What are benefits of integrated accounting system?

To make effective business and accounting decisions you need to choose the right tools. The same goes for accounting integrations. At Volopay we strive to facilitate you with the best business accounting software for efficiently handling all your accounting needs.

Volopay is equipped with one of the most advanced accounting systems out there. The system can store, process, and manage large amounts of financial data effortlessly. With features like OCR, index, search, and analytical tools, you can sort your business data and scrutinize valuable insights from it, hassle-free. Along with this, at Volopay your data is extremely safe with multiple layers of protection technology.

Why choose direct integration to manage your accounting processes?

In the integration process, the authorized person or accountant still has the job to approve transactions and move them towards the accounting tools. This may lead to a few problems like the whole process going on hold if any document is missing or there is an error or your accounting system maybe be lagging behind and waiting for all the payments to be sent through or maybe the changes you make in the accounting tool are not made in the spend management software.

This means you ultimately are still closely looking over and working on your accounts, manually entering data and entering every payment in the ledger. However, you can skip all the hassle with Volopay which gives a direct integration facility where any hold-ups or complications, or challenges are easily solved by the system itself and because an integrated accounting system is fully united with your company’s system, accounting gets a new face in your business.

Advantages of integrated accounting system

Improve accuracy

While using any cloud accounting software, if your new journal entries do not match the system will immediately send an alert and highlight the potential error. Now you can be ahead of the problem before the process completed.

This is one simple example of how accounting automation can highly increase the accuracy of the financial data of your business. Integrated accounting systems ensure that your accounting records are precise and appropriately organized. With extremely accurate financial reports your team will be empowered to make faster and more profitable decisions.

Eliminate manual coding

With the fast-paced business world, accounting is also rapidly changing, and ignoring the benefits of accounting automation means you can lose the competitive edge of your business and also be in a significant loss of time and money. Automating manual and repetitive accounting tasks gives your team enough time that can be invested in other important areas like customer experience and can colossally improve it.

Processing and retention of all paperwork are done automatically your company can literally save a lot of time and money and invest it in other crucial areas of the business for better growth and development.

