Key benefits of virtual cards for employee satisfaction

A virtual card is more than just a payment method to pay your vendors—it comes with many benefits of virtual cards that extend beyond transactions. One of the most impactful advantages is the ability to invest in your company’s greatest asset: your employees. Assigning virtual corporate cards to employees shows that you care about them and are ready to go the extra mile to provide what they need.

Evidently, higher employee satisfaction leads to a better retention rate. Employees appreciate it when their company trusts them and prioritizes their comfort, even if they are working from home. And, satisfied employees not only work more productively but also help attract new business.

How can businesses leverage virtual cards for employee satisfaction?

Using virtual cards for employee satisfaction helps modern businesses enhance flexibility, improve morale, and streamline expenses. These cards offer instant access to funds while maintaining control and transparency.

By aligning financial tools with employee needs, virtual card benefits your business by creating a supportive environment that builds trust, boosts engagement, and encourages long-term retention across diverse teams.

Boost recognition and motivation

Recognizing achievements becomes more effective when rewards are immediate. Virtual cards let you issue bonuses or gifts instantly, making appreciation timely and impactful. When employees feel seen and valued, motivation rises naturally.

This simple, flexible method replaces delayed reimbursements and generic rewards, reinforcing a culture where good performance is consistently acknowledged and celebrated.

Enable hassle-free team outings

Group events often involve complicated billing and reimbursement processes. With virtual cards, you can assign a spending limit to managers or team leads, simplifying team outing payments.

This makes organizing meals, celebrations, or retreats smoother and faster. Everyone enjoys the moment instead of worrying about who paid or when reimbursements will arrive.

Support upskilling and development

Funding learning opportunities like courses, certifications, or books becomes seamless with virtual cards. You can assign personalized budgets to team members for professional growth, removing financial or approval delays.

This support shows a commitment to employee development, encouraging career advancement while improving retention. It fosters a workplace culture that values long-term employee investment.

Simplify conference and travel spend

Traveling for conferences, sales meetings, or training? Virtual cards offer employees easy access to pre-approved funds. You avoid personal payments and messy expense claims.

Real-time spend tracking keeps you in control, while employees feel trusted and supported during work-related travel. This streamlines logistics and boosts satisfaction during off-site assignments or events.

Personalized rewards and incentives

Everyone values different things some prefer gift cards, others want wellness subscriptions or dining vouchers. Virtual cards allow you to offer tailored rewards that meet individual preferences.

Unlike generic incentives, this personal approach makes your appreciation more meaningful. When employees feel their preferences are understood, satisfaction and loyalty naturally follow over time.

Fast equipment and tools access

Remote or new employees often wait weeks for essential tools or devices. Virtual cards remove those delays by enabling immediate purchases within approved limits.

Employees can buy what they need, when they need it without jumping through procurement hoops. This speeds up onboarding and productivity while reducing frustration and downtime significantly.

Transparent and trust-driven spend culture

Using virtual cards encourages open, auditable transactions and eliminates opaque reimbursement practices. With spend visibility and pre-set limits, you create a transparent environment that builds trust.

Employees know what's approved and feel confident in using their allocated funds. This clarity enhances employee satisfaction with virtual cards while maintaining financial accountability company-wide.

Empower remote and hybrid workforces

Remote and hybrid teams face unique challenges in accessing company funds. Virtual cards empower them with autonomy to manage day-to-day expenses, from coworking spaces to internet bills.

They no longer rely on centralized approvals or out-of-pocket spending. This convenience reduces friction, making distributed employees feel equally supported and trusted.

Importance of employee satisfaction for your business

When employees feel valued, they’re more engaged, proactive, and willing to take initiative leading to smoother workflows.

Reducing dissatisfaction and inefficiencies allows teams to focus on priorities and achieve more in less time.

Providing the right resources, such as virtual card benefits, equips employees to work smarter and boost daily output.

Satisfied employees are more likely to share ideas, exchange feedback, and work together on projects.

Positive relationships and mutual respect strengthen team dynamics and create a supportive environment.

Recognizing collective achievements motivates teams and encourages continued cooperation and outcomes.

