How do virtual cards help in subscription management?

With the explosion of web-based, SaaS subscriptions in the cybersphere, companies now have more online subscriptions than ever before – utilizing tools to maximize profitability, but it doesn’t always end in their best interest.

By giving your employees the accessibility to create their own departmental or team tech stack using business credit cards, you risk paying for SaaS subscriptions your company doesn’t need, without knowing who the billing owner is. Using a corporate virtual card can help mitigate this issue, offering better control over subscriptions and ensuring transparency in recurring billing.

What are virtual cards payments?

In short, virtual card payments are any kind of payment made using a 16-digit card number without needing the physical form of a payment token. The transaction happens entirely digitally from one account to another. Unlike physical card payments, which are payments made from one account to another that still require a tangible card to make, virtual card payments are cardless.

All you need is a device like your computer, tablet, or mobile phone that can generate your virtual card details. This includes your 16-digit card number, CVV, as well as the card expiry date. When you have these details on hand, you can make online payments using your virtual cards in a similar way you would with a physical card.

Manage subscriptions with virtual cards

Managing SaaS subscriptions the ol’ business credit card way is challenging, to say the least. Not only is it hard to track recurring payments and know exactly what you are being charged for, but it is also nerve-wracking to not know when you have to renew or upgrade your subscription; or worse, not know when to cancel your free trial before you end up paying for it!

On top of not knowing who authorized which subscription when using credit cards, you also risk losing your company’s monetary resources in case the SaaS software company you have subscribed to experiences a big data breach. For efficient and secure recurring billing management, Volopay virtual cards for subscriptions are the best course of action for you.

How do virtual cards help in subscription management?

Card data security

You would be sharing your card information with multiple subscription providers if you use one corporate card for all your online subscriptions. A security concern that comes with this practice is that your card information could get stolen. You could run into fraud attempts that will compromise your card. While most online payment portals are likely to be safe, there’s still a small risk of data breaches.

Late payments

The more online subscriptions you have, the more difficult it gets to track everything. You run into the risk of missing or making late payments. Most subscription services do automatic recurring payments, but there’s still the risk of declined card payments. When you pay many subscriptions using just one card, it can be difficult to track which of the payments have yet to go through.

Sharing one card

One of the biggest risks that come with sharing one company card across multiple subscriptions is that in the unfortunate event that your card gets compromised, all your subscriptions will have to be paused until you get it sorted out. A situation like that will undoubtedly throw your business into disarray.

However, separate virtual cards for HR teams, AP teams, sales teams and others can solve this problem. Virtual cards can be generated instantaneously and you can assign one card for one subscription. If one card gets compromised, the rest of your subscriptions won’t be affected.

Overdue free trials

Using a virtual card for subscriptions can help you manage your free trials. The last thing that you want is to get charged for free trials that have ended but you have no intentions of continuing the subscription. When you use one physical corporate card, you might end up forgetting to cancel your subscription and having a bill automatically charged to your card. Virtual cards eliminate the risk, as you not only can track your subscriptions better, but you can also set an expiry date on your cards so you won’t have to worry about canceling your subscriptions manually.

Are you tired of losing track of your subscriptions and renewing them?

Why should you switch to virtual cards to manage all your online subscriptions?

Eliminate unnecessary spend

How many times has your finance department seemed frazzled because they just couldn’t keep up with the duplicate or similar SaaS subscriptions that your teams subscribe to? When your company is paying for Asana and Slack at the team level instead of getting a huge discount by simply subscribing to one of them at an enterprise level, only then do you get the full picture!

