Prepaid expenses vs accrued expenses: Key differences

Managing business expenses effectively is crucial for maintaining accurate financial records and ensuring smooth cash flow. Two common accounting concepts that often cause confusion are prepaid expenses and accrued expenses.

Prepaid expenses refer to payments made in advance for goods or services to be received in the future, such as insurance premiums or rent.

In contrast, accrued expenses are costs that a business has incurred but not yet paid, like utilities or wages payable at the end of a month.

Understanding the differences between prepaid and accrued expenses helps businesses allocate costs to the correct accounting periods, which is essential for compliance and financial reporting.

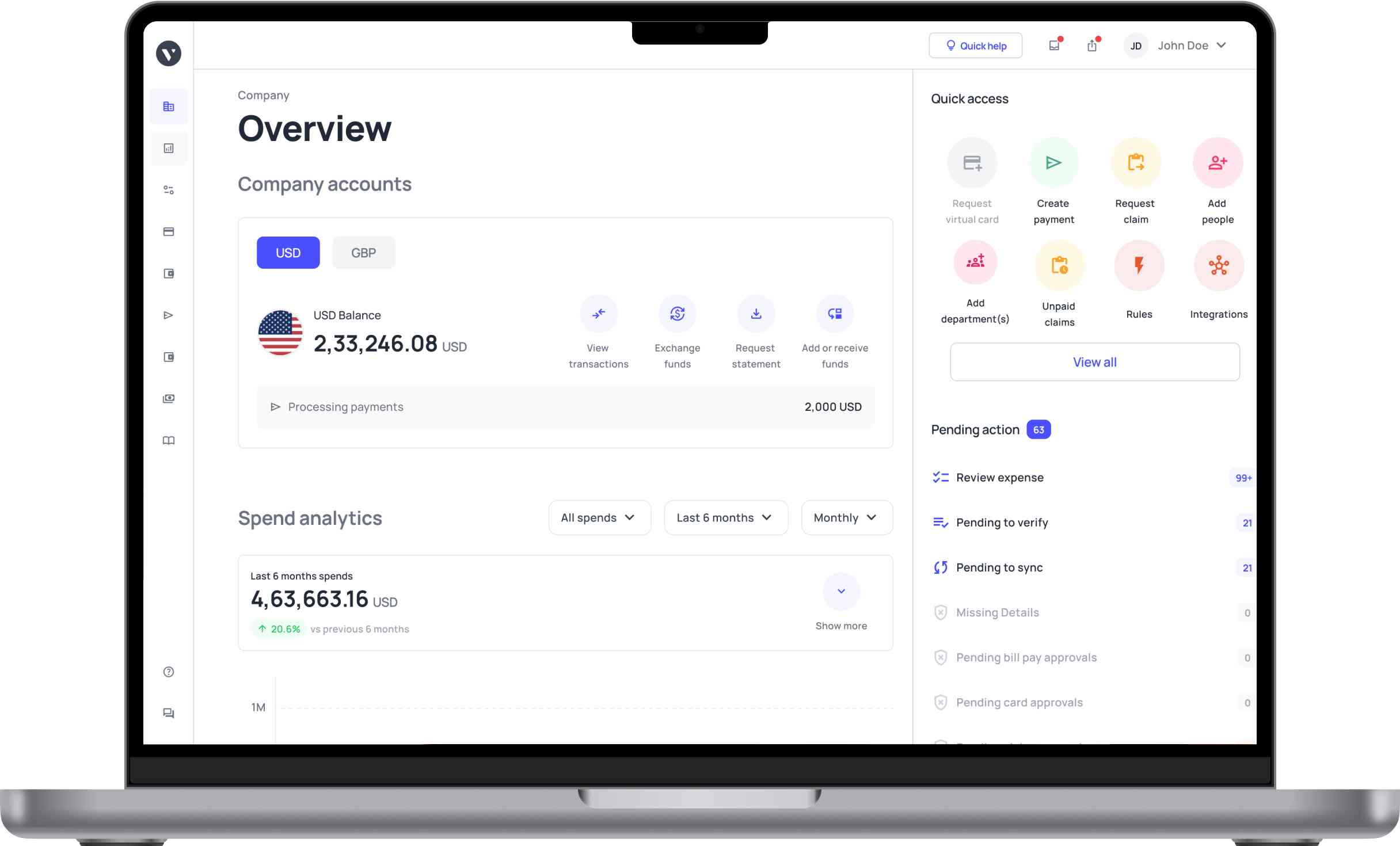

Tools like Volopay’s prepaid cards streamline the process by offering businesses a smart way to manage advance payments. These cards give finance teams real-time visibility into prepayments, making it easier to track, categorize, and reconcile prepaid expenses. This blog explores both types of expenses and how they impact your books.

