Empower growth with corporate credit cards for small businesses

When you're running a small business, managing expenses can quickly become overwhelming. Traditional corporate credit cards often come with complex approval processes, high fees, and limited control over employee spending. Your growing business needs a financial solution that adapts to your unique requirements while providing the oversight and flexibility you demand.

Volopay's corporate cards offer a smarter alternative designed specifically for small businesses like yours. Unlike conventional corporate credit cards that burden you with unnecessary complications, Volopay delivers intelligent expense management through innovative technology, real-time controls, and transparent pricing that scales with your business growth.

What are small business corporate credit cards?

Corporate credit cards for small business operations represent a specialized financial tool designed to streamline your company's spending and expense management.

Unlike personal credit cards, these business-focused solutions offer enhanced controls, detailed reporting, and tax advantages that align with your operational needs.

What is a corporate credit card program?

A corporate credit card program is typically issued to small businesses by a bank. While there’s no universal definition, small businesses are generally privately owned, with fewer employees and lower annual revenue compared to larger corporations.

This was the go-to option for business owners back in the day. But now, the trend is shifting in favor of structured corporate credit card programs as businesses learn more about the benefits of corporate credit card management.

More companies are realizing that picking the right corporate credit card is essential for tracking expenses efficiently, managing employee spending, and simplifying the overall financial process.

Understanding corporate credit cards for small businesses

What are corporate credit cards, and how they work for small businesses

Corporate credit cards function as dedicated payment instruments tied directly to your business account rather than personal finances. They operate through established credit lines based on your company's creditworthiness, allowing multiple employees to access funds while maintaining centralized oversight.

Each card typically features spending limits, category restrictions, and real-time transaction monitoring that you control through online dashboards. The issuing bank reports activity under your business name, helping establish and build your company's credit profile independently from personal credit history.

Why small businesses invest in corporate credit cards

They offer flexibility, real-time control, and separation from personal finance. Corporate cards provide immediate access to working capital without requiring lengthy loan approvals, enabling quick responses to business opportunities.

You gain comprehensive expense tracking through automated categorization and integration with accounting software, reducing manual bookkeeping tasks. The clear separation between business and personal expenses simplifies tax preparation and ensures compliance with IRS requirements.

Additionally, many cards offer rewards programs, cashback incentives, and enhanced fraud protection specifically tailored to business spending patterns.

Common use cases for your team

Travel expenses, subscription services, vendor payments, and client entertainment represent the most frequent applications for corporate credit cards.

● Your traveling employees can book flights, hotels, and meals without a personal financial burden while maintaining receipt tracking through mobile apps.

● Monthly software subscriptions and recurring vendor payments benefit from automated billing and consolidated statements.

● Client entertainment expenses, from business dinners to conference attendance, become easily trackable and tax-deductible when processed through dedicated business cards.

● Emergency purchases, office supplies, and equipment acquisitions also stream through these dedicated payment channels.

