Best business bank account alternatives in 2025

A paradigm shift has been noticed in the banking sector of India, particularly over the past two decades. In terms of regulations, technology advancements, and quality of assets, it has undergone significant change. Digital anchors, which include branchless banking made viable by cutting-edge, contactless technologies, have replaced traditional forms of physical banking, such as direct interactions and consumer walk-ins, in this sector.

The digital age has significantly shaped India's banking sector's growth prospects. They offer extraordinary services to their customers and ensure unprecedented productivity gains. Particularly when looking at the period following the demonetization, the financial sector has seen a significant transformation toward digitization. However, the effects of digitization in the financial sector can be seen in the rise of new business bank account alternatives.

Challenges of traditional business banking for growing businesses

A growing business cannot afford to rely on traditional business banking because the system is somewhat outdated in terms of modern business requirements.

Businesses have multiple factors to consider when choosing a business account; whether it’s a traditional option or a modern business bank account alternative, to survive in the competitive market.

Understanding these factors is crucial to selecting the right banking solution for sustained growth. Following are some of the challenges traditional business banking poses for growing businesses.

Laborsome procedures for opening a bank account

For instance, you visit the physical branch of a bank to open a bank account for your business. There, you are required to fill out a form for opening a bank account. You need to stand in a long queue to wait for your turn to submit the form. Along with the form, you are required to submit several tedious documents about your business.

The bank manager checks all the documents and suggests amendments if any. Isn’t it a complex process to deal with? Traditional business banking is all about roaming from one window to another for approvals. Therefore, it’s wise to research some business bank account alternatives. It makes your work simpler.

Requirements to get a traditional business bank account

There are several requirements for a business to be eligible to open a business bank account in a traditional bank in India, for example; the business PAN number, Declaration form 60-61, personal identification details, and documents of the business owner, government-issued ID, and the residential of the business partners, tax certificate and many more.

Various intricate details need to be submitted to the bank with proof in order to be eligible. Collecting, arranging, and submitting those is a heavy task in itself.

Transaction costs

For a variety of financial services, such as maintaining an ATM or checking your bank balance, a fee is charged by traditional banks; if you are unable to find your bank account, there are fees for almost everything, which can quickly add up.

You likewise need to pay an expense to move cash to different banks. You must always maintain a certain minimum balance for some bank accounts. Traditional banks automatically deduct the cost of a transaction from your bank account.

Complications in handling complaints from customers

Despite offering in-person customer service, traditional banks sometimes take longer to respond to complaints in comparison to other non-traditional business bank providers. The processing of this procedure also necessitates several forms and bureaucracy, which can waste time.

Availability

The days and hours of operation of traditional banks are specified. As a result, the only time you can visit traditional banks is during this time.

Therefore, depending on the services you require, if you have a complaint outside of these hours or days, you can only get in touch with their online representatives or wait until the next office day or hour.

These were some of the drawbacks of having an account in a traditional bank. Growing businesses should start accepting business bank account alternatives.

Factors driving non-traditional banking acceptance

Because of their ease of use and efficiency, mobile banking and fintech are a constant trend that has taken over the traditional banking system. It is a banking system offered by banks or other financial institutions that gives customers and users access to financial services like making withdrawals, transferring funds, and paying bills, among other things, on their handheld gadgets. The following are the factors driving the acceptance of non-traditional banking for small businesses.

Hasle-free transactions

Mobile and online banking let you initiate quick and efficient transactions, whether you're making national or international transfers or initiating payment for an online order.

These platforms also offer the convenience of managing your finances from anywhere, at any time, without the need to visit a physical branch.

In addition, they frequently send notifications to customers to let them know in advance of service outages or routine maintenance so you can use other transfer methods.

Supports contactless payments

QR codes, NFC, virtual cards, and other contactless payment options are available through mobile and online banking. Online payments can be made easily.

The requirement to carry cash or even physical cards gets eliminated. Online banking allows you to pay anytime and anywhere with just a tap on your screen.

Additionally, these contactless options offer enhanced security features, such as tokenization and encryption, to protect your financial information from potential fraud.

Offers Security to the users

Multiple levels of security are used in online banking to ensure that your funds and information are always safe.

