Volopay prepaid cards - Smart alternative to company prepaid credit card

If you're looking for more control and visibility over your business spending, Volopay prepaid cards are a smarter choice than company prepaid credit cards.

With real-time expense tracking, spending limits, and zero debt risk, you can streamline expense management and eliminate the hassles of traditional methods.

What is a prepaid card?

A prepaid card is a payment option you load with funds in advance. It’s not linked to a credit line, so you avoid debt while still managing team expenses effectively.

With prepaid cards, you set spending limits, stay on budget, and make payments without relying on credit.

Difference between prepaid cards and prepaid credit cards

When you use prepaid cards, you're spending only what you load onto them—no debt, no surprises. Unlike company prepaid credit cards, which are tied to a credit line, prepaid cards help you avoid interest charges and repayment hassles.

Both business prepaid credit cards and company-issued prepaid cards serve different operational needs—while credit-based options offer flexibility for larger purchases, prepaid cards provide tighter control and real-time visibility into spending.

They give you better control and visibility over your company’s expenses in real time. With prepaid cards, you can track spending instantly, enforce budgets easily, and eliminate the risk of overspending, all while staying financially disciplined.

For a comprehensive overview of how these modern solutions compare and benefit your operations, delve into our guide on prepaid debit cards for business.

Why choose Volopay prepaid cards?

With Volopay prepaid cards, you gain full control over your team’s spending. Unlike company prepaid credit cards, these cards let you set limits, load funds instantly, and track every transaction in real time. You won’t have to worry about debt or interest—just smart, secure financial management.

Volopay helps you simplify expense tracking and stay ahead with scalable, easy-to-manage solutions built for growing businesses like yours.

Instant card top-ups

You can load funds onto Volopay reloadable prepaid cards instantly through an easy-to-use online dashboard. This allows you to fund employee cards in real time, ensuring your team never faces payment delays.

Whether for planned expenses or last-minute needs, instant top-ups help keep your operations running smoothly without interruption.

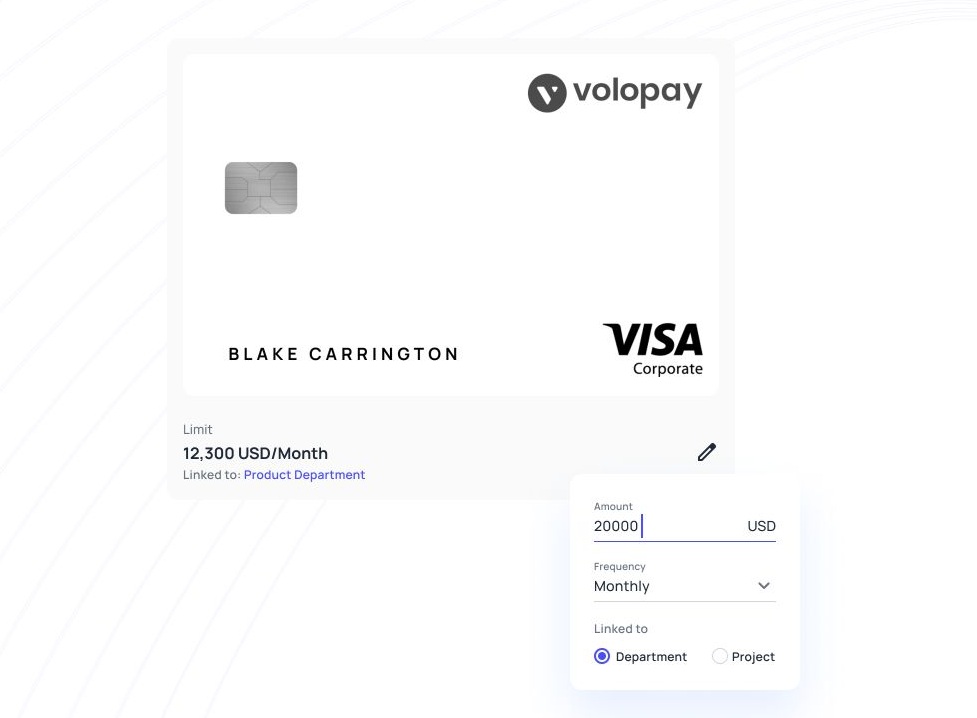

Tailored spending restrictions

Volopay lets you set custom spending limits for each card, so your team only spends what you allow. You can also restrict usage to specific merchants or categories.