Core benefits of small-business corporate credit cards

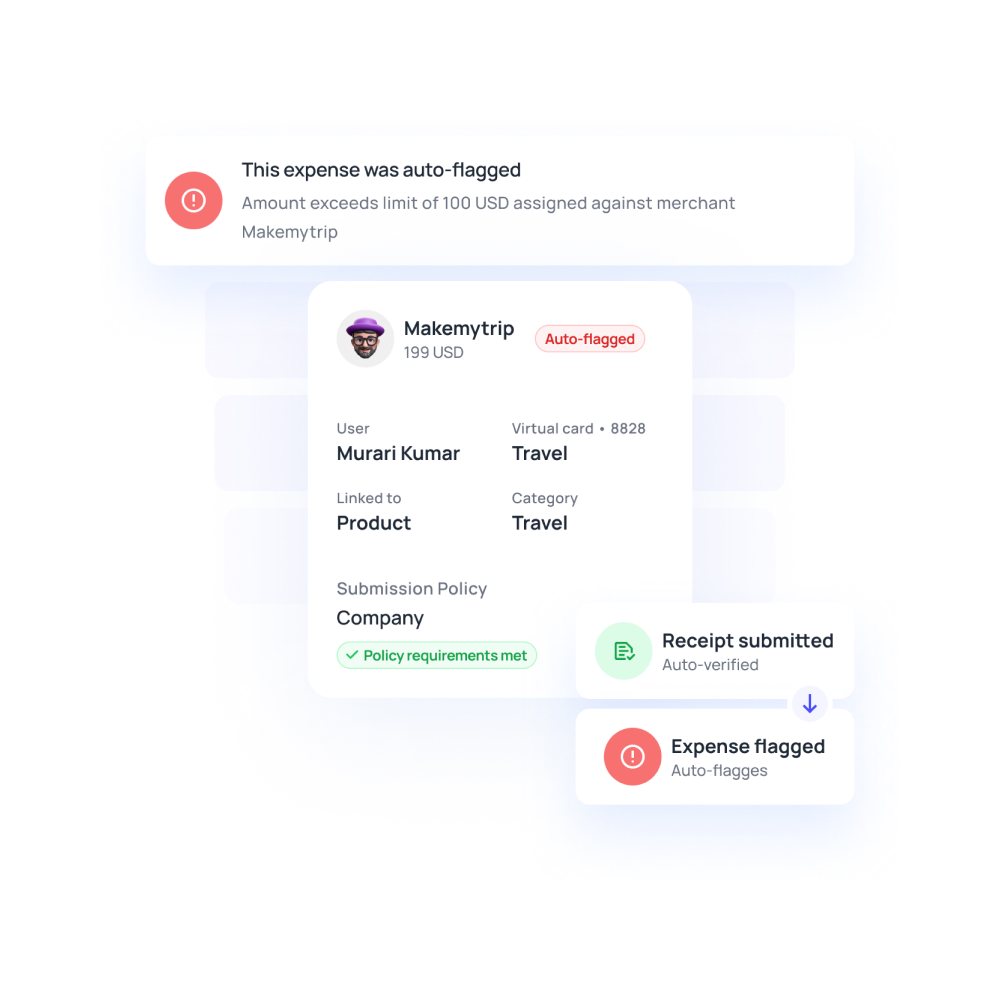

Monitoring your corporate card transactions as they happen is crucial, as it gives you visibility across all teams and spending categories.

Real-time reporting eliminates delays in expense tracking and reporting, allowing you to make informed financial decisions quickly.

You'll see exactly where your money goes, helping you identify spending patterns and optimize your budget allocation for better business outcomes.

Eliminate the tedious reimbursement cycle by equipping your employees with company cards for business expenses.

No more collecting receipts, processing expense reports, or waiting for reimbursements to be approved and paid.

Your team can focus on productive work instead of administrative tasks, while you maintain complete oversight of all transactions without the paperwork burden.

Protect your business with EMV-secured physical cards and virtual cards designed specifically for online purchases.

Advanced fraud protection monitors transactions 24/7, while customizable spending controls let you set limits and restrictions for each employee.

You'll have complete oversight of all card activity with detailed reporting and alerts for suspicious transactions.

How Volopay's corporate cards outperform traditional credit cards for small businesses

Traditional credit cards weren't built for modern business operations. You're stuck with lengthy approval processes, limited control over spending, and tedious expense reconciliation. Small business corporate credit cards from traditional providers often fall short when you need granular control and instant deployment.

Volopay's corporate cards transform how you manage business expenses with instant issuance, comprehensive spending controls, and an intuitive interface designed specifically for today's fast-moving small businesses. Here's how you can revolutionize your expense management.

