Business prepaid debit cards for smarter spend

Managing business expenses shouldn't drain your energy or slow operations. If you're tired of manual reimbursements, employee overspending, and poor expense visibility, you need a better solution.

Business prepaid debit cards offer real-time spending controls and automated expense management. Companies like Volopay provide smarter alternatives with complete transaction control.

What is a business prepaid debit card, and why it matters in modern corporate finance

A business prepaid debit card lets you load specific funds onto cards for employees or departments. Unlike credit cards, these prevent overspending by limiting transactions to preloaded amounts, giving you precise expense control.

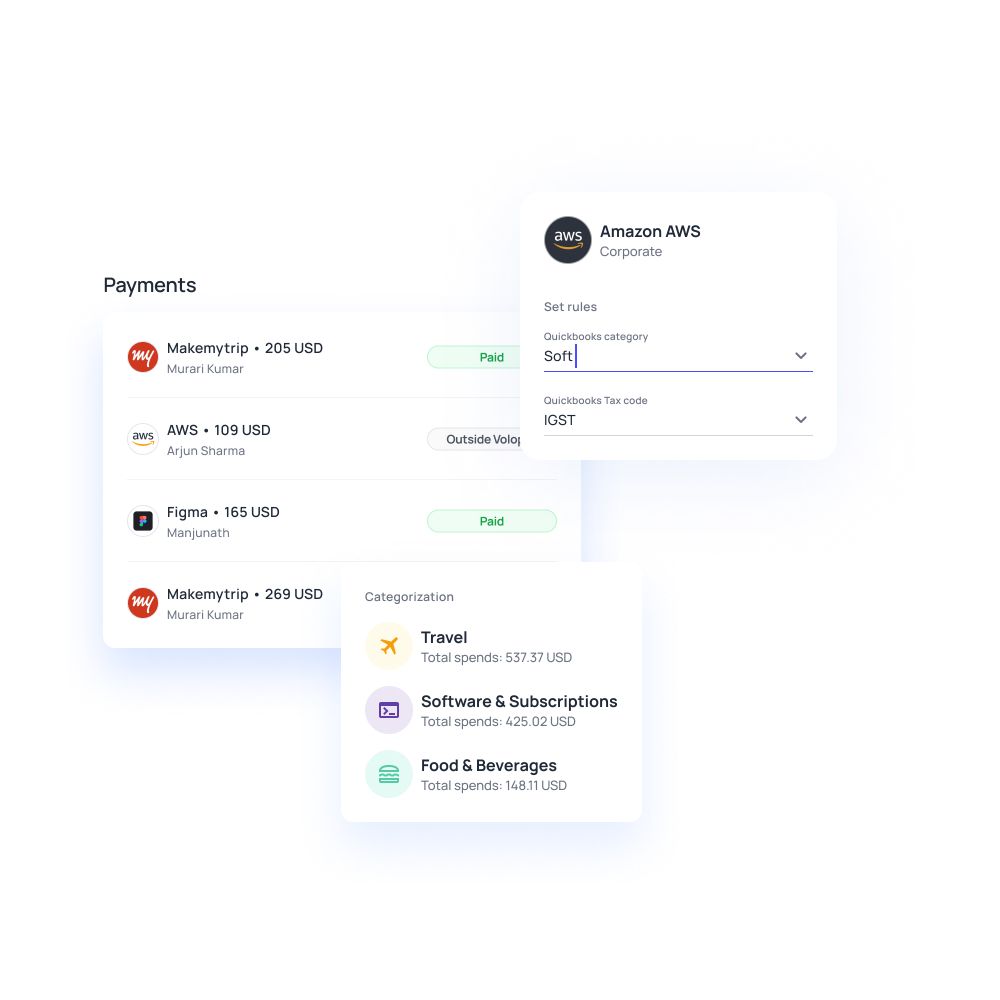

For US businesses, prepaid debit cards for business shift expense management from reactive to proactive. You set spending limits upfront and monitor transactions in real-time, eliminating cash flow unpredictability. Cards integrate with accounting systems, automatically categorizing expenses and generating reports.

How business prepaid debit cards work

Business prepaid debit cards operate on a preload-and-spend model. You load funds from your bank account, and cardholders can then make purchases up to their balance. You can set spending limits by merchant category, block transaction types, or restrict usage to specific vendors.

