Importance of expense management policy for employees

For any business, small or large, official company expense policies are an important part of effectively running and developing the business. A properly and clearly written expense policy rules document terminates any risk related to team members spending the company funds without getting expenses approved, or the expense limits and budgets per activity, and how to get reimbursements if the employees have made out-of-pocket company expenses and how is an accurate expense report created.

Writing down a plainly defined and fair expense management policy can help your employees understand what is best for the company and how should the company fund be put to its most productive use, which in turn reduces any misunderstandings and offenses which contribute in create a constructive and productive workplace culture.

What is company expense policy?

A company expense policy is a set of regulations that are created to direct the employees on how should the company funds be used for business purposes. The employee expense policy should transparently state the rules and expectations for much company money is available to be spent, on what tools is the money allowed to be spent like a company card, Saas subscription, etc., and what are the situations and circumstances under which the money can be spent.

This kind of transparency in company expense policies improves expense policy compliance and decreases the whole back and forth running between your staff and financial department. A meticulously laid down expense management policy during the initial stages of launching your business has potential to save your time in the future when you will be in the process of hiring employees, as of course candidates have questions related to reimbursement policies, expense categories, expense policy rules, and process questions. Instead of spontaneously blabbering the expense policy rules, the best option is to have a planned guide document.

The need to create expense policy for employees

Control spending

The most crucial reason why a company must have an expense system and company expense policies is that they clearly state the highest amount which the employees can spend on anything business-related. This is not just for the large expenses made by managers or financial team leaders, employee expense policy is for everyone. A set amount is a limit marker for all the employees who would make small expenses like booking a hotel or airplane tickets for business trips or laptops for the team.

Establish clear understanding among everyone

If the reimbursement approval and expense policy rules are not managed precisely, expenses can create serious problems in the business and also raise the feeling of dissatisfaction and mistreatment amongst the employees. An overall company expense policy establishes significant uniformity in understanding the expense policy compliance for everyone right from the Managing Director.

Build a plan for the future

When you have a clear understanding of what your team members must be spending, planning the future finances of the business and forecasting budgets becomes a little less complicated. Analyzing the spending habits and patterns and figuring out what spending is going against the policy can also help in identifying areas to save money.

Reduce the risk of fraud

Business expense fraud is not a topic that can be easily discussed, however, it is extremely important. Company expense policies are not just made for setting ground spending rules, it also is a bar and if any employee crosses it, serious action can be taken against them.

Points to consider when designing expense management policy for employees

Don’t be too strict

In the reimbursement approval and expense policy compliance, there is no need to particularly mention the punishments or what would happen when someone goes against the policy. You just have to clearly lay out the guidelines. When someone acts against expense management policy, that time you can decide what needs to be done.

Keep it brief

While designing the company expense policy rules, you need to keep in mind that this document is for everyone in your business, not just the financial team or managers. This means the document needs to be something that people quickly refer.

Accessibility is key

In the olden times, the company expense policies were printed out once and then lost somewhere. However, with the drastic improvement in technology make sure that these policies are saved and available online so that anyone can access them any second.

Maintain relevance

With your business growing, the spending habits all over the company will be changing, so you need to be updated with the status of the company and update the employee expense policy accordingly.

Take input from your team

Taking input from the team does not mean that you need to take an overall company survey or talk to everyone, but it is suggested to get as many opinions as possible.

Related page: Prepaid expenses - Best practices to manage employee expense advances

How can Volopay help your company enforce expense policy?