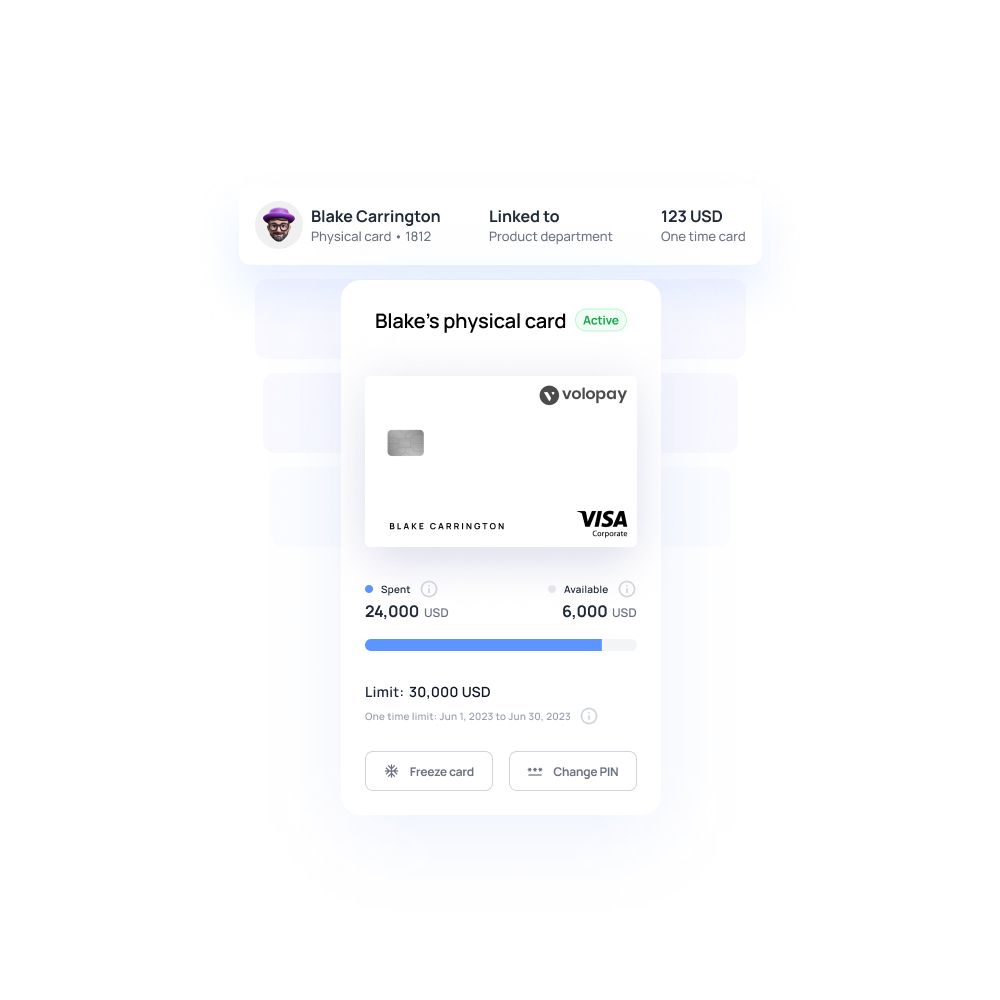

Issue physical and virtual cards instantly

You can add team members and issue cards within seconds directly from your online dashboard. No more waiting days or weeks for card approval and delivery.

Whether you need a physical card for office purchases or virtual cards for online subscriptions, you're equipped instantly with complete control over who gets what access.