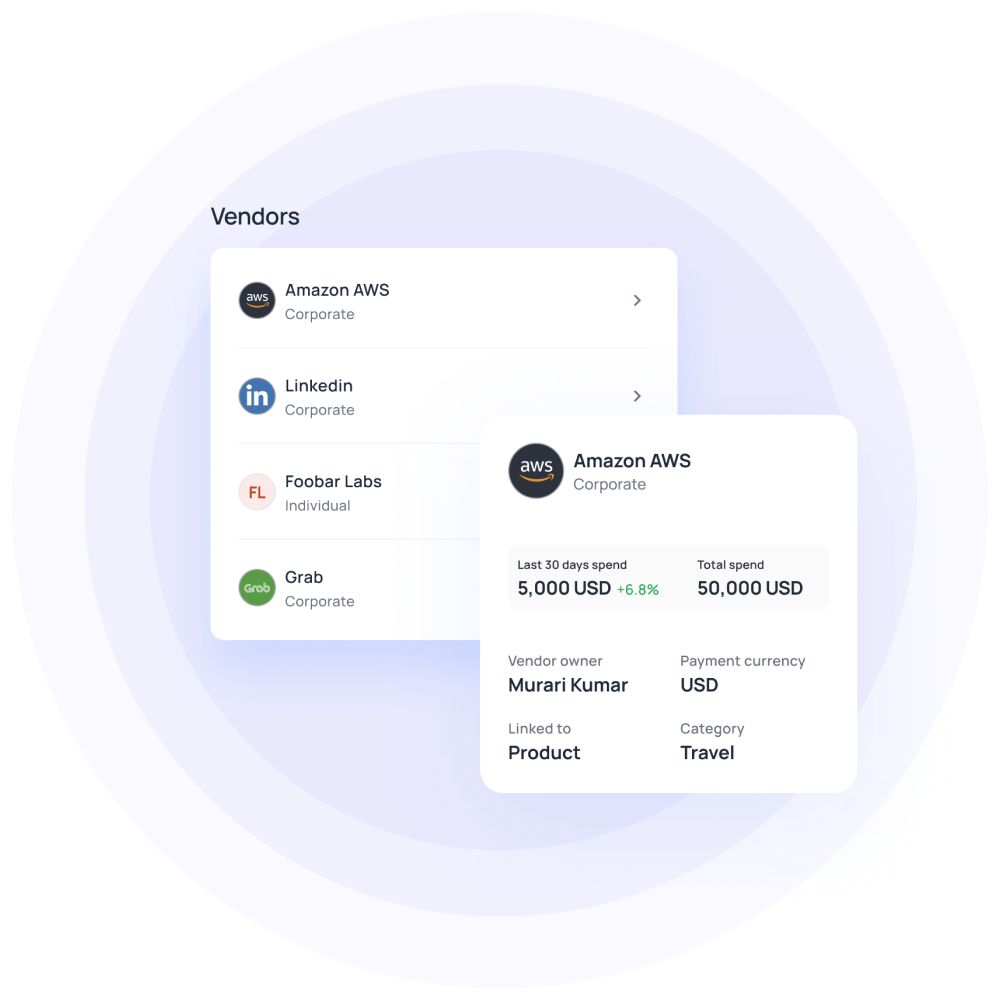

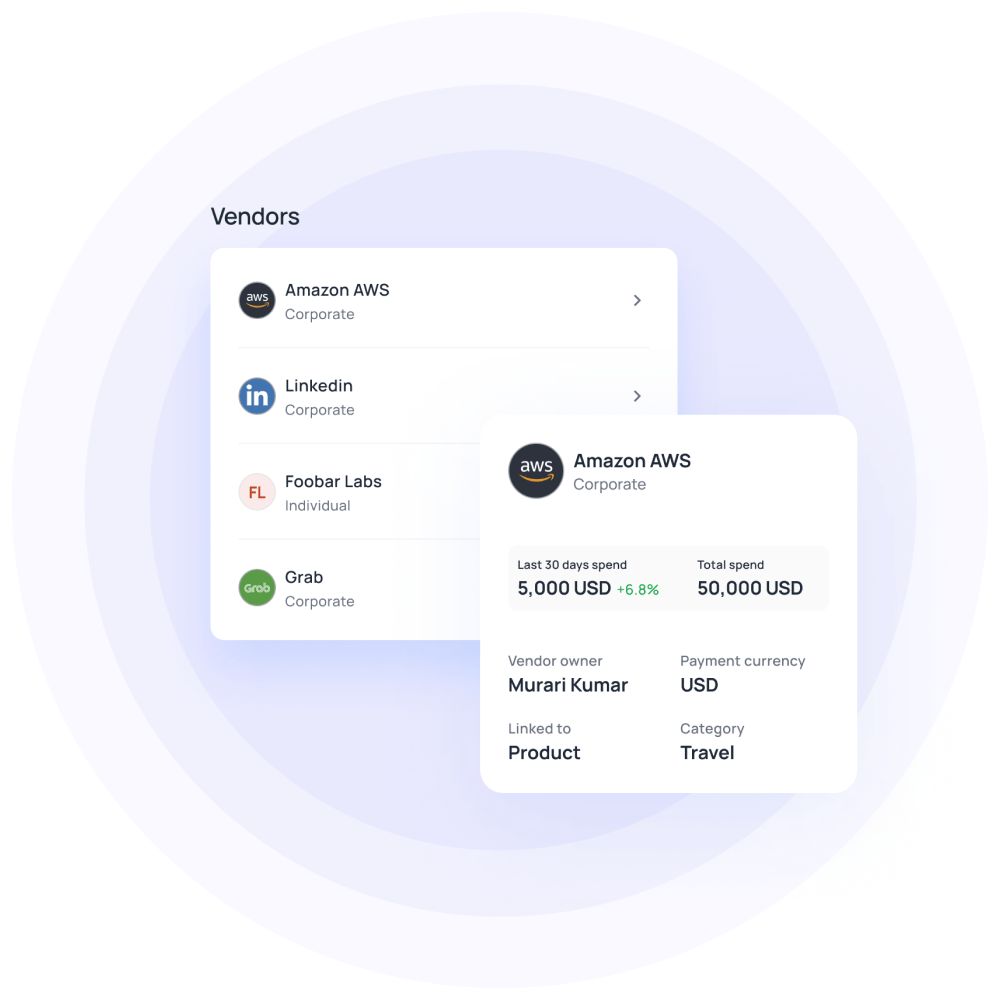

Volopay empowers your finance team with a transparent view of all your SaaS subscriptions so you can track recurring payments from the get-go, not just at the end of the month. Find out common subscriptions between different departments’ tech stacks and weed out the unnecessary spending effortlessly.

