👋Session Alert! How the Top 1% Finance Leaders Think - 11th Feb. Register Now→

How to get a startup business loan in Singapore?

Starting a business in Singapore requires more than just a great idea it demands adequate funding to turn your vision into reality. While personal savings and bootstrapping can take you so far, many entrepreneurs eventually need external financing to scale their operations and achieve sustainable growth.

Securing the right funding solution can be the difference between a thriving business and one that struggles to survive its early stages. Understanding how to get a startup business loan and choosing the right financing partner will set your startup on the path to success.

What is a startup business loan?

A startup business loan is a financial product specifically designed to provide early-stage companies with the capital they need to launch, operate, and grow their business. Unlike traditional business loans that often require extensive trading history, startup business loans cater to newer companies with limited financial track records.

These loans can fund various business needs, from purchasing equipment and inventory to covering operational expenses and hiring staff. The key distinction lies in how lenders assess risk and eligibility, often focusing on business potential, founder experience, and market opportunity rather than purely historical financial performance.

How does a startup business loan work?

When you apply for a startup business loan, lenders evaluate your business plan, financial projections, and creditworthiness to determine your eligibility and loan terms.

The approval process typically involves submitting detailed documentation about your business, including incorporation papers, financial statements, and revenue forecasts.

Once approved, you receive a lump sum or access to a credit line that you can use according to the agreed terms.

Repayment usually occurs through fixed monthly installments over a predetermined period, though some lenders offer flexible repayment structures that align with your business's cash flow patterns.

Why startups opt for business loans in Singapore

Singapore's business environment presents numerous opportunities for startups, but success often requires strategic financial investments that exceed founders' initial capital.

1. Working capital needs

Every startup faces periods where expenses exceed immediate revenue, creating cash flow gaps that can threaten operations. Understanding startup business loan in Singapore and related options becomes crucial when you need to bridge these gaps while maintaining business continuity.

Working capital loans provide the breathing room necessary to manage inventory, pay suppliers, and maintain operations during slower periods.

2. Equipment or technology purchases

Modern businesses rely heavily on technology and specialized equipment to remain competitive. Whether you need computers, software licenses, manufacturing equipment, or office furniture, these upfront costs can strain your budget.

Equipment financing allows you to acquire essential assets without depleting your cash reserves.

3. Hiring and payroll support

Talent acquisition remains one of the biggest challenges for growing startups. When you identify key personnel who can accelerate your growth, you can't afford to wait until you have sufficient cash flow.

Payroll financing ensures you can attract and retain quality employees during critical growth phases.

4. Marketing and customer acquisition

Building brand awareness and acquiring customers requires consistent marketing investment. Digital advertising, content creation, trade shows, and promotional campaigns all demand upfront capital.

Understanding how to get a startup business loan for marketing purposes enables you to execute comprehensive strategies that drive revenue growth and market penetration.

5. Expansion or operational scaling

When your business reaches a tipping point where demand exceeds capacity, scaling becomes essential. This might involve opening new locations, expanding product lines, or increasing production capacity.

Expansion financing provides the resources needed to capitalize on growth opportunities without missing critical market windows.

Types of startup business loans in Singapore

Singapore offers diverse lending options tailored to different business needs and circumstances.

Startup business loans come in various forms, each designed to address specific funding requirements and business situations.

Bank term loans

Traditional banks offer term loans with fixed repayment schedules, typically ranging from one to five years. These loans usually provide competitive interest rates for established businesses but require strong credit profiles and collateral. The application process can be lengthy, often taking several weeks for approval.

SME working capital loans

Specifically designed for small and medium enterprises, these loans address short-term liquidity needs. They offer flexible repayment terms aligned with business cash flow cycles and often require minimal collateral. Interest rates vary based on business risk assessment and loan duration.

Invoice financing

This option allows you to convert outstanding invoices into immediate cash flow. Lenders advance a percentage of your invoice value, typically 70-90%, and collect payment directly from your customers.

It's particularly useful for businesses with long payment cycles or large outstanding receivables.

Business lines of credit

Unlike traditional loans, credit lines provide ongoing access to funds up to a predetermined limit. You only pay interest on the amount you actually use, making it cost-effective for managing variable expenses.

This flexibility makes it ideal for seasonal businesses or those with unpredictable cash flow patterns.

Startup grants

Government agencies and private organizations offer non-repayable grants to support innovation and entrepreneurship. While competitive, these grants provide valuable funding without debt obligations.

They often come with specific eligibility criteria and reporting requirements that complement traditional startup business loans.

Microloans

Smaller loan amounts, typically under $50,000, are designed for businesses with modest funding needs.

These loans often have relaxed eligibility requirements and faster approval processes. Interest rates may be higher than traditional loans, but they provide accessible financing for micro-businesses.

Trade financing

Essential for businesses involved in import/export activities, trade financing covers the gap between payment and delivery. Options include letters of credit, documentary collections, and trade credit insurance. These products facilitate international commerce while managing payment risks.

Venture debt financing

A hybrid option that combines debt and equity features, often used alongside venture capital funding.

It provides additional capital without diluting ownership as much as pure equity financing. However, it typically includes warrants or conversion features that may affect future ownership structure.