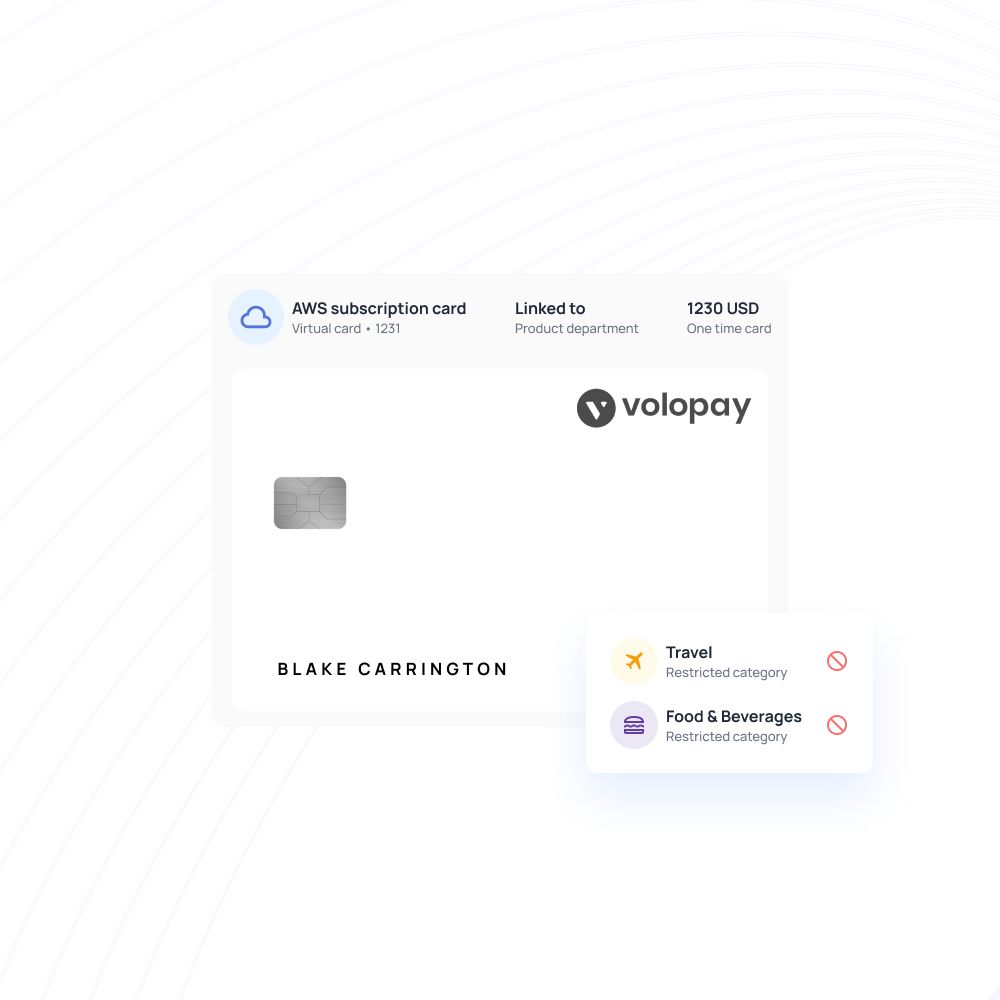

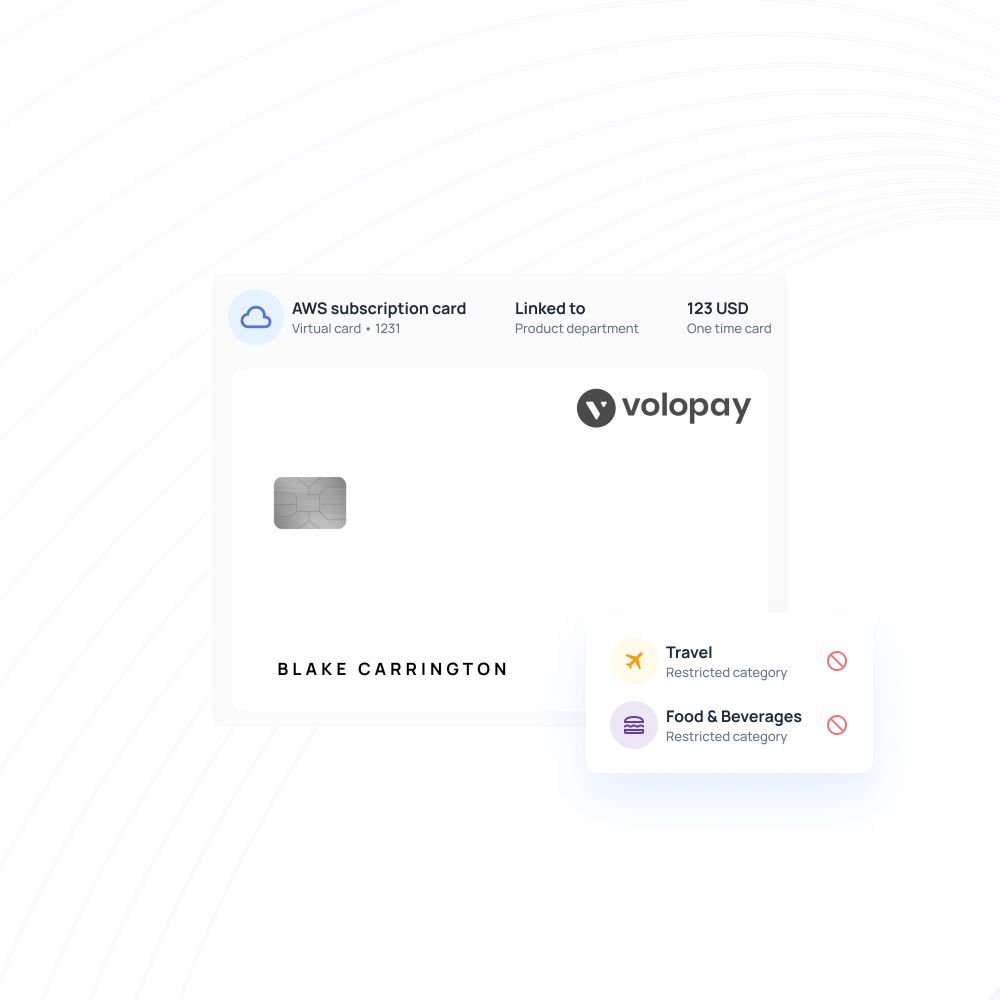

Create unlimited cards for any purpose

Generate dedicated cards for specific vendors, individual projects, or recurring SaaS subscriptions without limits. You can organize expenses by department, campaign, or purpose from day one.

This targeted approach eliminates confusion during reconciliation and gives you crystal-clear visibility into where every dollar goes across your operations.

