What is a purchasing card (P-card) and how does it work?

Companies are becoming more efficient with the advancement of technology. To eliminate issues relating to spending, P-cards are introduced. It stands for Purchasing cards.

A purchasing card is quite beneficial for a business as it helps in the efficient management of business spending.

Purchasing cards offer the advantage of initiating electronic business payments for the purpose of purchasing goods & services. The purpose and meaning of p-cards should be clearly understood before acquiring them.

What is a purchasing card (P-card)?

A purchasing card (P-card) is a corporate payment solution that enables employees to make business-related purchases directly without the need for a traditional procurement process. Unlike standard corporate credit cards, P-cards are specifically designed for low-value, high-frequency transactions, helping companies streamline expenses and reduce administrative burdens.

Organizations benefit from using P-cards by improving cash flow management, minimizing paperwork, and enhancing spend visibility. These cards come with customizable spending controls, allowing businesses to set limits on transactions and vendor categories.

By simplifying procurement, a P-card helps organizations increase efficiency and enforce compliance with purchasing policies. Companies across industries use P-cards to manage operational expenses while maintaining better control over their purchasing activities.

Key functions of a purchasing card (P-card)

A purchasing card (P-card) is a payment solution that simplifies business expenses by reducing reliance on traditional procurement processes. As a type of business expense card, it enables organizations to make controlled purchases efficiently, improving cost management and oversight.

A P-card streamlines transactions, enhances expense tracking, and provides greater flexibility for business spending while ensuring compliance with company policies.

Streamline purchasing

A P-card helps organizations streamline purchasing by eliminating time-consuming purchase requisitions and approvals. Employees can quickly acquire necessary goods and services without delays, improving operational efficiency.

Unlike traditional methods, a purchasing card automates transaction tracking, reducing paperwork and manual processing. This not only speeds up procurement but also enhances financial visibility, making it easier to monitor and control expenses while maintaining compliance with spending policies.

Manage travel and entertainment expenses

Using a purchasing card for travel and entertainment expenses simplifies expense management. As an expense management card, a P-card allows employees to book flights, accommodations, and meals without needing reimbursement requests.

It provides real-time spending insights, ensuring policy compliance and budget control. The procurement card also integrates with expense reporting tools, reducing administrative burdens and streamlining the approval process, ultimately improving financial oversight for corporate travel.

Pay for office supplies

A P-card enables businesses to efficiently pay for office supplies, reducing procurement delays. Employees can purchase essential items like stationery, printing materials, and technology accessories without going through lengthy approval processes. This ensures uninterrupted operations while maintaining cost control.

Additionally, a purchasing card allows finance teams to monitor expenses in real time, providing better insights into purchasing trends and vendor relationships for strategic budgeting.

Simplify vendor payments

Businesses can use a P-card to simplify vendor payments, eliminating the need for paper checks and manual invoicing. This speeds up transactions, ensuring vendors receive timely payments while improving cash flow management.

A purchasing card enhances financial accuracy by reducing errors in payment processing. Additionally, automated tracking through P-cards provides transparency, making it easier to reconcile accounts and maintain strong supplier relationships.

Purchase software and subscriptions

A P-card is an effective tool to purchase software and subscriptions, ensuring uninterrupted access to essential business tools. It allows organizations to manage recurring payments for cloud services, SaaS platforms, and security applications without the hassle of manual invoicing.

Using a purchasing card also enhances control over digital expenses, offering detailed reports on spending patterns and ensuring compliance with corporate procurement policies.

Buy equipment and tools

A P-card simplifies the process of purchasing equipment and tools by eliminating lengthy procurement steps. Businesses can quickly acquire essential items such as machinery, office devices, and hardware without delays.

Using a purchasing card ensures better expense tracking, improves budgeting accuracy, and provides real-time visibility into spending. Additionally, the procurement card allows companies to take advantage of supplier discounts and streamline payment reconciliation processes.

Fund training and development

Organizations can use a P-card to fund training and development initiatives, ensuring employees have access to essential learning programs. Businesses can pay for courses, certifications, and professional workshops without complex purchase approvals.

A purchasing card provides a streamlined payment method for online and in-person training sessions. With a procurement card, companies can monitor educational expenses, optimize learning investments, and improve workforce skills without administrative bottlenecks.

Cover client entertainment costs

A P-card helps businesses efficiently cover client entertainment costs by enabling seamless payments for meals, event tickets, and hospitality expenses. Employees can use a purchasing card to handle business-related entertainment while ensuring compliance with company policies.

The procurement card simplifies expense reporting, providing clear documentation for financial audits. Additionally, real-time tracking through a P-card ensures businesses stay within budget and maintain transparency in client-related spending.

Handle emergency purchases

A P-card is an essential tool to handle emergency purchases, allowing businesses to respond quickly to urgent needs. Whether replacing broken equipment, securing last-minute travel, or covering unexpected repairs, a purchasing card provides instant access to funds.

The procurement card ensures quick approvals and eliminates reimbursement delays. Moreover, real-time transaction monitoring enhances financial control, preventing unauthorized spending while ensuring business operations remain uninterrupted during emergencies.

How do purchasing cards work?

A purchasing card (P-card) is a payment solution that simplifies business expenses by reducing manual processes and paperwork. It allows employees to make company-approved purchases without relying on traditional procurement methods.

With built-in controls like spending limits and real-time tracking, P-cards help organizations maintain financial oversight while improving efficiency and expense management.

1. Issuance by financial institutions

Banks and financial institutions issue P-cards to businesses based on their financial requirements and policies. Companies collaborate with providers to set up card programs that align with their spending controls and approval workflows.

P-cards are linked to corporate accounts, eliminating the need for reimbursements. Many institutions offer additional security measures, transaction monitoring, and integration with expense management systems to enhance visibility and compliance.

2. Assigning cards to employees or departments

Organizations allocate P-cards to employees or departments to facilitate purchasing within defined budgets. Each cardholder is assigned a unique account, which helps in ensuring clear accountability.

Some companies issue individual cards for specific roles, while others provide shared cards for departmental use. This structured approach helps manage spending efficiently, reduces dependency on petty cash, and improves financial transparency across the organization.

3. Setting spending limits for cardholders

Companies establish spending controls on P-cards to prevent unauthorized transactions and maintain budget discipline. Limits can be set based on employee roles, transaction types, or purchase categories and varies from company to company.

Businesses may implement daily, monthly, or per-transaction caps to align with financial policies. Additionally, administrators can restrict certain merchants or expense types, ensuring that all purchases remain compliant with company guidelines.

4. Making purchases with the P-card

Employees use P-cards to make authorized business transactions at approved vendors. Purchases are processed similarly to credit card payments but are directly charged to the company’s account. This helps to eliminate the need for reimbursement claims and speeds up procurement.

Automated reporting tools track spending in real time, allowing organizations to review, approve, and reconcile expenses efficiently while minimizing fraud risks.

5. Approval process for purchases (if required)

Some organizations implement an approval process before purchases can be made using a P-card. This may involve pre-authorization for specific transactions or vendor categories.

Managers or finance teams review and approve requests based on spending policies. Automated approval workflows streamline this process, ensuring compliance while minimizing delays.

By enforcing controlled spending, businesses maintain financial oversight and reduce the risk of unauthorized or excessive purchases.

6. Tracking and recording transactions in real-time

P-cards offer real-time transaction tracking, allowing businesses to monitor expenses as they occur. Transactions are automatically recorded in expense management systems, reducing manual data entry and errors. This visibility helps finance teams detect unusual spending patterns and enforce budget controls.