Employees who feel appreciated and supported are more likely to stay with the company.

Minimizing pain points like slow reimbursements or rigid processes improves satisfaction.

Offering flexible benefits and tools builds trust, lowers turnover costs, and sustains organizational growth.

A culture built on transparency, recognition, and support fosters long-term loyalty among employees.

Investing in employee satisfaction turns company values from words into daily actions and habits.

Empowering staff with flexible tools and recognizing contributions creates a motivated workforce aligned with your mission.

Happy employees become your strongest ambassadors, sharing positive experiences both online and offline.

Positive word-of-mouth greatly strengthens your employer brand values and attracts top talent.

Clients and partners are more likely to trust and engage with a business that has a loyal, satisfied workforce.

Real-world use cases: How companies use virtual cards for employee spend

Tech startups managing SaaS and remote teams

Startups often juggle multiple SaaS subscriptions and remote team expenses. Virtual cards let you assign specific budgets to employees or tools, reducing billing confusion.

The benefits of virtual cards for employees include easier access to essential tools, streamlined approvals, and smoother operational support across global teams.

HR teams streamlining onboarding and perks

HR departments use virtual cards to provide instant perks and onboarding essentials. You can issue cards for welcome kits, training tools, or wellness allowances.

This simplifies logistics while making new hires feel valued from day one. With preset limits and easy tracking, HR teams save time and enhance the employee experience effortlessly.

Marketing teams tracking campaign spend

Marketing budgets are diverse and fast-moving. Virtual cards allow you to allocate specific budgets for ads, influencers, or design tools. Your team can execute campaigns without delays or red tape.

Real-time tracking helps prevent overspending, while employees appreciate the autonomy to make marketing decisions quickly and efficiently within pre-approved limits.

Finance teams automating vendor payments

Finance teams benefit from using virtual cards to automate vendor and subscription payments. Instead of processing multiple invoices, you assign cards with fixed budgets to each vendor.

This reduces manual work, improves accuracy, and prevents missed payments. It also enhances employee satisfaction by eliminating delays in accessing essential services or tools.

Operations teams managing recurring expenses

Operations teams handle daily recurring costs like utilities, software, or office supplies. With virtual cards, you assign and control these payments seamlessly. No more shared corporate cards or reimbursement delays.

Employees can manage tasks confidently, knowing their expenses are covered without needing multiple approvals. This creates smoother workflows and higher efficiency.

Sales teams managing travel and client entertainment

Sales teams frequently travel and entertain prospects. Virtual cards enable them to book travel, cover meals, or host clients without using personal funds. You set limits in advance, keeping costs under control while empowering quick decisions.

This flexibility helps improve employee morale, reduce friction, and significantly enhance their ability to build strong, lasting client relationships with ease and confidence.

Common spending challenges faced by growing teams

1. Slow reimbursement processes

When employees pay out of pocket, waiting weeks for reimbursements can lower morale and trust. Manual claims add unnecessary friction, especially during urgent purchases. You risk frustrating your team and creating operational delays.

Streamlining access to company funds helps avoid resentment and keeps employees focused on their work instead of expense paperwork.