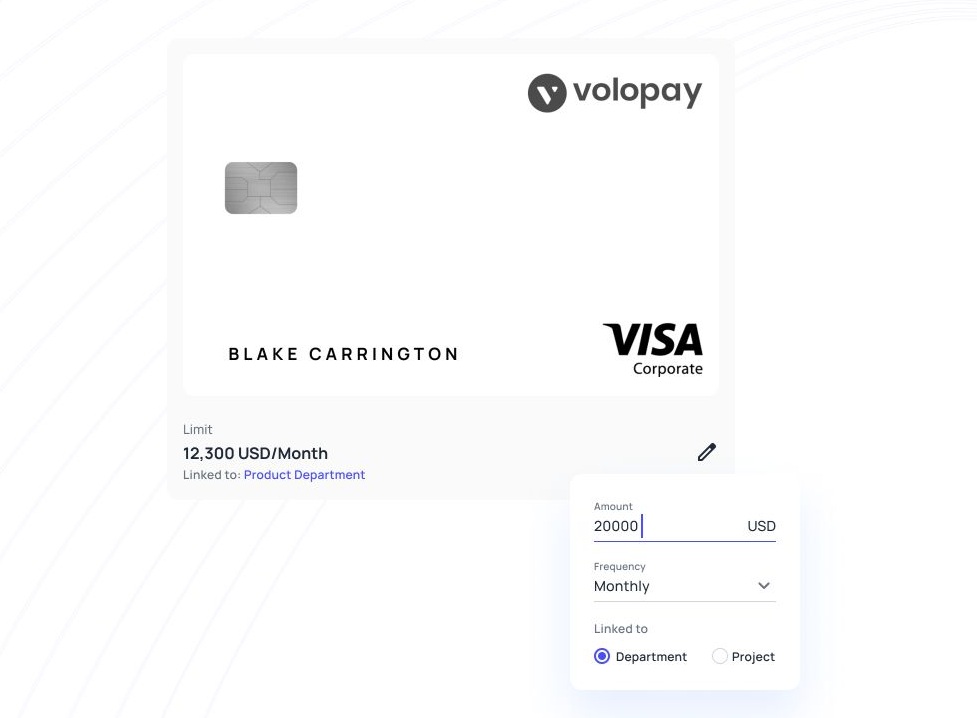

Apply per-card spend rules & expiry

Set precise spend caps, restrict specific merchant categories, and configure automatic expiry dates for each card you issue.

You maintain complete control over spending parameters while empowering your team to make necessary purchases.

These granular controls prevent overspending and ensure compliance with your budget allocations automatically.

