What is a corporate account and how does it work?

Having a separate bank account for your business is becoming essential in today's competitive business climate. A corporate account ensures regulatory compliance, improves business credibility, and streamlines your financial operations.

Whether your company is small or large, having a business bank account makes it easier to access basic banking services, increase transparency, and track finances accurately.

If you plan to open a corporate bank account in the US, understanding the process and requirements is key. In this blog, we’ll answer the question: What is a corporate account, and why is it so important for your business?

What is a corporate account?

A corporate account is a bank account you open specifically for your company's financial management. It offers features like multiple user access, greater transaction limits, and accounting software integration, and is intended for corporations, private companies, or partnerships.

Establishing a corporate bank account gives your business greater financial control and professionalism by enabling it to handle finances independently of personal funds. Payroll processing, vendor payments, payment invoices, and financial transparency entail corporate bank accounts.

You can open a corporate bank account under your company’s legal name, helping establish business credibility and trust. Choose an account with low fees and services tailored to your business needs to optimize financial management.

How does a corporate account work?

Once you understand what a corporate account is, you’ll see how it helps streamline your business finances. To handle the funds of your company, you create a multi-currency account. Utilize it to process payroll, deposit income, and handle invoices. You can issue checks, use a debit card, or set up online transfers.

It ensures clarity and legal compliance by keeping your personal and company finances separate. For easy record-keeping, the account generates statements, tracks transactions, and connects with accounting software. Maintain clear separation from personal funds to ensure compliance and protect assets.

Difference between corporate account and business account

When you’re planning to manage your company’s finances, understanding the difference between a corporate bank account and a regular business account is key. While both are designed to handle business transactions, they serve different scales and structures of business operations.

What is the importance of a corporate account for businesses?

A corporate account, which provides multiple benefits that improve productivity and streamline operations, is important for the success of your company. When you open a corporate bank account, you gain access to features that simplify financial operations, enhance credibility, and support long-term growth.

1. Easier financial transactions

A corporate account can help you effectively handle payroll, payments, and expenses. It integrates with payment platforms to streamline cash flow management for your company's operations and facilitates smooth transactions using checks, debit cards, and online transfers. It improves daily operations by streamlining procedures like paying vendors, transferring money, and receiving payments.

2. Builds business credibility

When you open a corporate bank account under your company’s name, it adds professionalism to your dealings. By enabling you to send invoices and accept payments under your company name, it builds credibility and improves the standing of your brand in the marketplace.

3. Allows for multiple signatories

Multiple employees, each with different degrees of access, can be designated as signatories on the account. This makes it possible to assign financial responsibilities with ease, ensuring effective operations while keeping control over the financial operations of your company.

4. Makes accounting and filing taxes easier

A corporate account streamlines bookkeeping by keeping your business activities unique. Reducing errors and saving time during tax season is made possible by the ease with which you can manage income and expenses, create reports, and complete accurate tax return files.

5. Improved protection

Corporate bank accounts come with advanced fraud detection and security features to protect company funds. This keeps your assets safe against unauthorized access, ensuring the security and reliability of your financial resources.

6. Better personal liability protection

Your personal assets are protected from business debts or lawsuits when your personal and company funds are kept separately. In the event of business challenges, a corporate account lowers your personal financial risk by reinforcing this legal separation. Even if your company has financial or legal problems, your personal assets are protected.

7. Better for business growth/expansion

Higher transaction limits and credit lines are two examples of characteristics that help a corporate account scale. In order to set your company up for long-term success, you can grow operations, invest in potential consumers, and handle growing financial needs.

Factors to consider before opening a corporate account for your business

Be mindful of introductory offers

Before opening a corporate account for your business, carefully evaluate several factors to ensure it meets your needs. The correct corporate account can promote expansion and simplify operations.

Any promotional offers, like gifts or introductory interest rates, should be reviewed. Check the terms and length of these to prevent unexpected expenses once the promotional time expires, even though they may offer immediate savings.

Even if these deals seem tempting, you should consider whether they will last and result in more expenses in the future.

Consider adopting an investment strategy

A good corporate bank account should support your business’s financial goals. Your account can be aligned with an investing strategy.

Certain accounts allow you to increase excess assets through linked investing alternatives. Ensure these choices fit your company's risk tolerance and financial objectives.

