How to choose the right corporate credit card for your business?

With the help of corporate cards, companies have scaled up their business operations and established company-wide expense control. Apart from being the first choice of large corporates, corporate business cards have also created a firm grip on small businesses allowing them to lower their operational costs and maintain adequate working capital.

But, as you compare business credit cards segment, one can find many alternatives catering to a specific niche. Owing to this, companies choose between high price, high-performance cards, or low cost, low performance.

Finding a corporate card that addresses your expense management needs, delivers boosted results, offers highly functional features, all while being economical, is what stands out to companies.

What is a corporate credit card?

A corporate credit card is a specialized financial tool designed to help manage and streamline company expenses. Unlike personal credit cards, which are linked to the credit history of an individual, corporate cards for business expense are tailored specifically for organizational needs. They have numerous features that help companies maintain financial control, making accounting procedures simpler.

They have numerous features that help businesses track expenses and maintain financial control, making accounting procedures simpler.

Apart from benefits like detailed reporting and integration into expense management systems, they help businesses track expenses, maintain financial control, and simplify accounting processes.

A corporate credit card program for small business needs gives a business a definite glance at spending patterns and aids in cost control, empowering its budget management and scaling capabilities.

How do corporate credit cards benefit your business?

Corporate credit cards are valuable tools for businesses, offering numerous advantages beyond simple payment facilitation. They help streamline financial processes, provide better control over spending, and offer additional benefits that can enhance overall business operations.

Here are some of the key ways corporate credit cards can benefit your business.

Simplified expense management

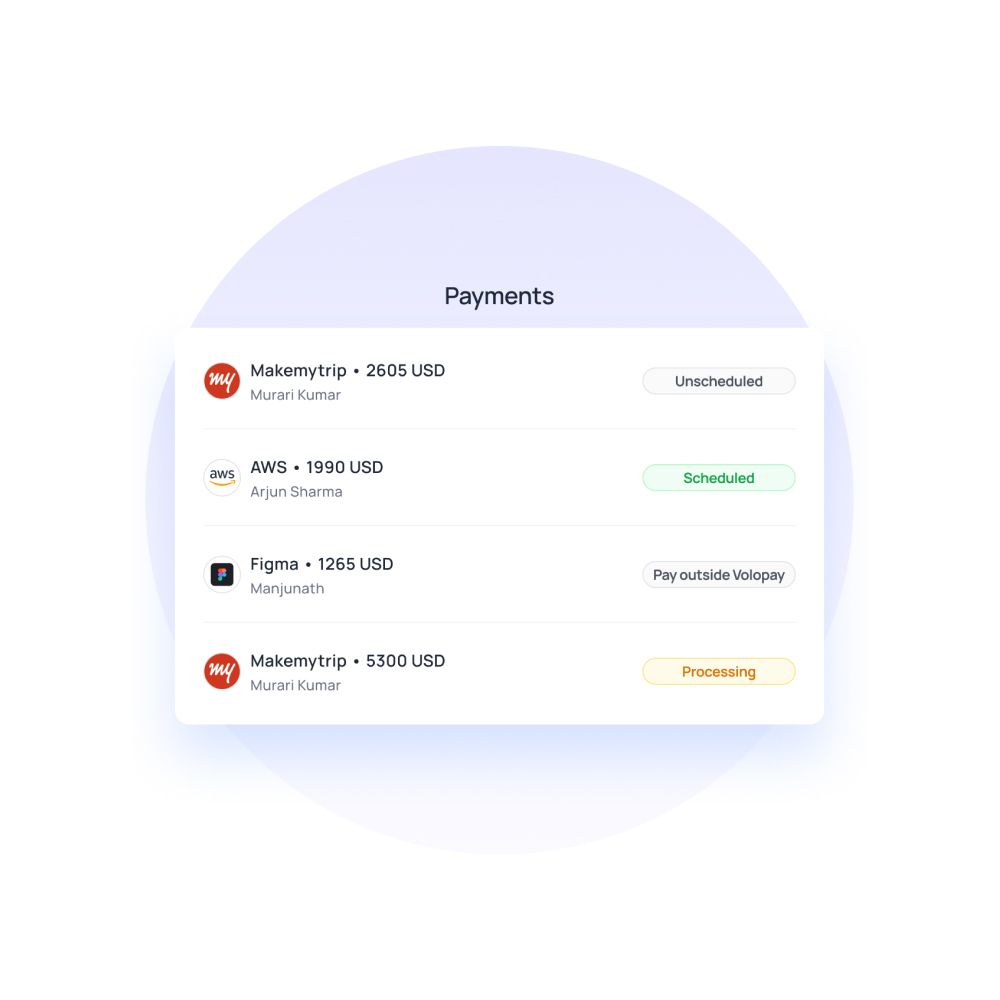

Corporate credit cards simplify expense management by consolidating all company expenses into one centralized system.

This centralization makes it easier to track and monitor spending across various different departments and employees.

Automatic expense tracking and detailed transaction reports greatly reduce manual data entry, helping maintain and reliable financial records.

By streamlining these processes, businesses can manage budgets more efficiently and control costs, enhancing overall financial management and operational efficiency.

Improved visibility and control

Corporate credit cards provide businesses with significantly improved visibility and control over financial activities.

Real-time transaction tracking allows companies to effectively monitor expenses as they occur, offering a clear and comprehensive overview of overall spending.

This transparency helps identify spending patterns, spot anomalies, and make informed financial decisions.

Enhanced visibility and control over finances ultimately lead to better financial management, supporting long-term strategic planning and operational efficiency.