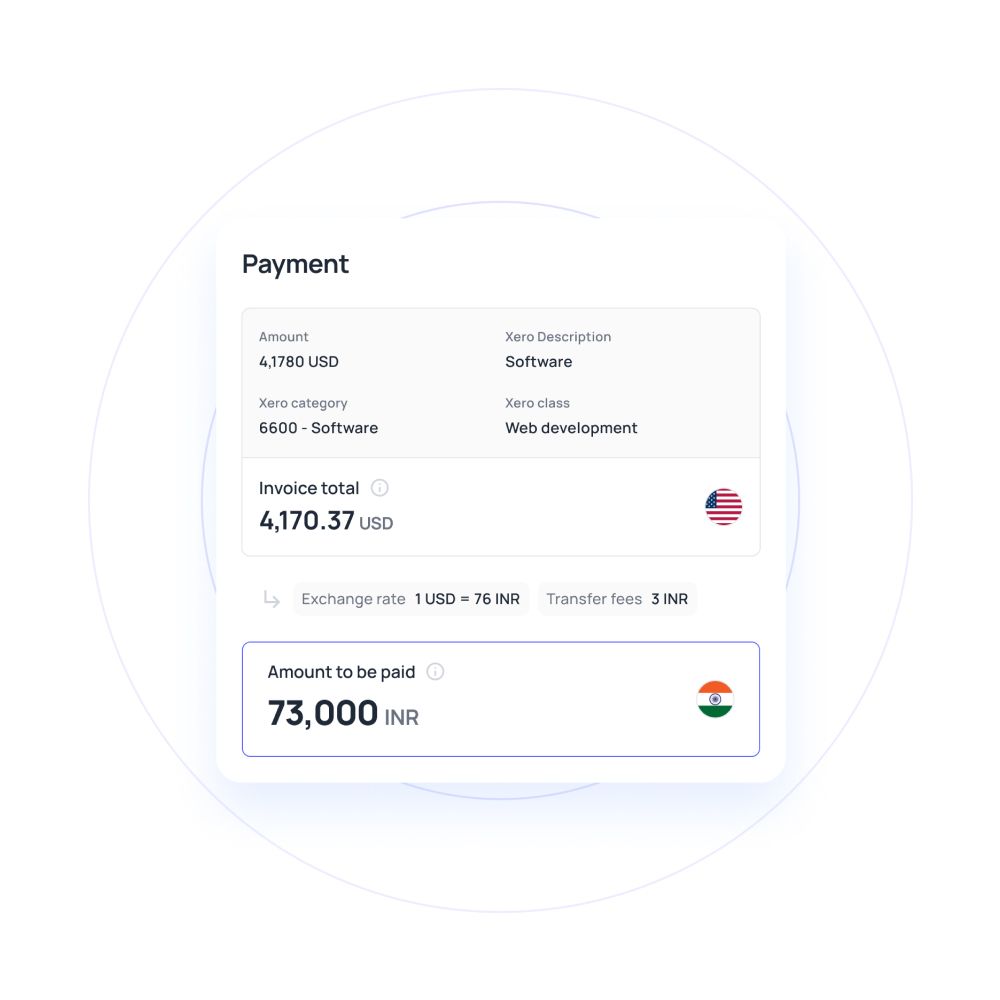

Support for multiple currencies

Maintain balances in USD, EUR, and GBP with automated foreign exchange conversion at competitive rates.

You can expand internationally without worrying about currency complications or hidden fees.

Your team can make purchases in local currencies while you track everything seamlessly within a single, unified dashboard.