Real-time tracking also simplifies reporting, enabling organizations to analyze purchasing trends, manage cash flow effectively, and ensure that all expenses align with company policies.

7. Reconciliation of purchases with monthly statements

At the end of each billing cycle, P-card transactions are reconciled with monthly statements to ensure accuracy. Cardholders review their purchases, match receipts, and verify that charges align with company guidelines.

Finance teams compare transactions against budgets and correct discrepancies if needed. Automated reconciliation tools simplify this process, reducing administrative work while ensuring all expenditures are properly recorded, categorized, and accounted for in financial records.

8. Auditing and compliance checks

Regular audits and compliance checks help ensure that P-card usage adheres to company policies and regulatory requirements. Finance teams review transaction reports to identify policy violations, unauthorized purchases, or fraudulent activity.

Businesses may implement periodic internal audits or external reviews to maintain transparency. By enforcing compliance, organizations minimize financial risks, improve accountability, and strengthen internal controls over purchasing and expense management.

Types of purchasing cards

All purchasing cards have a relatively similar goal, which is to improve and streamline an organization’s expense management. However, there are several different types of cards that may suit your needs better than others.

1. Corporate purchasing cards

All types of purchasing cards are typically designed for organizations, but a corporate purchasing card is specifically aimed at companies and corporations.

You will need to be a registered company to apply for corporate purchasing cards. These can be issued to employees for them to use as a charge card.

2. Business purchasing cards

Like corporate purchasing cards, a business purchasing card is a type of commercial card intended to make purchases on behalf of your business.

It’s a generalized card that can be used to make all sorts of business purchases, such as office supplies and employee expenses. Typically, there are fewer requirements for a business card.

3. Government purchasing cards

Like businesses, government bodies have to make expenses to ensure that they run smoothly.

They can take advantage of government purchasing cards to do this, which will help them manage their budgets more efficiently. These are relatively similar to purchasing cards for business entities but tailored to government bodies.

4. Non-profit organization purchasing cards

Non-profit organizations might not be eligible for certain purchasing cards, such as corporate purchasing cards.

The good news is that several banks and card providers also offer purchasing cards specific to non-profit organizations. These may have special offerings such as a 0 USD annual fee or no interest rates on purchases.

5. Travel purchasing cards

Traditional, travel corporate cards function very similarly to personal credit cards. The biggest difference is that they are used specifically to make business travel expenses.

However, travel purchasing cards have an added layer to them, allowing managers and executives to set further spending limits before the cards are used for travel purposes.

6. Fleet purchasing cards

Fleet purchasing cards, often referred to as just fleet cards, are cards your employees can use to make vehicle expenses.

These cards are typically issued to employees who work with the company’s transportation, with usage such as fuel, maintenance, parking, and more. It is one of the best payment methods to track fuel expenses.

7. Virtual purchasing cards

A virtual purchasing card isn’t all that different from its standard physical counterpart. They function almost exactly the same, except virtual cards don’t have a physical form.

There are also some more flexible features with virtual purchasing cards, such as the ability to customize expiry dates and adjust spending parameters.

8. One-time use purchasing cards

With virtual cards, you get the ability to also issue only single-use cards. These one-time-use purchasing cards are useful when you don’t intend to make a repeat purchase with the vendor.

They introduce a higher level of security as they expire after their initial transaction, rendering the card data useless in the future.

9. Travel and entertainment (T&E) cards

As the name suggests, travel and entertainment, or T&E cards are used to make purchases related to the two categories.

These are useful for activities such as business trips, coffee meetings, client dinners, and more. Every employee equipped with a T&E purchasing card can easily make these purchases.

P-cards vs. corporate cards vs. business credit cards

Corporate cards, business credit cards, and P-cards are financial tools used by businesses to manage purchases, expenses, and payments.

While they all serve similar purposes, each has specific features tailored to different business needs, including control over spending, expense management, and ease of use for employees.

Purpose of use

● P-card

A P-card is primarily used for low-cost purchases, often related to supplies, services, or travel. It simplifies procurement processes by allowing employees to make small transactions directly, without requiring a traditional purchase order. P-cards are often used to handle routine, frequent expenses efficiently.

● Corporate card

A corporate card is designed for larger expenses, typically used by senior executives or employees who need to make purchases on behalf of the company. These cards can be used for business-related travel, entertainment, or supplies, streamlining corporate spending and reducing the need for reimbursement processes.

● Business credit card

A business credit card is a versatile financial tool used to manage business expenses by providing a revolving credit line. It allows businesses to make purchases and pay them off over time, providing flexibility for cash flow management. These cards can be used for a wide range of business-related expenses.

Expense management

● P-card

A P-card simplifies expense management by allowing businesses to track smaller transactions and reduce the paperwork involved in procurement. It helps ensure purchases stay within company policy while providing a transparent, real-time view of spending. This leads to better control and quicker reconciliation of expenses.

● Corporate card

A corporate card aids in managing larger corporate expenses by centralizing payments for travel, entertainment, and other work-related activities. It typically comes with more robust reporting features to streamline the reconciliation process and improve tracking, making it easier for businesses to manage and audit their expenses effectively.

● Business credit card

A business credit card offers detailed expense tracking, helping businesses manage their purchases across departments or employees. It allows for flexibility in payments and helps businesses track and control cash flow by offering reporting tools, monthly statements, and expense categorization, ensuring clear visibility over company spending.

User scope

● P-card

A P-card is typically issued to individual employees responsible for smaller, routine purchases. These cards are usually assigned to specific roles or departments to help manage the procurement process for low-cost items, making it easier for employees to make purchases directly while maintaining company policies.

● Corporate card

A corporate card is generally issued to senior employees or executives who frequently incur business-related expenses, such as travel and entertainment.

It is often assigned to individuals or teams with significant purchasing authority, providing a controlled way to manage larger expenses that align with the company’s overall financial strategy.

● Business credit card

A business credit card is issued to businesses or organizations and can be used by multiple employees within the company. These cards allow employees at various levels to make purchases, while the business has oversight and control over spending.

Business credit cards are typically used across the entire organization to manage expenses and facilitate payments.

Transaction limits

● P-card

P-cards typically have lower transaction limits, making them ideal for small, frequent purchases. These limits can be customized based on the employee’s role and department.

By setting specific thresholds, businesses can control spending and ensure purchases remain within the defined budget for routine expenses like office supplies.

● Corporate card

Corporate cards generally have higher transaction limits to accommodate larger business-related purchases. These limits are set for employees or executives with more significant purchasing authority.

It helps ensure that expenses, such as travel and high-cost supplies, are approved while maintaining proper control over larger transactions within the company.

● Business credit card

Business credit cards usually offer flexible transaction limits, often determined by the company’s creditworthiness. These cards provide the freedom to make larger or ongoing purchases while offering a revolving credit line.

Limits can be adjusted as needed, helping businesses manage their cash flow while covering a range of business expenses.

Expense control

● P-card

P-cards allow businesses to maintain strict control over small-scale spending. With customized limits for each cardholder, businesses can ensure that employees only make purchases within predefined categories or amounts.

This helps prevent unauthorized spending while allowing companies to track all transactions, improving overall financial oversight and control.

● Corporate card

Corporate cards provide companies with a means of controlling larger, high-value expenses, such as travel and entertainment.

Businesses can set policies on approved categories and monitor spending patterns to ensure expenses align with company budgets. This level of oversight helps reduce the risk of overspending and ensures compliance with financial regulations.