Verify the applicable fees

Account fees, such as monthly maintenance, transaction, or overdraft fees, need to be reviewed. Compare banks to identify affordable choices that offer the services your company needs at the lowest possible cost.

Look carefully for penalties for failing to maintain a minimum balance, hidden transaction fees, or recurring monthly maintenance costs.

Inquire about additional services and benefits

Inquire about additional services, including flexible business loans, integrated payroll software, and efficient merchant payment processing options.

Select a bank that offers benefits that are specific to your needs because these can improve value and streamline operations. These value-added services can improve productivity and streamline daily tasks.

Examine local regulations

Verify the banking and company regulations in your area. To prevent legal or operational problems, make sure you comply with any regional requirements for special documents or limits on corporate accounts.

Staying compliant avoids legal complications and helps your business operate smoothly within the required legal and regulatory framework.

Investigate access options

Examine your options for access, including in-person services, smartphone apps, and internet banking. To effectively manage transactions and keep a tab on finances from anywhere, use an account with easy, secure access.

For team-based financial management, having multi-user access with roles that can be customized is a significant benefit.

Evaluate various interest options

Check if the corporate bank account earns interest on your balance. Accounts that earn interest can be evaluated if your company keeps large balances.

Examine conditions and rates offered by various banks to optimize returns on idle funds while maintaining operational liquidity.

Explore diverse features

Features like multi-user access, connection with accounting software, or customisable notifications are the features you need to look for.

Choose an account that supports the particular requirements of your company and has features that improve financial management. Examining these aspects ensures that the account you select will meet your operating requirements.

Consider insurance and fund protection

Verify that the account provides insurance, such as FDIC coverage, to safeguard your money.

Check the bank's fraud detection and other security measures to protect the financial assets of your company. This adds a layer of safety to your corporate bank account.

List of documents required to open a corporate bank account

To open a corporate bank account, you must provide specific documents to verify your business’s identity and operations. These requirements ensure compliance and secure account setup, tailored to your business’s structure and location.

The official name of the business

Documents such as a certificate of incorporation or business registration are required to confirm the formal name of your company. All formal documents, such as your business license or certificate of formation, must have this name since it will be used for the corporate bank account.

By confirming the legal identification of your company, this ensure that the account was established under the correct registered name.

Details regarding the business's activities or nature

Using a company profile or business plan, you must outline the operations of your organization. This ensures adherence to banking standards and risk assessments by giving the bank a better understanding of your business, sector, and goals.

Whether your business is in retail, technology, services, or another sector, banks must know what it does to evaluate the risk and compliance needs for your corporate account.

Contact information

You should provide the phone number, email address, and website (if applicable) of your company. During account setup, the bank can confirm the operational legitimacy of your business and connect with you more efficiently if you provide accurate contact information.

These particulars are utilized for official interactions related to your company bank account, account verification, and communication.

Proof of business address

You must present proof of your business address. Submit documentation proving your company's working address, such as utility bills, leasing agreements, or property ownership records.

This verifies the physical location of your company, ensures adherence to banking laws, and validates your operational base, which are essential for activating the corporate account.

Documentation confirming the business's legal structure (e.g., sole proprietorship, partnership, LLC)

To verify the legal structure of your company, you must submit documents such as partnership agreements or articles of formation.

These ensure that your account is set up correctly by making it clear if you are a sole proprietorship, partnership, or LLC. This aids the bank in accurately classifying your account type and ensuring appropriate compliance.

Government-issued employer identification documents (if applicable in the respective country)

If necessary, you must present your Employer Identification Number (EIN) or a comparable tax ID. This official document, which is frequently required for corporate accounts in many nations, validates your company for tax purposes.

This ensures smooth legal operations and securely connects your corporate account to your company's official tax profile.

Identification copies

All account signatories and owners must provide copies of their official identification, such as passports or driver's licenses. These ensure security and regulatory compliance by confirming the identities of those in charge of the account.

These assist in confirming your identification and fulfilling the KYC (Know Your Customer) standards set forth by the bank.

A copy of the board resolution of the company authorising the opening of the account

You must present a board resolution with directors' signatures approving the account opening. This document ensures legal authority and compliance with corporate governance standards by confirming your company's approval for the account.

It should clearly list the approved users who are able to securely manage the account on the business's behalf at all times.

How to open a corporate bank account

If you’re looking to streamline your business finances and maintain professionalism, understanding what a corporate account is becomes essential. A corporate bank account is a dedicated account created under your business name to manage income, expenses, payroll, and vendor payments.