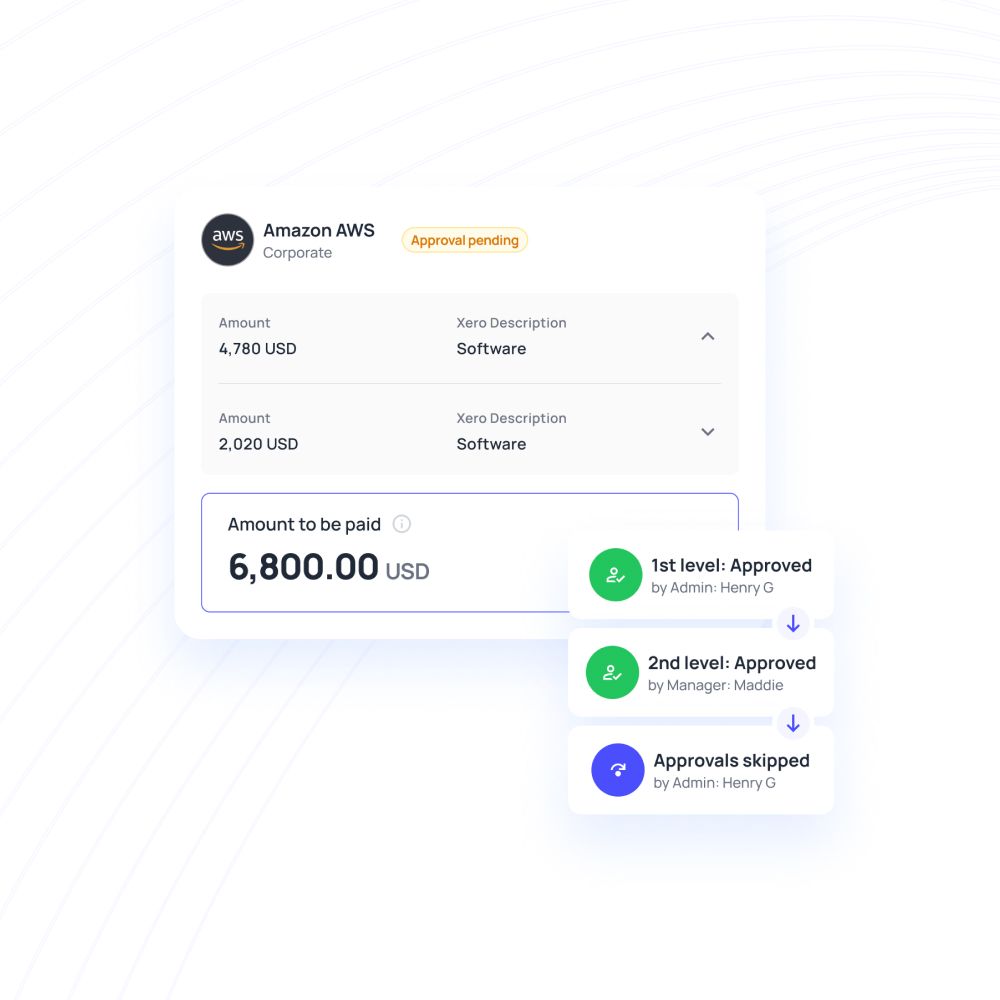

Leveraged approval workflows & alerts

Tie card reloads and high-value transactions to customizable approval workflows with real-time policy enforcement.

You receive instant alerts for any activity that requires attention, ensuring compliance while maintaining operational speed.

These intelligent workflows adapt to your business processes rather than forcing you to adapt to rigid banking structures.

Security, compliance & control you can count on

Your sensitive financial data deserves enterprise-grade protection.

Our platform maintains the highest security standards through PCI-DSS compliance for payment card data handling and SOC 2 Type II certification for operational security controls.

These certifications make sure your corporate card transactions meet the necessary rigorous security requirements, protecting both your business and customer information from any potential breaches.

Take complete control over your corporate card spending with granular permission limits and settings.

You can assign specific team members the authority to issue new cards, load funds, set spending limits, and approve transactions based on their role and responsibility level.

This flexible permission structure ensures that only authorized personnel can make critical financial decisions while maintaining operational efficiency across your organization.

Respond immediately to security threats with real-time protection features.

If suspicious activity is detected or a card is reported lost, you can instantly freeze the affected card through our platform or mobile app.

Our advanced fraud detection system continuously monitors patterns and sends quick alerts for unusual spending behavior, helping you prevent unauthorized charges before they impact your finances.

Scale with Volopay—For startups to growing SMBs

Whether you're launching your first startup or expanding an established small business, you need corporate cards that grow with you. Volopay's flexible platform adapts to your changing needs, from day-one operations to multi-department management.

Get started quickly for startups

Skip the lengthy bank approval processes that slow down fast-moving startups. You can get your first corporate cards issued within minutes of onboarding, without lengthy credit checks or extensive paperwork.

Our streamlined onboarding process understands that startups operate on lean timelines and need immediate access to spending tools. Start making essential purchases, paying for software subscriptions, and handling business expenses right away.