Merchant cash advance

Provides immediate cash in exchange for a percentage of future sales. Repayment occurs through daily credit card sales deductions, making it suitable for businesses with consistent card transactions. While convenient, it can be expensive and may impact cash flow significantly.

Collateral vs. unsecured loans: Which suits your business?

Choosing between secured and unsecured financing options significantly impacts your business's financial flexibility and risk exposure.

1. Meaning

Collateral loans require you to pledge specific assets as security against the loan amount. These assets can include real estate, equipment, inventory, or other valuable business property.

If you default on repayment, the lender has the legal right to seize and sell these assets to recover their money.

Unsecured loans don't require any collateral, relying instead on your creditworthiness, business performance, and personal guarantees. Lenders assess your ability to repay based on cash flow, credit history, and business projections rather than physical assets.

2. Approval process

Collateral loans typically involve extensive asset valuation and legal documentation, making the approval process longer and more complex.

Lenders must verify asset ownership, conduct appraisals, and complete legal formalities before approval. This thorough process can take several weeks or months.

Unsecured loans generally have streamlined approval processes since there's no asset evaluation required. However, lenders conduct more rigorous credit checks and financial analysis to compensate for the higher risk. Many fintech lenders can process unsecured applications within days or hours.

3. Risk exposure

Collateral loans present a significant risk to your business assets. If you encounter financial difficulties and cannot meet repayment obligations, you risk losing the pledged assets, which could severely impact your operations.

This risk is particularly concerning for assets essential to your business operations when exploring how to get a startup business loan in Singapore.

Unsecured loans limit your risk exposure to the loan amount and associated penalties. While defaulting can damage your credit score and result in legal action, you won't lose specific business assets. However, personal guarantees may still put your personal assets at risk.

4. Flexibility and usage

Collateral loans often provide larger loan amounts and longer repayment terms due to reduced lender risk. The presence of security allows for more flexible terms and potentially lower interest rates.

However, the pledged assets remain encumbered until full repayment, limiting your ability to use or sell them.

Unsecured loans offer greater operational flexibility since no assets are tied up as collateral. You maintain full control over your business assets and can use them as needed for operations or future financing. However, loan amounts may be smaller, and terms might be more restrictive.

5. Impact on credit score

Collateral loans can positively impact your credit score when managed properly, as they demonstrate your ability to handle secured debt responsibly.

The presence of collateral may also help you qualify for better terms despite a lower credit score.

Unsecured loans rely heavily on your existing credit profile for approval and terms. Successfully managing unsecured debt can significantly improve your credit score, but the initial qualification requirements are typically stricter. Late payments or defaults have more immediate impact on your credit rating.

Understanding interest rates and loan costs

1. What is the effective interest rate (EIR)?

The Effective Interest Rate represents the true cost of borrowing by incorporating all fees, charges, and compounding effects into a single percentage. Unlike nominal rates that only show the basic interest charge, EIR provides a comprehensive view of what you'll actually pay over the loan term.

This calculation includes processing fees, administrative charges, and the compounding frequency, giving you a realistic comparison tool when evaluating different loan options. Always request the EIR when comparing offers from multiple lenders.

2. Common fees to account for

Processing fees typically range from 1–3% of the loan amount and cover administrative costs associated with application review and approval. Administrative charges may include documentation fees, legal costs, and account maintenance fees that add to your total borrowing cost.

Late payment penalties can significantly increase your loan cost if you miss repayment deadlines. These penalties often compound, creating a spiral of increasing debt that can severely impact your business cash flow and financial stability.

3. Hidden costs startups often miss

Prepayment penalties can catch borrowers off guard when they want to pay off loans early. Some lenders charge these fees to compensate for lost interest income, potentially negating the benefits of early repayment.

Annual charges and platform fees for digital lending services can accumulate over time, especially for longer-term loans. Integration fees for connecting loan accounts with your business systems may also apply, adding to your overall financing costs.

4. Fixed vs. floating rates: What's right for you?

Fixed rates provide predictable monthly payments throughout the loan term, making budgeting easier and protecting you from interest rate increases. This stability is particularly valuable for businesses with tight cash flow margins or those in volatile industries.

Floating rates can offer lower initial costs and potential savings if interest rates decline. However, they expose you to payment increases if rates rise, which can strain your cash flow. Consider your risk tolerance and cash flow stability when choosing between these options.

Startup loans vs. equity funding: What to choose?

The choice between debt and equity financing fundamentally shapes your business's future structure, control, and growth trajectory.

Understanding how to get a startup business loan versus equity funding helps you make informed decisions about your business's financial future.

Definition and structure of startup loans vs. equity funding

● Startup loans

Startup business loans require regular repayment with interest, maintaining your full ownership while creating debt obligations.

You retain complete control over business decisions and operations, but must service debt regardless of business performance. This structure works well for businesses with predictable cash flows and established revenue streams.

● Equity funding

Equity funding involves selling ownership stakes to investors in exchange for capital. Investors become partial owners with rights to future profits and potentially business decisions.

While this eliminates repayment obligations, it permanently dilutes your ownership percentage and may limit your control over strategic decisions.

Ownership and control: What do you give up?