2. Limited visibility into team spend

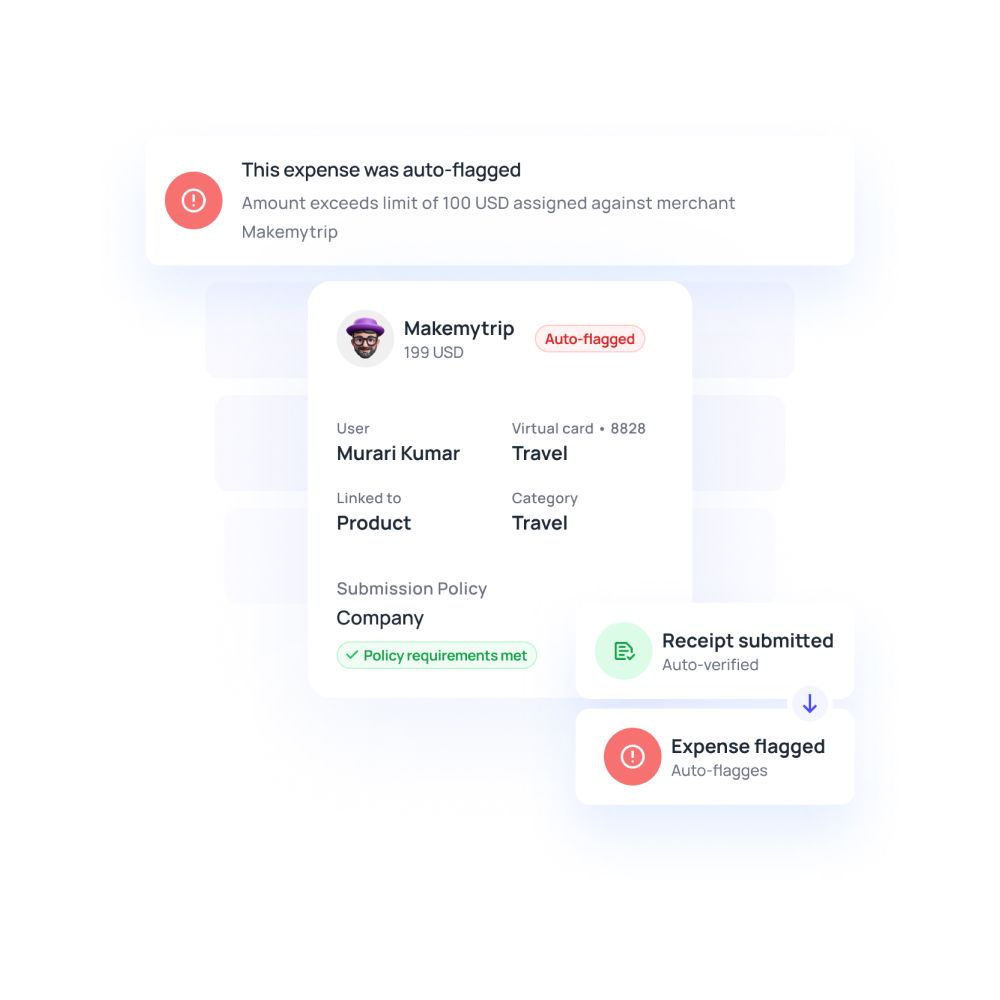

Without clear insight into who’s spending what, you face difficulties managing budgets effectively. When multiple departments make purchases, tracking becomes disjointed. You may discover overspending too late.

With limited visibility, financial planning suffers, and accountability drops. Real-time tracking ensures transparency and allows your team to stay aligned with budget expectations and goals.

3. Overspending and budget breaches

Growing teams often exceed budgets when spending isn’t monitored in real time. You may set monthly limits, but without controls in place, those limits are easily broken.

This creates financial strain and hinders forecasting. Implementing pre-set limits and usage tracking helps prevent budget breaches and encourages responsible spending habits across departments.

4. Shared corporate cards create confusion

Sharing one corporate card across multiple employees leads to messy records and accountability issues. You may struggle to match expenses with users or purposes.

It increases the risk of unauthorized use and makes reconciliation time-consuming. Assigning individual cards or spend limits eliminates confusion and allows for cleaner, more accurate reporting.

5. Approval bottlenecks and delays

When purchases require multiple approvals, you slow down everyday operations. Employees waste time chasing approvals for minor expenses, and urgent needs go unmet. This not only delays projects but also impacts morale.

By reducing layers of approval and setting spend controls, you empower teams to move faster without compromising oversight.

6. Difficulty managing remote or distributed teams

Remote teams face extra hurdles accessing funds for tools, internet, or coworking spaces. Centralized systems often leave them waiting or relying on personal expenses. This creates frustration and unequal support across locations.

Providing decentralized, controlled spending access ensures your remote workforce feels empowered and trusted, no matter where they work from.

How Volopay’s virtual cards drive employee satisfaction and smarter spending

Volopay’s virtual cards help you simplify employee spending while increasing transparency and trust. By giving teams easy access to company funds, you reduce delays and eliminate outdated reimbursement workflows. This approach supports a positive work environment, improves morale, and helps you stay in control of budgets without adding extra administrative load.