● Business credit card

Business credit cards offer companies the flexibility to manage expenses across multiple departments or employees. With tools to track purchases, set limits, and generate reports, businesses can maintain control over spending.

By using these cards, businesses can better align expenses with their overall financial strategy, ensuring better budget management.

Reconciliation process

● P-card

Reconciliation of P-card transactions is typically straightforward, as purchases are recorded automatically in real-time. Employees can submit receipts and match them to the transactions for quick verification.

The process reduces manual effort and ensures accurate accounting of small, routine purchases, which simplifies monthly financial reviews and reporting.

● Corporate card

Corporate card reconciliation involves matching higher-value transactions to receipts or expense reports. Businesses use centralized reporting tools to verify travel and entertainment expenses, ensuring they align with company policies.

The process allows for efficient auditing and helps identify any discrepancies, making it easier to maintain accurate and up-to-date financial records.

● Business credit card

The reconciliation process for business credit cards involves tracking multiple transactions across different departments and employees.

Monthly statements can be categorized, and automated reports can be generated, making it easier to verify each expense. This helps companies ensure all purchases align with budgetary constraints and provides a clear overview of spending.

Fraud prevention

● P-card

P-cards are equipped with security features like transaction monitoring and fraud alerts, minimizing unauthorized purchases. Spending limits and usage restrictions add an additional layer of protection.

Regular audits also help detect unusual activity, ensuring that businesses can quickly identify and prevent fraudulent transactions.

● Corporate card

Corporate cards provide robust fraud prevention tools such as real-time transaction monitoring and automated fraud detection systems. Businesses can implement additional safeguards, like setting up alerts for unusual transactions.

This reduces the risk of unauthorized spending and enhances security for larger, high-value purchases typically made with corporate cards.

● Business credit card

Business credit cards offer fraud prevention features such as fraud detection software, customizable alerts, and purchase tracking. Many credit cards also come with zero liability protection for unauthorized charges.

These security measures help businesses protect themselves from fraud and maintain oversight of multiple cardholder transactions.

Reporting and data insights

● P-card

P-cards offer real-time transaction tracking, providing businesses with immediate data on purchases. These cards enable easy generation of detailed expense reports, allowing businesses to analyze spending patterns.

With built-in reporting features, finance teams can quickly review transactions, ensure policy compliance, and improve budget management.

● Corporate card

Corporate cards provide comprehensive reporting tools that consolidate data from multiple users. This allows businesses to generate detailed expense reports, track spending trends, and ensure compliance with financial policies.

Data insights help businesses optimize spending, making it easier to review corporate expenditures and identify opportunities for cost savings.

● Business credit card

Business credit cards offer robust reporting capabilities, allowing businesses to track multiple cardholder expenses across departments. Detailed analytics provide insights into spending patterns, budget allocations, and areas where costs can be controlled.

With centralized reporting, businesses can make informed decisions, ensuring better financial management and improved cash flow.

Vendor payments

● P-card

P-cards simplify vendor payments by allowing businesses to pay for products and services directly without requiring lengthy invoicing processes. This leads to quicker transactions, helping vendors receive payments faster and improving supplier relationships.

Businesses benefit from reduced administrative work, streamlined payments, and better control over spending.

● Corporate card

Corporate cards streamline vendor payments by centralizing purchasing and reducing the need for manual invoices. With higher credit limits, businesses can make substantial payments quickly, maintaining strong vendor relationships.

This process also reduces paperwork, increases efficiency, and offers better control over corporate spending across departments and employees.

● Business credit card

Business credit cards facilitate vendor payments by offering flexibility in managing cash flow. These cards allow businesses to pay for goods and services while deferring payment until the end of the billing cycle.

The ability to track payments ensures accuracy and transparency in managing vendor relationships and payment histories.

Policy and usage restrictions

● P-card

P-cards come with predefined policies and usage restrictions, such as limits on transaction amounts and categories. Businesses can restrict employees from using the card for non-approved items or services. These restrictions ensure that purchases align with company guidelines and provide better control over spending practices.

● Corporate card

Corporate cards have specific usage restrictions, such as limits on travel or entertainment expenses. Policies are often in place to prevent misuse of the card for personal purchases.

These restrictions ensure that employees use the card only for business-related expenses, helping companies maintain budget control and reduce fraudulent activity.

● Business credit card

Business credit cards are governed by clear usage policies, ensuring that cardholders use them only for approved business expenses. Restrictions may include spending limits, category-based restrictions, and reporting requirements.

These controls ensure compliance with corporate financial policies and help businesses manage expenses in line with their budgets and objectives.

Benefits of using purchasing cards for businesses

A purchasing card offers businesses a simpler, more efficient way to handle payments for goods and services. By streamlining the procurement process, it helps businesses save time, reduce costs, and helps improve financial oversight. Companies can gain better control over their expenses and ensure compliance with spending policies using this tool.

Streamlined purchasing process

Using a purchasing card significantly streamlines the purchasing process. It eliminates the need for paper-based requisitions and lengthy approval workflows, reducing the administrative burden. Employees can quickly make authorized purchases, reducing procurement delays and improving operational efficiency.

With automated transaction tracking, businesses gain better visibility into spending, enabling faster reconciliation and decision-making. This makes the overall process more efficient, less prone to errors, and more cost-effective, ultimately saving both time and resources across the organization.

Improved cash flow management

A purchasing card can help businesses improve cash flow management by consolidating expenses and providing more predictable spending. With real-time tracking, companies can monitor their expenditures, ensuring they stay within budget.

What is a purchasing card becomes clear when considering its role in cash flow, by offering a clear view of upcoming payments, it enables businesses to manage their funds more effectively, avoiding cash shortages.

Enhanced spending control

A procurement card offers enhanced spending control by setting customized spending limits for each cardholder.

Businesses can restrict spending to specific categories or merchants, ensuring that employees stay within predefined budgets. This helps prevent unauthorized or excessive spending, giving finance teams greater oversight of business expenses.

Additionally, businesses can track real-time purchases to detect any irregularities promptly and make immediate adjustments, improving financial control and reducing the risk of budget overruns.

Reduced administrative burden

Implementing a purchasing card reduces the administrative burden typically associated with procurement processes. By eliminating manual invoicing and reimbursement claims, businesses save significant time on administrative tasks.

The integration of automated reporting and reconciliation further reduces the need for manual data entry, freeing up resources for more strategic activities. This increased efficiency contributes to overall productivity across departments, allowing teams to focus on high-priority goals and enhancing operational performance across the organization.

Cost savings

The use of purchasing cards can lead to significant cost savings for businesses. By consolidating purchases onto a single platform, businesses can negotiate better vendor terms and discounts.

Additionally, What is a P-card becomes relevant here, as it allows businesses to avoid late fees and penalties associated with delayed payments. The automation of processes also reduces operational costs, helping businesses achieve better financial outcomes.

Increased transparency

Purchasing cards provide increased transparency by offering real-time visibility into transactions. All purchases are automatically recorded and categorized, making it easy for finance teams to monitor and analyze spending.

This transparency ensures that all expenses align with company policies and budget guidelines. It also simplifies financial reporting and auditing, providing businesses with a clear and accurate picture of their expenditures.

Strengthened supplier relationships

Using purchasing cards can help businesses strengthen supplier relationships by ensuring timely payments and reducing the complexity of transactions. Suppliers benefit from quicker, more reliable payments, which can lead to improved trust and loyalty.

Additionally, streamlined payment processes reduce administrative costs for both the business and suppliers, fostering a positive, long-term partnership that benefits both parties.