● Startup loans

Loans preserve your complete ownership and decision-making authority. You maintain full control over business strategy, operations, and future direction without needing investor approval for major decisions. This autonomy allows you to execute your vision without external interference or conflicting interests.

● Equity funding

Equity funding requires sharing ownership and potentially control with investors. Depending on the investment terms, you may need investor approval for significant decisions, strategic changes, or additional funding rounds. This shared control can provide valuable expertise but may also create conflicts over business direction.

Financial risk and repayment obligations

● Startup loans

Debt financing creates fixed repayment obligations that must be met regardless of business performance. This predictable cost structure allows for better financial planning but can strain cash flow during difficult periods. Personal guarantees may put your personal assets at risk if the business fails.

● Equity funding

Equity investors share both the risk and potential rewards of your business success. They don't require repayment if the business struggles, but they also expect proportional returns if it succeeds. This shared risk model can provide financial relief during challenging times while aligning investor interests with business success.

Time to funding and approval process

● Startup loans

Learning how to get a startup business loan in Singapore typically involves faster approval processes than equity funding. Many lenders can provide decisions within days or weeks, making debt financing ideal for urgent capital needs. The documentation requirements are usually standardized and predictable.

● Equity funding

Equity funding often requires extensive due diligence, investor meetings, and negotiation periods that can extend for months. The process involves pitching to multiple investors, legal documentation, and valuation discussions. While potentially more rewarding, equity funding requires significant time investment and may not suit immediate funding needs.

Suitability based on business stage

● Startup loans

Early-stage startups with limited revenue may find loans challenging to obtain without strong personal guarantees or collateral. However, businesses with proven revenue streams and growth potential can leverage startup business loans to accelerate growth while maintaining ownership control.

● Equity funding

Equity funding suits businesses with high growth potential but limited current cash flow. Investors provide not just capital but also expertise, networks, and strategic guidance that can accelerate business development. This option works particularly well for technology startups and scalable business models.

Impact on future fundraising and valuation

● Startup loans

Debt financing doesn't dilute your ownership or affect your company's valuation for future investment rounds. However, high debt levels can impact your debt-to-equity ratio and potentially concern future investors about financial stability and cash flow allocation.

● Equity funding

Equity funding sets valuation benchmarks that influence future investment rounds. Early equity dilution can become expensive if your business value increases significantly. However, successful equity rounds can validate your business model and attract additional investors more easily.

Which option is right for you?

● Startup loans

Consider debt financing if you have steady cash flow, want to maintain full control, and can service regular payments. This option suits businesses with predictable revenue and growth plans that don't require massive capital injections.

● Equity funding

Choose equity funding if you need substantial capital, lack sufficient cash flow for debt service, or want strategic investors who can provide expertise and networks. This option works best for high-growth businesses with scalable models and significant market opportunities.

Eligibility requirements for startup business loans

Understanding eligibility criteria helps you assess your readiness and choose appropriate lenders for your situation.

Different ways of how to get a startup business loan in Singapore have varying requirements that you should understand before applying.

Minimum business age and incorporation status

Most traditional lenders require businesses to be operational for at least six months to two years, though some fintech lenders accept newer businesses. Your company must be properly incorporated and registered with the relevant authorities.

Different loan types have varying age requirements. While some specialized startup loans accept very new businesses, others may require established trading history. Research specific lender requirements to find suitable options for your business age.

Revenue and turnover requirements

Lenders typically require minimum monthly or annual revenue thresholds, often ranging from $5,000 to $50,000 per month, depending on the loan amount and lender. These requirements help ensure you have sufficient cash flow to support repayment.

Revenue consistency is often more important than absolute amounts. Lenders prefer businesses with steady, predictable income streams over those with volatile or declining revenues. Bank statements and sales records provide evidence of revenue stability.

Shareholding structure

Many lenders require a majority local ownership or at least one local director for Singapore-based businesses. This requirement ensures compliance with local regulations and provides lenders with recourse in case of default.

Complex shareholding structures may complicate the application process and require additional documentation. Simple, clear ownership structures with transparent beneficial ownership are preferred by most lenders.

Local director or guarantor needs

Most lenders require at least one director to be a Singapore citizen or permanent resident. This person often serves as a personal guarantor, accepting responsibility for loan repayment if the business defaults.

Personal guarantees from directors or major shareholders are common requirements, especially for unsecured loans. Understanding these obligations and their implications is crucial before committing to any loan agreement.

Credit score or financial history

Both business and personal credit scores influence loan approval and terms. Most lenders require minimum credit scores, though specific requirements vary by lender and loan type. Some alternative lenders focus more on business performance than credit scores.

Limited credit history doesn't automatically disqualify you, but it may result in higher interest rates or stricter terms. Building good credit relationships and maintaining proper financial records improves your position for future financing needs.

Your pre-application checklist for startup business loans

Thorough preparation significantly improves your chances of loan approval and helps you secure better terms.

Understanding startup business loan in Singapore and its requirements ensures you're ready for the application process.

1. Do you have a registered and operational business?

Your business must be legally incorporated and actively operating to qualify for most loan programs. This means having proper registration with ACRA, obtaining necessary licenses, and demonstrating actual business activities through transactions and operations.

