Travel expense audit checklist and best practices

Travel expense is one of the most difficult expense categories to manage and control. On average, a business trip costs $1300, and the cost may increase. Not only this, travel expenses are known as the report fraud “gateway” for even big expense claims.

Even if your organization has a full-fledged corporate travel policy that covers anything and everything that the employees need to know, managing and auditing travel expense regularly is an important step. These expenses can turn into large overhead costs if not checked and kept within limits in time. It can be the reason for huge drains from your business funds.

What is travel expense audit?

A basic protocol is that employees are supposed to keep all the receipts related to their business travel expenses, which may include hotel fees, meals, drinks, etc. However, the item which would be reimbursed is subjective to every company’s travel expense policy. The employees then submit those receipts, travel expense forms, and any other important document for reimbursement claims.

The purpose of a travel expense audit is to: Identify any errors in the submission, check the genuinity of the expense items. determine the usefulness and alignment of the expense document submission to the business’s travel expense policies. Furthermore, travel expense audits are essential to control costs, get precise insights on travel expenses of the business.

Challenges of conducting travel expense audits

Travel expense policies are difficult to understand

It is highly unlikely that employees or business travelers who are going to move would read through a large volume of business expense policies. Along with this, if the policies are written in a confusing and gibberish type of language, employees tend to misinterpret or ignore some policy points. So, it is the responsibility of the company to write the policy rules in an easy-to-understand and simple-to-follow manner.

Categorizing which things fall under reimbursement acceptable and reimbursement non-acceptable can help avoid policy violations. One best solution for this would be to have a mobile application through which the employees can have easy access to all the travel expense-related information and can also file reimbursements through the same app.

Manual process renders errors

A manual travel expense management method includes employees submitting paper receipts as reimbursement claim proof and using spreadsheets for recording all travel expense management data. These things tend to complicate the whole travel expense audit process.

For a large-scale business, these processes become even more complicated because of the large number of employees making travel expense submissions using the manual method. Travel and expense process automation can help streamline all the business operations related to travel expense audits.

Time consuming

Travel expense audits are intensively time-consuming whether a small-scale business or a large-scale business. An immense amount of time in the auditing process is spent double-checking all the information submitted by the employees. Then again, if an error or fraud is detected, rectifying and working on the error takes another significant portion of time. However, travel expense management software can help in majorly reducing the time invested in the audit and can automate the whole process.

Heavy expense submissions

With a growing and expanding, business, travel expenses are bound to grow along. So many employees manually submitting travel expense receipts for even a small expense incurred during the travel will, of course increase the amount of audit data significantly, and the task of performing a thorough analysis becomes much more difficult. This means that there would be numerous mistakes and errors, and you won’t be able to make any quick decisions related to it.

Travel expense audit checklist

Evaluate the business expense policy

Auditors who conduct the auditing process must review the company travel and expense policies. This is helpful to determine how thoroughly everyone is complying with the rules and policies set by the company and also check how efficiently the managers are taking care of the fact that the employees follow the traveling regulations.

Expense report assessment

The auditor is first supposed to conduct rigorous examination sessions of the company’s travel expense financial information by doing the matching process of the receipts submitted by the employees to the travel expense records. In order to run this process smoothly and organized travel expense management system is needed.