It separates personal and business transactions, offers enhanced credibility, and supports financial compliance especially important for businesses operating in the US.

1. Register your business

Ensure your company is legally registered in the state where you’ll operate.

Obtaining a certificate of incorporation or similar document is necessary to register your business with the state.

This gives your business the legal identity it needs to open a corporate bank account in the United States.

2. Select a provider

Choose a financial institution or corporate account provider that aligns with your business needs.

Choosing a bank or credit union that fits the demands of your business is an ideal decision.

Browse around for the best support for business operations by comparing features, costs, and services like online banking.

3. Compile essential documents

You must collect documentation such as your business registration, IDs, board resolution, and EIN.

These ensure that your company complies with US banking requirements for account opening by validating its identification and authorization.

Having these ready will speed up the process of opening a corporate bank account.

4. Initiate the account application process

You can begin the application at your preferred bank in person or online.

To speed up approval and account establishment, send in your paperwork and fill out the bank's forms with accurate information.

Wait for verification after submitting the paperwork and accurately completing the forms.

5. Familiarise yourself with associated fees

Examine the bank's fee schedule, taking into account any monthly maintenance, transaction, or wire transfer expenses.

Understanding these costs enables you to choose an account that fits the financial requirements and budget of your company.

This helps you avoid unexpected expenses and manage your corporate bank account effectively from the start.

6. Complete fund transfers

Once your account is approved, deposit the initial funding amount as required.

The bank requires you to make an initial deposit in order to activate the account.

Start using the account to manage your company's finances by transferring money via check or electronic transfer.

How to manage your corporate bank account

Now that you understand what a corporate account is and have successfully opened one, managing it effectively is key to smooth operations and adopting practices that ensure financial clarity, security, and efficiency, supporting your business’s operational and growth objectives.

Separate business and personal finances

You have to keep your personal and business finances apart. Use your corporate account solely for business transactions to maintain clear records, simplify taxes, and protect personal assets from business liabilities.

You can effectively prevent potential legal or tax issues by using your corporate account exclusively for official business purposes.

Regularly monitor your accounts

You ought to frequently utilize mobile apps or internet banking to check your account. To maintain your accounts secure and accurate, check balances, statements, and transactions for mistakes or inconsistencies.

You can detect odd activity, reconcile payments, and ensure everything matches your financial records with the help of routine monitoring.

Maintain accurate bookkeeping

All transactions must be precisely documented using ledgers or accounting software. Regular bookkeeping makes financial reporting and compliance easier by keeping track of spending, income, and tax duties.

Proper bookkeeping facilitates accurate tax filings and audits and significantly improves overall financial clarity and business understanding.

Optimize cash flow

Tracking receivables and timing payments are two ways to manage cash flow. Forecast your cash demands using the tools in your account to minimize idle funds and ensure operational liquidity.

You will always have sufficient available cash on hand to easily pay your bills if you consistently practice good cash flow management.

Understand fees

Examine the fees charged by your bank, including any maintenance or transaction fees. Understanding transaction fees, overdraft fees, and account maintenance costs enhances your financial planning and helps you prevent unexpected deductions.

Monitor statements to avoid unexpected charges and consider switching to a cost-effective account if fees become burdensome.

Protect your finances

You must secure your account with strong passwords, two-factor authentication, and fraud alerts.

Regularly update security settings and train staff to recognize phishing attempts, safeguarding your business’s financial assets.

Charges associated with corporate bank accounts

You may encounter various fees when maintaining a corporate bank account. Understanding these charges helps you budget effectively and choose an account that aligns with your business’s financial needs.

1. Monthly or annual fee

You might pay a monthly or annual fee for account maintenance. This charge, often based on account type or balance, covers basic services, though some banks waive it with minimum balances.

Businesses should compare these fees while choosing a corporate bank account to ensure long-term affordability and efficiency.

2. International transaction fee

You could incur fees for international transactions, such as wire transfers or foreign currency payments. These vary by bank and transaction type, so confirm costs before conducting global business.

Businesses involved in frequent international dealings must evaluate this fee structure to avoid significant losses in the long term.

3. Account limits

You may face fees for exceeding account limits, like transaction or withdrawal caps.

Review your account’s terms to avoid charges by staying within free transaction thresholds or upgrading plans.