Lenders verify your business's legitimacy through official documentation and may require proof of ongoing operations. Having a registered business address, active business accounts, and evidence of commercial activities strengthens your application and builds lender confidence.

2. Is your business plan investor-ready?

A comprehensive business plan demonstrates your understanding of the market, competition, and growth strategy. It should include detailed financial projections, market analysis, and clear explanations of how loan funds will be used to generate returns.

Your business plan should address potential risks and mitigation strategies, showing lenders that you've thoughtfully considered challenges and have contingency plans. This document serves as your primary tool for communicating your vision and convincing lenders of your business's viability.

3. Are your financial statements in order?

Accurate, up-to-date financial statements provide lenders with essential information about your business's financial health and performance. This includes profit and loss statements, balance sheets, and cash flow statements prepared according to proper accounting standards.

Even new businesses should maintain proper financial records from inception. Bank statements, transaction records, and preliminary financial projections help lenders assess your financial management capabilities and business potential.

4. Do you know how much you need and why?

Determine the exact loan amount required based on specific business needs and detailed cost calculations. Avoid requesting arbitrary amounts or significantly over-borrowing, as this can raise concerns about your financial planning abilities.

Clearly articulate how loan funds will be used and how this investment will generate returns to support repayment. Lenders appreciate specific, well-justified funding requests that demonstrate thoughtful planning and realistic expectations when evaluating how to get a startup business loan.

5. Have you checked your credit profile?

Both personal and business credit scores significantly impact loan approval and terms. Review your credit reports for errors and address any issues before applying. A strong credit profile can result in better interest rates and more favorable loan terms.

If your credit score needs improvement, consider delaying your loan application while you work on building better credit. Small improvements in credit scores can result in significant savings over the loan term.

6. Can you service the loan?

Honestly assess your ability to meet monthly repayment obligations based on current and projected cash flow. Consider seasonal fluctuations, market uncertainties, and potential business challenges that could affect your repayment capacity.

Lenders evaluate your debt-service coverage ratio and may require personal guarantees if business cash flow appears insufficient. Demonstrating strong repayment capacity through realistic projections and conservative assumptions improves your approval chances.

7. Do you have all required documents ready?

Gather all necessary documentation before starting the application process to avoid delays and demonstrate your preparedness. This includes business registration documents, financial statements, tax filings, and director identification documents.

Having complete documentation ready shows lenders that you're organized and serious about the application. Missing or incomplete documents can significantly delay the approval process and may negatively impact the lender's perception of your business management capabilities.

Key documents required for a loan application

Proper documentation streamlines the application process and demonstrates your business's legitimacy and financial stability.

1. ACRA business profile

Your ACRA business profile provides essential information about your company's legal structure, directors, and shareholding. This document must be current and accurately reflect your business's current status and ownership structure.

Lenders use this information to verify your business's legitimacy and assess the people behind the company. Any discrepancies between your application and ACRA records can delay approval or result in rejection.

2. Financial statements or bank statements

Recent bank statements, typically covering the last 3–6 months, show your business's cash flow patterns and financial activity. These documents provide lenders with insights into your revenue consistency, expense patterns, and overall financial management.

If available, audited financial statements carry more weight than bank statements alone. However, many startups may only have bank statements and basic accounting records, which are acceptable for most lenders.

3. Director/guarantor ID proof

Valid identification documents for all directors and guarantors are required to verify identities and enable credit checks. This typically includes NRICs for locals and passports for foreigners, along with proof of address.

Lenders may also require additional documentation for foreign directors, such as employment passes or other legal status documents. Ensuring all directors have proper documentation prevents application delays.

4. Business plan and cash flow projections

A detailed business plan explaining your business model, market opportunity, and growth strategy helps lenders understand your business potential. Financial projections should be realistic and based on sound assumptions.

Cash flow projections are particularly important as they demonstrate your ability to service debt. These projections should account for seasonal variations, market uncertainties, and the impact of loan repayments on your cash flow.

5. GST filings and NOA (notice of assessment)

If your business is GST-registered, recent GST filings provide additional verification of your revenue and business activity. These documents help lenders assess your business's scale and legitimacy.

Personal and business tax assessments, where applicable, provide additional income verification and demonstrate compliance with tax obligations. These documents strengthen your application by showing responsible financial management.

How to strengthen your loan application

Strategic preparation can significantly improve your chances of approval and help you secure better loan terms.

Build a solid business plan

A comprehensive business plan demonstrates your understanding of the market, competition, and growth opportunities. Include detailed market research, competitive analysis, and realistic financial projections that show how you'll achieve profitability and growth.

Your business plan should clearly explain how loan funds will be used and how this investment will generate returns. Lenders want to see that you've thoughtfully considered your business strategy and have realistic expectations about growth and challenges.

Improve your credit score

Both personal and business credit scores significantly impact loan approval and terms. Focus on paying bills on time, reducing outstanding debt, and correcting any errors on your credit reports.

Building business credit through supplier relationships, business credit cards, and trade credit helps establish your company's creditworthiness independently of your personal credit. This separation becomes increasingly important as your business grows.

Show steady cash flow or revenue growth

Consistent revenue growth and positive cash flow trends demonstrate business viability and repayment capacity. Even modest but steady growth is preferable to volatile or declining revenue patterns.

