Prepaid expenses: Best practices to manage employee expenses

A company offers expense advances or prepaid expenses to employees to cover company expenses. While reimbursements and corporate cards are the most preferred ways, there are limitations associated with them, significantly if the costs are not streamlined.

It is unfair to ask the employee to spend out of their pocket if the money requirement is too high. Corporate cards are possessed in limited numbers in many organizations, and it’s a challenge to apply and get one of these.

What are prepaid expenses?

There are cases when companies pay employees in advance for business-related expenses. A prepaid expense is usually preferred if companies don’t have corporate card features or the expense is unmanageable from the employee’s end. It is not given much importance because it is not understood clearly and is not practiced everywhere.

For example, there is an associate who wants to get a prepaid corporate card for a business trip that’s going to happen. But the admin doesn’t own enough cards at the moment. Instead of asking the employee to manage the expenses independently, the company can provide them with an expense advance.

What is the difference between payroll advance and expense advance?

While addressing this, you must also be informed about another similar-sounding payment term. Payroll advance is a common practice among many organizations. When an employee is in dire need of money in the middle of the month, they approach their company management for payroll advance. A part of their salary for next month gets credited from the employer's side to fulfill their requirements.

Payroll advance is more like a temporary loan or an advance amount provided out of their salary to help their employees with their financial needs. At the same time, expense advance is a fund provided in advance to manage company-related expenses. Payroll advance is taxable in whatever form it gets received.

For a deeper understanding of how advances differ from expenses and their impact on your finances, explore our blog on Prepaid expenses vs. accrued expenses: Key differences.

Why does business need employee advances?

Companies are obligated to cover the business expenses of their employees, including insubstantial but everyday expenses like meals. The basic procedure that companies usually follow is asking employees to apply for an expense claim at the end of the month. Some companies have internal prepaid employee expense cards that they distribute to employees to manage company expenses.

But employee advances are often discouraged as organizations are not aware of the workflow and paperwork involved. In the case of grown organizations, if they don’t have policies created, they don’t follow them or consider implementing them.

From the employees' perspective, they see every out-of-pocket company expense as an inconvenience despite the amount spent. Because the expense claim processes are usually cumbersome and take months to get the money back, this can affect their plans and create a cash demand. Imagine an employee who gets a salary of $1200 spending more than $200 on company expenses.

There are also scenarios where reimbursement gets rejected or put off due to policy-related or other reasons. Employee expense cards are still new to the business world, and not every company has them.

Your business can get seriously impacted if your employees postpone or don't engage in business activity on the grounds of money. To not interrupt a business process and show employees that their concerns are valued, every company should have the employee advances policy.

Streamline your employee expense management process

Way to minimize need for expense advances

Expense advances need a regulated process and need proper documentation. At the same time, your employees should be empowered to continue making business expenses without any delay. Here is how you can minimize the need for a prepaid expense card by providing them with alternative options.