Enhanced fraud protection

Purchasing cards offer enhanced fraud protection by providing built-in security features like transaction alerts and customizable spending limits. If unauthorized transactions occur, businesses can quickly detect and address them.

Many cards also include fraud protection services, ensuring that funds are safeguarded against potential risks. This level of security helps minimize the impact of fraud and ensures that businesses can operate with confidence.

Greater employee efficiency

A purchasing card increases employee efficiency by simplifying the purchasing process. Employees can make purchases directly without waiting for approval or going through lengthy procurement procedures. This reduces delays and enables employees to focus on their primary tasks.

Automated tracking and reporting further reduce administrative workload, allowing employees to spend less time on paperwork and more on productive activities that drive business success.

Improved budget management

Purchasing cards contribute to improved budget management by providing real-time insights into spending patterns. Businesses can set spending limits and track purchases, making it easier to stay within budget.

The automated reporting features of purchasing cards allow finance teams to identify trends, allocate resources more effectively, and make data-driven decisions to optimize future spending. This control helps companies manage their finances more efficiently and prevent overspending.

Admin controls available in a purchasing card

Purchasing cards offer a variety of admin controls to help businesses manage spending efficiently. These controls give administrators the flexibility to set spending limits, monitor transactions, and ensure compliance with company policies.

By using these tools, organizations can maintain financial oversight and minimize the risk of unauthorized purchases.

Set spending limits per cardholder

Administrators can set spending limits for each cardholder, ensuring that individual purchases remain within defined financial boundaries. These limits help prevent excessive spending and ensure that each employee’s purchases are in line with company budgets and policies.

Spending caps can be adjusted based on role, department, or specific needs, offering greater control over business expenses and reducing the risk of overspending or unauthorized transactions.

Define transaction limits by category

With purchasing cards, businesses can define transaction limits by category, restricting employees to specific types of purchases. For example, administrators can set individual spending limits for office supplies, travel expenses, or software subscriptions.

This control ensures that employees only use the card for authorized and necessary purchases, reducing the potential for misuse, improving compliance with company policies, and ensuring that spending stays within budgeted categories.

Restrict vendor usage

Administrators can restrict vendor usage on purchasing cards, ensuring purchases are made only from approved or preferred suppliers. This feature prevents employees from buying from unauthorized vendors or engaging in off-contract purchases, offering enhanced control over business spending.

By limiting transactions to specific vendors, businesses can negotiate better rates, streamline procurement processes, and strengthen supplier relationships while maintaining stricter budget control and compliance with corporate purchasing policies.

Monitor real-time transaction activity

Purchasing cards allow businesses to monitor real-time transaction activity, providing up-to-the-minute insights into employee spending. Administrators can track each transaction as it occurs, allowing them to identify irregularities, unauthorized purchases, or potential fraud promptly.

This transparency enables better financial oversight, minimizes risks, improves compliance with the company’s financial policies, and helps to prevent unnecessary or improper expenditures that could affect the organization’s overall budget.

Suspend or cancel cards instantly

In case of emergencies, administrators can suspend or cancel cards instantly, providing businesses with immediate control over potential security risks or misuse. This feature allows businesses to quickly disable cards if they are lost, stolen, or suspected of being compromised, minimizing the risk of unauthorized transactions.

It also helps businesses address any issues related to card misuse or non-compliance, offering greater flexibility, security, and confidence in managing purchasing programs effectively.

Customize approval workflows

Administrators can customize approval workflows to match their organization’s purchasing needs as and when required. They can set up multiple approval levels based on the size of the transaction or department.

This ensures that higher-value purchases require additional sign-offs, reducing the likelihood of unauthorized spending. Tailoring these workflows streamlines the purchasing process, ensuring compliance with company policies and maintaining control over business expenses.

Enable or disable international transactions

Businesses can enable or disable international transactions on purchasing cards, providing enhanced control over cross-border purchases. This feature not only allows administrators to restrict international transactions for specific cardholders or departments but also helps in preventing unwanted foreign expenses.

By controlling international spending, companies can reduce currency exchange risks, minimize fraud, and better manage their global spending in alignment with budgetary constraints and procurement policies.

Enforce budget restrictions

Purchasing card administrators can enforce budget restrictions, ensuring that all transactions stay within predetermined financial limits. These restrictions can be set at both the department and individual levels to promote compliance with the overall company budget.

By monitoring spending closely, businesses can prevent overspending, ensure financial accountability, and align card usage with organizational goals, helping to maintain financial discipline across the company.

Access detailed reporting and analytics

Managers can access detailed reporting and analytics on purchasing card transactions, providing real-time insights into company spending. This data helps identify spending patterns, monitor compliance with budget restrictions, and make informed decisions about future purchases.

The ability to analyze detailed reports enables businesses to track expenses, detect anomalies, and improve cost management strategies, ultimately supporting better financial planning and operational efficiency.

Manage card issuance and expiration dates

Admin can manage card issuance and expiration dates, ensuring that cards are issued promptly and renewed in a timely manner. This control helps maintain an active and efficient purchasing system by preventing expired cards from hindering transactions.

By tracking card issuance and expiration, businesses can ensure continuity in their procurement process, minimize delays, and ensure that all employees have access to the necessary payment tools when required.

How do purchasing cards improve procurement efficiency?

Purchasing cards simplify procurement by speeding up purchases, reducing payment processing times, and minimizing administrative tasks. They offer quicker approvals and eliminate the need for traditional purchase orders, resulting in smoother operations. Companies must understand fully what is a purchase card in order to optimize efficiency, save costs, and improve financial control.

1. Eliminating purchase order delays

Purchasing cards eliminate delays often associated with purchase orders by enabling immediate purchases without waiting for approvals or purchase order creation. This allows businesses to buy goods or services quickly, preventing delays in production or service delivery.

Faster purchasing accelerates the entire procurement cycle, improving overall business efficiency and responsiveness to demand. With fewer approval steps, procurement becomes more agile and able to adapt to changing business needs.

2. Faster vendor payments with P-cards

Purchasing cards speed up vendor payments by providing instant transaction approval and reducing payment processing times. Vendors receive payment promptly without the typical delays in invoicing and account reconciliation.

This faster payment process helps businesses strengthen supplier relationships and ensures smoother, more reliable transactions, ultimately improving cash flow management. Additionally, quick payments can also result in early payment discounts and enhanced business credibility with suppliers.

3. Reducing manual paperwork in procurement

Purchasing cards help reduce manual paperwork by automating transaction recording and integrating with accounting systems. This minimizes the need for paperwork related to purchase orders, invoicing, and receipts.

By digitizing the procurement process, businesses save time on administrative tasks and ensure more accurate records, ultimately reducing errors and increasing operational productivity. This automation also allows for better audit trails and easier compliance with financial regulations.

4. Using P-cards for small and repetitive purchases

P-cards are ideal for small and repetitive purchases, such as office supplies and travel expenses.

They streamline these transactions by eliminating the need for purchase orders or requisition forms. This reduces procurement delays, saves time, and ensures quicker processing for frequent, low-value purchases, enhancing overall procurement efficiency.

Additionally, P-cards help employees manage routine purchases without needing lengthy approval processes, simplifying the buying experience.

5. Real-time transaction processing with P-cards

P-cards enable real-time transaction processing, allowing businesses to track purchases immediately after they occur. This instant tracking ensures greater visibility into spending patterns, facilitating prompt financial oversight.

It also helps prevent fraudulent activities, as transaction data is available for immediate review and can be easily reconciled with budgets. By providing real-time updates, P-cards also ensure that companies can maintain accurate records, reducing the risk of errors.