Document your revenue sources and growth drivers clearly. Multiple revenue streams and diversified customer bases reduce risk in lenders' eyes and improve your chances of approval.

Limit outstanding debt

High debt levels can strain your cash flow and concern lenders about your ability to take on additional debt. Focus on paying down existing debt before applying for new loans.

Calculate your debt-to-income ratio and ensure it falls within acceptable ranges for your industry. Lower debt levels not only improve approval chances but also result in better interest rates and terms.

Be transparent about risks and projections

Honesty about potential challenges and realistic projections build trust with lenders. Acknowledge market risks, competitive threats, and potential obstacles while explaining how you'll address them.

Overly optimistic projections can backfire if they appear unrealistic. Conservative estimates that you can exceed are better than aggressive projections that may seem unrealistic to experienced lenders.

How to apply for a startup business loan in Singapore

Research your options

The application process requires careful preparation and a strategic approach to maximize your chances of success. Understanding how to get a startup business loan involves following proper procedures and presenting your business professionally.

Before applying, research different lenders and loan products to find the best fit for your needs. Compare interest rates, terms, eligibility requirements, and application processes across multiple options.

Consider both traditional banks and alternative lenders, including fintech companies that may offer more flexible terms for startups. Each lender has different strengths and specializations that may suit your specific situation.

Prepare required documents

Gather all necessary documentation before starting any applications. Having complete, accurate documentation ready speeds up the process and demonstrates your professionalism to lenders.

Organize documents clearly and ensure they're current and accurate. Many lenders provide document checklists that can help you prepare thoroughly before beginning the application process.

Use bank portals or fintech platforms

Most lenders offer online application portals that streamline the process and provide real-time status updates. These platforms often include document upload capabilities and automated preliminary assessments.

Fintech platforms may offer faster processing times and more user-friendly interfaces than traditional bank applications. However, ensure you understand the terms and conditions before submitting applications through any platform.

Submit your application

Complete applications accurately and thoroughly, double-checking all information before submission. Incomplete or inaccurate applications can result in delays or rejection.

Submit applications to multiple lenders if appropriate, but be mindful that multiple credit inquiries can impact your credit score. Space out applications strategically to minimize credit impact while maximizing your options.

Follow up and await approval

Stay in regular contact with lenders throughout the approval process. Respond promptly to requests for additional information or documentation to avoid delays.

Use the waiting period to continue improving your business position. Strong performance during the approval process can strengthen your application and may result in better terms.

Loan approval timeline and what to expect

Understanding typical timelines helps you plan your funding strategy and set realistic expectations.

Application processing time (banks vs. fintechs)

Traditional banks typically require 2–6 weeks for loan approval, depending on the complexity of your application and internal processes. This timeline includes document verification, credit checks, and committee approvals.

Fintech lenders often provide much faster processing, with some offering approvals within 24–48 hours. However, faster approval doesn't always mean better terms, so consider both speed and overall value when choosing lenders.

Preliminary vs. final approval

Preliminary approvals indicate likely approval, subject to final verification and documentation. This stage gives you confidence to proceed with business plans, but doesn't guarantee final approval.

Final approval occurs after complete documentation review and verification. This stage may involve additional conditions or requirements that must be met before fund disbursement.

Loan disbursement process

Once approved, funds are typically disbursed within 1–5 business days, depending on the lender and disbursement method. Some lenders offer same-day disbursement for urgent needs.

Disbursement may be subject to additional conditions, such as insurance requirements or specific account setups.

Understanding these requirements beforehand prevents delays when you need funds most urgently.

Common causes for delays

Incomplete documentation is the most common cause of application delays. Missing signatures, outdated documents, or insufficient financial information can significantly extend processing times.

Credit issues, complex business structures, or unusual business models may require additional review time. Being proactive about addressing potential concerns can help minimize delays.

How to choose the right business loan for your startup

Selecting the appropriate loan product requires careful consideration of your business needs, financial situation, and growth plans. The right startup business loans choices depend on multiple factors specific to your situation.

Comparing loan amounts and interest rates

Evaluate loan amounts relative to your actual needs, avoiding both under-borrowing and over-borrowing. Consider the total cost of borrowing, including all fees and charges, rather than just the stated interest rate.

Compare effective interest rates across different lenders to understand the true cost of each option. Remember that the lowest rate isn't always the best choice if it comes with restrictive terms or hidden fees.

Evaluating flexibility in repayment

Consider repayment schedules that align with your business cash flow patterns. Some lenders offer seasonal payment adjustments or flexible schedules that can help manage cash flow challenges.

Look for options that allow early repayment without significant penalties if your business performs better than expected. This flexibility can save significant interest costs over the loan term.

Considering the reputation of lender

Research lender reputation through online reviews, industry publications, and recommendations from other business owners. A lender's track record for customer service and fair dealing is crucial for long-term relationships.

Consider the lender's understanding of your industry and their experience working with similar businesses. Industry-specialized lenders may offer better terms and more flexible approaches to underwriting.

Aligning loan terms with your growth stage

Match loan terms to your business's growth stage and future plans. Short-term loans may suit immediate needs, while longer-term financing might be better for major investments or expansion plans.

Consider how loan terms will affect your future financing options. Some loan covenants may restrict additional borrowing or require lender consent for major business changes.