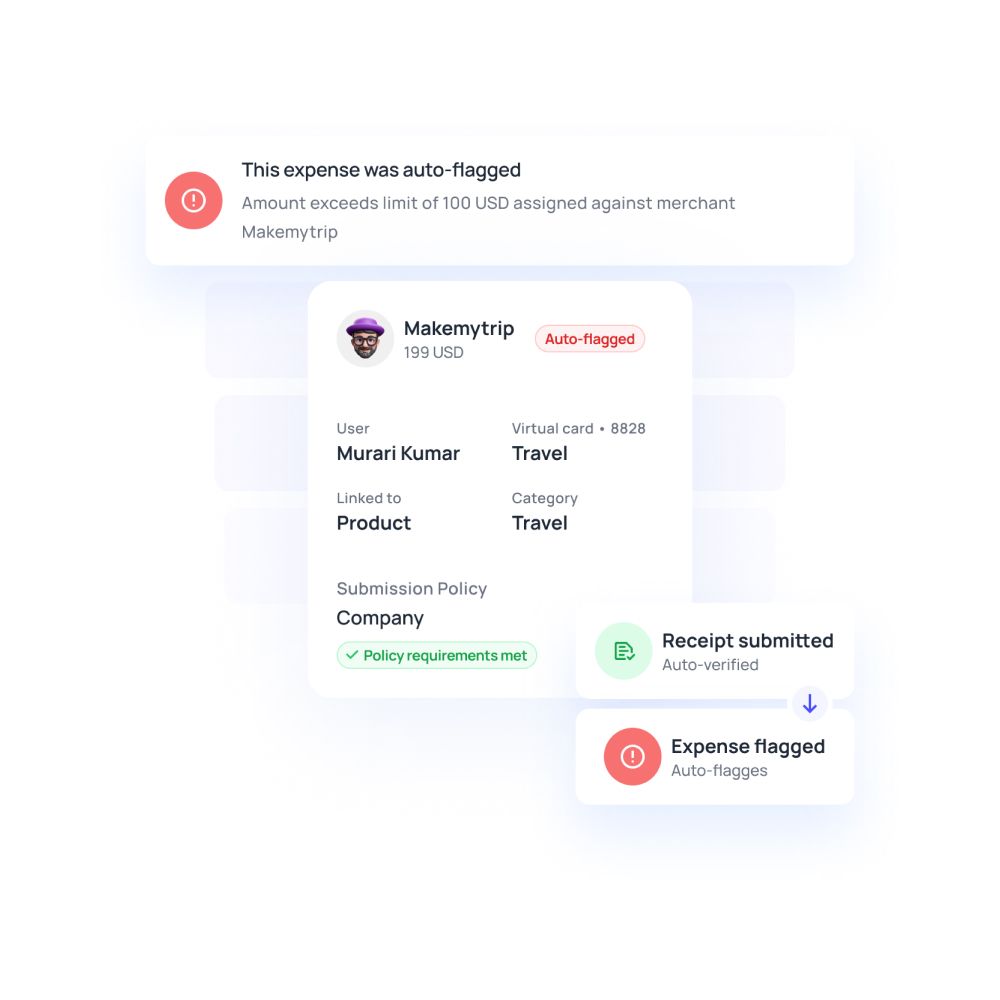

Reduced expense fraud

Corporate credit cards come with enhanced security features such as fraud detection and zero liability for unauthorized transactions.

These features significantly reduce the risk of expense fraud, protecting the company from potential financial losses.

By assigning specific spending limits and tracking transactions, businesses can better control employee spending and prevent misuse of corporate cards by employees, including unauthorized purchases.

This level of control and security ensures that company funds are used appropriately and helps maintain financial integrity.

Maximized rewards and benefits

Many corporate credit cards offer rewards programs that provide significant value to businesses.

Whether it's cashback, travel miles, or points redeemable for products and services, these rewards can offset some of the costs associated with business expenses.

Additionally, other benefits such as discounts with specific vendors or partners can lead to further savings.

These rewards and benefits make the card a cost-effective financial tool, enhancing the overall value for the company.

Enhanced employee experience

Issuing corporate credit cards to employees enhances their experience by simplifying the process of managing business expenses.

Employees no longer need to use personal funds and wait for reimbursements, as expenses can be charged directly to the corporate card.

This convenience increases job satisfaction and makes it easier for employees to handle business-related purchases.

Streamlined expense management also saves time and reduces administrative burdens for both employees and the company.

Streamlined recordkeeping

Corporate credit cards facilitate streamlined recordkeeping by providing detailed monthly statements and transaction summaries.

This documentation simplifies the accounting process, making it easier to categorize expenses and prepare financial reports.

Accurate and organized recordkeeping helps ensure compliance with tax regulations and can be invaluable during audits.

By automating and centralizing expense records, businesses can maintain financial accuracy and efficiency, supporting better financial management and planning.

Perfect corporate card solution for your business!

Factors to consider when choosing a corporate card for your business

Choosing the right corporate credit card for small business involves careful consideration of various factors to ensure it meets your company's needs. A corporate card is much more than a way of making payments; it can provide valuable features and benefits that help streamline operations and enhance financial control.

Here are the key factors to consider in choosing the corporate card for your business.

Understanding your business needs

Start by assessing your business’s specific needs.

Consider the nature of your expenses, whether they are primarily related to travel, office supplies, or other operational costs.

Determine if you require multiple cards for different employees or departments.

Understanding these needs will help you identify the most relevant card features, ensuring the chosen card aligns with your business operations and financial goals.

