Best practices for effective travel expense audit management

A receipt is a document that acts as the confirmation of the processed payment. In older days, companies used to send paper receipts in the mail once the payment was received on their end. It had been a backbreaking task for companies to maintain this for a long time. But there is always a better way to do it. Enter digital receipts. Digital receipts are when you store receipts electronically in the digital medium. This has indeed transformed the way we organize and save receipts.

Receipts are essential for both conformations of the transaction and tax compliance. For this reason, you are obliged to manage receipts at least for a few months. Long gone are the days we were sitting in an office with walls and cupboards piled with papers. We are slowly progressing towards remote-style work environments. Even if we have a static workplace, storing paper receipts is out of the question.

What is travel expense audit?

Corporate travel expenses that companies usually approve are flight ticket charges, room booking, meals, coffee, and so on. When we say audit, it’s carefully going through the records and bills submitted by employees as proof to back up their claim request.

This way you can identify if all these claims are true and identify non-claimable and fake ones. The purpose of the audit is to save money that the company might lose on approving false and improper claims. This way, you gain more control and get to see if the outgoing business money is for the right reasons.

What does travel expense audit entail?

Travel expense audit is all manageable when you follow the right steps. An auditor should be involved and the trail of actions to conduct a thorough travel expense audit is as follows.

Examine your entire internal control environment

How is your company currently handling the employee travel expenses? What is the frequency at which employees from different departments are traveling? What is the approval process, and which departments are involved? Are there any expenses that get automatically approved? Do an internal audit of costs and evaluate and obtain a gist of the entire workflow of your travel reimbursement policy.

Examine the efficacy of your current processes

Once you evaluate it in every way, try understanding the loopholes and drawbacks in your current system. Check if it is efficient in the way it is. Is this cut out to serve the needs of your organization? And also find if this same process will support the future needs of your company.

Examine selected reports in depth

Now that you have all the records related to your company’s employee travel expenses investigate them in detail. It can be a lot to do in one go. You can handpick some and examine just that to understand the best parts of your current travel expense practice. When you try going beyond your primary research, you can totally understand a pattern of what comes under the business expense category.

Review your T&E policies

It’s time when you have to write down your travel and expense policies and guidelines or review your current travel policy, mileage reimbursement policy for employees. You should clearly draw every employee’s roles and responsibilities related to travel and expense management system. There should be no room for any disorder. With a carefully written travel expense guideline, one can avoid wasting money on fraudulent claim requests. Sometimes, these requests are not deliberate; employees can be confused too. That’s where T&E policy comes in.

Related page: Benefits of employee mileage reimbursement for businesses

Travel expense audit procedures

It is the duty of the auditor to formulate and perform travel expense audits. This auditing prevents expense-based frauds and holds clear records for every company expense. The audit includes the following steps, and at the end of it, you will get the travel expense report. This report will paint a picture of your company’s financial condition and performance.

Insightful analysis of travel expense reports

Most companies process reimbursement by requesting the employee to submit bills and receipts. In this step, these receipts are verified. The auditor will try to match these receipts with the reimbursed amount record. Even a roundup is considered as an error here.

Assessing business travel policy for employees

The auditor can also tear down and look into your current business travel policies. They can point out loopholes, blocks, problematic areas and point out the missed roles of respective departments. For instance, how a manager should have been careful in providing initial approval.

Examining doubtful expense claims

It’s not hard to tell a legitimate bill from a not-so one. The auditor here is in the position to question the employee if something doesn’t add up. The employee is also answerable if they submit bills for categories that don't come under reimbursement. Adding expenses spent by employees’ family members on the business trip doesn’t count. An auditor can and should identify and call that out.

Verification of fiscal records

More complex questions arise about your expense travel policy until you find the answer for every flaw. In the end, your whole business travel expense record has been analyzed, and every item that didn’t add up at first is solved. A rigid and proper travel expense audit saves your time and money and doesn't cause another one in the coming years.

Business travel expense audit best practices

Conducting an audit every time you see an abnormality is a waste of time and sometimes even uncalled for if you follow best practices. Following are some simple measures that can significantly impact your travel expense management system. Following are some simple measures that can significantly impact your travel expense management system.

No double-dealing can happen when your employees know that there are frequent audits. Create a set of guidelines to conduct internal audits for this category and assign the responsibilities over to a related team. Overseeing the records on a frequent basis can also help watch out for unusual requests.

It’s about time employees learn business travel etiquette. You should instill a basic understanding of how their salary and growth depend on the company’s profits in their mind.