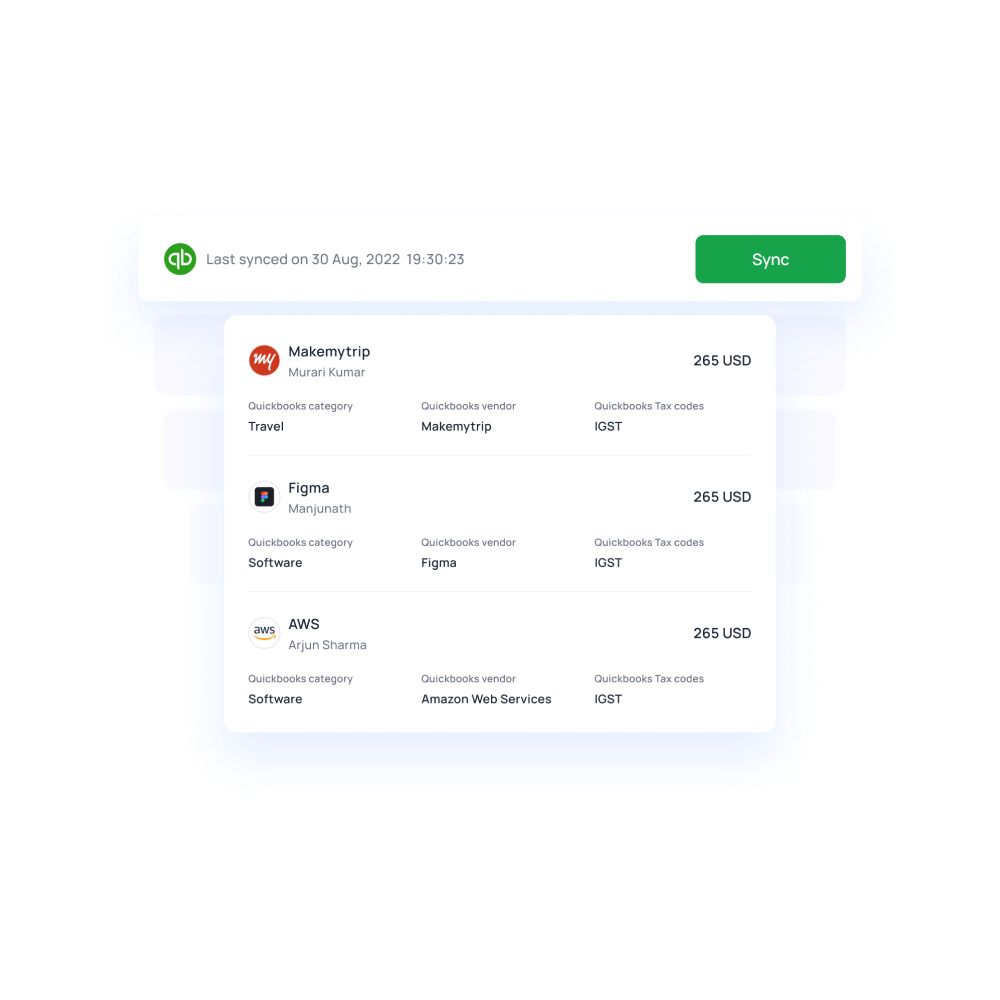

Sync transactions in real-time

The top advantages of automated accounting software are real-time tracking and reporting. To avail of these benefits, you simply have to integrate your online accounting software into your business bank accounts, and all your transactions like expenses, sales, inventory, everything will be tracked and reported in real-time.

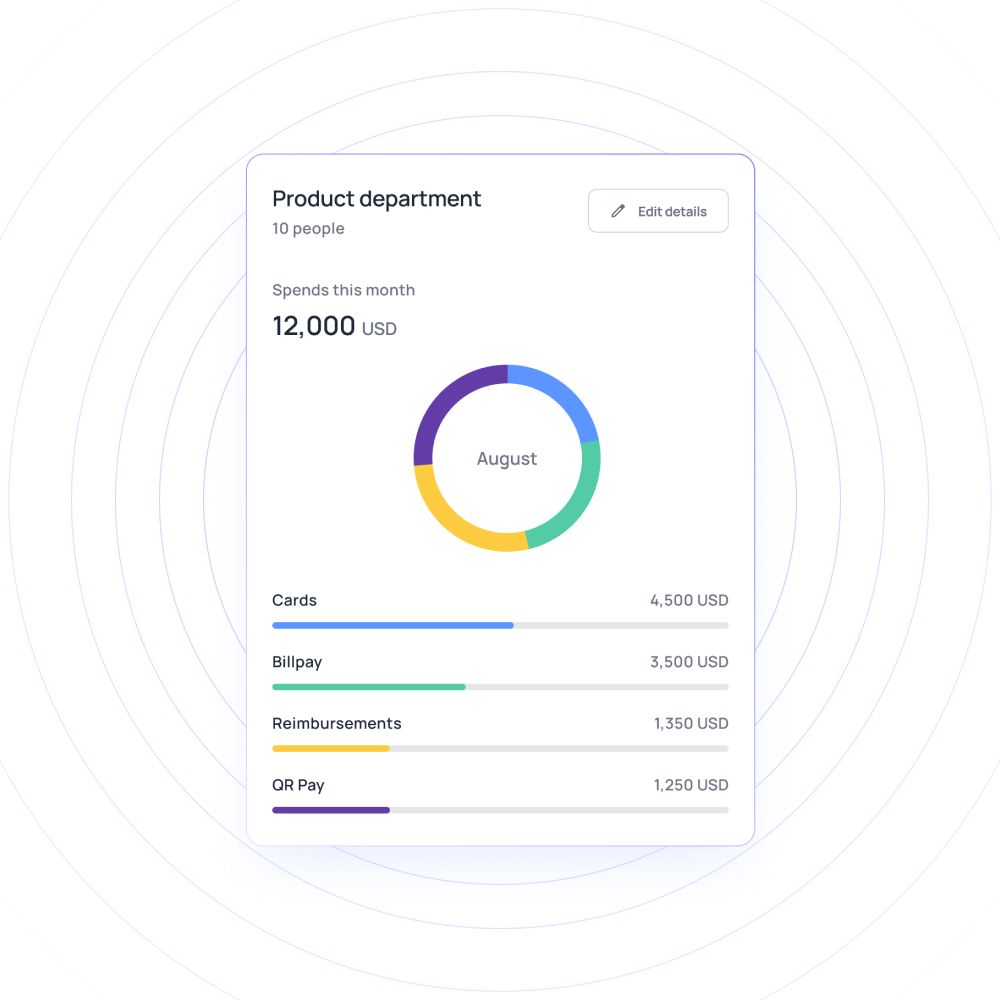

Accounting software gives you a personalized dashboard that gives you the option to track all the accounts and metrics of the company.