You can protect your records with two element verification strategies, including your mobile secret key, finger impression lock, and exchange passwords/PIN, which gives a remarkable layer of safety for your record.

The business bank account alternatives like mobile banking ensure that your payment is securely initiated, with multiple encryption protocols in place to protect sensitive data.

Reasonable prices

Users of mobile banks can take advantage of a variety of free financial services. You can initiate payments, download bank articulations, and check your account balance without paying extra charges.

Additionally, there are few or no extra fees, making mobile banks more accessible, cost-effective and convinient than traditional banks for streamlining financial management.

Convenience

You only require an internet connection to use online banking to conduct your banking transactions from any place. This means there will be no more lengthy bank lines or paperwork.

You can access your money anytime to pay bills, make payments, transfer funds, and make payments. The business bank account alternatives have made your work simple and convenient.

What are some top alternatives to business banking in 2025?

1. Neobanks

A cheaper business bank account alternative to the traditional ones is Neobanks. These are also known as "digital-only banks" or “challenger banks.”

These are cheaper because they offer low-interest rates and fees, and they don’t bear similar overhead costs as traditional banks and mortar banks do. Plus, you only have to fill out an application form and present some identity proof to open an account with Neobanks.

2. Peer-to-peer lenders for business credit

A form of crowdfunding known as peer-to-peer (P2P) lending lets businesses borrow money from individual investors. Businesses use P2P lending to ask for a loan on a P2P platform, where interested investors can choose whether or not to fund the loan.

P2P loans typically have much lower interest rates than those offered by traditional lenders like banks. This is due to the fact that P2P lenders do not have the same overhead expenses as conventional lenders.

3. Google wallet/Apple pay cash

Similar to Apple Pay, Apple Pay Cash lets you store both gift cards and credit and debit cards in a single location. You can also send and receive money from friends and family using Apple Pay Cash.

You can store your loyalty cards, as well as your debit and credit cards, in one convenient location with Google Wallet and Apple Pay Cash, two excellent business bank account alternatives.

4. Online banks

Online banks provide all of the features and capabilities of the traditional banking system, but they are only accessible online, without the need for physical bank branches or ATMs.

Small businesses that don't have time to go to a bank in person and those who want to visit banks only when they want to can benefit greatly from this business bank account alternative. Numerous online banks provide good interest rates on deposited funds and charge no monthly fees.

5. Community Banks

Community banks are one more choice for organizations that need a business bank account alternative. These banks are little, nearby banks that pay attention to giving financial administrations to the occupants and organizations in their networks.

They additionally frequently have more adaptable loaning measures than public banks. Opening a record with a local area bank is typically extremely basic, including minimal more than finishing up an application structure and giving verification of identity.

Potential advantages of switching to alternative banking solutions

Zero fees or low-cost access

As mentioned above, in comparison to traditional banks, other business banking solutions are cheaper. This is because their overhead costs are lower, thanks to the absence of physical branches. Hence, they charge less and pay more.

Open an account online

Unlike traditional banks, other business bank account alternatives allow you to easily open an account online and fulfill all the requirements without actually having to go to the banking establishment.