4. Account maintenance fee

You might be charged an account maintenance fee to cover administrative costs.

This recurring fee depends on account features, but maintaining a minimum balance can sometimes reduce or eliminate it.

5. Establishment fee

You could pay a one-time establishment fee when opening your account.

This covers setup costs, such as document verification, and varies by bank, so compare options before committing.

6. Internet banking fee

You may encounter fees for internet banking services, especially for premium features like multi-user access or advanced reporting.

Check carefully if these are already included or require any additional payment or service charges.

7. Overdraft fee

You might also face costly overdraft fees if your account balance unexpectedly goes negative.

These charges, applied per transaction or daily, can be costly, so monitor balances or set up overdraft protection.

Optimize your business with Volopay's corporate account solutions

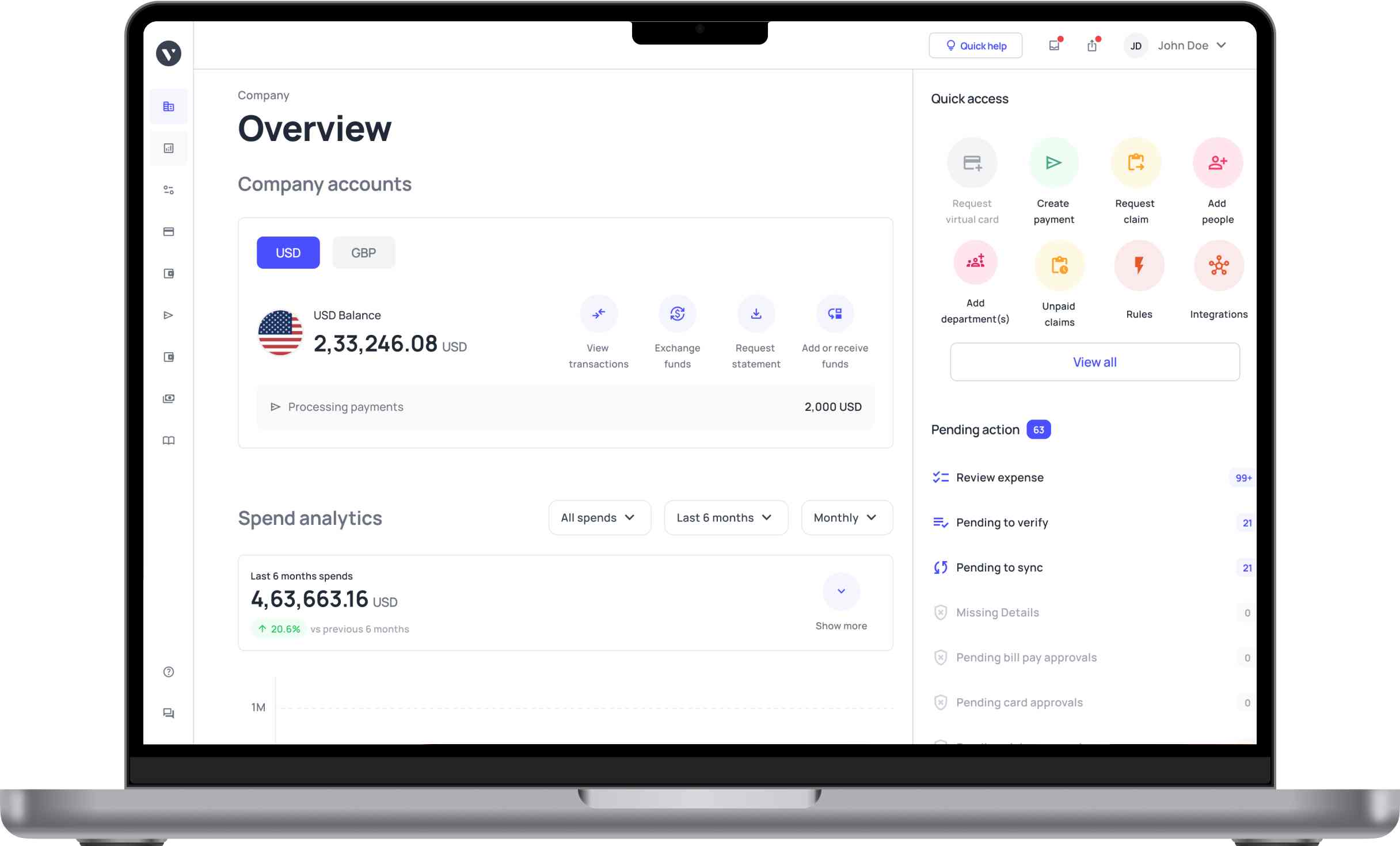

You can streamline your business operations with Volopay’s corporate account, offering tools to manage finances, ensure compliance, and enhance efficiency across global transactions.