Common mistakes to avoid when applying for a loan

Avoiding these common pitfalls can improve your chances of approval and help you secure better terms.

Submitting incomplete documentation

Missing or incomplete documentation is the most frequent cause of application delays and rejections. Create a comprehensive checklist and verify that all documents are current, accurate, and properly formatted.

Double-check that all required signatures and attestations are included. Many applications are delayed simply because forms weren't properly completed or signed by authorized individuals.

Underestimating required loan amount

Borrowing too little can leave you short of funds when you need them most, forcing you to seek additional financing at potentially higher costs. Calculate your needs conservatively and include a buffer for unexpected expenses.

Consider all costs associated with your plans, including working capital needs during implementation. It's often better to borrow slightly more than needed rather than face cash flow shortages later.

Ignoring terms and fine print

Loan agreements contain important terms and conditions that affect your obligations and rights. Pay particular attention to default provisions, prepayment penalties, and any covenants that might restrict your business operations.

Understand all fees and charges, including those that may apply during the loan term. Some fees only become apparent after you've used the loan facility, creating unexpected costs.

Choosing the wrong type of loan

Different loan products serve different purposes and business stages. A line of credit might be better than a term loan for working capital needs, while equipment financing might be more appropriate for asset purchases. Understanding startup business loan in Singapore and their options helps you match products to your specific needs.

Consider your business's specific needs and cash flow patterns when selecting loan types. How to get a startup business loan isn't just about approval it's about choosing the right structure for your business's success.

When should you not take a startup loan?

Understanding when debt financing isn't appropriate can save you from financial difficulties and help you consider alternative funding options.

1. If your business model isn't proven yet

Taking on debt before validating your business model creates significant risk. If your concept doesn't work as expected, you'll still have repayment obligations regardless of business performance.

Focus on proving your concept through bootstrap funding, grants, or equity investment before committing to debt service. Once you've demonstrated market demand and revenue potential, debt financing becomes more appropriate.

2. If your debt-service ratio is too high

If loan payments consume too large a portion of your cash flow, you risk creating financial strain that could threaten your business's survival. Most experts recommend keeping debt service below 25–30% of gross revenue.

High debt-service ratios leave little room for unexpected expenses or revenue fluctuations. Consider smaller loan amounts or improving your cash flow before taking on additional debt obligations.

3. If you're relying on loans for ongoing losses

Using debt to cover operational losses rather than growth investments creates a dangerous cycle. If your business isn't generating positive cash flow, additional debt will only worsen your financial position.

Focus on achieving profitability or positive cash flow before seeking debt financing. Loans should fund growth opportunities, not subsidize unprofitable operations.

4. When alternative funding (grants, equity) is a better fit

Government grants and equity funding might be more appropriate for certain business stages or industries. These options don't create repayment obligations and may provide additional benefits beyond just funding.

Research available grants and equity opportunities before committing to debt financing. When researching how to get a startup business loan in Singapore, options should be compared against all available alternatives to ensure you're choosing the best fit for your situation.

How to manage your loan responsibly after approval

Proper loan management protects your credit rating and positions you for future financing opportunities.

Setting up a repayment calendar

Create a detailed repayment schedule that aligns with your business cash flow patterns. Mark payment dates prominently in your business calendar and plan cash flow around these obligations.

Consider seasonal variations in your business and plan accordingly. Setting aside funds during stronger periods can help ensure payments during slower times.

Automating EMI deductions

Set up automatic payments to ensure you never miss due dates. This protects your credit rating and eliminates the risk of late payment penalties that can significantly increase your borrowing costs.

Maintain sufficient buffer funds in your designated account to cover automatic payments. Monitor your account regularly to ensure adequate funds are available for deductions.

Monitoring business cash flow

Regular cash flow monitoring helps you identify potential payment difficulties early. Use accounting software or financial management tools to track income, expenses, and cash flow trends.

Create cash flow projections that include loan payments and monitor actual performance against projections. This early warning system helps you address issues before they become critical.

Planning for prepayment if revenue improves

If your business performs better than expected, consider prepaying loans to reduce interest costs. However, check for prepayment penalties and ensure you maintain adequate working capital.

Prepayment can free up cash flow for other investments and improve your debt-to-equity ratio. This improvement in financial position can help you qualify for better terms on future financing.

How Singapore's business loan landscape is evolving

Singapore's lending environment is rapidly transforming, creating new opportunities and challenges for startup funding.

1. Traditional lending is no longer the default for startups

Traditional banks maintain rigid approval criteria that often exclude early-stage businesses without extensive collateral or trading history. Their conservative approach and lengthy approval processes don't align with the fast-paced nature of startup funding needs.

Many banks require personal guarantees, substantial down payments, and extensive documentation that new businesses simply cannot provide. This traditional approach has created a significant gap in the market for startup-friendly financing solutions.

2. Fintech platforms offer speed, flexibility, and fairer access

Digital lenders have revolutionized the lending landscape by offering rapid approval processes and more flexible qualification criteria. These platforms can process applications within hours rather than weeks, providing the agility that startups require.

Many fintech lenders focus on business potential and cash flow rather than historical performance, making them more accessible to newer businesses. This approach democratizes access to funding and supports innovation in Singapore's startup ecosystem.

