Virtual prepaid card: Key to safe and secure spending

The rise of secure digital employee spending

As cyber fraud and data breaches continue to rise, businesses across the US are facing increasing pressure to safeguard financial transactions.

Traditional payment methods often expose companies to risks of fund misuse and unauthorized spending. This growing concern has led many to adopt modern solutions such as virtual prepaid cards, which provide stronger control and enhanced security.

For companies seeking debit-based options, prepaid virtual debit cards allow direct, budget-linked spending with built-in safeguards. Meanwhile, prepaid virtual credit cards offer flexible credit-backed payments with the same advanced security and real-time visibility.

A prepaid virtual card ensures employees can make business purchases safely, with predefined limits and real-time tracking. These cards reduce the risk of fraud while supporting flexible, remote-friendly operations. Secure digital spending is no longer optional—it’s essential for modern businesses.

Demystifying virtual prepaid cards

What is a virtual prepaid card?

A virtual prepaid card is a digital payment card issued electronically, not physically, and is preloaded with a specific amount of funds. It allows businesses to assign spending power to employees without tying purchases to a corporate bank account.

These cards are commonly used for online transactions, offering greater control, flexibility, and security for business-related spending. They’re beneficial for remote teams and digital-first companies.

Core features at a glance

A prepaid virtual card is instantly generated and accessible online, eliminating the need for plastic cards. Key features include set spending limits, expiration dates, and one-time use options for added safety.

Businesses in the US favor them for their real-time issuance, customizable controls, and seamless integration with digital expense management systems. These features make them a reliable choice for secure and scalable corporate payments.

The core benefit of virtual employee card: Unparalleled security

1. Single-use and merchant-locked cards

A virtual prepaid card can be set up for a single transaction or restricted to specific merchants, making it difficult for fraudsters to misuse. This level of control significantly limits exposure to unauthorized spending.

Businesses can issue cards for one-time supplier payments or department-specific purchases, ensuring tighter security and financial discipline at every level. These tailored settings reduce the need for manual intervention while maintaining high control.

2. Enhanced protection against data breaches

A prepaid virtual card minimizes the risk of financial data theft since card details aren’t reused or tied to a company’s main account. Even if exposed, these cards offer limited access and expire quickly.

By using these cards for online purchases, companies reduce their vulnerability to data breaches and safeguard sensitive financial information. This is especially vital for firms handling high volumes of vendor transactions or remote payments.

3. Real-time fraud detection and alerts

Modern platforms that issue virtual employee cards provide instant alerts for any unusual or unauthorized transactions. Business administrators can freeze or cancel the card immediately, preventing further misuse.

This proactive approach helps mitigate risks before they cause financial damage, offering peace of mind to finance teams and managers alike. These real-time insights help reinforce accountability and oversight.

4. No physical card risk

Since these cards exist only in digital form, the threat of losing a physical card or falling victim to card skimming is completely removed.

Employees can access them securely through mobile apps or web portals. This is especially important for businesses managing distributed teams or handling frequent remote transactions.

Virtual-only access also reduces the risk of cards being duplicated or cloned.

Get a convenient and flexible payment option for your business

Beyond protection: Empowering smart spending

Precise expenditure control

A virtual prepaid card gives employers the ability to define exact spending limits by team, project, or individual. This ensures company funds are used only as intended, with zero risk of overspending.

Managers gain transparency into how each dollar is used. These controls make financial tracking simpler and more accurate across departments. As a result, businesses can optimize resource allocation and improve overall financial discipline.

Fostering budgetary discipline

Pre-funded card limits ensure employees cannot overspend, promoting strict adherence to budgets and preventing unapproved expenses. With these constraints in place, financial teams can trust that all spending remains within pre-approved thresholds.

It reduces the need for corrective follow-ups. This system encourages accountability and thoughtful purchasing behavior. Over time, this disciplined spending fosters stronger budget compliance and cost savings.

Agile card deployment and management

A prepaid virtual card can be issued instantly to meet urgent needs or revoked when roles shift, or projects wrap up. This flexibility supports dynamic teams and fast-changing business environments.

Administrators can assign, edit, or cancel cards in just a few clicks. This agility saves time and minimizes operational bottlenecks. It also allows businesses to stay responsive without compromising financial control.

Automating financial oversight

Digital transactions made with virtual corporate cards automatically sync with expense management platforms. This automation simplifies reconciliation, reduces manual data entry, and enhances secure business spending.

It ensures timely reporting and improves audit readiness. With clearer records, finance teams can focus on insights rather than admin work. Consequently, companies benefit from greater accuracy and efficiency in managing their finances.