These controls help prevent misuse and keep your company budget on track, giving you tighter control over every dollar spent.

Real-time transaction monitoring

Every time a Volopay prepaid card is used, the transaction is logged immediately in your account’s ledger. You get instant updates and full visibility into where, when, and how funds are being spent.

This real-time tracking eliminates guesswork and helps you manage business expenses with total clarity.

Simplified accounting integration

Volopay integrates seamlessly with accounting platforms like QuickBooks, Xero, and NetSuite. Every transaction automatically syncs with your system, reducing manual data entry.

This not only saves time but also ensures accurate reconciliation. With Volopay, you streamline your expense reporting and keep your financial records clean and current.

Multi-currency wallet for global payments

Volopay’s multi-currency wallet allows you to hold and spend in multiple currencies without unnecessary conversion fees. You can easily make international payments and manage cross-border expenses from a single platform.

It’s an efficient solution for global businesses that need to pay vendors or teams across different countries and currencies.

Unlimited virtual cards for online expenses

With Volopay, you can instantly generate unlimited virtual prepaid cards for secure online transactions. Use them for SaaS subscriptions, vendor payments, or e-commerce purchases without exposing your main account.

Each virtual card can be customized with spending rules, offering a safer, more organized way to manage digital expenses.

Automated reimbursement processing

Employees can submit reimbursement requests quickly through Volopay’s mobile app. Built-in OCR (optical character recognition) scans and reads receipts automatically, speeding up data entry.

This automation reduces delays, minimizes errors, and helps your finance team approve and process claims efficiently, giving your employees a smoother reimbursement experience.

Industry-leading security protections

Volopay is certified with ISO and PCI DSS standards to ensure top-tier security. You can instantly freeze or block cards in case of suspicious activity, adding a strong layer of fraud prevention.

These features protect your financial data while giving you confidence in every transaction your business makes.

Multi-tier approval workflows

Volopay offers customizable approval workflows with up to five layers of review to ensure thorough oversight. You can pre-set rules based on amount, department, or role, streamlining how expenses are submitted and approved.

This structure improves accountability, speeds up processing, and keeps your company’s spending policy firmly enforced.

Mobile app for on-the-go management

With Volopay’s mobile app, you and your team can manage expenses anytime, from anywhere. Employees can submit receipts, request reimbursements, and view transactions instantly.

Managers can approve requests, track spending, and freeze cards on the spot—perfect for staying in control even when you're out of the office.

Get the perfect prepaid card for your business!

Versatile applications for every team

Corporate travel management

Volopay makes business travel easier by giving employees pre-funded cards for flights, lodging, and meals. You can set specific limits and track spending in real time.

This helps your team stay within policy while eliminating the need for personal reimbursements, ensuring a smoother, more transparent travel experience.

Subscription payments

Easily manage recurring SaaS and software subscriptions with dedicated virtual cards. Volopay allows you to assign one card per subscription, making cancellations, renewals, and budget tracking simpler.

You gain better control over recurring costs and can instantly freeze cards to prevent unauthorized or forgotten charges from continuing.

Procurement and vendor transactions

Handle vendor payments and procurement purchases more efficiently with Volopay. Assign cards to departments or specific vendors, set limits, and monitor activity in real time.

This helps eliminate bottlenecks, reduces paperwork, and improves accountability across your procurement process, all while maintaining full control over every transaction.