What are prepaid expenses?

Prepaid expenses are advance payments made by a business for goods or services that will be received or used in future accounting periods. Common examples include prepaid insurance, rent, subscriptions, or service contracts.

Although the payment is made upfront, the expense is not recognized immediately in the income statement. Instead, it is initially recorded as an asset on the balance sheet and then gradually expensed over time as the benefit is realized.

Example

For instance, if a company pays $6,000 upfront for a one-year insurance policy, only $500 is recognized as an expense each month, while the remaining $5,500 stays on the balance sheet as a prepaid asset. This approach aligns with the accrual accounting principle of matching expenses with the period in which they are incurred.

Tracking these expenses accurately ensures proper financial reporting and avoids overstating or understating income. When mismanaged, prepaid expenses can distort a company’s financial position and profitability.

With modern financial tools like Volopay’s prepaid cards, small businesses can automate and monitor prepaid transactions with ease. These cards allow you to allocate specific budgets for recurring expenses and provide real-time expense tracking. This not only simplifies recordkeeping but also minimizes human error and reduces reconciliation time.

Understanding how prepaid expenses vs accrued expenses function within your accounting system is essential for maintaining compliance and financial transparency. By properly categorizing and systematically amortizing prepaid expenses, businesses can enhance their budgeting accuracy and avoid unexpected end-of-period surprises.

What are accrued expenses?

Accrued expenses are costs that a business has incurred during an accounting period but has not yet paid. These expenses are recorded as liabilities on the balance sheet because they represent obligations the company must settle in the future.

Common examples include unpaid salaries, utilities, interest, and taxes that are due after the accounting period ends but relate to that period’s operations.

Under accrual accounting, businesses must recognize expenses when they are incurred, not when the cash is paid. This ensures that financial statements reflect the true financial position of the business. For instance, if a company receives a utility service in March but pays the bill in April, the cost is still recorded as an expense for March and marked as an accrued liability.

Accurate tracking of accrued expenses is essential for maintaining transparency and ensuring that expenses are matched with the revenues they help generate. This approach helps businesses avoid understating liabilities and ensures more accurate profit reporting.

Businesses often face challenges managing these costs without the right tools. Automated systems like Volopay help streamline expense recognition by improving visibility into recurring and upcoming obligations.

In the broader discussion of prepaid expenses vs accrued expenses, accrued expenses highlight a company’s future cash outflows, while prepaid expenses represent future benefits already paid for. Understanding the differences between prepaid and accrued expenses is critical for accurate financial planning, compliance, and decision-making. Keeping proper records of accrued liabilities supports better cash flow forecasting and strengthens financial control.

Key differences between prepaid and accrued expenses

Payment timing

One of the most notable distinctions in the prepaid expenses vs accrued expenses comparison is the timing of payment. Prepaid expenses are settled in advance, before the actual receipt of goods or services. Businesses pay upfront to secure future benefits, such as insurance, rent, or subscriptions.

In contrast, accrued expenses are recorded after the cost has been incurred but before payment is made. These typically include items like wages, utilities, and interest. Recognizing this timing difference is essential for accurate financial reporting, as it determines when and how expenses impact the company’s books and overall cash flow.

Accounting treatment

From an accounting standpoint, prepaid expenses are first recorded as current assets on the balance sheet and gradually transferred to the income statement as the benefit is consumed over time. This amortization aligns the expense with the period it supports.

On the other hand, accrued expenses are logged as current liabilities because they represent amounts owed for services already received. These are expensed immediately in the relevant period and later removed once payment is made.

Understanding the accounting treatment helps highlight the prepaid expenses vs accrued expenses concept and ensures financial statements reflect a company’s true obligations and resource usage.

Financial statement impact

Prepaid expenses and accrued expenses affect different parts of a company’s financial statements. Prepaid expenses are recorded as current assets on the balance sheet until the benefit is fully used, at which point the amount is expensed gradually. This helps in accurately matching costs with the periods they benefit.