Practical use case of virtual prepaid cards for businesses

Optimizing SaaS subscriptions

Businesses can use a virtual prepaid card to manage and pay for multiple SaaS subscriptions efficiently. This allows clear tracking of recurring expenses while avoiding overspending on unused services.

It simplifies vendor management by consolidating payments under controlled budgets. Having a dedicated card for each subscription also enhances security by limiting access.

Controlling digital ad campaign spends

Marketers can be assigned prepaid virtual cards with preset limits to control digital advertising budgets. This ensures campaigns stay within financial parameters and prevent overspending.

Real-time monitoring helps optimize ad spend across platforms. The ability to adjust limits quickly supports shifting marketing priorities without delays.

Equipping your distributed workforce

Remote employees can receive prepaid virtual cards to cover approved business expenses securely. This approach eliminates the need for reimbursements and reduces fraud risk.

It empowers teams to make timely purchases without compromising financial oversight. Additionally, centralized control helps maintain consistent spending policies across locations.

Securely handling ad-hoc payments

Virtual prepaid cards provide a safe method for managing unexpected or one-time payments. Businesses can issue single-use cards to employees or contractors, limiting exposure and simplifying expense tracking. This flexibility improves operational efficiency.

It also reduces administrative burdens related to manual approvals and cash handling.

Streamlining project costing

Project managers can be issued virtual prepaid cards with specific budgets for project-related purchases. This allows precise control over spending and simplifies expense reporting.

By restricting cards to project limits, companies maintain budget discipline and improve financial transparency. Furthermore, it speeds up procurement by eliminating lengthy approval chains.

Ensuring regulatory adherence and audit efficiency

Facilitating federal tax reporting

Using a prepaid virtual card simplifies federal tax reporting by automatically capturing transaction details and digital receipts. This organized expense data aids in accurate categorization, making it easier for businesses to claim deductions and comply with IRS requirements.

The streamlined process reduces the risk of errors and supports thorough tax documentation throughout the fiscal year. This level of automation helps businesses stay prepared for tax season without last-minute scrambling.

Automating data capture for accuracy

Prepaid virtual card transactions are automatically categorized and securely stored, minimizing manual input and the chance of errors. This automation enhances data accuracy and creates a reliable record-keeping system.

With complete and precise financial data readily available, businesses improve their financial reporting and decision-making processes. Such accuracy also builds greater confidence among stakeholders and regulatory bodies.

Expediting audits with clear records

Digitally stored transaction histories and transparent audit trails generated by prepaid virtual card platforms simplify both internal and external audits. These comprehensive records provide auditors with clear, easy-to-follow documentation, reducing the time and effort involved. This efficiency ultimately lowers audit costs and helps maintain compliance with regulatory standards.

Faster audits also free up resources that can be redirected to core business activities.

Implementing virtual prepaid cards: Best practices

1. Develop clear usage policies

Creating detailed policies is essential to ensure prepaid virtual card usage aligns with business goals in the US. These policies should define acceptable expenses, spending limits, and required documentation for purchases.

Clear guidelines help prevent misuse and make it easier to monitor spending. Well-communicated policies also support accountability among employees and streamline internal controls for expense management.

2. Employee training and adoption

Providing thorough training equips employees with the knowledge to use prepaid virtual cards correctly and responsibly. Training should cover card activation, uploading receipts, and following company expense policies.

Encouraging adoption through easy-to-understand instructions boosts compliance and minimizes errors. Ongoing support ensures employees stay informed about updates and best practices, fostering smoother financial operations.

3. Choose a robust platform

Selecting a secure, user-friendly prepaid virtual card provider tailored to the US market is crucial for success. Look for platforms offering strong security features, seamless integration with popular expense tracking software in the US, and responsive customer support.

A reliable platform simplifies expense management, enhances visibility, and adapts to evolving business needs. Prioritizing these factors ensures a smooth implementation and long-term value.