Ad hoc business purchases

Volopay gives your team the flexibility to handle unexpected or one-time business expenses securely. You can issue virtual or physical cards instantly, set temporary limits, and approve usage on the go.

This ensures operational needs are met quickly without compromising your budget or exposing your accounts to risk.

Effortless budget allocation with Volopay

Departmental budget setup

Volopay allows your finance team to allocate prepaid card budgets to individual departments with ease. You can assign spending limits for teams like sales, HR, or IT, ensuring each department operates within its allocated funds.

This helps streamline financial planning and promotes greater accountability across the organization.

Project-based funding

You can issue project-specific prepaid cards through Volopay to fund initiatives like marketing campaigns or product launches. These cards allow you to monitor spending by project in real time.

This targeted approach ensures every dollar is accounted for, helping you stay on budget and measure project-related financial performance.

Flexible budget adjustments

Volopay makes it easy to adjust card budgets as your business needs evolve. Whether increasing limits during peak periods or tightening controls during cost-saving phases, changes can be made instantly.

This flexibility ensures your teams always have the right amount of funding at the right time.

Automated budget alerts

With Volopay, you receive instant alerts when spending nears or exceeds predefined limits. These notifications help you take quick action, preventing overspending and ensuring compliance with internal policies.

Automated alerts offer peace of mind by keeping your financial operations disciplined and aligned with your company’s budget strategy.

Tailored solutions for every role

1. Finance leaders

Volopay gives finance leaders full visibility and control over company spending. You can allocate budgets, set approval workflows, and track expenses in real time.

This strategic oversight helps drive smarter financial decisions, enforce policy compliance, and maintain tighter control of your organization’s cash flow without compromising operational flexibility.

2. Tech managers

Tech managers can use Volopay to efficiently manage software purchases, developer tools, and infrastructure costs. With virtual cards assigned per vendor or subscription, tracking IT expenses becomes seamless.

Spending limits and approvals help maintain budget discipline while giving your team the autonomy to access essential tech resources quickly.

3. Accounting teams

Volopay simplifies expense reconciliation for accounting teams by syncing automatically with tools like Xero, QuickBooks, and NetSuite. Real-time transaction logging reduces manual entry and errors.

With categorized expenses and digital receipts, your team can close books faster, streamline audits, and focus more on strategic financial analysis.

4. Marketing directors

Marketing directors can issue virtual cards for ad platforms, subscriptions, and creative tools, each with set limits. Volopay makes it easy to track campaign-specific spending in real time.

This transparency helps you stay within budget, avoid billing surprises, and measure return on investment across all marketing initiatives.

Empowering businesses of all sizes

Volopay helps startups gain control over their finances from day one. With prepaid cards, you can set clear spending limits, track every transaction in real time, and avoid unnecessary debt.

This visibility and control make it easier to manage cash flow and scale confidently without financial guesswork.

Small and medium-sized businesses benefit from Volopay’s streamlined approval workflows and accounting integrations. You can automate expense tracking, simplify reimbursement processes, and connect with platforms like QuickBooks.

This saves time, reduces errors, and helps growing companies stay organized while focusing resources on core business expansion.

For large enterprises, Volopay offers powerful analytics, advanced workflows, and customizable controls to manage complex financial operations. You can oversee global spending, enforce multi-tier approvals, and generate real-time insights across departments.

These features support strategic planning and help maintain operational efficiency across multiple entities and markets.

Trusted by industry leaders

Customer success stories

Companies like ParallelDots have transformed their expense management with Volopay. From improved visibility to faster reconciliations, our clients consistently report increased efficiency and control.

Discover how Volopay is delivering real results—read the full ParallelDots success story.

Awards and certifications

Volopay holds a 4.3 out of 5 rating on G2, backed by verified user feedback. We’re also certified with ISO 27001 and PCI DSS, ensuring high standards of security and performance.

These recognitions make Volopay a trusted solution for businesses seeking efficient, secure, and scalable financial management tools.

Bring Volopay to your business

Get started now