Zero credit risk and no debt exposure

Prepaid debit cards for businesses eliminate debt accumulation since employees only spend preloaded amounts. There are no interest charges or credit card debt affecting your business credit score. This creates natural budget enforcement that prevents financial surprises.

Everyday use cases in US businesses

Business prepaid debit cards work perfectly for vendor payments, travel expenses, event planning, SaaS subscriptions, and team purchases. You allocate specific budgets while maintaining spending oversight and eliminating reimbursement delays.

Key benefits of a business prepaid debit card for US companies

Business prepaid debit cards eliminate surprise charges by capping spending at preloaded amounts. You can't exceed your budget because there's no credit line to tap into.

This built-in protection prevents employees from making unauthorized purchases or falling victim to fraud schemes that could drain company accounts.

The prepaid nature of these cards means you're spending your own money, not borrowing. There are no credit lines, interest charges, or late fees to worry about.

This structure helps protects your business credit score and eliminates all the financial risks associated with traditional corporate credit cards.

Real-time tracking gives your finance teams full visibility—each purchase appears instantly with merchant, amount, and timestamp.

This immediate insight reveals spending patterns, flags issues, and enables smarter budgeting. Prepaid debit cards for business turn expense management from guesswork into data-driven decision-making.

Volopay prepaid card: Modern control with powerful spend management

Volopay's digital-first business prepaid debit cards are designed for modern US companies. The platform combines instant card issuance with powerful automation features and global transaction capability, eliminating traditional expense management headaches while providing unprecedented control over company spending.