In contrast, accrued expenses increase current liabilities and are recognized immediately on the income statement as expenses. This reflects the company’s unpaid obligations.

By understanding how each impacts assets, liabilities, and expenses, businesses can ensure accurate financial reporting and maintain transparency in their income and balance sheet presentations.

Cash flow effects

The timing of cash movement for prepaid and accrued expenses creates different cash flow implications. Prepaid expenses require an upfront cash payment, which can temporarily strain liquidity, especially for small businesses. This reduces available funds before the benefit is realized.

Accrued expenses, however, are recognized before cash is paid, allowing businesses to delay cash outflows while still reporting the expense. This helps maintain short-term liquidity but increases future payment obligations.

Managing these cash flow differences is crucial for budgeting and forecasting, enabling companies to make informed decisions and ensure consistent operational funding throughout each accounting period.

Management tools

Managing prepaid and accrued expenses efficiently requires distinct tools and processes. For prepaid expenses, prepaid cards like those offered by Volopay provide a structured way to control and track advance payments. These cards help allocate budgets, monitor usage, and simplify reconciliation.

On the other hand, accrued expenses demand precise liability tracking to ensure timely payments and accurate financial statements. Businesses often use accounting software to automate accrual entries, schedule payments, and avoid missed obligations.

By using the right tools for each, companies can maintain accurate records, improve compliance, and enhance overall financial management and reporting accuracy.

Accounting for prepaid vs accrued expenses

Recording prepaid expenses

When recording prepaid expenses, businesses make an initial entry by debiting the prepaid expense account and crediting cash or the payment method used, such as a prepaid card. This entry reflects an advance payment for a future benefit, such as insurance, rent, or subscriptions.

Over time, as the benefit is received, the prepaid expense is gradually amortized by debiting the related expense account and crediting the prepaid asset account.

This process ensures that the expense is recognized in the correct accounting period, aligning with the matching principle and providing a more accurate representation of the company’s financial position.

Recording accrued expenses

To record accrued expenses, businesses debit the appropriate expense account to reflect the cost incurred and credit an accrued liability account to show the obligation to pay in the future. This entry is made at the end of the accounting period when goods or services have been received but the payment is still outstanding.

Examples include accrued wages, utilities, or interest. Once the payment is made, the liability is cleared by debiting the liability account and crediting cash. Recording accrued expenses ensures financial statements capture all obligations, supporting accuracy and transparency in reporting and enabling better financial planning.

Amortization vs settlement

In the prepaid expenses vs accrued expenses comparison, amortization and settlement highlight key differences in accounting treatment. Prepaid expenses are amortized gradually over time as the benefit is consumed.

For example, if a company pays a year’s insurance in advance, the expense is spread monthly over twelve periods. This approach ensures the cost is matched to the period it supports. In contrast, accrued expenses are settled in full once payment is made. These costs are recognized before payment and cleared upon settlement, such as paying accrued wages after month-end, ensuring financial statements remain accurate, and obligations are fulfilled.

GAAP compliance

Both prepaid and accrued expenses follow Generally Accepted Accounting Principles (GAAP), which uses the accrual accounting method to ensure financial reporting reflects the actual financial position of a business.

Prepaid expenses are recorded as assets and recognized as expenses over time, aligning with the matching principle. Accrued expenses are recorded as liabilities in the period they are incurred, even if payment occurs later.

This ensures that revenues and related expenses are accurately matched within the same period. Adhering to GAAP promotes consistency, transparency, and comparability in financial statements, which is critical for stakeholders, auditors, and regulatory bodies.

Software integration

Modern accounting software simplifies how businesses handle prepaid and accrued expenses. For prepaid expenses, companies can sync prepaid card transactions directly with tools like QuickBooks, allowing automated categorization and expense scheduling. This reduces manual entry and improves tracking.

On the other hand, platforms like Xero help manage accrued expenses by recording liabilities and automating reminders for future payments. With software integration, businesses gain better control, improve compliance, and reduce errors.

Understanding how systems handle prepaid expenses vs accrued expenses helps finance teams streamline workflows and maintain accuracy in their accounting and financial reporting processes.

Benefits of managing prepaid and accrued expenses

Financial accuracy

Effectively managing prepaid and accrued expenses ensures expenses are recorded in the correct accounting periods, improving the reliability of financial reports. By matching costs with the revenues they generate, businesses can present a more accurate view of profitability and financial health.