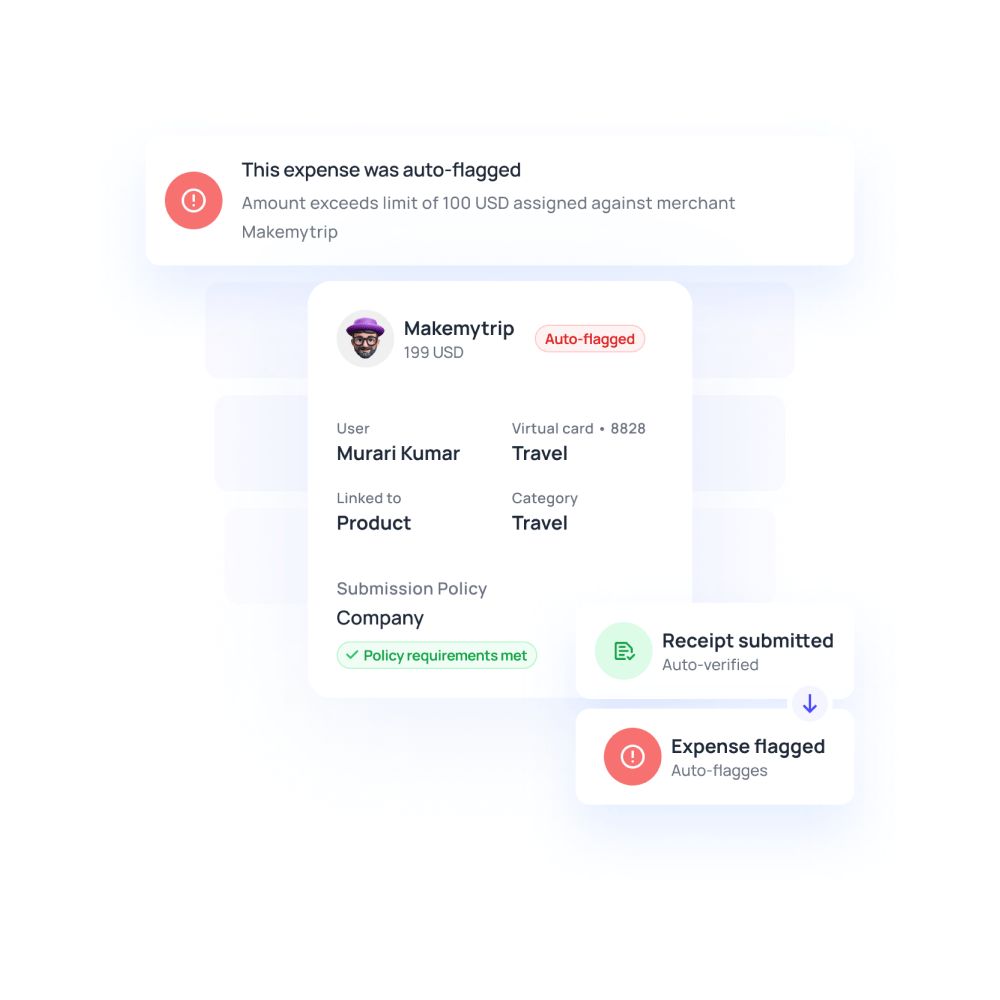

Suspicious expense claims identification

In this step, the auditor interviews the employees of the company to find out if any suspicious behaviors are presented. Questions related to dining or client dealing or small expenses incurred on the trip can help find any irregularities or doubtful expenses.

Financial record verification

This is the last step where the auditors re-evaluate and scrutinize every financial asymmetry and error accounted for. As the audit process become smoother and more stable, audits may be done a little less frequently.

Travel expense audit best practices

Audit regularly to sidestep any errors

We understand that an audit of the travel and expense process can be extremely difficult. However, you can choose to audit different numbers of employees for their company travel expenses. Generally, companies are able to finish the travel expense audit between 10% to 100% part of their company expenses. Doing a 100% review will force the department or employees who are used to committing reimbursement fraud to change their behavior because when every expense will be carefully monitored any faulty reimbursement claim is bound to come out.