6. Lowering the cost of procurement administration

Using P-cards lowers procurement administration costs by automating routine processes like transaction tracking and reconciliation. This eliminates manual steps involved in invoicing, approval workflows, and payment processing.

As a result, businesses can allocate fewer resources to administrative tasks, increasing efficiency and freeing up staff for more strategic activities. By minimizing paperwork, P-cards also reduce the likelihood of errors and improve the overall accuracy of financial records.

7. Tracking procurement trends using P-card data

P-cards offer valuable data that businesses can use to track procurement trends over time. By analyzing transaction details, companies gain insights into spending patterns, vendor performance, and purchasing behaviors.

This data helps identify cost-saving opportunities, optimize supplier relationships, and improve budgeting accuracy for future procurement cycles. With these insights, businesses can make more informed decisions, improving both short-term and long-term procurement strategies.

How can purchasing cards help with expense reporting?

Purchasing cards simplify expense reporting by automating the process, reducing manual work, and enhancing accuracy. By providing real-time data and integrating with expense management systems, P-cards streamline tracking and reporting. This allows businesses to maintain financial control and ensure compliance, leading to more efficient financial processes.

Automating the generation of expense reports

Purchasing cards automate the generation of expense reports by capturing transaction data directly from card purchases. This eliminates the need for employees to manually log expenses, reducing the time spent on report creation.

Automated reports ensure that the information is accurate and up-to-date, streamlining the entire expense reporting process. Furthermore, it reduces administrative overhead by ensuring that all expenses are automatically compiled in a consistent format, saving time for the finance team.

Seamlessly integrating with expense management systems

Purchasing cards can integrate seamlessly with existing expense management systems, allowing businesses to track and categorize expenses in real time. This integration ensures that expenses are automatically recorded and categorized according to company policies.

It simplifies the reconciliation process and enhances overall visibility into spending, improving the efficiency of financial reporting. The integration also enables automatic syncing of data, further reducing the risk of discrepancies between the records of the cardholder and the finance department.

Minimizing errors through reduced manual data entry

Using purchasing cards helps minimize errors by reducing the need for manual data entry. Since transactions are automatically recorded, the likelihood of human error is significantly lower.

This leads to more accurate reporting and reduces the time spent correcting mistakes, enabling businesses to maintain more reliable financial records. Additionally, reduced manual input frees up valuable time for employees to focus on more critical tasks, thereby enhancing overall productivity.

Accelerating the approval process for expenses

Purchasing cards accelerate the approval process for expenses by providing real-time transaction data. Finance teams can quickly review and approve purchases as they occur, eliminating delays that typically arise in traditional expense reporting systems.

This streamlined approval process helps businesses maintain cash flow and ensures that expenses are processed in a timely manner. With the ability to approve expenses on the go, managers can make faster decisions, contributing to the agility of the business.

Providing detailed transaction details for accurate reporting

Purchasing cards provide detailed transaction information, including merchant names, transaction amounts, and dates. This level of detail ensures that expense reports are accurate and transparent, making it easier to track spending and identify discrepancies.

Detailed transaction data also simplifies audits and enhances compliance with internal and external financial regulations. The comprehensive data allows businesses to gain deeper insights into their spending patterns, enabling better financial decision-making.

Challenges of using p-cards and its solutions

1. Risk of fraud and misuse

● Challenges

When you allow employees easy access to company funds via purchasing cards for business purposes, there’s a risk that employees may misuse the card. You must be vigilant of any fraud attempts.

● Solution

It’s important to monitor your purchasing card usage regularly. Set up spend guidelines and leverage technology to track how employees are using their cards. Ensure that everyone knows the consequences of card misuse.

2. Non-compliance and policy violations

● Challenges

As with every other finance-related process in your organization, there is a risk of non-compliance when you issue cards. Employees could use their assigned cards inappropriately and violate your policies.

● Solution

The clearer the policies you set are, the less likely it is that you’ll run into policy violations. You want to be clear and firm about the consequences of non-compliance and address them immediately.

3. Data security and privacy concerns

● Challenges

Trusting your data with a third party like a p-card provider can be daunting, especially when you consider fraud attempts. Losing your card data to a criminal could result in a loss of funds.

● Solution

The best way to ensure that your data is secure is to find a reputable provider to work with. Check if they have industry-standard certifications and security measures. Flexible card blocking and freezing are also a must-have.

4. Lack of spend visibility

● Challenges

It’s hard to tell how your employees are using company funds without regular monitoring, especially when the cards are used out of the office. You’ll need to trust your employees with their card spending.

● Solution

Make sure that your purchasing card provider has a card management dashboard integrated with your cards. This allows you to view transactions easily and will help you track your spending accurately in real-time.

5. Vendor acceptance

● Challenges

Not all vendors will accept card payments. Even with vendors that accept cards, they may prefer other payment methods like cash, cheque, or electronic transfers for cheaper transaction fees.

● Solution

Ensure that your vendors know that card payments are not only convenient but also secure and fast. When you pick a card provider, you also want to ask about the card’s acceptance network. A higher acceptance is always preferable.

6. Complex reconciliation and reporting

● Challenges

You’ll have to reconcile your accounts and procurement records with the spending made through your purchasing cards. This is a time-consuming and complex process when performed manually.

● Solution

Accounting integration and automated reconciliation can help you reduce the complexities. With all your transaction data in one place, it’s easier to compare accounts and records to ensure that all transactions are valid and accurate.

7. Lack of control and oversight

● Challenges

It’s harder to appoint someone to oversee purchasing card payments when each cardholder has full authority to use their card. It’s not just the procurement manager who has control over funds.

● Solution

Set and customize spend parameters for the cards you issue. This way, you know that the spend categories they are being used on are pre-approved. The procurement manager should also make use of the spend tracking features on your card dashboard.

8. Vendor discount loss

● Challenges

You could miss out on vendor discounts if you purchase their products or services in smaller quantities. While the p-card is useful for these smaller purchases, the discount loss will add up.

● Solution

Negotiate with your vendors if it’s possible to get a discount regardless. If you spend a significant amount on multiple transactions over a monthly period, you may still be eligible. This could be handy for things like periodic refueling.

9. Integration with accounting systems

● Challenges

The end-of-month process of closing your books can be a tedious one. The last thing you want to do is make it worse with manual data entry for small p-card purchases.

● Solution

A good card provider will have integration capabilities available to you. Before you pick a provider for your purchasing cards, ask if you’ll be able to integrate your existing accounting systems. You can also get help setting up the integration.

10. Employee resistance

● Challenges

It’s no secret that change can be difficult to implement, especially when your employees are already used to and comfortable with current processes. They may not want to change how they do things.

● Solution

It’s equally important to introduce change slowly and incrementally. Before you let your employees use purchasing cards for business expenses, ensure that they first know what is a p-card. Host training sessions and address the issues and concerns employees have.

How can businesses apply for a purchasing card?

Applying for a purchasing card involves researching providers, comparing features, and submitting required documentation. Businesses must undergo a credit check and financial review. By understanding their needs and choosing the right card, businesses can streamline their purchasing process and enhance financial control.

1. Research available purchasing card providers

Start by researching various purchasing card providers to find the best fit for your business needs. Many financial institutions offer different types of cards, each with unique features and benefits.

It’s important to consider provider reputation, customer service, and whether their services align with your company’s goals and procurement processes. Additionally, exploring online reviews and testimonials from other businesses can provide valuable insights into the provider's reliability and customer experience.