Clear audit trail

Auditors use audit trails to reiterate the transaction history of a particular expense right from its origin. Volopay helps you by gathering all user and system-generated transactions and does not give permission to disable the audit trails. The audit trails can give you a record of all transactions performed within Volopay, along with the specifics like time and user details.

Eliminate expense reporting

Automated accounting integrations can successfully remove all the paperwork requirements. With an expense management system in place, all your employees just have to capture their receipts and submit them. Once it is approved all the transaction information is automatically synced and updated with the accounting software. This means you don’t have to worry about entering each transaction or making changes in any old one manually.

Eliminate errors and save time with accounting integration

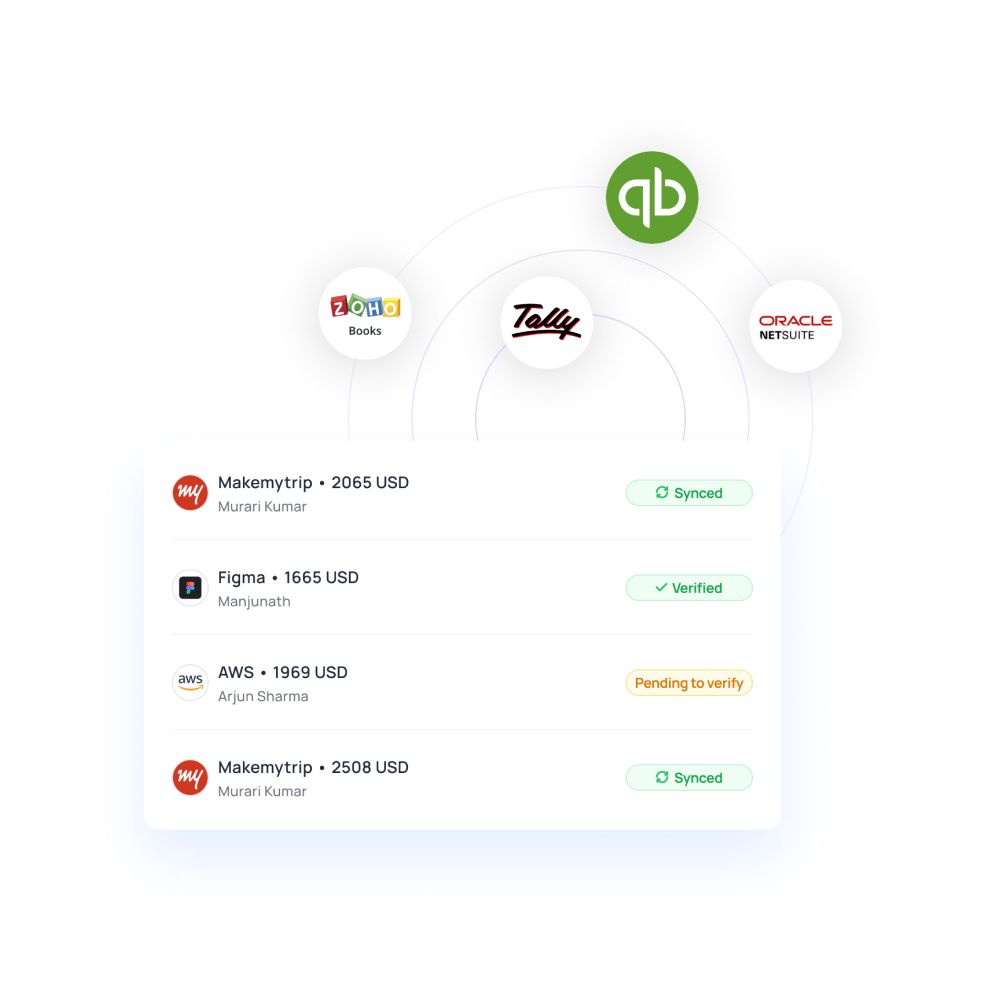

Which accounting integrations does Volopay provide?