Get corporate card

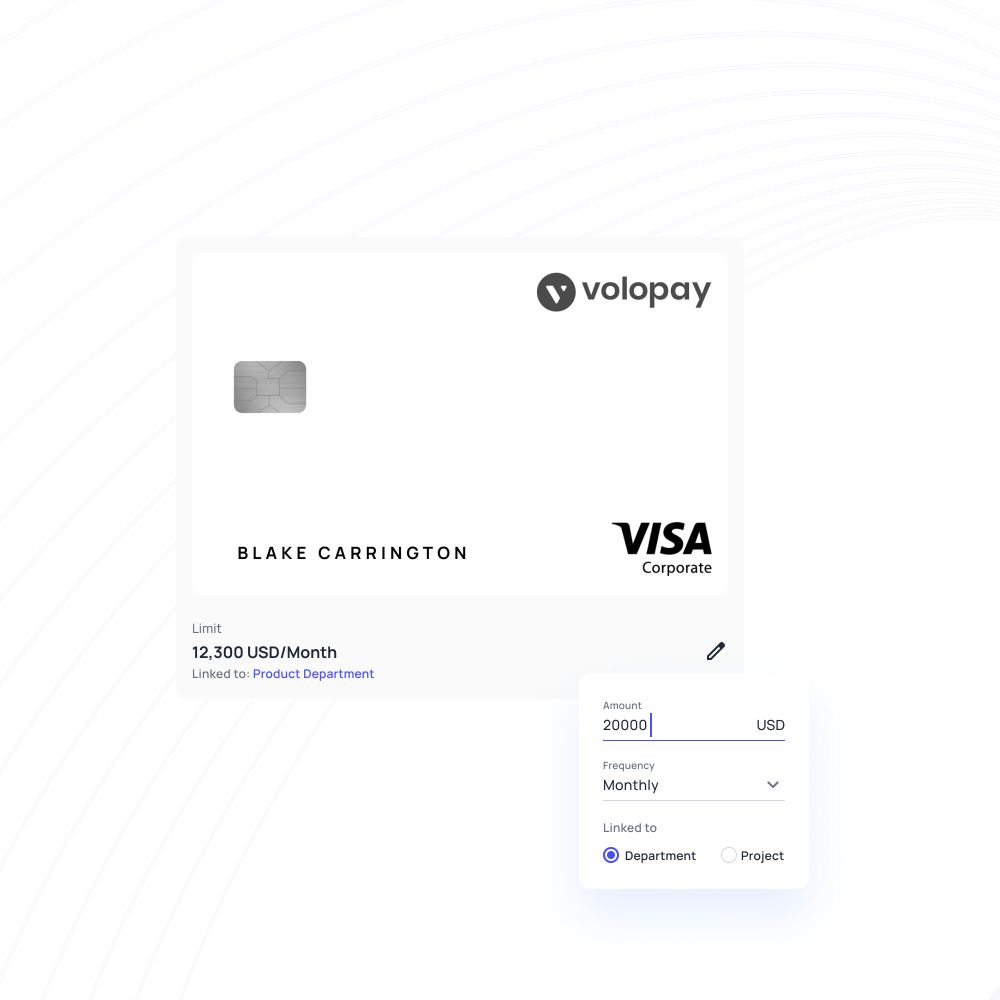

Corporate cards are the ultimate solution as they come with instant credit and can be obtained without much fuss. Corporate cards are versatile to use, and you have both physical and virtual card options. The limitation of traditional corporate cards is the number of cards you can hold.

But when you are backed up with a modern banking solution provider like Volopay, you get maximum benefits like the ability to create as many cards as possible, preset budgets, etc. They are also highly secured as each card is not directly related to your primary bank account. With the help of an admin, you can manage the employee expense needs efficiently.

Make payments with prepaid expense card

Prepaid expense cards are also like corporate cards where employees are given preloaded cards to accommodate their expenses. You can only add the money that will suffice the cost, and there is no need to go through an unnecessary reimbursement procedure. This prepaid expense card acts just like a normal credit card which they can swipe and finish off the transaction.

Once it's over, they can hand it over to the admin department and the proof of payment. A prepaid card is a neat, inexpensive solution when there is a one-time payment need. This card is in no way connected to your major account, so it’s safe to distribute.