2. Compare card features and fees

Before applying, businesses should carefully compare the features and fees of each purchasing card option. Key factors to assess include transaction limits, spending controls, rewards programs, and any additional charges, such as annual fees or foreign transaction fees.

Selecting a card with low fees and robust features helps maximize value. Furthermore, understanding the interest rates, late payment penalties, and how the provider handles disputes can help avoid unexpected costs down the line.

3. Gather required business documentation

Businesses must gather necessary documentation before submitting an application. Commonly required documents include financial statements, proof of business registration, tax identification numbers, and details of key company officers.

Preparing these documents in advance can expedite the application process and ensure that the business meets all the requirements set by the card provider. Having all requested paperwork organized and ready to submit increases the chances of a smooth application process and faster approval.

4. Submit an application to the card provider

Once all required documentation is gathered, submit the application to your chosen purchasing card provider. The application typically includes providing company information, desired card features, and the financial health of the business.

Ensure all details are accurate to avoid delays or rejections in the approval process. Additionally, some providers may require an explanation of your business's purchasing practices or specific needs, which can be included in the application to help demonstrate why you're an ideal candidate.

5. Undergo credit checks and financial review

After submitting the application, businesses will undergo a credit check and financial review. The card provider assesses the company's creditworthiness to determine whether it qualifies for the card and the appropriate credit limit.

This review helps the provider assess the risk and ensure that the business can manage the spending on the purchasing card. It is important for businesses to maintain strong credit scores and financial stability, as this increases the likelihood of approval and favorable terms.

6. Set spending limits and user access

Once the application is approved, businesses need to set spending limits for each purchasing card. This includes determining daily, monthly, or transaction-specific caps, which help control overall spending.

User access should be tailored based on job roles or departments, ensuring that each employee can only access funds appropriate for their responsibilities. Setting clear limits enhances oversight and reduces the risk of misuse.

7. Review and agree to card terms and conditions

Before activating the cards, businesses must thoroughly review the card provider's terms and conditions. This includes understanding fees, interest rates, penalties, and the card’s policies on usage.

It is essential to agree to these terms to avoid any misunderstandings later. Ensure all stakeholders, including finance teams and cardholders, are aware of these conditions, as they govern how the card can be used within the company.

8. Receive and distribute the cards to employees

Once the purchasing cards are approved, businesses will receive the physical cards. These should be securely distributed to the relevant employees based on their role and responsibilities.

It’s important to track which cards are given to which employee to maintain accountability. Employees should be informed about the card’s usage guidelines and be made aware of the limits and restrictions set for their use.

9. Activate the cards for use

After receiving the cards, businesses must activate them before they can be used for transactions. This activation process typically involves confirming the cardholder's identity and entering a PIN or other security details.

Once activated, the cards are ready to be used for approved purchases, providing employees with the tools to streamline procurement and manage expenses. Activation is usually done online or over the phone with the card provider.

10. Implement internal policies for card usage

To ensure proper use of the purchasing cards, businesses must establish internal policies outlining acceptable practices. These policies should define which types of purchases are authorized, the process for requesting card use, and procedures for tracking and reporting expenses.

By implementing clear guidelines, companies can mitigate misuse and ensure compliance with financial regulations. Regular audits and reviews of spending patterns should also be incorporated into the policies.

What are the key features to look for in a purchasing card?

A purchasing card (P-card) is an essential tool for streamlining procurement processes. When selecting the right P-card for your business, it’s important to consider features that align with your company's needs, improve financial control, and simplify transactions. Below are key features to look for in a purchasing card.

Spending controls and limits

One of the most important features of a purchasing card is the ability to set spending controls and limits. This allows businesses to restrict cardholder spending based on predefined categories, departments, or transaction types.

Spending caps help to avoid overspending and ensure that purchases remain within budget, making financial management easier. Additionally, these controls allow businesses to enforce accountability by defining spending parameters for each individual or department.

Real-time transaction monitoring

Real-time transaction monitoring is a crucial feature of a purchasing card. This functionality allows businesses to track expenses as they occur, providing immediate visibility into spending.

By reviewing transactions in real time, finance teams can detect anomalies, ensure compliance, and quickly address any potential issues, leading to better financial oversight. It also enhances the ability to maintain control over cash flow, ensuring that all expenses are recorded and managed in a timely manner.

Expense reporting and integration

A purchasing card should offer seamless integration with your expense management systems. This feature simplifies the process of creating detailed expense reports, automatically categorizing purchases, and streamlining reconciliation.

Integration reduces the need for manual data entry and ensures that reports are accurate, up-to-date, and easy to access for financial analysis and budgeting purposes. Moreover, this functionality enhances accuracy by minimizing human errors and improving reporting efficiency across teams.

Detailed transaction data

Purchasing cards should provide detailed transaction data for each purchase made. This includes information such as merchant names, purchase amounts, itemized descriptions, and dates.

Access to detailed data enhances transparency, improves audit capabilities, and helps businesses analyze spending patterns. This comprehensive data can also aid in budgeting, forecasting, and decision-making processes.

With detailed records, businesses can ensure compliance with internal policies and external regulations while optimizing their purchasing strategies.

Fraud protection and security

Fraud protection and security are essential features of purchasing cards, offering multiple layers of defense against unauthorized transactions. These include encryption, alerts for suspicious activity, and fraud detection mechanisms.

Card issuers often provide zero-liability policies, protecting businesses from financial losses. Enhanced security ensures that only authorized users can access the cards, reducing the risk of theft and misuse.

Furthermore, regular monitoring and real-time alerts can quickly flag fraudulent transactions, helping to mitigate potential risks immediately.

Customizable reporting

Customizable reporting allows businesses to tailor purchasing card reports according to their specific needs. This feature enables users to filter by department, expense category, or employee, making it easier to track and analyze spending patterns.

It also supports budgeting and forecasting efforts. Custom reports can be scheduled for automatic generation, saving time and enhancing the accuracy of financial reporting. This flexibility in reporting helps businesses focus on critical areas, ensuring more informed decision-making and financial insights.

Supplier discounts and rewards

Many purchasing cards offer supplier discounts and rewards to businesses. These incentives help reduce costs, offering rebates, cashback, or other perks when making purchases from specific vendors.

The rewards can be used to reinvest in the business or offset operational expenses. This feature not only boosts savings but also strengthens supplier relationships by encouraging long-term business partnerships. These rewards can also incentivize employees to make cost-effective purchasing decisions, further contributing to overall business efficiency.

Mobile app access

Mobile app access is a valuable feature for purchasing cardholders, allowing them to manage expenses on the go. With a mobile app, employees can track transactions, upload receipts, and submit reports from their smartphones.

The convenience of mobile access enhances compliance and provides real-time oversight of purchases, which is essential for managing business expenses. Additionally, mobile apps often include features like push notifications for transactions, which can help ensure that employees are aware of any potential issues or approvals needed.

Global acceptance

Global acceptance is a significant advantage of purchasing cards, especially for businesses that operate internationally.

Purchasing cards are widely accepted by suppliers and merchants across the globe. This feature simplifies global procurement processes, allowing businesses to make purchases without worrying about currency exchange issues.

It also ensures that businesses can manage expenses more efficiently across various regions and markets. By eliminating the need for local payment methods, companies can streamline international transactions and reduce administrative overhead.

Compliance with company policies

Purchasing cards ensure compliance with company policies by allowing businesses to set spending rules and guidelines for employees.

Administrators can restrict purchases to specific categories or vendors and enforce spending limits. This feature helps prevent unauthorized spending and ensures that all transactions align with the company’s financial policies.