Issue instant virtual cards for every team

With Volopay, you can instantly create virtual cards for employees, departments, or specific use cases. Whether it’s onboarding, travel, or tools, each card is ready to use immediately.

No need to wait for physical cards or centralized approvals. Your teams can move faster and make decisions without administrative bottlenecks holding them back.

Empower employees with pre-approved budgets

You assign custom budgets to each virtual card, allowing your team to spend confidently within limits.

Employees don’t need to request approvals every time they need something. This autonomy builds trust and speeds up daily operations.

Meanwhile, you retain control through policy-driven settings, making spend management efficient and predictable for everyone involved.

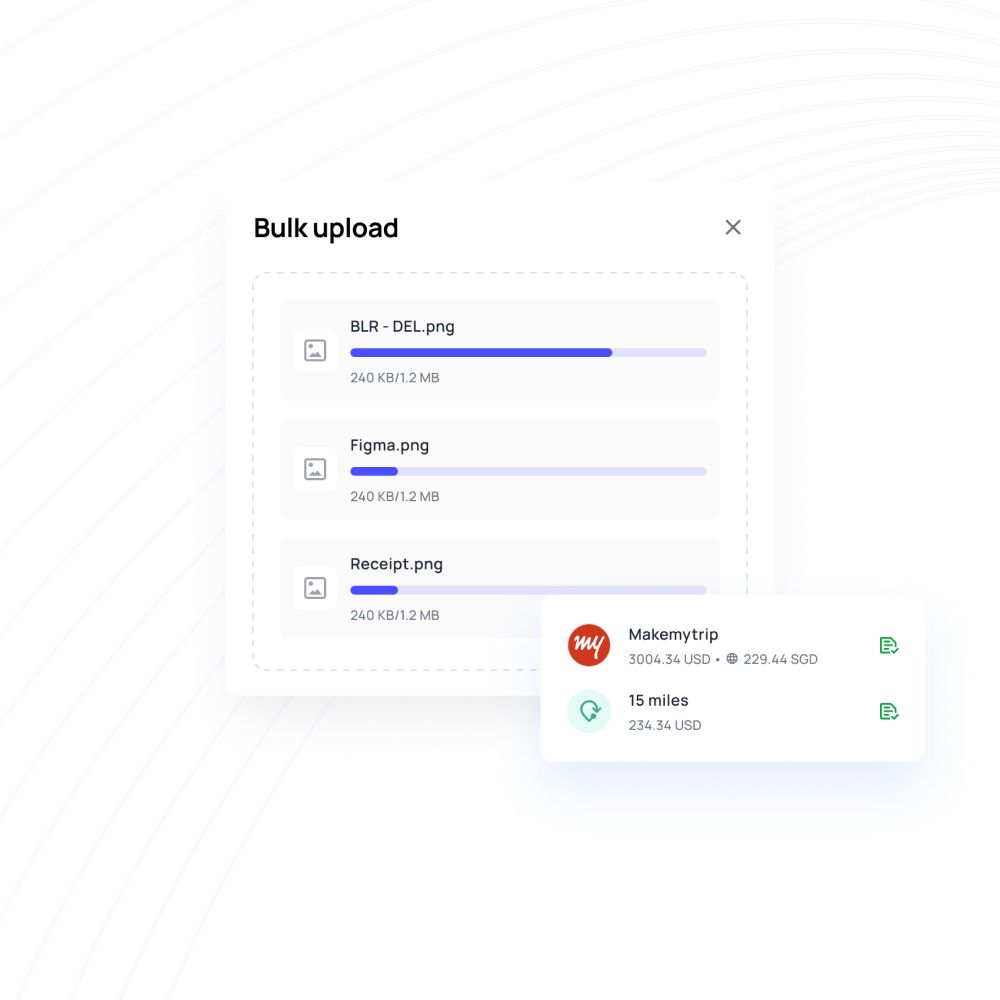

Eliminate reimbursements and delays

Volopay removes the need for employees to pay upfront and wait for reimbursements. With direct access to virtual cards, spending becomes immediate and seamless.