Added perks and priveleges

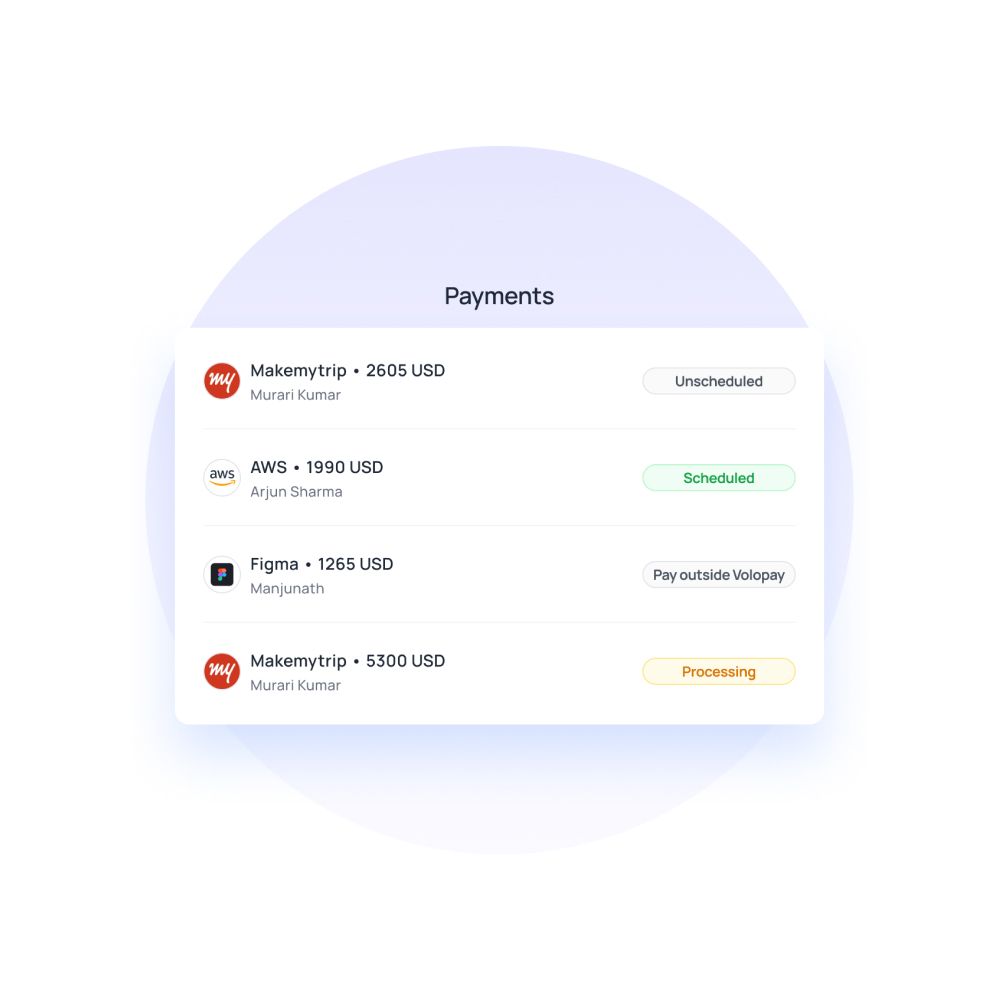

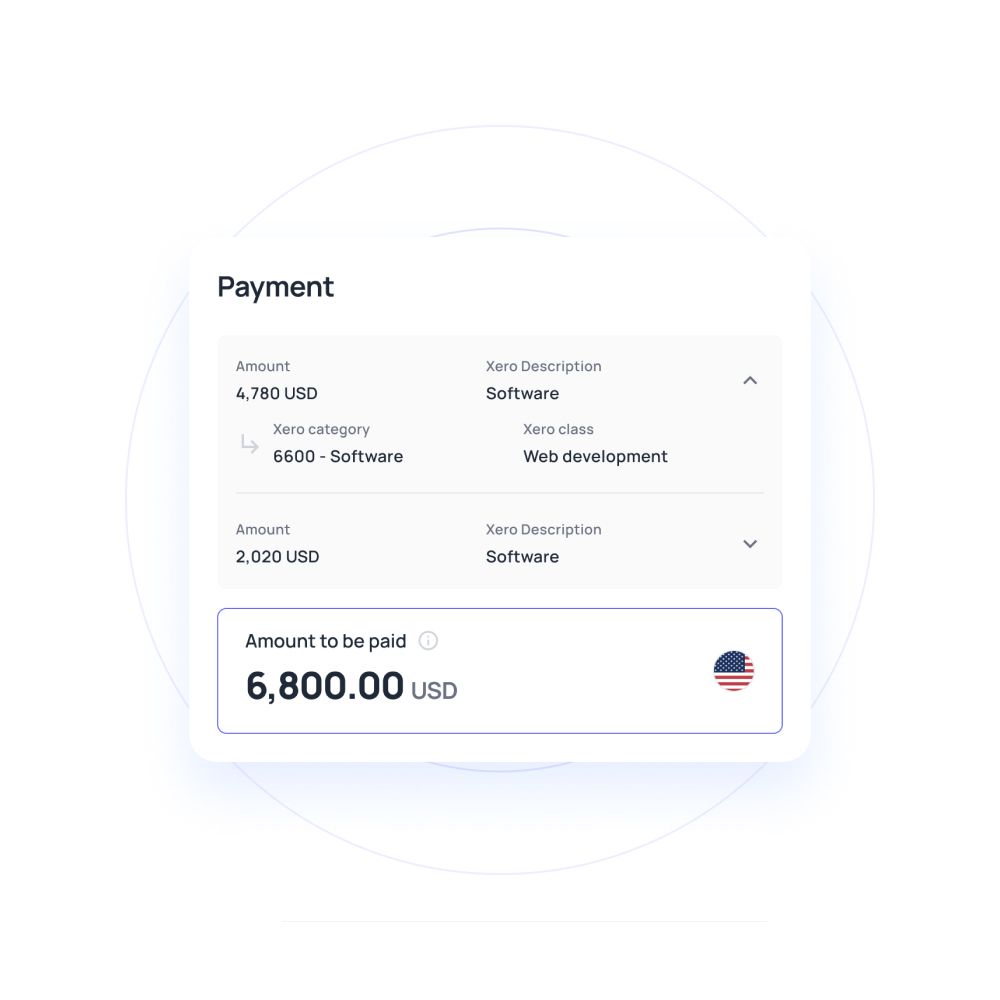

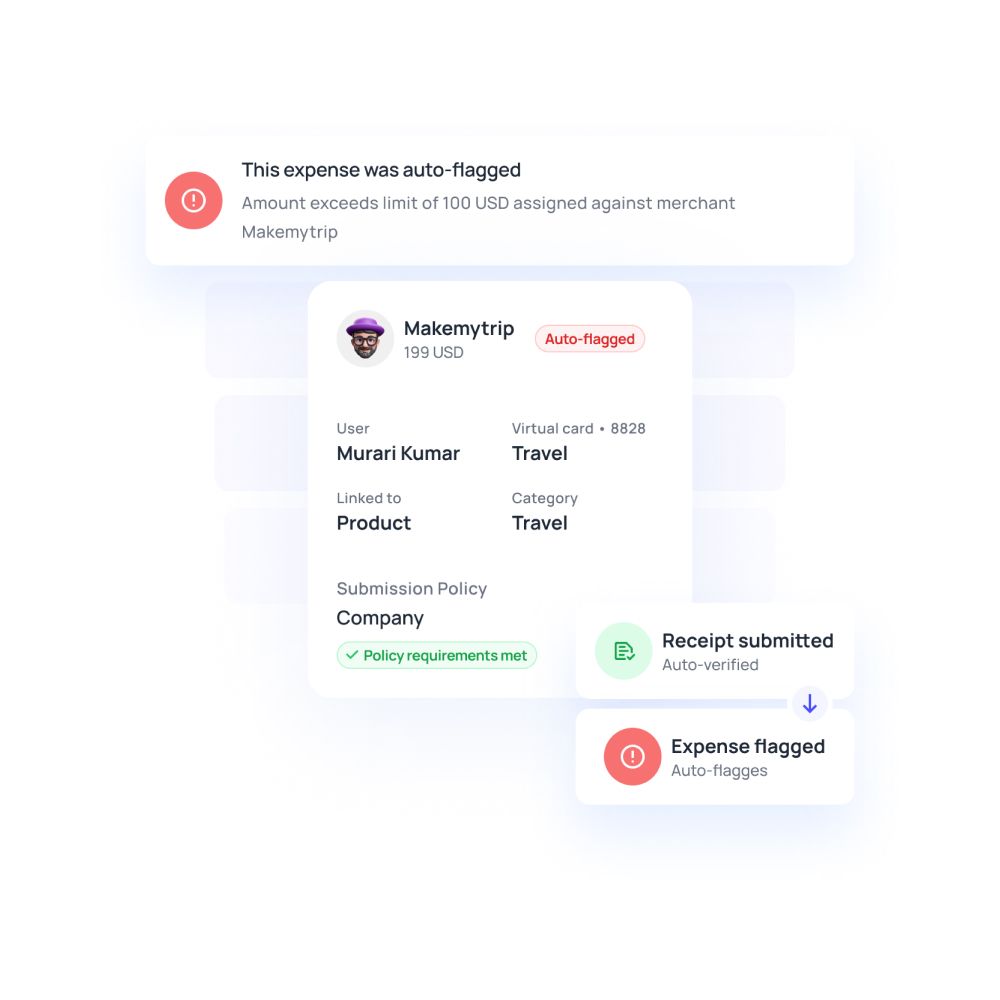

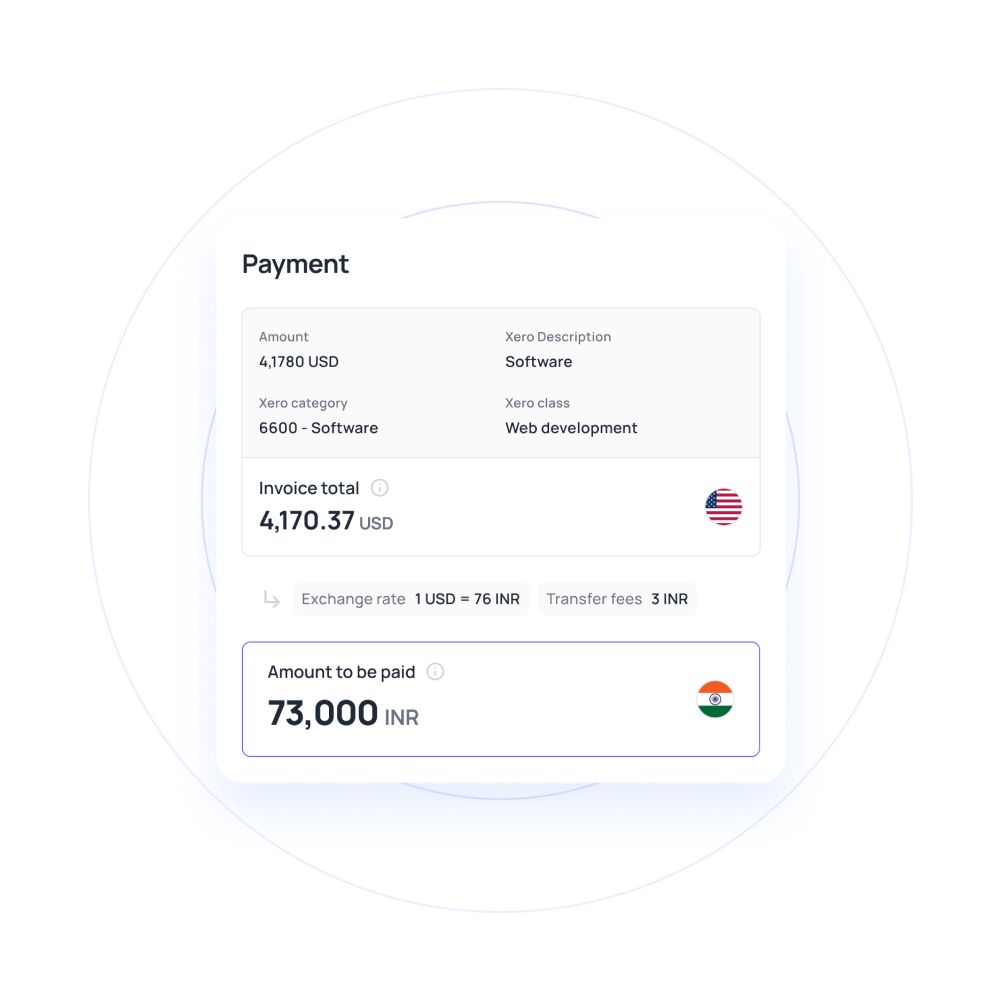

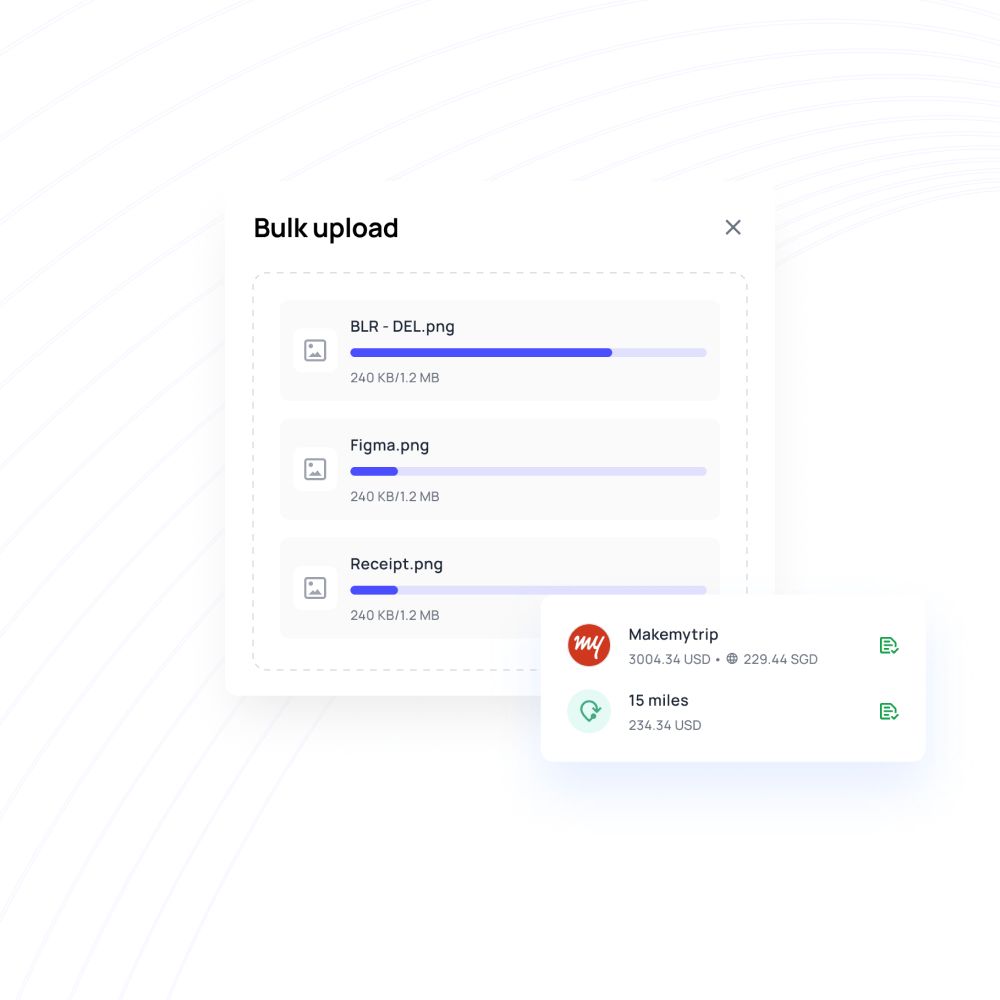

If you use online business financial management platforms like Volopay, not only do they provide corporate cards for payments, but they also facilitate a business with various features to automate other functions like accounting, reimbursement, invoice management, integrations, and more. So you get an all-in-one deal.

Zero transaction fees

Alternative banking solutions are majorly popular because they do not charge any transaction fees. All payments made through these platforms do not take any hidden or extra cost. However, for international payments, FX charges are still applied, but those are also competitive in comparison to what the traditional banks charge.

Integrations with accounting software

As everything is conducted online, business banking alternative options come with accounting integrations. This means that any and all transactions made using that platform or app would automatically be reconciled into the accounting books, so you are free from the tedious job of data entry.

Advanced bank-level security features

Business bank account alternatives are better than transitional banks in many ways, even when it comes to security. With advanced technologies like two-factor authentications, multi-layered password protection, one-time passcodes (OTPs), and real-time updates of transactions, provide immense security for your funds.

How can Volopay stack up to all business needs?

Every modern business has a certain set of technologically advanced requirements which help them stay on top of the game. Some of these are accounting automation, integrations with different tools, online payment support, and overall financial management aid. Your one-stop shop for all these is Volopay!

Volopay is a meticulously created spend management platform providing businesses with the modern-day tools to organize and manage their finances smartly. The various features provided by Volopay are as follows:

● Direct accounting integration

● Reimbursement workflow

● Multi-currency digital wallets

● Vendor and invoice management