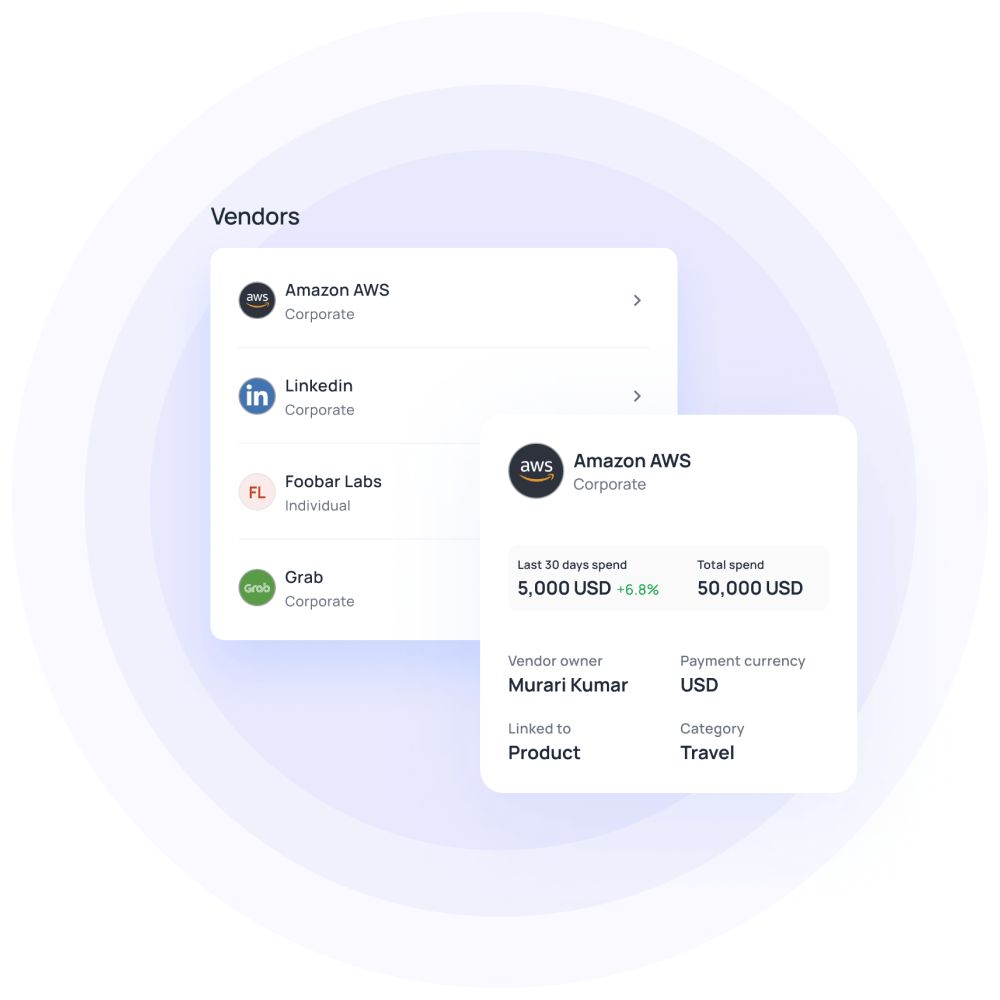

Have accounts with specific vendors

Instead of asking employees to handle the expenses by themselves, companies can take care of a few common expenses. For example, for ticket bookings, your company can hold a premium account with any provider and book tickets for employees at no extra cost whenever required.

It avoids double work where your employee books a ticket and makes your accounting teamwork again by submitting a claim. Being a corporate vendor, you can enjoy certain benefits from vendors. This pre-booking is easy for an organization to do rather than an employee.

Give deferred credit cards to employees

Deferred credit cards let you use added credits without having to pay the interest during the promotional period. You might have to pay an annual maintenance fee. You can provide your employees with this card, and before they have to repay it, they can get it reimbursed from their company.

They can repay it anywhere between 60 to 90 days after the original payment has been made. Apart from the maintenance cost, which can be a little pricey for startups, the company doesn’t have to endure anything. Companies can either use it as a significant expense advance option or not at all, considering the expense associated with it.