Evaluating spending patterns

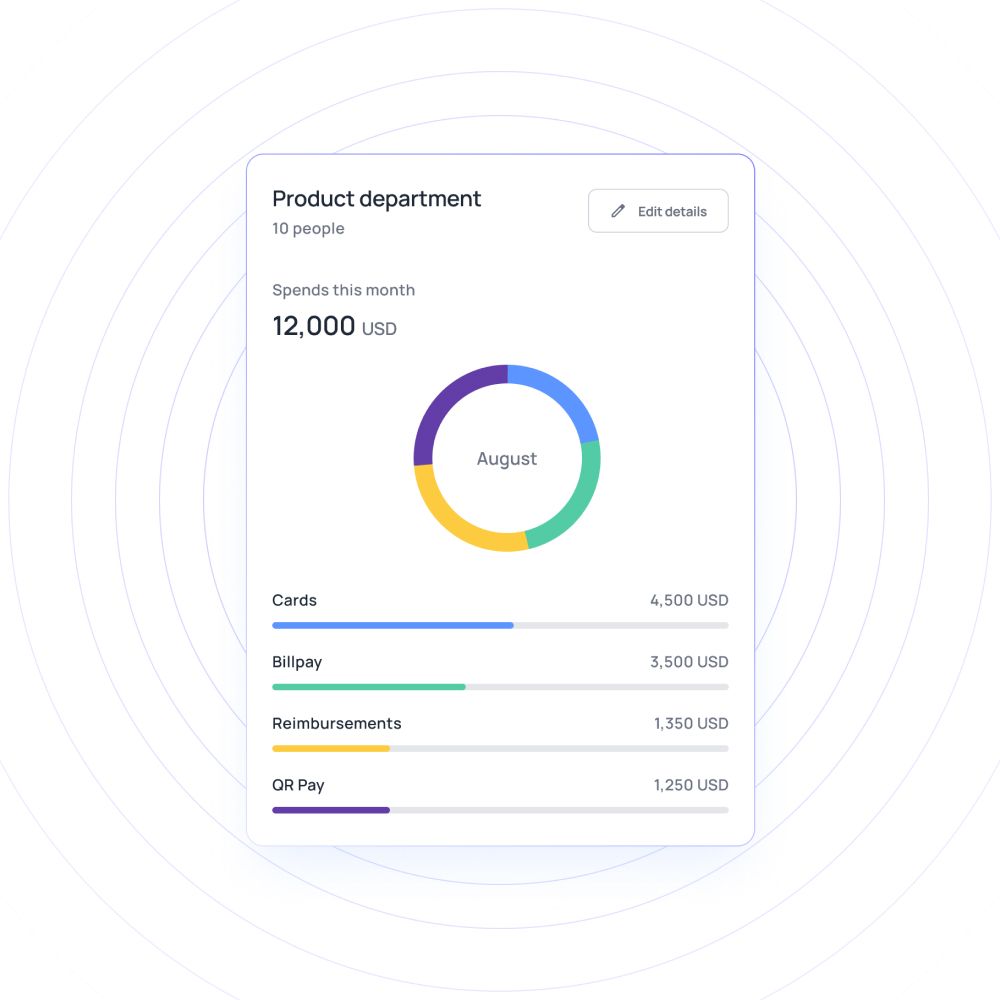

Understanding your company's spending patterns is a major step toward selecting the appropriate corporate card.

Go through your past expenses and see where most of your spending occurs.

This can help you decide on a card that gives rewards in those areas, be it travel, dining, or office supplies.

You can get maximum value by aligning the reward structure of the card with your expenditure pattern.

Comparing rewards programs

Corporate cards often come with various rewards programs, such as cashback, points, or travel miles.

Compare these programs to see which one offers the most benefits for your business.

Consider how easy it is to redeem rewards and if they apply to your company's needs.

A good rewards program can provide significant overall value, helping to offset the cost of using the card and providing additional valuable perks for your business.

Assessing travel benefits

If your business involves frequent travel, it's essential to evaluate the travel benefits offered by the corporate card.

Look for features like travel insurance, airport lounge access, and rewards for travel-related expenses.

These additional benefits can provide convenience and cost savings, making travel more comfortable for your employees and reducing overall travel expenses.

Prioritizing security features

Security should be a top priority when choosing a corporate card.

Ensure the card offers robust security features, such as fraud detection, zero liability for unauthorized transactions, and secure online transaction protocols.

These features protect your company’s finances and provide peace of mind, knowing that your business is safeguarded against potential security threats.

Integration with expense management

Analyzing your company’s spending patterns is crucial in selecting the right corporate card.

Look carefully at your past expenses to identify where the majority of your spending typically occurs.

In order to do this, your card must integrate with an expense management system that provides the necessary tools to recognize, analyze, and take actionable steps based on spending patterns to manage expenses.

Reviewing annual fees and interest rates

Reviewing the costs associated with a corporate card, including annual fees and interest rates, is essential.

Compare these costs against the card's benefits to determine if it provides good value.

Some cards may have higher fees but offer superior rewards or benefits that justify the price.

Understanding the fee structure ensures you select a card that fits your budget and offers a good return on investment. This evaluation helps in making a cost-effective choice.

Dedicated customer support

Access to dedicated customer support is invaluable, especially when issues or questions arise.

Look for a corporate card provider that offers responsive and expert customer service.

Whether it's resolving a dispute, handling a lost card, or answering billing questions, reliable support can save time and reduce frustration.

Excellent customer support ensures that problems are swiftly and efficiently addressed, allowing your business to operate smoothly without any major disruptions.

Exploring additional cardholder benefits

Many corporate cards offer additional benefits beyond standard rewards and features.

These can include concierge services, purchase protection, extended warranties, and more. Evaluate these extra perks to see if they align with your business needs.

These benefits can enhance the overall value of the card, providing added convenience and protection for your company and its employees.