Volopay: Secure your business spending with virtual prepaid cards

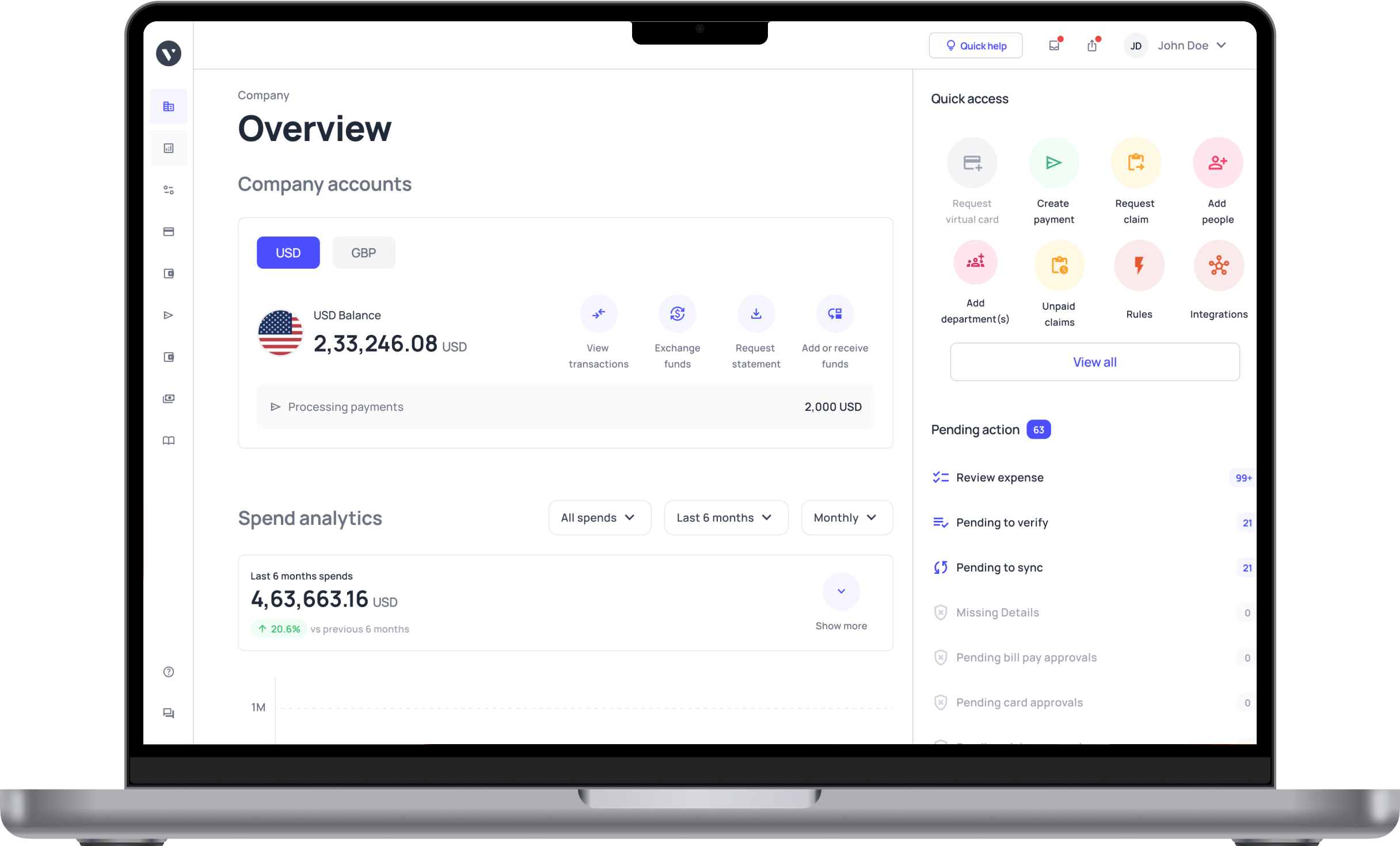

Volopay offers a cutting-edge prepaid business card designed to simplify and secure company spending. Instant virtual card issuance, customizable limits, and real-time expense tracking give businesses full control over their finances. Its robust security features minimize fraud risks while seamless integration with accounting systems streamlines reconciliation.

Volopay’s prepaid business card is the ideal choice for businesses seeking efficient, transparent, and safe expense management solutions tailored to modern needs. Volopay’s user-friendly platform ensures quick adoption across teams, empowering businesses to optimize spending and focus on growth without financial worries.

Corporate cards to help streamline your expense reporting process

FAQs: Virtual employee prepaid cards for US businesses

Virtual cards are accepted anywhere major credit or debit cards are, especially for online transactions. While physical cards are necessary for in-person purchases, virtual cards excel in digital payments and provide secure alternatives for most business expenses. Their increasing acceptance makes them a versatile tool for modern businesses.

Generally, virtual cards are designed for online and phone transactions and cannot be used in physical stores. However, some providers offer virtual cards linked to mobile wallets, enabling limited offline use via contactless payments. This feature enhances convenience while maintaining security.

If a virtual card is compromised, it can be instantly blocked or canceled without affecting other cards or accounts. Many platforms allow quick reissuance of new virtual cards to minimize risk and disruption. This rapid response helps businesses maintain uninterrupted spending control.

Most providers allow businesses to issue multiple virtual cards, often with no strict limits. This flexibility helps allocate cards by department, project, or employee, streamlining spending control and reporting. It supports scalable growth and better financial management as companies expand.