This approach minimizes discrepancies in income statements and balance sheets, fostering trust with stakeholders and auditors. Proper expense timing also supports compliance with accounting standards and avoids misleading financial data that could result from premature or delayed expense recognition.

Budget control

Managing prepaid and accrued expenses supports better budget control and financial planning. Prepaid cards help limit overspending by capping prepayments and assigning clear budgets for specific vendors or categories. This prevents unapproved or excessive advance payments.

On the other hand, accurately tracking accrued expenses allows businesses to monitor upcoming financial obligations and plan future cash flows accordingly. By overseeing both types of expenses, finance teams can reduce surprises, maintain liquidity, and improve decision-making based on up-to-date financial data and scheduled commitments.

Tax optimization

Managing prepaid and accrued expenses strategically can help businesses optimize their tax position. By timing deductions carefully, companies can maximize tax benefits while ensuring compliance with IRS regulations.

Prepaid expenses may be deducted over the period they cover, while accrued expenses can be deducted when incurred, not when paid. This timing flexibility allows businesses to better manage their taxable income, reducing the overall tax burden and improving cash flow, all while adhering to tax laws and avoiding penalties.

Cash flow planning

Properly managing prepaid and accrued expenses is essential for effective cash flow planning. By balancing prepayments and accruals, businesses can smooth out cash flows, ensuring liquidity when it’s needed most.

Prepaid expenses require upfront payments, which may affect short-term cash flow, while accrued expenses allow businesses to defer payments. Maintaining a balance between these two types of expenses helps optimize cash management, enabling businesses to plan for future obligations, avoid cash shortages, and allocate resources more efficiently.

Vendor relations

Managing prepaid expenses with tools like prepaid cards helps foster strong vendor relationships by ensuring timely and accurate payments. These cards streamline the payment process, reducing delays and confusion.

For vendors, timely payments lead to improved trust and reliability, which can result in better terms or discounts for future transactions. By using prepaid cards, businesses can also track and control payments, ensuring they remain within budget and that suppliers are paid promptly, strengthening long-term partnerships and reducing payment disputes.

Track prepaid & accrued expenses easily with Volopay

Challenges of managing prepaid and accrued expenses

Tracking complexity

One of the main challenges in managing prepaid and accrued expenses is the complexity of tracking and recording them accurately. Prepaid amortization requires careful scheduling to ensure expenses are recognized in the right periods.

Similarly, managing accrued liabilities demands continuous monitoring to prevent errors and ensure timely settlement. Automating these processes using accounting software can simplify tracking, improve accuracy, and reduce manual errors, helping businesses stay on top of both types of expenses while ensuring proper reporting.

Cash flow strain

Prepaid expenses can place a strain on cash flow, especially if large upfront payments are required. This makes effective budgeting essential for managing liquidity. Using prepaid cards offers a practical solution by enabling businesses to set clear budgets for prepayments, allocate funds efficiently, and track spending.

With better control over cash outflows, businesses can avoid the negative impact on cash flow, making it easier to maintain liquidity and plan for future expenses without disrupting daily operations or financial stability.

Error risks

Managing prepaid and accrued expenses can be prone to errors if not handled carefully, especially when tracking large volumes of transactions. Mistakes in recording prepayments or accruals can lead to inaccurate financial statements and compliance issues.

Using card transaction logs to track prepaid expenses helps minimize these risks. These logs provide clear records, reducing human error and ensuring that all transactions are accurately captured and categorized, aligning with the differences between prepaid and accrued expenses and maintaining financial integrity.

Compliance issues

Ensuring compliance with GAAP and IRS regulations is a significant concern when managing prepaid and accrued expenses. Prepaid expenses must be amortized over time, while accrued expenses should be recognized in the period they occur.

By using card-based records, businesses can maintain clear documentation that supports prepaid expenses vs accrued expenses treatment, making it easier to adhere to accounting standards and tax requirements.

This also provides a reliable audit trail for IRS purposes, preventing penalties from improper expense reporting.

Vendor disputes

Vendor disputes can arise when payment terms aren’t clearly defined, particularly with prepaid expenses. Using prepaid cards to handle prepayments helps clarify the terms of these payments, as both parties have a clear record of the transaction.

This transparency reduces misunderstandings and ensures that vendors receive timely payments according to agreed-upon terms. By maintaining accurate documentation through prepaid cards, businesses can avoid conflicts and ensure smoother interactions with vendors, enhancing trust and long-term partnerships.