By leveraging these extra features, you can maximize the card's utility and support your business operations effectively.

Features to look for in corporate credit card

Choosing the right corporate credit card goes a long way in managing your business expenses the right way. It is a thoughtless perception that opting for an expensive company card will vanish your unnecessary spending.

In the bottom line, it increases your opportunity cost and leads to poor outcome quality. Additionally, before choosing a corporate card program, companies need to understand their requirements from the selected card. Blindly going for a card without a clear picture in mind will increase your costs unnecessarily.

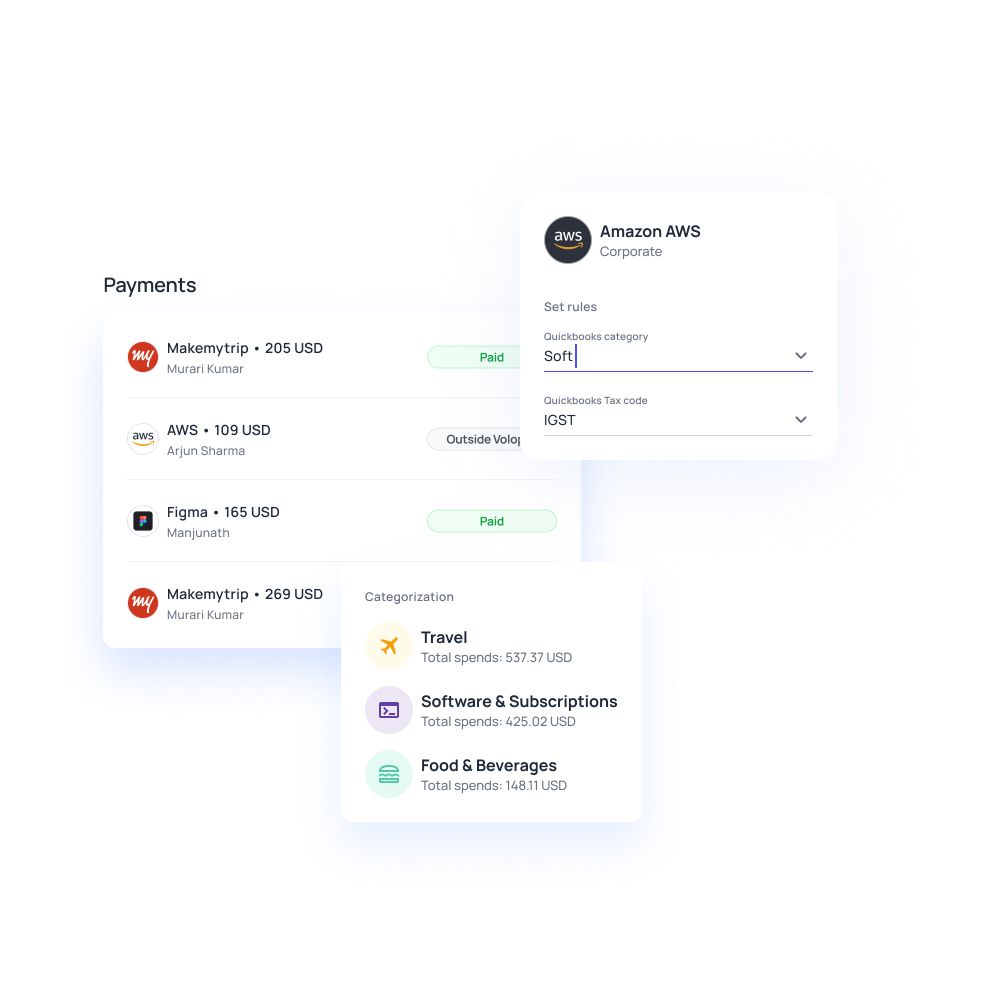

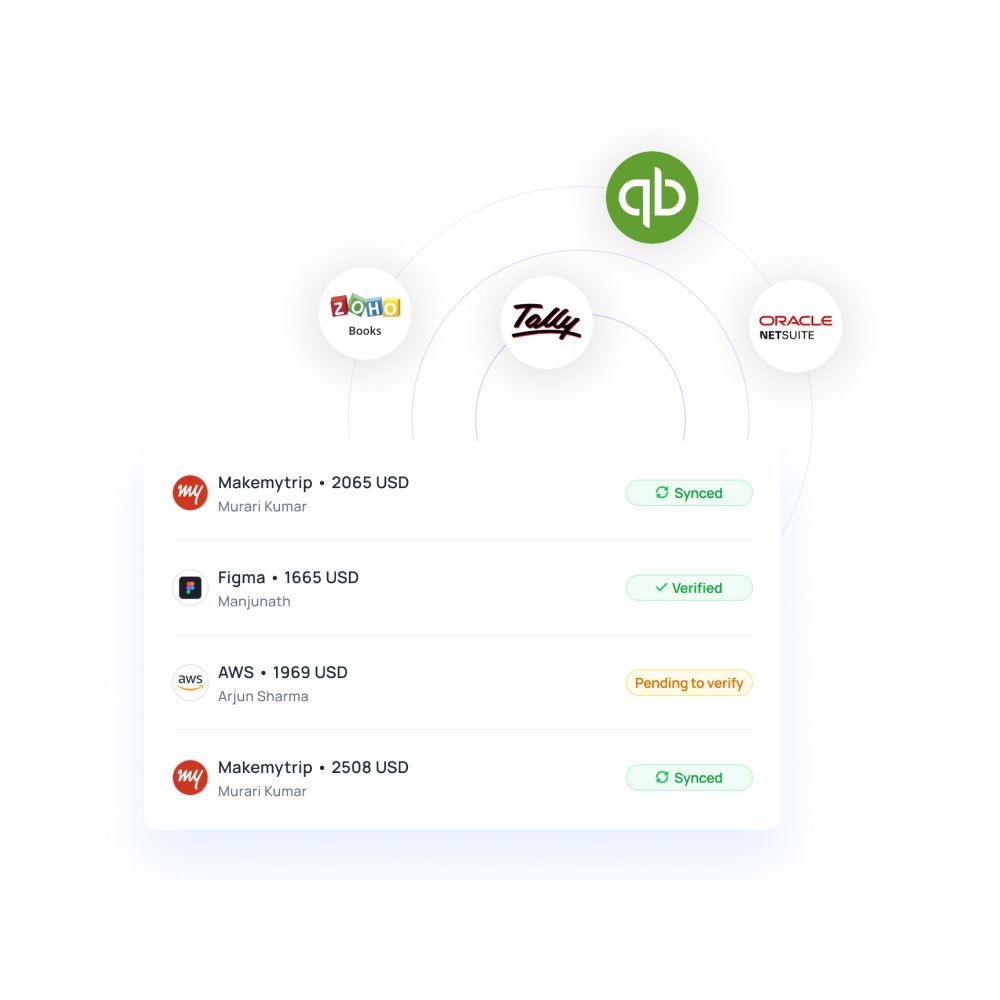

1. Bookkeeping integration

Accounting for corporate cards is necessary to understand your gross spending on each card and map out the expense categories. Through the help of these insights, companies understand the spending patterns of the employees and adopt corporate credit card policies based on these insights.

Therefore, it's required for these expense management cards to seamlessly integrate with the accounting software to provide an analytical overview of the company's expenses.

2. Spending limit

Corporate credit cards are enabled with in-built spending limits. These limits ensure the card owner does not exceed the spending limit to keep their expenses under control and within the budget of their spending.

However, if your corporate credit card issuer considers the owner's credit score before issuing you the cards, you know it's not an ideal card for you. As your corporate credit card limit and usability should not impact the owner's credit rating any point of a given time.

3. No founder's guarantee

Corporate business card is supposed to be free from the founder's deposit and mortgage of assets. Because the corporate business card is not a loan for a business.

It works like any other credit card, where you use the card whenever required and pay it back on the due date. Moreover, a corporate credit card is not an individual term; the card is created explicitly for corporates. A single person's validation might not be practical for fraud-check or authentication.

4. Usable rewards

Corporate cards that offer rewards in the form of cashbacks, vouchers, discounts on SaaS platforms, and other benefits are bound to help your business grow.

These rewards can assist in saving money by availing SaaS subscriptions at a discounted rate. Companies either receive free subscriptions for a period of time, or the highest-rated plan is available at a concession price.

5. Real time visibility

Corporate card issuers claim they offer real-time visibility, but the actual reflecting time is an hour or even more.

Through real-time visibility, your expenses are reflected and could be easily monitored via the app, which could be managed for better spending through these expense management tools. But, with delayed visibility, impromptu actions cannot be taken on the transactions.