QuickBooks

QuickBooks is one of the business accounting software for small businesses of those reviews. The majority of the small business accounting professionals prefer to use QuickBooks and all accounting features are perfectly blended in the software because of which it can be conveniently accessed on the main dashboard of Volopay which in turn makes bookkeeping more efficient and error-free.

Deskera

Deskera is a popular and award-winning all-in-one online accounting software for small businesses made to help them improve their growth rate at a much faster pace. It can be used for accounting, payroll, CRM, HR, email marketing, no-code website-building, and much more. Volopay presents to you seamless integration with Deskera and you can export all your expenses at a click of a button.

NetSuite

NetSuite is a cloud accounting software that gives its users a complete financial performance view and cash flow analysis. The system possesses features like general ledgers, cash flow management, tax filing management, accounts receivable and payable, fixed asset organization, and payment management. Volopay and NetSuite are excellently integrated and without a hitch, they can take over all your accounting burden and display maximum profitable results.

MYOB

MYOB Accounting has become the most famous accounting brand in many countries because of its amazing marketable factor which is “super easy-to-use accounting software functions.” It can skillfully create a chart of accounts, keep a track of daily transactions and give real-time visibility into the accounting reports. Volopay makes it easier for you to manually integrate your transactions from Volopay onto MYOB by exporting a single file in the required format. It eliminates the need to upload every transaction individually and reduces any chances of manual error.

Xero

Xero is another renowned cloud accounting software created for the development of small businesses. It provides the business owner with instant visibility of their financial position. Being a web-based solution it offers robust accounting features like cash flow visibility, transactions and accounting details, etc. Along with this all bank transactions are automatically updated and imported into the system and you can always keep a track of your business spending and bill payments. Once again, Volopay provides smooth integration with Xero and makes accounting the simplest process for the financial team.

Volopay's accounting automation features

Automatically update data

Business accounting software integrated with Volopay discards your job to manually make changes in the accounting books. All the updates made in transactions, expenses are automatically updated in the accounting sheets.

Manual MYOB integration

Volopay makes the process of manually integrating transactions on MYOB extremely effortless, this is possible as only a single file needs to be exported in the required format. It terminated the process where you have to upload every single transaction individually & this successfully reduces the manual errors.