Use cases for prepaid and accrued expenses in small businesses

Prepaid expenses

Small businesses can use prepaid cards to pay for annual SaaS subscriptions or software licenses in advance. This ensures uninterrupted access to services and allows businesses to manage their cash flow more effectively by spreading out the costs over the year.

By using prepaid cards, businesses can also track and manage these expenses conveniently, ensuring that they stay within budget while making timely payments.

Additionally, prepaying for services can sometimes lead to discounts or favorable terms, further benefiting the business.

Accrued expenses

For ongoing expenses like utilities or monthly subscriptions, small businesses can accrue costs until the billing cycle ends. This means that businesses can recognize the expenses in the correct period without immediately impacting cash flow.

By tracking accrued expenses, businesses ensure that their financial statements accurately reflect costs incurred, aligning with differences between prepaid and accrued expenses while preventing cash flow disruptions.

This practice helps businesses avoid overestimating their cash requirements and enables smoother financial planning.

Combined scenarios

Small businesses can combine prepaid cards with accurate accrual tracking to manage both types of expenses effectively. Cards allow for easy prepayments for services like insurance, while accrual systems ensure proper recognition of ongoing costs.

This combination helps businesses maintain a clear financial picture, reducing the risk of errors in both short-term and long-term financial planning. By effectively managing both types of expenses, businesses can improve their budgeting process and ensure more accurate financial reporting.

Small business benefits

Prepaid cards simplify prepayment management for small and medium-sized enterprises (SMEs), providing a clear way to handle various expenses. With prepaid cards, SMEs can allocate funds for specific expenses and track them seamlessly.

This solution helps SMEs stay organized and on top of their financial commitments, offering greater visibility and control over spending. Additionally, prepaid cards offer flexibility and ease of use, making them a practical solution for businesses with fluctuating or seasonal cash flow.

Compliance support

Using prepaid cards provides a detailed transaction record that supports GAAP and IRS compliance. These records help small businesses ensure proper documentation for audits and tax reporting.

With organized and transparent payment histories, businesses can avoid potential compliance issues while simplifying their year-end audits and tax filings, reinforcing accurate financial reporting in line with accounting standards.

This level of documentation also ensures that businesses remain prepared for unexpected audits, offering peace of mind in their financial processes.

How prepaid cards streamline prepaid expense management

Budget control

Prepaid cards allow businesses to set specific limits for prepayments, such as rent or insurance. This ensures that the spending remains within budget, preventing overspending. By allocating a defined amount to each category, businesses can better manage cash flow and avoid unexpected financial strain.

Additionally, these limits can be adjusted easily as business needs change, providing flexibility to accommodate fluctuating expenses while maintaining financial discipline.

Real-time tracking

With prepaid cards, businesses can track transactions in real time via integrated dashboards. This provides immediate visibility into spending patterns and helps finance teams monitor expenses more closely, ensuring that all payments are recorded accurately and in a timely manner.

The ability to review transaction history and current balances at any moment also aids in making informed decisions quickly. This real-time monitoring feature enhances transparency and allows for faster identification of any discrepancies or issues.

Fraud protection

Prepaid cards enhance security for prepayments by offering PIN protection and the ability to lock cards when necessary. This reduces the risk of unauthorized transactions and fraud, ensuring that payments are only made for legitimate expenses. Businesses can safeguard their finances with these built-in security features.

Moreover, by restricting card usage to specific vendors or pre-approved categories, companies can further mitigate the risk of misuse, ensuring payments are controlled and secure.

Simplified bookkeeping

By syncing prepaid card data directly with accounting tools, businesses can streamline their bookkeeping process. This eliminates manual entry and reduces the risk of errors, ensuring that all prepayment transactions are accurately recorded. Integration with accounting software makes it easier to manage financial records and ensures consistent reporting.

Additionally, automated reconciliation of prepaid card transactions helps finance teams stay organized and saves time spent on month-end closing tasks, resulting in more efficient financial management.

Vendor flexibility

Prepaid cards provide flexibility in paying vendors, as they can be used with major networks like Visa or Mastercard. This gives businesses the ability to pay suppliers easily and efficiently, without the need for traditional payment methods like checks or bank transfers, offering convenience for both parties involved.