6. Comprehensive travel benefits

Corporate credit cards frequently offer travel benefits like complimentary travel insurance, airport lounge access, and travel rewards. These are pretty useful features for businesses with frequent travelers and help in saving on convenience and expenses.

Corporate credit cards can be very useful to travelling employees, as they help employees stay within budget during their trips, promoting responsible spending behavior. With such features, corporate credit cards facilitate smoother travel arrangements and reduce costs for companies involved in frequent business travels.

7. Enhanced security features

Security in corporate credit cards is crucial. Seek features such as fraud detection, zero liability for unauthorized transactions, and secure online transaction protocols. These are critical steps if you want to protect your company's finances from potential threats.

Enhanced security features ensure that your business’s financial information remains safe and secure, providing peace of mind and reliable protection against fraud. This way you can seamlessly manage your business finances without constantly worrying about them.

8. Integration with expense management systems

A crucial feature of corporate credit cards is their seamless integration with expense management systems. This functionality enables automatic tracking, reporting, and reconciliation of expenses, significantly reducing administrative workload. By automating these processes, businesses can maintain accurate financial records and improve oversight.

This integration ensures that all expenses are easily tracked and accounted for, enhancing efficiency and providing a clear view of company spending, which is essential for effective financial management.

9. Exclusive vendor discounts

Corporate credit cards often provide exclusive discounts with select vendors, offering businesses significant savings on a range of services and products. These discounts can be particularly valuable, as they help reduce overall costs and enhance the company's bottom line.

Over time, the cumulative savings from these discounts can be substantial, making corporate credit cards a cost-effective tool for managing business expenses. Access to exclusive vendor deals adds another layer of benefit, maximizing value for companies that utilize these cards.

10. Transparent fee structures

Understanding the fee structure of a corporate credit card is crucial, especially for a corporate credit card for small business. Choose cards that provide clear, upfront details about annual fees, transaction fees, and other costs.

This transparency aids in better financial planning, ensuring that the card aligns with your company's budget and spending needs. Clear fee structures support effective expense management and help avoid unexpected costs, making it easier to manage finances efficiently.

Make secure and convenient business payments with corporate cards

What makes Volopay corporate cards best in industry?