Save hours every month

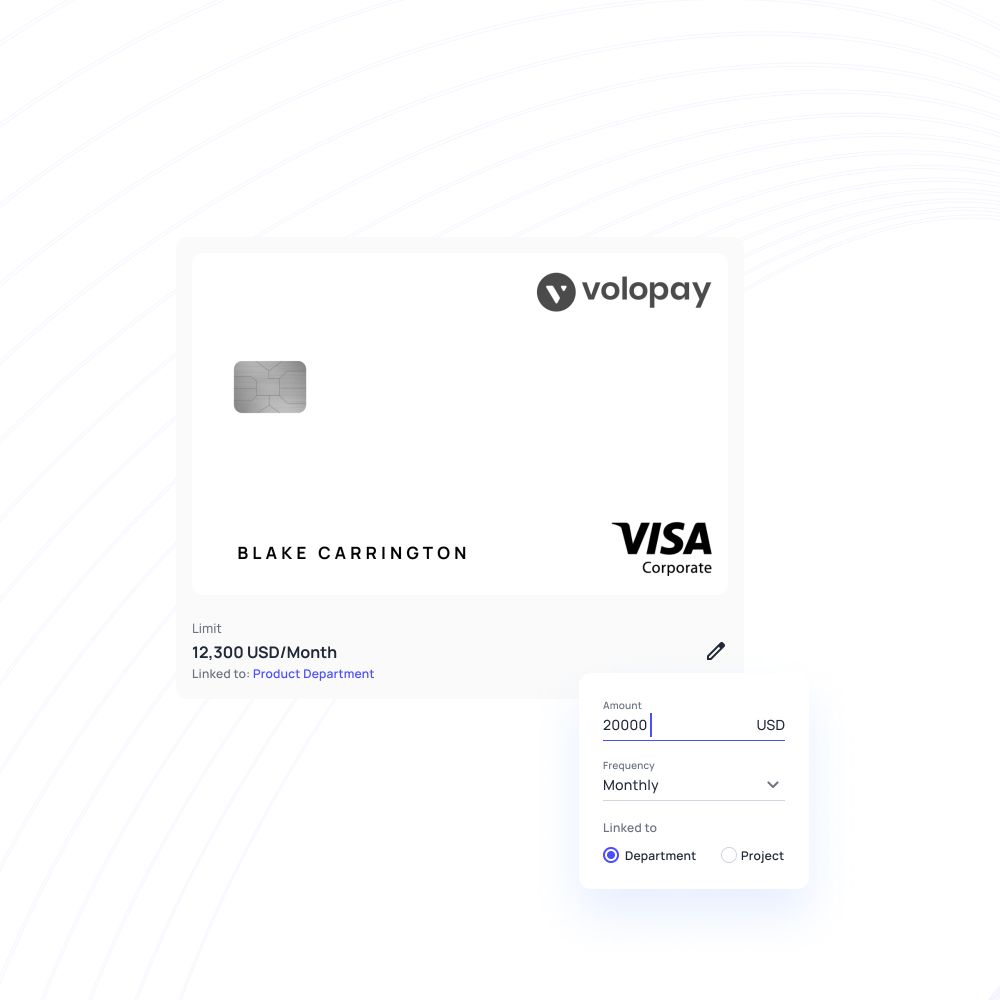

Does your business calendar look like a total mess, with more subscription renewal, upgrade, and cancellation reminders than actual revenue-generating meetings? Manually paying for subscriptions is a chore, but not anymore! With Volopay virtual VISA cards, you can set autopay features for recurring subscriptions.