Additionally, detailed reporting and real-time monitoring enhance policy adherence and accountability. Regular audits and checks can be easily conducted, ensuring that employees follow the company’s set guidelines for business expenses.

Which software should you use to manage your purchasing card?

Managing purchasing card (P-card) transactions effectively is crucial for businesses to maintain control over expenses. Various tools are available to streamline the management process, from manual tracking methods to specialized software solutions. Selecting the right option depends on the complexity and size of the organization’s needs.

1. Manual management of P-card transactions

Using spreadsheets or paper for managing P-card transactions involves tracking each expense manually, which can be time-consuming and prone to errors. This method often requires compiling receipts and inputting data into spreadsheets for reconciliation.

While it may be suitable for small businesses, it becomes inefficient as transaction volume increases. The lack of automation also complicates real-time tracking and reporting, potentially leading to inaccuracies and delays.

2. Managing P-card transactions with traditional expense reports

Traditional expense reports are used to track P-card transactions by gathering receipts, categorizing expenses, and compiling the data into reports for approval and reimbursement. This method may work well for smaller organizations, but it lacks automation and can be cumbersome.

The process of manually inputting data into expense reports increases the risk of errors and delays. Additionally, it can be difficult to maintain visibility into spending without real-time tracking and reporting features.

3. Using expense management software for P-card transactions

Expense management software offers a more efficient way to manage P-card transactions by automating data entry and streamlining approval processes. These platforms allow businesses to integrate P-cards with their expense reporting systems, reducing manual effort.

They provide real-time tracking and reporting, offering better visibility into spending patterns. By automating the categorization and approval processes, these tools can reduce errors, improve compliance, and enhance overall efficiency in managing purchasing card transactions.

4. Utilizing dedicated P-card management systems

Dedicated P-card management systems are specialized tools designed specifically for managing purchasing cards.

These systems offer a range of features, including real-time transaction monitoring, automated reconciliation, and enhanced reporting capabilities. They allow businesses to set spending limits, track expenses, and ensure compliance with company policies.

By focusing solely on P-card transactions, these systems offer more customization and control than general expense management software, making them ideal for larger organizations or those with complex needs.

What to consider when choosing a purchasing card for your business?

Choosing the right purchasing card for your business requires careful consideration of various factors to ensure it meets your financial needs. It’s essential to assess your business’s spending patterns, the card’s features, and its terms to make an informed decision. This will help optimize financial control and maximize benefits.

Assess your business spending needs

Before selecting a purchasing card, analyze your company’s spending habits to determine the best card option. Consider the frequency of transactions, typical purchase amounts, and the types of expenses you regularly incur.

Understanding these factors helps in choosing a card with appropriate spending limits and controls, ensuring it aligns with your business requirements. Additionally, ensure that the card’s features can scale as your business grows and its spending needs evolve.

Evaluate credit limits and repayment terms

It’s important to evaluate the credit limits offered by purchasing cards and their repayment terms. Ensure that the limits are sufficient to cover your business’s spending needs without exceeding your budget.

Additionally, review the repayment schedule to ensure it aligns with your cash flow cycle, helping avoid late fees and maintaining financial stability. Look for cards that offer flexible repayment options, especially if your business experiences fluctuating cash flow.

Compare transaction fees and any associated costs

Transaction fees and other associated costs, such as annual fees or foreign exchange charges, should be carefully compared when selecting a purchasing card. These costs can add up over time and impact your overall expenses.

Ensure that the card’s fees align with your business’s budget and are justified by the benefits offered. Also, consider cards with no hidden charges, which can help keep expenses predictable and easier to manage.

Consider available rewards, rebates, and benefits

Many purchasing cards offer rewards, rebates, or other benefits, such as cashback or discounts on purchases. Evaluate the value of these perks and consider how they align with your business’s goals.

Choosing a card with attractive rewards or cost-saving benefits can provide additional value to your company, making the card a more profitable choice. Furthermore, consider cards that offer specific benefits tailored to your industry’s needs for added savings.

Check for integration with your accounting and ERP systems

Ensure that the purchasing card integrates seamlessly with your accounting and ERP systems. This allows for automated transaction posting and accurate financial tracking, eliminating the need for manual data entry.

A smooth integration streamlines the reconciliation process and improves the overall accuracy of financial reporting, reducing the chance of errors. It also enhances productivity across finance and accounting teams, allowing them to focus on higher-value tasks.

Review fraud protection and security features

When selecting a purchasing card, prioritize security features such as fraud protection and secure transaction monitoring. Look for cards that offer real-time alerts, EMV chip technology, and secure online purchase safeguards.

These security measures help prevent unauthorized transactions and minimize the risk of fraud. A robust fraud protection system provides peace of mind, ensuring your company’s financial transactions remain safe and compliant with industry regulations.

Examine reporting and analytics tools offered

Review the reporting and analytics tools provided by the purchasing card issuer. These tools should offer detailed transaction breakdowns, spending trends, and budget tracking capabilities.

Powerful analytics can help identify areas for cost reduction, monitor compliance, and evaluate the effectiveness of purchasing policies. A comprehensive reporting suite ensures you have the insights necessary for informed financial decision-making and efficient expense management.

Look for robust expense management solutions

A good purchasing card should come with a robust expense management solution to track, categorize, and analyze expenses. This feature helps automate the approval process, streamlining workflows and reducing administrative tasks.

By providing detailed expense reports, the solution enables businesses to monitor and manage spending more effectively. It also supports real-time tracking, ensuring greater visibility and control over company finances.

Evaluate the quality of customer support services

Before choosing a purchasing card, evaluate the quality of customer support services offered by the card provider. Ensure that their support team is accessible, knowledgeable, and responsive to inquiries or issues.

Excellent customer support can make a significant difference in resolving problems quickly and minimizing disruptions. Look for providers that offer 24/7 support, particularly if your business operates in multiple time zones or requires immediate assistance during critical moments.

Research the card issuer’s reputation and reliability

Research the reputation and reliability of the purchasing card issuer. Look for a provider with a proven track record of offering reliable services, strong customer support, and consistent performance.

Check for reviews, ratings, and testimonials from other businesses to gauge the issuer’s reputation in the market. A reputable card issuer will ensure a smooth, trustworthy experience and offer the stability needed for long-term business operations.