Manage your employee expense with Volopay

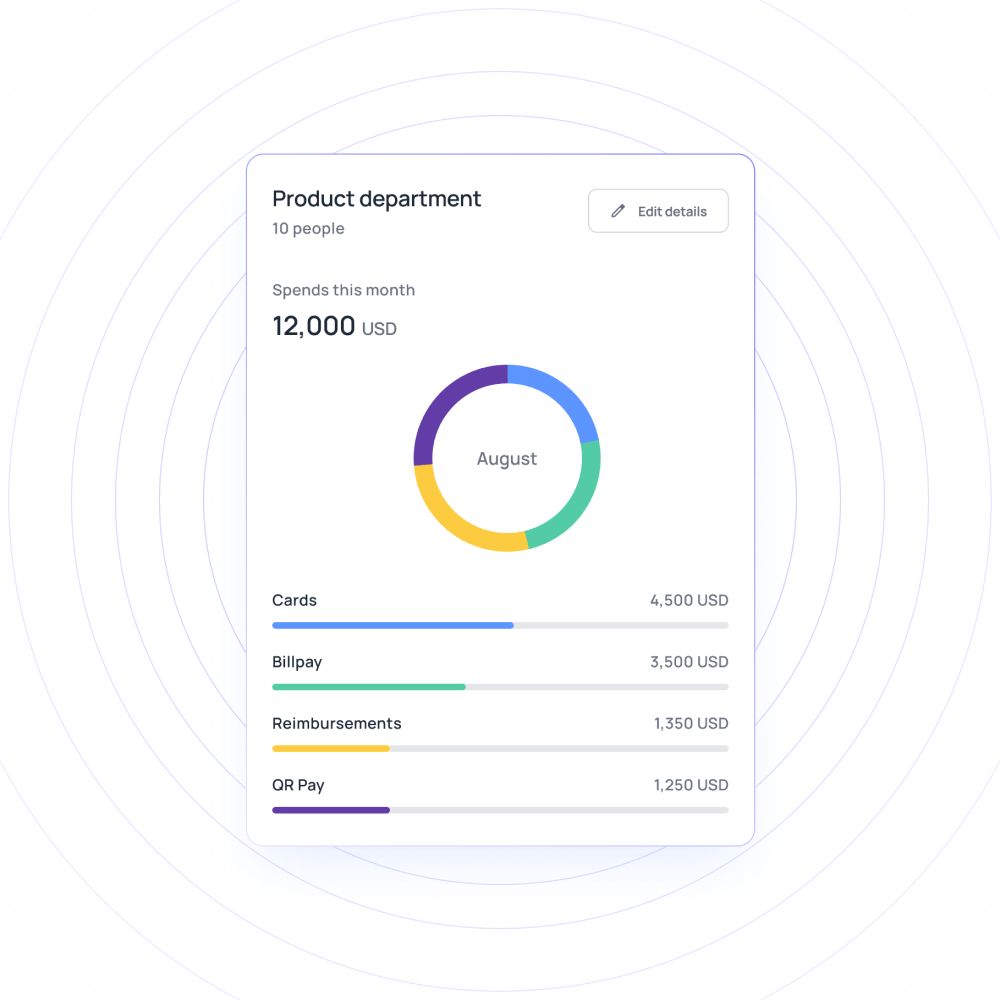

Volopay clears the way for payment management and allows your accounting department to perform to its best capabilities. Volopay has a trailblazing expense management system that can make you fling your reimbursement processes and out-of-pocket employee expenses.