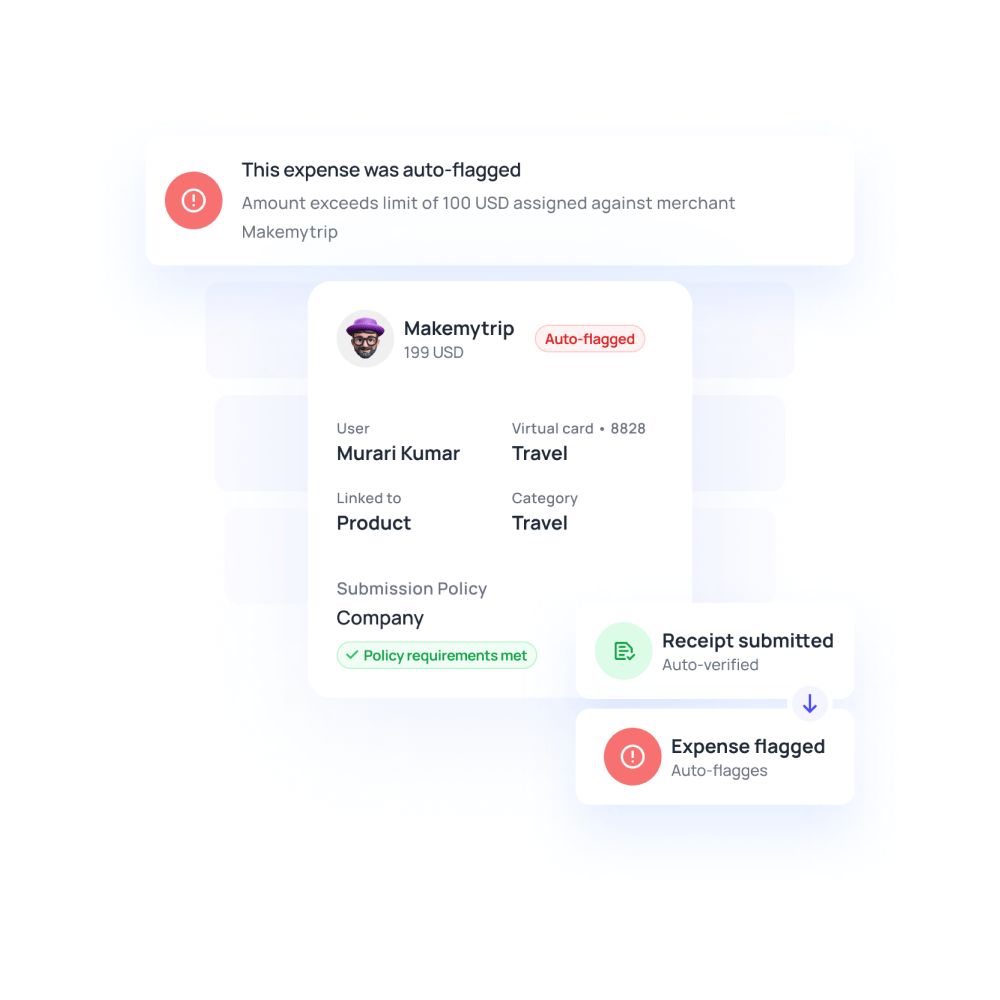

To make your task effortless and less hectic, Volopay is here to take over all the expense-related processes and can smartly automate all of them according to your convenience. With the corporate expense management software which was designed to solve all financial problems for businesses and help them grow better and faster.

Volopay's expense management software help you control your business's indirect spending. With various features like expense approval policy where you can set multi-level workflows and procedures for requests and approvals and establish precise approval workflows to handle staff spending, payments, and fund requests. Compliance is simple, quick, and transparent. Not only this, the approval policies can work for your business from company-wide to specific departments, expense levels, or categories.

You get the option to select the admin(s) who must approve each of the rules you've set, and you'll have the budget supervision you require. Along with this you also get the facility to easily design custom approval workflows and automatically route them to one or more approvers in any order. Create inter-departmental, spend-type, and-category flows. When decision-makers are absent, create workflows that automatically move to next-in-line.

Furthermore, another exciting and colossally useful feature we offer is corporate card requests. Set automatic approvals for lower card spends or set multi-level approval route of admins and finance team for higher card limits. Route spend requests to the right people based on the spend amount with instant approvals and smart notifications.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free