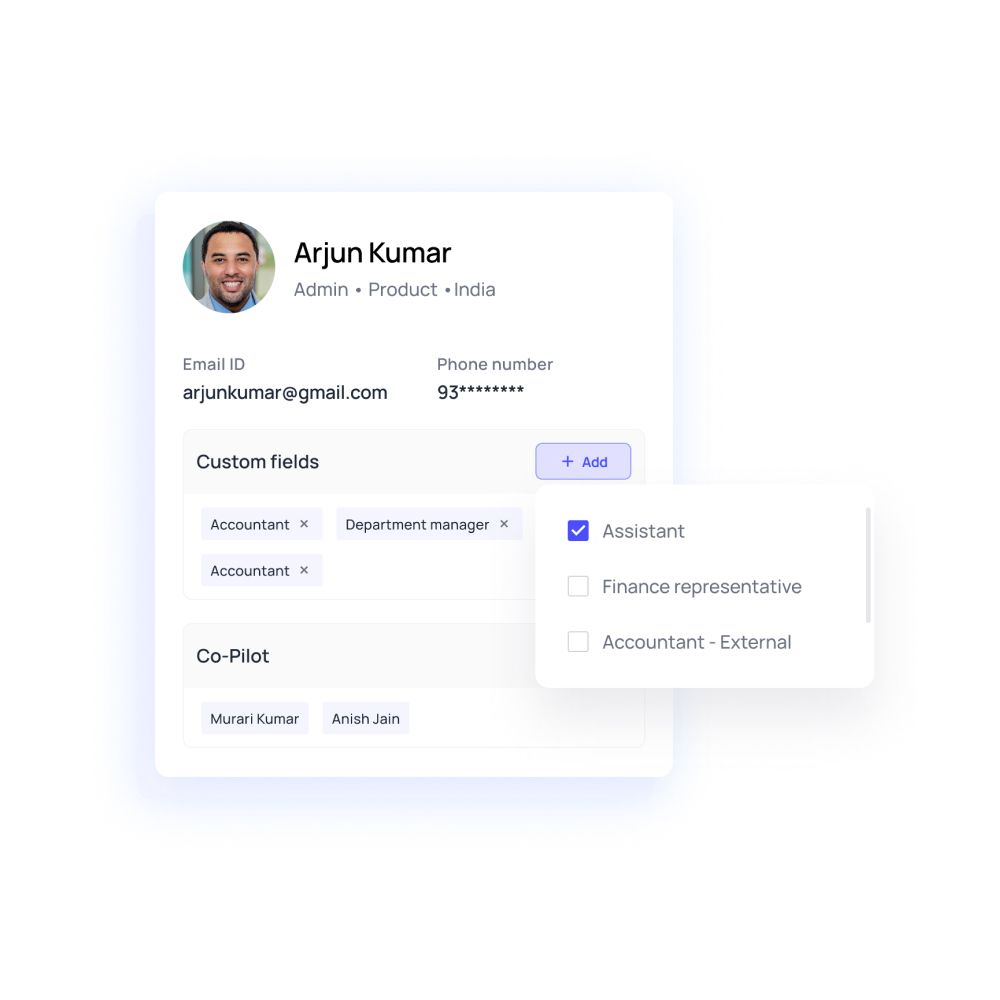

To optimize and escalate your business spending, Volopay empowers companies with corporate cards. Volopay's corporate cards are high-functional, multi-purpose, and data-driven. These smart cards streamline your entire accounting and financial stack, making it more proactive and robust. With a vast number of features, you can quickly grab control of your business and employee expenses and an interactive software that lets you easily navigate without any complex commands and structure.

Volopay caters to the needs of more than 700+ customers, helping them revive their financial management techniques. With problem-solving being the core value of Volopay's team, we assist companies in deriving at their root problems, uncovering their critical points, and designing a custom-made solution based on your company's spend requirements.

At Volopay, we realize that tracking expenses are the essence of expense management. Companies with no overview of their spending can never escape the hamster wheel of scattered and unambiguous expense reporting.

For this very purpose, Volopay's complete spend management software is equipped with a corporate card. These digital cards are highly capable of tracing every dollar in and out of your company, making them one of the best corporate credit cards in the US. To provide depth to your business expenses, our software captures granular expense details ranging from the purpose of the transaction to the approver of the transaction. And in doing so, our expense management cards help us to a great extent.