SMEs authenticate departments & projects

Organize your growing business with purpose-built card allocation for different teams and initiatives. You can create separate cards for marketing campaigns, sales activities, operations, or specific projects, each with clearly defined budgets and spending categories.

This departmental approach helps you track ROI on individual initiatives while maintaining centralized oversight of all corporate spending across your expanding organization.

Empower teams with governance

Support your growing workforce with sophisticated approval workflows and user management systems. You can implement multi-level approval processes where junior team members request spending authorization from department heads or project managers before transactions are processed.

Role-based controls ensure each team member has appropriate spending authority while comprehensive reporting keeps leadership informed of all financial activities across departments and projects.

Why Volopay corporate cards are a smarter alternative to corporate credit cards

When you're evaluating corporate credit cards for small business operations, you deserve more than what traditional banks offer. Volopay's modern card solution delivers superior control, automation, and global capability—far beyond what legacy bank-issued small business corporate credit cards provide.

1. Precision spend limits and merchant controls

You can set granular spending parameters that go far beyond simple limits. Configure individual card budgets, restrict transactions to specific merchant categories like office supplies or software subscriptions, and establish automatic expiration dates for project-based spending.

These precision controls let you prevent unauthorized purchases while giving teams the flexibility they need. Unlike traditional cards that offer basic spending limits, Volopay's merchant filtering ensures every transaction aligns with your business policies and budget allocations.

2. Digital‑first: API and mobile‑ready management

Manage your entire corporate card program from anywhere without visiting bank branches or filling out paper forms.

You can create new cards instantly through our mobile app, monitor real-time spending across all team members, and integrate card management directly into your existing business systems through our robust API.

This digital-first approach eliminates the bureaucratic delays common with traditional bank-issued cards, giving you immediate control over your corporate spending infrastructure from your smartphone or business dashboard.

3. Automated finance workflow integration

Eliminate the manual work that makes traditional corporate card management so time-consuming. Our platform automatically captures receipt images, categorizes transactions based on your business rules, and syncs seamlessly with popular accounting software like QuickBooks and Xero.

You can streamline monthly expense reporting with automated reconciliation that matches transactions to receipts and assigns them to proper budget categories. This automation reduces accounting overhead while ensuring compliance and accuracy in your financial records.

Get started with your corporate card program today

Risk-free trial or demo

Experience the power of modern corporate card management without any financial commitment. You can explore all platform features, test spending controls, and evaluate our automated expense reporting through a comprehensive demo.

See firsthand how our merchant restrictions, budget controls, and real-time monitoring work for your specific business needs before making any decisions about your corporate spending solution.

Get your first card in under 5 minutes

Transform your business expense management faster than ordering lunch. You can complete the entire setup process, from account onboarding to your first active corporate card, in under five minutes.

No lengthy paperwork, credit committee reviews, or branch visits required. Simply verify your business details and start issuing cards to your team members immediately for controlled, trackable business spending.

Highly trusted by small businesses

Join thousands of growing companies that have transformed their expense management with Volopay's corporate card solution. Our platform serves businesses across industries, from tech startups managing software subscriptions to retail companies handling inventory purchases.

Small business owners consistently rate our customer support, security features, and ease of use as superior to traditional banking alternatives, making us the preferred choice for modern expense management.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs

Yes, most providers require a registered business entity, minimum revenue thresholds, and credit history verification. Volopay simplifies this process with streamlined requirements focused on business legitimacy rather than extensive credit checks, making approval faster for qualifying small businesses.

Absolutely. Volopay provides instant virtual cards for immediate online purchases and software subscriptions, plus physical cards for in-person transactions. You can issue both types instantly through our platform, giving your team flexible spending options for all business needs.

Corporate cards centralize all business spending into one system with real-time transaction monitoring and automated categorization. This eliminates petty cash reimbursements, provides instant expense visibility, and generates detailed reports that help you manage cash flow and budget allocation more effectively.

Volopay cards work globally with competitive exchange rates and transparent fee structures. International transactions are automatically converted and tracked in your base currency, while our platform provides real-time exchange rate information to help you manage foreign exchange costs effectively.