This eliminates delays, avoids paperwork, and reduces friction in day-to-day operations. Your employees feel supported and valued, knowing their expenses are covered without unnecessary personal financial strain.

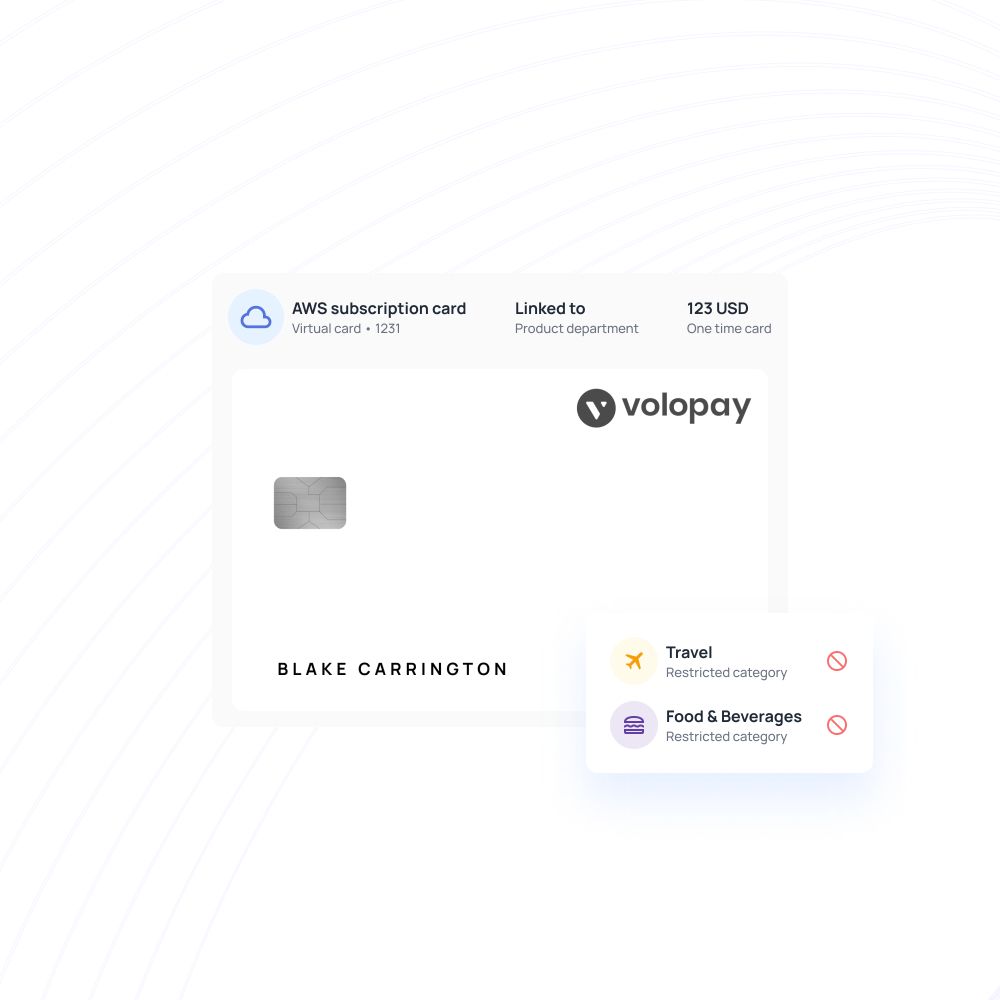

Customize spend limits for full control

Volopay lets you define spending rules by card, team, or project. You can set limits, block merchants, or restrict usage dates to prevent misuse. This customization ensures compliance without micromanaging every purchase.

As a result, your employees enjoy flexibility while you maintain clear boundaries and accountability across the organization’s financial activities.