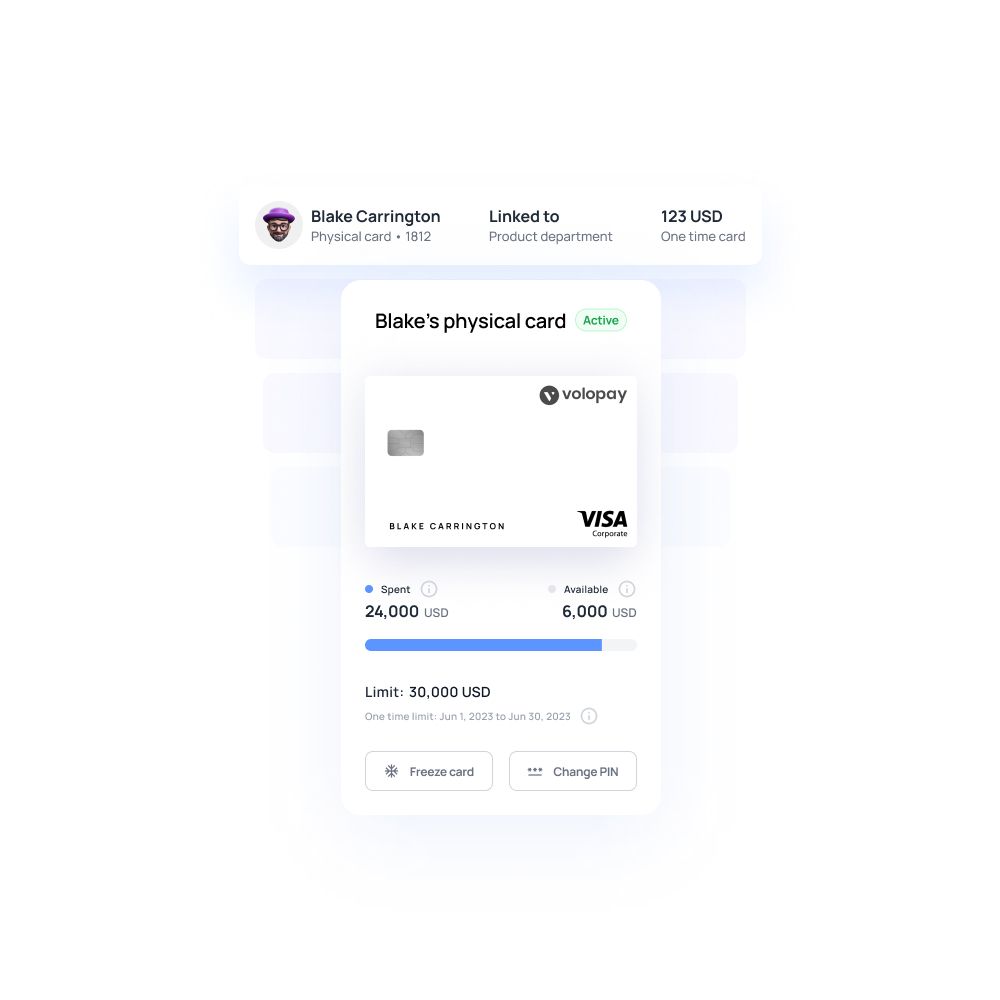

Instant virtual & physical card issuance

Issue business prepaid debit cards directly from your Volopay dashboard within seconds. Create virtual cards instantly for online purchases or SaaS subscriptions, then request physical cards for in-person transactions. This immediate availability eliminates waiting periods and keeps your operations moving.