Prepaid cards can also be used for international transactions, expanding the range of vendors that businesses can pay without dealing with complex currency conversion or international bank fees.

Automate expense tracking with Volopay

Simplify expense management with Volopay’s prepaid cards

Budget control

With Volopay’s prepaid cards, businesses can set predefined limits for various prepayments such as insurance or subscription services, allowing for better financial discipline. This control ensures that funds are allocated efficiently, preventing overspending and ensuring that the budget remains intact.

The ability to allocate specific amounts to each expense category enhances expense management through Volopay’s expense management system, providing clear tracking of financial commitments. By setting limits, companies can stick to budgetary constraints while managing multiple ongoing expenses, reducing the risk of unexpected costs.

Additionally, the prepayment system allows businesses to manage cash flow predictability, making it easier to allocate resources for other business needs, improving financial forecasting and planning.

Combined with Volopay's budgeting software capabilities, this approach empowers finance teams to monitor spending in real time, enforce controls, and support smarter decision-making across departments.

Real-time tracking

Volopay’s prepaid cards allow businesses to monitor transactions in real-time through an intuitive dashboard, offering full visibility into spending. This feature enables seamless synchronization with accounting software such as QuickBooks, Xero, or NetSuite, ensuring that records are updated instantaneously.

With automatic updates and detailed transaction logs, businesses can track expenses and reconcile accounts quickly and accurately, minimizing the time spent on manual reconciliation. The real-time tracking system eliminates manual errors and ensures financial transparency, providing teams with up-to-date data for better decision-making.

This enables businesses to stay on top of their finances, avoid budget overruns, and make informed decisions based on current financial data.

Security

Security is a top priority with Volopay’s prepaid cards, which come equipped with PIN protection, lock features, and approval workflows to ensure that funds are protected from unauthorized access.

These features safeguard funds from theft or misuse, providing businesses with peace of mind when managing expenses like rent or vendor payments. The ability to lock cards after use adds an extra layer of security, ensuring that the card cannot be used fraudulently.

Additionally, businesses can customize approval workflows to control spending, ensuring that only authorized personnel can make prepayments or adjustments.

Vendor flexibility

Volopay’s prepaid cards offer the flexibility to pay vendors globally using Visa or Mastercard-backed cards, expanding payment capabilities beyond local borders. This means businesses can streamline international transactions without worrying about exchange rates or third-party fees, making global procurement easier.

With global payment capabilities, Volopay’s vendor management system is particularly beneficial for companies that have diverse supplier networks across multiple countries, ensuring that payments are completed on time, regardless of location.

The ability to make payments quickly and efficiently helps businesses maintain positive vendor relationships while simplifying cross-border financial operations. This flexibility is perfect for growing businesses managing complex international transactions, ensuring smooth operations without traditional payment complications.

Compliance

Volopay helps businesses stay compliant by generating audit-ready reports that provide accurate and detailed financial records. These reports are aligned with accounting standards, ensuring proper documentation for tax filings and internal audits, simplifying the compliance process.

With these reports, businesses can easily track their prepaid expenses, which are critical for aligning financial statements with generally accepted accounting principles (GAAP).

By automating this process, businesses save time on manual recordkeeping while ensuring adherence to regulations like prepaid expenses vs accrued expenses. With detailed, organized reports, companies can easily prepare for audits, ensuring that their financial practices are always in line with industry standards and legal requirements.

FAQs

Prepaid expenses are upfront payments recorded as assets, while accrued expenses are unpaid costs recorded as liabilities. Managing both ensures accurate financial reporting and a clear view of a company’s financial health.

Prepaid cards help manage prepaid expenses by enforcing budget limits, enabling real-time tracking, and syncing with accounting software for accurate reporting. They simplify expense management, improve transparency, and automate payment scheduling to prevent missed deadlines or overpayments.

Prepaid expenses are assets amortized over time, while accrued expenses are recorded as liabilities and income statement expenses. Properly managing both ensures accurate financial statements and compliance with accounting standards.

Prepaid expenses reduce cash flow by requiring upfront payments, while accrued expenses delay outflows, helping businesses manage liquidity. Balancing both is key to optimizing cash flow and maintaining financial stability.

Businesses can track prepaid and accrued expenses using card records and accounting software to ensure GAAP and IRS compliance. These tools simplify audits and help maintain accurate, audit-ready records, reducing the risk of penalties. Regular reviews of financial statements support ongoing compliance.