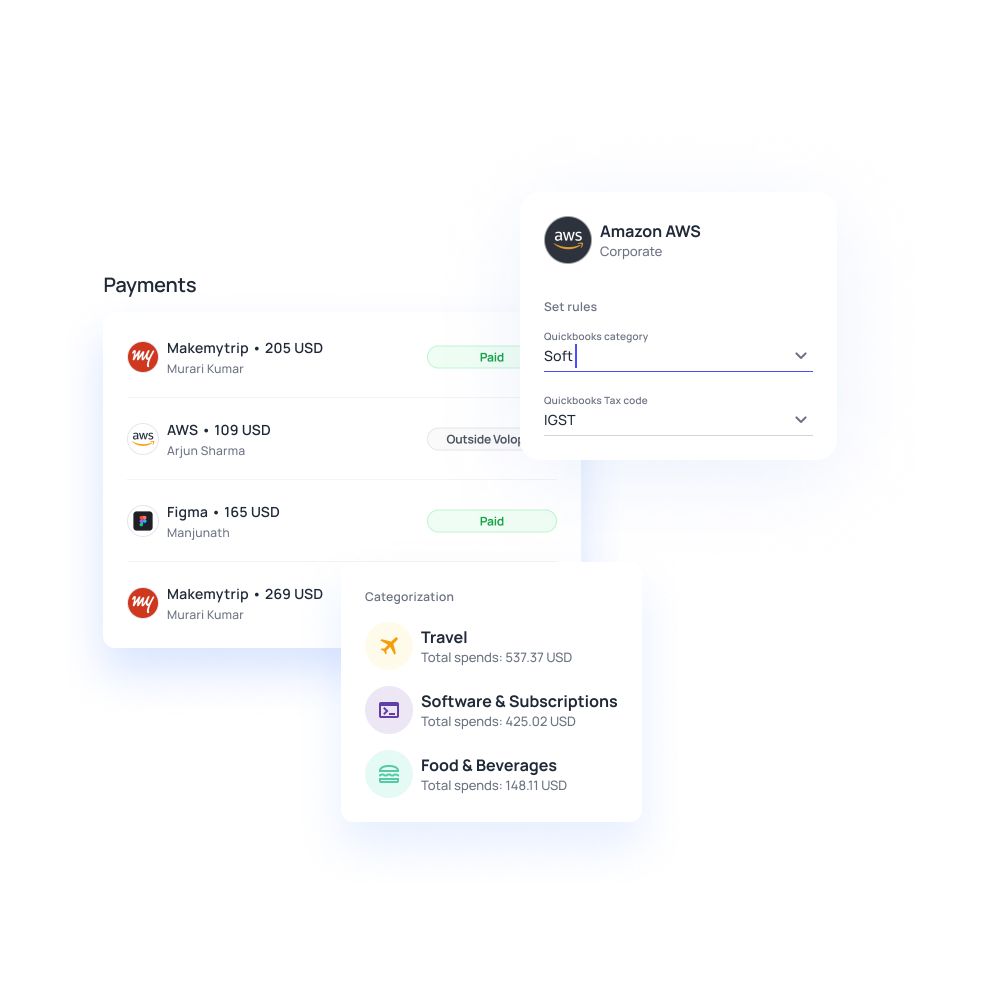

Monitor and optimize team spending in real-time

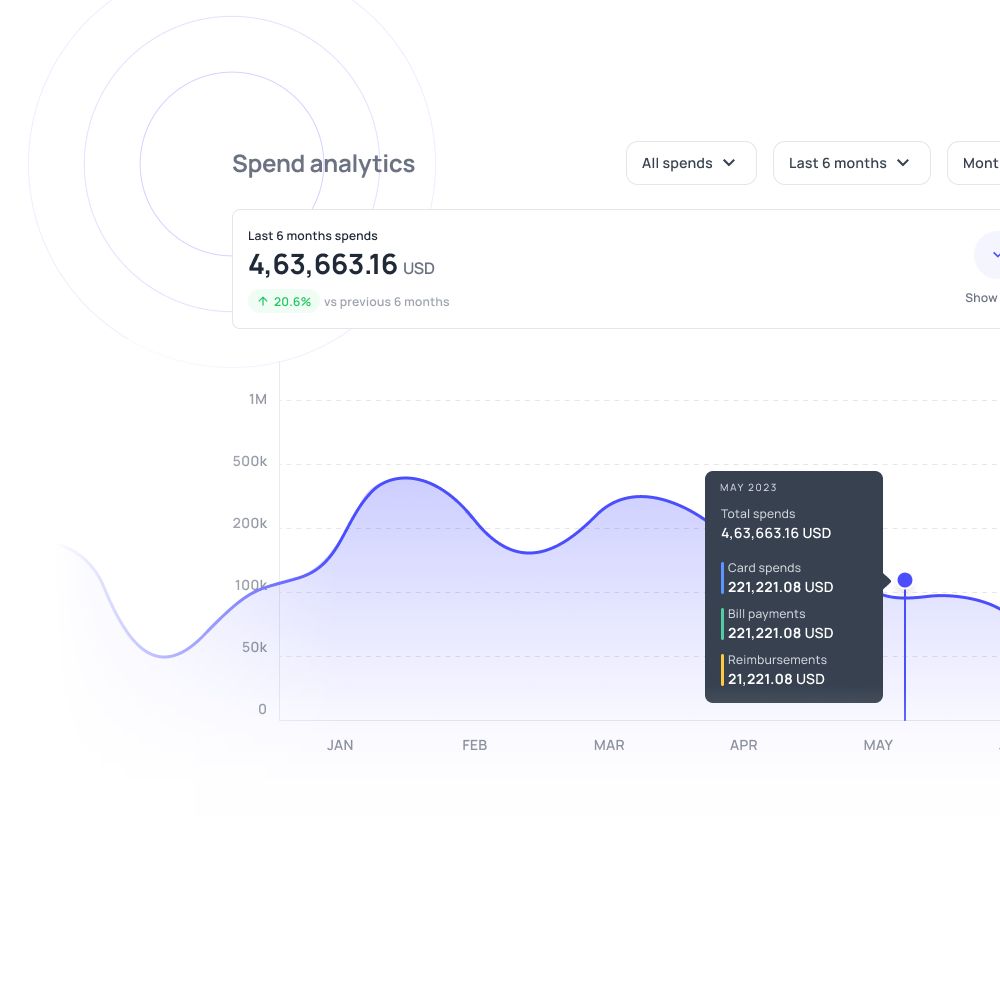

Volopay’s dashboard gives you real-time visibility into how, when, and where money is being spent. You can identify trends, spot anomalies, and adjust budgets on the fly.

This oversight ensures smarter financial decisions while eliminating the guesswork. Your teams operate with clarity, and you stay on top of expenses effortlessly.

Volopay: The all-in-one spend solution built for modern US teams

Simplify global payments with multi-currency support

Volopay lets you make cross-border payments effortlessly with built-in multi-currency support. You can have vendor payments, freelancers, or global partners without switching platforms or incurring high fees.

This flexibility supports international growth and helps your team manage overseas expenses with precision. Transactions are faster, smoother, and fully traceable for financial clarity.

Advanced security features for safer transactions

Security is at the core of every Volopay transaction. With features like role-based access, spending limits, and merchant restrictions, Volopay’s corporate cards keep you protected from misuse or fraud.

Real-time alerts and dynamic card controls give you peace of mind, so your team can spend confidently knowing every payment is secured and fully traceable.

Integrate seamlessly with your accounting stack

Volopay integrates easily with your accounting software, eliminating manual data entry and reducing errors. You can sync transactions, categorize expenses, and close books faster.

This automation streamlines financial workflows and saves valuable time for your team. With clean, real-time data flowing into your system, financial management becomes more efficient and reliable.

Trusted by finance teams at startups to enterprises.

FAQs

Yes, virtual cards are a great tool for employee engagement programs. You can use them to instantly issue rewards, perks, or bonuses, making recognition more personal, timely, and impactful.

Absolutely. You can assign spending limits, restrict merchant categories, or set expiration dates. These controls help manage budgets effectively while allowing employees to spend within clearly defined parameters.

Yes, Volopay lets you tailor virtual cards to each employee's role or needs. You can set unique budgets, controls, and usage rules to align with their specific responsibilities or projects.