3. Data-driven lending is replacing old-school credit checks

Modern lenders increasingly rely on real-time business data, transaction history, and cash flow analysis rather than traditional credit scoring models. This approach provides more accurate risk assessment and enables funding for businesses that might not qualify under traditional criteria.

Advanced analytics and machine learning algorithms help lenders make faster, more informed decisions. This technology-driven approach reduces bias and provides more objective evaluation of lending risk.

4. Credit lines over lump-sum loans

Flexible credit lines are becoming increasingly popular as they allow businesses to access funds only when needed. This approach reduces interest costs and provides better cash flow management for growing businesses.

Unlike traditional term loans, credit lines can be drawn upon repeatedly up to approved limits, providing ongoing financing flexibility. This model better matches the unpredictable funding needs of growing startups.

5. Integrated financing meets spend management

Modern fintech solutions combine credit access with comprehensive spend management tools, creating integrated financial platforms. These solutions provide not just funding but also expense tracking, budget controls, and financial analytics in a single platform.

This integration helps startups manage their finances more effectively while accessing credit when needed. The combination of funding and financial management tools creates significant operational efficiencies for growing businesses.

Fintech solutions for startup loans: Why speed and flexibility matter

The fintech revolution has fundamentally changed how startups access and manage business financing, offering significant advantages over traditional banking.

1. Traditional loan processes: Where startups face roadblocks

Traditional banks operate with legacy systems and conservative risk models that often exclude innovative businesses. Their requirement for extensive collateral, lengthy trading histories, and complex approval processes creates barriers for startups that need rapid access to capital.

The bureaucratic nature of traditional lending means decisions can take weeks or months, during which market opportunities may be lost. This slow pace conflicts with the agile nature of startup operations and growth requirements.

2. Faster approval and disbursement times

Fintech platforms leverage automated underwriting and digital processes to provide loan decisions within 24–48 hours. This speed advantage allows startups to capitalize on time-sensitive opportunities and respond quickly to market changes.

Rapid disbursement capabilities mean funds can be available within hours of approval, providing the immediate liquidity that startups often require. This responsiveness is crucial for businesses operating in fast-moving markets or facing urgent funding needs.

3. Credit access without collateral

Many fintech lenders offer unsecured credit lines based on business performance and cash flow rather than asset collateral. This approach is particularly valuable for service-based businesses or those with limited physical assets.

The absence of collateral requirements reduces the risk to business operations and allows founders to maintain full control over their assets. This flexibility is especially important for startups that need to remain agile and responsive to market changes.

4. Streamlined digital application experience

Digital-first platforms provide intuitive application processes with automated document collection and real-time status updates. This user experience reduces the administrative burden on business owners and accelerates the entire funding process.

Integration with business systems allows for automatic data population and verification, reducing errors and speeding up approval. These platforms often provide transparency throughout the process, keeping applicants informed of progress and requirements.

5. Dynamic credit limits and spend control

Fintech solutions often provide adaptive credit limits that adjust based on business performance and needs. This flexibility allows growing businesses to access increased funding as they demonstrate success and growth.

Integrated spend controls help businesses manage their credit usage effectively, preventing over-borrowing and maintaining healthy cash flow. These tools provide real-time visibility into spending patterns and credit utilization.

6. Integration with startup finance tools

Modern fintech platforms integrate seamlessly with popular business tools like accounting software, expense management systems, and banking platforms. This integration creates a comprehensive financial ecosystem that supports business operations beyond just lending.

The ability to manage multiple financial functions through integrated platforms reduces complexity and improves efficiency. This holistic approach to business finance is particularly valuable for resource-constrained startups.

7. Why fintech credit is better aligned with startup growth

Fintech lenders understand the unique challenges and opportunities facing startups, offering more flexible terms and repayment structures. Their focus on business potential rather than historical performance aligns better with the startup growth model.

The combination of speed, flexibility, and integrated tools creates a financing solution that supports rather than constrains startup growth. This alignment between lender capabilities and startup needs drives the increasing popularity of fintech financing solutions.