Manage expenses with automation software

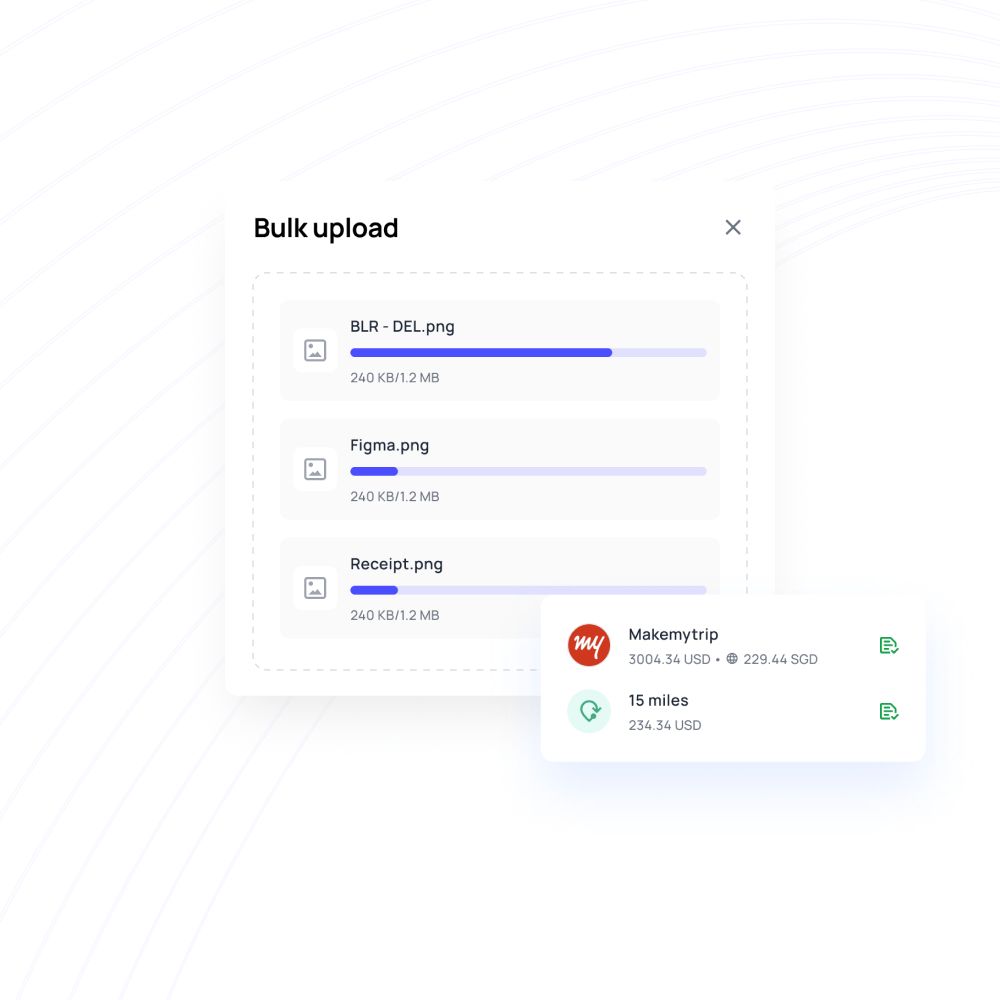

Travel-management software can potentially automate the whole system in which the employees can import the expense documentation into a streamlined system. This promotes more transparency across the whole organization, makes the process of sending reports here and there very easy without any physical movement and the workflow also improves prominently. Automated travel expense management smoothens the whole travel expense process. With this, the travel expense audits become much less complicated.

Prepare detailed travel and expense policy

Your company must have a clear and precisely documented set of travel and expense guidelines. This will also define the position of every stakeholder in the expense management process without confusion or crossovers. A precise documented business expense policy can significantly reduce the number of reimbursement frauds.

Set approval policies

It is a good practice to set up a multi-level approval process for sanctioning all the travel expenses so that if the fault is not caught at one level, but definitely in the other two levels it will be brought out.

Manage travel expense audits with Volopay

A seamless and comprehensive travel expense management software like Volopay has the potential to assist you in implementing your business expense policy rigorously throughout the organization.

We streamline the entire corporate travel expense management process of your business and make sure that all the expense reports are submitted timely, meet all the guidelines, and pass the policy checks. This will prove to be a great help to our accounting team, as they will quickly be able to reimburse all the employees.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free