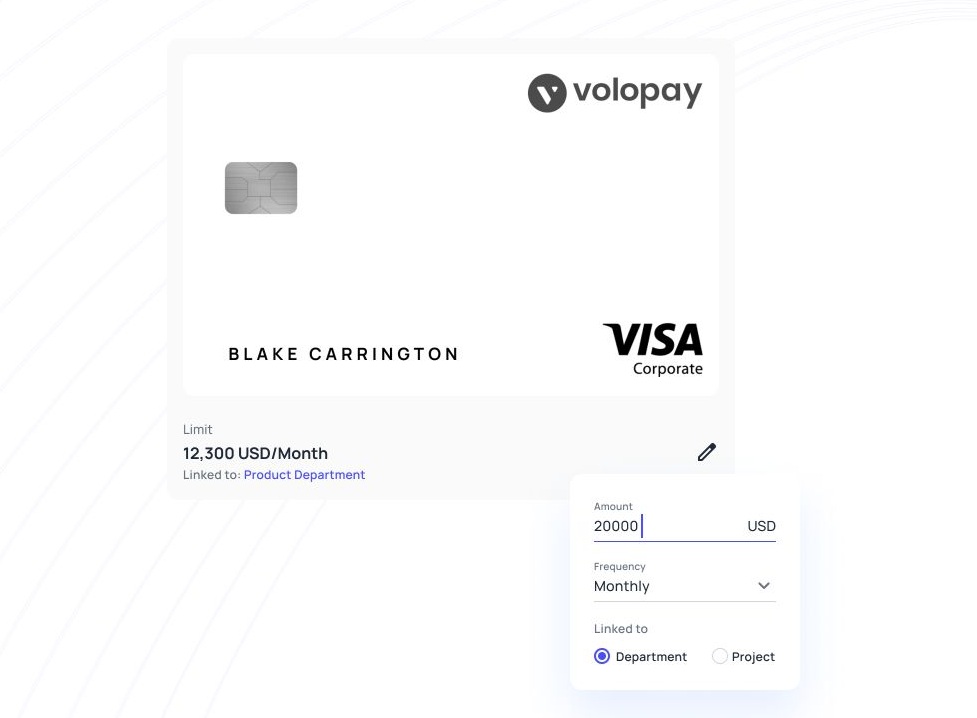

Customized control settings

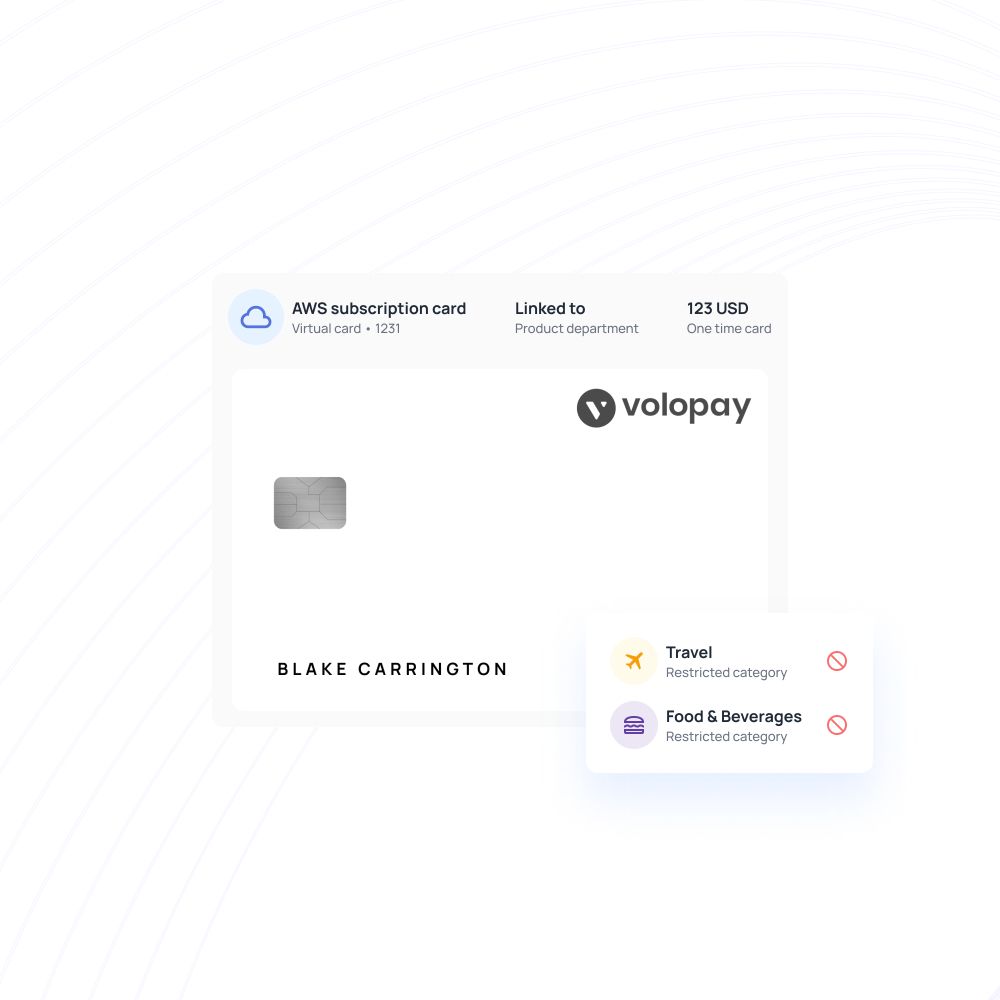

Set precise spend caps, merchant category restrictions, and expiration dates for each card. You can limit cards to specific vendors, block certain transaction types, or create time-bound spending windows. These granular controls ensure prepaid debit cards for business align perfectly with your budget requirements.

Real-time freeze, reload & revoke options

Manage cards instantly through your online dashboard as business needs evolve. Freeze suspicious cards immediately, reload funds when budgets increase, or permanently revoke access when employees leave. This flexibility keeps your expense management responsive and secure.

Security and compliance in every prepaid debit card

Enterprise-grade PCI-DSS & SOC 2 certified

Business prepaid debit cards operate on a robust, enterprise-grade security infrastructure with strict PCI-DSS and SOC 2 certifications.

These industry-standard security and compliance frameworks ensure your business transaction data and customer information remain protected through encrypted processing and secure storage protocols.

Fraud notifications & instant card locking

Advanced fraud detection systems monitor every transaction for suspicious activity. You receive immediate notifications for unusual spending patterns or potentially fraudulent charges.

When threats are detected, you can instantly freeze any card with one click, preventing further unauthorized transactions and protecting your business funds.

Admin roles & permissions control

Role-based access controls let you define exactly who can issue cards, load funds, or make purchases within your organization. Create different permission levels for managers, finance teams, and employees.

This granular control ensures only authorized personnel can access sensitive financial functions while maintaining proper oversight of your prepaid debit cards.

Prepaid debit card use cases for businesses

Travel, meals, and per diem expenses

Business prepaid debit cards eliminate the need for employees to use personal cards during business travel. Load specific amounts for flights, hotels, meals, and incidentals, ensuring compliance with company travel policies. You can set daily spending limits and restrict usage to travel-related merchants, preventing misuse while simplifying expense tracking and reimbursement processes.