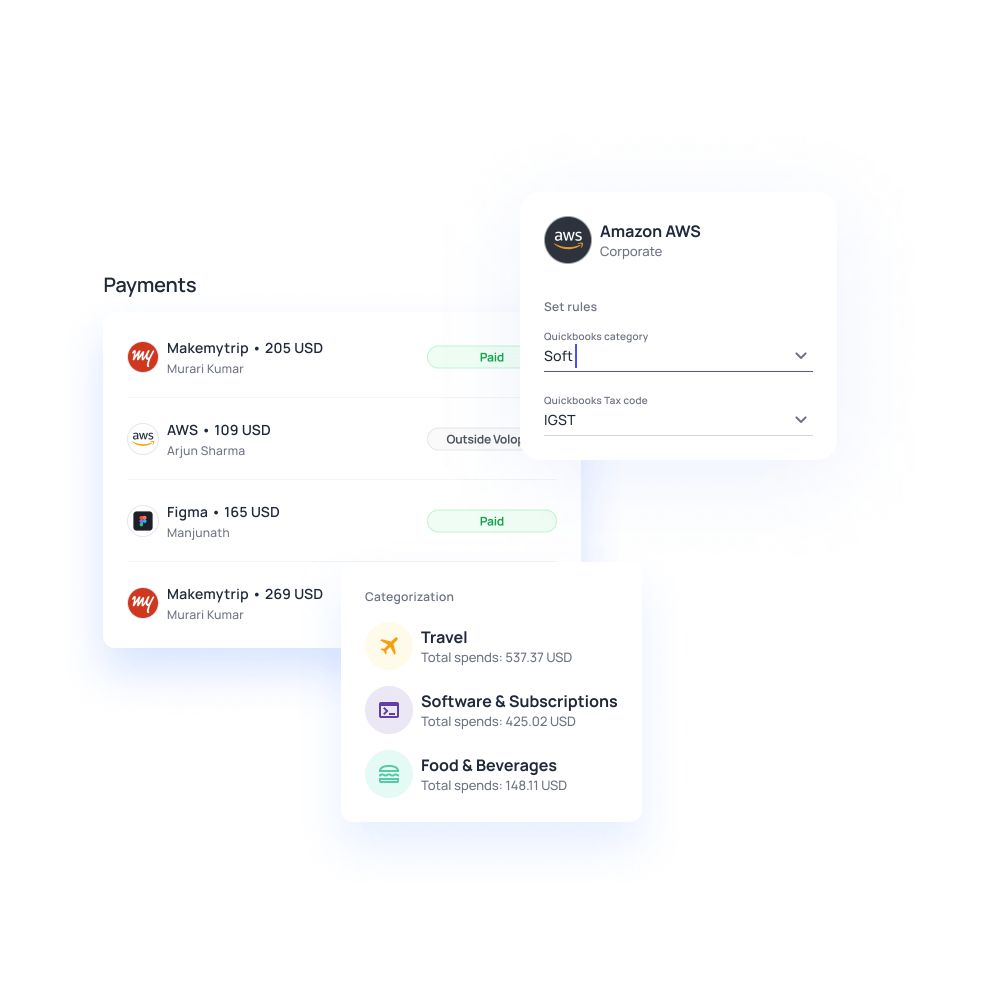

Accounting triggers

Volopay has introduced something new which has made accounting much easier. “Triggers” is a fresh Volopay feature that accounting automation to the next level. You just have to set one trigger for any vendor, department, card, or user and let our platform do the rest. Triggers eliminate the manual way of selecting the Xero category, Tax codes, etc. each time for every transaction, it auto-fills if a trigger is set.

Automated categorization

With Volopay’s accounting integrations, each vendor, category, and transaction tag input field in the ledger will be auto-categorized. You just have to simply create mapping rules for every accounting field, from merchant to department. This can easily be done by importing your chart of accounts. Once this is done, Volopay takes it from there, it classifies and syncs all your business transactions into your general ledger.

Multi-currency assistance

Volopay’s accounting integrations support multiple currencies which makes managing your company expenses and stuff from anywhere in the world, painless. Now, you gain total visibility and control over every business transaction made in your company regardless of the location. This is a colossally beneficial feature for companies which have branches located in different parts of the world.

How to set up accounting integrations with Volopay?

Volopay gives you seamless accounting integration. Our accounting encompasses 3 essential components ledger, integrations, and transactions. The accounting features are only accessible to admins and accountants on the Volopay platform. The admin will have to provide access to others if required.

Ledger

A ledger is an amalgamation of all the financial accounts. The basic division of a ledger is into credit, cards, and Bill pay. This displays all transactions whether debit or credit, with specifics like time, date, vendor, etc. The credit tab available on our platform is used to show all transactions which are funded through the credit line. The platform also displays the opening and closing balance following each transaction. You also get the facility to sort and view all transactions on the basis of date, user, etc. You can also easily download the transaction details or the expense report in a simple form like pdf or excel sheet.

Integrations

The integrations tab is designed to help you confirm your accounting software with your Volopay account.

Transactions

Volopay’s platform offers a transactions tab which is used to display all the transactions whether funded from cards, bill pay, or other methods.

FAQs

Yes, you can disable any integration anytime you want.

- Adjustments are usually the difference that may arise between the billing amount and the settlement amount at the merchant's end for any transaction.

- Adjustments can also be a refund from a merchant. In case you were overcharged or canceled an order, the amount is refunded after a few days that is reflected as Adjustments on your ledger in case then it can't be reversed to the original transaction (the transaction was already synced/verified before the settlement came in).

If in case your accounting software doesn’t integrate with your Volopay accounts. We offer the option to simply download the expense report in CSV or PDF format, after which you can upload it to your accounting system.

Trusted by finance teams at startups to enterprises.