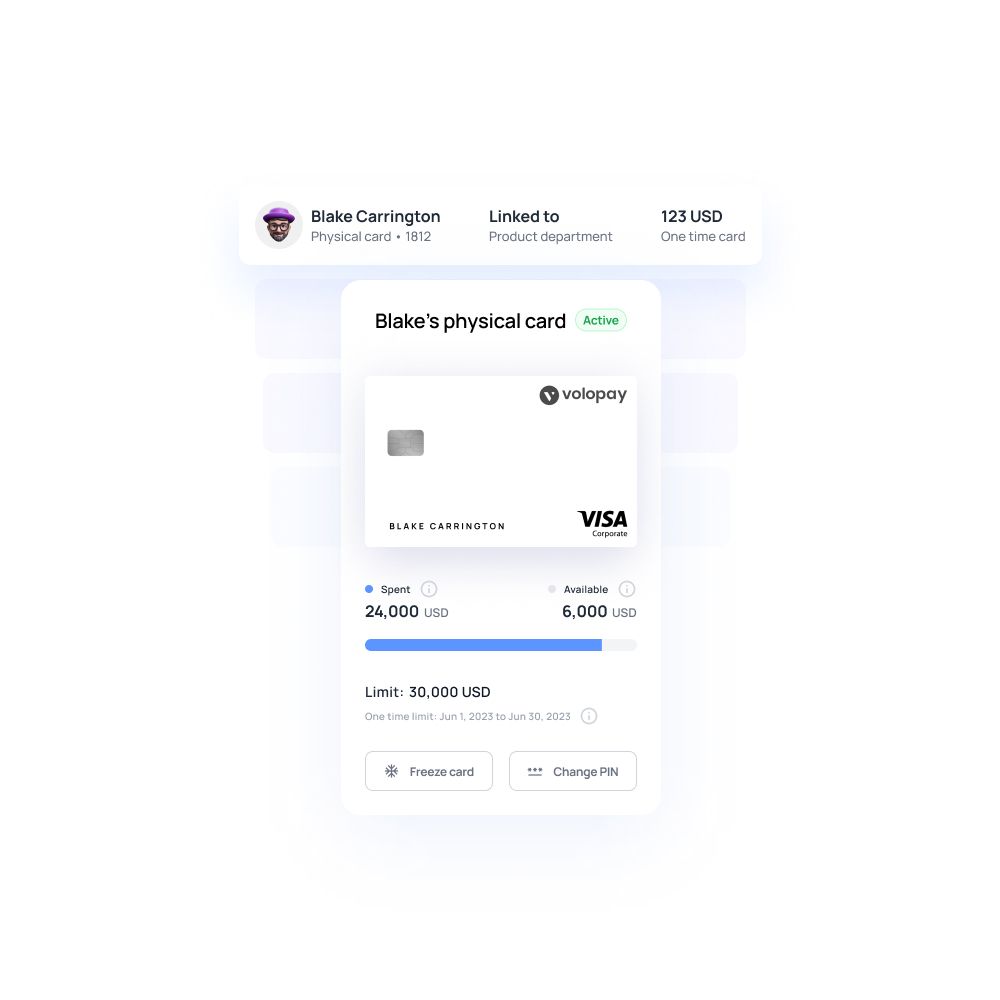

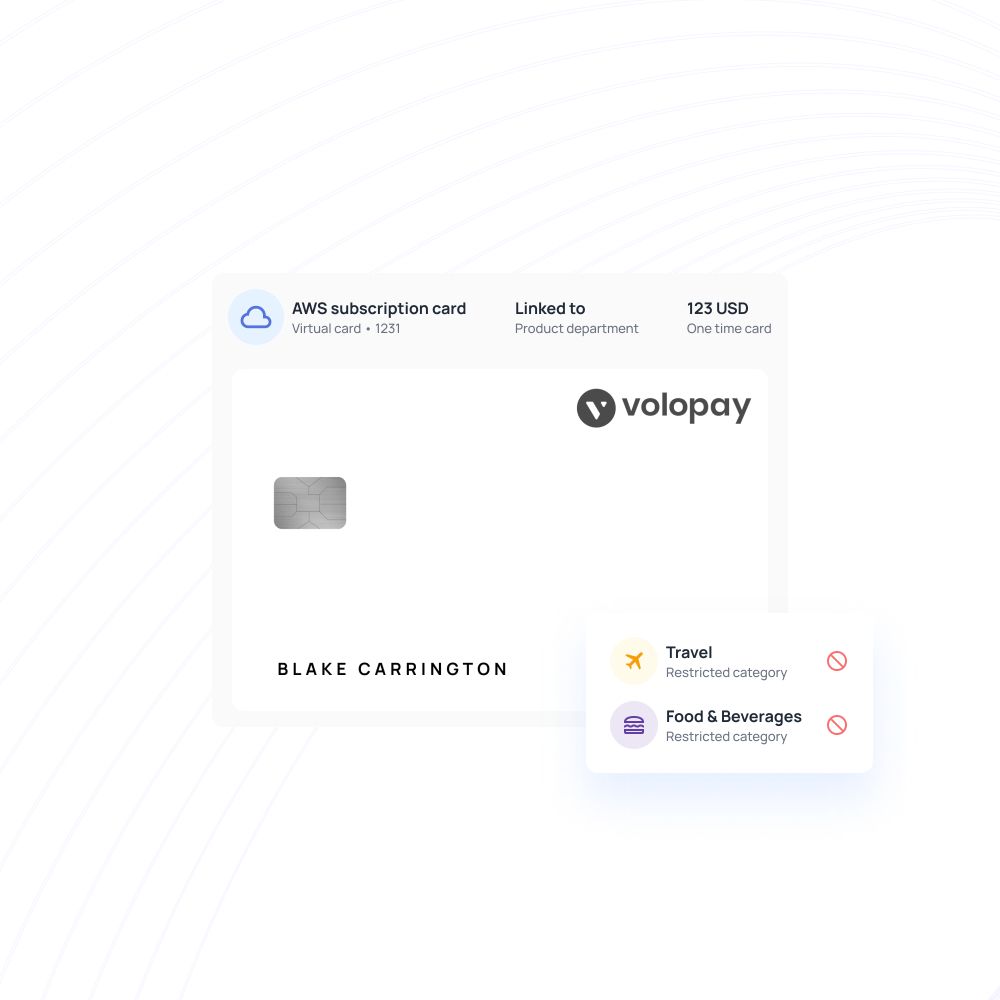

Physical and virtual corporate credit cards

Volopay's physical prepaid cards are issued to the employees and work like any other debit card. These cards can be used for financing business trips and paying the expenses for meals and commuting. Managers load funds into the employee spending card based on their spending requirements.

On the other hand, Volopay's virtual cards are intangible in nature, used explicitly for subscription management and vendor payments. These cards are funded via a single budget and created for a purpose, project, activity, or department.

In-built spend controls

Allocating corporate cards does not end the task of the managers and will not help your company in cost control. You still need to oversee employee spending. And for this, you don't need to monitor their expenses manually.

Volopay's corporate cards are enabled with in-built spending limits, so you know your employees cannot make expenses beyond a specific limit.

Card security

Volopay corporate cards prioritize security with advanced fraud protection, secure online transactions, and real-time alerts. These features ensure your business’s financial information is well-protected, allowing for immediate action if any suspicious activity is detected.

