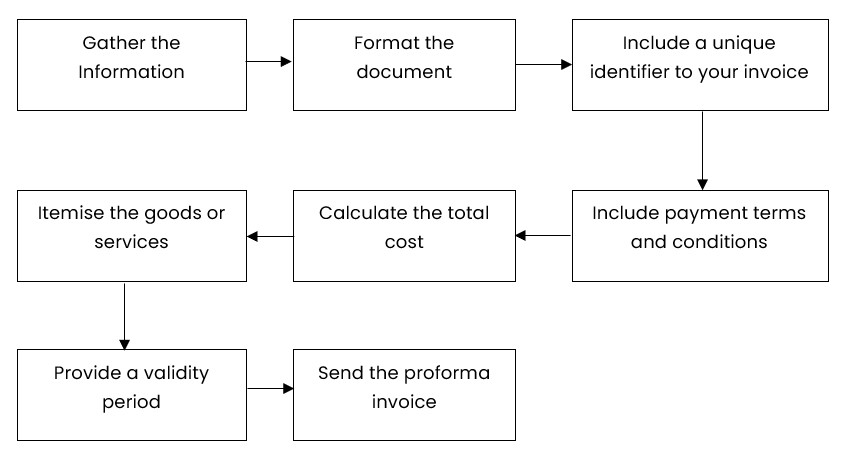

How to create a proforma invoice?

1. Determine costs

Determining costs of the products or services you are providing. The proforma invoice must include the costs of each item in proportion to its quantity. Everything that your customer is expected to pay should be clearly mentioned.

Along with the cost of the product, including expenses of transporting or shipping, taxes related to it, any custom fee, etc. The customer should know everything they are supposed to pay for. So be transparent and mention all costs and fees.

2. Start creating the proforma invoice

Once the costs of the items are finalized, next comes the creation of the proforma invoice. You can choose to design it as a regular invoice or create another format according to your company’s requirements.

However, the proforma invoice, similar to a normal invoice, must have the title “Proforma Invoice.” Then include all the above-mentioned details.

3. Invoice item list

A proforma invoice must be as detailed as possible. A section briefing the details about each item being sold should be added. This brief can include a description of the type and characteristics of the items.

Along with this, the country name and the code where the product is being manufactured in case you are exporting the product. Make sure to parallel it with individual costs and then the total amount according to the quantity.

4. Include agreement terms

Along with product and cost details, the proforma invoice also has all the agreement and payment terms and conditions. Details of the currency accepted as payment, payment channels, and other specifics of the deal are supposed to be clearly laid out in the proforma invoice.

When should you use a proforma invoice?

A proforma invoice is typically used to inform a buyer of all transaction details before making the sale. In some cases where an initial payment is made, such an invoice is issued to ensure that the payment process is guaranteed before the order is completed.

It is useful in cases that require repayment to guarantee the financial information of a sale process. The proforma invoice is also useful in cases where there is a high probability of the sale going through.

Providing the required transaction information beforehand and keeping the client informed of this invoice type improves the likeliness of a sale going through by reducing the chances of a cancellation happening.

Common mistakes to avoid when creating a proforma invoice

Inconsistent information

One of the biggest mistakes businesses make while preparing a proforma invoice is not being consistent with the format and information. Even though a proforma invoice is not the final invoice, it is still a pretty solid way to specify all the details about the purchase and the expectations held by both sides.

Omission of key details

Just because the proforma invoice is not the final one, professionals tend not to pay much attention to it. This created errors and mistakes in the invoice.

Many a time, there are omissions in payment details, invoice validity period, and terms and conditions. This does not present a good image of the business before the purchasing party. This can create miscommunication and stress in the relationship.

Inaccurate pricing

Another colossal mistake in a proforma invoice is calculation errors. You might mess up the total cost, add the wrong percentage of taxes, or end up calculating an incorrect percentage, etc.

Using OCR invoice processing can help automate data entry, reducing errors and enhancing the accuracy of information in your proforma invoices.

Hence, be extremely detail-focused and try to maintain precise accuracy when it comes to the numbers in the invoice.

Missing or incomplete documentation

Make sure always to double-check the documents related to the shipping and billing addresses, date of the invoices, due dates, and delivery dated. Everything on that invoice and all documents related to it must be precise and updated.

You do not want to face issues of the shipment going to the wrong address or any other delays in the process because of incomplete documentation.

Improper structure

Proforma invoice is an official document and must strictly follow a structure. Do not just generally put information and detail together in a document and calls it a proforma invoice.

According to the details and information that needs to be communicated, create a template and follow it every time. Improper structure again results in miscommunication and shows lousiness on the business’s part.

Seamlessly manage all your AP invoices in Singapore with Volopay

Volopay is a highly advanced expense management and accounts payable platform that can be used to automate your company’s entire AP process from start to finish.

The platform comes with invoice processing and management features that greatly reduce the amount of manual work required to ensure quicker and more accurate payments.

Volopay also acts as a vendor management platform that can help you get better insights into your company’s spending behavior on a vendor level.

Additionally, you can make seamless international payments, set up a recurring payment for repeat vendors, as well as schedule any future payments.

You can do all this from a unified dashboard that also gives you in-depth insights and analytics into how money is being spent and managed in your company.

Do hassle-free invoice management and manage vendors

FAQ's

No, since a proforma invoice is not essentially a legally binding document it does need to have any GST applied to it.

The proforma invoice does not include any information that is not directly related to the sale and does not use it for accounting purposes or as a binding agreement.

A commercial invoice is only required when you are shipping commodities internationally.