Expense monitoring

You gain real-time visibility into expenses with Volopay’s dashboard. Track spending, set budgets, and receive instant alerts for discrepancies, ensuring complete control and transparency over your business’s financial activities.

Corporate cards

You can issue unlimited virtual cards and physical corporate cards with Volopay. Set custom spending limits and track transactions instantly, simplifying payments for travel, subscriptions, and vendor expenses.

Regulatory compliance assistance

You benefit from Volopay’s compliance tools, which include automated policy checks and audit trails. Stay aligned with tax regulations and industry standards, reducing risks and simplifying audits.

Business account supporting multiple currencies

You can hold and transact in over 60 currencies with Volopay’s multi-currency account. Avoid high FX fees and manage global payments seamlessly, supporting your international operations.

Affordable global payment solutions

You can make low-cost domestic and international transfers with Volopay. Use SWIFT or non-SWIFT methods to pay vendors in 130+ countries, minimizing fees and delays.

Expense management software

You streamline expense tracking with Volopay’s expense management software. Automate reporting, receipt capture, and approvals, reducing manual work and ensuring accurate, timely financial management for your business.

Simple account opening process

You can open a Volopay account online with minimal documentation. Enjoy hassle-free onboarding with personalized support, making setup quick and tailored to your business needs.

Integration with accounting software

You can sync Volopay with popular tools like QuickBooks or NetSuite. Real-time data transfer eliminates manual entries, ensuring accurate records and streamlined accounting processes.

Improved security measures

You protect funds with Volopay’s SOC 2, ISO 27001, and PCI DSS compliance. Multi-level approvals and encryption safeguard your data and transactions from fraud.

Analytics and reporting features

You access detailed analytics with Volopay’s reporting tools. Generate one-click reports to track spending trends, optimize budgets, and make data-driven financial decisions.

Manage you expenses effectively with Volopay

FAQs

Opening a corporate account typically takes anywhere from a few hours to a few business days, depending on the bank or platform you choose. You’ll need to submit documents like business registration, PAN, and proof of address. With platforms like Volopay, the process is often faster, thanks to digital onboarding and simplified KYC procedures.

Corporate bank accounts may involve fees such as account opening charges, monthly maintenance fees, transaction fees, and ATM charges. Some banks also charge for additional services like overdrafts or bulk payments. With digital platforms like Volopay, you can expect transparent pricing and often lower fees compared to traditional banks. Always review the fee structure before you open a corporate bank account.

Yes, you can grant access to multiple users when you open a corporate bank account. You can assign roles and permissions, like who can view transactions, initiate payments, or approve expenses. This is especially helpful in streamlining workflows and delegating responsibilities securely within your finance team.

Though often used interchangeably, a corporate account is typically for registered companies like private limited or public limited entities, while a business account may also include sole proprietorships or partnerships. Corporate bank accounts usually offer more advanced features, multiple user access, and better scalability compared to basic business accounts.

If your business undergoes structural changes like a change in ownership, directors, or legal status you must inform your bank immediately. Updated documents will be required to reflect the changes in your corporate bank account. Keeping your account details accurate ensures compliance and avoids disruptions in financial operations.

Volopay uses bank-grade encryption, two-factor authentication (2FA), and real-time transaction monitoring to ensure your funds and data remain secure. It also offers role-based access control to minimize risks from internal errors or fraud. These features make managing your business account with Volopay safe and trustworthy.

Yes, Volopay offers seamless integration with popular accounting software like QuickBooks, Xero, and NetSuite. This helps you sync your transactions, automate reconciliations, and streamline financial reporting. It reduces manual effort and enhances the accuracy of your business account records, making accounting much easier for your team.

Volopay’s business accounts come with a range of benefits like smart corporate cards, automated bill payments, real-time expense tracking, budgeting tools, and multi-user access. It also offers international payments, accounting integrations, and centralized financial control helping you manage all aspects of your company’s finances in one platform.