Just load your virtual card with a balance and set the recurring amount with the expiration date. The card will automatically update itself with the set amount at the start of each month, ready for auto-renewal! This can shave valuable time off of your finance department which they previously had to reserve for this mundane task. Also, say goodbye to late fees forever!

Easy to cancel one vendor without affecting all other payments

When you are using the same credit card for marketing, sales, and tech SaaS subscriptions, it is almost impossible for you to set a budget and calculate your expenses, unless you use yet another recurring bill tracker. What’s more, if your card’s security is compromised (either due to fraud or a software data leak), you will have to block your card to save yourself from theft, but that also means you’ll risk your other subscriptions by taking away the payment source card.

Volopay lets you create unlimited (yep, you read it right!) virtual VISA cards with their unique 16-digit number and CVV, backed by VISA’s unmatched security features. Not only are our safety features reliable, but in case of fraud or a SaaS company’s data breach, you can simply freeze or block your card. Since Volopay virtual cards for subscriptions are pre-loaded and therefore do not have direct access to your business account, your resources are 100% safe under all circumstances.

Control over payments

We understand that sometimes automation might feel like putting things in motion over which you might end up losing control. But with Volopay virtual card, it is exactly the opposite. With

Volopay, you not only get the freedom to set and track recurring payments, but you also get access to a live dashboard, with real-time insights into your virtual card spending.

Also, Volopay helps you assign cards to particular employees, access their spending habits, and get a true picture of every dollar that leaves your company.

Our user-friendly UI provides quick access into your virtual cards repository, and customize and edit (and even freeze or block) according to the company’s needs at the very moment. With Volopay, you can rest easy knowing that you are in the driver’s seat, with scalable subscription management software right by your side!

How do virtual cards make subscription payments easier to manage?

Want a free trial period but do not want to share your sensitive business credit card details? Volopay provides virtual cards for subscriptions - both recurring and one-time! Create a single-use burner card for a one-time payment or for a trial period and recurring cards for subscriptions that your team loves using!

Empower your finance team and managers with a company-wide transparent view of all virtual cards. Your team gets an overview of the card along with other crucial information such as card owner details, type of card (one-time or recurring), pre-loaded funds and how much of it has been used, etc.

Never estimate your vendor spend ever again. With Volopay, you can make unlimited virtual cards for all your SaaS subscriptions across different revenue channels and company-wide organization systems such as Ahrefs, LinkedIn sales navigator, Facebook ads for Sales and MarTech, and Slack, Dropbox, Asana for project management and organization.

Worried about fraud or privacy breaches? Simply block or freeze your Volopay virtual VISA card and isolate the incident to just one card and one vendor. Your other funds are safeguarded, thanks to virtual cards!

No more subscription silos! Volopay brings all your departmental subscriptions onto one live dashboard with a clear view across all your SaaS tools. Track all recurring payments and subscriptions in one place. Create unlimited virtual cards, pause and cancel as necessary.

Don’t you just hate it when other applications give you notifications about SaaS expiring due to nonpayment after it expires? That’s not the case with Volopay. Get advance notification about insufficient funds for recurring subscriptions so that your work doesn’t have to suffer!

Why choose Volopay?

Volopay virtual cards can manage all the SaaS subscriptions with subscription management software that saves them time and makes them money through unbelievable cashback opportunities! Enjoy the fastest way to pay online, with Volopay.

FAQs

There are many benefits of virtual cards. For businesses, you can manage your vendor payments and subscriptions easily. Each vendor or subscription can be assigned a separate card. This helps ensure that every payment is made on time. Plus, you don't run into the risk of losing your card or any security breaches from sharing your card information. If your card is compromised, using a virtual card for subscriptions also means that you can easily freeze and void your card.

Yes. You can set up your virtual cards for recurring payments when you generate them. You can also set a recurring monthly limit, meaning that your limit each month can be refreshed to ensure that you can make all your recurring payments while staying within the card limit.

All virtual cards are customizable! Simply visit the virtual card of your choice, increase or decrease the monthly recurring fund limit.

No, a card once created in a team member’s name cannot be transferred to another.

In case your virtual card has a security and fraud threat, you can simply freeze the card to stop any unauthorized payment until further inspection. Or you can also block the card permanently.

You can set any expiry date on Volopay virtual cards yourself, unlike other business credit cards that come with a predetermined expiration date.

Trusted by finance teams at startups to enterprises.