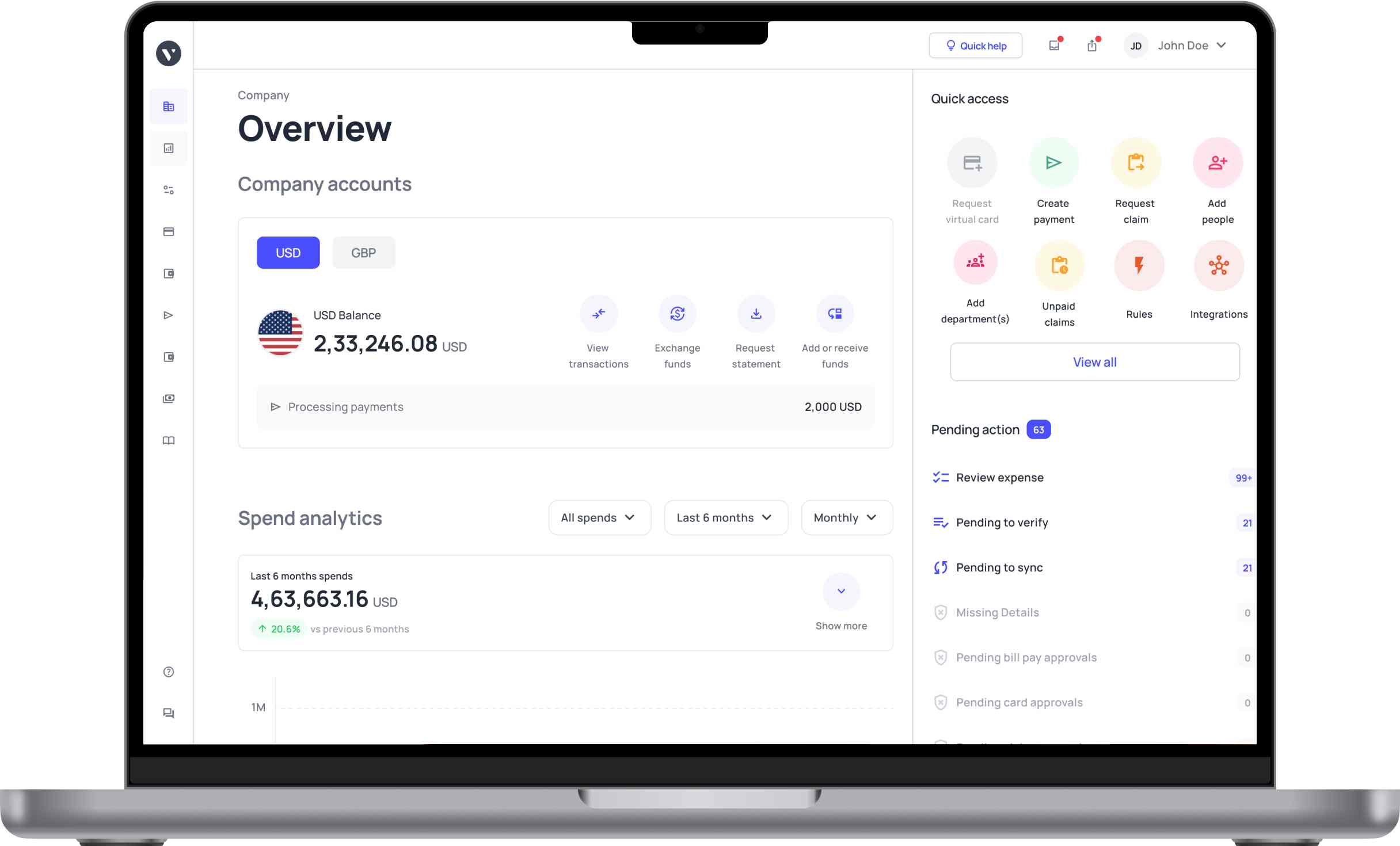

How can Volopay’s corporate card simplify your business expenses?

Volopay’s corporate card streamlines business expenses by offering a comprehensive solution that includes automated expense management, customizable spending limits, and seamless integration with finance tools.

The platform simplifies expense tracking, enables real-time monitoring, and provides the flexibility of both virtual and physical cards for various business needs. This solution ensures greater financial control, minimizes administrative workload, and enhances expense visibility, improving overall efficiency.

Automated expense management

Volopay’s corporate card automates expense management by tracking and categorizing transactions in real time. This reduces the manual work involved in report creation and reconciliation.

Automated processes help eliminate errors, ensure accurate financial records, and improve decision-making. With Volopay’s expense management system, businesses can save time, streamline their expense workflows, reduce administrative overhead, and ensure accurate records, leading to better budgeting and forecasting.

Tailored spending limits for teams

Volopay allows businesses to set customized spending limits for different teams, departments, or individuals. This feature ensures that each team adheres to their designated budget, preventing overspending.

By managing spending restrictions, businesses can gain greater control over their finances, making it easier to track and optimize expenses based on team needs. This also helps mitigate the risk of unauthorized spending and enforces responsible financial practices across the organization.

Seamless integration with finance tools

Volopay’s corporate card integrates smoothly with various finance and accounting tools, eliminating the need for manual data entry. This ensures that all transactions are automatically synced with the business's financial systems, improving the accuracy of financial reports and accelerating the reconciliation process.

Volopay's seamless integration leads to a more efficient and accurate financial workflow, reducing the time spent on manual tasks and enhancing data consistency across platforms.

Flexible virtual and physical cards

Volopay provides both virtual and physical cards, offering businesses the flexibility to meet different payment needs. Virtual cards can be issued instantly for online purchases, while physical cards are available for in-person transactions.

This flexibility helps businesses manage a wide range of spending activities efficiently, enhancing both convenience and control. With these options, businesses can adapt quickly to changing needs, ensuring smooth and efficient payments across various scenarios.

Instant transaction tracking and notifications

Volopay’s corporate card offers real-time transaction tracking, allowing businesses to monitor spending as it happens. Instant notifications ensure that teams are alerted to every transaction, keeping them informed and in control.

This feature helps prevent unauthorized or unexpected spending, allowing businesses to act quickly if there are discrepancies, and ensures financial accountability across all departments. It also helps businesses stay within their budgets and make timely adjustments when needed.

Advanced financial insights and reports

Volopay's comprehensive reporting software provides businesses with detailed financial insights and reports that are generated automatically. These reports offer valuable data, such as spending trends, department-wise expenditure, and budget adherence.

This functionality helps businesses analyze their financial health, identify areas for improvement, and make data-driven decisions. With such insights, businesses can fine-tune their spending strategies and improve overall financial planning. Additionally, these reports can be exported for easier sharing with stakeholders and for auditing purposes.

Hassle-free expense reconciliation process

Volopay simplifies the expense reconciliation process by automatically categorizing and matching transactions with the company’s accounts. This reduces the time and effort required for manual reconciliation.

Finance teams can quickly access and verify records, making the end-of-month closing faster and more accurate. With this automation, businesses avoid costly errors and streamline their accounting processes for smoother financial management. It also allows for faster detection of discrepancies, ensuring that all transactions are properly accounted for.

Quick and easy vendor payments

Volopay's vendor management system enables quick and easy payments to vendors using corporate cards, ensuring seamless transactions. Vendors are paid faster, improving relationships and fostering trust. The system provides businesses with an organized view of all payments, streamlining cash flow management.

With automated payment options, businesses can manage recurring payments or one-off transactions more efficiently and ensure timely, hassle-free settlements. This also reduces the administrative burden associated with manual payments and enhances vendor satisfaction.

Streamlined approval processes for expenses

Volopay’s corporate card allows businesses to implement customizable approval workflows for expense management.

Managers can set specific approval levels based on transaction size or department. This ensures that all expenses are reviewed and approved before being processed, preventing unauthorized or unnecessary spending.

The streamlined process saves time, improves accountability, and helps maintain financial discipline across the organization. It also enhances transparency, making it easier for managers to track and oversee all expenses.

FAQs

To prevent misuse, set clear spending limits, monitor transactions in real time, and establish strict approval workflows. Regular audits and employee training can also help ensure compliance.

Common fees include annual fees, transaction fees, foreign exchange fees, and interest on overdue balances. Some providers may also charge fees for card replacement or additional cardholders.

Typically, it takes 1 to 2 weeks for a purchasing card to be issued after the application process is completed, depending on the provider's approval procedures and documentation requirements.

If an employee overspends, they may be required to reimburse the company, and disciplinary action could follow. The company can also suspend or cancel the card to prevent further misuse.

Not all vendors accept purchasing cards, but most major retailers and service providers do. It's important to confirm with the vendor beforehand if they support purchasing card payments.