Training employees on what expenses are valid to claim on, what steps to follow, what kind of receipts are accepted should be conducted.

Set reasonable limits on each category so that you save money while processing reimbursements. Depending on your company’s travel pattern, these limits can vary under different circumstances based on the employee hierarchy, reason for travel, and so on.

This can be so helpful to determine where your employees spend the most and what you can do to prevent it. Split the expenses you allow into categories like food, travel, etc. Employees can also choose the category while submitting.

While expecting employees to be transparent and honest, the company should do the same back too. Reasons, why a claim is rejected should be sent forth to the employees. Transparency is the key to owning clear records that saves time while auditing.

Not updating properly or unclear notes are what raises questions during an audit. The accounting team or anyone involved in the travel expense system should keep this in mind. You should include every minute detail along with the respective requests.

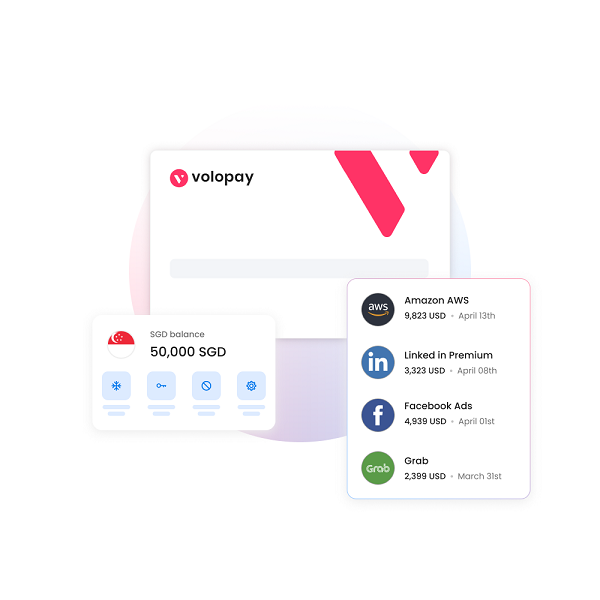

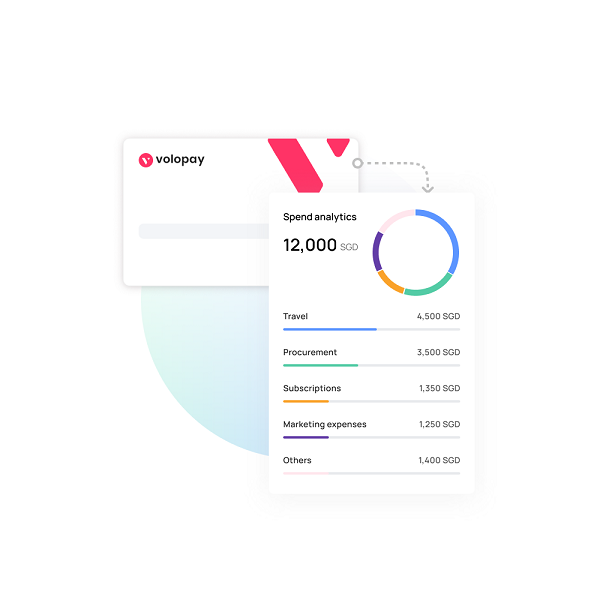

Make travel expense audit easy with Volopay

Volopay is the travel expense management system you need to regulate your claim processes. It favors you in two ways that make the whole travel expense audit process easy and rapid.