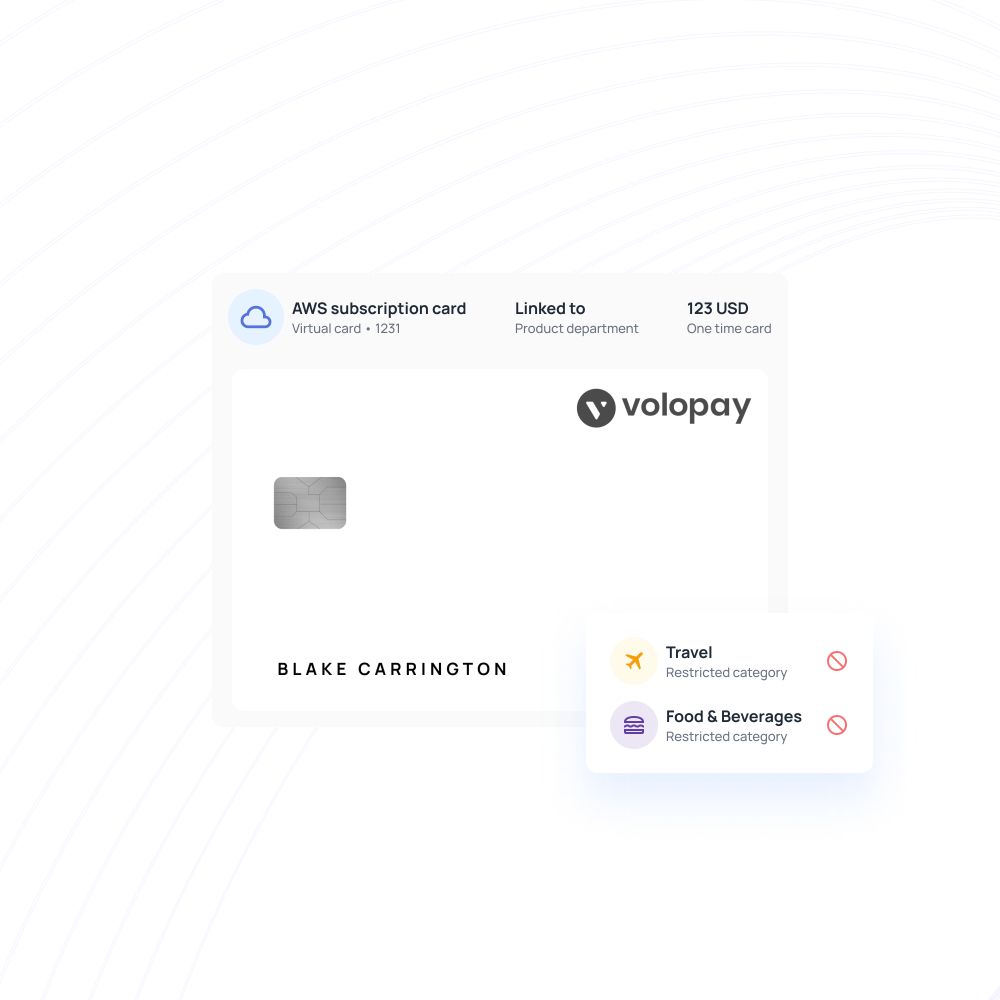

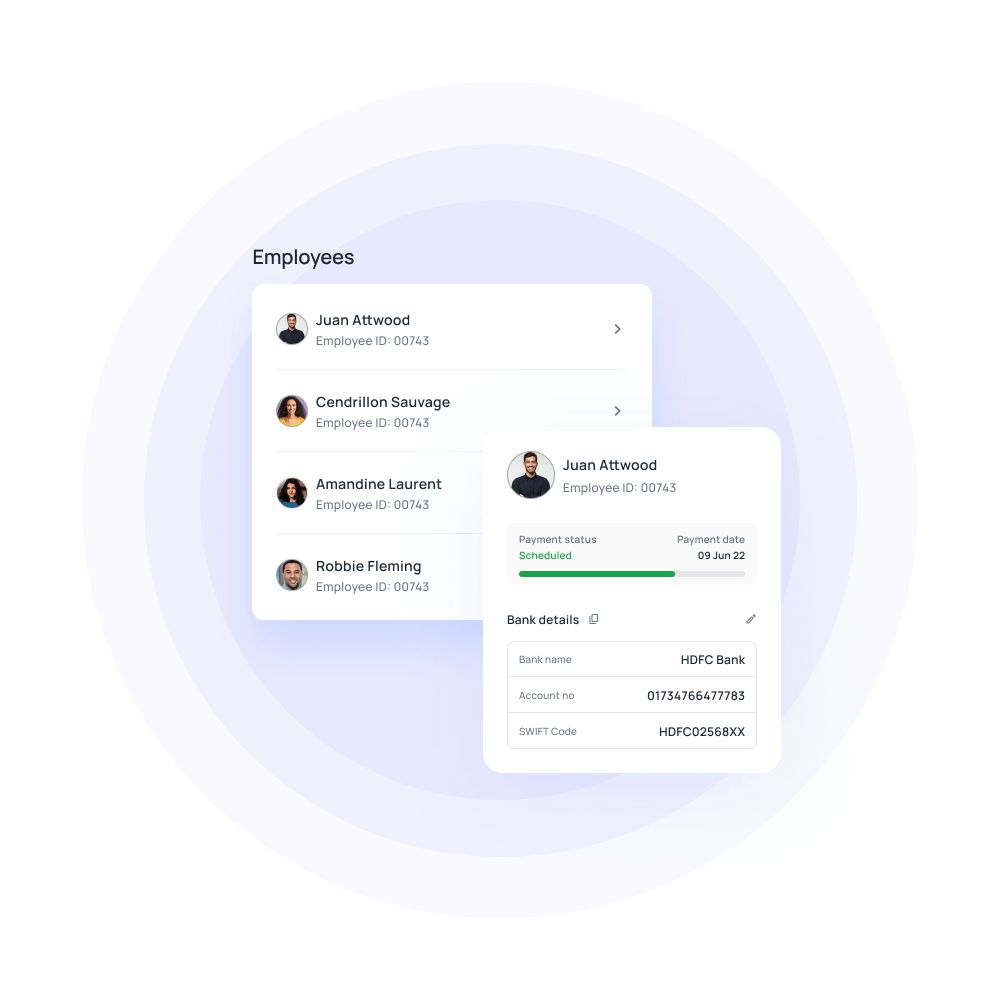

You can assign prepaid employee expense cards to your employees within seconds and minimize the unwanted application and follow-up procedures. When the need arises, they can contact the administrator who can assign them a card based on your organization's workflow. You can set the required amount as budget to each card, and if needed extra money, the employee can request additional money, which will get credited instantly once approved.

You can keep yourself away from needless expense advance situations by propelling your employees with corporate credit cards. Virtual cards are even more straightforward as you can get as many cards as possible. Hence, this is suitable for companies with any number of employees.

If needed, employees can submit expense claims too through Volopay’s mobile application. Give them the freedom to spend when they are on business trips, yet keep the employee expenses under control by enforcing a budget limit. Let your employees' pay focus on business activities and not receipts collection.

Related pages

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free