Marketing, digital ads, and freelancers

Control your creative spend by issuing dedicated prepaid debit cards for business. Set clear budgets for ad platforms like Google and Meta, or allocate funds for design tools and freelance projects.

For one-time campaigns or incentive-based payouts, teams may also consider corporate prepaid gift cards—a flexible complement to business prepaid debit cards that offers spending control without long-term commitment.

SaaS and recurring subscriptions

Prevent service interruptions and security risks by dedicating specific cards to software subscriptions. Instead of using shared company cards that create security vulnerabilities, assign individual cards to different software categories. This approach protects your primary accounts from potential breaches while ensuring critical business tools remain active and properly budgeted.

Office supplies and procurement

Empower office managers and procurement teams with spending freedom within defined limits. Load cards with monthly supply budgets and set merchant restrictions to office supply stores and approved vendors. This system eliminates approval delays for routine purchases while maintaining budget control and proper expense categorization for accounting purposes.

If you're looking to optimize spend management across categories like travel, subscriptions, procurement, and more, understanding the range of available card options can help you make informed decisions. Explore our comprehensive guide on the best prepaid business cards in the US to find the right fit for your company's unique needs.

Why Volopay is the ideal prepaid debit card solution for businesses

Unified platform for expense management

Volopay combines business prepaid debit cards with comprehensive expense workflows and reporting in one integrated platform.

Instead of juggling multiple tools, you get card management, approval workflows, receipt capture, and financial reporting software capabilities unified under a single dashboard.

Volopay's corporate cards work seamlessly within this system, eliminating data silos and streamlining your entire expense management process.

Instant freeze and unfreeze capabilities

Take immediate control over prepaid debit cards for business with one-click freeze functionality. Whether you're addressing suspicious activity or simply pausing spending, you can instantly freeze and unfreeze any card. This real-time control safeguards your business while ensuring flexibility and uninterrupted operations.

Unlimited virtual cards for every use case

Issue unlimited virtual business prepaid debit cards for different teams, vendors, or projects without additional fees. Create specific cards for marketing campaigns, software subscriptions, or department budgets, each with customized controls and spending limits tailored to your exact requirements.

How to get started with Volopay

Quick setup and instant card activation

Getting started with Volopay's business prepaid debit cards takes just minutes. Sign up through our streamlined onboarding process, verify your business information, and issue your first virtual card immediately. Physical cards arrive within days, but you can begin managing expenses with virtual cards right away.

Customize roles, teams, and controls

Map your organization's structure by creating departments, assigning user roles, and setting spending controls that match your business needs. Define budgets for different departments, establish approval workflows, and configure merchant restrictions. This customization ensures your prepaid debit cards for business align perfectly with your existing operational structure.

Book a demo and explore Volopay

Experience Volopay's platform firsthand by booking a personalized demo with our team. See how business prepaid debit cards integrate with your current processes, explore advanced features like automated expense reporting, and discover how the platform can transform your expense management. Our experts will walk you through real-world scenarios relevant to your industry and business size.

FAQs about business prepaid debit cards

Yes, you can set individual spending limits, merchant category restrictions, expiration dates, and transaction types for each card. This granular control ensures every business prepaid debit card aligns with specific budget requirements and usage policies.

Yes, Volopay provides instant virtual card issuance for immediate online use and physical cards for in-person transactions. You can issue both types directly from your dashboard based on your team's needs.

Business prepaid debit cards offer superior security with PCI-DSS compliance, real-time fraud monitoring, instant freeze capabilities, and spending limits. Unlike cash, they provide transaction tracking and unlike credit cards, eliminate debt exposure.

Yes, prepaid debit cards work perfectly for recurring payments like SaaS subscriptions, vendor services, and monthly bills. You can dedicate specific cards to different subscription categories for better expense tracking.

Fund cards directly from your business bank account through the platform dashboard. You can reload cards instantly as needed, set up automatic reloading schedules, or transfer funds between different cards.

Yes, you get instant transaction notifications, real-time spending dashboards, and comprehensive reports. All business prepaid debit card activity appears immediately with merchant details, amounts, and spending analytics for informed decision-making.

Yes, business prepaid debit cards work globally for international transactions, online purchases from foreign vendors, and travel expenses. Currency conversion fees may apply depending on your card program terms.