Employees can easily block or freeze cards if lost or stolen, and reset PINs as needed. This robust security framework helps in preventing unauthorized transactions and maintaining the integrity of your company’s finances.

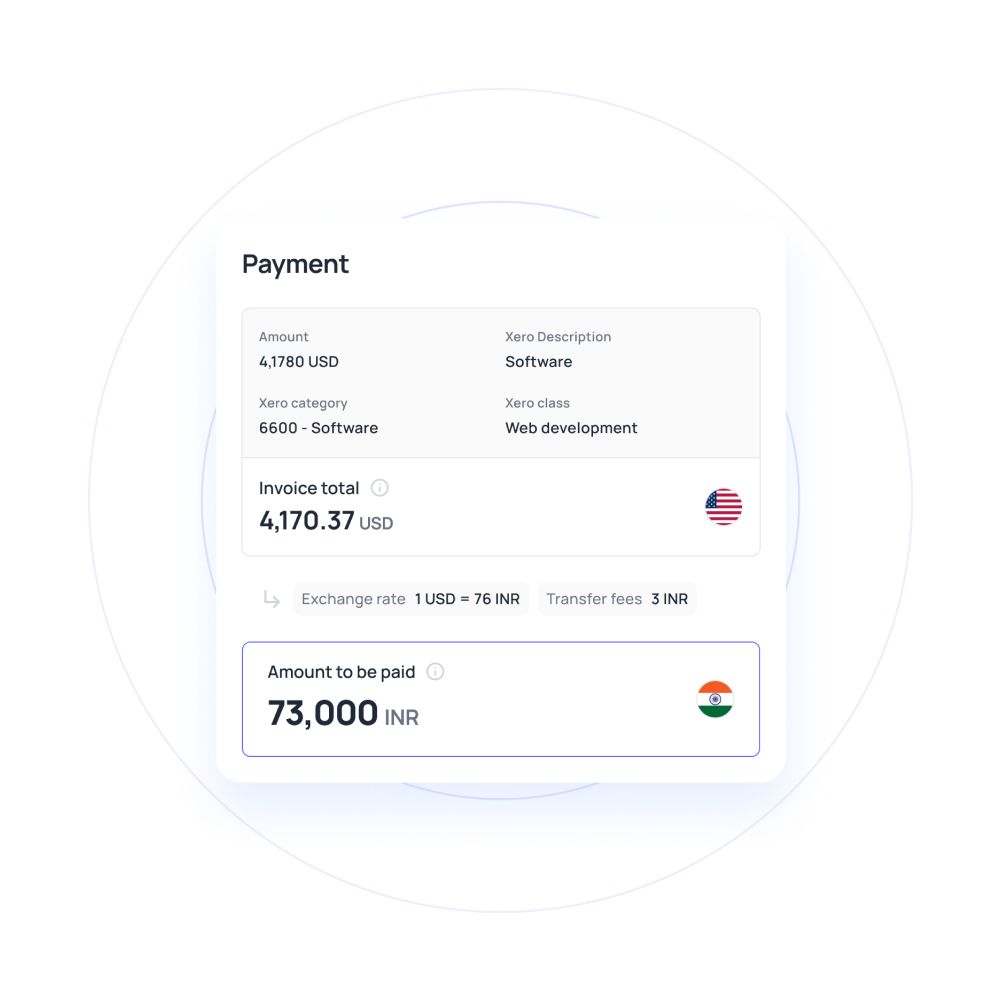

Multi-currency wallet

Well, do international payments burn your pockets? Yes, for a majority of companies, they do. So, is there a way companies can escape the hefty transaction costs without comprising security and settlement time?

With Volopay's corporate cards, you can hold and pay in international currencies without having to worry about long settlement hours. With no remittance and transfer fees, Volopay truly revamps your business payments.

Subscription management with virtual credit card

Volopay's virtual card for business helps you in assorting your online SaaS subscriptions. You no longer have to track and manage your SaaS payments through a single card. Create individual cards for each SaaS subscription. Each subscription card displays the payment made, the employee who made the payment, date, and payment method.

To unload the burden of funding these cards every month, Volopay offers one-time and recurring card options. With one-time card funding, the cards will not get funded every month. The budget owner or admin can add funds to these cards as and when needed. At the same time, the recurring cards get funded automatically on the first of every month, until made changes.

FAQs

Firstly, with Volopay's corporate cards, you won't be able to cross your spending limits. After multiple failed attempts, the admin will be notified about this.

If you want to cancel an employee's corporate card, you can go to card settings, block or freeze the card, and the card cannot be used any further. However, this action is irreversible. You cannot reactivate the card once blocked.

Yes, you can change the budget limit of a virtual card anytime by changing the limit in the setting tab. Enter your new limit and click save.

Corporate credit cards consolidate expenses, give detailed reporting, and integrate with expense management systems simplifying tracking and management.

Corporate credit cards offer business-specific features, such as higher credit limits, detailed reporting, and better control over company expenses, which personal cards do not. Additionally, they also keep business and personal spends separate for a clear business financial statement.

Volopay’s cards are known for their robust expense management features, high security standards, and an all-in-one payable management dashboard, tailored to meet the needs of businesses.

Fees can include annual fees, transaction fees, and interest rates. It’s important to review these fees to understand the total cost of using the card.

Yes, many corporate credit card programs allow businesses to issue cards to multiple employees, with centralized management and oversight.

While personal credit scores may influence the approval process, corporate credit cards primarily focus on the business’s creditworthiness and financial health.

Businesses can reconcile expenses using detailed transaction reports provided by the credit card issuer, often integrating with accounting or expense management systems.