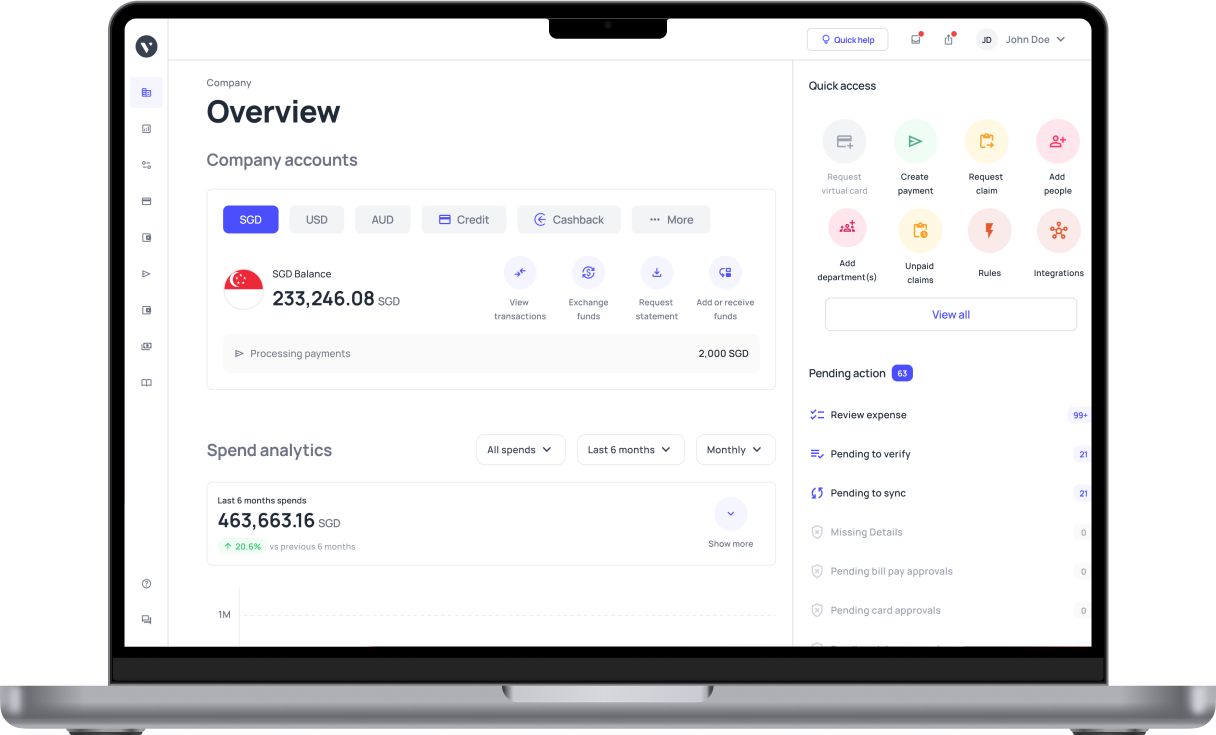

Volopay business credit: Smarter financing built for Singapore SMEs

Volopay represents the evolution of business financing, combining credit access with comprehensive expense management to create a unified financial platform for growing businesses.

No collateral, fast processing

Volopay provides credit lines without requiring collateral, making financing accessible to service businesses and startups with limited assets. The streamlined application process delivers decisions quickly.

This approach removes traditional barriers to funding while maintaining responsible lending practices. The focus on business performance and cash flow rather than asset backing creates opportunities for businesses that might not qualify for traditional financing.

Credit lines tailored to startup needs

Understanding that startup funding needs vary greatly, Volopay offers flexible credit limits that can adapt to business growth and seasonal variations. This flexibility allows businesses to access exactly the funding they need when they need it.

The revolving credit structure means businesses only pay interest on funds actually used, making it cost-effective for managing variable expenses. This approach provides the financial flexibility that growing businesses require without the burden of unnecessary debt service.

Seamless integration with Volopay spend tools

Beyond just providing credit, Volopay integrates lending with comprehensive expense management tools. This integration allows businesses to manage their entire financial workflow through a single platform, improving efficiency and financial control.

The combination of credit access and spend management creates visibility into cash flow patterns and spending trends. This insight helps businesses make better financial decisions and optimize their credit usage.

Transparent repayment terms

Volopay's business line of credit maintains transparency in all fee structures and repayment terms, ensuring businesses understand exactly what they're committing to. Clear terms and conditions eliminate surprises and help businesses plan their finances effectively.

The platform provides real-time visibility into credit utilization, repayment schedules, and outstanding balances. This transparency builds trust and helps businesses maintain healthy financial relationships.

Empowering finance teams with real-time control

Volopay's platform provides finance teams with comprehensive tools for managing credit, expenses, and cash flow in real-time. This control enables proactive financial management and better decision-making.

The integrated approach means finance teams can monitor spending, multi level workflows, and optimize credit usage through a single interface. This efficiency is particularly valuable for growing businesses with limited financial management resources.

Paperless application with minimal requirements

The digital-first approach eliminates paperwork and streamlines the application process. Minimal documentation requirements and automated verification processes reduce the administrative burden on business owners.

This efficiency allows businesses to focus on operations rather than financing applications. The simplified process doesn't compromise on quality or security, maintaining high standards while improving user experience.

FAQs

Startup loan amounts vary significantly based on business revenue, creditworthiness, and lender policies. Most lenders offer amounts ranging from $10,000 to $500,000, with some specialized lenders providing higher limits for established businesses with strong cash flows.

Government grants are non-repayable funds provided to support specific business activities or industries, while loans must be repaid with interest. Grants often have stricter eligibility criteria and reporting requirements, but don't create debt obligations for your business.

A loan provides a lump sum that you repay over a fixed period, while a line of credit offers ongoing access to funds up to a predetermined limit. You only pay interest on the amount you actually use with a credit line, making it more flexible for variable funding needs.

While challenging, some lenders offer loans to pre-revenue startups based on business plans, founder experience, and market potential. However, most lenders prefer businesses with at least some revenue history to demonstrate viability and repayment capacity.

Traditional banks typically require 2–6 weeks for approval, while fintech lenders often provide decisions within 24–48 hours. The timeline depends on application completeness, business complexity, and lender processes. Having all documentation ready can significantly speed up the process.