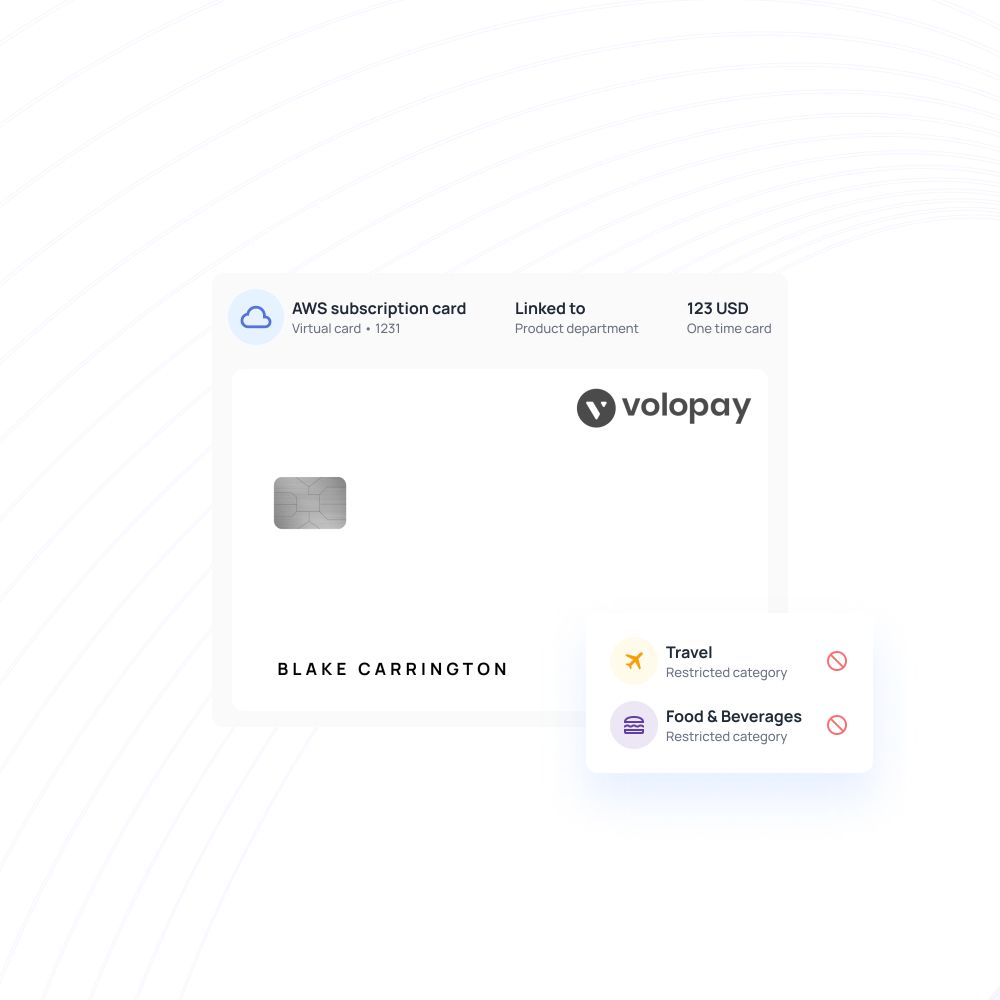

Corporate cards

While on business trips, employees can be too busy to collect receipts, come back, and apply for claims. That is precisely why your company should incorporate corporate cards. Corporate cards have both physical and virtual cards that you can assign to your employees. They can use it as a regular card to book tickets, swipe while paying, etc.

Your admin can release as many virtual cards as possible, keep an eye over them and freeze or delete them if not in use. Every expense that happens through the card is registered, which you need while auditing. These cards function like regular cards, and your employees need little or no training on using them.

Automated reimbursement process

Employees might face moments when they make out-of-pocket business expenses, even with cards. Volopay facilitates mess-free employee reimbursements where employees can submit requests on the go. They can submit the receipts right away through the mobile app and get reimbursed.

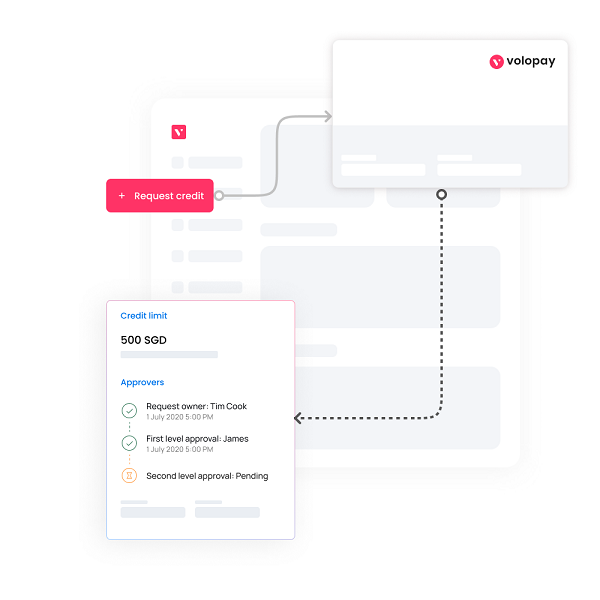

The admin can categorize the requests and assign workflow control based on the claim request. The automated multi-level approval process makes sure no fraudulent requests are sent through, and employees get their money back on time. You can also enable custom approval methods that enforce your company’s travel reimbursement policy.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free